Petrus Resources Announces Credit Facility Increase and Approval For Normal Course Issuer Bid

June 21 2023 - 5:05PM

Petrus Resources Ltd. ("Petrus" or the "Company") (TSX: PRQ) is

pleased to announce an increase to its Senior Secured Credit

Facility (“Credit Facility”). Petrus’ lender, ATB Financial, has

completed their semi-annual borrowing base redetermination and have

agreed to increase the borrowing limit from $30.0 million to $45.0

million. The Credit Facility is payable on demand by the lender and

the next semi-annual review is scheduled on or before November 30,

2023.

The increase demonstrates confidence in the

Company and our strategic direction. A combination of debt

reduction and production growth have bolstered Petrus’ financial

position and strengthened our balance sheet, which will allow us to

continue to actively pursue our corporate objectives.

Petrus is also pleased to announce that the

Toronto Stock Exchange (the "TSX") has accepted Petrus' notice of

intention to commence a normal course issuer bid (the "NCIB"). The

NCIB allows Petrus to purchase up to 6,192,426 common shares

(representing 5% of Petrus' outstanding common shares as of June

15, 2023) over a period of twelve months commencing on June 28,

2023. On June 15, 2023, Petrus had 123,848,528 common shares

outstanding. The NCIB will expire no later than June 27, 2024.

Under the NCIB, common shares may be repurchased

on the open market through the facilities of the TSX, other

designated exchanges and/or alternative Canadian trading systems

and in accordance with the rules of the TSX governing normal course

issuer bids. The total number of common shares Petrus is permitted

to purchase through the facilities of the TSX is subject to a daily

purchase limit of 11,527 common shares, representing 25% of the

average daily trading volume of 46,110 common shares on the TSX

calculated for the six-month period ended May 31, 2023, however,

Petrus may make one block purchase per calendar week which exceeds

such daily repurchase restrictions. Any common shares that are

purchased under the NCIB will be cancelled upon their purchase by

Petrus.

Petrus believes that, at times, the prevailing

share price does not reflect the underlying value of the common

shares and the repurchase of its common shares for cancellation

represents an attractive opportunity to enhance Petrus' per share

metrics and thereby increase the underlying value of Petrus' common

shares to its shareholders.

ABOUT PETRUSPetrus is a public

Canadian oil and gas company focused on property exploitation,

strategic acquisitions and risk-managed exploration in Alberta.

For further information, please

contact:Ken GrayPresident and Chief Executive OfficerT:

403-930-0889E: kgray@petrusresources.com

ADVISORIES

Forward-Looking

Statements

Certain information regarding Petrus set forth

in this press release contains forward-looking statements within

the meaning of applicable securities law, that involve substantial

known and unknown risks and uncertainties. The use of any of the

words “anticipate”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “should”, “believe” and similar expressions are

intended to identify forward-looking statements. In particular,

forward-looking statements in this press release include statements

with respect to the Company's focus and strategy, our belief that

our financial position and strengthened balance sheet allows us to

actively pursue our corporate objectives, the Company’s commitment

to maximize shareholder value, review of the Company’s capital

strategy for the remainder of 2023, and the Company’s belief that

repurchase of its common shares for cancellation under the NCIB

represents an attractive opportunity to enhance Petrus' per share

metrics and the underlying value of its common shares. Such

statements represent Petrus’ internal views about future events.

These statements are only predictions and actual events or results

may differ materially. Although Petrus believes that the

expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results or achievement since

such expectations are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Many factors could cause Petrus’ actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Petrus.

The forward-looking statements contained herein

are based on certain key expectations and assumptions made by our

management, including: that we will continue to conduct our

operations in a manner consistent with past operations except as

specifically noted herein; the general continuance or improvement

in current industry conditions; the continuance of existing (and in

certain circumstances, the implementation of proposed) tax, royalty

and regulatory regimes; the ability of OPEC+ nations and other

major producers of crude oil to adjust crude oil production levels

and thereby manage world crude oil prices; the impact (and the

duration thereof) of the ongoing military actions between Russia

and Ukraine and related sanctions on commodity prices; expectations

and assumptions concerning prevailing and forecast commodity

prices, exchange rates, interest rates, inflation rates, applicable

royalty rates and tax laws and our ability to access capital and

the cost and terms thereof.

These forward-looking statements are subject to

certain risks and uncertainties, some of which are beyond the

Company’s control, including but not limited to, the impact of

general economic conditions; volatility in market prices for crude

oil, NGL and natural gas; industry conditions; currency, inflation,

and interest rate fluctuations; any future asset dispositions; the

utilization of financial derivative contracts, the inability of the

Company to reach agreements on further renewals of its credit

arrangements described herein; and other risks described in our

public filings, including our most recently filed annual

information form.

These forward-looking statements are made as of the date of this

press release and the Company disclaims any intent or obligation to

update any forward-looking statements, whether as a result of new

information, future events or results or otherwise, other than as

required by applicable securities laws.

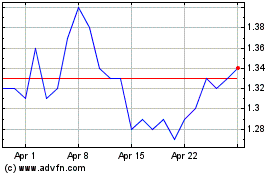

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

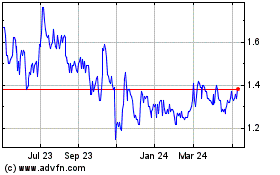

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Nov 2023 to Nov 2024