As filed with the Securities and Exchange Commission on February 28, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SOMNIGROUP INTERNATIONAL INC.

| | | | | |

| (Exact name of Registrant as specified in its charter) |

| Delaware | 33-1022198 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification Number) |

1000 Tempur Way

Lexington, Kentucky 40511

(800) 878-8889

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Mohammad Vakil

Vice President, General Counsel and Secretary

Somnigroup International Inc.

1000 Tempur Way

Lexington, Kentucky 40511

(800) 878-8889

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| | |

| Copies to: |

Paul Shim Lillian Tsu

Cleary Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, New York 10006

(212) 225-2000 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | Emerging Growth Company |

| x | ☐ | ☐ | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

Common Stock

This prospectus relates to the proposed resale from time to time of up to 34,200,000 shares of common stock, par value $0.01 per share (the “common stock”), by the selling stockholders named herein, together with any of such stockholders’ transferees, pledgees, donees or successors. The selling stockholders acquired these shares from us pursuant to an Agreement and Plan of Merger, dated May 9, 2023, by and among us, Lima Holdings Corporation, Lima Deal Corporation LLC, Mattress Firm Group Inc. and Steenbok Newco 9 Limited, as the stockholders’ representative (the “Stockholder Representative”), in connection with our acquisition of Mattress Firm Group Inc. (“Mattress Firm”).

The selling stockholders may offer and sell or otherwise dispose of the shares of common stock described in this prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholders will bear all underwriting fees, commissions and discounts, if any, attributable to the sales of shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of the shares. See “Plan of Distribution” for more information about how the selling stockholders may sell or dispose of their shares of the common stock.

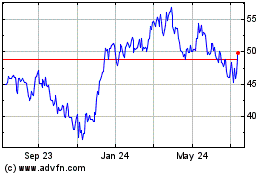

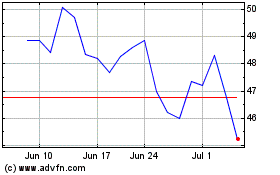

Our common stock is listed on the New York Stock Exchange under the trading symbol “SGI.” On February 25, 2025, the last reported sale price of our common stock was $65.13 per share.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 3 of this prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 28, 2025.

TABLE OF CONTENTS

We are responsible for the information contained and incorporated by reference in this prospectus, any accompanying prospectus supplement and in any related free writing prospectus we prepare or authorize. Neither we nor the selling stockholders have authorized anyone to provide you with any other information, and we take no responsibility for any other information that others may provide you. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell, or a solicitation of an offer to purchase, any securities other than the registered securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered hereby, or thereby in any jurisdiction to or from any person whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. The information appearing or incorporated by reference in this prospectus, any accompanying prospectus supplement and any related free writing prospectus is accurate only as of the date thereof, regardless of the time of delivery of this prospectus, any accompanying prospectus supplement or any related free writing prospectus, or of any sale of our securities. Our business, financial condition and results of operations may have changed since those dates. It is important for you to read and consider all the information contained in this prospectus and in any accompanying prospectus supplement, including the documents incorporated by reference herein or therein, before making your investment decision.

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). Under this process, selling stockholders named in this prospectus or in one or more supplements to this prospectus may offer or sell shares of our common stock, as described in this prospectus, in one or more offerings from time to time. Each time any selling stockholder not named in this prospectus (or in any supplement to this prospectus) sells shares of common stock under the registration statement of which this prospectus is a part, such selling stockholder must provide a copy of this prospectus and a prospectus supplement naming such selling stockholder as a selling stockholder, to a potential purchaser, as required by law.

We may also authorize one or more free writing prospectuses or prospectus supplements to be provided to you in connection with these offerings. Any related free writing prospectus or prospectus supplement may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus and, accordingly, to the extent inconsistent, information in this prospectus is superseded by the information in any prospectus supplement or any related free writing prospectus and any documents incorporated by reference.

The selling stockholders may offer and sell shares of our common stock directly to purchasers through agents selected by the selling stockholders, or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of shares of our common stock. See “Plan of Distribution.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find More Information.”

Unless the context indicates otherwise, as used in this prospectus, the term “Somnigroup International” refers to Somnigroup International Inc. only, and the terms “Somnigroup,” “Company,” “we,” “our,” “ours” and “us” refer to Somnigroup International Inc. and, where appropriate, its subsidiaries on a consolidated basis.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities discussed under the sections titled “Risk Factors” contained in this prospectus and under similar sections in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Somnigroup International Inc.

Somnigroup is the world’s largest bedding company, dedicated to enriching people’s lives through the power of a good night’s sleep. With superior capabilities in design, manufacturing, distribution and retail, we deliver breakthrough sleep solutions and serve the evolving needs of consumers in over 100 countries worldwide through our fully-owned businesses, Tempur Sealy, Mattress Firm and Dreams. Our portfolio includes the most highly recognized brands in the industry, including Tempur-Pedic®, Sealy® and Stearns & Foster®, and our global omni-channel platform enables us to meet consumers wherever they shop, offering a personal connection and innovation to provide a unique retail experience and tailored solutions.

Company Information

Our principal executive office is located at 1000 Tempur Way, Lexington, Kentucky 40511 and our telephone number is (800) 878-8889. Somnigroup International Inc. was incorporated under the laws of the State of Delaware in September 2002. Our website address is www.somnigroup.com. Information contained on or accessible through our website is not a part of this prospectus and is not incorporated by reference herein, and the inclusion of our website address in this prospectus is an inactive textual reference only.

The Somnigroup logo and other trademarks or service marks of Somnigroup appearing in this prospectus are the property of Somnigroup. Other trademarks, service marks or trade names appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

THE OFFERING

| | | | | |

| Common Stock | Up to 34,200,000 shares of our common stock. |

| Use of Proceeds | We will not receive any of the proceeds from the sale of shares of our common stock in this offering. The selling stockholders will receive all of the proceeds from the sale of shares of common stock hereunder. |

| New York Stock Exchange Symbol | Our common stock is listed on the New York Stock Exchange under the symbol “SGI.” |

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding whether to purchase our common stock, you should consider carefully the risks and uncertainties discussed under the section titled “Risk Factors” contained in our most recent Annual Report on Form 10-K, as updated by our subsequent Quarterly Reports on Form 10-Q and other filings we make with the SEC, which are incorporated by reference into this prospectus in their entirety, together with other information in this prospectus and the documents incorporated by reference. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below titled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which includes information concerning one or more of our plans; objectives; goals; strategies and other information that is not historical information. When used in this prospectus, the words “assumes,” “estimates,” “expects,” “guidance,” “anticipates,” “might,” “projects,” “predicts,” “plans,” “proposed,” “targets,” “intends,” “believes,” “will,” “may,” “could,” “is likely to” and variations of such words or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon our current expectations and beliefs and various assumptions. There can be no assurance that we will realize our expectations or that our beliefs will prove correct.

Numerous factors, many of which are beyond the Company’s control, could cause actual results to differ materially from any that may be expressed herein as forward-looking statements in this prospectus. These risk factors include the impact of the macroeconomic environment including its impact on consumer behavior in both the U.S. and internationally on our business segments and expectations regarding growth of the mattress industry; changes in economic conditions, including inflationary trends in the price of raw materials; uncertainties arising from global events (including the Russia-Ukraine conflict and the conflict in the Middle East), labor costs and other employment-related costs; loss of suppliers and disruptions in the supply of raw materials; competition in our industry; the effects of strategic investments on our operations, including our efforts to expand our global market share and actions taken to increase sales growth, including the recently completed acquisition of Mattress Firm; expectations regarding Mattress Firm’s ongoing operations; the ability to successfully integrate Mattress Firm into the Company’s operations and realize synergies from the transaction; the possibility that the expected benefits of the acquisition are not realized when expected or at all; general economic, financial and industry conditions, particularly conditions relating to the financial performance and related credit issues present in the retail sector, as well as consumer confidence and the availability of consumer financing; the ability to develop and successfully launch new products; capital project timelines; the ability to realize all synergies and benefits of acquisitions (including the merger with Mattress Firm); our reliance on information technology (“IT”) and the associated risks involving realized or potential security lapses and/or cyber based attacks; the impact of cybersecurity incidents (such as the July 2023 incident) on our business, results of operations or financial condition, including our assessments of such impact; the Company’s ability to restore its critical operational data and IT systems in a reasonable time frame following a cybersecurity incident; changes in interest rates; effects of changes in foreign exchange rates on our reported earnings; expectations regarding our target leverage and our share repurchase program; compliance with regulatory requirements and the possible exposure to liability for failures to comply with these requirements; the outcome of pending tax audits or other tax, regulatory or investigation proceedings and pending litigation; changes in foreign tax rates and changes in tax laws generally, including the ability to utilize tax loss carryforwards; and our capital structure and debt level, including our ability to meet financial obligations and continue to comply with the terms and financial ratio covenants of our credit facilities.

Other potential risk factors include the factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2024. In addition, there may be other factors that may cause our actual results to differ materially from the forward-looking statements.

All forward-looking statements attributable to us apply only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. Except as may be required by law, we undertake no obligation to publicly update or revise any of the forward-looking statements, whether as a result of new information, future events, or otherwise.

USE OF PROCEEDS

All the shares of common stock to be sold pursuant to this prospectus will be sold by the selling stockholders. We will not receive any of the proceeds from such sales. The selling stockholders will pay any fees and expenses of any legal counsel engaged by the selling stockholders and all applicable underwriting discounts, selling commissions and transfer taxes, if any, and any other expenses incurred by the selling stockholders in respect of the sale of these shares. We will bear all other costs, fees and expenses incurred in effecting the registration statement of which this prospectus forms a part, including, without limitation, all registration fees, listing fees of the New York Stock Exchange and fees and expenses of our counsel and our accountants.

DESCRIPTION OF CAPITAL STOCK

As of the date of this prospectus, our authorized capital stock is 500,000,000 shares of common stock, par value $0.01 per share, and 10,000,000 shares of undesignated preferred stock, $0.01 par value per share, none of which are issued and outstanding.

A description of the material terms and provisions of our amended and restated certificate of incorporation and amended and restated bylaws affecting the rights of holders of our capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to our amended and restated certificate of incorporation and our amended and restated bylaws which are incorporated by reference into the registration statement of which this prospectus is a part.

Common Stock

Voting Rights. Holders of our common stock are entitled to one vote per share for each share held of record on all matters to be voted upon by the stockholders.

With respect to any matter other than the election of directors or a matter for which the affirmative vote of the holders of a specified portion of the shares entitled to vote is required by Delaware law or our certificate of incorporation, the act of the stockholders shall be the affirmative vote of the holders of a majority of the shares present or represented by proxy and entitled to vote on the matter at a meeting of stockholders at which a quorum is present; provided that, for purposes thereof, (a) all abstentions are counted as votes present and entitled to vote and have the same effect as votes against the matter and (b) broker nonvotes are not counted as voted either for or against such matter.

Holders of a majority of the shares of our common stock entitled to vote in any election of directors may elect all of the directors standing for election. The Company’s amended and restated bylaws provide that a director in an uncontested election will be elected by a majority of the votes cast at the annual meeting of stockholders. In the event that the number of votes “against” a director exceeds the number of votes “for” that director, that director must tender his or her resignation to our board of directors. The nominating and corporate governance committee of our board of directors will make a recommendation to the board whether to accept the resignation. In an election for directors where the number of nominees exceeds the number of directors to be elected—a contested election—the amended and restated bylaws provide that each director shall be elected by the vote of a plurality of the shares represented at the meeting and entitled to vote on the matter. Abstentions, broker nonvotes and withheld votes are not counted as votes cast.

Classified Board. Neither the Company’s amended and restated certificate of incorporation nor its amended and restated bylaws provide for a classified board of directors.

Dividend Rights. Subject to preferences that may be applicable to any outstanding preferred stock, holders of our common stock are entitled to receive ratably such dividends as may be declared from time to time by our board of directors out of funds legally available for that purpose.

Liquidation Rights. In the event of our liquidation, dissolution or winding up, the holders of our common stock are entitled to share ratably in all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock, if any, then outstanding.

Preemptive, Conversion, Subscription or Redemptive or Sinking Fund Rights. The holders of our common stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to our common stock.

Certain Business Combination Restrictions. We are not subject to the provisions of Section 203 of the Delaware General Corporation Law. Subject to certain exceptions, Section 203 of the Delaware General Corporation Law prohibits a publicly-held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the interested stockholder attained such status with approval of our board of directors or unless the business combination is approved in a prescribed manner. A “business combination” includes certain mergers, asset sales or other transactions resulting in a financial benefit to the interested stockholder. Subject to various exceptions, an “interested stockholder” is a person who, together with his or her affiliates and associates, owns, or within the past three years did own, 15% or more of the corporation’s voting stock. The statute is intended to prohibit or delay mergers or other takeover or change in control attempts. Although we have elected out of the statute’s provisions, we could elect to be subject to Section 203 in the future.

Preferred Stock

Our amended and restated certificate of incorporation provides for the authorization of 10,000,000 shares of preferred stock. The shares of preferred stock may be issued by our board of directors, subject to any limitations prescribed by law, without further vote or action by the stockholders from time to time in one or more series. Each such series of preferred stock shall have such number of shares, designations, preferences, voting powers, qualifications and special or relative rights or privileges as shall be determined by the board of directors, which may include, among others, dividend rights, voting rights, redemption and sinking fund provisions, liquidation preferences, conversion rights and preemptive rights.

The rights of the holders of our common stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. Such rights may include voting and conversion rights which could adversely affect the holders of our common stock. Satisfaction of any dividend preferences of outstanding preferred stock would reduce the amount of funds available, if any, for the payment of dividends on common stock. Holders of our preferred stock would typically be entitled to receive a preference payment in the event of our liquidation, dissolution or winding up before any payment is made to the holders of common stock. Additionally, the issuance of our preferred stock could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, a majority of our outstanding voting stock. There are currently no shares of preferred stock outstanding.

Certain Provisions of Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

Stockholder Action; Special Meeting of Stockholders. Our amended and restated certificate of incorporation and amended and restated bylaws provide that stockholders may not take action by written consent, but only at a duly called annual or special meeting of the stockholders, and that special meetings of our stockholders may be called only by the chairman of the board of directors, the president or a majority of the board of directors. Thus, without approval by the chairman of the board of directors, the president or a majority of the board of directors, stockholders may take no action between meetings. These provisions may have the effect of delaying until the next annual stockholders’ meeting stockholder actions that are favored by the holders of a majority of our outstanding voting securities, including actions to remove directors. These provisions may also discourage another person or entity from making a tender offer for our common stock, because such person or entity, even if it acquired all or a majority of our outstanding voting securities, would be able to take action as a stockholder (such as electing new directors or approving a merger) only at a duly called stockholders’ meeting, and not by written consent.

Proxy Access. Our amended and restated bylaws permit a stockholder or group of stockholders meeting certain eligibility requirements to nominate directors (up to the greater of two or twenty percent of the number of directors then in office) to serve on the board and to have those nominees included in the Company’s proxy solicitation materials. The eligibility requirements include the requirement to continuously hold an aggregate of three percent or more of the voting power of the Company’s outstanding common stock for at least three years, with up to twenty stockholders being able to aggregate their holdings to meet this requirement.

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our amended and restated certificate of incorporation and amended and restated bylaws provide that a stockholder seeking to bring business before an annual meeting of stockholders, or to nominate candidates for election as directors at an annual meeting of stockholders, provide timely notice of this intention in writing. To be timely, a stockholder’s notice shall be delivered to or mailed and received at the principal executive offices of the Company not less than 120 days nor more than 150 days prior to the first anniversary of the preceding year’s annual meeting of stockholders; provided, however, that in the event that the date of the annual meeting of stockholders is advanced more than 30 days prior to such anniversary date or delayed more than 60 days after such anniversary date, then to be timely such notice must be received by the Company no later than the later of (i) 60 days prior to the date of the meeting or (ii) the 10 day following the day on which public announcement of the date of the meeting was made. With respect to special meetings of stockholders, such notice must be delivered to our secretary not more than 90 days prior to such meeting and not later than the later of (i) 60 days prior to such meeting or (ii) 10 days following the date on which public announcement of the date of such meeting is first made.

The notice must contain, among other things, certain information about the stockholder delivering the notice and, as applicable, background information about each nominee or a description of the proposed business to be brought before the meeting. These provisions may preclude stockholders from bringing matters before an annual meeting of stockholders or from making nominations for directors at an annual or special meeting of stockholders.

Authorized but Unissued Shares. The authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval, subject to any limitations imposed by the New York Stock Exchange. These additional shares may be utilized for a variety of corporate acquisitions and employee benefit plans.

Super-Majority Voting. Delaware law provides generally that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate of incorporation or bylaws, unless a corporation’s certificate of incorporation or bylaws require a greater percentage. Provisions in our amended and restated certificate of incorporation require the affirmative vote of the holders of at least 67% of our authorized voting stock to amend or repeal certain provisions of our certificate of incorporation which include, but are not limited to, provisions which would reduce or eliminate the number of authorized common or preferred shares and all indemnification provisions. Such 67% stockholder vote would in either case be in addition to any separate class vote that might in the future be required pursuant to the terms of any preferred stock at the time any such amendments are submitted to stockholders. Our amended and restated bylaws may also be amended or repealed by a majority vote of our board of directors.

Board Discretion in Considering Certain Offers. Our amended and restated certificate of incorporation empowers our board of directors, when considering a tender offer or merger or acquisition proposal, to take into account factors in addition to potential economic benefit to stockholders. Such factors may include (i) comparison of the proposed consideration to be received by stockholders in relation to the then-current market price of our capital stock, our estimated current value in a freely negotiated transaction and our estimated future value as an independent entity, and (ii) the impact of such a transaction on our employees, suppliers and customers and its effect on the communities in which we operate.

Limitation of Liability. Our amended and restated certificate of incorporation contains certain provisions permitted under Delaware General Corporation Law relating to the liability of directors. These provisions eliminate a director’s personal liability for monetary damages resulting from a breach of fiduciary duty, except in certain circumstances involving certain wrongful acts, such as the breach of a director’s duty of loyalty or acts or omissions that involve intentional misconduct or a knowing violation of law. These provisions do not limit or eliminate our rights or the rights of any stockholder to seek non-monetary relief, such as an injunction or rescission, in the event of a breach of a director’s fiduciary duty. These provisions will not alter a director’s liability under federal securities laws. Our amended and restated certificate of incorporation and amended and restated bylaws also contain provisions indemnifying our directors and officers to the fullest extent permitted by the Delaware General Corporation Law. We believe that these provisions will assist us in attracting and retaining qualified individuals to serve as directors.

Transfer Agent and Registrar

The transfer agent and registrar for the common stock is Equiniti Trust Company, LLC.

New York Stock Exchange Listing

Our common stock is listed on the New York Stock Exchange under the symbol “SGI.”

SELLING STOCKHOLDERS

We have prepared this prospectus to allow the selling stockholders to offer and sell from time to time up to 34,200,000 shares of our common stock for their own account. We are registering the offer and sale of the shares beneficially owned by the selling stockholders to satisfy certain registration obligations that we granted the selling stockholders in connection with our acquisition of Mattress Firm. Pursuant to the Agreement and Plan of Merger dated May 9, 2023 (the “Merger Agreement”) we entered into in connection with such acquisition, we have agreed to use commercially reasonable efforts to keep the registration statement, of which this prospectus forms a part, effective and usable until August 5, 2026, which is the 18-month anniversary of the closing date of such acquisition (the “Closing Date”), or such earlier time as (i) the date that all shares covered by this registration statement have been sold hereunder or otherwise, or (ii) no selling stockholder is an “affiliate” of the Company or owns at least 2% of shares of common stock outstanding. In addition, the Company may be obligated to file additional registration statements at the request of certain of the selling stockholders under the circumstances specified in the Merger Agreement.

The following table sets forth certain information with respect to each selling stockholder, including (i) the name of each selling stockholder; (ii) the number of shares beneficially owned by each of the respective selling stockholders prior to this offering; (iii) the number of shares that may be offered under this prospectus by each selling stockholder; and (iv) the number of shares of our common stock beneficially owned by each selling stockholder after completion of this offering, assuming all of the shares covered hereby are sold. The selling stockholders may sell some, all or none of their shares of common stock covered by this prospectus. We do not know how long the selling stockholders will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholders regarding the sale or other disposition of any shares, except as follows. Of the 34,200,000 shares issued in connection with our acquisition of Mattress Firm to the selling stockholders, 18,771,653 shares are subject to certain lock-up agreements with the Company. The lock-up with respect to 15,376,743 shares held by the Stockholder Representative is subject to certain customary exceptions and will expire on May 5, 2025, three months after the Closing Date. The lock-up with respect to 3,219,740 shares held by certain employees of Mattress Firm is subject to certain customary exceptions and will expire on February 5, 2027, two years after the Closing Date. The selling stockholders may, from time to time, sell, transfer or otherwise dispose of any or all of the shares on any stock exchange, market or trading facility on which our common stock is traded or in private transactions. As a result, we cannot estimate the number of shares of common stock covered by this prospectus each of the selling stockholders will own in the future. Except as otherwise disclosed herein, the selling stockholders do not have, and within the past three years have not had, any position, office or other material relationship with us.

The information set forth in the table below is based upon information obtained from the selling stockholders and is as of February 25, 2025. Beneficial ownership of the selling stockholders is determined in accordance with Rule 13d-3(d) under the Exchange Act. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own. The percentage of shares beneficially owned prior to, and after, the offering is based on 208,524,132 shares of common stock outstanding as of February 25, 2025, which includes the issuance of 34,200,000 shares of common stock upon the closing of the merger with Mattress Firm on February 5, 2025.

As used in this prospectus, the term “selling stockholders” includes the selling stockholders listed in the table below, together with any additional selling stockholders listed in a prospectus supplement, and their donees, pledgees, assignees, transferees, distributees and successors-in-interest that receive shares in any non-sale transfer after the date of this prospectus. Information about the selling stockholders may change over time. Any changed information will be set forth in an amendment to the registration statement or supplement to this prospectus, to the extent required by law.

| | | | | | | | | | | | | | | | | |

| Beneficial Ownership

Prior to This Offering | | Beneficial Ownership

After This Offering |

| Name of Selling Stockholder | Shares of Common Stock | % of Total Voting Power Before This Offering | Number of Shares of Common Stock Being Offered | Shares of Common Stock | % of Total Voting Power After This Offering |

Stockholder Representative (1) | 15,376,743 | 7.4% | 15,376,743 | — | —% |

Certain funds and accounts managed by Abrams Capital Management, L.P. |

Abrams Capital Partners I, L.P.(2) | 360,361 | * | 101,483 | 258,878 | * |

Abrams Capital Partners II, L.P.(2) | 4,818,606 | 2.3% | 1,388,729 | 3,429,877 | 1.6% |

Whitecrest Partners, LP (2) | 666,279 | * | 185,424 | 480,855 | * |

| Entities affiliated with JPMorgan Chase & Co. |

Aldermanbury Investments Limited (3) | 18,543 | * | 18,543 | — | —% |

| Fund managed by the European Special Situations Trading Desk at Barclays |

Barclays Bank PLC (4) | 157,662 | * | 157,662 | — | —% |

| Entities affiliated with The Baupost Group, L.L.C. |

Entities affiliated with The Baupost Group, L.L.C. (5) | 1,568,349 | * | 1,568,349 | — | —% |

| Fund managed by Catalur Capital Management, LP |

Catalur Master Fund, LP (6) | 37,235 | * | 37,235 | — | —% |

| Certain funds and accounts managed or advised by or affiliated with CSCP III Cayman GP Ltd. or Centerbridge Credit GP Investors, L.L.C. |

Centerbridge Credit Partners Master AIV III, L.P. (7) | 1,798,388 | * | 1,798,388 | — | —% |

Centerbridge Special Credit Partners III AIV III, L.P. (7) | 825,061 | * | 825,061 | — | —% |

| Holdings managed by the Markets division of Citigroup |

Citigroup Global Markets Limited (8) | 221,975 | * | 221,975 | — | —% |

| Certain funds and accounts managed by Davidson Kempner Capital Management LP |

Midtown Acquisitions L.P. (9) | 1,047,690 | * | 1,047,690 | — | —% |

| Fund managed by Farallon Capital Management, L.L.C. |

Affix Holdings, LLC (10) | 1,341,242 | * | 1,341,242 | — | —% |

| Fund managed by Goldman Sachs Group, Inc. |

ELQ Investors II Ltd (11) | 962,983 | * | 962,983 | — | —% |

| Certain funds and accounts managed by Bardin Hill Investment Partners LP |

Bardin Hill Opportunistic Credit Master Fund LP (12) | 19,362 | * | 19,362 | — | —% |

Bardin Hill NE Fund LP (12) | 7,447 | * | 7,447 | — | —% |

Brown Cayman I (12) | 21,968 | * | 21,968 | — | —% |

Bardin Hill WC Fund LP (12) | 37,347 | * | 37,347 | — | —% |

HCN LP (12) | 145,173 | * | 145,173 | — | —% |

HDML Fund I LLC (12) | 3,647 | * | 3,647 | — | —% |

Halcyon Eversource Credit LLC (12) | 19,525 | * | 19,525 | — | —% |

HDML Fund II LLC (12) | 52,396 | * | 52,396 | — | —% |

Halcyon Vallee Blanche Master Fund LP (12) | 52,588 | * | 52,588 | — | —% |

Halcyon Event-Driven Master Fund LP (12) | 60,099 | * | 60,099 | — | —% |

| Fund managed by Joseph Femenia |

Jefferies LLC (13) | 254 | * | 254 | — | —% |

| Certain funds and accounts managed by Stonehill Capital Management LLC |

Stonehill Master Fund Ltd. (14) | 382,783 | * | 382,783 | — | —% |

Stonehill Institutional Partners, L.P. (14) | 442,360 | * | 442,360 | — | —% |

| Certain funds and accounts managed by Silver Point Capital, L.P. |

SPCP Access Holdings, LLC (15) | 287,279 | * | 287,279 | — | —% |

SPCP Institutional Group, LLC (15) | 682,913 | * | 682,913 | — | —% |

SPCP Group, LLC (15) | 1,815,760 | * | 1,815,760 | — | —% |

| Certain funds and accounts managed by Strategic Value Partners, LLC |

Strategic Value Capital Solutions Master Fund, L.P. (16) | 280,325 | * | 280,325 | — | —% |

Strategic Value Opportunities Fund, L.P. (16) | 526,655 | * | 526,655 | — | —% |

Strategic Value Special Situations Master Fund IV, L.P. (16) | 147,044 | * | 147,044 | — | —% |

Strategic Value Special Situations Master Fund V, L.P. (16) | 195,115 | * | 195,115 | — | —% |

| All other selling stockholders |

| All other selling stockholders | 3,875,441 | 1.9% | 3,875,441 | — | —% |

| All selling stockholders | 38,256,598 | 18.3% | 34,086,988 | 4,169,610 | 2.0% |

* Denotes less than 1%.

| | | | | |

| (1) | The Stockholder Representative’s shares are owned by Steenbok Newco 9 Limited, which is a wholly-owned, indirect subsidiary of Ibex Topco B.V. (previously known as Steinhoff Topco B.V.). The Stockholder Representative’s registered address is The Space (Floor 3), 120 Regent Street, London, England, W1B 5FE. |

| (2) | Abrams Capital Management, L.P., a Delaware limited partnership that is registered with the SEC as an investment adviser, manages Abrams Capital Partners I, L.P., Abrams Capital Partners II, L.P. and Whitecrest Partners, LP. Abrams Capital, LLC is the general partner of Abrams Capital Partners I, L.P., Abrams Capital Partners II, L.P. and Whitecrest Partners, LP. David C. Abrams (“Mr. Abrams”) is the managing member of Abrams Capital, LLC. By virtue of the relationships described above, Mr. Abrams has voting power with respect to the shares of common stock held by, Abrams Capital Partners I, L.P., Abrams Capital Partners II, L.P. and Whitecrest Partners, LP. The address for each of the foregoing entities is c/o Abrams Capital, 222 Berkeley Street, 21st Floor, Boston, Massachusetts 02116. |

| (3) | Aldermanbury Investments Limited (“AIL”) is an indirect wholly owned subsidiary of JPMorgan Chase & Co. (“JPM”). JPM, in its capacity as parent holding company, disclaims beneficial ownership of these shares. Each of Jennifer Margaret Ballinger, Clare Louise Johns, Nazy Namazi and Kimberley Harden Taylor are directors of AIL, a private limited company incorporated in England and Wales, and as such may be deemed to have voting and dispositive power over the ordinary shares held by AIL. Each of Jennifer Margaret Ballinger, Clare Louise Johns, Nazy Namazi and Kimberley Harden Taylor disclaims beneficial ownership of these ordinary shares, except to the extent of any pecuniary interest therein. AIL is an affiliate of JPM, a registered broker-dealer. The shares of common stock held by AIL were acquired in the ordinary course of its investment business, and at the time of acquisition of such shares of common stock, AIL had no agreements or understandings, directly or indirectly, with any person to distribute the shares of common stock. The address for each of AIL, Jennifer Margaret Ballinger, Clare Louise Johns, Nazy Namazi and Kimberley Harden Taylor is 25 Bank Street, Canary Wharf, London, E14 5JP. |

| (4) | Romain Rachidi (“Mr. Rachidi”) is a managing director of Barclays Bank PLC (“Barclays”). By virtue of this relationship, Mr. Rachidi has voting and investment control over the shares held by Barclays, solely in respect of its European Special Situations Trading Desk (the “Special Situations Desk”) in its capacity as holder of the shares, and not any other desk, unit, group, division, or affiliate of Barclays and solely in respect of the Special Situations Desk’s shares. The address of this entity is 1 Churchill Place, Canary Wharf, London, E14 5HP. |

| (5) | The Baupost Group, L.L.C. (“Baupost”) is a registered investment adviser and acts as the investment adviser and general partner to certain private investment limited partnerships on whose behalf these shares were indirectly purchased. Baupost Group GP, L.L.C. (“Baupost GP”), as the manager of Baupost, and Seth A. Klarman (“Mr. Klarman”), as the sole managing member of Baupost GP and a controlling person of Baupost, may be deemed to have beneficial ownership of the shares beneficially owned by Baupost. Baupost GP and Mr. Klarman disclaim beneficial ownership of such shares except to the extent of their pecuniary interest therein, if any. Baupost is the managing general partner to eleven domestic investment limited partnerships (“Baupost Partnerships”). Certain Baupost Partnerships own an interest in Leerink Partners LLC (“Leerink”), a broker-dealer registered with the SEC and a member of FINRA. Baupost does not have an ownership interest in Leerink but by virtue of its role as the managing general partner of the Baupost Partnerships is deemed to have indirect control over Leerink. The shares of common stock indirectly held by Baupost were acquired in the ordinary course of its investment business, and at the time of acquisition of such shares of common stock, Baupost had no agreements or understandings, directly or indirectly, with any person to distribute the shares of common stock. The address of Baupost, Baupost GP and Mr. Klarman is 10 St. James Ave., Suite 1700, Boston, Massachusetts 02116. |

| (6) | Catalur Capital Management, LP, an investment adviser registered with the SEC, is the investment manager of Catalur Master Fund, LP. David Tiomkin is the managing member of Catalur Capital Management, LP. The address of this entity is c/o Catalur Capital Management, LP is 60 East 42nd Street, Suite 1130, New York, New York 10165. |

| (7) | Centerbridge Special Credit Partners General Partner III, L.P. is the general partner of Centerbridge Special Credit Partners III AIV III, L.P. CSCP III Cayman GP Ltd. is the general partner of Centerbridge Special Credit Partners General Partner III, L.P. Centerbridge Credit Partners Offshore General Partner, L.P. is the general partner of Centerbridge Credit Partners Master AIV III, L.P. Centerbridge Credit Cayman GP, Ltd. is the general partner of Centerbridge Credit Partners Offshore General Partner, L.P. Centerbridge Credit GP Investors, L.L.C. is the sole director of Centerbridge Credit Cayman GP, Ltd. Jeffrey H. Aronson (“Mr. Aronson”) is director of CSCP III Cayman GP Ltd. and managing member of Centerbridge Credit GP Investors, L.L.C. The address of Mr. Aronson and each of the foregoing entities is c/o Centerbridge Partners, L.P., 375 Park Avenue, 11th Fl., New York, New York 10152. |

| (8) | Alexis Serero and George Bearryman, as members of the EMEA Flow Credit Trading desk in the Markets division of Citigroup, may be deemed to share voting and investment power of the shares owned by Citigroup Global Markets Limited (“CGML”). CGML is a registered broker-dealer in the United Kingdom and is an affiliate of Citigroup Global Markets Inc. The shares of common stock held by CGML were acquired in the ordinary course of its investment business, and at the time of acquisition of such shares of common stock, CGML had no agreements or understandings, directly or indirectly, with any person to distribute the shares of common stock. The address of CGML is Citigroup Centre, 33 Canada Square, London E14 5LB, United Kingdom. |

| (9) | Davidson Kempner Capital Management LP (“DKCM”), a Delaware limited partnership and registered investment adviser with the SEC, acts as the investment manager to Midtown Acquisitions L.P. Anthony A. Yoseloff (“Mr. Yoseloff”) is the Executive Managing Member of DKCM. In that position, Mr. Yoseloff, through DKCM, exercises investment authority over the securities held by Midtown Acquisitions L.P. The business address of DKCM is 520 Madison Avenue, 30th Floor, New York, New York 10022. |

| (10) | As the manager of Affix Holdings, LLC (“Affix”), Farallon Capital Management, L.L.C., a Delaware limited liability company (“FCM”), may be deemed to be a beneficial owner of the shares held by Affix. Each of Joshua J. Dapice, Philip D. Dreyfuss, Hannah E. Dunn, Richard B. Fried, Varun N. Gehani, Nicolas Giauque, David T. Kim, Michael G. Linn, Patrick (Cheng) Luo, Rajiv A. Patel, Dr. Thomas G. Roberts, Jr., Edric C. Saito, William Seybold, Daniel S. Short, Andrew J.M. Spokes, John R. Warren, and Mark C. Wehrly (collectively, the “Farallon Managing Members”), as a senior managing member or managing member, as the case may be, of FCM, in each case with the power to exercise investment discretion, may be deemed to be a beneficial owner of such shares held by Affix. Each of FCM and the Farallon Managing Members disclaims any beneficial ownership of any such shares. The address of each of the entities and individuals referenced in this note is c/o Farallon Capital Management, L.L.C., One Maritime Plaza, Suite 2100, San Francisco, California 94111. |

| (11) | Reflects shares held by ELQ Investors II Ltd (the “GS Entity”). The Goldman Sachs Group, Inc. (“Goldman Sachs”) is deemed to beneficially own all of the abovementioned shares. The GS Entity is an indirectly wholly owned subsidiary of Goldman Sachs. Each of Jeremy Alan Wiltshire (“Wiltshire”), Vikram Sethi (“Sethi”) and Paolo Santi (“Santi”) serves on the GS Entity’s board of directors and is also an employee of affiliates of Goldman Sachs and may be deemed to have beneficial ownership of the shares held by the GS Entity. Each of Wiltshire, Sethi and Santi disclaim beneficial ownership of the equity interests and the shares described above held directly or indirectly by the GS Entities, except to the extent of their pecuniary interest therein, if any. The address of Goldman Sachs is 200 West Street, New York, New York 10282. The shares of common stock held by the GS Entity were acquired in the ordinary course of its investment business, and at the time of acquisition of such shares of common stock, the GS Entity had no agreements or understandings, directly or indirectly, with any person to distribute the shares of common stock. |

| (12) | Bardin Hill Investment Partners LP (“BHIP”), an investment advisor registered with the SEC, is the investment manager for Bardin Hill Opportunistic Credit Master Fund LP, Bardin Hill NE Fund LP, Brown Cayman I, Bardin Hill WC Fund LP, HCN LP, HDML Fund I LLC, Halcyon Eversource Credit LLC, HDML Fund II LLC, Halcyon Vallee Blanche Master Fund LP and Halcyon Event-Driven Master Fund LP. Investment decisions of BHIP are made by one of three individuals, each of whom has individual decision making authority in their capacity as a Portfolio Manager of BHIP: Jason Dillow, John Greene or Pratik Desai. The address of BHIP is c/o Bardin Hill Investment Partners LP, 299 Park Ave., 24th Floor, New York, New York 10171. |

| (13) | Joseph Femenia, a trader of Jefferies LLC, has voting and investment control over the Class A Common Stock held by Jefferies LLC. Jefferies LLC is a registered broker-dealer. The business address of Jefferies LLC and Joseph Femenia is 520 Madison Avenue New York, New York 10022. |

| (14) | Stonehill Capital Management LLC, a Delaware limited liability company (“SCM”), is the investment adviser of Stonehill Institutional Partners, L.P. and Stonehill Master Fund Ltd. Stonehill General Partner, LLC (“Stonehill GP”) is the general partner of Stonehill Institutional Partners, L.P. By virtue of such relationships, SCM and Stonehill GP and the principals of such entities may be deemed to have voting and dispositive power over the shares owned by Stonehill Institutional Partners, L.P, and SCM and the principals of SCM may be deemed to have voting and dispositive power over the shares owned by Stonehill Master Fund Ltd. The principals of SCM and Stonehill GP are Samir Arora, John Motulsky, Jonathan Sacks, Peter Sisitsky, Michael Thoyer, Michael Stern and Garrett Zwahlen. The address of each of the foregoing entities is c/o Stonehill Capital Management LLC, 320 Park Avenue, 26th Floor, New York, New York 10022. |

| (15) | Silver Point Capital, L.P. (“Silver Point”) or its wholly owned subsidiaries are the investment managers of Silver Point Capital Fund, L.P., Silver Point Capital Offshore Master Fund, L.P., Silver Point Distressed Opportunities Fund, L.P., Silver Point Distressed Opportunities Offshore Master Fund, L.P., Silver Point Distressed Opportunity Institutional Partners, L.P. and Silver Point Distressed Opportunity Institutional Partners Master Fund (Offshore), L.P. (the “Silver Point Funds”) and, by reason of such status, may be deemed to be the beneficial owner of all of the reported securities held by SPCP Group, LLC on behalf of Silver Point Capital Fund, L.P. and Silver Point Capital Offshore Master Fund, L.P., SPCP Access Holdings, LLC on behalf of Silver Point Distressed Opportunities Fund, L.P. and Silver Point Distressed Opportunities Offshore Master Fund, L.P. and SPCP Institutional Group, LLC on behalf of Silver Point Distressed Opportunity Institutional Partners, L.P. and Silver Point Distressed Opportunity Institutional Partners Master Fund (Offshore), L.P. Silver Point Capital Management, LLC (“Silver Point Management”) is the general partner of Silver Point and as a result may be deemed to be the beneficial owner of all securities held by the Silver Point Funds. Messrs. Edward A. Mulé and Robert J. O’Shea are each members of Silver Point Management and as a result may be deemed to be the beneficial owner of all of the securities held by the Silver Point Funds. Silver Point, Silver Point Management and Messrs. Mulé and O’Shea disclaim beneficial ownership of the reported securities held by Silver Point Funds except to the extent of their pecuniary interests. The address of each of the foregoing entities is 2 Greenwich Plaza, Suite 1, Greenwich, Connecticut 06830. |

| (16) | Mr. Victor Khosla (“Mr. Khosla”) is the sole member of Midwood Holdings, LLC, which is the managing member of Strategic Value Partners, LLC (“SVP”). Furthermore, Mr. Khosla is the Chief Investment Officer and controlling person of SVP, SVP Special Situations III-A LLC, SVP Special Situations IV LLC, SVP Special Situations V LLC and SVP Capital Solutions LLC. SVP Special Situations III-A LLC is the investment manager of Strategic Value Opportunities Fund, L.P., SVP Special Situations IV LLC, is the investment manager of Strategic Value Special Situations Master Fund IV, L.P., SVP Special Situations V LLC is the investment manager of Strategic Value Special Situations Master Fund V, L.P. and SVP Capital Solutions LLC is the Investment Manager of Strategic Value Capital Solutions Master Fund, L.P. The address of SVP is 100 West Putnam Avenue, Greenwich, Connecticut 06830. |

PLAN OF DISTRIBUTION

We are registering the shares of common stock held by the selling stockholders from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the shares of common stock.

Each selling stockholder of the common stock and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the principal trading market for the common stock or any other stock exchange, market or trading facility on which the common stock is traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following methods when selling securities:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales;

•in transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such common stock at a stipulated price per security;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•a combination of any such methods of sale; or

•any other method permitted pursuant to applicable law.

The selling stockholders may also sell the shares of common stock under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of common stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Financial Industry Regulatory Authority, or FINRA, Rule 5110; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell common stock short and deliver these shares to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these shares. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the shares of common stock.

We are required to pay certain fees and expenses incurred by us incident to the registration of the shares of common stock. We and the selling stockholders have agreed to indemnify each other against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this registration statement of which this prospectus forms a part effective and usable until the earlier of (i) August 5, 2026, which is the 18-month anniversary of the Closing Date, or such earlier time as (i) the date that all shares covered by this registration statement have been sold hereunder or otherwise, or (ii) no selling stockholder is an “affiliate” of the Company or owns at least 2% of shares of common stock outstanding. In addition, the Company may be obligated to file additional registration statements at the request of certain of the selling stockholders under the circumstances specified in the Merger Agreement. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale shares of common stock may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

Cleary Gottlieb Steen & Hamilton LLP, New York, New York, will pass upon the validity of the shares of common stock offered by this prospectus.

EXPERTS

The consolidated financial statements of Somnigroup International incorporated in this prospectus by reference from the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and the effectiveness of the Company’s internal control over financial reporting as of December 31, 2024 have been audited by Ernst & Young LLP, an independent registered public accounting firm, as set forth in their reports thereon, incorporated by reference therein, and incorporated herein by reference. Such consolidated financial statements and Somnigroup International management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2024 are incorporated herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

The financial statements of Mattress Firm as of October 1, 2024 and October 3, 2023, and for the years then ended, incorporated by reference in this prospectus by reference to Somnigroup International’s Amendment No. 2 to Current Report on Form 8-K, dated February 28, 2025, have been audited by Deloitte & Touche LLP, an independent auditor, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth or incorporated by reference in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge on the Investor Relations section of our website, which is located at investor.somnigroup.com. These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our website address is https://www.somnigroup.com. Information contained on or accessible through our website is not a part of this prospectus and is not incorporated by reference herein, and the inclusion of our website address in this prospectus is an inactive textual reference only.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We are “incorporating by reference” certain documents that we have filed with the SEC under the Exchange Act, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for any information superseded by information contained directly in this prospectus, or any subsequently filed document deemed incorporated by reference. We incorporate by reference into this prospectus the documents listed below (excluding any portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act):

•our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed on February 28, 2025; •the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 from our Definitive Proxy Statement on Schedule 14A related to our 2024 annual meeting of stockholders, filed with the SEC on March 27, 2024; •our Current Reports on Form 8-K, filed with the SEC on January 24, 2025, February 5, 2025, as amended on February 6, 2025 and February 28, 2025 (with respect to Items 2.01, 2.03, 3.02, 5.02 and 9.01), and February 18, 2025; and •the description of our common stock set forth in Exhibit 4.6 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed on February 28, 2025.

Any future filings Somnigroup International makes with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus are incorporated herein by reference (excluding any portions of such filings that have been “furnished” but not “filed” for purposes of the Exchange Act). Any statement contained in this prospectus or in a document incorporated by reference shall be deemed to be modified or superseded to the extent that a statement contained in those documents modifies or supersedes that statement. Any statement so modified or superseded will not be deemed to constitute a part of this prospectus except as so modified or superseded. Statements contained in this prospectus as to the contents of any contract or other document referred to in this prospectus do not purport to be complete, and, where reference is made to the particular provisions of such contract or other document, such provisions are qualified in all respects by reference to all of the provisions of such contract or other document. See “Where You Can Find More Information” for details on how you can obtain any of the documents we incorporate by reference or refer to in this prospectus through our website or from the SEC.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth an estimate of the fees and expenses, other than the underwriting discounts and commissions, payable by us in connection with the issuance and distribution of the securities being registered. All the amounts shown are estimates, except for the SEC registration fee.

| | | | | |

| Amount |

SEC registration fee | $ | 339,085 | |

Accounting fees and expenses | ** |

Legal fees and expenses | ** |

Transfer agent and registrar fees and expenses | ** |

Miscellaneous fees and expenses | ** |

Total | ** |

** Fees and expenses are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time.

Item 15. Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act. Our amended and restated certificate of incorporation provides for indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General Corporation Law, and our amended and restated bylaws provide for indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General Corporation Law.

We maintain insurance policies that indemnify our directors and officers against various liabilities arising under the Securities Act and the Exchange Act, that might be incurred by any director or officer in his capacity as such.

Any underwriting agreement may provide for indemnification by the underwriters of Somnigroup and our officers and directors for certain liabilities arising under the Securities Act or otherwise.

Item 16. Exhibits

| | | | | | | | | | | | | | | | | |

| | Incorporated by Reference |

| Exhibit Number | Description | Schedule Form | File Number | Exhibit | Filing Date |

| 2.1 | | 8-K | 001-31922 | 2.1 | May 11, 2023 |

| 2.2 | | 10-K | 001-31922 | 2.2 | February 28, 2025 |

| 3.1 | | S-1/A | 333-109798 | 3.1 | December 12, 2003 |

| 3.2 | | 8-K | 001-31922 | 3.1 | May 24, 2013 |

| 3.3 | | 8-K | 001-31922 | 3.1 | May 10, 2021 |

| 3.4 | | 8-K | 001-31922 | 3.2 | February 18, 2025 |

| 3.5 | | 8-K | 001-31922 | 3.1 | February 18, 2025 |

| 4.1 | | 10-K | 001-31922 | 4.1 | March 1, 2018 |

| 5.1 | | | | | |

| 23.1 | | | | | |

| 23.2 | | | | | |

| 23.3 | | | | | |

| 24.1 | | | | | |

| 107 | | | | | |

Item 17. Undertakings

1.The undersigned registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5)That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

2.The undersigned registrant hereby undertakes that, for the purpose of determining liability of the registrant under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.