Fortis Inc. ("Fortis" or the "Corporation") (TSX/NYSE: FTS), a

well-diversified leader in the North American regulated electric

and gas utility industry, released its 2024-2028 outlook1.

Highlights

- 2024-2028 capital plan of $25.0

billion, representing 6.3% rate base growth; up $2.7 billion from

2023-2027 five-year plan

- Growth largely driven by

investments in transmission in the U.S. Midwest and resource

transition plan in Arizona

- Fourth quarter common share

dividend increasing by 4.4%, will mark 50 years of consecutive

increases in dividends paid

- Annual dividend growth guidance of

4-6% extended to 2028

"Our Board of Directors declared a fourth

quarter dividend representing a 4.4% increase that will mark 50

years of consecutive increases in dividends paid," said David

Hutchens, President and CEO, Fortis Inc. "This makes Fortis one of

only two companies listed on the Toronto Stock Exchange to reach

this significant milestone."

"Our sustainable regulated growth strategy is

focused on delivering cleaner energy that remains affordable and

reliable for our customers while supporting annual dividend growth

of 4-6% through 2028,” said Mr. Hutchens.

New Five-Year Capital PlanToday

the Corporation announced its new 2024-2028 capital plan of $25.0

billion, the largest in the Corporation’s history, and

$2.7 billion higher than the previous five-year plan. The

increase is supported by the Inflation Reduction Act of 2022, and

largely reflects regional transmission projects at ITC associated

with tranche one of the Midcontinent Independent System Operator

long-range transmission plan, as well as investments in Arizona to

support Tucson Electric Power’s exit from coal. Investments

supporting system adaptation and resiliency, customer growth and

economic development are also driving growth across our entire

footprint.

The five-year capital plan is low risk and

highly executable, with nearly 100% regulated investments and 18%

relating to major capital projects. Approximately 27% of the

five-year capital plan is allocated to cleaner energy investments

focused on connecting renewables to the grid, renewable and storage

investments in Arizona and the Caribbean, and cleaner fuel

solutions in British Columbia. The Corporation's $25.0 billion

five-year capital plan is expected to increase midyear rate base

from $36.8 billion in 2023 to $49.4 billion by 2028,

translating into a five-year compound annual growth rate of 6.3% on

a constant foreign exchange basis. The plan maintains a focus on

customer affordability, while ensuring reliable and resilient

energy delivery service as the Corporation transitions to a cleaner

energy future.

The five-year capital plan is expected to be

funded primarily by cash from operations and regulated debt. Common

equity proceeds are expected to be sourced from the Corporation's

dividend reinvestment plan and an at-the-market common equity

program.

Beyond the five-year capital plan, additional

opportunities to expand and extend growth include: further

expansion of the electric transmission grid in the U.S. to

facilitate the interconnection of cleaner energy, including

infrastructure investments associated with the Inflation Reduction

Act of 2022 and the Midcontinent Independent System Operator, Inc.

long-range transmission plan; climate adaptation and grid

resiliency investments; renewable gas solutions and liquefied

natural gas infrastructure in British Columbia; and the

acceleration of cleaner energy infrastructure investments across

our jurisdictions._________________________

1 All information referenced is presented

in Canadian dollars unless otherwise specified.

Dividends and Dividend

Guidance

The Board of Directors of Fortis declared a

common share dividend of $0.59 per share on the issued and

outstanding fully paid common shares of the Corporation,

representing an approximate 4.4% increase in the quarterly

dividend, payable on December 1, 2023 to the common

Shareholders of Record at the close of business on November 17,

2023, marking 50 consecutive years of increased dividends.

- $0.3063 per share on the First

Preference Shares, Series "F" of the Corporation, payable on

December 1, 2023 to the Shareholders of Record at the close of

business on November 17, 2023;

- $0.3826875 per share on the First

Preference Shares, Series "G" of the Corporation, payable on

December 1, 2023 to the Shareholders of Record at the close of

business on November 17, 2023;

- $0.11469 per share on the First

Preference Shares, Series "H" of the Corporation, payable on

December 1, 2023 to the Shareholders of Record at the close of

business on November 17, 2023;

- $0.406571 per share on the First

Preference Shares, Series "I" of the Corporation, payable on

December 1, 2023 to the Shareholders of Record at the close of

business on November 17, 2023;

- $0.2969 per share on the First

Preference Shares, Series "J" of the Corporation, payable on

December 1, 2023 to the Shareholders of Record at the close of

business on November 17, 2023;

- $0.2455625 per share on the First

Preference Shares, Series "K" of the Corporation, payable on

December 1, 2023 to the Shareholders of Record at the close of

business on November 17, 2023;

- $0.2445625 per share on the First

Preference Shares, Series "M" of the Corporation, payable on

December 1, 2023 to the Shareholders of Record at the close of

business on November 17, 2023; and

- $0.59 per share on the Common

Shares of the Corporation, payable on December 1, 2023 to the

Shareholders of Record at the close of business on November 17,

2023.

The Corporation has designated the common share

dividend and preference share dividends as eligible dividends for

federal and provincial dividend tax credit purposes. All amounts

are given in Canadian dollars unless otherwise indicated.

Fortis expects its long-term growth in rate base

will drive earnings that support annual dividend growth. The

Corporation’s annual dividend growth guidance of 4-6% has been

extended one year through 2028 and is premised on the assumptions

listed under "Forward-Looking Information".

About Fortis

Fortis is a well-diversified leader in the North

American regulated electric and gas utility industry with 2022

revenue of $11.0 billion and total assets of $64 billion as at June

30, 2023. The Corporation's 9,200 employees serve utility

customers in five Canadian provinces, 10 U.S. states and three

Caribbean countries.

Fortis shares are listed on the TSX and NYSE and

trade under the symbol FTS. Additional information can be accessed

at www.fortisinc.com, www.sedarplus.ca, or

www.sec.gov.Forward-Looking Information

Fortis includes forward-looking information in

this media release within the meaning of applicable Canadian

securities laws and forward-looking statements within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995

(collectively referred to as "forward-looking information").

Forward-looking information reflects expectations of Fortis

management regarding future growth, results of operations,

performance and business prospects and opportunities. Wherever

possible, words such as anticipates, believes, budgets, could,

estimates, expects, forecasts, intends, may, might, plans,

projects, schedule, should, target, will, would and the negative of

these terms and other similar terminology or expressions have been

used to identify the forward-looking information, which includes,

without limitation: forecast capital expenditures for 2024-2028,

including cleaner energy investments; forecast rate base and rate

base growth through 2028; targeted annual dividend growth through

2028; the expectation that the funding plan will support

investment-grade credit ratings and will provide flexibility as the

Corporation pursues incremental growth opportunities; the impact of

the Inflation Reduction Act on the capital plan; the nature, timing

and benefits of certain capital projects, including ITC LRTP

Tranche 1 and further interconnection investments, generation

investments in Arizona to support the TEP's Integrated Resource

Plan, climate adaptation and grid resiliency investments, and

customer growth and economic development; the expectation to exit

coal by 2032; the expected sources of funding for the capital plan;

the expectation that long-term growth in rate base will drive

earnings, support dividend growth and reduce the dividend payout

ratio over time to be in line with historical levels; and the

expectation that the dividend growth guidance will provide

flexibility to fund more capital with internally generated

funds.

Forward-looking information involves significant

risks, uncertainties and assumptions. Certain material factors or

assumptions have been applied in drawing the conclusions contained

in the forward-looking information, including, without limitation:

no material impact from volatility in energy prices, global supply

chain constraints and persistent inflation; reasonable outcomes for

regulatory proceedings and the expectation of regulatory stability;

the successful execution of the five-year capital plan; no material

capital project and financing cost overrun; sufficient human

resources to deliver service and execute the capital plan; the

realization of additional opportunities; no material changes in the

assumed U.S. dollar to Canadian dollar exchange rate; no

significant variability in interest rates; and the Board exercising

its discretion to declare dividends, taking into account the

business performance and financial condition of the Corporation.

Fortis cautions readers that a number of factors could cause actual

results, performance or achievements to differ materially from the

results discussed or implied in the forward-looking information.

For additional information with respect to certain risk factors,

reference should be made to the continuous disclosure materials

filed from time to time by the Corporation with Canadian securities

regulatory authorities and the Securities and Exchange Commission.

All forward-looking information herein is given as of the date of

this media release. Fortis disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise.

Investor Day Webcast to Discuss New

Five-Year Outlook

A webcast will be held today, September 19,

2023, with a formal presentation scheduled from 10:00 a.m. to 12:00

p.m. NDT (8:30 a.m. to 10:30 a.m. EDT). David Hutchens,

President and Chief Executive Officer and Jocelyn Perry, Executive

Vice President and Chief Financial Officer and executives from

certain subsidiaries will provide an update on operations, recent

developments and the strategic outlook for 2024 to 2028.

Shareholders, analysts, members of the media and

other interested parties are invited to participate in the

webcast. A live and archived webcast of the event will be available

on the Corporation's website at www.fortisinc.com.

For more information, please contact:

|

Investor Enquiries: |

Media Enquiries: |

| Ms. Stephanie Amaimo |

Ms. Karen McCarthy |

| Vice President, Investor

Relations |

Vice President, Communications

& Government Relations |

| Fortis Inc. |

Fortis Inc. |

| 248.946.3572 |

709.737.5323 |

|

investorrelations@fortisinc.com |

media@fortisinc.com |

A .pdf version of this press release is available

at: http://ml.globenewswire.com/Resource/Download/cd1ba56b-e32d-4cfa-aa65-4279da471af8

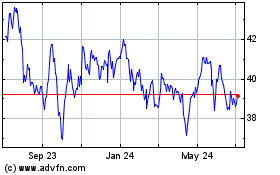

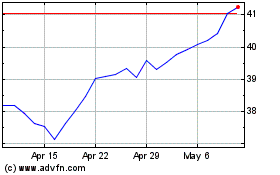

Fortis (NYSE:FTS)

Historical Stock Chart

From Oct 2024 to Oct 2024

Fortis (NYSE:FTS)

Historical Stock Chart

From Oct 2023 to Oct 2024