CanElson Announces Strong First Quarter Results, Additional Rig Builds and Increases Quarterly Dividend

May 09 2013 - 8:40AM

Marketwired Canada

CanElson Drilling Inc. (TSX:CDI) today announces strong financial results for

the first quarter ending March 31, 2013, plans additional rig builds and

declares first quarter dividend.

FIRST QUARTER 2013 SUMMARY (Compared with a year earlier)

-- Services revenue $72.3 million, up 16% from $62.5 million

-- EBITDA $27.4 million, consistent with 2012 of $27.4 million

-- Income attributable to shareholders of the Corporation $13.3 million,

down 15% from $15.6 million

-- EPS (diluted) $0.17, down 19% from $0.21

-- Weighted average diluted shares outstanding 76.8 million, up 4% from

74.0 million

-- First quarter dividend of $0.06 per share, up 20% from previous

quarterly rate of $0.05

-- United States segment revenue $29.1 million, up 14% from $25.5 million,

representing 40% of total service revenue for the quarter, up from 36%

CanElson maintained the same high Canadian utilization rate (spud to rig release

days) in the first quarter of 2013 and increased the rate of industry

outperformance. At a 73% utilization rate for Q1 2013, CanElson outperformed the

industry by 1.24 times, compared to 1.09 times for the first quarter of 2012.

In the USA, CanElson had a utilization rate of 86%, up 3% compared to the first

quarter of 2012. The total corporate utilization rate increased to 78% from 76%

in Q1 2012.

ADDITIONAL RIG BUILDS

Given the demand for our existing drilling rig fleet, relative industry

outperformance and based on customer requests we are finalizing additional rig

contracts, resulting in additional 2013 tele-double drilling rig construction

and deployment as follows:

-- Rig #37: Expected to be delivered Q3 2013

-- Rig #38: Expected to be delivered Q4 2013

-- Rig #39: Expected to be delivered Q4 2013

-- Rig #44: Long lead items will be procured in Q3 and Q4 of 2013

"During the quarter we generated growth in our operational activity levels while

the industry saw contraction. We believe that key factors in this success

include the extensive drilling and operational experience of our people and our

modern purpose built equipment." stated Randy Hawkings, President and CEO of

CanElson. "Our top decile financial and operating results combined with our

disciplined use of leverage have positioned us with the flexibility to increase

our dividend by 20% and add three new rig builds and long lead items for a

fourth drilling rig to our 2013 capital program."

Fleet deployment (by rigs)

North

Canada Texas Dakota

----------------------------------------------------------------------------

At March 31, 2013 23 (net 22) 12 (net 10.5) 4

At December 31, 2012 23 (net 22.5) 10 (net 8.5) 4

----------------------------------------------------------------------------

Change % Unchanged 20% Unchanged

----------------------------------------------------------------------------

Fleet deployment (by rigs)

Mexico

Drilling Mexico

(Leased) Service Total

----------------------------------------------------------------------------

At March 31, 2013 1 (net 0.5) 2 (net 1) 42 (net 38)

At December 31, 2012 1 (net 0.5) 2 (net 1) 40 (net 36.5)

----------------------------------------------------------------------------

Change % Unchanged Unchanged 5%

----------------------------------------------------------------------------

Gross fleet deployment (by %)

North

Canada Texas Dakota

----------------------------------------------------------------------------

At March 31, 2013 55% 28% 10%

At December 31, 2012 57% 25% 10%

----------------------------------------------------------------------------

Gross fleet deployment (by %)

Mexico

Drilling Mexico

(Leased) Service Total

----------------------------------------------------------------------------

At March 31, 2013 2% 5% 100%

At December 31, 2012 3% 5% 100%

----------------------------------------------------------------------------

OUTLOOK

Drilling Services

Once again, in the first quarter of 2013 CanElson outperformed the drilling

services industry in both Canada and the US amid continued subdued markets. We

believe that our strategy has uniquely positioned us to sustain relatively

strong profitability during the full drilling industry cycle. The key drivers

for our relative industry strength, profitability, and top decile financial

results are:

1. Strategically diversified operations in oil-weighted regions within two

balanced geographical segments, which provide diversity of earnings and

less seasonality while maintaining focus and operational efficiency

2. Standardized deep, modern rigs (average age of approximately 4.5 years

and average vertical rating of greater than 4,000 metres) allowing us to

outperform peers when considering the total costs of safely drilling

wells

3. A problem-solving culture as evidenced by our ability to service our

customers with performance drilling and innovative cost saving

initiatives such as our natural gas fuel and flare gas initiative with

CanGas

4. A history of developing mutually-beneficial partnerships and strong

client relationships with First Nations organizations, oil and gas

operators and the joint venture which leverages the established Mexican

footprint of Diavaz CanElson de Mexico, S.A. de C.V. ("DCM")

5. Prudent financial management, which allows the company to be

opportunistic at any point in the cycle

6. Operational excellence based on a culture of safety, as reflected by

superior drilling industry safety performance relative to benchmarks

from third party sources such as provincial and state workers

compensation boards and private insurance providers

At the time of this press release 93% of the drilling rig fleet is committed for

after spring break up based on current customer requests and 33% of the rigs

have long-term commitments with an average term slightly greater than one and a

half years.

Canada and North Dakota

Our customers in Canada and North Dakota are cautious with respect to their

capital spending programs as a result of the current volatility in oil and

natural gas commodity prices, increased price differentials, reduced access to

capital, transportation challenges, and global macro-economic concerns.

Consequently, we expect typical seasonal utilization through the remainder of

the year including a normal seasonal decrease in revenues for Q2 and Q3 of 2013.

There may also be some seasonal revenue rate pressure as less efficient

competitor drilling contractors try to obtain work with low revenue rates during

the spring and summer drilling seasons. We expect to maintain our competitive

edge and to continue to exceed average industry utilization levels due to our

strong relationships, modern drilling rig fleet, cost reduction initiatives

(e.g. CanGas) and long term contracts with customers.

Texas

CanElson has 28% of its fleet focused on oil directed drilling in the Permian

Basin in Texas. CanElson continues to grow its fully contracted fleet in this

basin even though the industry-wide rig count in this area has recently declined

due to some of the same macro-economic industry trends described above. We

anticipate that the current revenue rates for CanElson's Texas rigs will

continue for the balance of the year. We also expect to achieve capacity

utilization in excess of 90% for 2013 with downtime caused only by rig move

intervals and planned re-certifications of some drilling equipment.

Mexico

In Mexico, DCM is retrofitting and modernizing two recently acquired

tele-doubles at an estimated total investment of approximately $6.5 million per

rig. We are expecting to deploy one of the new rigs in Q2 and the other in Q3 of

2013. Although the timing for deployment is approximately one month behind our

initially anticipated start date, the process has allowed us to further develop

the local knowledge of DCM drilling management in rig assembly and design, which

we expect DCM to leverage in the future.

We have demonstrated our ability to successfully do business in Mexico. We

believe our performance in the region and our alignment with an experienced and

strong local partner (Grupo Diavaz, with 40 years of experience serving PEMEX)

provides an excellent opportunity for our joint venture DCM to expand its range

of services, including potentially expanding its drilling rig fleet beyond the

two rigs currently anticipated for deployment in Q2 and Q3 of 2013.

As previously disclosed, DCM's customer is transitioning to a production sharing

style of contract with PEMEX. Therefore, DCM is experiencing a temporary lull in

activity and we expect this to continue during the transition period. We are

anticipating that PEMEX and our customer will have completed this transition

period by the time the newly acquired rigs are retrofitted and deployed.

CanGas Solutions Inc.

During 2013, we expect to continue investment in our fleet of truck-hauled CNG

delivery trailers and to convert the primary diesel engines in our drilling rigs

to bi-fuel capacity based on customer requests.

Capital Availability and Capital Program

CanElson is well capitalized to take advantage of strategic opportunities with

net debt (debt less cash) at March 31, 2013 of only $17.5 million and $98.4

million available on our existing credit facilities. Funds flow continues to be

strong and will fully support our quarterly dividend rate of $0.06 per share as

well as a significant portion of the expected 2013 capital expenditures with the

remaining amount funded through undrawn loans and borrowings facilities.

Excluding $0.25 million of anticipated remaining capitalized development costs

for the new triple rig design, CanElson's total 2013 capital program is expected

to be as follows:

Drilling Services

------------------------------------------

Spare

equipment, Upgrades &

Capital facilities &

Expenditures overhead maintenance Expansion CanGas Total

----------------------------------------------------------------------------

Three months

ended March

31, 2013 $ 2.2 $ 2.6 $ 8.5 $ 2.9 $ 16.2

Anticipated

costs to

complete

2013 capital

projects 4.2 10.6 41.4 9.6 65.8

--------------------------------------------------------------

Total approved

costs for

2013 capital

projects $ 6.4 $ 13.2 $ 50.0 $ 12.5 $ 82.1

Previously

anticipated

costs for

2013 capital

projects (i) 5.7 11.5 16.5 12.0 45.7

--------------------------------------------------------------

Variance from

previously

anticipated

2013 capital

projects $ 0.6 $ 1.7 $ 33.5 $ 0.5 $ 36.4

(i) Refer to the MD&A dated February 28, 2013, noting that the numbers have been

reduced for the capital expenditures relating to DCM as it is now accounted for

using the equity method (see Financial Statements and MD&A reference below).

Our modern standardized fleet allows us to minimize capital expenditures on

maintenance and spare equipment. As in the past, construction of any additional

drilling rigs is pending receipt of long-term contracts. The 2013 total expected

capital expenditures of $82.1 million has been increased by $36.4 million from

the previously announced anticipated capital program at $45.7 million. The

increase includes $31.5 million for the completion of three additional rigs and

additional long lead components for a fourth rig, including top drives, based on

anticipation of finalizing long-term commitments. The remainder of the

incremental capital relates to additional recertification costs and incremental

spare equipment. During the first quarter of 2013, our expansion capital

expenditures represented over half of the capital expenditures required for the

completion and deployment of Rig #35 and #36 and long lead items for Rig #37.

The remaining anticipated costs to complete 2013 capital projects are allocated

as follows:

Drilling Services

$56.2 million capital program allocated as follows:

1. $39.1 million for the construction and completion of three tele-doubles

with top drives (relating to rigs #37, #38, and #39), long lead items

for one tele-double (rig #44) and $2.3 million on other growth capital;

and

2. Approximately $14.8 million for spares, shop upgrades and maintenance

capital.

CanGas

$9.6 million capital program allocated as follows:

1. Convert primary diesel engines on our drilling rigs to bi-fuel

capability to enable operation on a mixture of natural gas and diesel

fuel;

2. Expand our fleet of truck-hauled natural gas delivery trailers,

compression and conditioning equipment to meet both current and

anticipated demand;

3. Collect and leverage operating data to facilitate greater diesel fuel

displacement and better manage costs; and

4. Further research and development associated with our proprietary raw gas

conditioning technology to employ portable small-scale field facilities

to condition raw natural gas for use as fuel.

2013 Primary Objectives

Looking to the end of 2013, CanElson's primary objectives are to maintain and

strengthen its industry leading position by consistently providing operational

excellence and drilling efficiencies to its customers. With this focus we will

be well positioned to obtain strong customer commitments and capitalize on new

opportunities. Subject to obtaining customer commitments, we intend to carry out

the following activities that will enhance our competitive positioning:

-- Continue to expand our standard tele-double fleet

-- Expand our service offering in Mexico

-- Continue with strategic conversion of the diesel engines in our rig

fleet to bi-fuel capacity

-- Continue to form innovative long-term business relationships

Achieving these objectives will present new opportunities for CanElson, its

customers and shareholders.

DIVIDEND

On May 8, 2013, the Board of Directors declared a first quarter dividend of

$0.06 per share for the three month period ended March 31, 2013, payable on June

7, 2013 to shareholders of record at the close of business on May 29, 2013. The

dividend is an eligible dividend for Canadian tax purposes.

FINANCIAL SUMMARY

For the three months ended

March 31,

2013 2012 % change

----------------------------------------------------------------------------

Services revenue $ 72,277 $ 62,510 16%

EBITDA (i) $ 27,455 $ 27,473 0%

Share of profit unconsolidated joint venture 38 500 -92%

Net income attributable to shareholders of

the

Corporation $ 13,335 $ 15,609 -15%

Net income per share

Basic $ 0.17 $ 0.21 -19%

Diluted $ 0.17 $ 0.21 -19%

Funds flow (i) $ 23,964 $ 24,113 -1%

Gross Margin (services) (i) $ 32,397 $ 31,008 4%

Weighted average diluted shares outstanding 76,784 73,965 4%

----------------------------------------------------------------------------

(Tabular amounts are stated in thousands of Canadian dollars, except per share

amounts and rig operating days)

FINANCIAL STATEMENTS AND MD&A

This is the Corporation's first reporting period adopting IFRS 11 accounting for

Joint Arrangements. In accordance with IFRS 11 the transition date was January

1, 2013 with retroactive application to January 1, 2012 and, accordingly, the

comparative information for 2012 has been restated to conform to the

requirements of IFRS 11. The application of IFRS 11 has changed the

classification and subsequent accounting of the Corporation's investment in DCM,

which was classified as a jointly controlled entity and previously accounted for

using the proportionate consolidation method. Applying IFRS 11 requires that the

Corporation apply equity accounting for its 50% interest in DCM. Additional

information about the adoption of this standard and the Corporation's IFRSs

accounting policies is discussed in the Accounting Policies and Critical

Estimates section of the MD&A as well as in the notes to the March 31, 2013

condensed consolidated financial statements and the audited December 31, 2012

consolidated financial statements.

CanElson's complete unaudited interim financial results and Management's

Discussion and Analysis (MD&A) for the first quarter ended March 31, 2013 have

been filed on SEDAR and posted to the company's website at this link:

http://www.canelsondrilling.com/investor-relations/financial-reports

FORWARD-LOOKING INFORMATION

This press release contains certain statements or disclosures relating to

CanElson that are based on the expectations of CanElson as well as assumptions

made by and information currently available to CanElson which may constitute

forward-looking information under applicable securities laws. In particular,

this press release contains forward-looking information related to: intention to

construct three additional rigs in 2013; our belief that our strategy positions

us to sustain profitability during the full drilling industry cycle; expected

typical seasonal utilization and revenue rate effects through the remainder of

the year; in Canada and North Dakota expectation to continue to exceed average

industry utilization levels; in Texas current revenue rate anticipated to

continue and to achieve capacity utilization in excess of 90% for the remainder

of 2013; expected deployment of rigs in Mexico in Q2 and Q3 of 2013 and

estimated cost of these rigs; our belief that our performance in the region and

our alignment with an experienced local partner provides an opportunity for DCM

to expand its drilling services in the region; the temporary lull in our

activity will be limited only until the newly acquired rigs are re-deployed; our

expectation to continue investment in the fleet of truck-hauled CNG delivery

trailers and to convert the primary diesel engines in our drilling rigs to

bi-fuel capacity; expected 2013 capital programs and anticipated cost to

complete 2013 capital program; and our primary objectives. Such forward looking

information involves material assumptions and known and unknown risks and

uncertainties, certain of which are beyond CanElson's control. Many factors

could cause the performance or achievement by CanElson to be materially

different from any future results, performance or achievements that may be

expressed or implied by such forward looking information. CanElson's Annual

Information Form and other documents filed with securities regulatory

authorities (accessible through the SEDAR website at www.sedar.com) describe the

risks, material assumptions and other factors that could influence actual

results and which are incorporated herein by reference. CanElson disclaims any

intention or obligation to publicly update or revise any forward looking

information, whether as a result of new information, future events or otherwise,

except as may be expressly required by applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

CanElson Drilling Inc.

Randy Hawkings

President and CEO

(403) 266-3922

CanElson Drilling Inc.

Robert Skilnick

Chief Financial Officer

(403) 266-3922

www.canelsondrilling.com

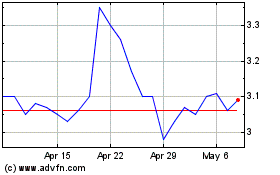

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

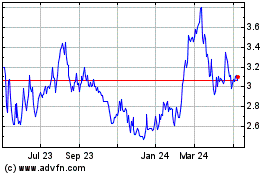

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Jul 2023 to Jul 2024