0000037785FALSE00000377852024-02-052024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 8-K

_______________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 5, 2024

__________________________________________________________________________

FMC CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________________________________

| | | | | | | | | | | |

| Delaware | 1-2376 | 94-0479804 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | |

| 2929 Walnut Street | Philadelphia | Pennsylvania | 19104 |

| (Address of Principal Executive Offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: 215-299-6000

__________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | | FMC | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | | | | | | | | | | | | | |

Emerging growth company | ☐ | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. | |

| ☐ |

|

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 5, 2024, FMC Corporation issued a press release announcing the financial results for the three and twelve months ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| FMC CORPORATION (Registrant) |

| | | |

| By: | /s/ ANDREW D. SANDIFER |

| | Andrew D. Sandifer

Executive Vice President and Chief Financial Officer |

Date: February 5, 2024

Exhibit 99.1 | | | | | | | | | | | | | | |

| | FMC Corporation |

| 2929 Walnut Street |

| Philadelphia, PA 19104 |

| USA |

| News Release | | | | 215.299.6000 |

| | | fmc.com |

| | | | |

| For Release: Immediate | | | |

| | | | |

| | Media contact: Nicole Canning +1.215.299.5916 |

| | Nicole.Canning@fmc.com |

| | Investor contact: Zack Zaki +1.215.299.5899 |

| | Zack.Zaki@fmc.com |

FMC Corporation announces fourth quarter and full-year 2023 results within guidance ranges, provides 2024 outlook

New products and branded diamides delivered strong results despite continued destocking.

Fourth Quarter 2023 Highlights

•Revenue of $1.15 billion, a decrease of 29 percent versus Q4 2022 and down 30 percent organically1

•Consolidated GAAP net income of $1.10 billion, up 291 percent versus Q4 2022

•Adjusted EBITDA of $254 million, down 41 percent versus Q4 2022

•Consolidated GAAP earnings of $8.77 per diluted share, up 304 percent versus Q4 2022

•Adjusted earnings of $1.07 per diluted share, down 55 percent versus Q4 2022

•14 percent of sales in the quarter from new product introductions (NPI)

Full-Year 2023 Highlights

•Revenue of $4.49 billion, reflecting a year-over-year decline of 23 percent and down 22 percent organically1

•Consolidated GAAP net income of $1.32 billion, up 78 percent versus 2022

•Adjusted EBITDA of $978 million, down 30 percent versus 2022

•Consolidated GAAP earnings of $10.53 per diluted share, up 81 percent versus 2022

•Adjusted earnings of $3.78 per diluted share, down 49 percent versus 2022

•Consolidated GAAP cash flow from operations of negative $300 million, down 145 percent versus 2022

•Free cash flow of negative $524 million, down 202 percent versus 2022

•NPI sales of $590 million represented annual record 13 percent of total revenue

Full-Year 2024 Outlook2

•Revenue of $4.50 to $4.70 billion, reflecting 2.5 percent growth at the midpoint

•Adjusted EBITDA of $900 million to $1.05 billion, essentially flat to prior year at the midpoint

•Restructuring fully underway and expect to receive $50 to $75 million of adjusted EBITDA benefit

•Adjusted earnings per diluted share of $3.23 to $4.41, reflecting 1 percent growth at the midpoint

•Free cash flow is expected to be in the range of $400 to $600 million, reflecting greater than 100 percent cash flow conversion at the midpoint

Page 2/ FMC Corporation announces fourth quarter and full-year 2023 results within guidance ranges, provides 2024 outlook

PHILADELPHIA, February 5, 2024 – FMC Corporation (NYSE:FMC) today reported fourth quarter 2023

revenue of $1.15 billion, a decrease of 29 percent versus fourth quarter 2022, driven by continued channel destocking in all regions with adverse weather in Brazil being a further headwind in Latin America. Excluding the impact of foreign currencies, organic revenue declined 30 percent year-over-year. On a GAAP basis, the company reported earnings of $8.77 per diluted share in the fourth quarter, up 304 percent versus fourth quarter 2022 due to significant one-time tax benefits largely driven by new tax incentives granted to the company’s Swiss subsidiaries. Adjusted earnings were $1.07 per diluted share, a decline of 55 percent versus fourth quarter 2022.

| | | | | | |

| Fourth Quarter Adjusted EPS versus Guidance (midpoint)* | | -7 cents* |

| Adjusted EBITDA | | -15 cents |

| Depreciation and amortization | | 0 cent |

| Interest expense | | +4 cents |

| Taxes | | +2 cents |

| Minority interest | | +2 cents |

| Share count | | 0 cent |

| | |

* Guidance refers to midpoint of EPS guidance presented in October 2023 | | |

| | |

“During the fourth quarter we observed continued channel destocking in all regions, while drought in Brazil also amplified challenges in Latin America,” said Mark Douglas, FMC president and chief executive officer. “Despite this, sales of our newer and more differentiated products were robust, including branded diamide growth of 5 percent. Our leading technologies continue to gain traction with growers, who remain invested in protecting their yields with steady on-the-ground application of crop protection products.”

FMC revenue in the fourth quarter was driven by a 25 percent decline from volume. A 5 percent decline in pricing was partially offset by a 1 percent FX tailwind. Sales of products launched in the last five years comprised 14 percent of total revenue in the quarter.

Sales in North America declined 37 percent versus a very strong fourth quarter 2022 driven by lower volume. Latin America sales declined 38 percent (down 41 percent organically) mainly from lower volume from weaker demand, as well as adverse weather in Brazil. Pricing in the region declined by low-double digits. Despite the overall decrease in sales in the region, branded diamide sales in Latin America were essentially flat to prior year, aided by the successful launch of Premio® Star insecticide in Brazil. In Asia, fourth quarter revenue was flat versus prior year period as fungicides grew and branded diamides were essentially flat. In EMEA, sales declined 24 percent (down 22 percent organically) driven by volume declines due to channel destocking, mainly in herbicides. This was partially offset by a low-to-mid single digit price

Page 3/ FMC Corporation announces fourth quarter and full-year 2023 results within guidance ranges, provides 2024 outlook

increase as well as strong growth in branded diamides. The Plant Health business was down 25 percent versus the prior-year period as the business experienced similar volume headwinds as the rest of the portfolio.

| | | | | | | | | |

| FMC Revenue | Q4 2023 | Full Year 2023 | |

| Total Revenue Change (GAAP) | (29)% | (23)% | |

| Less FX Impact | 1% | (1%) | |

Organic1 Revenue Change (Non-GAAP) | (30%) | (22%) | |

| | | |

Fourth quarter adjusted EBITDA was $254 million, 41 percent lower than prior-year period primarily driven by volume decline, with lower pricing more than offset by cost tailwinds. Costs were favorable due to lower input costs as well as aggressive cost controls. FX was a modest tailwind.

For the full year, FMC reported revenue of $4.49 billion, a decrease of 23 percent compared to 2022. Excluding the impact of FX, year-over-year sales declined 22 percent organically. On a GAAP basis, the company reported full-year net income of $1.32 billion, up 78 percent versus the previous year due to one-time tax benefits reported in the fourth quarter. Consolidated earnings of $10.53 per diluted share represents a year-over-year increase of 81 percent. Full-year adjusted earnings were $3.78 per diluted share, a decrease of 49 percent compared to 2022.

“Despite challenging market conditions in 2023, we maintained very healthy adjusted EBITDA margins by holding or raising price in most countries and by aggressively managing costs in response to the demand decline. NPI sales were down 2 percent, while our branded diamides were down by 7 percent, outperforming the rest of our portfolio and the broader market. The resilient performance of these differentiated products illustrates the importance of innovation in our business,” Douglas said.

On a GAAP basis, cash flow from operations was negative $300 million, a decrease of 145 percent versus 2022, primarily due to significantly lower payables and lower adjusted EBITDA, partially offset by lower use of cash for receivables and inventory with additional headwinds primarily from cash interest and taxes. Free cash flow in 2023 was negative $524 million, down 202 percent versus 2022, primarily due to lower cash from operations.

Full Year 2024 Outlook2

Full-year 2024 revenue is forecasted to be in the range of $4.50 billion to $4.70 billion. The increase of 2.5 percent at the midpoint versus 2023 is expected to be largely driven by growth of new products, primarily in the second half. The midpoint of revenue guidance assumes the crop protection market is flat-to-down low-single digits as modest market growth during the second half is offset by market contraction in the first half. Full-year adjusted EBITDA is expected to be between $900 million and $1.05 billion, essentially flat at the

Page 4/ FMC Corporation announces fourth quarter and full-year 2023 results within guidance ranges, provides 2024 outlook

midpoint to the prior year. Headwinds to adjusted EBITDA in the first half are expected from continued destocking, higher inventory costs and modest pricing pressure. Tailwinds in the second half are expected from sales growth of new products, a greater portion of savings from restructuring actions and some benefit from market recovery. The range for 2024 adjusted EPS is expected to be $3.23 to $4.41 per diluted share, representing an increase of 1 percent year-over-year at the midpoint due to lower interest expense and D&A. Full-year free cash flow is expected to be $400 million to $600 million, an increase of over $1.0 billion versus 2023 at the midpoint driven largely by rebuilding of payables and lower inventory.

“Our outlook for this year largely relies on factors within our control. We are viewing 2024 as a transition year, with momentum expected to build as the year progresses, driven by our new technologies and the benefits of our restructuring actions along with an improving demand backdrop. The structural actions we are taking now combined with the transitory nature of the majority of the cost headwinds should provide a strong setup for us to achieve our mid-term goals, including our unchanged 2026 financial projections.” said Douglas.

First Quarter Outlook2

First quarter revenue is expected to be in the range of $925 million to $1.075 billion, a 26 percent decrease at the midpoint compared to first quarter 2023 due to lower volume from destocking activity in all regions. In addition, price is expected to be a low-to-mid single digit headwind, mainly in Latin America and Asia. Adjusted EBITDA is forecasted to be in the range of $135 million to $165 million, a decline of 59 percent at the midpoint versus the prior-year period due to lower sales as well as the gross margin impacts of high-cost inventory carried over from prior year. Adjusted EPS is expected to be in the range of $0.21 to $0.43 in the first quarter, representing a decrease of 82 percent at the midpoint versus first quarter 2023 mainly due to lower adjusted EBITDA.

| | | | | | | | |

| Full Year 2024 Outlook2 | Q1 2024 Outlook2 |

| Revenue | $4.5 to $4.7 billion | $925 million to $1.075 billion |

| | |

| | |

| Growth at midpoint vs. 2023* | 2.5% | -26% |

| Adjusted EBITDA | $900 million to $1.05 billion | $135 to $165 million |

| Growth at midpoint vs. 2023* | 0% | -59% |

| Adjusted EPS^ | $3.23 to $4.41 | $0.21 to $0.43 |

| Growth at midpoint vs. 2023* | 1% | -82% |

^Adjusted EPS estimates assume 125.5 million diluted shares for full year and 125.5 million diluted shares for Q1. Outlook for Adjusted EPS and WADSO does not include the impact of any share repurchases that may take place in 2024. |

*Percentages are calculated using whole numbers. Minor differences may exist due to rounding. |

Page 5/ FMC Corporation announces fourth quarter and full-year 2023 results within guidance ranges, provides 2024 outlook

Supplemental Information

The company will post supplemental information on the web at https://investors.fmc.com, including its webcast slides for tomorrow’s earnings call, definitions of non-GAAP terms and reconciliations of non-GAAP figures to the nearest available GAAP term.

Always read and follow all label directions, restrictions and precautions for use. Products listed here may not be registered for sale or use in all states, countries or jurisdictions. FMC, the FMC logo and Premio® Star are trademarks of FMC Corporation or an affiliate.

About FMC

FMC Corporation is a global agricultural sciences company dedicated to helping growers produce food, feed, fiber and fuel for an expanding world population while adapting to a changing environment. FMC’s innovative crop protection solutions – including biologicals, crop nutrition, digital and precision agriculture – enable growers, crop advisers and turf and pest management professionals to address their toughest challenges economically while protecting the environment. With approximately 6,600 employees at more than 100 sites worldwide, FMC is committed to discovering new herbicide, insecticide and fungicide active ingredients, product formulations and pioneering technologies that are consistently better for the planet. Visit fmc.com to learn more and follow us on LinkedIn®.

Statement under the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995: FMC and its representatives may from time to time make written or oral statements that are “forward-looking” and provide other than historical information, including statements contained in this press release, in FMC’s other filings with the SEC, and in presentations, reports or letters to FMC stockholders.

In some cases, FMC has identified these forward-looking statements by such words or phrases as “outlook”, "will likely result," "is confident that," "expect," "expects," "should," "could," "may," "will continue to," "believe," "believes," "anticipates," "predicts," "forecasts," "estimates," "projects," "potential," "intends" or similar expressions identifying "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including the negative of those words or phrases. Such forward-looking statements are based on our current views and assumptions regarding future events, future business conditions and the outlook for the company based on currently available information. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement. These statements are qualified by reference to the risk factors included in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022 (the "2022 Form 10-K"), the section captioned "Forward-Looking Information" in Part II of the 2022 Form 10-K and to similar risk factors and cautionary statements in all other reports and forms filed with the Securities and Exchange Commission ("SEC"). We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Forward-looking statements are qualified in their entirety by the above cautionary statement.

We specifically decline to undertake any obligation, and specifically disclaims any duty, to publicly update or revise any forward-looking statements that have been made to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as may be required by law.

Page 6/ FMC Corporation announces fourth quarter and full-year 2023 results within guidance ranges, provides 2024 outlook

This press release contains certain “non-GAAP financial terms” which are defined on our website www.fmc.com/investors. Such terms include adjusted EBITDA, adjusted earnings, free cash flow and organic revenue growth. In addition, we have also provided on our website reconciliations of non-GAAP terms to the most directly comparable GAAP term.

(1)Organic revenue growth (non-GAAP) excludes the impact of foreign currency changes.

(2)Although we provide forecasts for adjusted earnings per share, adjusted EBITDA, and free cash flow (non-GAAP financial measures), we are not able to forecast the most directly comparable measures calculated and presented in accordance with GAAP. Certain elements of the composition of the GAAP amounts are not predictable, making it impractical for us to forecast. Such elements include, but are not limited to, restructuring, acquisition charges, and discontinued operations. As a result, no GAAP outlook is provided.

# # #

FMC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| (In millions, except per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 1,146.1 | | | $ | 1,622.0 | | | $ | 4,486.8 | | | $ | 5,802.3 | |

| Costs of sales and services | 710.4 | | | 936.4 | | | 2,655.8 | | | 3,475.5 | |

| Gross margin | $ | 435.7 | | | $ | 685.6 | | | $ | 1,831.0 | | | $ | 2,326.8 | |

| Selling, general and administrative expenses | $ | 171.5 | | | $ | 212.5 | | | $ | 734.3 | | | $ | 775.2 | |

| Research and development expenses | 81.8 | | | 84.4 | | | 328.8 | | | 314.2 | |

| Restructuring and other charges (income) | 164.3 | | | (5.8) | | | 212.3 | | | 93.1 | |

| Total costs and expenses | $ | 1,128.0 | | | $ | 1,227.5 | | | $ | 3,931.2 | | | $ | 4,658.0 | |

| Income (loss) from continuing operations before non-operating pension and postretirement charges (income), interest expense, net and income taxes | $ | 18.1 | | | $ | 394.5 | | | $ | 555.6 | | | $ | 1,144.3 | |

| | | | | | | |

| Non-operating pension and postretirement charges (income) | 4.8 | | | 2.1 | | | 18.2 | | | 8.6 | |

| Interest expense, net | 56.7 | | | 44.8 | | | 237.2 | | | 151.8 | |

| Income (loss) from continuing operations before income taxes | $ | (43.4) | | | $ | 347.6 | | | $ | 300.2 | | | $ | 983.9 | |

| Provision (benefit) for income taxes | (1,197.0) | | | 12.2 | | | (1,119.3) | | | 145.2 | |

| Income (loss) from continuing operations | $ | 1,153.6 | | | $ | 335.4 | | | $ | 1,419.5 | | | $ | 838.7 | |

| Discontinued operations, net of income taxes | (57.2) | | | (55.0) | | | (98.5) | | | (97.2) | |

| Net income (loss) | $ | 1,096.4 | | | $ | 280.4 | | | $ | 1,321.0 | | | $ | 741.5 | |

| Less: Net income (loss) attributable to noncontrolling interests | (2.1) | | | 6.5 | | | (0.5) | | | 5.0 | |

| Net income (loss) attributable to FMC stockholders | $ | 1,098.5 | | | $ | 273.9 | | | $ | 1,321.5 | | | $ | 736.5 | |

| Amounts attributable to FMC stockholders: | | | | | | | |

| Income (loss) from continuing operations, net of tax | $ | 1,155.7 | | | $ | 328.9 | | | $ | 1,420.0 | | | $ | 833.7 | |

| Discontinued operations, net of tax | (57.2) | | | (55.0) | | | (98.5) | | | (97.2) | |

| Net income (loss) | $ | 1,098.5 | | | $ | 273.9 | | | $ | 1,321.5 | | | $ | 736.5 | |

| Basic earnings (loss) per common share attributable to FMC stockholders: | | | | | | | |

| Continuing operations | $ | 9.23 | | | $ | 2.61 | | | $ | 11.34 | | | $ | 6.60 | |

| Discontinued operations | (0.46) | | | (0.44) | | | (0.79) | | | (0.77) | |

| Basic earnings per common share | $ | 8.77 | | | $ | 2.17 | | | $ | 10.55 | | | $ | 5.83 | |

| Average number of shares outstanding used in basic earnings per share computations | 124.9 | | | 125.6 | | | 125.1 | | | 126.0 | |

| Diluted earnings (loss) per common share attributable to FMC stockholders: | | | | | | | |

| Continuing operations | $ | 9.23 | | | $ | 2.61 | | | $ | 11.31 | | | $ | 6.58 | |

| Discontinued operations | (0.46) | | | (0.44) | | | (0.78) | | | (0.77) | |

| Diluted earnings per common share | $ | 8.77 | | | $ | 2.17 | | | $ | 10.53 | | | $ | 5.81 | |

| Average number of shares outstanding used in diluted earnings per share computations | 125.2 | | | 126.4 | | | 125.5 | | | 126.7 | |

| | | | | | | |

| Other Data: | | | | | | | |

| Capital additions and other investing activities | $ | 27.1 | | | $ | 16.0 | | | $ | 143.7 | | | $ | 118.7 | |

| Depreciation and amortization expense | 45.9 | | | 42.8 | | | 184.3 | | | 169.4 | |

FMC CORPORATION

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

RECONCILIATION OF NET INCOME (LOSS) ATTRIBUTABLE TO FMC STOCKHOLDERS (GAAP)

TO ADJUSTED AFTER-TAX EARNINGS FROM CONTINUING OPERATIONS,

ATTRIBUTABLE TO FMC STOCKHOLDERS (NON-GAAP)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| (In millions, except per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

Net income (loss) attributable to FMC stockholders (GAAP) | $ | 1,098.5 | | | $ | 273.9 | | | $ | 1,321.5 | | | $ | 736.5 | |

| Corporate special charges (income): | | | | | | | |

Restructuring and other charges (income) (a) | 190.1 | | | (5.8) | | | 238.1 | | | 93.1 | |

Non-operating pension and postretirement charges (income) (b) | 4.8 | | | 2.1 | | | 18.2 | | | 8.6 | |

| | | | | | | |

Income tax expense (benefit) on Corporate special charges (income) (c) | (24.3) | | | 4.3 | | | (32.8) | | | 1.5 | |

| Adjustment for noncontrolling interest, net of tax on Corporate special charges (income) | — | | | 6.8 | | | (1.6) | | | 6.8 | |

Discontinued operations attributable to FMC stockholders, net of income taxes (d) | 57.2 | | | 55.0 | | | 98.5 | | | 97.2 | |

Tax adjustment (e) | (1,192.9) | | | (37.3) | | | (1,167.4) | | | (5.3) | |

Adjusted after-tax earnings from continuing operations attributable to FMC stockholders (Non-GAAP) (1) | $ | 133.4 | | | $ | 299.0 | | | $ | 474.5 | | | $ | 938.4 | |

| | | | | | | |

Diluted earnings per common share (GAAP) | $ | 8.77 | | | $ | 2.17 | | | $ | 10.53 | | | $ | 5.81 | |

| Corporate special charges (income) per diluted share, before tax: | | | | | | | |

| Restructuring and other charges (income) | 1.52 | | | (0.04) | | | 1.90 | | | 0.74 | |

| Non-operating pension and postretirement charges (income) | 0.04 | | | 0.02 | | | 0.15 | | | 0.07 | |

| | | | | | | |

| Income tax expense (benefit) on Corporate special charges (income), per diluted share | (0.19) | | | 0.03 | | | (0.26) | | | 0.01 | |

| Adjustment for noncontrolling interest, net of tax on Corporate special charges (income) per diluted share | — | | | 0.05 | | | (0.02) | | | 0.05 | |

| Discontinued operations attributable to FMC stockholders, net of income taxes per diluted share | 0.46 | | | 0.44 | | | 0.78 | | | 0.77 | |

| | | | | | | |

| Tax adjustments per diluted share | (9.53) | | | (0.30) | | | (9.30) | | | (0.04) | |

| Diluted adjusted after-tax earnings from continuing operations per share, attributable to FMC stockholders (Non-GAAP) | $ | 1.07 | | | $ | 2.37 | | | $ | 3.78 | | | $ | 7.41 | |

| | | | | | | |

| Average number of shares outstanding used in diluted adjusted after-tax earnings from continuing operations per share computations | 125.2 | | | 126.4 | | | 125.5 | | | 126.7 | |

____________________

(1)Referred to as Adjusted earnings. The Company believes that Adjusted earnings, a Non-GAAP financial measure, and its presentation on a per share basis, provides useful information about the Company’s operating results to management, investors, and securities analysts. Adjusted earnings excludes the effects of Corporate special charges, tax-related adjustments and the results of our discontinued operations. The Company also believes that excluding the effects of these items from operating results allows management and investors to compare more easily the financial performance of its underlying businesses from period to period.

(a)Three Months Ended December 31, 2023:

Restructuring and other charges (income) includes $40.1 million of severance and employee separation costs and $5.4 million of provider costs associated with the Project Focus restructuring initiative. We incurred $89.2 million in currency related charges primarily driven by the significant actions taken by the Argentine Government during the fourth quarter of 2023. First, the adjustment of the official exchange rate announced during December 2023 resulted in $63.4 million of foreign exchange remeasurement losses. Second, in combination with the devaluation actions, the government expanded the scope and rates of the existing Impuesto PAIS tax ("PAIS"). The tax targets the import of goods and services that will be paid in a foreign currency. As a result of this initial adoption, which was required to be applied retroactively, we recognized a charge of $25.8 million recorded within our "Cost of Sales and Services" line item within our Consolidated Statements of Income (Loss). Additionally, we incurred $52.6 million in environmental charges associated with remediation activities and other miscellaneous charges of $2.8 million.

Three Months Ended December 31, 2022:

Restructuring and other charges (income) includes $2.1 million of severance and employee separation costs, $3.0 million related to fixed asset charges, and $2.7 million of other restructuring related charges incurred as part of various restructuring initiatives. These restructuring charges were offset by a gain of $50.5 million recognized on the disposition of land related to a closed manufacturing facility. Other charges of $36.9 million relate primarily to environmental charges.

Twelve Months Ended December 31, 2023:

Restructuring and other charges (income) includes $40.1 million of severance and employee separation costs and $5.4 million of provider costs associated with the Project Focus restructuring initiative. Other restructuring costs of $8.7 million relate to employee separation and asset impairment costs incurred as part of various ongoing initiatives. These restructuring charges were offset by a $5.8 million gain recognized on the disposition of land related to a previously closed manufacturing facility. We incurred $101.0 million in currency related charges primarily driven by the significant actions taken by the Argentine Government during the fourth quarter of 2023. This includes the $89.2 million discussed above for the three month period, $25.8 million of which is recorded within our "Cost of Sales and Services" line item within our Consolidated Statements of Income (Loss), as well as $11.8 million resulting from similar devaluation actions in Argentina and Pakistan during previous quarters. Other charges (income) also includes $13.0 million in charges primarily resulting from the third quarter acquisition of in-process research and development assets that do not meet the criteria for capitalization. Additionally, we incurred $66.9 million in environmental charges associated with remediation activities and other miscellaneous charges of $8.8 million.

Twelve Months Ended December 31, 2022:

Restructuring and other charges (income) is primarily comprised of $76.8 million in exit charges related to our decision to cease operations and business in Russia. Restructuring and other charges (income) is also comprised of $5.9 million of severance and employee separation costs, $11.2 million related to fixed asset charges, and $7.3 million of other restructuring related charges incurred as part of various restructuring initiatives. These restructuring charges were partially offset by a gain of $50.5 million recognized on the disposition of land related to a closed manufacturing facility. Other charges of $42.4 million relate primarily to environmental charges.

(b)Our non-operating pension and postretirement charges (income) are defined as those costs (benefits) related to interest, expected return on plan assets, amortized actuarial gains and losses and the impacts of any plan curtailments or settlements. These are excluded from our Adjusted Earnings and are primarily related to changes in pension plan assets and liabilities which are tied to financial market performance and we consider these costs to be outside our operational performance. We continue to include the service cost and amortization of prior service cost in our Adjusted Earnings results noted above. These elements reflect the current year operating costs to our businesses for the employment benefits provided to active employees.

(c)The income tax expense (benefit) on Corporate special charges (income) is determined using the applicable rates in the taxing jurisdictions in which the Corporate special charge or income occurred and includes both current and deferred income tax expense (benefit) based on the nature of the non-GAAP performance measure.

(d)Discontinued operations for all periods presented includes provisions, net of recoveries, for environmental liabilities and legal reserves and expenses related to previously discontinued operations and retained liabilities.

(e)We exclude the GAAP tax provision, including discrete items, from the Non-GAAP measure of income, and include a Non-GAAP tax provision based upon the annual Non-GAAP effective tax rate. The GAAP tax provision includes certain discrete tax items including, but not limited to: income tax expenses or benefits that are not related to continuing operating results in the current year; unusual or infrequently occurring items; tax adjustments associated with fluctuations in foreign currency remeasurement of certain foreign operations; certain changes in estimates of tax matters related to prior fiscal years; certain changes in the realizability of deferred tax assets; and changes in tax law. Management believes excluding these discrete tax items assists investors and securities analysts in understanding the tax provision and the effective tax rate related to continuing operations thereby providing investors with useful supplemental information about FMC's operational performance.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| (In millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Tax adjustments: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Impacts of valuation allowances of deferred tax assets | 95.0 | | | 1.8 | | | 95.0 | | | 1.8 | |

| Foreign currency remeasurement and other discrete items | (1,287.9) | | | (39.1) | | | (1,262.4) | | | (7.1) | |

| Total Non-GAAP tax adjustments | $ | (1,192.9) | | | $ | (37.3) | | | $ | (1,167.4) | | | $ | (5.3) | |

During the three months ended December 31, 2023, the Company’s Swiss subsidiaries were granted ten-year tax incentives effective for 2023 and retroactively for 2021 and 2022. The tax incentives were awarded for the Company’s commitment to invest in additional headcount and transfer significant intellectual property, which is planned for 2024, as well as establishing a new global technology and innovation center in Switzerland. Deferred tax benefits of $1,149 million and related valuation allowances of $318 million were recorded during the three months ended December 31, 2023 to reflect the net estimated future reductions in tax of $831 million associated with the incentives.

Historically, FMC’s Brazil valuation allowance position was based on long-standing local transfer pricing rules, as well as certain material favorable permanent statutory tax deductions available to FMC Brazil as part of local tax law. During the three months ended June 30, 2023, Brazil passed legislation to conform to Organization for Economic Cooperation and Development ('OECD') transfer pricing rules effective in 2024. Conformity to OECD transfer pricing rules favorably impacts the statutory income level of FMC Brazil. In 2023, the Company continued to monitor its valuation allowance throughout the third and fourth quarters considering this law change. Further, on December 29, 2023, the Brazilian Government enacted new tax law that significantly limits FMC Brazil’s ability to benefit in the future from the material favorable permanent statutory tax deductions previously available as part of local tax law. During the three months ended December 31, 2023, the Company released its FMC Brazil valuation allowance and recorded a tax benefit of $223 million.

RECONCILIATION OF NET INCOME (LOSS) (GAAP) TO ADJUSTED EARNINGS FROM CONTINUING OPERATIONS, BEFORE INTEREST AND INCOME TAXES, DEPRECIATION AND AMORTIZATION, AND NONCONTROLLING INTERESTS (NON-GAAP)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| (In millions) | 2023 | | 2022 | | 2023 | | 2022 |

Net income (loss) (GAAP) | $ | 1,096.4 | | | $ | 280.4 | | | $ | 1,321.0 | | | $ | 741.5 | |

Restructuring and other charges (income) (2) | 190.1 | | | (5.8) | | | 238.1 | | | 93.1 | |

| Non-operating pension and postretirement charges (income) | 4.8 | | | 2.1 | | | 18.2 | | | 8.6 | |

| | | | | | | |

| Discontinued operations, net of income taxes | 57.2 | | | 55.0 | | | 98.5 | | | 97.2 | |

| Interest expense, net | 56.7 | | | 44.8 | | | 237.2 | | | 151.8 | |

| Depreciation and amortization | 45.9 | | | 42.8 | | | 184.3 | | | 169.4 | |

| Provision (benefit) for income taxes | (1,197.0) | | | 12.2 | | | (1,119.3) | | | 145.2 | |

Adjusted earnings from continuing operations, before interest, income taxes, depreciation and amortization, and noncontrolling interests (Non-GAAP) (1) | $ | 254.1 | | | $ | 431.5 | | | $ | 978.0 | | | $ | 1,406.8 | |

___________________

(1)Referred to as Adjusted EBITDA. Defined as operating profit excluding corporate special charges (income) and depreciation and amortization expense.

(2)Includes $25.8 million of charges related to the PAIS tax which was recorded to "Cost of Sales and services" on the consolidated statements of income (loss) as well as $164.3 million and $212.3 million shown as Restructuring and other charges (income) on the consolidated statements of income (loss) for the three and twelve months ended December 31, 2023, respectively. The PAIS tax is related to significant actions taken by the Argentine Government during the fourth quarter of 2023, which also resulted in foreign exchange remeasurement losses included within the "Restructuring and other charges (income)" line item on our Consolidated Statements of Income (Loss).

RECONCILIATION OF CASH PROVIDED (REQUIRED) BY OPERATING ACTIVITIES (GAAP) TO FREE CASH FLOW (NON-GAAP)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| (In millions) | 2023 | | 2022 | | 2023 | | 2022 |

Cash provided (required) by operating activities of continuing operations (GAAP) (1) | $ | 317.9 | | | $ | 644.3 | | | $ | (300.3) | | | $ | 660.0 | |

| Transaction and integration costs | — | | | — | | | — | | | 0.5 | |

Adjusted cash from operations (2) | $ | 317.9 | | | $ | 644.3 | | | $ | (300.3) | | | $ | 660.5 | |

| | | | | | | |

| Capital expenditures | $ | (25.1) | | | $ | (33.9) | | | $ | (133.9) | | | $ | (142.3) | |

| Other investing activities | (2.0) | | | 17.9 | | | (9.8) | | | 23.6 | |

| Capital additions and other investing activities | $ | (27.1) | | | $ | (16.0) | | | $ | (143.7) | | | $ | (118.7) | |

| | | | | | | |

| Cash provided (required) by operating activities of discontinued operations | $ | (25.1) | | | $ | (25.8) | | | $ | (86.1) | | | $ | (77.6) | |

| | | | | | | |

| Transaction and integration costs | — | | | — | | | — | | | (0.5) | |

| | | | | | | |

Proceeds from land disposition (3) | — | | | 50.5 | | | 5.8 | | | 50.5 | |

| Legacy and transformation | $ | (25.1) | | | $ | 24.7 | | | $ | (80.3) | | | $ | (27.6) | |

Free cash flow (Non-GAAP) (4) | $ | 265.7 | | | $ | 653.0 | | | $ | (524.3) | | | $ | 514.2 | |

___________________

(1)The cash provided (required) by operating activities for the three months ended December 31, 2023 and 2022 is the calculation of the twelve months ended December 31, 2023 and 2022 less the previously reported nine months ended September 30, 2023 and 2022, respectively.

(2)Adjusted cash from operations is defined as cash provided (required) by operating activities of continuing operations excluding the effects of transaction-related cash flows.

(3)Amounts for the year ended December 31, 2023 and 2022 include proceeds of $5.8 million and $50.5 million, respectively, received on the disposition of land related to a closed manufacturing facility.

(4)Free cash flow is defined as Adjusted cash from operations reduced by spending for capital additions and other investing activities as well as legacy and transformation spending. We believe that this Non-GAAP financial measure provides a useful basis for investors and securities analysts about the cash generated by routine business operations, including capital expenditures, in addition to assessing our ability to repay debt, fund acquisitions and return capital to shareholders through share repurchases and dividends. Our use of free cash flow has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of our results under U.S. GAAP.

RECONCILIATION OF REVENUE CHANGE (GAAP) TO

ORGANIC REVENUE CHANGE (NON-GAAP) (1)

(Unaudited) | | | | | | | | | | | |

| Three Months Ended December 31, 2023 vs. 2022 | | Twelve Months Ended December 31, 2023 vs. 2022 |

| Total Revenue Change (GAAP) | (29) | % | | (23) | % |

| Less: Foreign Currency Impact | 1 | % | | (1) | % |

| Organic Revenue Change (Non-GAAP) | (30) | % | | (22) | % |

| | | |

___________________

(1)We believe organic revenue growth (non-GAAP) provides management and investors with useful supplemental information regarding our ongoing revenue performance and trends by presenting revenue growth excluding the impact of fluctuations in foreign exchange rates.

RECONCILIATION OF NET INCOME (LOSS) ATTRIBUTABLE TO

FMC STOCKHOLDERS (GAAP) TO RETURN ON INVESTED CAPITAL ("ROIC")

NUMERATOR (NON-GAAP) AND ROIC (USING NON-GAAP NUMERATOR)(1)

(Unaudited)

| | | | | | | | | | | |

| Twelve Months Ended | | |

| December 31, 2023 | | |

Net income (loss) attributable to FMC stockholders (GAAP) | $ | 1,321.5 | | | |

| Interest expense, net, net of income taxes | 202.8 | | | |

| Corporate special charges (income) | 256.3 | | | |

| Income tax expense (benefit) on Corporate special charges (income) | (32.8) | | | |

| Adjustment for noncontrolling interest, net of tax on Corporate special charges (income) | (1.6) | | | |

| Discontinued operations attributable to FMC stockholders, net of income taxes | 98.5 | | | |

| Tax adjustments | (1,167.4) | | | |

| ROIC numerator (Non-GAAP) | 677.3 | | | |

| | | |

| December 31, 2023 | | December 31, 2022 |

| Total debt | 3,957.6 | | | 3,274.0 | |

| Total FMC stockholders’ equity | 4,410.9 | | | 3,377.9 | |

Total debt and FMC stockholders' equity (GAAP) | 8,368.5 | | | 6,651.9 | |

| ROIC denominator (2 yr average total debt and FMC stockholders' equity) | 7,510.2 | | | |

| | | |

| ROIC (using Non-GAAP numerator) | 9.02 | % | | |

___________________

(1)We believe ROIC provides management and investors with useful supplemental information regarding our utilization of capital provided by both equity and debt as well as our working capital and free cash flow management.

FMC CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) | | | | | | | | | | | |

| (In millions) | December 31, 2023 | | December 31, 2022 |

| Cash and cash equivalents | $ | 302.4 | | | $ | 572.0 | |

| Trade receivables, net of allowance of $29.1 in 2023 and $33.9 in 2022 | 2,703.2 | | | 2,871.4 | |

| Inventories | 1,724.6 | | | 1,651.6 | |

| Prepaid and other current assets | 398.9 | | | 343.6 | |

| | | |

| | | |

| Total current assets | $ | 5,129.1 | | | $ | 5,438.6 | |

| Property, plant and equipment, net | 892.5 | | | 849.6 | |

| Goodwill | 1,593.6 | | | 1,589.3 | |

| Other intangibles, net | 2,465.1 | | | 2,508.1 | |

| Deferred income taxes | 1,336.6 | | | 210.7 | |

| Other long-term assets | 509.3 | | | 575.0 | |

| | | |

| Total assets | $ | 11,926.2 | | | $ | 11,171.3 | |

| Short-term debt and current portion of long-term debt | $ | 934.0 | | | $ | 540.8 | |

| Accounts payable, trade and other | 602.4 | | | 1,252.2 | |

| Advanced payments from customers | 482.1 | | | 680.5 | |

| Accrued and other liabilities | 684.8 | | | 601.8 | |

| Accrued customer rebates | 480.9 | | | 465.3 | |

| Guarantees of vendor financing | 69.6 | | | 142.0 | |

| Accrued pensions and other postretirement benefits, current | 6.4 | | | 2.3 | |

| Income taxes | 124.4 | | | 114.7 | |

| | | |

| | | |

| Total current liabilities | $ | 3,384.6 | | | $ | 3,799.6 | |

| Long-term debt, less current portion | $ | 3,023.6 | | | $ | 2,733.2 | |

| Long-term liabilities | 1,084.6 | | | 1,237.6 | |

| | | |

| Equity | 4,433.4 | | | 3,400.9 | |

| Total liabilities and equity | $ | 11,926.2 | | | $ | 11,171.3 | |

FMC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) | | | | | | | | | | | |

| Year Ended December 31, |

| (In millions) | 2023 | | 2022 |

| Cash provided (required) by operating activities of continuing operations | $ | (300.3) | | | $ | 660.0 | |

| | | |

| Cash provided (required) by operating activities of discontinued operations | (86.1) | | | (77.6) | |

| | | |

| Cash provided (required) by investing activities of continuing operations | (154.4) | | | (266.4) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash provided (required) by financing activities of continuing operations | 331.5 | | | (237.4) | |

| | | |

| | | |

| Effect of exchange rate changes on cash | (60.3) | | | (23.4) | |

| | | |

| Increase (decrease) in cash and cash equivalents | $ | (269.6) | | | $ | 55.2 | |

| | | |

| | | |

| | | |

| Cash and cash equivalents, beginning of period | 572.0 | | | 516.8 | |

| | | |

| | | |

| Cash and cash equivalents, end of period | $ | 302.4 | | | $ | 572.0 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

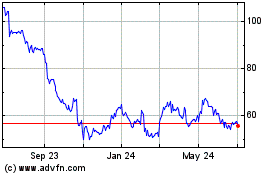

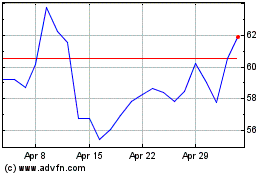

FMC (NYSE:FMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

FMC (NYSE:FMC)

Historical Stock Chart

From Nov 2023 to Nov 2024