0000726728false00007267282024-05-062024-05-060000726728us-gaap:CommonClassAMember2024-05-062024-05-060000726728o:A6000SeriesACumulativeRedeemablePreferredStock001ParValueMember2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable1.125DueJuly2027Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable1.875DueJanuary2027Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable1.625DueDecember2030Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable4.875DueJuly2030Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable5750Due2031Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable1.750DueJuly2033Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable5.125DueJuly2034Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable6000Due2039Member2024-05-062024-05-060000726728o:SeniorUnsecuredNotesPayable2.500DueJanuary2042Member2024-05-062024-05-06

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: May 6, 2024

(Date of Earliest Event Reported)

REALTY INCOME CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 1-13374 | | 33-0580106 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange On Which Registered |

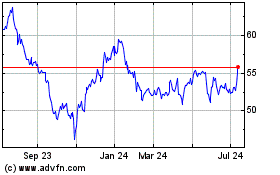

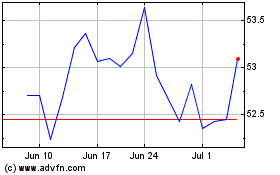

| Common Stock, $0.01 Par Value | O | New York Stock Exchange |

| 6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value | O PR | New York Stock Exchange |

| 1.125% Notes due 2027 | O27A | New York Stock Exchange |

| 1.875% Notes due 2027 | O27B | New York Stock Exchange |

| 1.625% Notes due 2030 | O30 | New York Stock Exchange |

| 4.875% Notes due 2030 | O30A | New York Stock Exchange |

| 5.750% Notes due 2031 | O31A | New York Stock Exchange |

| 1.750% Notes due 2033 | O33A | New York Stock Exchange |

| 5.125% Notes due 2034 | O34 | New York Stock Exchange |

| 6.000% Notes due 2039 | O39 | New York Stock Exchange |

| 2.500% Notes due 2042 | O42 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On May 6, 2024, Realty Income Corporation (the “Company”) issued a press release setting forth its results of operations for the three months ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. This information, including the information contained in the press release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Additionally, on May 6, 2024, the Company made available on its website a financial supplement containing operating and financial data of the Company (“Supplemental Operating and Financial Data”) for the three months ended March 31, 2024, and such Supplemental Operating and Financial Data is furnished as Exhibit 99.2 hereto. The Supplemental Operating and Financial Data included as Exhibit 99.2 to this report is being furnished pursuant to this Item 2.02 of Form 8-K and is also being furnished under Item 7.01—“Regulation FD Disclosure” of Form 8-K, and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Item 7.01 Regulation FD Disclosure.

On May 6, 2024, the Company made available on its website a financial supplement containing operating and financial data of the Company (“Supplemental Operating and Financial Data”) for the three months ended March 31, 2024, and such Supplemental Operating and Financial Data is furnished as Exhibit 99.2 hereto. The Supplemental Operating and Financial Data included as Exhibit 99.2 to this report is being furnished pursuant to this Item 7.01 of Form 8-K and is also being furnished under Item 2.02—“Results of Operations and Financial Condition” of Form 8-K, and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 The Form 8-K cover page, formatted in Inline Extensible Business Reporting Language and included as Exhibit 101

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: May 6, 2024 | REALTY INCOME CORPORATION |

| | |

| | By: | /s/ JONATHAN PONG |

| | | Jonathan Pong |

| | | Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

REALTY INCOME ANNOUNCES OPERATING RESULTS FOR

THE THREE MONTHS ENDED MARCH 31, 2024

SAN DIEGO, CALIFORNIA, May 6, 2024....Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced operating results for the three months ended March 31, 2024. All per share amounts presented in this press release are on a diluted per common share basis unless stated otherwise.

“I am pleased with our first quarter results, as we continue to strengthen our role as real estate partner to the world’s leading companies,” said Sumit Roy, Realty Income's President and Chief Executive Officer. “We remain a highly selective capital allocator based on available product that meets our stringent long-term, risk-adjusted return hurdles. During the quarter, we completed $598 million of investment volume at an initial weighted average cash yield of 7.8%. Approximately 54% of total investment volume was in the U.K. and Europe at an initial weighted average cash yield of 8.2%. International growth continues to be a differentiating avenue for Realty Income to generate accretive earnings growth as our unique platform allows us to partner with best-in-class clients in a highly fragmented net lease market.”

COMPANY HIGHLIGHTS:

For the three months ended March 31, 2024:

•Net income available to common stockholders was $129.7 million, or $0.16 per share

•AFFO available to common stockholders was $862.9 million, or $1.03 per share

•On January 23, 2024, closed on our previously announced stock-for-stock merger with Spirit Realty Capital, Inc. ("Spirit")

•Excluding our merger with Spirit, we invested $598.0 million at an initial weighted average cash yield of 7.8%

•Raised $550.1 million from the sale of common stock, primarily through our At-The-Market (ATM) program, at a weighted average price of $56.93

•Net Debt and Preferred Stock to Annualized Pro Forma Adjusted EBITDAre was 5.5x

•Issued $450.0 million of 4.750% senior unsecured notes due February 2029 and $800.0 million of 5.125% senior unsecured notes due February 2034, for which proceeds were used to repay $1.1 billion of senior unsecured notes and mortgages upon maturity

Event subsequent to March 31, 2024:

•In April 2024, a $33.0 million secured loan to an operator of Emagine Theaters, assumed in the Spirit merger, was repaid in full

CEO Comments

“Given the health of our balance sheet and ample liquidity, which was further bolstered by a well-timed $1.25 billion bond offering in January, we continue to emphasize that our unchanged $2.0 billion investments guidance for the year requires no new external capital. Following closing of the Spirit merger, our annualized adjusted free cash flow(1) of approximately $825 million is a competitive advantage that increasingly positions us to self-fund our external growth.”

“Underpinning the health of our balance sheet is continued stability in our high-quality portfolio. In the first quarter, occupancy remains stable at 98.6%, we delivered a rent recapture rate of 104.3% on properties re-leased, and we generated same store rental revenue growth of 0.8%. We believe our diversified portfolio of investments generates consistent recurring cash flow to support dependable monthly dividends that grow over time. In March, we announced our 124th common stock monthly dividend increase since Realty Income's listing on the NYSE in 1994. Dependable total operational returns with limited downside earnings volatility continues to be core to our investment proposition for our shareholders.”

(1) Annualized Adjusted Free Cash Flow is a non-GAAP financial measure. Please see the Glossary for our definition and an explanation of how we utilize this measure.

Select Financial Results

The following summarizes our select financial results (dollars in millions, except per share data).

| | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| | 2024 | | 2023 | | | | |

Total revenue | | $ | 1,260.5 | | $ | 944.4 | | | | |

Net income available to common stockholders (1) (2) | | $ | 129.7 | | $ | 225.0 | | | | |

Net income per share | | $ | 0.16 | | $ | 0.34 | | | | |

Funds from operations available to common stockholders (FFO) (3) | | $ | 785.7 | | $ | 684.3 | | | | |

FFO per share | | $ | 0.94 | | $ | 1.03 | | | | |

Normalized funds from operations available to common stockholders (Normalized FFO) (3) | | $ | 879.8 | | $ | 685.6 | | | | |

Normalized FFO per share | | $ | 1.05 | | $ | 1.04 | | | | |

Adjusted funds from operations available to common stockholders (AFFO) (3) | | $ | 862.9 | | $ | 650.7 | | | | |

AFFO per share | | $ | 1.03 | | $ | 0.98 | | | | |

(1) The calculation to determine net income attributable to common stockholders includes provisions for impairment, gain on sales of real estate, and foreign currency gain and loss. These items can vary from quarter to quarter and can significantly impact net income available to common stockholders and period to period comparisons.

(2) Our financial results during the three months ended March 31, 2024 were primarily impacted by the following transactions: (i) $94.1 million of merger and integration-related costs related to our merger with Spirit, and (ii) $89.5 million provisions of impairment, primarily on two office properties which were acquired and retained in our merger with VEREIT, Inc. ("VEREIT") in 2021.

(3) FFO, Normalized FFO, and AFFO are non-GAAP financial measures. Normalized FFO is based on FFO and adjusted to exclude merger and integration-related costs and AFFO further adjusts Normalized FFO for unique revenue and expense items. Please see the Glossary for our definitions and explanations of how we utilize these metrics. Please see pages 9 and 10 herein for reconciliations to the most directly comparable GAAP measure.

Dividend Increases

In March 2024, we announced the 106th consecutive quarterly dividend increase, which is the 124th increase in the amount of the dividend since our listing on the New York Stock Exchange (NYSE) in 1994. The annualized dividend amount as of March 31, 2024 was $3.084 per share. The amount of monthly dividends paid per share increased 2.4% to $0.770 during the three months ended March 31, 2024, as compared to $0.752 with the same period in 2023, representing 74.8% of our diluted AFFO per share of $1.03 during the three months ended March 31, 2024.

Real Estate Portfolio Update

As of March 31, 2024, we owned or held interests in 15,485 properties, which were leased to 1,552 clients doing business in 89 industries. Our diversified portfolio of commercial properties under long-term, net lease agreements is actively managed with a weighted average remaining lease term of approximately 9.8 years. Our portfolio of commercial real estate has historically provided dependable rental revenue supporting the payment of monthly dividends. As of March 31, 2024, portfolio occupancy was 98.6% with 217 properties available for lease or sale, as compared to 98.6% as of December 31, 2023 and 99.0% as of March 31, 2023. Our property-level occupancy rates exclude properties with ancillary leases only, such as cell towers and billboards, and properties with possession pending and include properties owned by unconsolidated joint ventures. Below is a summary of our portfolio activity for the period indicated below:

Changes in Occupancy

| | | | | |

Three months ended March 31, 2024 | |

Properties available for lease at December 31, 2023 | 193 | |

Lease expirations (1) (2) | 245 | |

| Re-leases to same client | (166) | |

| Re-leases to new client | (12) | |

| Vacant dispositions | (43) | |

Properties available for lease at March 31, 2024 | 217 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

(1)Includes scheduled and unscheduled expirations (including leases rejected in bankruptcy), as well as future expirations resolved in the periods indicated above.

(2) Includes 26 properties acquired through the merger with Spirit in January 2024.

During the three months ended March 31, 2024, the new annualized contractual rent on re-leases was $59.37 million, as compared to the previous annual rent of $56.91 million on the same units, representing a rent recapture rate of 104.3% on the units re-leased. We re-leased nine units to new clients without a period of vacancy, and seven units to new clients after a period of vacancy. Please see the Glossary for our definition of annualized contractual income.

Investment Summary

The following table summarizes our acquisitions in the U.S. and Europe for the period indicated below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of

Properties | | Investment

($ in millions) | | Leasable

Square Feet

(in thousands) | | Initial Weighted Average Cash Yield (1) | | Weighted

Average Term

(Years) |

Three months ended March 31, 2024 | | | | | | | | | |

| Acquisitions - U.S. real estate | 5 | | | $ | 16.0 | | | 194 | | | 7.1 | % | | 8.9 | |

Acquisitions - Europe real estate | 8 | | | 302.6 | | | 1,064 | | | 8.2 | % | | 6.2 | |

| Total real estate acquisitions | 13 | | | $ | 318.6 | | | 1,258 | | | 8.2 | % | | 6.3 | |

Real estate properties under development (2) (3) | 142 | | | 279.4 | | | 5,776 | | | 7.3 | % | | 15.1 | |

| | | | | | | | | |

Total investments (4) | 155 | | | $ | 598.0 | | | 7,034 | | | 7.8 | % | | 10.2 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1)Initial weighted average cash yield is a supplemental operating measure. Cash income used in the calculation of initial weighted average cash yield for investments includes $0.5 million received as settlement credits as reimbursement of free rent periods. Please see the Glossary for our definitions of Initial Weighted Average Cash Yield and Cash Income.

(2) Includes £8.7 million of investments relating to United Kingdom ("U.K.") development properties and €8.4 million of investments relating to Spain development properties, converted at the applicable exchange rates on the funding dates.

(3) Includes $38.1 million of investments in an unconsolidated U.S. data center joint venture.

(4) Clients we have invested in are 84.5% retail, 9.7% industrial, and 5.8% other based on cash income. Approximately 44% of the annualized cash income generated from acquisitions is from investment grade rated clients, their subsidiaries or affiliated companies. Please see the Glossary for our definition of Investment Grade Clients and Cash Income.

Same Store Rental Revenue

The following summarizes our same store rental revenue for 11,716 properties under lease (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | |

| 2024 | | 2023 | | | | | | % Increase | | |

Same store rental revenue | $843.5 | | $837.1 | | | | | | 0.8% | | |

For purposes of comparability, same store rental revenue is presented on a constant currency basis using the applicable exchange rate as of March 31, 2024. None of the properties in France, Germany, Ireland or Portugal met our same store pool definition for the periods presented. In addition, the same store pool excludes properties assumed on January 23, 2024 as a result of our merger with Spirit. Please see the Glossary to see definitions of our Same Store Pool and Same Store Rental Revenue.

Liquidity and Capital Markets

Capital Raising

During the three months ended March 31, 2024, we raised $550.1 million of proceeds from the sale of common stock at a weighted average price of $56.93 per share, primarily through the settlement of approximately 9.6 million shares of common stock sales previously executed pursuant to forward sale agreements through our ATM program. As of March 31, 2024, there were approximately 1.2 million shares of unsettled common stock subject to forward sale agreements through our ATM program, representing approximately $62.9 million in expected net proceeds and a weighted average initial gross price of $54.00 per share. ATM net sale proceed amounts assume full physical settlement of all outstanding shares of common stock, subject to such forward sale agreements and certain assumptions made with respect to settlement dates.

In January 2024, we issued $450.0 million of 4.750% senior unsecured notes due February 2029 (the “2029 Notes”), and $800.0 million of 5.125% senior unsecured notes due February 2034 (the “2034 Notes”). Combined, the Notes have a weighted average tenor of approximately 8.3 years, a weighted average semi-annual yield to maturity of 5.142%, and weighted average coupon rate of 4.990%.

Liquidity

As of March 31, 2024, we had $4.0 billion of liquidity, which consists of cash and cash equivalents of $680.2 million, unsettled ATM forward equity of $62.9 million, and $3.2 billion of availability under our $4.25 billion unsecured revolving credit facility, net of $806.5 million of borrowing on the revolving credit facility and after deducting $216.0 million in borrowings under our commercial paper programs. We use our unsecured revolving credit facility as a liquidity backstop for the repayment of the notes issued under these programs.

Earnings Guidance

Summarized below are approximate estimates of the key components of our 2024 earnings guidance.

| | | | | | | | | | | | | | | |

| | Prior 2024 Guidance (1) | | Revised 2024 Guidance | |

Net income per share (2) | | $1.22 - $1.34 | | $1.23 - $1.35 | |

Real estate depreciation and impairments per share (3) | | $2.82 | | $2.84 | |

Other adjustments per share (3) | | $0.13 | | $0.10 | |

Normalized FFO per share (2)(4) | | $4.17 - $4.29 | | $4.17 - $4.29 | |

AFFO per share (4) | | $4.13 - $4.21 | | $4.13 - $4.21 | |

Same store rent growth (5) | | Approx 1.0% | | Approx 1.0% | |

| Occupancy | | Over 98% | | Over 98% | |

Cash G&A expenses (% of revenues) (6)(7) | | Approx 3.0% | | Approx 3.0% | |

Property expenses (non-reimbursable) (% of revenues) (6) | | 1.0% - 1.5% | | 1.0% - 1.5% | |

| Income tax expenses | | $65 to $75 million | | $65 to $75 million | |

Acquisition volume (8) | | Approx $2.0 billion | | Approx $2.0 billion | |

| | | | | |

(1) As issued on February 21, 2024. | |

(2) Net income per share and Normalized FFO per share include non-cash interest expense impact related to the Spirit merger. | |

(3) Includes gain on sales of properties and merger and integration-related costs. | |

(4) Normalized FFO per share and AFFO per share exclude merger and integration-related costs associated with our merger with Spirit. Per share amounts may not add due to rounding. | |

(5) Reserve reversals recognized in 2023 represent an approximately 30 basis point headwind to same store rent growth in 2024. | |

(6) Revenue excludes contractually obligated reimbursements by our clients. Cash G&A expenses exclude stock-based compensation expense. | |

(7) G&A expenses inclusive of stock-based compensation expense as a percentage of rental revenue, excluding reimbursements, is expected to be approximately 3.4% - 3.7% in 2024. | |

(8) Acquisition volume excludes merger with Spirit, which closed January 23, 2024. | |

Conference Call Information

In conjunction with the release of our operating results, we will host a conference call on May 7, 2024 at 11:00 a.m. PDT to discuss the results. To access the conference call, dial (833) 816-1264 (United States) or (412) 317-5632 (International). When prompted, please ask for the Realty Income conference call.

A telephone replay of the conference call can also be accessed by calling (877) 344-7529 and entering the conference ID 4176200. The telephone replay will be available through May 14, 2024.

A live webcast will be available in listen-only mode by clicking on the webcast link on the company’s home page or in the investors section at www.realtyincome.com. A replay of the conference call webcast will be available approximately one hour after the conclusion of the live broadcast. No access code is required for this replay.

Supplemental Materials and Sustainability Report

Supplemental Operating and Financial Data for the three months ended March 31, 2024 is available on our corporate website at www.realtyincome.com/investors/quarterly-and-annual-results.

The Sustainability Report for the year ended December 31, 2022 is available on our corporate website at esg.realtyincome.com/indicators/sustainability_report. Our Green Financing Framework is also available on our corporate website at esg.realtyincome.com/indicators/green_financing.

About Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies. Founded in 1969, we invest in diversified commercial real estate and have a portfolio of over 15,450 properties in all 50 U.S. states, the U.K., and six other countries in Europe. We are known as "The Monthly Dividend Company®," and have a mission to deliver stockholders dependable monthly dividends that grow over time. Since our founding, we have declared 646 consecutive monthly dividends and are a member of the S&P 500 Dividend Aristocrats® index for having increased our dividend for the last 25 consecutive years. Additional information about the company can be found at www.realtyincome.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the words “estimated,” “anticipated,” “expect,” “believe,” “intend,” “continue,” “should,” “may,” “likely,” “plans,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions of our business and portfolio; growth strategies and intentions to acquire or dispose of properties (including timing, partners, clients and terms); re-leases, re-development and speculative development of properties and expenditures related thereto; future operations and results; the announcement of operating results, strategy, plans, and the intentions of management; guidance; settlement of shares of common stock sold pursuant to forward sale confirmations under our ATM program; dividends; and trends in our business, including trends in the market for long-term leases of freestanding, single-client properties. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment trust; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding (including the terms and partners of such funding); continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients' solvency, client defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in domestic and foreign income tax laws and rates; property ownership through joint ventures, partnerships and other arrangements which may limit control of the underlying investments; epidemics or pandemics including measures taken to limit their spread, the impacts on us, our business, our clients, and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the anticipated benefits from mergers and acquisitions including from the merger with Spirit; and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this press release. Actual plans and operating results may differ materially from what is expressed or forecasted in this press release. We do not undertake any obligation to update

forward-looking statements or publicly release the results of any forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

Investor Relations:

Steve Bakke

Senior Vice President, Corporate Finance

+1 858 284 5425

sbakke@realtyincome.com

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts) (unaudited)

| | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| | 2024 | | 2023 | | | | |

| REVENUE | | | | | | | | |

Rental (including reimbursable) (1) | | $ | 1,208,169 | | | $ | 925,289 | | | | | |

Other | | 52,316 | | | 19,110 | | | | | |

| Total revenue | | 1,260,485 | | | 944,399 | | | | | |

| | | | | | | | |

| EXPENSES | | | | | | | | |

| Depreciation and amortization | | 581,064 | | | 451,477 | | | | | |

| Interest | | 240,614 | | | 154,132 | | | | | |

| Property (including reimbursable) | | 89,361 | | | 69,397 | | | | | |

| General and administrative | | 40,842 | | | 34,167 | | | | | |

| Provisions for impairment | | 89,489 | | | 13,178 | | | | | |

| Merger and integration-related costs | | 94,104 | | | 1,307 | | | | | |

| Total expenses | | 1,135,474 | | | 723,658 | | | | | |

| Gain on sales of real estate | | 16,574 | | | 4,279 | | | | | |

| Foreign currency and derivative gain, net | | 4,046 | | | 10,322 | | | | | |

| | | | | | | | |

| Equity in (losses) earnings of unconsolidated entities | | (1,676) | | | — | | | | | |

Other income, net | | 5,446 | | | 2,730 | | | | | |

| Income before income taxes | | 149,401 | | | 238,072 | | | | | |

| Income taxes | | (15,502) | | | (11,950) | | | | | |

| Net income | | 133,899 | | | 226,122 | | | | | |

| Net income attributable to noncontrolling interests | | (1,615) | | | (1,106) | | | | | |

| Net income attributable to the Company | | 132,284 | | | 225,016 | | | | | |

| Preferred stock dividends | | (2,588) | | | — | | | | | |

| Net income available to common stockholders | | $ | 129,696 | | | $ | 225,016 | | | | | |

| | | | | | | | |

| Funds from operations available to common stockholders (FFO) | | $ | 785,683 | | | $ | 684,291 | | | | | |

| Normalized funds from operations available to common stockholders (Normalized FFO) | | $ | 879,787 | | | $ | 685,598 | | | | | |

| Adjusted funds from operations available to common stockholders (AFFO) | | $ | 862,871 | | | $ | 650,728 | | | | | |

| | | | | | | | |

| Per share information for common stockholders: | | | | | | | | |

| | | | | | | | |

| Net income available to common stockholders per common share, basic and diluted | | $ | 0.16 | | | $ | 0.34 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| FFO per common share | | | | | | | | |

| Basic | | $ | 0.94 | | | $ | 1.04 | | | | | |

| Diluted | | $ | 0.94 | | | $ | 1.03 | | | | | |

| | | | | | | | |

| Normalized FFO per common share, basic and diluted | | $ | 1.05 | | | $ | 1.04 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| AFFO per common share | | | | | | | | |

| Basic | | $ | 1.03 | | | $ | 0.99 | | | | | |

| Diluted | | $ | 1.03 | | | $ | 0.98 | | | | | |

| | | | | | | | |

| Cash dividends paid per common share | | $ | 0.7695 | | | $ | 0.7515 | | | | | |

| | | | | | | | |

(1)Includes reserves to rental revenue of $1.4 million for the three months ended March 31, 2024, and reserve reversals to rental revenue of $1.8 million for the three months ended March 31, 2023. References to reserves recorded as a reduction of rental revenue include amounts reserved for in the current period, as well as unrecognized contractual revenue and unrecognized straight-line rental revenue for leases accounted for on a cash basis. References to reserve reversals recorded as increases to rental revenue include amounts where the accounting for recognition of rental revenue and straight-line rental revenue has been moved from the cash to the accrual basis.

FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FUNDS FROM OPERATIONS (Normalized FFO)

(in thousands, except per share amounts)

FFO and Normalized FFO are non-GAAP financial measures. Please see the Glossary for our definitions and explanations of how we utilize these metrics.

| | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| | 2024 | | 2023 | | | | |

| | | | | | | | |

Net income available to common stockholders | | $ | 129,696 | | | $ | 225,016 | | | | | |

Depreciation and amortization | | 581,064 | | | 451,477 | | | | | |

Depreciation of furniture, fixtures and equipment | | (623) | | | (542) | | | | | |

| Provisions for impairment of real estate | | 88,197 | | | 13,178 | | | | | |

Gain on sales of real estate | | (16,574) | | | (4,279) | | | | | |

Proportionate share of adjustments for unconsolidated entities | | 4,674 | | | — | | | | | |

FFO adjustments allocable to noncontrolling interests | | (751) | | | (559) | | | | | |

FFO available to common stockholders | | $ | 785,683 | | | $ | 684,291 | | | | | |

FFO allocable to dilutive noncontrolling interests | | 1,340 | | | 1,420 | | | | | |

Diluted FFO | | $ | 787,023 | | | $ | 685,711 | | | | | |

| | | | | | | | |

FFO available to common stockholders | | $ | 785,683 | | | $ | 684,291 | | | | | |

Merger and integration-related costs | | 94,104 | | | 1,307 | | | | | |

Normalized FFO available to common stockholders | | $ | 879,787 | | | $ | 685,598 | | | | | |

Normalized FFO allocable to dilutive noncontrolling interests | | 1,340 | | | 1,420 | | | | | |

Diluted Normalized FFO | | $ | 881,127 | | | $ | 687,018 | | | | | |

| | | | | | | | |

| FFO per common share | | | | | | | | |

| Basic | | $ | 0.94 | | | $ | 1.04 | | | | | |

| Diluted | | $ | 0.94 | | | $ | 1.03 | | | | | |

| | | | | | | | |

| Normalized FFO per common share, basic and diluted | | $ | 1.05 | | | $ | 1.04 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Distributions paid to common stockholders | | $ | 636,499 | | | $ | 497,245 | | | | | |

| | | | | | | | |

FFO available to common stockholders in excess of distributions paid to common stockholders | | $ | 149,184 | | | $ | 187,046 | | | | | |

| | | | | | | | |

Normalized FFO available to common stockholders in excess of distributions paid to common stockholders | | $ | 243,288 | | | $ | 188,353 | | | | | |

| | | | | | | | |

Weighted average number of common shares used for FFO and Normalized FFO | | | | | | | | |

Basic | | 834,940 | | | 660,462 | | | | | |

Diluted | | 837,037 | | | 663,034 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

ADJUSTED FUNDS FROM OPERATIONS (AFFO)

(in thousands, except per share amounts)

AFFO is a non-GAAP financial measure. Please see the Glossary for our definition and an explanation of how we utilize this metric.

| | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| | 2024 | | 2023 | | | | |

Net income available to common stockholders | | $ | 129,696 | | | $ | 225,016 | | | | | |

Cumulative adjustments to calculate Normalized FFO (1) | | 750,091 | | | 460,582 | | | | | |

Normalized FFO available to common stockholders | | 879,787 | | | 685,598 | | | | | |

| | | | | | | | |

Amortization of share-based compensation | | 9,252 | | | 6,300 | | | | | |

Amortization of net debt discounts (premiums) and deferred financing costs (2) | | 4,201 | | | (13,688) | | | | | |

Non-cash gain on interest rate swaps | | (1,800) | | | (1,801) | | | | | |

| Non-cash change in allowance for credit losses | | 1,292 | | | — | | | | | |

Straight-line impact of cash settlement on interest rate swaps (3) | | 1,797 | | | 1,797 | | | | | |

Leasing costs and commissions | | (927) | | | (444) | | | | | |

Recurring capital expenditures | | — | | | (53) | | | | | |

| Straight-line rent and expenses, net | | (44,860) | | | (36,485) | | | | | |

Amortization of above and below-market leases, net | | 14,274 | | | 17,358 | | | | | |

| Proportionate share of adjustments for unconsolidated entities | | 920 | | | — | | | | | |

Other adjustments (4) | | (1,065) | | | (7,854) | | | | | |

AFFO available to common stockholders | | $ | 862,871 | | | $ | 650,728 | | | | | |

AFFO allocable to dilutive noncontrolling interests | | 1,359 | | | 1,431 | | | | | |

Diluted AFFO | | $ | 864,230 | | | $ | 652,159 | | | | | |

| | | | | | | | |

| AFFO per common share | | | | | | | | |

| Basic | | $ | 1.03 | | | $ | 0.99 | | | | | |

| Diluted | | $ | 1.03 | | | $ | 0.98 | | | | | |

| | | | | | | | |

| | | | | | | | |

Distributions paid to common stockholders | | $ | 636,499 | | | $ | 497,245 | | | | | |

| | | | | | | | |

AFFO available to common stockholders in excess of distributions paid to common stockholders | | $ | 226,372 | | | $ | 153,483 | | | | | |

| |

| | | | | | |

Weighted average number of common shares used for AFFO: | | | | | | | | |

Basic | | 834,940 | | | 660,462 | | | | | |

Diluted | | 837,037 | | | 663,034 | | | | | |

(1)See Normalized FFO calculations on page 9 for reconciling items.

(2)Includes the amortization of net premiums and discounts on notes payable and assumption of our mortgages payable, which are being amortized over the life of the applicable debt, and costs incurred and capitalized upon issuance and exchange of our notes payable, assumption of our mortgages payable and issuance of our term loans, which are also being amortized over the lives of the applicable debt. No costs associated with our credit facility agreements or annual fees paid to credit rating agencies have been included.

(3)Represents the straight-line amortization of $72.0 million gain realized upon the termination of $500.0 million in notional interest rate swaps, over the term of the $750.0 million of 5.625% senior unsecured notes due October 2032.

(4)Includes non-cash foreign currency losses (gains) from remeasurement to USD, mark-to-market adjustments on investments and derivatives that are non-cash in nature, straight-line payments from cross-currency swaps, obligations related to financing lease liabilities, and adjustments allocable to noncontrolling interests.

HISTORICAL FFO AND AFFO

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the three months ended March 31, | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 |

| | | | | | | | | | |

Net income available to common stockholders | | $ | 129,696 | | | $ | 225,016 | | | $ | 199,369 | | | $ | 95,940 | | | $ | 146,827 | |

Depreciation and amortization, net of furniture, fixtures and equipment | | 580,441 | | | 450,935 | | | 403,284 | | | 177,614 | | | 164,459 | |

Provisions for impairment of real estate | | 88,197 | | | 13,178 | | | 7,038 | | | 2,720 | | | 4,478 | |

Gain on sales of real estate | | (16,574) | | | (4,279) | | | (10,156) | | | (8,401) | | | (38,506) | |

Proportionate share of adjustments for unconsolidated entities | | 4,674 | | | — | | | 2,235 | | | — | | | — | |

FFO adjustments allocable to noncontrolling interests | | (751) | | | (559) | | | (354) | | | (166) | | | (154) | |

| | | | | | | | | | |

| FFO available to common stockholders | | $ | 785,683 | | | $ | 684,291 | | | $ | 601,416 | | | $ | 267,707 | | | $ | 277,104 | |

| Merger and integration-related costs | | 94,104 | | | 1,307 | | | 6,519 | | | — | | | — | |

| | | | | | | | | | |

| Normalized FFO available to common stockholders | | $ | 879,787 | | | $ | 685,598 | | | $ | 607,935 | | | $ | 267,707 | | | $ | 277,104 | |

| | | | | | | | | | |

FFO per diluted share | | $ | 0.94 | | | $ | 1.03 | | | $ | 1.01 | | | $ | 0.72 | | | $ | 0.82 | |

| | | | | | | | | | |

| Normalized FFO per diluted share | | $ | 1.05 | | | $ | 1.04 | | | $ | 1.02 | | | $ | 0.72 | | | $ | 0.82 | |

| | | | | | | | | | |

| AFFO available to common stockholders | | $ | 862,871 | | | $ | 650,728 | | | $ | 580,098 | | | $ | 318,222 | | | $ | 297,223 | |

| | | | | | | | | | |

AFFO per diluted share | | $ | 1.03 | | | $ | 0.98 | | | $ | 0.98 | | | $ | 0.86 | | | $ | 0.88 | |

| | | | | | | | | | |

| Common stock dividends paid | | $ | 0.7695 | | | $ | 0.7515 | | | $ | 0.7395 | | | $ | 0.7035 | | | $ | 0.6925 | |

| | | | | | | | | | |

| Weighted average diluted shares outstanding - FFO and Normalized FFO | | 837,037 | | | 663,034 | | | 595,103 | | | 371,602 | | | 337,440 | |

| Weighted average diluted shares outstanding - AFFO | | 837,037 | | | 663,034 | | | 595,103 | | | 372,065 | | | 337,440 | |

| | | | | | | | | | |

| | | | | | | | | | |

ADJUSTED EBITDAre

(dollars in thousands)

Adjusted EBITDAre, Annualized Adjusted EBITDAre, Pro Forma Adjusted EBITDAre, Annualized Pro Forma Adjusted EBITDAre, Net Debt/Annualized Adjusted EBITDAre, Net Debt/Annualized Pro Forma Adjusted EBITDAre, Net Debt and Preferred/ Annualized Adjusted EBITDAre, and Net Debt and Preferred/ Annualized Pro Forma Adjusted EBITDAre are non-GAAP financial measures. Please see the Glossary for our definition and an explanation of how we utilize these metrics.

| | | | | | | | | | | | | | |

| | Three months ended March 31, |

| | 2024 | | 2023 |

| Net income | | $ | 133,899 | | | $ | 226,122 | |

| Interest | | 240,614 | | | 154,132 | |

| | | | |

| Income taxes | | 15,502 | | | 11,950 | |

| Depreciation and amortization | | 581,064 | | | 451,477 | |

| Provisions for impairment | | 89,489 | | | 13,178 | |

| Merger and integration-related costs | | 94,104 | | | 1,307 | |

| Gain on sales of real estate | | (16,574) | | | (4,279) | |

| Foreign currency and derivative gain, net | | (4,046) | | | (10,322) | |

| | | | |

| Proportionate share of adjustments from unconsolidated entities | | 15,236 | | | — | |

Quarterly Adjusted EBITDAre | | $ | 1,149,288 | | | $ | 843,565 | |

Annualized Adjusted EBITDAre (1) | | $ | 4,597,152 | | | $ | 3,374,260 | |

| Annualized Pro Forma Adjustments | | $ | 82,199 | | | $ | 83,015 | |

Annualized Pro Forma Adjusted EBITDAre | | $ | 4,679,351 | | | $ | 3,457,275 | |

| Total debt per the consolidated balance sheet, excluding deferred financing costs and net premiums and discounts | | $ | 25,598,604 | | | $ | 18,748,217 | |

| Proportionate share of unconsolidated entities debt, excluding deferred financing costs | | 659,190 | | | — | |

| Less: Cash and cash equivalents | | (680,159) | | | (164,576) | |

Net Debt (2) | | $ | 25,577,635 | | | $ | 18,583,641 | |

| Preferred Stock | | 167,394 | | | — | |

| Net Debt and Preferred Stock | | $ | 25,745,029 | | | $ | 18,583,641 | |

Net Debt/Annualized Adjusted EBITDAre | | 5.6 | x | | 5.5 | x |

Net Debt/Annualized Pro Forma Adjusted EBITDAre | | 5.5 | x | | 5.4 | x |

Net Debt and Preferred/ Annualized Adjusted EBITDAre | | 5.6 | x | | 5.5 | x |

Net Debt and Preferred/ Annualized Pro Forma Adjusted EBITDAre | | 5.5 | x | | 5.4 | x |

(1) We calculate Annualized Adjusted EBITDAre by multiplying the Quarterly Adjusted EBITDAre by four.

(2) Net Debt is total debt per our consolidated balance sheets, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents.

The Annualized Pro Forma Adjustments, which include transaction accounting adjustments in accordance with U.S GAAP, consist of adjustments to incorporate Adjusted EBITDAre from properties we acquired or stabilized during the applicable quarter and remove Adjusted EBITDAre from properties we disposed of during the applicable quarter, giving pro forma effect to all transactions as if they occurred at the beginning of the applicable period. Our calculation includes all adjustments consistent with the requirements to present Adjusted EBITDAre on a pro forma basis in accordance with Article 11 of Regulation S-X. The Annualized Pro Forma Adjustments are consistent with the debt service coverage ratio calculated under financial covenants for our senior unsecured notes. The following table summarizes our Annualized Pro Forma Adjustments related to our Annualized Pro Forma Adjusted EBITDAre calculation for the periods indicated below (in thousands):

| | | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| | 2024 | | 2023 | | |

| Annualized pro forma adjustments from properties acquired or stabilized | | $ | 83,152 | | | $ | 85,835 | | | |

| Annualized pro forma adjustments from properties disposed | | (953) | | | (2,820) | | | |

| Annualized Pro forma Adjustments | | $ | 82,199 | | | $ | 83,015 | | | |

Adjusted Free Cash Flow

(in thousands)

Adjusted Free Cash Flow and Annualized Adjusted Free Cash Flow are non-GAAP financial measures. Please see the Glossary for our definition and an explanation of how we utilize these metrics.

| | | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| | 2024 | | 2023 | | |

| Net cash provided by operating activities | | $ | 778,673 | | | $ | 731,234 | | | |

| Non-recurring capital expenditures | | (9,628) | | | (13,261) | | | |

| Distributions paid to common stockholders | | (636,499) | | | (497,245) | | | |

| Distributions paid to preferred stockholders | | (2,588) | | | — | | | |

Merger and integration-related costs (1) | | 69,353 | | | 1,307 | | | |

| Change in net working capital decrease (increase) | | 6,724 | | | (80,564) | | | |

| Adjusted Free Cash Flow | | $ | 206,035 | | | $ | 141,471 | | | |

| Annualized Adjusted Free Cash Flow | | $ | 824,140 | | | $ | 565,884 | | | |

(1) Excludes share-based compensation costs recognized in merger and integration-related costs.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts) (unaudited)

| | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 | | | | |

| ASSETS | | | | | | | | |

Real estate held for investment, at cost: | | | | | | | | |

Land | | $ | 16,787,731 | | | $ | 14,929,310 | | | | | |

Buildings and improvements | | 39,674,812 | | | 34,657,094 | | | | | |

Total real estate held for investment, at cost | | 56,462,543 | | | 49,586,404 | | | | | |

Less accumulated depreciation and amortization | | (6,392,472) | | | (6,072,118) | | | | | |

Real estate held for investment, net | | 50,070,071 | | | 43,514,286 | | | | | |

Real estate and lease intangibles held for sale, net | | 78,254 | | | 31,466 | | | | | |

Cash and cash equivalents | | 680,159 | | | 232,923 | | | | | |

| Accounts receivable, net | | 789,244 | | | 710,536 | | | | | |

| Lease intangible assets, net | | 7,037,328 | | | 5,017,907 | | | | | |

| Goodwill | | 4,991,342 | | | 3,731,478 | | | | | |

| Investment in unconsolidated entities | | 1,203,263 | | | 1,172,118 | | | | | |

Other assets, net | | 3,478,588 | | | 3,368,643 | | | | | |

Total assets | | $ | 68,328,249 | | | $ | 57,779,357 | | | | | |

| | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | |

Distributions payable | | $ | 225,757 | | | $ | 195,222 | | | | | |

Accounts payable and accrued expenses | | 802,652 | | | 738,526 | | | | | |

Lease intangible liabilities, net | | 1,740,200 | | | 1,406,853 | | | | | |

Other liabilities | | 900,106 | | | 811,650 | | | | | |

Line of credit payable and commercial paper | | 1,022,516 | | | 764,390 | | | | | |

Term loan, net | | 2,370,455 | | | 1,331,841 | | | | | |

Mortgages payable, net | | 200,075 | | | 821,587 | | | | | |

Notes payable, net | | 21,748,004 | | | 18,602,319 | | | | | |

Total liabilities | | $ | 29,009,765 | | | $ | 24,672,388 | | | | | |

| | | | | | | | |

6.000% Series A cumulative redeemable preferred stock and paid in capital, par value $0.01 per share, 69,900 shares authorized, 6,900 shares and no shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively, liquidation preference $25.00 per share | | $ | 167,394 | | | $ | — | | | | | |

| | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Common stock and paid in capital, par value $0.01 per share, 1,300,000 shares authorized, 870,756 and 752,460 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | | $ | 46,220,761 | | | $ | 39,629,709 | | | | | |

Distributions in excess of net income | | (7,299,514) | | | (6,762,136) | | | | | |

| Accumulated other comprehensive income | | 64,780 | | | 73,894 | | | | | |

Total stockholders’ equity | | $ | 38,986,027 | | | $ | 32,941,467 | | | | | |

Noncontrolling interests | | 165,063 | | | 165,502 | | | | | |

Total equity | | $ | 39,151,090 | | | $ | 33,106,969 | | | | | |

Total liabilities and equity | | $ | 68,328,249 | | | $ | 57,779,357 | | | | | |

GLOSSARY

Adjusted EBITDAre. The National Association of Real Estate Investment Trusts (Nareit) established an EBITDA metric for real estate companies (i.e., EBITDA for real estate, or EBITDAre) it believed would provide investors with a consistent measure to help make investment decisions among certain REITs. Our definition of “Adjusted EBITDAre” is generally consistent with the Nareit definition, other than our adjustment to remove foreign currency and derivative gain and loss, excluding the gain and loss from the settlement of foreign currency forwards not designated as hedges (which is consistent with our previous calculations of "Adjusted EBITDAre"). We define Adjusted EBITDAre, a non-GAAP financial measure, for the most recent quarter as earnings (net income) before (i) interest expense, including non-cash loss (gain) on swaps, (ii) income and franchise taxes, (iii) gain on extinguishment of debt, (iv) real estate depreciation and amortization, (v) provisions for impairment, (vi) merger and integration-related costs, (vii) gain on sales of real estate, (viii) foreign currency and derivative gain and loss, net, (ix) gain on settlement of foreign currency forwards, and (x) our proportionate share of adjustments from unconsolidated entities. Our Adjusted EBITDAre may not be comparable to Adjusted EBITDAre reported by other companies or as defined by Nareit, and other companies may interpret or define Adjusted EBITDAre differently than we do. Management believes Adjusted EBITDAre to be a meaningful measure of a REIT’s performance because it provides a view of our operating performance, analyzes our ability to meet interest payment obligations before the effects of income tax, depreciation and amortization expense, provisions for impairment, gain on sales of real estate and other items, as defined above, that affect comparability, including the removal of non-recurring and non-cash items that industry observers believe are less relevant to evaluating the operating performance of a company. In addition, EBITDAre is widely followed by industry analysts, lenders, investors, rating agencies, and others as a means of evaluating the operational cash generating capacity of a company prior to servicing debt obligations. Management also believes the use of an annualized quarterly Adjusted EBITDAre metric is meaningful because it represents our current earnings run rate for the period presented. The ratio of our total debt to our annualized quarterly Adjusted EBITDAre is also used to determine vesting of performance share awards granted to our executive officers. Adjusted EBITDAre should be considered along with, but not as an alternative to, net income as a measure of our operating performance.

Adjusted Free Cash Flow, a non-GAAP financial measure, is defined as net cash provided by operating activities, excluding merger and integration-related costs and changes in net working capital, less non-recurring capital expenditures and dividends paid. We believe adjusted free cash flow to be a useful liquidity measure for us and our investors by helping to evaluate our ability to generate cash beyond what is needed to fund capital expenditures, debt service and other obligations. Notwithstanding cash on hand and incremental borrowing capacity, adjusted free cash flow reflects our ability to grow our business through investments and acquisitions, as well as our ability to return cash to shareholders through dividends. Adjusted free cash flow is not considered under generally accepted accounting principles to be a primary measure of an entity’s residual cash flow available for discretionary spending, and accordingly should not be considered an alternative to operating income, net income, or amounts shown in our consolidated statements of cash flows.

Adjusted Funds From Operations (AFFO), a non-GAAP financial measure, is defined as FFO adjusted for unique revenue and expense items, which we believe are not as pertinent to the measurement of our ongoing operating performance. Most companies in our industry use a similar measurement to AFFO, but they may use the term "CAD" (for Cash Available for Distribution) or "FAD" (for Funds Available for Distribution). We believe AFFO provides useful information to investors because it is a widely accepted industry measure of the operating performance of real estate companies used by the investment community. In particular, AFFO provides an additional measure to compare the operating performance of different REITs without having to account for differing depreciation assumptions and other unique revenue and expense items which are not pertinent to measuring a particular company’s ongoing operating performance. Therefore, we believe that AFFO is an appropriate supplemental performance metric, and that the most appropriate GAAP performance metric to which AFFO should be reconciled is net income available to common stockholders.

Annualized Adjusted EBITDAre, a non-GAAP financial measure, is calculated by annualizing Adjusted EBITDAre.

Annualized Contractual Rent of our acquisitions and properties under development is the monthly aggregate cash amount charged to clients, inclusive of monthly base rent receivables, as of the balance sheet date, multiplied by 12, excluding percentage rent, interest income on loans and preferred equity investments, and including our pro rata share of such revenues from properties owned by unconsolidated joint ventures. We believe total annualized contractual rent is a useful supplemental operating measure, as it excludes entities that were no longer owned at the balance sheet date and includes the annualized rent from properties acquired during the quarter. Total annualized contractual rent has not been reduced to reflect reserves recorded as reductions to GAAP rental revenue in the periods presented.

Annualized Adjusted Free Cash Flow, a non-GAAP financial measure, is calculated by annualizing Adjusted Free Cash Flow.

Annualized Pro Forma Adjusted EBITDAre, a non-GAAP financial measure, is defined as Adjusted EBITDAre, which includes transaction accounting adjustments in accordance with U.S. GAAP, consists of adjustments to incorporate Adjusted EBITDAre from properties we acquired or stabilized during the applicable quarter and removes Adjusted EBITDAre from properties we disposed of during the applicable quarter, giving pro forma effect to all transactions as if they occurred at the beginning of the applicable quarter. Our calculation includes all adjustments consistent with the requirements to present Adjusted EBITDAre on a pro forma basis in accordance with Article 11 of Regulation S-X. The annualized pro forma adjustments are consistent with the debt service coverage ratio calculated under financial covenants for our senior unsecured notes and bonds.

Cash Income represents actual rent for real estate acquisitions as well as rent to be received upon completion of the properties under development. For unconsolidated entities, this represents our pro rata share of the cash income. For loans receivable and preferred equity investments, this represents interest income and preferred dividend income, respectively.

Funds From Operations (FFO), a non-GAAP financial measure, consistent with the Nareit definition, is net income available to common stockholders, plus depreciation and amortization of real estate assets, plus provisions for impairments of depreciable real estate assets, and reduced by gain on property sales. Presentation of the information regarding FFO and AFFO is intended to assist the reader in comparing the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and AFFO in the same way, so comparisons with other REITs may not be meaningful. FFO and AFFO should not be considered alternatives to reviewing our cash flows from operating, investing, and financing activities. In addition, FFO and AFFO should not be considered measures of liquidity, of our ability to make cash distributions, or of our ability to pay interest payments. We consider FFO to be an appropriate supplemental measure of a REIT’s operating performance as it is based on a net income analysis of property portfolio performance that adds back items such as depreciation and impairments for FFO. The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values historically rise and fall with market conditions, presentations of operating results for a REIT using historical accounting for depreciation could be less informative. The use of FFO is recommended by the REIT industry as a supplemental performance measure. In addition, FFO is used as a measure of our compliance with the financial covenants of our credit facility.

Initial Weighted Average Cash Yield for acquisitions and properties under development is computed as Cash Income for the first twelve months following the acquisition date, divided by the total cost of the property (including all expenses borne by us), and includes our pro-rata share of Cash Income from unconsolidated joint ventures. Initial weighted average cash yield for loans receivable and preferred equity investment is computed using the Cash Income for the first twelve months following the acquisition date (based on interest rates in place as of the date of acquisition), divided by the total cost of the investment.

Investment Grade Clients are our clients with a credit rating, and our clients that are subsidiaries or affiliates of companies with a credit rating, as of the balance sheet date, of Baa3/BBB- or higher from one of the three major rating agencies (Moody’s/S&P/Fitch).

Net Debt/Annualized Adjusted EBITDAre, a ratio used by management as a measure of leverage, is calculated as net debt (which we define as total debt per our consolidated balance sheet, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents), divided by Annualized Adjusted EBITDAre.

Net Debt/Annualized Pro Forma Adjusted EBITDAre, a ratio used by management as a measure of leverage, is calculated as net debt (which we define as total debt per our consolidated balance sheet, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents), divided by Annualized Pro Forma Adjusted EBITDAre.

Net Debt and Preferred/Annualized Adjusted EBITDAre, a ratio used by management as a measure of leverage, is calculated as net debt (which we define as total debt per our consolidated balance sheet, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents) plus our preferred stock, divided by Annualized Adjusted EBITDAre.

Net Debt and Preferred/Annualized Pro Forma Adjusted EBITDAre, a ratio used by management as a measure of leverage, is calculated as net debt (which we define as total debt per our consolidated balance sheet, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents) plus our preferred stock, divided by Annualized Pro Forma Adjusted EBITDAre.

Normalized Funds from Operations Available to Common Stockholders (Normalized FFO), a non-GAAP financial measure, is FFO excluding merger and integration-related costs.

Same Store Pool, for purposes of determining the properties used to calculate our same store rental revenue, includes all properties that we owned for the entire year-to-date period, for both the current and prior year except for properties during the current or prior year that were: (i) vacant at any time,(ii) under development or redevelopment, or (iii) involved in eminent domain and rent was reduced.

Same Store Rental Revenue excludes straight-line rent, the amortization of above and below-market leases, and reimbursements from clients for recoverable real estate taxes and operating expenses. For purposes of comparability, same store rental revenue is presented on a constant currency basis by applying the exchange rate as of the balance sheet date to base currency rental revenue.

SUPPLEMENTAL OPERATING & FINANCIAL DATA Q1 2024 An S&P 500 company S&P 500 Dividend Aristocrats® index member Exhibit 99.2

Q1 2024 Supplemental Operating & Financial Data 2 Table of Contents Corporate Overview 3 Financial Summary Consolidated Statements of Income 4 Funds From Operations (FFO) and Normalized Funds From Operations (Normalized FFO) 5 Adjusted Funds From Operations (AFFO) 6 Consolidated Balance Sheets 7 Debt Summary 8 Debt Maturities 9 Debt by Currency 10 Capitalization & Financial Ratios 11 Adjusted EBITDAre & Coverage Ratios 12 Debt Covenants 13 Transaction Summary Investment Summary 14 Disposition Summary 15 Development Pipeline 16 Real Estate Portfolio Summary Client Diversification 17 Top 10 Industries 18 Industry Diversification 19 Geographic Diversification 21 Property Type Composition 22 Same Store Rental Revenue 23 Leasing Data Occupancy 25 Leasing Activity 26 Lease Expirations 27 Earnings Guidance 28 Analyst Coverage 29 Glossary 30 This Supplemental Operating & Financial Data should be read in connection with the company's earnings press release for the three months ended March 31, 2024, (included as Exhibit 99.1 of the company's Current Report on Form 8-K, filed on May 6, 2024) as certain disclosures, definitions, and reconciliations in such announcement have not been included in this Supplemental Operating & Financial Data. Realty Income is not affiliated or associated with, is not endorsed by, does not endorse, and is not sponsored by or a sponsor of the clients or of their products or services pictured or mentioned. The names, logos, and all related product and service names, design marks, and slogans are the trademarks or service marks of their respective companies.

Q1 2024 Supplemental Operating & Financial Data 3 One Team Senior Management Neil M. Abraham, EVP, Chief Strategy Officer, Realty Income International - President Michelle Bushore, EVP, Chief Legal Officer, General Counsel and Secretary Mark E. Hagan, EVP, Chief Investment Officer Shannon Kehle, EVP, Chief People Officer Jonathan Pong, EVP, Chief Financial Officer and Treasurer Sumit Roy, President, Chief Executive Officer Gregory J. Whyte, EVP, Chief Operating Officer Credit Ratings Senior Unsecured Outlook Commercial Paper Moody’s A3 Stable P-2 Standard & Poor’s A- Stable A-2 Dividend Information as of April 2024 ▪ Current annualized dividend of $3.084 per share ▪ Compound average annual dividend growth rate of approximately 4.3% ▪ 646 consecutive monthly dividends declared ▪ 106 consecutive quarterly dividend increases Corporate Headquarters Phoenix Office 11995 El Camino Real 2325 E. Camelback Rd, 9th Floor San Diego, CA 92130 Phoenix, AZ 85016 Phone: +1 (858) 284-5000 Phone: +1 (602) 778-6000 Website: www.realtyincome.com London Office Amsterdam Office 19 Wells Street Eduard van Beinumstraat 8 London, United Kingdom W1T 3PQ Amsterdam, Netherlands 1077 CZ Phone: +44 (20) 3931 6858 Corporate Overview Transfer Agent Computershare Phone: (877) 218-2434 Website: www.computershare.com (1) Total annualized contractual rent is a supplemental operating measure. Please see the Glossary for our definition, reconciliation, and an explanation of how we utilize this metric. (2) Total annualized contractual rent includes 0.5% of rent from clients accounted for on a cash basis. March 31, 2024 Closing price $ 54.10 Shares and units outstanding 872,551 Market value of common equity $ 47,205,010 Total market capitalization $ 73,635,304 Corporate Profile Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies. Founded in 1969, we invest in diversified commercial real estate and have a portfolio of over 15,450 properties in all 50 U.S. states, the U.K., and six other countries in Europe. We are known as "The Monthly Dividend Company®," and have a mission to deliver stockholders dependable monthly dividends that grow over time. Portfolio Overview As of March 31, 2024, we owned or held interests in 15,485 properties, with approximately 334.2 million square feet of leasable space. Our properties are leased to 1,552 different clients doing business in 89 industries. Also as of March 31, 2024, approximately 79.6% of our total annualized contractual rent(1) was generated from retail properties, 14.7% from industrial properties, 3.3% from gaming properties, and the remaining 2.4% from other property types. Our physical occupancy as of March 31, 2024 was 98.6%, with a weighted average remaining lease term of approximately 9.8 years. Total annualized contractual rent on our leases as of March 31, 2024 was $4.79 billion(2). Common Stock Our common stock is traded on the New York Stock Exchange under the symbol "O“ (in thousands, except per share amount).

Q1 2024 Supplemental Operating & Financial Data 4 Three months ended March 31, 2024 2023 REVENUE Rental (including reimbursable) (1) $ 1,208,169 $ 925,289 Other 52,316 19,110 Total revenue 1,260,485 944,399 EXPENSES Depreciation and amortization 581,064 451,477 Interest 240,614 154,132 Property (including reimbursable) 89,361 69,397 General and administrative 40,842 34,167 Provisions for impairment 89,489 13,178 Merger and integration-related 94,104 1,307 Total expenses 1,135,474 723,658 Gain on sales of real estate 16,574 4,279 Foreign currency and derivative gain, net 4,046 10,322 Equity in (losses) earnings of unconsolidated entities (1,676) — Other income, net 5,446 2,730 Income before income taxes 149,401 238,072 Income taxes (15,502) (11,950) Net income 133,899 226,122 Net income attributable to noncontrolling interests (1,615) (1,106) Net income attributable to the Company 132,284 225,016 Preferred stock dividends (2,588) — Net income available to common stockholders $ 129,696 $ 225,016 Net income available to common stockholders per common share, basic and diluted $ 0.16 $ 0.34 (1) Includes rental revenue (reimbursable) of $72.7 million and $59.6 million for the three months ended March 31, 2024 and 2023, respectively. Unless otherwise specified, references to rental revenue in this document are exclusive of reimbursements from clients for recoverable real estate taxes and operating expenses. Additionally, it includes reserves to rental revenue of $1.4 million for the three months ended March 31, 2024, and reserve reversals to rental revenue of $1.8 million for the three months ended March 31, 2023. References to reserves recorded as a reduction of rental revenue include amounts reserved for in the current period, as well as unrecognized contractual revenue and unrecognized straight-line rental revenue for leases accounted for on a cash basis. References to reserve reversals recorded as increases to rental revenue include amounts where the accounting for recognition of rental revenue and straight-line rental revenue has been moved from the cash to the accrual basis. Consolidated Statements of Income (in thousands, except per share amounts) (unaudited)

Q1 2024 Supplemental Operating & Financial Data 5 FFO and Normalized FFO (1) (in thousands, except per share amounts) The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to FFO and Normalized FFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted FFO and Normalized FFO per share computations. Three months ended March 31, 2024 2023 Net income available to common stockholders $ 129,696 $ 225,016 Depreciation and amortization 581,064 451,477 Depreciation of furniture, fixtures and equipment (623) (542) Provisions for impairment of real estate 88,197 13,178 Gain on sales of real estate (16,574) (4,279) Proportionate share of adjustments for unconsolidated entities 4,674 — FFO adjustments allocable to noncontrolling interests (751) (559) FFO available to common stockholders $ 785,683 $ 684,291 FFO allocable to dilutive noncontrolling interests 1,340 1,420 Diluted FFO $ 787,023 $ 685,711 FFO available to common stockholders $ 785,683 $ 684,291 Merger and integration-related costs 94,104 1,307 Normalized FFO available to common stockholders $ 879,787 $ 685,598 Normalized FFO allocable to dilutive noncontrolling interests 1,340 1,420 Diluted Normalized FFO $ 881,127 $ 687,018 FFO per common share Basic $ 0.94 $ 1.04 Diluted $ 0.94 $ 1.03 Normalized FFO per common share, basic and diluted $ 1.05 $ 1.04 Distributions paid to common stockholders $ 636,499 $ 497,245 FFO available to common stockholders in excess of distributions paid to common stockholders $ 149,184 $ 187,046 Normalized FFO available to common stockholders in excess of distributions paid to common stockholders $ 243,288 $ 188,353 Weighted average number of common shares used for FFO and Normalized FFO Basic 834,940 660,462 Diluted 837,037 663,034 (1) FFO and Normalized FFO are non-GAAP financial measures. Please see the Glossary for our definitions of these terms and an explanation of how we utilize these metrics.

Q1 2024 Supplemental Operating & Financial Data 6 The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to Normalized FFO and AFFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted AFFO per share computations. Three months ended March 31, 2024 2023 Net income available to common stockholders $ 129,696 $ 225,016 Cumulative adjustments to calculate Normalized FFO (2) 750,091 460,582 Normalized FFO available to common stockholders 879,787 685,598 Amortization of share-based compensation 9,252 6,300 Amortization of net debt discounts (premiums) and deferred financing costs 4,201 (13,688) Non-cash gain on interest rate swaps (1,800) (1,801) Non-cash change in allowance for credit losses 1,292 — Straight-line impact of cash settlement on interest rate swaps (3) 1,797 1,797 Leasing costs and commissions (927) (444) Recurring capital expenditures — (53) Straight-line rent and expenses, net (44,860) (36,485) Amortization of above and below-market leases, net 14,274 17,358 Proportionate share of adjustments for unconsolidated entities 920 — Other adjustments (4) (1,065) (7,854) AFFO available to common stockholders $ 862,871 $ 650,728 AFFO allocable to dilutive noncontrolling interests 1,359 1,431 Diluted AFFO $ 864,230 $ 652,159 AFFO per common share Basic $ 1.03 $ 0.99 Diluted $ 1.03 $ 0.98 Distributions paid to common stockholders $ 636,499 $ 497,245 AFFO available to common stockholders in excess of distributions paid to common stockholders $ 226,372 $ 153,483 Weighted average number of common shares used for AFFO: Basic 834,940 660,462 Diluted 837,037 663,034 (1) AFFO is a non-GAAP financial measure. Please see the Glossary for our definition and an explanation of how we utilize this metric. (2) See reconciling items for Normalized FFO presented on page 5 under "FFO and Normalized FFO." (3) Represents the straight-line amortization of $72.0 million gain realized upon the termination of $500.0 million in notional interest rate swaps in October 2022, over the term of the $750.0 million of 5.625% senior unsecured notes due October 2032. (4) Includes non-cash foreign currency losses (gains) from remeasurement to USD, mark-to-market adjustments on investments and derivatives that are non-cash in nature, straight-line payments from cross-currency swaps, obligations related to financing lease liabilities, and adjustments allocable to noncontrolling interests. AFFO (1) (in thousands, except per share amounts)

Q1 2024 Supplemental Operating & Financial Data 7 Consolidated Balance Sheets (in thousands, except per share amounts) (unaudited) March 31, 2024 December 31, 2023 ASSETS Real estate held for investment, at cost: Land $ 16,787,731 $ 14,929,310 Buildings and improvements 39,674,812 34,657,094 Total real estate held for investment, at cost 56,462,543 49,586,404 Less accumulated depreciation and amortization (6,392,472) (6,072,118) Real estate held for investment, net 50,070,071 43,514,286 Real estate and lease intangibles held for sale, net 78,254 31,466 Cash and cash equivalents 680,159 232,923 Accounts receivable, net 789,244 710,536 Lease intangible assets, net 7,037,328 5,017,907 Goodwill 4,991,342 3,731,478 Investment in unconsolidated entities 1,203,263 1,172,118 Other assets, net 3,478,588 3,368,643 Total assets $ 68,328,249 $ 57,779,357 LIABILITIES AND EQUITY Distributions payable $ 225,757 $ 195,222 Accounts payable and accrued expenses 802,652 738,526 Lease intangible liabilities, net 1,740,200 1,406,853 Other liabilities 900,106 811,650 Line of credit payable and commercial paper 1,022,516 764,390 Term loan, net 2,370,455 1,331,841 Mortgages payable, net 200,075 821,587 Notes payable, net 21,748,004 18,602,319 Total liabilities $ 29,009,765 $ 24,672,388 6.000% Series A cumulative redeemable preferred stock and paid in capital, par value $0.01 per share, 69,900 shares authorized, 6,900 shares and no shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively, liquidation preference $25.00 per share $ 167,394 $ — Stockholders’ equity: Common stock and paid in capital, par value $0.01 per share, 1,300,000 shares authorized, 870,756 and 752,460 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively $ 46,220,761 $ 39,629,709 Distributions in excess of net income (7,299,514) (6,762,136) Accumulated other comprehensive income 64,780 73,894 Total stockholders’ equity $ 38,986,027 $ 32,941,467 Noncontrolling interests 165,063 165,502 Total equity $ 39,151,090 $ 33,106,969 Total liabilities and equity $ 68,328,249 $ 57,779,357