Form 8-K - Current report

September 09 2024 - 5:22PM

Edgar (US Regulatory)

0000070145 false 0000070145 2024-09-09 2024-09-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2024

NATIONAL FUEL GAS COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| New Jersey |

|

1-3880 |

|

13-1086010 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

6363 Main Street, Williamsville, New York |

|

14221 |

|

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (716) 857-7000

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $1.00 per share |

|

NFG |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

On September 9, 2024, National Fuel Gas Company (the “Company”) published a supplemental investor presentation to provide information regarding its Utility segment’s ongoing New York rate case. A copy of the presentation is furnished as part of this Current Report as Exhibit 99.

Neither the furnishing of the presentation as an exhibit to this Current Report nor the inclusion in such presentation of any reference to the Company’s internet address shall, under any circumstances, be deemed to incorporate the information available at such internet address into this Current Report. The information available at the Company’s internet address is not part of this Current Report or any other report filed or furnished by the Company with the Securities and Exchange Commission.

In addition to financial measures calculated in accordance with generally accepted accounting principles (“GAAP”), the press release furnished as part of this Current Report as Exhibit 99 contains certain non-GAAP financial measures. The Company believes that such non-GAAP financial measures are useful to investors because they provide an alternative method for assessing the Company’s operating results in a manner that is focused on the performance of the Company’s ongoing operations, for measuring the Company’s cash flow and liquidity, and for comparing the Company’s financial performance to other companies. The Company’s management uses these non-GAAP financial measures for the same purpose, and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP.

Certain statements contained herein or in the press release furnished as part of this Current Report, including statements regarding estimated future earnings and statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will” and “may” and similar expressions, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. There can be no assurance that the Company’s projections will in fact be achieved nor do these projections reflect any acquisitions or divestitures that may occur in the future. While the Company’s expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis, actual results may differ materially from those projected in forward-looking statements. Furthermore, each forward-looking statement speaks only as of the date on which it is made. In addition to other factors, the following are important factors that could cause actual results to differ materially from those discussed in the forward-looking statements: impairments under the SEC’s full cost ceiling test for natural gas reserves; changes in the price of natural gas; changes in laws, regulations or judicial interpretations to which the Company is subject, including those involving derivatives, taxes, safety, employment, climate change, other environmental matters, real property, and exploration and production activities such as hydraulic fracturing; governmental/regulatory actions, initiatives and proceedings, including those involving rate cases (which address, among other things, target rates of return, rate design, retained natural gas and system modernization), environmental/safety requirements, affiliate relationships, industry structure, and franchise renewal; the Company’s ability to estimate accurately the time and resources necessary to meet emissions targets;

governmental/regulatory actions and/or market pressures to reduce or eliminate reliance on natural gas; increased costs or delays or changes in plans with respect to Company projects or related projects of other companies, as well as difficulties or delays in obtaining necessary governmental approvals, permits or orders or in obtaining the cooperation of interconnecting facility operators; changes in economic conditions, including inflationary pressures, supply chain issues, liquidity challenges, and global, national or regional recessions, and their effect on the demand for, and customers’ ability to pay for, the Company’s products and services; the creditworthiness or performance of the Company’s key suppliers, customers and counterparties; financial and economic conditions, including the availability of credit, and occurrences affecting the Company’s ability to obtain financing on acceptable terms for working capital, capital expenditures and other investments, including any downgrades in the Company’s credit ratings and changes in interest rates and other capital market conditions; changes in price differentials between similar quantities of natural gas sold at different geographic locations, and the effect of such changes on commodity production, revenues and demand for pipeline transportation capacity to or from such locations; the impact of information technology disruptions, cybersecurity or data security breaches; factors affecting the Company’s ability to successfully identify, drill for and produce economically viable natural gas reserves, including among others geology, lease availability and costs, title disputes, weather conditions, water availability and disposal or recycling opportunities of used water, shortages, delays or unavailability of equipment and services required in drilling operations, insufficient gathering, processing and transportation capacity, the need to obtain governmental approvals and permits, and compliance with environmental laws and regulations; the Company’s ability to complete strategic transactions; increasing health care costs and the resulting effect on health insurance premiums and on the obligation to provide other post-retirement benefits; other changes in price differentials between similar quantities of natural gas having different quality, heating value, hydrocarbon mix or delivery date; the cost and effects of legal and administrative claims against the Company or activist shareholder campaigns to effect changes at the Company; negotiations with the collective bargaining units representing the Company’s workforce, including potential work stoppages during negotiations; uncertainty of natural gas reserve estimates; significant differences between the Company’s projected and actual production levels for natural gas; changes in demographic patterns and weather conditions (including those related to climate change); changes in the availability, price or accounting treatment of derivative financial instruments; changes in laws, actuarial assumptions, the interest rate environment and the return on plan/trust assets related to the Company’s pension and other post-retirement benefits, which can affect future funding obligations and costs and plan liabilities; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural disasters, terrorist activities or acts of war, as well as economic and operational disruptions due to third-party outages; significant differences between the Company’s projected and actual capital expenditures and operating expenses; or increasing costs of insurance, changes in coverage and the ability to obtain insurance. The Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| NATIONAL FUEL GAS COMPANY |

|

|

| By: |

|

/s/ Michael W. Reville |

|

|

Michael W. Reville |

|

|

General Counsel and Secretary |

Dated: September 9, 2024

Exhibit 99 Investor Presentation New York Utility Rate Case Update

September 9, 2024 September 9, 2024 Supplement 1

Utility NY Utility Rate Case Status th Joint Proposal Filed September 9 ,

2024 – Pending NY PSC Approval ü Filed case on October 31, 2023 requesting base delivery revenue increase of $88.8 million (1) ü Filed a Joint Proposal (JP) with NY PSC on September 9, 2024 for 3-year settlement Rate Case Status

ü Rate plan effective October 1, 2024. Start of new rates pending NY PSC approval and Timing ü JP includes standard make-whole language allowing for the recovery of authorized revenues between October 1, 2024 and the start of new rates

Rate Case Drivers Requested JP ROE 9.8% 9.7% Equity Ratio 52% 48% Rate Base $1.03B $1.04B Utility ü 3-year revenue requirement increase: RY1 +$57.3M; RY2 +$15.8M; and RY3 +$12.7M Key Ratemaking § Includes amortized recovery of regulatory

assets and liabilities (~$13M per year) Items ü Increasing rate base and depreciation expense associated with higher plant in-service § Maintain leak prone pipe replacement target at ~110 miles per year ü Ratemaking mechanisms: §

Continuation of: weather normalization; revenue decoupling; industrial 90/10 symmetrical sharing; merchant function charge § New: uncollectible expense tracker; gas safety and customer service performance metrics; customer bill impact

levelization (1) A Joint Proposal (JP) was filed with the NY PSC on September 9, 2024 (see Case 23-G-0627). The JP is not deemed final as it is subject to Commission approval. NFG can not provide assurance as to the timing of any approval or that

the Commission will approve the JP at all, on the terms set forth therein or with such modifications or additional terms that are acceptable to National Fuel Gas Distribution Corporation. September 9, 2024 Supplement 2

Rate Case Overview: Timing and Status Recent updates in orange Pipeline

& Storge Utility (2) Supply Empire NY PA Regulatory Agency FERC FERC NY PSC PAPUC (Governed by) • Settlement approved by • Rates in effect since • Filed rate case October • Settlement approved FERC June 11, 2024 January

1, 2019 31, 2023 in June 2023 • New rates went into • Must file for new rates • JP filed, pending NY • Rates in effect since effect February 1, 2024 by May 1, 2025 PSC approval August 1, 2023 • No moratorium or •

Rate plan effective Timing/ Status comeback period October 1, 2024, subject to make- whole provision if new rates start after (1) Rate base $823 $1,244 $317 $412 (in millions) Pending JP à $1,040 NY PSC Rate Case Not stated – Not stated

– Not stated – April 2017 à 43% Equity Ratio Black box settlement Black box settlement Black box settlement Pending JP à 48% NY PSC Rate Case Not Stated – Not Stated – Not Stated – April 2017 à 8.7%

Authorized ROE Black box settlement Black box settlement Black box settlement Pending JP à 9.7% (1) Represents the latest available information in regulatory filings. Supply and Empire rate base amounts are as of 12/31/2023. NY is as of

8/31/2023 and PA is as of 12/31/2023. (2) A Joint Proposal (JP) was filed with the NY PSC on September 9, 2024 (see Case 23-G-0627). The JP is not deemed final as it is subject to Commission approval. NFG can not provide assurance as to the timing

of any approval or that the Commission will approve the JP at all, on the terms set forth therein or with such modifications or additional terms that are acceptable to National Fuel Gas Distribution Corporation. September 9, 2024 Supplement

3

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

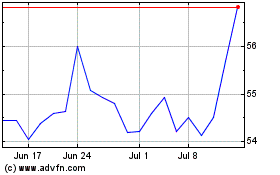

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

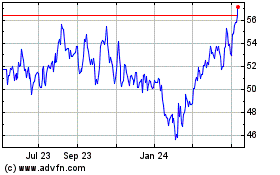

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Nov 2023 to Nov 2024