Over $19 million in revenue and $43 million in

bookings in the second quarter 2023

Now targeting annualized cost savings of over

$110 million exiting the fourth quarter 2023

Ouster, Inc. (NYSE: OUST) (“Ouster” or the “Company”), a leading

provider of high-performance lidar sensors for the automotive,

industrial, robotics, and smart infrastructure industries,

announced today financial results for the three and six months

ended June 30, 2023. The second quarter 2022 comparative financial

highlights reflect only the results of standalone Ouster. First

quarter 2023 comparative financial highlights are composed of

Ouster standalone performance through February 10, 2023 and

combined performance of both companies following the merger with

Velodyne on February 10, 2023 through March 31, 2023.

Second Quarter 2023 Highlights

- Over $19 million in revenue, up 13% quarter over quarter, and

up 88% year over year.

- Booked1 $43 million in business with new and existing

customers.

- Gross margins of 1%, compared to (2)% in the first quarter 2023

and 27% in the second quarter 2022.

- Non-GAAP gross margins of 26%, up from 25% in the first quarter

of 2023.

- Shipped over 3,000 sensors for revenue in the second quarter,

up 1% quarter over quarter and 71% year over year.

- Net loss of $123 million in the second quarter of 2023,

compared to $177 million in the first quarter of 2023 and $28

million in the second quarter of 2022.2

- Adjusted EBITDA3 loss improved to $24 million, compared to a

loss of $27 million in the first quarter of 2023 and a loss of $23

million in the second quarter of 2022.

- Cash, cash equivalents and short-term investments balance of

$224 million as of June 30, 2023.

“Ouster exited the second quarter 2023 with record quarterly

revenues and strong bookings. These results, coupled with our cost

reduction efforts, and continued execution on our cutting-edge

product roadmap, position the Company for long-term success,” said

Ouster CEO Angus Pacala. “We remain on track to build a strong

go-forward enterprise that will create value for all of our

stakeholders.”

Ouster’s second quarter GAAP gross margins of 1% include certain

expenses outside of our ordinary operations, including excess and

obsolete costs, of $3.8 million associated with the consolidation

of product lines and manufacturing transition from the REV6 to REV7

OS sensors. The Company improved non-GAAP gross margins to 26% in

the second quarter of 2023, through strong demand for the REV7

sensor product line and improved average selling prices. Continued

commercial traction for the REV7 sensor and recent cost reduction

efforts support management’s expectations that margins will improve

in the second half of 2023.

______________________________________ 1 Bookings represent

binding contract orders entered during the period. 2 Net loss

includes goodwill impairment non-cash charges of $99 million in

first quarter 2023 and $67 million in second quarter 2023. 3

Adjusted EBITDA loss and non-GAAP gross margin are non-GAAP

financial measures. See Non-GAAP Financial Measures for additional

information and reconciliations of these measures, the most

directly comparable financial measures calculated in accordance

with U.S. GAAP.

2023 Business Objectives and Updates

- Drive new business through targeted sales approach to deliver

near-term growth

- Execute on the digital lidar roadmap for OS and DF series to

expand serviceable market

- Develop a robust software ecosystem to accelerate lidar

adoption

- Build a financially strong business to support long-term growth

and deliver value to shareholders

Drive New Business: Ouster

increased shipments of its REV7 OS sensors in the second quarter

with higher average selling prices. REV7 sensors now account for

the majority of OS sensor revenue and bookings. The Company also

shipped VLS-128 sensors to Motional and May Mobility coinciding

with new and expanded customer agreements.

Execute on Digital Product Roadmap:

Ouster continued to make progress on its digital lidar roadmap with

the release of early B-samples of its solid-state Digital Flash

(DF) sensors. At only 40mm tall, and fully solid state, these final

form-factor DF sensors can detect 10% reflective objects at up to

200 meters range with camera-like resolution. Early B-samples will

be offered to leading automakers starting in the third quarter of

2023, which we expect will be a major catalyst to our automotive

platform.

Develop Robust Software Ecosystem:

Ouster enabled OS sensor compatibility for BlueCity, its turnkey

traffic management solution, as part of its plans to unify the

solution with Ouster Gemini, its digital lidar perception platform

for smart infrastructure applications.

Build Financially Strong

Business:

- Cost Savings: Following its June cost reduction announcement,

Ouster now expects to realize annualized cost savings of over $110

million exiting the fourth quarter of 2023, baselined against the

standalone cost structures of the two companies as of the third

quarter 2022. The Company reduced annual run-rate costs by an

additional approximately $40 million in the second quarter of 2023.

The Company recognized a one-time cash expense of over $3 million

in the quarter.

- Scaling Manufacturing: As part of its outsourced manufacturing

strategy to scale production and reduce costs, Ouster completed the

transition of the VLP-32 sensor to Fabrinet in Thailand, and is on

track to fully transition the VLS-128 by the end of the year.

Third Quarter 2023 Outlook

For the third quarter of 2023, Ouster expects to achieve $20

million to $22 million in revenue.

Conference Call

Information

Ouster will host a conference call and live webcast for analysts

and investors at 5:00 p.m. ET today, August 10, 2023 to discuss its

financial results and business outlook. To access the call, please

register at https://conferencingportals.com/event/ERDXYEAl.

Upon registering, each participant will be provided with call

details and a registrant ID. The webcast and related presentation

materials will be accessible for at least 30 days on Ouster’s

investor relations website at https://investors.ouster.com. A

telephonic replay of the conference call will be available through

August 24, 2023. To access the replay, please dial (800) 770-2030

from the U.S. or (647) 362-9199 from outside the U.S. and enter the

conference ID number: 93428.

About Ouster

Ouster (NYSE: OUST) is a leading global provider of

high-resolution scanning and solid-state digital lidar sensors,

Velodyne Lidar sensors, and software solutions for the automotive,

industrial, robotics, and smart infrastructure industries. Ouster

is on a mission to build a safer and more sustainable future by

offering affordable, high-performance sensors that drive mass

adoption across a wide variety of applications. Ouster is

headquartered in San Francisco, CA with offices in the Americas,

Europe, Asia-Pacific, and the Middle East. For more information,

visit www.ouster.com, or connect with us on Twitter or

LinkedIn.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. The Company intends such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act of 1933,

as amended and Section 21E of the Securities Exchange Act of 1934,

as amended. Such statements are based upon current plans, estimates

and expectations of management that are subject to various risks

and uncertainties that could cause actual results to differ

materially from such statements. The inclusion of forward-looking

statements should not be regarded as a representation that such

plans, estimates and expectations will be achieved. Words such as

“anticipate,” “expect,” “project,” “intend,” “believe,” “may,”

“will,” “should,” “plan,” “could,” “may,” “continue,” “target,”

“contemplate,” “estimate,” “forecast,” “guidance,” “predict,”

“possible,” “potential,” “pursue,” “likely,” and the negative of

these terms and similar expressions are intended to identify

forward-looking statements, though not all forward-looking

statements use these words or expressions. All statements, other

than historical facts, including statements regarding Ouster’s

revenue guidance; anticipated new product launches and

developments; its future results of operations, cash reserve and

financial position; anticipated cost savings; execution against the

Company’s product roadmap; industry and business trends; its

business objectives, plans, strategic partnerships, market growth;

manufacturing transitions; and its competitive market position

constitute forward-looking statements. All forward-looking

statements are subject to risks and uncertainties that may cause

actual results to differ materially from those that we expected,

including, but not limited to, risks related to Ouster’s limited

operating history and history of losses; the negotiating power and

product standards of its customers; fluctuations in its operating

results; its ability to successfully integrate its business with

Velodyne and achieve the anticipated benefits of the Velodyne

merger; supply chain constraints and challenges; cancellation or

postponement of contracts or unsuccessful implementations; the

ability of its lidar technology roadmap and new software solutions

to catalyze growth; the adoption of its products and the growth of

the lidar market generally; Ouster’s ability to grow its sales and

marketing organization; substantial research and development costs

needed to develop and commercialize new products; the competitive

environment in which Ouster operates; selection of Ouster’s

products for inclusion in target markets; Ouster’s future capital

needs and ability to secure additional capital on favorable terms

or at all; its ability to use tax attributes; Ouster’s dependence

on key third party suppliers, in particular Benchmark Electronics,

Inc., Fabrinet, and other suppliers; Ouster’s ability to maintain

inventory and the risk of inventory write-downs; inaccurate

forecasts of market growth; Ouster’s ability to manage growth and

recognize anticipated cost savings; the creditworthiness of

Ouster’s customers; risks related to acquisitions; risks related to

international operations; risks of product delivery problems or

defects; costs associated with product warranties; Ouster’s ability

to maintain competitive average selling prices or high sales

volumes or reduce product costs; conditions in its customers’

industries; Ouster’s ability to recruit and retain key personnel;

Ouster’s ability to adequately protect and enforce its intellectual

property rights, including as relates to Hesai Group; Ouster’s

ability to effectively respond to evolving regulations and

standards; risks related to operating as a public company; and

other important factors discussed in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022, that are further

updated from time to time in the Company’s other filings with the

SEC. Readers are urged to consider these factors carefully and in

the totality of the circumstances when evaluating these

forward-looking statements, and not to place undue reliance on any

of them. Any such forward-looking statements represent management’s

reasonable estimates and beliefs as of the date of this press

release. While Ouster may elect to update such forward-looking

statements at some point in the future, it disclaims any obligation

to do so, other than as may be required by law, even if subsequent

events cause its views to change.

In addition, see information below concerning non-GAAP financial

measures.

Non-GAAP Financial

Measures

In addition to its results determined in accordance with

generally accepted accounting principles in the United States

(“GAAP”), Ouster believes the non‑GAAP measures of Non-GAAP Gross

Profit, Non-GAAP Gross Margin and Adjusted EBITDA are useful in

evaluating its operating performance. Ouster calculates Non-GAAP

Gross Profit as gross profit (loss) excluding amortization of

acquired intangibles, certain excess and obsolete expenses and

losses on firm purchase commitments, and stock-based compensation

expenses. Non-GAAP Gross Margin is calculated as Non-GAAP Gross

Profit divided by revenues. Ouster calculates Adjusted EBITDA as

net loss excluding interest expense (income), net, other expense

(income), net, stock-based compensation expense, provision for

income tax expense, goodwill impairment charges, amortization of

acquired intangible assets, depreciation expenses, certain

restructuring costs excluding stock-based compensation expenses,

certain excess and obsolete expenses and losses on firm purchase

commitments, certain litigation and litigation related expenses and

merger and acquisition related expenses. Ouster believes that

Non-GAAP Gross Profit, Non-GAAP Gross Margin, and Adjusted EBITDA

may be helpful to investors because it provides consistency and

comparability with past financial performance and may be helpful in

comparison with other companies, some of which use similar non‑GAAP

information to supplement their GAAP results. The non-GAAP

financial information is presented for supplemental informational

purposes only, and should not be considered a substitute for

financial information presented in accordance with GAAP, and may be

different from similarly titled non‑GAAP measures used by other

companies. Reconciliation tables of the most comparable GAAP

financial measures to the non-GAAP financial measures are included

at the end of this press release.

OUSTER, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited) (in thousands) June

30,2023 December 31,2022 Assets Current assets:

Cash and cash equivalents

$

91,237

$

122,932

Restricted cash, current

528

257

Short-term investments

133,176

—

Accounts receivable, net

15,106

11,233

Inventory

27,812

19,533

Prepaid expenses and other current assets

12,565

8,543

Total current assets

280,424

162,498

Property and equipment, net

12,739

9,695

Operating lease, right-of-use assets

21,069

12,997

Unbilled receivable, long-term portion

7,433

—

Goodwill

—

51,152

Intangible assets, net

27,951

18,165

Restricted cash, non-current

1,090

1,089

Other non-current assets

3,079

541

Total assets

$

353,785

$

256,137

Liabilities and stockholders’ equity Current liabilities:

Accounts payable

$

10,296

$

8,798

Accrued and other current liabilities

39,843

17,071

Contract liabilities

9,776

402

Operating lease liability, current portion

7,317

3,221

Total current liabilities

67,232

29,492

Operating lease liability, long-term portion

22,455

13,400

Debt

40,135

39,574

Contract liabilities, long-term portion

5,264

342

Other non-current liabilities

1,708

1,710

Total liabilities

136,794

84,518

Commitments and contingencies Stockholders’ equity: Common stock

39

19

Additional paid-in capital

959,111

613,665

Accumulated deficit

(741,929

)

(441,916

)

Accumulated other comprehensive loss

(230

)

(149

)

Total stockholders’ equity

216,991

171,619

Total liabilities and stockholders’ equity

$

353,785

$

256,137

OUSTER, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS (unaudited) (in

thousands, except share and per share data) Three

Months Ended June 30, Six Months Ended June 30,

2023

2022

2023

2022

Revenue

$

19,396

$

10,329

$

36,626

$

18,887

Cost of revenue

19,210

7,547

36,816

13,514

Gross (loss) profit

186

2,782

(190

)

5,373

Operating expenses: Research and development

26,447

15,893

58,906

31,799

Sales and marketing

11,666

7,563

25,199

14,653

General and administrative

17,842

12,515

49,167

26,298

Goodwill impairment charges

67,266

—

166,675

—

Total operating expenses

123,221

35,971

299,947

72,750

Loss from operations

(123,035

)

(33,189

)

(300,137

)

(67,377

)

Other (expense) income: Interest income

2,245

344

3,964

498

Interest expense

(1,728

)

(444

)

(3,397

)

(444

)

Other income (expense), net

(165

)

5,326

(111

)

7,010

Total other income, net

352

5,226

456

7,064

Loss before income taxes

(122,683

)

(27,963

)

(299,681

)

(60,313

)

Provision for income tax expense

50

37

332

84

Net loss

$

(122,733

)

$

(28,000

)

$

(300,013

)

$

(60,397

)

Other comprehensive loss Changes in unrealized gain (loss) on

available for sale securities

$

(74

)

$

—

$

(24

)

$

—

Foreign currency translation adjustments

$

23

$

(76

)

$

(57

)

$

(88

)

Total comprehensive loss

$

(122,784

)

$

(28,076

)

$

(300,094

)

$

(60,485

)

Net loss per common share, basic and diluted

$

(3.19

)

$

(1.60

)

$

(8.84

)

$

(3.49

)

Weighted-average shares used to compute basic and diluted net loss

per share

38,448,241

17,505,736

33,937,505

17,296,583

OUSTER, INC. CONSOLIDATED STATEMENTS OF CASH

FLOWS (unaudited) (in thousands)

Six Months Ended June 30,

2023

2022

CASH FLOWS FROM OPERATING ACTIVITIES

Net loss

$

(300,013

)

$

(60,397

)

Adjustments to reconcile net loss to net cash used in operating

activities: Goodwill impairment charges

166,675

—

Depreciation and amortization

10,605

4,739

Loss on write-off of construction in progress and right-of-use

asset impairment

1,423

—

Stock-based compensation

38,246

16,869

Reduction of revenue related to stock warrant issued to customer

61

—

Change in right-of-use asset

2,012

1,358

Interest expense

889

402

Amortization of debt issuance costs and debt discount

125

42

Accretion or amortization on short-term investments

(2,097

)

—

Change in fair value of warrant liabilities

(126

)

(7,134

)

Inventory write down

5,065

447

Provision for doubtful accounts

541

—

Loss/(Gain) from disposal of property and equipment

(248

)

(100

)

Changes in operating assets and liabilities, net of acquisition

effects: Accounts receivable

3,420

1,341

Inventory

(3,644

)

(10,180

)

Prepaid expenses and other assets

(1,126

)

(1,957

)

Contract assets

—

—

Accounts payable

(1,741

)

1,094

Accrued and other liabilities

(4,779

)

(329

)

Contract liabilities

759

—

Operating lease liability

(2,525

)

(1,588

)

Net cash used in operating activities

(86,478

)

(55,393

)

CASH FLOWS FROM INVESTING ACTIVITIES

Proceeds from sale of property and equipment

560

275

Purchases of property and equipment

(1,973

)

(1,277

)

Purchase of short-term investments

(48,554

)

—

Proceeds from sales of short-term investments

72,481

—

Cash and cash equivalents acquired in the Velodyne Merger

32,137

—

Net cash provided by (used in) investing activities

54,651

(1,002

)

CASH FLOWS FROM FINANCING ACTIVITIES

Repurchase of common stock

—

(43

)

Proceeds from ESPP purchase

310

—

Proceeds from exercise of stock options

150

252

Proceeds from borrowings, net of debt discount and issuance costs

—

19,077

Proceeds from the issuance of common stock under at-the-market

offering, net of commissions and fees

—

14,568

At-the-market offering costs for the issuance of common stock

—

(196

)

Taxes paid related to net share settlement of restricted stock

units

—

(59

)

Net cash provided by financing activities

460

33,599

Effect of exchange rates on cash and cash equivalents

(56

)

(88

)

Net decrease in cash, cash equivalents and restricted cash

(31,423

)

(22,884

)

Cash, cash equivalents and restricted cash at beginning of period

124,278

184,656

Cash, cash equivalents and restricted cash at end of period

$

92,855

$

161,772

OUSTER, INC. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES (unaudited) (in thousands) Three

Months Ended June 30, Six Months Ended June 30,

2023

2022

2023

2022

GAAP net loss

$

(122,733

)

$

(28,000

)

$

(300,013

)

$

(60,397

)

Interest expense (income), net

(517

)

100

(567

)

(54

)

Other expense (income), net

165

(5,326

)

111

(7,010

)

Stock-based compensation(1)

16,466

8,119

38,246

16,869

Provision for income tax expense

50

37

332

84

Goodwill impairment charge

67,266

—

166,675

—

Amortization of acquired intangibles(2)

1,702

1,122

3,213

2,244

Restructuring costs, excluding stock-based compensation expense

3,342

—

15,977

—

Excess and obsolete expenses and loss on firm purchase commitments

3,750

—

7,380

—

Depreciation expense(2)

2,744

1,232

7,392

2,495

Litigation expenses(3)

3,364

92

3,901

592

Merger and acquisition related expenses(4)

—

—

6,058

—

Adjusted EBITDA

$

(24,401

)

$

(22,624

)

$

(51,294

)

$

(45,177

)

(1)Includes stock-based compensation expense as follows:

Three Months Ended June 30, Six Months Ended June 30,

2023

2022

2023

2022

Cost of revenue

$

654

$

146

$

1,428

$

365

Research and development

8,204

3,806

15,709

7,566

Sales and marketing

3,500

1,839

6,381

3,362

General and administrative

4,108

2,328

14,728

5,576

Total stock-based compensation

$

16,466

$

8,119

$

38,246

$

16,869

(2)Includes depreciation and amortization expense as

follows:

Three Months Ended June 30, Six Months Ended

June 30,

2023

2022

2023

2022

Cost of revenue

$

1,772

$

310

$

3,522

$

690

Research and development

892

823

3,856

1,613

Sales and marketing

258

75

440

150

General and administrative

1,524

1,146

2,787

2,286

Total depreciation and amortization expense

$

4,446

$

2,354

$

10,605

$

4,739

(3)Litigation expenses and litigation-related expenses

outside of the Company’s ordinary business operations (4)Merger and

acquisition related expenses represent transaction costs for the

Velodyne Merger which include legal and accounting professional

service fees

Three Months Ended June 30, Six Months Ended

June 30,

2023

2022

2023

2022

Gross profit (loss) on GAAP basis

$

186

$

2,782

$

(190

)

$

5,373

Stock-based compensation

654

146

1,428

365

Amortization of acquired intangible assets

412

—

661

—

Excess and obsolete expenses and loss on firm purchase commitments

3,750

—

7,380

—

Gross profit on non-GAAP basis

$

5,002

$

2,928

$

9,279

$

5,738

Gross margin on GAAP basis

1

%

27

%

(1

)%

28

%

Gross margin on non-GAAP basis

26

%

28

%

25

%

30

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230810248943/en/

For Investors investors@ouster.io

For Media press@ouster.io

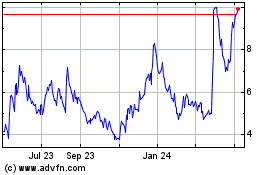

Ouster (NYSE:OUST)

Historical Stock Chart

From Oct 2024 to Nov 2024

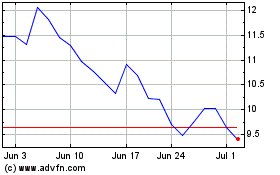

Ouster (NYSE:OUST)

Historical Stock Chart

From Nov 2023 to Nov 2024