New This Tax Season: H&R Block Filers Could Receive Up To $4,000 With Refund Advance Loan

January 06 2025 - 8:00AM

H&R Block (NYSE: HRB) is excited to announce the return of

Refund Advance loan1, a no-interest loan of up to $4,000, issued by

Pathward®, N.A, available to qualifying taxpayers who file their

taxes with H&R Block between Jan. 3 and Feb. 28, 2025. Designed

to help hardworking Americans access funds more quickly than

waiting for their refund, Refund Advance loan provides financial

relief to filers while they wait for their refund to be processed.

Unlike loans at some tax preparation providers, the Refund

Advance loan at H&R Block offices comes with no interest and no

loan fees—and funds availability began on January 3, so those who

are approved don’t need to wait until the IRS is open in late

January to receive the Refund Advance loan funds. Clients could

receive a Refund Advance loan within minutes of filing, making it a

truly consumer-friendly option for those needing financial

assistance while waiting for their refund. Plus, new this year,

filers have the opportunity to obtain up to $4,000 through a Refund

Advance loan.1

“This year, we're thrilled to expand the Refund Advance loan

offering, allowing filers to apply for a loan of up to $4,000

within minutes of filing without interest, loan fees, or

complications,” said Curtis Campbell, President of Global Consumer

Tax & Chief Product Officer at H&R Block. “For many of our

clients, receiving their tax refund is a significant financial

milestone each year, and we're proud to help them access funds

quickly while they are waiting for their refund—even before the IRS

officially opens in late January. For those who claim Path Act

related credits and must typically wait until mid-February for

refunds, a Refund Advance loan can make all the difference.”

Key Features of the Refund Advance Loan:

- Up to $4,000, making it one of the largest no

interest refund advance loans among national brands. If approved, a

Refund Advance loan will be issued in one of five amounts—$250,

$500, $750, $1,250, $4,000.

- No Interest and No Loan Fees: The loan is

issued with no interest and no loan fees, making it an affordable

option for consumers.

- Quick Access to Funds: If approved, funds can

be available the same day, providing easy and efficient

access.

- No Credit Impact and High Approval Rates:

There’s no impact to a taxpayer’s credit score when applying for or

receiving the Refund Advance loan. Plus, the Refund Advance loan

program has high approval rates.

- Repayment with Tax Refund: An H&R Block

tax professional will assist in setting up repayment from the tax

refund, ensuring that the loan is automatically repaid once the

refund is received, making it a seamless and convenient

solution.

H&R Block filers can apply for Refund Advance loan with the

help of one of H&R Block’s 60,000 tax professionals nationwide

during their virtual or in-office appointment. For filers approved

for the loan, the funds are typically available the same day and

can be deposited into a Spruce2 account or loaded onto an Emerald

Card®.

“For many of our clients, this loan could make a big

impact—whether it’s paying off bills, catching up on holiday

spending, or managing daily expenses,” added Campbell. "We know our

clients work hard, and this product is designed to better serve

them by getting them access to money, quickly, while waiting for

their refund."

For more information or to schedule an appointment, visit

www.hrblock.com.

1 This is an optional tax refund-related loan from Pathward®,

N.A.; it is not your tax refund. Loans are offered in amounts of

$250, $500, $750, $1,250 or $4,000. Approval and loan amount based

on expected refund amount, eligibility criteria, and underwriting.

If approved, funds will be disbursed as directed to a prepaid card

or checking account at Pathward. The loan amount will be deducted

from your tax refund, and any remaining balance will be sent to

you. Tax returns may be e-filed without applying for this loan.

Fees for other optional products or product features may apply.

Limited time offer at participating locations. H&R Block Maine

License No. FRA2. OBTP#13696-BR.

2 Spruce fintech platform is built by H&R Block, which is

not a bank. Spruce℠ Spending and Savings Accounts established at,

and the Spruce debit card and the H&R Block Emerald Prepaid

Mastercard® are issued by, Pathward®, N.A., Member FDIC, pursuant

to license by Mastercard®. Mastercard and the circles design are

registered trademarks of Mastercard International Incorporated.

Additional fees, conditions, and terms apply to how you use your

Emerald Card or Spruce account. Consult your Cardholder Agreement

or Spruce Spending Account Agreement for details.

About H&R Block H&R Block, Inc. (NYSE: HRB)

provides help and inspires confidence in its clients and

communities everywhere through global tax preparation services,

financial products, and small-business solutions. The company

blends digital innovation with human expertise and care as it helps

people get the best outcome at tax time and also be better with

money using its mobile banking app, Spruce. Through Block Advisors

and Wave, the company helps small-business owners thrive with

year-round bookkeeping, payroll, advisory, and payment processing

solutions. For more information, visit H&R Block News.

For inquiries, please contact:

|

Media Relations: |

Susan Fish, (816) 399-7280, susan.fish@hrblock.com |

| |

Media Desk:

Mediadesk@hrblock.com |

| |

|

| Investor Relations: |

Jordyn Eskijian, (816)

854-5674, jordyn.eskijian@hrblock.com |

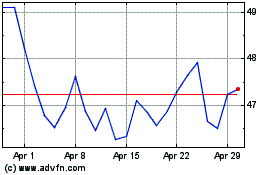

H and R Block (NYSE:HRB)

Historical Stock Chart

From Jan 2025 to Feb 2025

H and R Block (NYSE:HRB)

Historical Stock Chart

From Feb 2024 to Feb 2025