1 PRESS RELEASE V2X Delivers Solid First Quarter Results First Quarter 2024 Summary • Revenue up 7.1% y/y to $1.01 billion • Operating income of $30.3 million; adjusted operating income1 of $62.9 million • Net income of $1.1 million, up $18.6 million y/y • Adjusted EBITDA1 of $69.1 million with a margin1 of 6.8% • Diluted EPS of $0.04; Adjusted diluted EPS1 of $0.90 • Selected to provide technology solutions for threat detection and response to Chemical, Biological, Radiological, & Nuclear hazards • Awarded position on U.S. Navy’s Global Contingency Services Multiple Award Contract III valued up to $2 billion 2024 Guidance: • Reaffirming full-year 2024 guidance MCLEAN, Va., May 7, 2024 — V2X, Inc. (NYSE:VVX) announced first quarter 2024 financial results. “V2X reported a solid start to 2024 with revenue up 7% year-over-year,” said Chuck Prow, President and Chief Executive Officer of V2X. “Our leading growth indicators remain strong with a robust backlog of $12.6 billion and a pipeline of nearer-term new business opportunities of $25 billion. V2X continues to advance our transformation to deliver enhanced capabilities in an expanding market. Given our first quarter results and trends we are seeing in our business, we are reaffirming our 2024 guidance.” “We continue to witness growth in the Pacific or INDOPACOM, with our presence in the region proving to be a key channel to support increasing mission requirements,” said Mr. Prow. “Revenue in the region was up 7% year- over-year. We continue to expand our scope of services in the region, which includes a new award to deploy an assured and protected private 5G communications solution and enable smart logistics in the Philippines. Additionally, our position in the Middle East or CENTCOM continues to expand with revenue up 22% year-over- year. As the largest services provider to the Department of Defense in the Middle East, V2X stands ready to support our clients mission requirements.” Mr. Prow continued, “V2X remains focused on differentiated operational technologies that fuse the digital and physical aspects of our clients' missions. This differentiation is driving growth and was recently demonstrated Exhibit 99.1

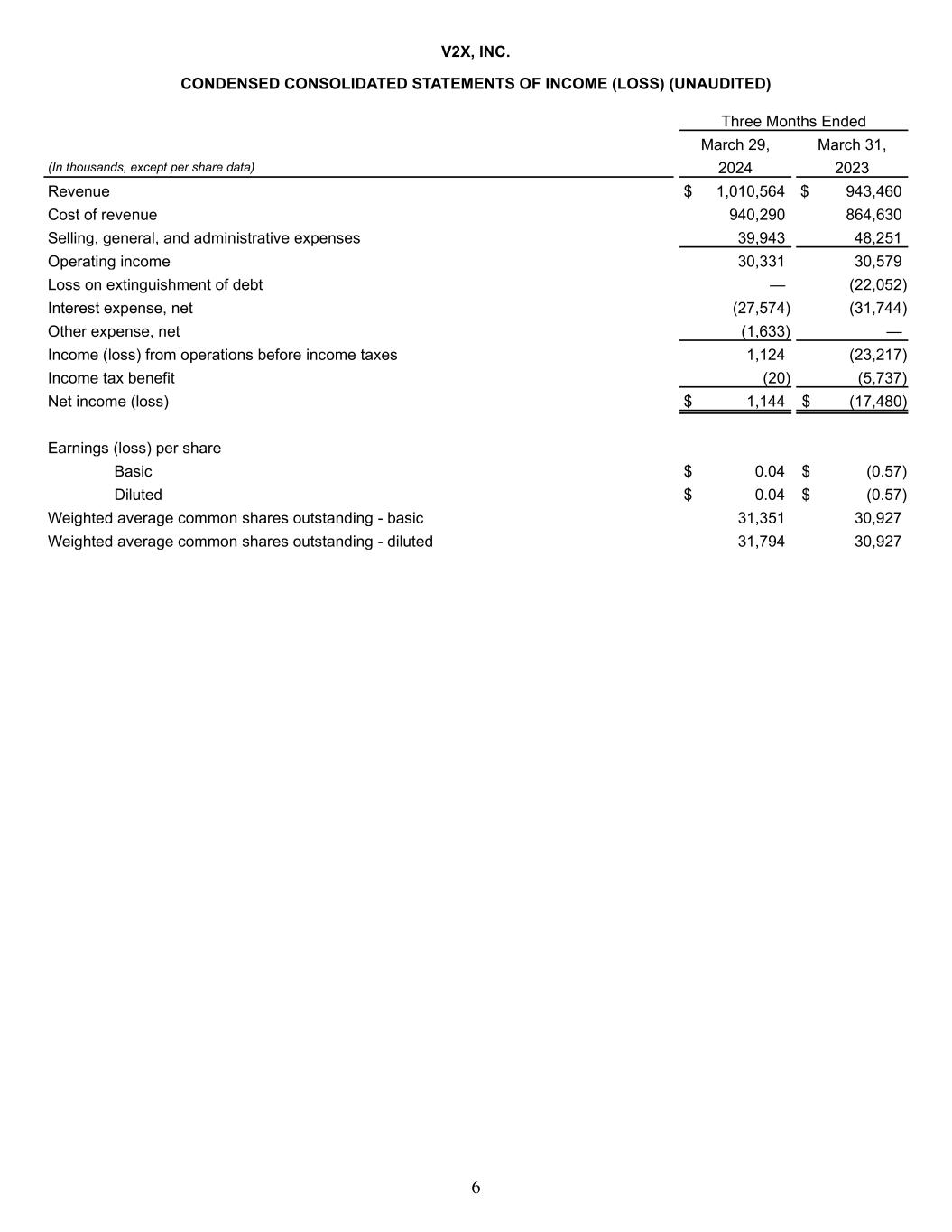

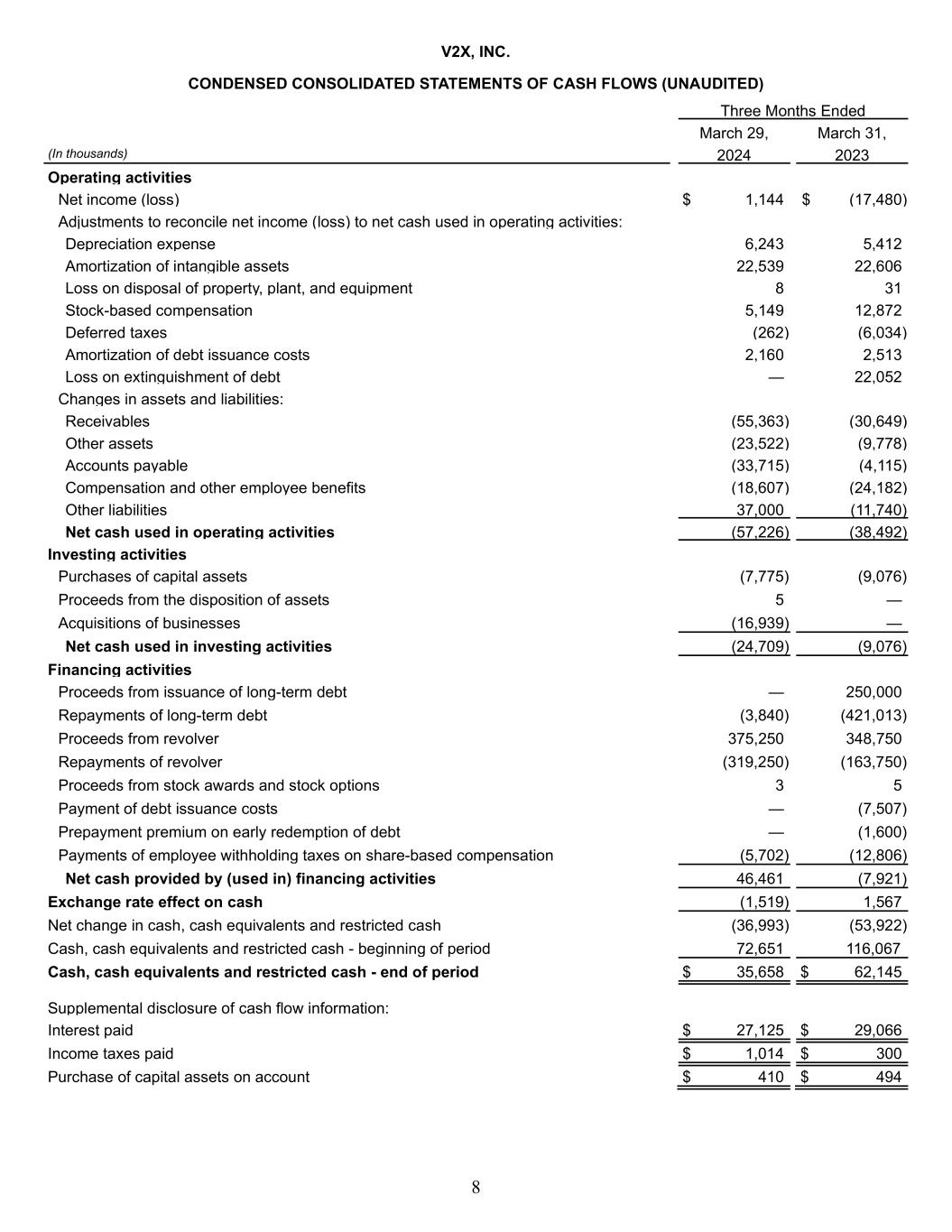

2 through contract awards valued at $75 million to provide technology solutions for threat detection and response to Chemical, Biological, Radiological, and Nuclear (CBRN) hazards. This work expanded from a prototype effort to a new sole source award for the production, upgrade, and fielding of cutting-edge systems at overseas operational locations. Under the contract, V2X is the lead systems integrator for CBRN Support to Command and Control (CSC2) program. CSC2 is the program of record for the integration of CBRN, which will link sensors together to provide integrated situational awareness about potential hazards to inform end user decision making.” Mr. Prow concluded, “I’m pleased to announce that V2X was selected as a prime contractor for the U.S. Navy’s Global Contingency Services Multiple Award Contract III (GCSMAC III). The contract is valued at up to $2 billion, was awarded by the Naval Facilities Engineering Command, Pacific in Hawaii, and enables V2X to provide critical support services for a wide range of scenarios, including natural disasters, humanitarian efforts, and military actions. The total contract value for GCSMAC III was increased significantly from the prior iteration, which reached its ceiling value of $900 million. Importantly, V2X was the leading provider of services under the prior iteration of the contract, winning $300 million in task orders.” First Quarter 2024 Results “V2X reported revenue of $1.0 billion in the quarter, which represents 7.1% year-over-year growth,” said Shawn Mural, Senior Vice President and Chief Financial Officer. “Revenue growth in the quarter was achieved through continued expansion of existing business in the Pacific and Middle East regions, as well as new programs. Growth in the Pacific was driven by continued expansion of scope and services, particularly at Kwajalein Atoll. Growth in the Middle East was driven primarily by expansion in Qatar and the ramp up of our longer-term Saudi Aviation Support & Training program.” “For the quarter, the Company reported operating income of $30.3 million and adjusted operating income1 of $62.9 million. Adjusted EBITDA1 was $69.1 million with a margin of 6.8%. First quarter GAAP diluted EPS was $0.04, due primarily to merger and integration related costs, amortization of acquired intangible assets, and interest expense. Adjusted diluted EPS1 for the quarter was $0.90.” “An important attribute of our business is the ability to generate strong cash flow with low capital expenditure requirements. We expect to deliver full-year adjusted net cash provided by operating activities1 of $145 million to $165 million, representing 120% adjusted net income conversion1 at the mid-point. During the quarter, net cash used by operating activities was $57.2 million, in line with our historical pattern and reflective of a receivable delay that collected shortly after the quarter closed. Adjusted net cash used by operating activities1 was $83.5 million, adding back approximately $5.8 million of M&A and integration costs and removing the contribution of the master accounts receivable purchase or MARPA facility of $32.1 million.”

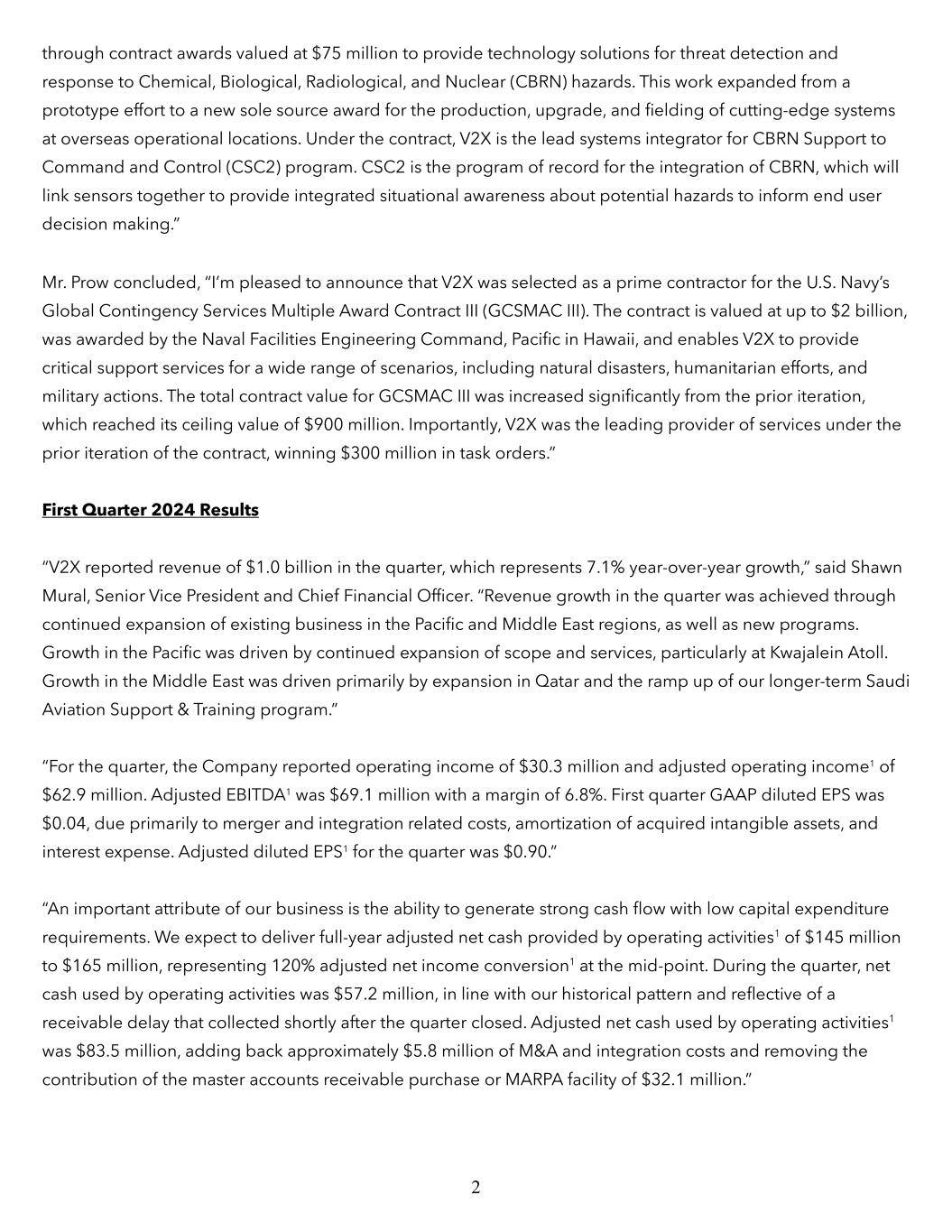

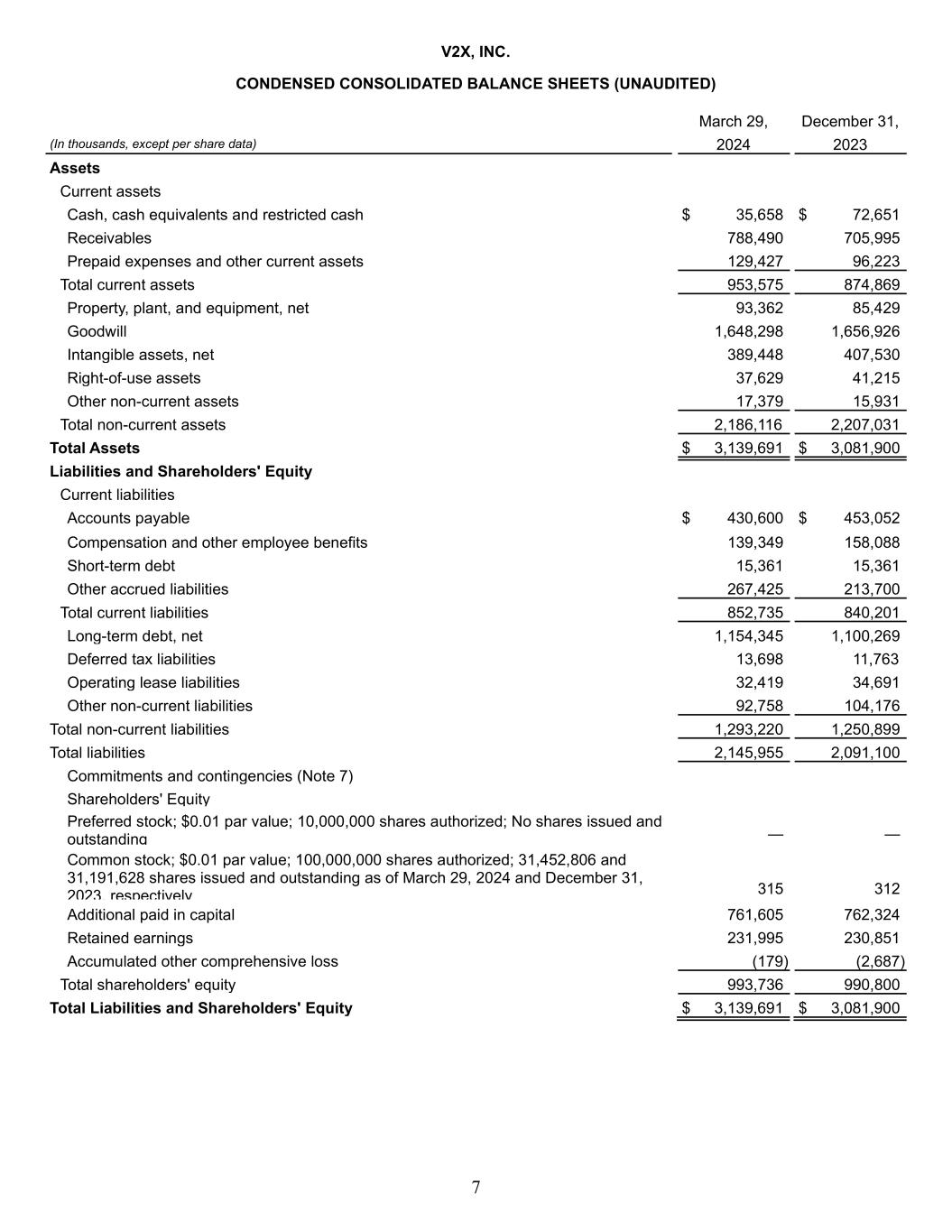

3 “At the end of the quarter, net debt for V2X was $1,173 million. Net leverage ratio1was 3.5x, down from 3.8x at the end of the first quarter 2023. We expect to achieve a net leverage ratio of 3.0x, or below, by the end of 2024.” “Total backlog as of March 29, 2024, was $12.6 billion. Funded backlog was $2.7 billion. Bookings in the quarter were $0.8 billion, resulting in a trailing twelve-month book-to-bill of 1.2x.” Reaffirming 2024 Guidance Mr. Mural concluded, “We are pleased with the performance across our business and start to the year. Our teams continue to execute, driving expansion on existing operations and phasing in of new programs. As such, the Company is reaffirming its guidance for 2024.” Guidance for 2024 remains as follows: $ millions, except for per share amounts 2024 Guidance 2024 Mid-Point Revenue $4,100 $4,200 $4,150 Adjusted EBITDA1 $300 $315 $308 Adjusted Diluted Earnings Per Share1 $3.85 $4.20 $4.03 Adjusted Net Cash Provided by Operating Activities1 $145 $165 $155 The Company is not providing a quantitative reconciliation with respect to this forward-looking non-GAAP measure in reliance on the “unreasonable efforts” exception set forth in SEC rules because certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. For example, unusual, one-time, non-ordinary, or non-recurring costs, which relate to M&A, integration and related activities cannot be reasonably estimated. Forward-looking statements are based upon current expectations and are subject to factors that could cause actual results to differ materially from those suggested here, including those factors set forth in the Safe Harbor Statement below. First Quarter Conference Call Management will conduct a conference call with analysts and investors at 8:00 a.m. ET on Tuesday, May 7, 2024. U.S.-based participants may dial in to the conference call at 877-407-3982, while international participants may dial 201-493-6780. A live webcast of the conference call as well as an accompanying slide presentation will be available here: https://app.webinar.net/24war3pJ8n7 A replay of the conference call will be posted on the V2X website shortly after completion of the call and will be available for one year. A telephonic replay will also be available through May 21, 2024, at 844-512-2921 (domestic) or 412-317-6671 (international) with passcode 13745566.

4 Presentation slides that will be used in conjunction with the conference call will also be made available online in advance on the “investors” section of the company’s website at https://gov2x.com/. V2X recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under the U.S. Securities and Exchange Commission (“SEC”) Regulation FD. Footnotes: 1 See "Key Performance Indicators and Non-GAAP Financial Measures" for descriptions and reconciliations. About V2X V2X builds smart solutions designed to integrate physical and digital infrastructure – by aligning people, actions, and outputs. Our lifecycle solutions improve security, streamline logistics, and enhance readiness. The Company delivers a comprehensive suite of integrated solutions across the operations and logistics, aerospace, training, and technology markets to national security, defense, civilian and international clients. Our global team of approximately 16,000 employees brings innovation to every point in the mission lifecycle, from preparation to operations, to sustainment, as it tackles the most complex challenges with agility, grit, and dedication. Contact Information Investor Contact Media Contact Mike Smith, CFA Angelica Spanos Deoudes IR@goV2X.com Communications@goV2X.com 719-637-5773 571-338-5195 Safe Harbor Statement Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the "Act"): Certain material presented herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, all the statements and items listed under "2024 Guidance" above and other assumptions contained therein for purposes of such guidance, other statements about our 2024 performance outlook, revenue, contract opportunities, and any discussion of future operating or financial performance. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “could,” “potential,” “continue” or similar terminology. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management.

5 These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, many of which are outside our management’s control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company's historical experience and our present expectations or projections. For a discussion of some of the risks and uncertainties that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the SEC. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

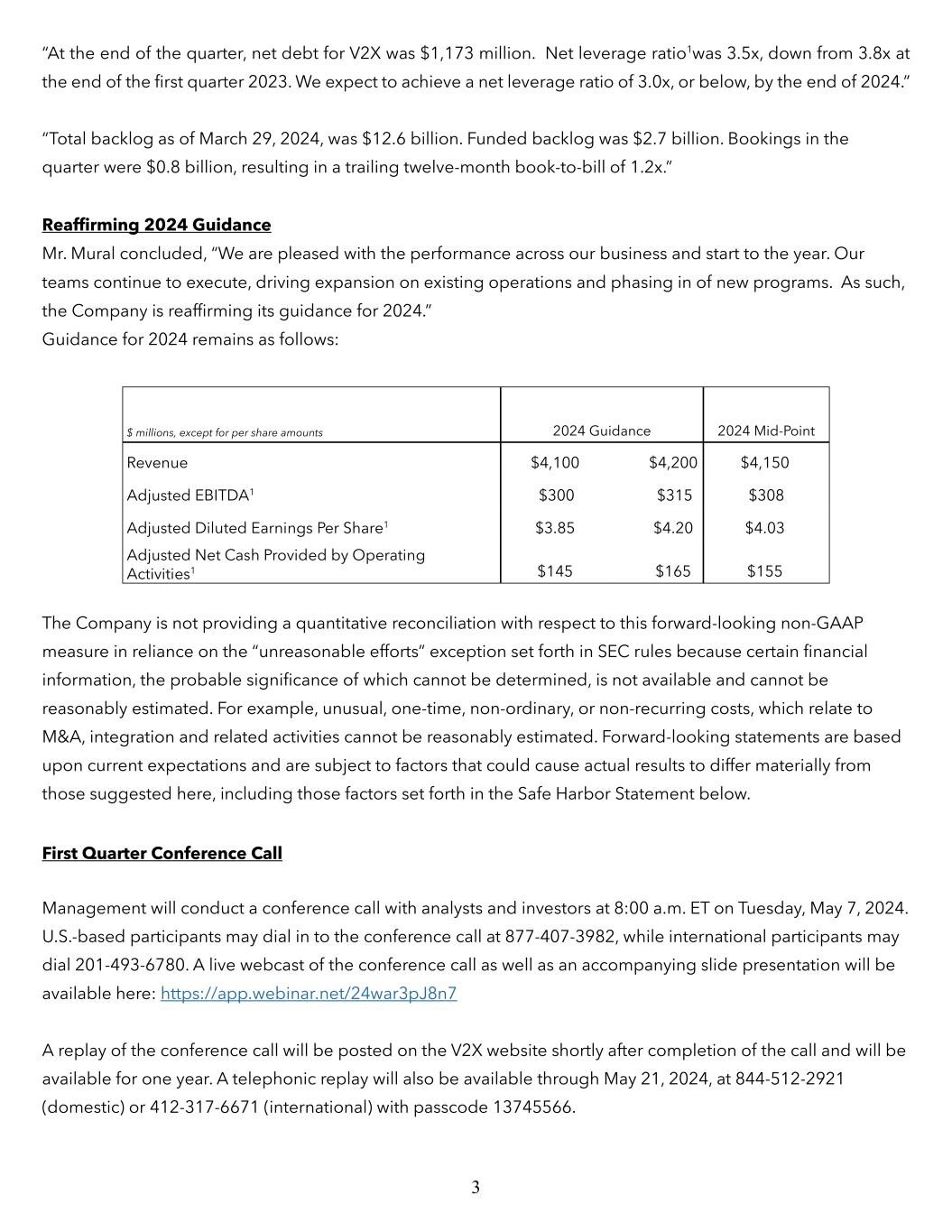

6 V2X, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) (UNAUDITED) Three Months Ended March 29, March 31, (In thousands, except per share data) 2024 2023 Revenue $ 1,010,564 $ 943,460 Cost of revenue 940,290 864,630 Selling, general, and administrative expenses 39,943 48,251 Operating income 30,331 30,579 Loss on extinguishment of debt — (22,052) Interest expense, net (27,574) (31,744) Other expense, net (1,633) — Income (loss) from operations before income taxes 1,124 (23,217) Income tax benefit (20) (5,737) Net income (loss) $ 1,144 $ (17,480) Earnings (loss) per share Basic $ 0.04 $ (0.57) Diluted $ 0.04 $ (0.57) Weighted average common shares outstanding - basic 31,351 30,927 Weighted average common shares outstanding - diluted 31,794 30,927

7 V2X, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) March 29, December 31, (In thousands, except per share data) 2024 2023 Assets Current assets Cash, cash equivalents and restricted cash $ 35,658 $ 72,651 Receivables 788,490 705,995 Prepaid expenses and other current assets 129,427 96,223 Total current assets 953,575 874,869 Property, plant, and equipment, net 93,362 85,429 Goodwill 1,648,298 1,656,926 Intangible assets, net 389,448 407,530 Right-of-use assets 37,629 41,215 Other non-current assets 17,379 15,931 Total non-current assets 2,186,116 2,207,031 Total Assets $ 3,139,691 $ 3,081,900 Liabilities and Shareholders' Equity Current liabilities Accounts payable $ 430,600 $ 453,052 Compensation and other employee benefits 139,349 158,088 Short-term debt 15,361 15,361 Other accrued liabilities 267,425 213,700 Total current liabilities 852,735 840,201 Long-term debt, net 1,154,345 1,100,269 Deferred tax liabilities 13,698 11,763 Operating lease liabilities 32,419 34,691 Other non-current liabilities 92,758 104,176 Total non-current liabilities 1,293,220 1,250,899 Total liabilities 2,145,955 2,091,100 Commitments and contingencies (Note 7) Shareholders' Equity Preferred stock; $0.01 par value; 10,000,000 shares authorized; No shares issued and outstanding — — Common stock; $0.01 par value; 100,000,000 shares authorized; 31,452,806 and 31,191,628 shares issued and outstanding as of March 29, 2024 and December 31, 2023, respectively 315 312 Additional paid in capital 761,605 762,324 Retained earnings 231,995 230,851 Accumulated other comprehensive loss (179) (2,687) Total shareholders' equity 993,736 990,800 Total Liabilities and Shareholders' Equity $ 3,139,691 $ 3,081,900

8 V2X, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) Three Months Ended March 29, March 31, (In thousands) 2024 2023 Operating activities Net income (loss) $ 1,144 $ (17,480) Adjustments to reconcile net income (loss) to net cash used in operating activities: Depreciation expense 6,243 5,412 Amortization of intangible assets 22,539 22,606 Loss on disposal of property, plant, and equipment 8 31 Stock-based compensation 5,149 12,872 Deferred taxes (262) (6,034) Amortization of debt issuance costs 2,160 2,513 Loss on extinguishment of debt — 22,052 Changes in assets and liabilities: Receivables (55,363) (30,649) Other assets (23,522) (9,778) Accounts payable (33,715) (4,115) Compensation and other employee benefits (18,607) (24,182) Other liabilities 37,000 (11,740) Net cash used in operating activities (57,226) (38,492) Investing activities Purchases of capital assets (7,775) (9,076) Proceeds from the disposition of assets 5 — Acquisitions of businesses (16,939) — Net cash used in investing activities (24,709) (9,076) Financing activities Proceeds from issuance of long-term debt — 250,000 Repayments of long-term debt (3,840) (421,013) Proceeds from revolver 375,250 348,750 Repayments of revolver (319,250) (163,750) Proceeds from stock awards and stock options 3 5 Payment of debt issuance costs — (7,507) Prepayment premium on early redemption of debt — (1,600) Payments of employee withholding taxes on share-based compensation (5,702) (12,806) Net cash provided by (used in) financing activities 46,461 (7,921) Exchange rate effect on cash (1,519) 1,567 Net change in cash, cash equivalents and restricted cash (36,993) (53,922) Cash, cash equivalents and restricted cash - beginning of period 72,651 116,067 Cash, cash equivalents and restricted cash - end of period $ 35,658 $ 62,145 Supplemental disclosure of cash flow information: Interest paid $ 27,125 $ 29,066 Income taxes paid $ 1,014 $ 300 Purchase of capital assets on account $ 410 $ 494

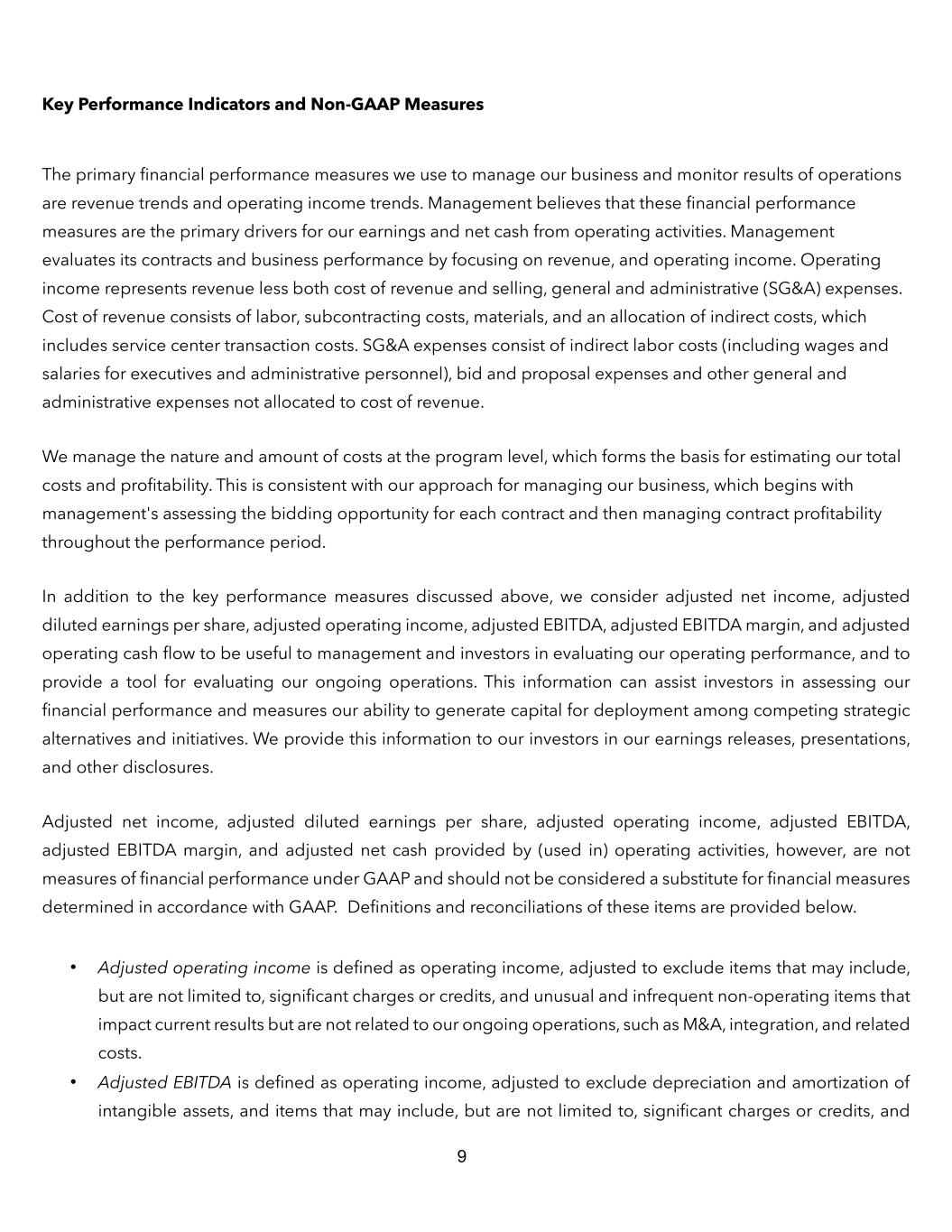

9 Key Performance Indicators and Non-GAAP Measures The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. Management believes that these financial performance measures are the primary drivers for our earnings and net cash from operating activities. Management evaluates its contracts and business performance by focusing on revenue, and operating income. Operating income represents revenue less both cost of revenue and selling, general and administrative (SG&A) expenses. Cost of revenue consists of labor, subcontracting costs, materials, and an allocation of indirect costs, which includes service center transaction costs. SG&A expenses consist of indirect labor costs (including wages and salaries for executives and administrative personnel), bid and proposal expenses and other general and administrative expenses not allocated to cost of revenue. We manage the nature and amount of costs at the program level, which forms the basis for estimating our total costs and profitability. This is consistent with our approach for managing our business, which begins with management's assessing the bidding opportunity for each contract and then managing contract profitability throughout the performance period. In addition to the key performance measures discussed above, we consider adjusted net income, adjusted diluted earnings per share, adjusted operating income, adjusted EBITDA, adjusted EBITDA margin, and adjusted operating cash flow to be useful to management and investors in evaluating our operating performance, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. We provide this information to our investors in our earnings releases, presentations, and other disclosures. Adjusted net income, adjusted diluted earnings per share, adjusted operating income, adjusted EBITDA, adjusted EBITDA margin, and adjusted net cash provided by (used in) operating activities, however, are not measures of financial performance under GAAP and should not be considered a substitute for financial measures determined in accordance with GAAP. Definitions and reconciliations of these items are provided below. • Adjusted operating income is defined as operating income, adjusted to exclude items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items that impact current results but are not related to our ongoing operations, such as M&A, integration, and related costs. • Adjusted EBITDA is defined as operating income, adjusted to exclude depreciation and amortization of intangible assets, and items that may include, but are not limited to, significant charges or credits, and

10 unusual and infrequent non-operating items that impact current results but are not related to our ongoing operations, such as M&A, integration, and related costs. • Adjusted EBITDA margin is defined as adjusted EBITDA divided by revenue. • Adjusted net income is defined as net income, adjusted to exclude items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items that impact current results but are not related to our ongoing operations, such as M&A, integration and related costs, amortization of acquired intangible assets, amortization of debt issuance costs, and loss on extinguishment of debt. • Adjusted diluted earnings per share is defined as adjusted net income divided by the weighted average diluted common shares outstanding. • Cash interest expense, net is defined as interest expense, net adjusted to exclude amortization of debt issuance costs. • Adjusted net cash provided by (used in) operating activities or adjusted operating cash flow is defined as net cash provided by (or used in) operating activities adjusted to exclude infrequent non-operating items, such as M&A payments and related costs. • Net leverage ratio is defined as net debt (or total debt less unrestricted cash) divided by trailing twelve- month (TTM) bank EBITDA.

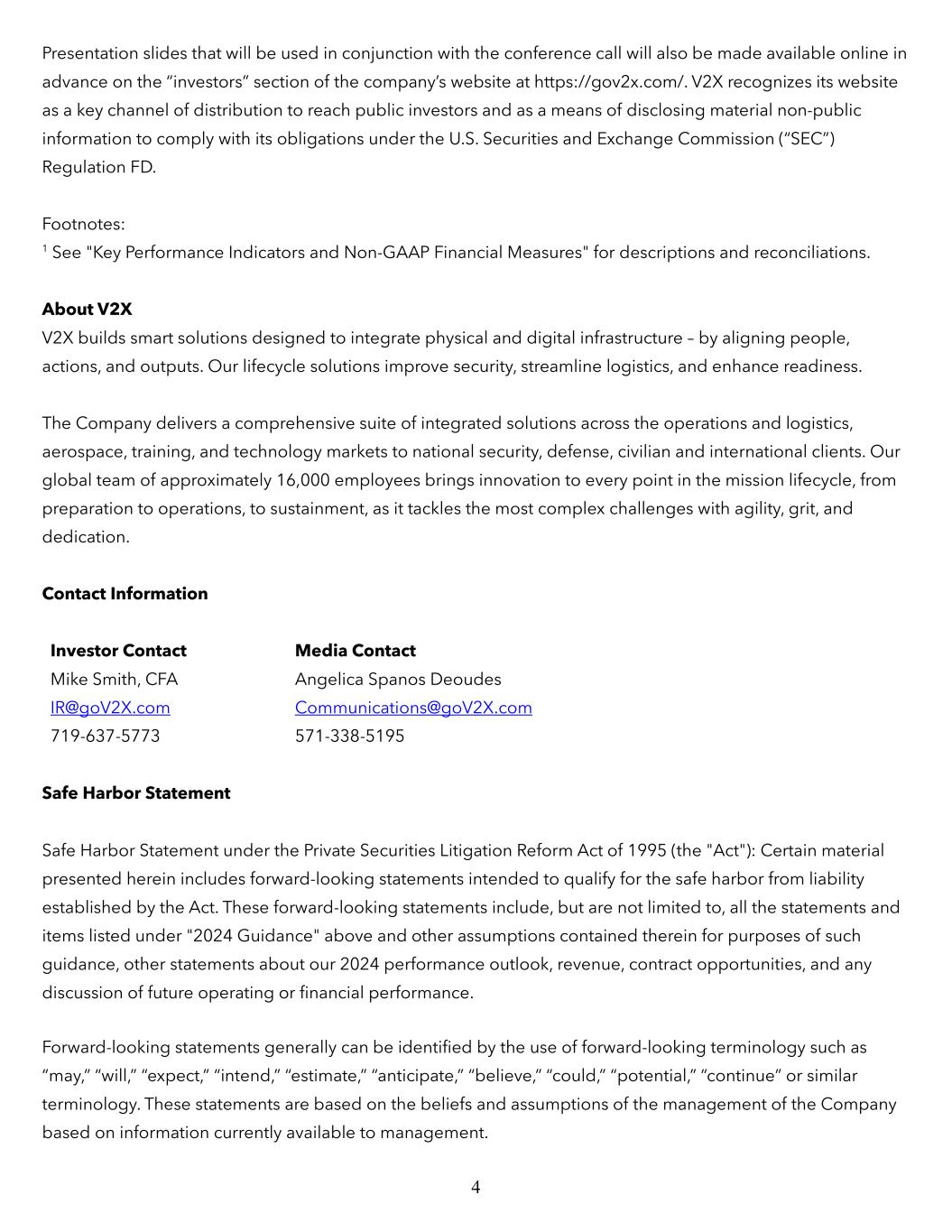

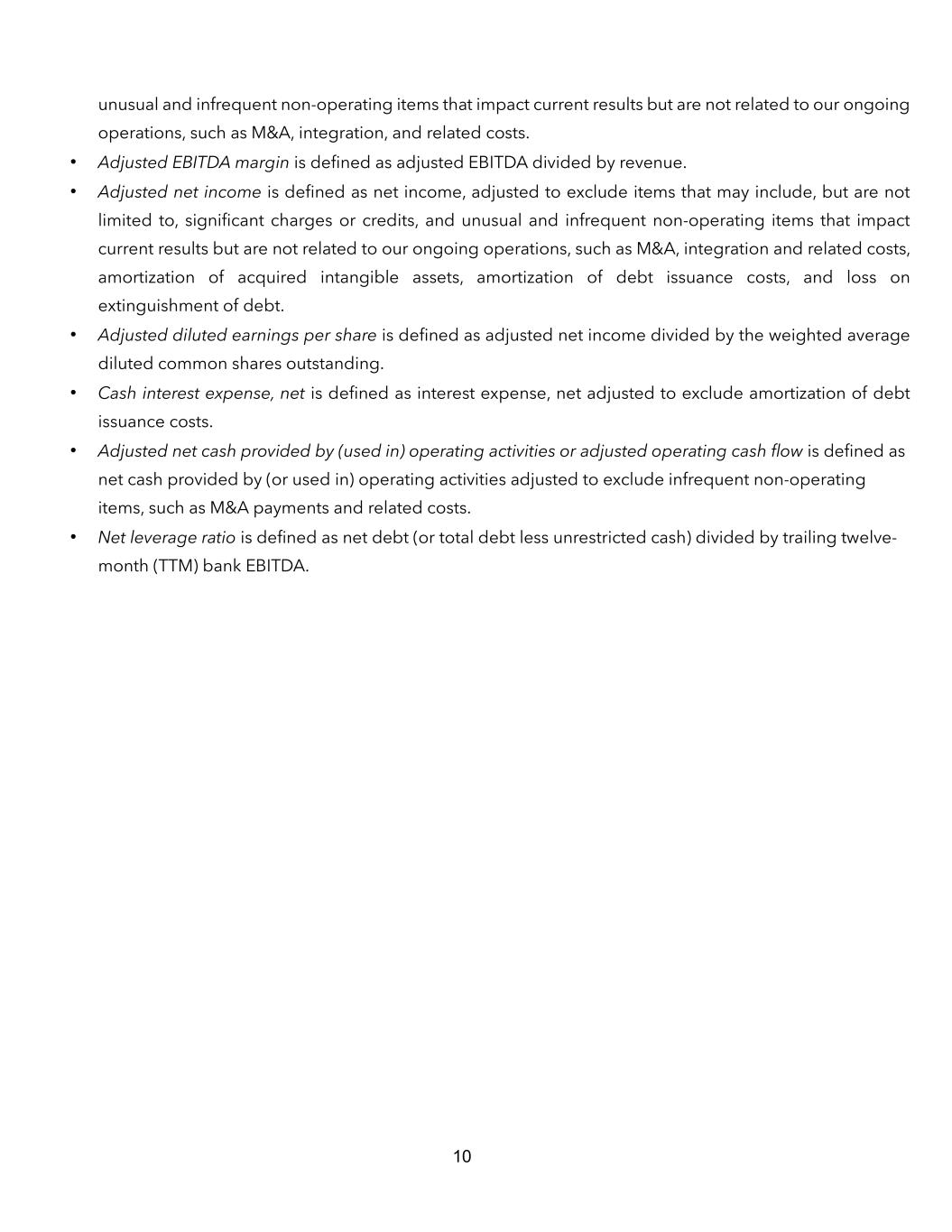

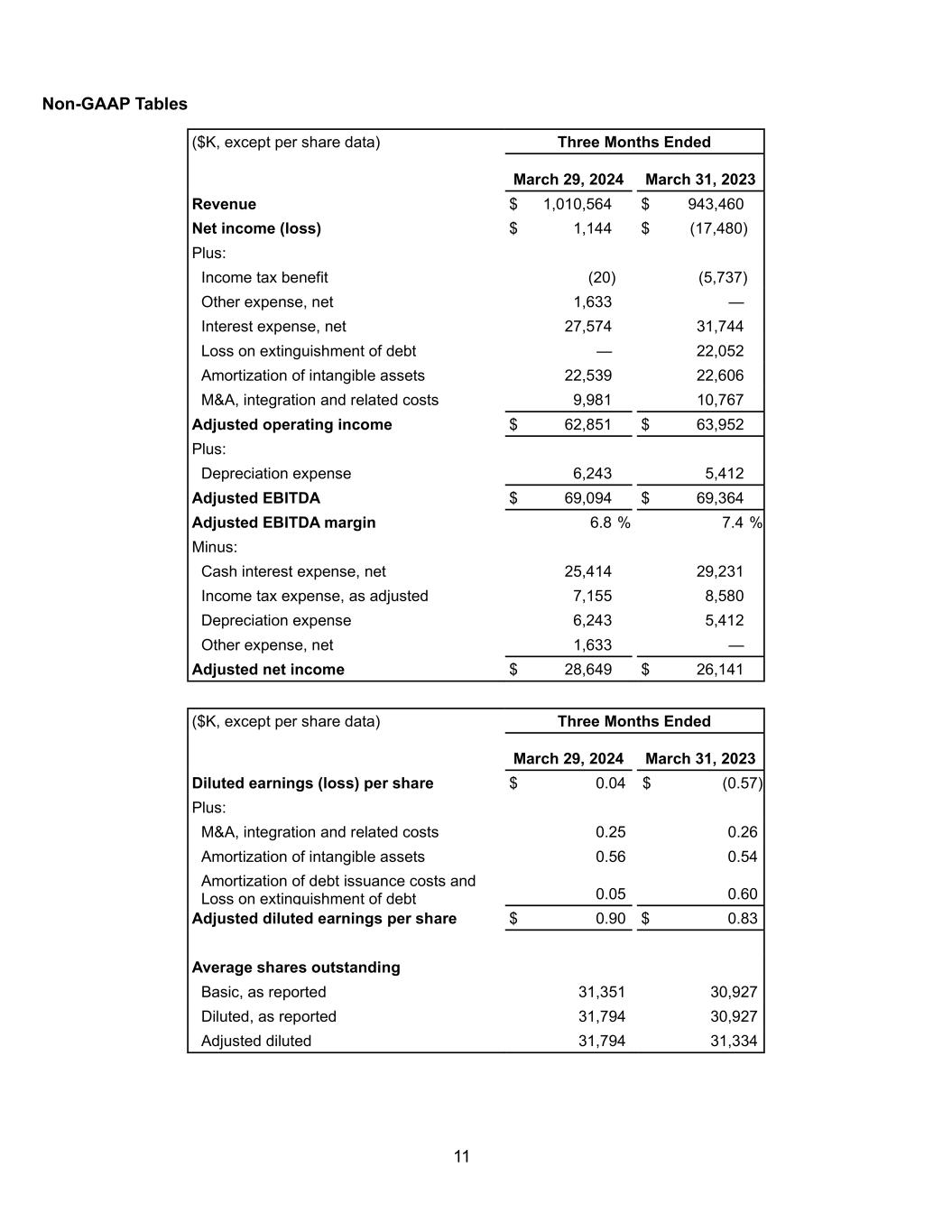

11 Non-GAAP Tables ($K, except per share data) Three Months Ended March 29, 2024 March 31, 2023 Revenue $ 1,010,564 $ 943,460 Net income (loss) $ 1,144 $ (17,480) Plus: Income tax benefit (20) (5,737) Other expense, net 1,633 — Interest expense, net 27,574 31,744 Loss on extinguishment of debt — 22,052 Amortization of intangible assets 22,539 22,606 M&A, integration and related costs 9,981 10,767 Adjusted operating income $ 62,851 $ 63,952 Plus: Depreciation expense 6,243 5,412 Adjusted EBITDA $ 69,094 $ 69,364 Adjusted EBITDA margin 6.8 % 7.4 % Minus: Cash interest expense, net 25,414 29,231 Income tax expense, as adjusted 7,155 8,580 Depreciation expense 6,243 5,412 Other expense, net 1,633 — Adjusted net income $ 28,649 $ 26,141 ($K, except per share data) Three Months Ended March 29, 2024 March 31, 2023 Diluted earnings (loss) per share $ 0.04 $ (0.57) Plus: M&A, integration and related costs 0.25 0.26 Amortization of intangible assets 0.56 0.54 Amortization of debt issuance costs and Loss on extinguishment of debt 0.05 0.60 Adjusted diluted earnings per share $ 0.90 $ 0.83 Average shares outstanding Basic, as reported 31,351 30,927 Diluted, as reported 31,794 30,927 Adjusted diluted 31,794 31,334

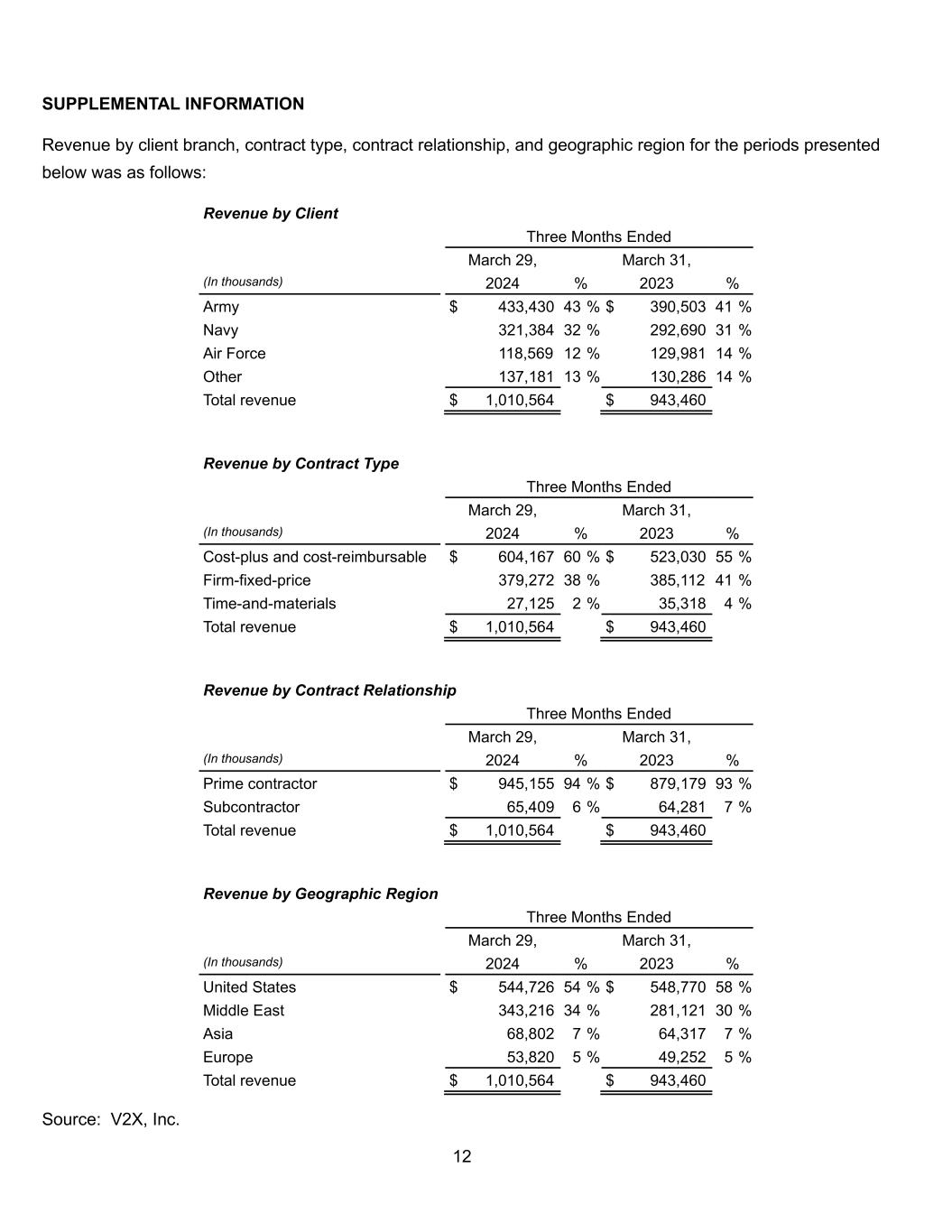

12 SUPPLEMENTAL INFORMATION Revenue by client branch, contract type, contract relationship, and geographic region for the periods presented below was as follows: Revenue by Client Three Months Ended March 29, March 31, (In thousands) 2024 % 2023 % Army $ 433,430 43 % $ 390,503 41 % Navy 321,384 32 % 292,690 31 % Air Force 118,569 12 % 129,981 14 % Other 137,181 13 % 130,286 14 % Total revenue $ 1,010,564 $ 943,460 Revenue by Contract Type Three Months Ended March 29, March 31, (In thousands) 2024 % 2023 % Cost-plus and cost-reimbursable $ 604,167 60 % $ 523,030 55 % Firm-fixed-price 379,272 38 % 385,112 41 % Time-and-materials 27,125 2 % 35,318 4 % Total revenue $ 1,010,564 $ 943,460 Revenue by Contract Relationship Three Months Ended March 29, March 31, (In thousands) 2024 % 2023 % Prime contractor $ 945,155 94 % $ 879,179 93 % Subcontractor 65,409 6 % 64,281 7 % Total revenue $ 1,010,564 $ 943,460 Revenue by Geographic Region Three Months Ended March 29, March 31, (In thousands) 2024 % 2023 % United States $ 544,726 54 % $ 548,770 58 % Middle East 343,216 34 % 281,121 30 % Asia 68,802 7 % 64,317 7 % Europe 53,820 5 % 49,252 5 % Total revenue $ 1,010,564 $ 943,460 Source: V2X, Inc.