0001613103H91 VY19false00016131032025-01-172025-01-170001613103us-gaap:CommonStockMember2025-01-172025-01-170001613103mdt:A0.250SeniorNotesDue2025Member2025-01-172025-01-170001613103mdt:A0.000SeniorNotesDue2025Member2025-01-172025-01-170001613103mdt:A2.625SeniorNotesDue2025Member2025-01-172025-01-170001613103mdt:A1.125SeniorNotesDue2027Member2025-01-172025-01-170001613103mdt:A0.375SeniorNotesDue2028Member2025-01-172025-01-170001613103mdt:A3.000SeniorNotesDue2028Member2025-01-172025-01-170001613103mdt:A3.650SeniorNotesDue2029Member2025-01-172025-01-170001613103mdt:A1.625SeniorNotesDue2031Member2025-01-172025-01-170001613103mdt:A1.000SeniorNotesDue2031Member2025-01-172025-01-170001613103mdt:A3.125SeniorNotesDue2031Member2025-01-172025-01-170001613103mdt:A0.750SeniorNotesDue2032Member2025-01-172025-01-170001613103mdt:A3.375SeniorNotesDue2034Member2025-01-172025-01-170001613103mdt:A3.875SeniorNotesDue2036Member2025-01-172025-01-170001613103mdt:A2.250SeniorNotesDue2039Member2025-01-172025-01-170001613103mdt:A1.500SeniorNotesDue2039Member2025-01-172025-01-170001613103mdt:A1.375SeniorNotesDue2040Member2025-01-172025-01-170001613103mdt:A4.150SeniorNotesDue2043Member2025-01-172025-01-170001613103mdt:A1.750SeniorNotesDue2049Member2025-01-172025-01-170001613103mdt:A1.625SeniorNotesDue2050Member2025-01-172025-01-170001613103mdt:A4.150SeniorNotesDue2053Member2025-01-172025-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2025

_____________________________

Medtronic plc

(Exact name of Registrant as Specified in its Charter)

_____________________________

| | | | | | | | | | | | | | |

| | | | |

| Ireland | | 1-36820 | | 98-1183488 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

Building Two

Parkmore Business Park West

Galway, Ireland

(Address of principal executive offices) (Zip Code)

+353 1 438-1700

(Registrant’s telephone number, including area code) | | |

|

| Not Applicable |

| Former name or former address, if changed since last report |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Ordinary shares, par value $0.0001 per share | MDT | New York Stock Exchange |

| 0.250% Senior Notes due 2025 | MDT/25 | New York Stock Exchange |

| 0.000% Senior Notes due 2025 | MDT/25A | New York Stock Exchange |

| 2.625% Senior Notes due 2025 | MDT/25B | New York Stock Exchange |

| 1.125% Senior Notes due 2027 | MDT/27 | New York Stock Exchange |

| 0.375% Senior Notes due 2028 | MDT/28 | New York Stock Exchange |

| 3.000% Senior Notes due 2028 | MDT/28A | New York Stock Exchange |

| 3.650% Senior Notes due 2029 | MDT/29 | New York Stock Exchange |

| 1.625% Senior Notes due 2031 | MDT/31 | New York Stock Exchange |

| 1.000% Senior Notes due 2031 | MDT/31A | New York Stock Exchange |

| 3.125% Senior Notes due 2031 | MDT/31B | New York Stock Exchange |

| 0.750% Senior Notes due 2032 | MDT/32 | New York Stock Exchange |

| 3.375% Senior Notes due 2034 | MDT/34 | New York Stock Exchange |

| 3.875% Senior Notes due 2036 | MDT/36 | New York Stock Exchange |

| 2.250% Senior Notes due 2039 | MDT/39A | New York Stock Exchange |

| 1.500% Senior Notes due 2039 | MDT/39B | New York Stock Exchange |

| 1.375% Senior Notes due 2040 | MDT/40A | New York Stock Exchange |

| 4.150% Senior Notes due 2043 | MDT/43A | New York Stock Exchange |

| 1.750% Senior Notes due 2049 | MDT/49 | New York Stock Exchange |

| 1.625% Senior Notes due 2050 | MDT/50 | New York Stock Exchange |

| 4.150% Senior Notes due 2053 | MDT/53 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Thierry Pieton as Chief Financial Officer of Medtronic plc

On January 21, 2025, Medtronic plc (Company) announced the appointment of Thierry Pieton, age 54, as the Company’s Executive Vice President and Chief Financial Officer (CFO), effective as of March 3, 2025 (Effective Date).

Thierry Pieton is a global finance executive with experience across many of the world's most operationally-focused companies and industries, including almost 16 years within the General Electric (GE) group of companies. Mr. Pieton began his career as an auditor at PricewaterhouseCoopers (PwC) before moving into finance business partner roles, first at GE Healthcare and then at GE. From GE, Mr. Pieton joined Nissan Motor Company in 2014 as its Senior Vice President, Administration & Finance for Europe. In 2016, Mr. Pieton moved to Renault, S. A., where he most recently served as Chief Financial Officer.

The Company has entered into a letter agreement (Agreement) with Mr. Pieton regarding the terms and conditions of his employment. Mr. Pieton’s initial annual base salary will be $850,000 and he will participate in the Medtronic Incentive Plan (MIP), with a target payout equal to 110% of his annual base salary for fiscal year 2025, prorated based on Mr. Pieton’s Effective Date. In addition, Mr. Pieton will participate in the Company’s 2021 Long-Term Incentive Plan (LTIP), with awards to be granted as of the Effective Date, with an aggregate target value of $2 million for fiscal year 2025, consisting of: (i) a $1 million target performance share unit (PSU) award under the FY2025-FY2027 PSU plan established by the Compensation Committee of the Board of Directors of the Company (Compensation Committee), (ii) a stock option with a targeted grant date fair value of $600,000, vesting in 25% increments beginning on the first anniversary of the grant date, and (iii) a restricted stock unit (RSU) award with a targeted grant date value of $400,000, vesting 100% on the third anniversary of the grant date. Future MIP and LTIP awards will be considered on a full annual basis by the Compensation Committee.

To compensate Mr. Pieton for foregone compensation at his prior employer, he will receive a $3 million cash bonus, payable in three equal installments with the first installment payable within 30 calendar days of the Effective Date, the second installment payable on the one year anniversary of the Effective Date, and the third installment payable on the date 18 months following the Effective Date (in each case subject to the Company’s standard clawback policy). To compensate Mr. Pieton for unvested equity compensation foregone at his prior employer, the Company will grant a one-time RSU award (the New Hire RSU) on the Effective Date. The New Hire RSU will have a grant date value of $2.5 million with the number of shares to be calculated based on the market closing price of Company stock on the grant date. The New Hire RSU will vest in 1/3 increments beginning on the first anniversary of the grant date. Mr. Pieton will be subject to the Company’s Stock Ownership Policy, requiring him to retain 50% of after-tax shares following settlement of equity compensation awards until he is able to maintain Company stock with a value equal to three times his annual salary.

The Agreement provides that Mr. Pieton will be entitled to certain relocation and commuter benefits, and an annual $24,000 allowance relating to automobile use, financial planning and other personal and job-related expenses, and that he will be eligible for the Company’s deferred compensation plan and employee health and welfare benefits commensurate with his job level. An additional contribution of 8% of base salary and actual MIP payout will be contributed annually to Mr. Pieton’s non-qualified deferred compensation program through his 62nd birthday (assuming continued employment).

Mr. Pieton’s employment will be on an at-will basis and may be terminated at any time by either party, provided that if the Company terminates Mr. Pieton’s employment without “cause” (as defined in the Company’s LTIP), and contingent upon Mr. Pieton signing and complying with a severance and release agreement, Mr. Pieton will be eligible for the Company’s Section 16 Officer severance plan as described in the Company’s most recent Proxy Statement on Schedule 14A filed on August 9, 2024 (Proxy Statement). The Company’s Section 16 Officer Change in Control Policy will also apply to Mr. Pieton, as described in the Proxy Statement. Mr. Pieton will enter into a standard Employee Agreement with the Company on the same form as all other officers, which contains provisions relating to confidentiality, post-employment restrictions and inventions, and Mr. Pieton’s equity grants will be governed by the Company’s standard forms of non-qualified stock option, PSU award, and RSU award agreements for executive officers.

There are no family relationships between Mr. Pieton and any director or executive officer of the Company that require disclosure under Item 401(d) of Regulation S-K. Other than his employment at the Company, there are no transactions between Mr. Pieton or any member of her immediate family, on the one hand, and the Company or any of its subsidiaries, on the other hand, that require disclosure under Item 404(a) of Regulation S-K. Furthermore, there are no arrangements or understandings between Mr. Pieton and any other persons pursuant to which Mr. Pieton was selected as the Company’s Executive Vice President and Chief Financial Officer.

Compensation of Interim Chief Financial Officer

On January 17, 2025, the Compensation Committee approved a one-time RSU grant to Gary Corona, Interim Chief Financial Officer, with a January 21, 2025 grant date, in the amount of $1,000,000 to recognize his leadership and contributions in this capacity. The RSUs will vest 100% on the one-year anniversary of the grant date. Mr. Corona will continue to serve as the Company’s Interim Chief Financial Officer until the Effective Date.

(d) List of Exhibits | | | | | | | | |

| Exhibit Number | | Description |

| |

| | |

| 104 | | Cover Page Interactive Data File (embedded with the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | Medtronic plc |

| | | |

| | | | By | | /s/ Ivan K. Fong |

| Date: January 21, 2025 | | | | | | Ivan K. Fong |

| | | | | | Executive Vice President, General Counsel and Secretary |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit Number | | Description |

| |

| | |

| 104 | | Cover Page Interactive Data File (embedded with the Inline XBRL document). |

NEWS RELEASE | | | | | | | | | | | |

| Contacts: | | |

| | | |

| Erika Winkels | | Ryan Weispfenning |

| Public Relations | | Investor Relations |

| +1-763-526-8478 | | +1-763-505-4626 |

FOR IMMEDIATE RELEASE

Medtronic appoints Thierry Piéton as Chief Financial Officer

GALWAY, Ireland – Date – Jan. 21, 2025 - / PRNewswire / - Medtronic plc (NYSE: MDT), a global leader in healthcare technology, today announced that Thierry Piéton has been appointed Chief Financial Officer for the company, effective March 3, 2025. He will report to Medtronic Chairman and Chief Executive Officer Geoff Martha and will join the Medtronic Executive Committee. Piéton joins Medtronic from Renault Group, where he has served as Chief Financial Officer since March 2022. Gary Corona, who has been serving as interim CFO, will continue in this role until Piéton joins Medtronic, after which Corona will become Senior Vice President, Corporate Finance and will remain on the Medtronic Executive Committee.

“Thierry is a strategic, creative, operationally focused, experienced CFO with a proven track record of delivering innovation-driven growth, margin improvement, and earnings power through strong financial leadership, which is directly aligned with our financial objectives,” said Geoff Martha, Medtronic chairman and chief executive officer. “We are confident he is the right choice at this important time for Medtronic and can’t wait to benefit from his expertise and leadership.”

Under Piéton’s leadership, Renault achieved its highest ever operating margins and improved free cash flow, while also executing portfolio management, including tuck-in acquisitions, divestitures, and funding development through innovative partnerships. This led to significant value creation for its shareholders. Piéton brings experience in both healthcare and other highly regulated, operationally focused manufacturing companies, including Nissan Motor Co. Ltd, General Electric, GE Healthcare and PricewaterhouseCoopers. His career path to CFO demonstrates intentional development through accretive experiences across several industries, geographies, companies, and all facets of a global finance function.

As CFO, Piéton will be responsible for leading the Medtronic global finance organization and key supporting functions, including Treasury, Controller, Tax, Internal Audit, Investor Relations, Corporate Strategy, and Business Development.

“I also want to recognize Gary Corona, who has served as interim CFO. Gary helped us deliver revenue growth and EPS that exceeded expectations in our first and second quarters and has provided strong leadership of our Finance function over the last six months. He will help ensure a smooth and successful transition, and I look forward to continuing to work with him in his new role leading several key Corporate finance functions,” said Martha.

About Medtronic

Bold thinking. Bolder actions. We are Medtronic. Medtronic plc, headquartered in Galway, Ireland, is the leading global healthcare technology company that boldly attacks the most challenging health problems facing humanity by searching out and finding solutions. Our Mission — to alleviate pain, restore health, and extend life — unites a global team of 95,000+ passionate people across more than 150 countries. Our technologies and therapies treat 70 health conditions and include cardiac devices, surgical robotics, insulin pumps, surgical tools, patient monitoring systems, and more. Powered by our diverse knowledge, insatiable curiosity, and desire to help all those who need it, we deliver innovative technologies that transform the lives of two people every second, every hour, every day. Expect more from us as we empower insight-driven care, experiences that put people first, and better outcomes for our world. In everything we do, we are engineering the extraordinary. For more information on Medtronic (NYSE: MDT), visit www.Medtronic.com and follow Medtronic on LinkedIn.

-end-

v3.24.4

Cover

|

Jan. 17, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 17, 2025

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

1-36820

|

| Entity Tax Identification Number |

98-1183488

|

| Entity Address, Address Line One |

Building Two

|

| Entity Address, Address Line Two |

Parkmore Business Park West

|

| Entity Address, City or Town |

Galway

|

| Entity Address, Country |

IE

|

| Country Region |

353

|

| City Area Code |

1

|

| Local Phone Number |

438-1700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001613103

|

| Entity Registrant Name |

Medtronic plc

|

| Entity Address, Postal Zip Code |

H91 VY19

|

| Amendment Flag |

false

|

| Ordinary shares, par value $0.0001 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

MDT

|

| Security Exchange Name |

NYSE

|

| 0.250% Senior Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.250% Senior Notes due 2025

|

| Trading Symbol |

MDT/25

|

| Security Exchange Name |

NYSE

|

| 0.000% Senior Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.000% Senior Notes due 2025

|

| Trading Symbol |

MDT/25A

|

| Security Exchange Name |

NYSE

|

| 2.625% Senior Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.625% Senior Notes due 2025

|

| Trading Symbol |

MDT/25B

|

| Security Exchange Name |

NYSE

|

| 1.125% Senior Notes due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Senior Notes due 2027

|

| Trading Symbol |

MDT/27

|

| Security Exchange Name |

NYSE

|

| 0.375% Senior Notes due 2028 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.375% Senior Notes due 2028

|

| Trading Symbol |

MDT/28

|

| Security Exchange Name |

NYSE

|

| 3.000% Senior Notes due 2028 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.000% Senior Notes due 2028

|

| Trading Symbol |

MDT/28A

|

| Security Exchange Name |

NYSE

|

| 3.650% Senior Notes due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.650% Senior Notes due 2029

|

| Trading Symbol |

MDT/29

|

| Security Exchange Name |

NYSE

|

| 1.625% Senior Notes due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Senior Notes due 2031

|

| Trading Symbol |

MDT/31

|

| Security Exchange Name |

NYSE

|

| 1.000% Senior Notes due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.000% Senior Notes due 2031

|

| Trading Symbol |

MDT/31A

|

| Security Exchange Name |

NYSE

|

| 3.125% Senior Notes due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.125% Senior Notes due 2031

|

| Trading Symbol |

MDT/31B

|

| Security Exchange Name |

NYSE

|

| 0.750% Senior Notes due 2032 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.750% Senior Notes due 2032

|

| Trading Symbol |

MDT/32

|

| Security Exchange Name |

NYSE

|

| 3.375% Senior Notes due 2034 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.375% Senior Notes due 2034

|

| Trading Symbol |

MDT/34

|

| Security Exchange Name |

NYSE

|

| 3.875% Senior Notes due 2036 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.875% Senior Notes due 2036

|

| Trading Symbol |

MDT/36

|

| Security Exchange Name |

NYSE

|

| 2.250% Senior Notes due 2039 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.250% Senior Notes due 2039

|

| Trading Symbol |

MDT/39A

|

| Security Exchange Name |

NYSE

|

| 1.500% Senior Notes due 2039 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Senior Notes due 2039

|

| Trading Symbol |

MDT/39B

|

| Security Exchange Name |

NYSE

|

| 1.375% Senior Notes due 2040 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.375% Senior Notes due 2040

|

| Trading Symbol |

MDT/40A

|

| Security Exchange Name |

NYSE

|

| 4.150% Senior Notes due 2043 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.150% Senior Notes due 2043

|

| Trading Symbol |

MDT/43A

|

| Security Exchange Name |

NYSE

|

| 1.750% Senior Notes due 2049 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Senior Notes due 2049

|

| Trading Symbol |

MDT/49

|

| Security Exchange Name |

NYSE

|

| 1.625% Senior Notes due 2050 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Senior Notes due 2050

|

| Trading Symbol |

MDT/50

|

| Security Exchange Name |

NYSE

|

| 4.150% Senior Notes due 2053 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.150% Senior Notes due 2053

|

| Trading Symbol |

MDT/53

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A0.250SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A0.000SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A2.625SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A1.125SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A0.375SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A3.000SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A3.650SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A1.625SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A1.000SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A3.125SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A0.750SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A3.375SeniorNotesDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A3.875SeniorNotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A2.250SeniorNotesDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A1.500SeniorNotesDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A1.375SeniorNotesDue2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A4.150SeniorNotesDue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A1.750SeniorNotesDue2049Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A1.625SeniorNotesDue2050Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdt_A4.150SeniorNotesDue2053Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

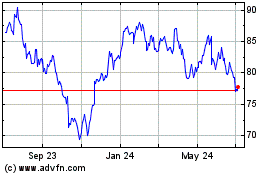

Medtronic (NYSE:MDT)

Historical Stock Chart

From Feb 2025 to Mar 2025

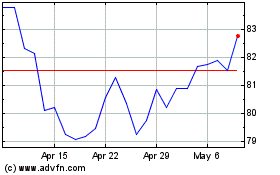

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Mar 2025