Compass Gold Corp. (TSX-V: CVB) (Compass or

the Company) is pleased to provide an update on

the results of the one diamond drill hole completed on extensive

artisanal workings at the Ouassada exploration permit on its

Sikasso Property in Southern Mali.

Highlights

- Identified three discrete mineralized zones within an

18 m-wide interval

- 4 m @ 83.82 g/t Au (from 63 m)

- 4 m @ 7.04 g/t Au (from 69 m)

- 3 m @ 4.18 g/t Au (from 78 m)

- 1 m interval (with a 45 cm true thickness vein)

contained 329.92 grams per tonne gold (g/t Au)

- Mineralization correlated well with adjacent reverse

circulation (RC) drill holes and a 1,600 m target structure

identified during recent ground geophysics

- 1,000 m drill program planned at Farabakoura to test

additional structures.

Compass CEO, Larry Phillips,

said, “The results from our first diamond drilling thus far at

Farabakoura are exceptional. While the 330 g/t Au (10.6 troy

ounces per tonne) interval reflects the nuggety nature of the gold,

it is important to note that the three mineralized structures

around it correlated with what we found in the adjacent RC holes

drilled in December. Looking at the larger picture, we also

see that the mineralization drilled to date at Farabakoura is

coincident with structures identified from our ground geophysical

surveys. We’re looking forward to starting to further drill

test these trends soon, which are up to 1,600 m in length, to

determine the full extent of the mineralization in this highly

prospective portion of our permits.”

Diamond Drilling (Farabakoura)

As previously announced (see Compass news releases dated January 10

and February 14, 2019), a single 201 m inclined diamond drill hole,

OUDD001, was drilled in early January 2019 beneath the artisanal

gold working at Farabakoura, Ouassada permit. The purpose of

the hole was to provide information on rock types, structure and

the nature of mineralization encountered in two adjacent, 10 m

away, reverse circulation (RC) drill holes (OURC004 and

OURC005). OURC004 contained a 37-m mineralized zone with 0.87

grams per tonne gold (g/t Au), which included intervals of 10 m @

2.25 g/t Au (from 29 m), and 9 m @ 0.84 g/t Au (from 59 m).

OURC005 contained two broad mineralized zones. The first zone

was a 46-m mineralized zone with 0.66 g/t Au (from 18 m), which

included intervals of 6 m @ 0.53 g/t Au (from 18 m), and 13 m @

1.97 g/t Au (from 51 m). The second zone was 27 m @ 0.92 g/t

Au (from 96 m), which included 16 m @ 1.47 g/t Au (from 96

m).

Figure

1. Location of OUDD001 (red text) in

relation to the adjacent drill holes at

Farabakoura.http://www.globenewswire.com/NewsRoom/AttachmentNg/6f3400a8-b680-4e21-a8b8-acf472220d13

Drill hole OUDD001 was drilled 10 m to the

southeast of OURC005 using the same angle (60°) and azimuth

(050°). Upon completion, the hole was surveyed, the recovered

core logged, and samples (with an appropriate number of standards,

blanks and duplicates) sent to the assay laboratory (SGS, Bamako)

for geochemical analysis. The most significant intervals are

presented in Table 1.

Table 1. Drill

intersections from OUDD001 at Farabakoura

|

MineralizedZone |

1Interval and 2,3Gold Grade |

From Depth (down hole) |

|

1 |

1 m @ 4.54 g/t Au |

22 m |

|

2 |

18 m @ 20.69 g/t Au |

63 m |

|

including |

4 m @ 83.32 g/t Au |

66 m |

|

[Including |

1 m @ 329.92 g/t Au |

66 m] |

|

including |

4 m @ 7.04 g/t Au |

69 m |

|

including |

3 m @ 4.18 g/t Au |

78 m |

|

3 |

9 m @ 0.23 g/t Au |

102 m |

|

4 |

7 m @ 0.20 g/t Au |

138 m |

|

5 |

1 m @ 0.39 g/t Au |

164 m |

1True thicknesses are interpreted as 60-90% of

stated intervals2No top-cut has been used on analyses3Intervals use

a 0.2 gram per tonne gold cut-off value

Mineralization was present in seven discrete

zones, with the highest grades present within the top 81 m of the

core (or 70 m from surface). Numerous instances of visible

gold were observed between 63.2 m and 72.2 m and this is reflected

in the extremely high gold grades determined by assaying. A

reanalysis of the 329.92 g/t Au (10.6 oz/t Au) interval returned a

grade of 361.48 g/t (11.6 oz/t Au). Gold enrichment caused

surficial oxidation is unlikely, since unaltered bedrock was

encountered at 31 m and the pyrite does not show signs of

alteration. The 18 m @ 20.69 g/t Au mineralized interval in

OUDD01 appears to correlate with the 13 m @ 1.98 g/t Au interval in

OURC05.

Geological Interpretation

Logging of chips from OURC004 and OURC005

suggested that mineralization was present within a granodiorite, at

the contact between a granodiorite and metavolcaniclastics, and

within the metavolcaniclastic unit. The preliminary

interpretation was that mineralization was both controlled by the

intrusion of the granodiorite, and later faults cutting the

units. The field relationship of the mineralization to the

host rock was not known, and the true thickness of mineralization

could not be determined.

Logging of the diamond hole indicated that the

mineralization is generally hosted within a thick intercalated

sequence of volcaniclastic metasedimentary rocks that vary from

coarse- to fine- grain-size, which have been extensively deformed

due to regional metamorphism. A weakly metamorphosed

granodiorite is present at the top of the hole.

Mineralization takes two forms: zones of silicified,

pyrite-rich (5-8%) metasedimentry rock generally conformable to

foliation (60-65°), and slightly lower-angle (40-45°) discordant

mineralization in thin (2-5 cm) quartz-carbonate veins. This

could indicate gold remobilization due to later structural

events. Core measurements indicated that mineralization is

dipping steeply to the southwest. This is in good agreement

with the previously drilled RC holes, and also the recently

interpreted ground geophysics (Compass news release dated March 26,

2019).

Three zones of low-grade gold mineralization are

noted at depths greater than 102 m. In each case, the gold is

associated with a chlorite-rich schist unit in the rock package

that is sometimes cut by fragmented and discontinuous

quartz-sulphide veins. This pyrite appears to be stratabound

(occurring between layers), and probably represents primary gold

mineralization. It is likely that the 9 m @ 0.23 g/t Au (from

102 m) interval correlates with a 16 m @ 1.47 g/t Au (from 96 m)

interval in OURC05. The presence of sulphide- and/or graphite-rich

lithologies are indicated from the IP survey data, and structures

(faults) and intrusions are interpreted from the ground magnetic

survey data (see Figure 2). These targets could host gold

mineralization, and are the focus of a planned short drilling

program.

Next Steps:

As noted in the Company’s news release dated

February 26, 2019, a 1,000-m RC drilling program will be initiated

shortly at Farabakoura. The purpose of this program is to

determine whether mineralization is present in the structures

recently identified using detailed ground geophysics. These

structures can be traced for up to 1,600 m and have geophysical

signatures similar to areas where gold mineralization was

encountered. Additional bedrock drilling will take place on

the remaining targets on the Ouassada and Faraba-Coura permits once

the permit wide IP survey is completed and interpreted.

Field teams are continuing to perform sampling

at nine artisanal gold sites on the Yanfolila South block, and

assay results will be released once this program is complete.

It is anticipated that limited bedrock drilling can take place on

some of these workings prior to the beginning of the rainy season

in late June.

Figure

2. Results of the filter-enhanced

high-resolution ground magnetic survey with target structures

(yellow lines) superimposed at Farabakoura. The locations of

the IP lines are also

identified.http://www.globenewswire.com/NewsRoom/AttachmentNg/250362e6-898f-490e-a497-ae390e87c4b0

About Compass Gold Corp.

Compass, a public company having been

incorporated into Ontario, is a Tier 2 issuer on the

TSX- Venture Exchange (TSX-V). Through the 2017 acquisition of

MGE and Malian subsidiaries, Compass holds gold exploration permits

in Mali that comprise the Sikasso Property. The

exploration permits are located in three sites in southern Mali

with a combined land holding of 854 km2. The

Sikasso Property is in the same region as several multi-million

ounce gold projects, including Morila, Syama, Kalana and

Kodiéran. The Company’s Mali-based technical team, led in the

field by Dr. Madani Diallo and under the supervision of Dr. Sandy

Archibald, P.Geo, is executing a technically-driven and

comprehensive exploration program. They are examining numerous

anomalies noted for further investigation in Dr. Archibald’s August

2017 *“National Instrument 43-101 Technical Report on the Sikasso

Property, Southern Mali.”

Qualified Person

This news release has been reviewed and approved

by EurGeol. Dr. Sandy Archibald, P.Geo, Compass’s Technical

Director, who is the Qualified Person for the technical information

in this news release under National Instrument 43-101

standards.

Forward‐Looking InformationThis

news release contains "forward‐looking information" within the

meaning of applicable securities laws, including statements

regarding the Company’s planned exploration work and management

appointments. Readers are cautioned not to place undue reliance on

forward‐looking information. Actual results and developments may

differ materially from those contemplated by such information. The

statements in this news release are made as of the date hereof. The

Company undertakes no obligation to update forward‐looking

information except as required by applicable law.

For further information please contact:

| Compass Gold

Corporation |

Compass Gold

Corporation |

|

Larry Phillips – Pres. & CEO |

Greg Taylor – Dir. Investor Relations & Corporate

Communications |

|

lphillips@compassgoldcorp.com |

gtaylor@compassgoldcorp.com |

|

T: +1 416-596-0996 X 302 |

T: +1 416-596-0996 X 301 |

Website: www.compassgoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

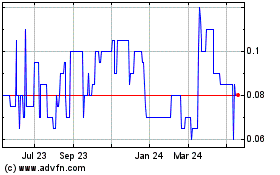

Compass Gold (TSXV:CVB)

Historical Stock Chart

From Mar 2025 to Apr 2025

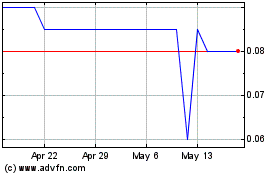

Compass Gold (TSXV:CVB)

Historical Stock Chart

From Apr 2024 to Apr 2025