Xanadu Mines Ltd (ASX: XAM, TSX: XAM)

(

Xanadu or the

Company) is

pleased to advise an initial

5,000m diamond

drilling programme to test five main target areas at the highly

prospective 100% owned Red Mountain copper and gold Project in the

South Gobi region of Mongolia is now underway, with drilling

expected to be completed by mid-May, and all assays available by

end-June.

Highlights

- Exploration drilling focused on discovery of shallow high-grade

gold and copper-gold deposit, akin to the shallower parts of the

Northparkes copper gold porphyry deposits in NSW, Australia .

- Systematic diamond drilling program designed to test five

high-priority targets, following up on more recent trenching and

previous drilling; compelling results from the latter are

highlighted, below:

- First results from the drilling program are anticipated late

April.

Xanadu’s Executive Chairman and Managing

Director, Mr Colin Moorhead, said,

“Drilling has commenced at our 100% owned Red

Mountain copper and gold project with an initial 5,000m diamond

hole programme targeting five of our highest priority targets. Red

Mountain offers a rare opportunity to access a large,

under-explored mineral district. We are conducting a systematic

exploration program, including diamond drilling, that we expect

will provide a new perspective on the mineral potential of the Red

Mountain district. Xanadu is entering an exciting period of new

opportunities for discovery and growth.”

Exploration Program Design

Five thousand meters of drilling has been

designed to test five shallow high-grade gold and copper-gold

targets across the Red Mountain Lease (Figures 1 and

2). Drilling is targeting:

- Shallow gold at Target 33,

- High-grade copper sulphide lodes at Target 10, and

- Shallow porphyry targets at Nowie, Stockwork and Bavuu

(Figure 3).

Figure 1: Map of Mongolia,

showing location of the Red Mountain Mining Lease.

Figure 2: The Red Mountain

Mining Lease with designed drill holes and target locations.

Figure 3: Exploration drilling

has commenced at Red Mountain.

Target 33 – Shallow Epithermal Gold

Mineralisation

Target 33 is a 1,000-metre-long and

100-wide-zone of alteration and anomalous gold mineralisation

associated with an east west trending intrusion. Trenching and

limited reverse circulation drilling in 2017 encountered

significant widths of gold mineralisation (Figure

4).

Previous results1 include:

|

OURC043 |

40m @

1.06g/t Au from 26m |

|

Including |

22m @ 1.82g/t Au from 40m |

|

Including |

10m @ 3.7g/t Au from 50m |

|

OURC055 |

30m @ 0.68g/t Au from surface |

|

Including |

4m @ 2.82g/t Au from surface |

|

Including |

8m @ 0.39g/t Au from 4m |

|

And |

16m @ 1.13g/t Au from 42m |

|

Including |

8m @ 1.7g/t Au from 42m |

|

|

|

Current Drilling Program: Five

shallow diamond drill holes have been planned to test a 300m strike

across the center of the gold anomalism at Target 33. Follow-up

drilling will be planned once interpretation of the initial results

has been completed.

Figure 4: Target 33 showing

previous drilling and trenching2 and planned drilling 2024.

Target 10 – High-Grade Cu and Porphyry

Cu-Au TargetTarget 10 was first identified in 2017 as a

copper and gold in soil anomaly with a molybdenum halo and

coincident bullseye magnetic feature. Two diamond drill holes were

drilled into the magnetic feature, returning3:

|

OUDDH089 |

6.2m @

4.24% Cu and 1.9g/t Au, from 128m |

| Including |

0.9m @ 22.1%Cu and 8.27g/t Au, from 129m |

| And |

79.5m @ 0.26% Cu and 0.21g/t Au, from

198.5m |

| OUDDH090 |

138m @ 0.27% Cu and 0.25g/t Au, from 200m |

| |

|

Current Drilling Program: Three

shallow drill holes and one deeper drill hole are planned to follow

up on these results. Shallow holes are targeting around the

high-grade copper intercept in OUDDH089 and are designed to

determine the orientation of this zone, with the aim of delivering

further expansion. A single deeper hole is planned to scissor the

broad porphyry intercept in OUDDH090, testing the theory that this

is associated with a south dipping structure, clearly visible in

the magnetics (Figure 5)

Figure 5: Target 10 showing

previous drilling and planned drilling 20244.

Bavuu Porphyry – Porphyry Cu-Au

Target

Bavuu Porphyry was first identified in 2016 as a

large-scale copper and gold soil anomaly. Trenching completed in

2016 returned very broad porphyry intercepts of copper and gold

mineralisation5;

|

OUCS030A |

188m @

0.24% Cu and 0.18g/t Au |

| Including |

52 m @ 0.36% Cu and 0.22g/t Au |

| OUCS030B |

220m @ 0.15% Cu and 0.16g/t Au |

| |

|

| Two shallow reverse circulation drill holes were

drilled under OUCS030A with the deeper hole returning; |

| OURC032 |

168m @ 0.22% Cu and 0.25g/t Au from

surface |

| Including |

32m @ 0.31% Cu and 0.4g/t Au from 132m |

| |

|

Current Drilling Program: Two

diamond drill holes have been designed to test behind this

intercept and along strike to the west (Figure

6).

Figure 6: Target 10 showing

previous drilling and planned drilling 20246.

Nowie Porphyry – Porphyry Cu-Au

Target

No work has previously been conducted at Nowie

by Xanadu. However, multiple drill hole collars and trenches from

previous explorers are visible at surface. Soil sampling at Nowie

has defined a 500m long copper in soil anomaly greater than 0.1% Cu

and 0.25g/t Au. Geological mapping has identified strong oxide

copper at surface associated with porphyry veining.

Current Drilling Program: Three

diamond drill holes have been designed to test beneath the 500m

strike of surface mineralisation.

Stockwork Porphyry – Porphyry Cu-Au

TargetLimited work has previously been conducted at

Stockwork by Xanadu. However, like the Nowie propsect, multiple

drill hole collars and trenches from previous explorers are visible

at surface. Soil sampling at Stockwork has defined a 650m long

copper in soil anomaly greater than 0.05% Cu. Geological mapping

has identified strong oxide copper at surface associated with

intense porphyry veining and a reinterpretation based on this

mapping has suggested an alternative orientation to drill test for

the system at Stockwork.

Current Drilling Program: Three

shallow diamond drill holes have been designed to test this

target.

About Red MountainThe 100%

owned Red Mountain project, located within the Dornogovi Province

of southern Mongolia, approximately 420 kilometres southeast of

Ulaanbaatar (Figures 1 and 2).

The project covers approximately 57 square

kilometres in a frontier terrane with significant mineral endowment

and has a granted 30-year mining licence. Red Mountain comprises a

cluster of outcropping mineralising porphyry intrusions which

display features typically found in the shallower parts of porphyry

systems where narrow dykes and patchy mineralisation branch out

above a mineralised stock. This underexplored porphyry district

includes multiple porphyry copper-gold centres, mineralised

tourmaline breccia pipes copper-gold/base metal skarns and

high-grade epithermal gold veins.

Existing porphyry mineralisation at Red Mountain

is hosted within narrow stockwork zones that have been focused

around several narrow structurally controlled monzonite porphyry

dykes. Emplacement of mineralisation appears to be controlled by

intersection of northeast and north-northwest trending structures.

The quartz-chalcopyrite-bornite stockwork mineralisation is

associated with strong reddening albite-sericite-biotite-magnetite

(potassic) alteration assemblage in the host lithology. The thin

nature of the mineralising dykes, their irregular intrusion

geometry, and the patchy distribution of stockwork mineralisation

are all features typically found in the shallower parts of porphyry

systems, where narrow dykes and patchy mineralisation branch out

above a mineralised stock. Similar orebody geometries are found in

the shallower parts of the Northparkes porphyry copper-gold (Cu-Au)

deposits in NSW, where porphyry mineralisation has also been

tightly focused along a controlling structure adjacent to a felsic

pluton. Like Northparkes, there is the potential for further

mineralisation along the main structures at Diorite Hill and

Stockwork Hill, and the likelihood that mineralisation extends (and

could amalgamate) at depth.

About Xanadu MinesXanadu is an

ASX and TSX listed Exploration company operating in Mongolia. We

give investors exposure to globally significant, large-scale

copper-gold discoveries and low-cost inventory growth. Xanadu

maintains a portfolio of exploration projects and remains one of

the few junior explorers on the ASX or TSX who jointly control a

globally significant copper-gold deposit in our flagship Kharmagtai

project. Xanadu is the Operator of a 50-50 JV with Zijin Mining

Group in Khuiten Metals Pte Ltd, which controls 76.5% of the

Kharmagtai project.

For further information on Xanadu, please visit:

www.xanadumines.com or contact:

| Colin MoorheadExecutive Chairman

& Managing DirectorE: colin.moorhead@xanadumines.com P: +61 2

8280 7497 |

|

| |

|

This Announcement was authorised for release by

Xanadu’s Board of Directors.

Appendix 1: Statements and

Disclaimers

Competent Person Statement

The information in this announcement that

relates to exploration results is based on information compiled by

Dr Andrew Stewart, who is responsible for the exploration data,

comments on exploration target sizes, QA/QC and geological

interpretation and information. Dr Stewart, who is an employee of

Xanadu and is a Member of the Australasian Institute of

Geoscientists, has sufficient experience relevant to the style of

mineralisation and type of deposit under consideration and to the

activity he is undertaking to qualify as the Competent Person as

defined in the 2012 Edition of the Australasian Code for Reporting

Exploration Results, Mineral Resources and Ore Reserves and the

National Instrument 43-101. Dr Stewart consents to the inclusion in

the report of the matters based on this information in the form and

context in which it appears.

Forward-Looking Statements

Certain statements contained in this

Announcement, including information as to the future financial or

operating performance of Xanadu and its projects may also include

statements which are ‘forward‐looking statements’ that may include,

amongst other things, statements regarding targets, estimates and

assumptions in respect of mineral reserves and mineral resources

and anticipated grades and recovery rates, production and prices,

recovery costs and results, capital expenditures and are or may be

based on assumptions and estimates related to future technical,

economic, market, political, social and other conditions. These

‘forward-looking statements’ are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by

Xanadu, are inherently subject to significant technical, business,

economic, competitive, political and social uncertainties and

contingencies and involve known and unknown risks and uncertainties

that could cause actual events or results to differ materially from

estimated or anticipated events or results reflected in such

forward‐looking statements.

Xanadu disclaims any intent or obligation to

update publicly or release any revisions to any forward‐looking

statements, whether as a result of new information, future events,

circumstances or results or otherwise after the date of this

Announcement or to reflect the occurrence of unanticipated events,

other than required by the Corporations Act 2001 (Cth) and the

Listing Rules of the Australian Securities Exchange

(ASX) and Toronto Stock Exchange

(TSX). The words ‘believe’, ‘expect’,

‘anticipate’, ‘indicate’, ‘contemplate’, ‘target’, ‘plan’,

‘intends’, ‘continue’, ‘budget’, ‘estimate’, ‘may’, ‘will’,

‘schedule’ and similar expressions identify forward‐looking

statements.

All ‘forward‐looking statements’ made in this

Announcement are qualified by the foregoing cautionary statements.

Investors are cautioned that ‘forward‐looking statements’ are not

guarantee of future performance and accordingly investors are

cautioned not to put undue reliance on ‘forward‐looking statements’

due to the inherent uncertainty therein.

For further information please visit the Xanadu

Mines’ Website at www.xanadumines.com.

Appendix 2: Red Mountain Table 1 (JORC Code,

2012)

Set out below is Section 1 and Section 2 of

Table 1 under the JORC Code, 2012 for the Red Mountain project.

Data provided by Xanadu. This Table 1 updates the JORC Table 1

disclosure dated 27 September 2022.7

1.1 JORC TABLE 1 -

SECTION 1 - SAMPLING TECHNIQUES AND DATA

|

Criteria |

Commentary |

|

Sampling techniques |

- The exploration

results are based on diamond drill core samples, reverse

circulation (RC) chip samples and channel samples

from surface trenches.

- Representative ½

core samples were split from PQ, HQ & NQ diameter diamond drill

core on site using rock saws, on a routine two metre sample

interval that also honours lithological/intrusive contacts.

- The orientation

of the cut line is controlled using the core orientation line

ensuring uniformity of core splitting wherever the core has been

successfully oriented.

- Sample intervals

are defined and subsequently checked by geologists, and sample tags

are attached (stapled) to the plastic core trays for every sample

interval.

- RC chip samples

are ¼ splits from 1m intervals using a 75%:25% riffle splitter to

obtain a 3kg sample.

- RC samples are

uniform 2m samples formed from the combination of two ¼ split 1m

samples.

- Trench samples

are collected as 2m composite from 30m above the trench toe.

- Sampling

generally honours lithological contacts.

- Trench samples

are continuous along the length of the trench

|

|

Drilling techniques |

- The exploration

results are based upon diamond drilling of PQ, HQ and NQ diameters

with both standard and triple tube core recovery configurations, RC

drilling and surface trenching with channel sampling.

- All drill core

drilled by Xanadu has been oriented using the “Reflex Ace”

tool.

|

|

Drill sample recovery |

- Diamond drill

core recoveries were assessed using the standard industry (best)

practice which involves removing the core from core trays;

reassembling multiple core runs in a v-rail; measuring core lengths

with a tape measure, assessing recovery against core block depth

measurements and recording any measured core loss for each core

run.

- Diamond core

recoveries average 97% through mineralisation.

- Overall, core

quality is good, with minimal core loss. Where there is localised

faulting and or fracturing core recoveries decrease, however, this

is a very small percentage of the mineralised intersections.

- RC recoveries

are measured using whole weight of each 1m intercept measured

before splitting

- Analysis of

recovery results vs grade shows no significant trends that might

indicate sampling bias introduced by variable recovery in

fault/fracture zones.

|

|

Logging |

- All drill core

is geologically logged by well-trained geologists using a modified

“Anaconda-style” logging system methodology. The Anaconda method of

logging and mapping is specifically designed for porphyry Cu-Au

mineral systems.

- Logging of

lithology, alteration and mineralogy is intrinsically qualitative

in nature. However, the logging is subsequently supported by 4 Acid

ICP-MS (48 element) geochemistry and SWIR spectral mineralogy

(facilitating semi-quantitative / calculated mineralogical,

lithological and alteration classification) which is integrated

with the logging to improve cross section interpretation and 3D

geological model development.

- Drill core is

also systematically logged for both geotechnical features and

geological structures. Where drill core has been successfully

oriented, the orientation of structures and geotechnical features

are also routinely measured.

- Both wet and dry

core photos are taken after core has been logged and marked-up but

before drill core has been cut.

|

|

Sub -sampling techniques and sample

preparation |

- All drill core

samples are ½ core splits from either PQ, HQ or NQ diameter cores.

A routine 2m sample interval is used, but this is varied locally to

honour lithological/intrusive contacts. The minimum allowed sample

length is 30cm.

- Core is

appropriately split (onsite) using diamond core saws with the cut

line routinely located relative to the core orientation line (where

present) to provide consistency of sample split selection.

- The diamond saws

are regularly flushed with water to minimize potential

contamination.

- A field

duplicate ¼ core sample is collected every 30th sample to ensure

the “representivity of the in-situ material collected”. The

performance of these field duplicates is routinely analysed as part

of Xanadu’s sample QC process.

- Routine sample

preparation and analyses of DDH samples were carried out by ALS

Mongolia LLC (ALS Mongolia), who operates an

independent sample preparation and analytical laboratory in

Ulaanbaatar.

- All samples were

prepared to meet standard quality control procedures as follows:

Crushed to 75% passing 2mm, split to 1kg, pulverised to 85% passing

200 mesh (75 microns) and split to 150g sample pulp.

- ALS Mongolia

Geochemistry labs quality management system is certified to ISO

9001:2008.

- The sample

support (sub-sample mass and comminution) is appropriate for the

grainsize and Cu-Au distribution of the porphyry Cu-Au

mineralization and associated host rocks.

- Trench samples

by previous explorers between 2001 to 2007 were prepared and

assayed by SGS Mongolia.

|

|

Quality of assay data and laboratory tests |

- All XAM samples

were routinely assayed by ALS Mongolia for gold.

- Au is determined

using a 25g fire assay fusion, cupelled to obtain a bead, and

digested with Aqua Regia, followed by an atomic absorption

spectroscopy (AAS) finish, with a lower detection limit

(LDL) of 0.01 ppm.

- All samples were

also submitted to ALS Mongolia for the 48-element package ME-ICP61

using a four-acid digest (considered to be an effective total

digest for the elements relevant to the MRE). Where copper is

over-range (>1% Cu), it is analysed by a second analytical

technique (Cu-OG62), which has a higher upper detection limit

(UDL) of 5% copper.

- Quality

assurance has been managed by insertion of appropriate Standards

(1:30 samples - suitable Ore Research Pty Ltd certified standards),

Blanks (1:30 samples), Duplicates (1:30 samples - ¼ core duplicate)

by Xanadu.

- Assay results

outside the optimal range for methods were re-analysed by

appropriate methods.

- Ore Research Pty

Ltd certified copper and gold standards have been implemented as a

part of QC procedures, as well as coarse and pulp blanks, and

certified matrix matched copper-gold standards.

- QC monitoring is

an active and ongoing processes on batch-by-batch basis by which

unacceptable results are re-assayed as soon as practicable.

- Prior to 2014:

Cu, Ag, Pb, Zn, As and Mo were routinely determined using a

three-acid-digestion of a 0.3g sub-sample followed by an AAS finish

(AAS21R) at SGS Mongolia. Samples were digested with nitric,

hydrochloric and perchloric acids to dryness before leaching with

hydrochloric acid to dissolve soluble salts and made to 15ml volume

with distilled water. The LDL for copper using this technique was

2ppm. Where copper was over-range (>1% Cu), it was analysed by a

second analytical technique (AAS22S), which has a higher upper

detection limit (UDL) of 5% copper. Gold analysis method was

essentially unchanged.

- Trenching

samples from 2001 to 2007 were analysed for 6 elements (Cu, Ag, Pb,

Zn, As and Mo) by SGS Mongolia using a three-acid-digestion of a

0.3g sub-sample followed by an AAS finish (AAS21R). Samples were

digested with nitric, hydrochloric and perchloric acids to dryness

before leaching with hydrochloric acid to dissolve soluble salts

and made to 15ml volume with distilled water. The LDL for copper

using this technique was 2ppm. Where copper was over-range (>1%

Cu), it was analysed by a second analytical technique (AAS22S),

which has a higher upper detection limit (UDL) of

5% copper. Gold analysis method was essentially unchanged.

|

|

Verification of sampling and assaying |

- All assay data

QA/QC is checked prior to loading into Xanadu’s Geobank data

base.

- The data is

managed by Xanadu geologists.

- The data base

and geological interpretation is managed by Xanadu.

- Check assays are

submitted to an umpire lab (SGS Mongolia) for duplicate

analysis.

- No twinned drill

holes exist.

- There have been

no adjustments to any of the assay data.

|

|

Location of data points |

- Diamond drill

holes have been surveyed with a differential global positioning

system (DGPS) to within 10cm accuracy.

- The grid system

used for the project is UTM WGS-84 Zone 49N

- Historically,

Eastman Kodak and Flexit electronic multi-shot downhole survey

tools have been used at Red Mountain to collect down hole azimuth

and inclination information for the majority of the diamond drill

holes. Single shots were typically taken every 30m to 50m during

the drilling process, and a multi-shot survey with readings every

3-5m are conducted at the completion of the drill hole. As these

tools rely on the earth’s magnetic field to measure azimuth, there

is some localised interference/inaccuracy introduced by the

presence of magnetite in some parts of the Red Mountain mineral

system. The extent of this interference cannot be quantified on a

reading-by-reading basis.

- More recently

(since September 2017), a north-seeking gyro has been employed by

the drilling crews on site (rented and operated by the drilling

contractor), providing accurate downhole orientation measurements

unaffected by magnetic effects. Xanadu have a permanent calibration

station setup for the gyro tool, which is routinely calibrated

every 2 weeks (calibration records are maintained and were

sighted).

- The project DTM

is based on 1 m contours from satellite imagery with an accuracy of

±0.1 m.

- Trenching

locations for trenches between 2001 and 2007 were located using a

handheld GPS.

|

|

Data spacing and distribution |

- Holes spacings

range from <50m spacings within the core of mineralisation to

+500m spacings for exploration drilling. Hole spacings can be

determined using the sections and drill plans provided.

- Holes range from

vertical to an inclination of -60 degrees depending on the attitude

of the target and the drilling method.

- The data spacing

and distribution is sufficient to establish anomalism and targeting

for porphyry Cu-Au, tourmaline breccia and epithermal target

types.

- Holes have been

drilled to a maximum of 1,300m vertical depth.

- The data spacing

and distribution is sufficient to establish geological and grade

continuity.

|

|

Orientation of data in relation to geological

structure |

- Drilling is

conducted in a predominantly regular grid to allow unbiased

interpretation and targeting.

- Scissor

drilling, as well as some vertical and oblique drilling, has been

used in key mineralised zones to achieve unbiased sampling of

interpreted structures and mineralised zones, and in particular to

assist in constraining the geometry of the mineralised hydrothermal

tourmaline-sulphide breccia domains.

|

|

Sample security |

- Samples are

delivered from the drill rig to the core shed twice daily and are

never left unattended at the rig.

- Samples are

dispatched from site in locked boxes transported on Xanadu company

vehicles to ALS lab in Ulaanbaatar.

- Sample shipment

receipt is signed off at the Laboratory with additional email

confirmation of receipt.

- Samples are then

stored at the lab and returned to a locked storage site.

|

|

Audits or reviews |

- Internal audits

of sampling techniques and data management are undertaken on a

regular basis, to ensure industry best practice is employed at all

times.

- External reviews

and audits have been conducted by the following groups:

- 2012: AMC

Consultants Pty Ltd. was engaged to conduct an Independent

Technical Report which reviewed drilling and sampling procedures.

It was concluded that sampling and data record was to an

appropriate standard.

- 2013: Mining

Associates Ltd. was engaged to conduct an Independent Technical

Report to review drilling, sampling techniques and QA/QC. Methods

were found to conform to international best practice.

|

1.2 JORC TABLE 1 - SECTION 2 - REPORTING

OF EXPLORATION RESULTS(Criteria in this section apply to

all succeeding sections).

|

Criteria |

Commentary |

|

Mineraltenementand

landtenurestatus |

- The Project

comprises 1 Mining Licence (MV-17129A).

- Xanadu now owns

90% of Vantage LLC, the 100% owner of the Oyut Ulaan mining

licence.

- The Mongolian

Minerals Law (2006) and Mongolian Land Law (2002) govern

exploration, mining and land use rights for the project.

|

|

Explorationdone byother

parties |

- Previous

exploration was conducted by Quincunx Ltd, Ivanhoe Mines Ltd and

Turquoise Hill Resources Ltd including extensive drilling, surface

geochemistry, geophysics, mapping.

|

|

Geology |

- The

mineralisation is characterised as porphyry copper-gold type.

- Porphyry

copper-gold deposits are formed from magmatic hydrothermal fluids

typically associated with felsic intrusive stocks that have

deposited metals as sulphides both within the intrusive and the

intruded host rocks. Quartz stockwork veining is typically

associated with sulphides occurring both within the quartz veinlets

and disseminated thought out the wall rock. Porphyry deposits are

typically large tonnage deposits ranging from low to high grade and

are generally mined by large scale open pit or underground bulk

mining methods. The deposits at Red Mountain are atypical in that

they are associated with intermediate intrusions of diorite to

quartz diorite composition; however, the deposits are in terms of

contained gold significant, and similar gold-rich porphyry

deposits.

|

|

Drill holeInformation |

- Diamond drill

holes are the principal source of geological and grade data for the

Project.

- See figures in

this ASX/TSX Announcement.

|

|

DataAggregation methods |

- A nominal

cut-off of 0.1% CuEq is used in copper dominant systems for

identification of potentially significant intercepts for reporting

purposes. Higher grade cut-offs are 0.3%, 0.6% and 1% CuEq.

- A nominal

cut-off of 0.1g/t AuEq is used in gold dominant systems like for

identification of potentially significant intercepts for reporting

purposes. Higher grade cut-offs are 0.3g/t, 0.6g/t and 1g/t

AuEq.

- Maximum

contiguous dilution within each intercept is 9m for 0.1%, 0.3%,

0.6% and 1% CuEq.

- Most of the

reported intercepts are shown in sufficient detail, including

maxima and subintervals, to allow the reader to make an assessment

of the balance of high and low grades in the intercept.

- Informing

samples have been composited to two metre lengths honouring the

geological domains and adjusted where necessary to ensure that no

residual sample lengths have been excluded (best fit).

- The copper

equivalent (CuEq) calculation represents the total

metal value for each metal, multiplied by the conversion factor,

summed and expressed in equivalent copper percentage with a

metallurgical recovery factor applied.

- Copper

equivalent (CuEq or eCu) grade values were calculated using the

following formula:

- CuEq = Cu + Au *

0.62097 * 0.8235,

- Gold Equivalent

(AuEq or eAu) grade values were calculated using the following

formula:

- AuEq = Au + Cu /

0.62097 * 0.8235

- Where: Cu =

copper grade (%); Au = gold grade (g/t); 0.62097 = conversion

factor (gold to copper); 0.8235 = relative recovery of gold to

copper (82.35%)

- The copper

equivalent formula was based on the following parameters (prices

are in USD):

- Copper price =

3.1 $/lb (or 6834 $/t)

- Gold price =

1320 $/oz

- Copper recovery

= 85%

- Gold recovery =

70%

- Relative

recovery of gold to copper = 70% / 85% = 82.35%.

|

|

Relationship between mineralisationon

widthsand

interceptlengths |

- Mineralised

structures are variable in orientation, and therefore drill

orientations have been adjusted from place to place in order to

allow intersection angles as close as possible to true widths.

- Exploration

results have been reported as an interval with 'from' and 'to'

stated in tables of significant economic intercepts. Tables clearly

indicate that true widths will generally be narrower than those

reported.

|

|

Diagrams |

- See figures in

this ASX/TSX Announcement.

|

|

BalancedReporting |

- Exploration

results have been reported at a range of cut-off grades, above a

minimum suitable for open pit mining, and above a minimum suitable

for underground mining.

|

|

Othersubstantiveexplorationdata |

- Extensive work

in this area has been done and is reported separately.

|

|

FurtherWork |

- The

mineralisation is open at depth and along strike.

- Current

estimates are restricted to those expected to be reasonable for

open pit mining. Limited drilling below this depth (-300m RL) shows

widths and grades potentially suitable for underground

extraction.

- Exploration

ongoing.

|

1.3 JORC TABLE 1 - SECTION 3 ESTIMATION

AND REPORTING OF MINERAL RESOURCES

Mineral Resources are not reported so this is

not applicable to this report.

1.4 JORC TABLE 1 -

SECTION 4 ESTIMATION AND REPORTING OF ORE RESERVES

Ore Reserves are not reported so this is not

applicable to this report.

1 ASX Announcement – Oyut Ulaan Exploration Update, 28th June

2017, ASX Announcement – XAM Quarterly Report Q2 2017 Final2 ASX

Announcement – Oyut Ulaan Exploration Update, 28th June 2017, ASX

Announcement – XAM Quarterly Report Q2 2017 Final3 ASX Announcement

– Oyut Ulaan Exploration Update – High Grade Massive Sulphide

Mineralisation Intersected, 19 July 20174 ASX Announcement – Oyut

Ulaan Exploration Update – High Grade Massive Sulphide

Mineralisation Intersected, 19 July 20175 XAM Quarterly Activities

Report, Quarter Ending 31 December 2016 and XAM Quarterly

Activities Report, Quarter Ending 31 March 20176 XAM Quarterly

Activities Report, Quarter Ending 31 December 2016 and XAM

Quarterly Activities Report, Quarter Ending 31 March 20177 ASX/TSX

Announcement 27 September 2022 – Broad, shallow gold zone at Red

Mountain

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/ab346f65-20aa-4c77-a3a2-c675bed03215

https://www.globenewswire.com/NewsRoom/AttachmentNg/a00507a3-2ea1-4e35-8824-10d7224137ea

https://www.globenewswire.com/NewsRoom/AttachmentNg/ac18cc1e-0f5c-4ecc-b5ce-08d2b2a3846a

https://www.globenewswire.com/NewsRoom/AttachmentNg/918d6130-0a43-4c4a-acbd-450f982947d6

https://www.globenewswire.com/NewsRoom/AttachmentNg/7a3262d9-fd1d-4ccf-8699-355a23bead0e

https://www.globenewswire.com/NewsRoom/AttachmentNg/6c230dd0-e983-4ca5-a0fe-e9e47ebda5a6

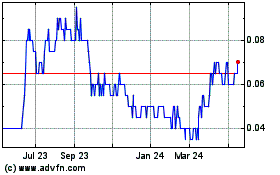

Xanadu Mines (TSX:XAM)

Historical Stock Chart

From Feb 2025 to Mar 2025

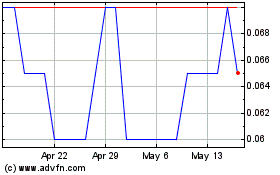

Xanadu Mines (TSX:XAM)

Historical Stock Chart

From Mar 2024 to Mar 2025