- Increased Permian oil and gas production by approximately

130,000 oil-equivalent barrels per day and refining throughput by

180,000 barrels per day versus first half of 2021 to meet

recovering product demand.

- Generated earnings of $17.9 billion and cash flow from

operating activities of $20 billion in second-quarter 2022 as a

result of increased production, higher realizations and margins,

and aggressive cost control.

- Capital investments totaled $9.5 billion for first half of

2022; on track with full-year guidance.

- New lower-emission initiatives included four large-scale carbon

capture and storage opportunities.

Exxon Mobil Corporation (NYSE:XOM):

Results Summary

2Q22

1Q22

Change

vs

1Q22

2Q21

Change

vs

2Q21

Dollars in millions (except per

share data)

YTD 2022

YTD 2021

Change

vs

YTD 2021

17,850

5,480

+12,370

4,690

+13,160

Earnings (U.S. GAAP)

23,330

7,420

+15,910

17,551

8,833

+8,718

4,702

+12,849

Earnings Excluding Identified Items

26,384

7,463

+18,921

4.21

1.28

+2.93

1.10

+3.11

Earnings Per Common Share ¹

5.49

1.74

+3.75

4.14

2.07

+2.07

1.10

+3.04

Earnings Excluding Identified Items Per

Common Share ¹

6.21

1.75

+4.46

4,609

4,904

-295

3,803

+806

Capital and Exploration Expenditures

9,513

6,936

+2,577

¹ Assuming dilution

Exxon Mobil Corporation today announced estimated second-quarter

2022 earnings of $17.9 billion, or $4.21 per share assuming

dilution. Second-quarter results included a favorable identified

item of nearly $300 million associated with the sale of the Barnett

Shale Upstream assets. Capital and exploration expenditures were

$4.6 billion in the second quarter and $9.5 billion for the first

half of 2022.

“Earnings and cash flow benefited from increased production,

higher realizations, and tight cost control,” said Darren Woods,

chairman and chief executive officer. “Strong second-quarter

results reflect our focus on the fundamentals and the investments

we put in motion several years ago and sustained through the depths

of the pandemic.”

“Key to our success is continued investment in our advantaged

portfolio, including Guyana, the Permian, global LNG, and in our

high-value performance products, along with efforts to reduce

structural costs and improve efficiency. We're also helping meet

increased demand by expanding our refining capacity by about

250,000 barrels per day in the first quarter of 2023 - representing

the industry's largest single capacity addition in the U.S. since

2012. At the same time, we’re supporting the transition to a

lower-emission future, growing our portfolio of opportunities in

carbon capture and storage, biofuels, and hydrogen.”

Financial Highlights

- Second-quarter earnings of $17.9 billion compared with $5.5

billion in the first quarter of 2022. Excluding identified items,

earnings of $17.6 billion increased $8.7 billion from the prior

quarter, driven by a tight supply/demand balance for oil, natural

gas, and refined products, which have increased both natural gas

realizations and refining margins well above the 10-year

range.

- Cash increased by $7.8 billion in the second quarter, as strong

cash flow from operating activities more than covered capital

investments and shareholder distributions. Free cash flow in the

quarter totaled $16.9 billion. Shareholder distributions were $7.6

billion for the quarter, including $3.7 billion of dividends.

- Net-debt-to-capital ratio improved to 13% reflecting a

period-end cash balance of $18.9 billion. The debt-to-capital ratio

was 20%, at the low-end of the company's target range.

- Effective April 1, to improve the effectiveness of operations

and to better serve customers, the Corporation formed ExxonMobil

Product Solutions, combining world-scale Downstream and Chemical

businesses. The company also centralized Technology &

Engineering and Operations & Sustainability groups to further

capture the benefits of technology, scale, and integration. The

company has changed its segment reporting to reflect the new

structure.

Leading the Drive to Net Zero

Carbon Capture and Storage

- ExxonMobil signed a memorandum of understanding to explore the

development of a carbon capture and storage project at the Dayawan

Industrial Park in Guangdong Province, China. The envisioned

project has the potential to capture up to 10 million metric tons

of CO2 per year, and could become one of the first large

petrochemical complexes to remove CO2 emissions.

- ExxonMobil, Neptune Energy, Rosewood, and EBN signed an

agreement to advance the L10 carbon capture and storage project in

the Dutch North Sea. This stage of the project has the potential to

store four to five million metric tons of CO2 annually for

industrial customers, and represents the first stage in the

potential development of the greater L10 area as a large-volume CO2

storage reservoir.

- ExxonMobil announced the start of early front-end engineering

design studies for a South East Australia carbon capture and

storage hub in Gippsland, Victoria. The project would initially use

existing infrastructure to store up to two million metric tons of

CO2 per year from multiple local industries in the depleted Bream

field off the coast of Gippsland. Operations could begin as early

as 2025.

- Earlier in the quarter, ExxonMobil and Pertamina, the

state-owned energy company for Indonesia, signed a joint study

agreement to assess the potential for large-scale implementation of

lower-emissions technologies, including carbon capture and storage

and hydrogen production. The agreement builds on efforts to advance

carbon capture and storage in Indonesia that began with a

memorandum of understanding signed at COP26.

Biofuels and Hydrogen

- In early July, ExxonMobil successfully delivered the first

cargo of certified sustainable aviation fuel (SAF) to Singapore

Changi Airport as part of a one-year pilot program launched by the

Civil Aviation Authority of Singapore, Singapore Airlines, and

Temasek. In addition, ExxonMobil delivered the first cargo of SAF

via proprietary pipeline to Virgin Atlantic at London Heathrow

Airport. These programs represent part of a global plan to provide

200,000 barrels per day of lower-emission fuels by 2030.

- ExxonMobil's majority-owned affiliate, Imperial Oil Ltd., is

progressing plans to produce renewable diesel at a new complex at

its Strathcona refinery in Edmonton, Canada. When construction is

complete, the refinery is expected to produce approximately 20,000

barrels per day of renewable diesel, which could reduce emissions

in the Canadian transportation sector by about three million metric

tons per year. The complex will use locally grown plant-based

feedstock and hydrogen with carbon capture and storage as part of

the manufacturing process.

- ExxonMobil is advancing the previously announced large-scale

blue hydrogen plant in Baytown, Texas. The facility will have the

capacity to produce up to one billion cubic feet of blue hydrogen

per day and store approximately 10 million metric tons of CO2 per

year, more than doubling ExxonMobil's current capacity.

- In June, ExxonMobil, Grieg Edge, North Ammonia, and GreenH

signed a memorandum of understanding to study potential production

and distribution of green hydrogen and ammonia for lower-emission

marine fuels at ExxonMobil’s Slagen terminal in Norway. The

production of up to 20,000 metric tons of green hydrogen and

distribution of up to 100,000 metric tons of green ammonia per year

would be driven by hydroelectric power.

EARNINGS AND VOLUME SUMMARY BY

SEGMENT

Upstream

2Q22

1Q22

2Q21

Dollars in millions (unless otherwise

noted)

YTD 2022

YTD 2021

Earnings (U.S. GAAP)

3,749

2,376

663

United States

6,125

1,026

7,622

2,112

2,522

Non-U.S.

9,734

4,713

11,371

4,488

3,185

Worldwide

15,859

5,739

Earnings Excluding Identified

Items

3,450

2,376

663

United States

5,826

1,026

7,622

5,367

2,522

Non-U.S.

12,989

4,713

11,072

7,743

3,185

Worldwide

18,815

5,739

3,732

3,675

3,582

Production (koebd)

3,704

3,684

- Upstream earnings in the second quarter of 2022 were $11.4

billion compared to $4.5 billion in the first quarter. Excluding

identified items, earnings were $11.1 billion, an increase of $3.3

billion from the previous quarter. Crude realizations improved 15%

and gas realizations increased 23% compared to the first quarter

driven by tight supply. Higher production from growth projects and

recovery from first quarter weather-related downtime in Canada were

partly offset by price entitlement effects and increased seasonal

scheduled maintenance.

- Oil-equivalent production in the second quarter was 3.7 million

barrels per day. Excluding entitlement effects, divestments, and

government mandates, including the impact of curtailed production

in Russia, oil-equivalent production increased 4% versus the first

quarter. Liquids volumes increased nearly 35,000 barrels per day

and natural gas volumes grew by more than 150 million cubic feet

per day.

- Earnings excluding identified items increased $7.9 billion

relative to the second quarter of 2021. This improvement was

primarily the result of a 71% increase in crude realizations and a

186% increase in natural gas realizations. Oil-equivalent

production increased 5%, excluding entitlement effects,

divestments, and government mandates. Liquids volumes rose nearly

100,000 barrels per day, while natural gas volumes increased by

almost 315 million cubic feet per day.

- Year-to-date earnings excluding identified items were $18.8

billion, an increase of $13.1 billion versus the first half of 2021

on higher crude and natural gas realizations.

- The Permian continued to improve efficiency and grow volumes,

with average production during the quarter of more than 550,000

oil-equivalent barrels per day. The company is expecting to achieve

a 25% production increase this year versus full-year 2021 and to

eliminate routine flaring in the Permian by year end.

- Offshore Guyana production capacity increased to more than

340,000 oil-equivalent barrels per day with Liza Phase 2 production

start-up earlier this year and Liza Phase 1 producing above design

capacity. In addition, two new discoveries were announced. The

company also reached an agreement to supply the country of Guyana

with natural gas to significantly reduce domestic energy costs and

provide opportunities for industrial growth.

- ExxonMobil and QatarEnergy signed an agreement to further

develop Qatar's North Field East project, which will expand Qatar's

annual LNG capacity with over 30 million tons per year by

2026.

- The Coral South Floating LNG project offshore Mozambique

initiated flow of gas in June, and is on track to deliver the first

LNG cargo in the second half of 2022.

- Asset sales and divestments resulting in more than $3 billion

of proceeds were announced during the second quarter. The sale of

the company's operated and non-operated Barnett Shale gas assets in

Texas was completed in June, contributing nearly $300 million in

earnings and more than $600 million in cash during the quarter. The

other announced divestments, including XTO Energy Canada and the

Romania Upstream affiliate, are anticipated to close later this

year, subject to regulatory approvals.

Energy Products

2Q22

1Q22

2Q21

Dollars in millions (unless otherwise

noted)

YTD 2022

YTD 2021

Earnings/(Loss) (U.S. GAAP)

2,655

489

(278)

United States

3,144

(510)

2,617

(684)

(578)

Non-U.S.

1,933

(1,267)

5,273

(196)

(856)

Worldwide

5,077

(1,777)

Earnings/(Loss) Excluding Identified

Items

2,655

489

(278)

United States

3,144

(510)

2,617

(684)

(578)

Non-U.S.

1,933

(1,267)

5,273

(196)

(856)

Worldwide

5,077

(1,777)

5,310

5,111

5,006

Energy Products Sales (kbd)

5,211

4,920

- Energy Products second-quarter 2022 earnings totaled $5.3

billion compared to a loss of $0.2 billion in the first quarter.

Strong refinery utilization in the quarter captured improved

industry margins. Higher sales volumes were more than offset by

unfavorable mix impacts and higher planned seasonal expenses. In

addition, earnings benefited from more moderate commodity price

increases which resulted in favorable unsettled derivative

mark-to-market impacts, and the expected reversal of price/timing

impacts from the first quarter.

- Earnings increased $6.1 billion compared to the second quarter

of 2021 due to stronger industry refining margins, favorable

derivative mark-to-market effects, and increased volumes on lower

scheduled maintenance.

- Year-to-date earnings of $5.1 billion compared to a loss of

$1.8 billion in the first half of 2021, driven by stronger industry

refining margins and higher volumes.

- Refining throughput in the first half of 2022 was up 180,000

barrels per day versus the first six months of 2021 to meet

recovering product demand.

- The Beaumont Refinery expansion remains on pace to add an

incremental 250,000 barrels per day of refining capacity in the

first quarter of 2023, which would increase the company's U.S. Gulf

Coast refining capacity by about 17%.

Chemical Products

2Q22

1Q22

2Q21

Dollars in millions (unless otherwise

noted)

YTD 2022

YTD 2021

Earnings (U.S. GAAP)

625

770

1,149

United States

1,395

1,803

450

636

1,051

Non-U.S.

1,086

1,788

1,076

1,405

2,200

Worldwide

2,481

3,591

Earnings Excluding Identified

Items

625

770

1,149

United States

1,395

1,803

450

636

1,051

Non-U.S.

1,086

1,788

1,076

1,405

2,200

Worldwide

2,481

3,591

4,811

5,018

4,731

Chemical Products Sales (kt)

9,829

9,496

- Chemical Products second-quarter 2022 earnings were $1.1

billion compared to $1.4 billion in the first quarter. Reliable

operations and cost discipline drove strong earnings despite

margins being impacted by higher ethane feed costs in North

America, a stronger U.S. dollar, higher planned seasonal expenses,

and lower volumes driven by China lockdown demand impacts and

logistics constraints.

- Earnings were $1.1 billion lower compared to second-quarter

2021 on reduced industry margins and unfavorable foreign exchange

effects.

- Year-to-date earnings totaled $2.5 billion compared to $3.6

billion in the first six months of 2021. Lower margins due to

rising North America feed costs, increased project and planned

maintenance expenses, and unfavorable foreign exchange effects were

partially offset by higher volumes.

Specialty Products

2Q22

1Q22

2Q21

Dollars in millions (unless otherwise

noted)

YTD 2022

YTD 2021

Earnings (U.S. GAAP)

232

246

262

United States

478

442

185

230

487

Non-U.S.

415

862

417

476

750

Worldwide

893

1,304

Earnings Excluding Identified

Items

232

246

262

United States

478

442

185

230

487

Non-U.S.

415

862

417

476

750

Worldwide

893

1,304

2,100

2,006

1,942

Specialty Products Sales (kt)

4,107

3,936

- Specialty Products earnings were $0.4 billion in the second

quarter of 2022 compared with $0.5 billion in the first quarter.

Earnings remained at historically strong levels on improved

basestock margins, with pricing offsetting rising feed and energy

costs, which were offset by higher planned seasonal expenses and

unfavorable foreign exchange impacts.

- Compared to the same quarter last year, earnings declined $0.3

billion on lower basestock industry margins and decreased volumes

driven by higher scheduled maintenance.

- Year-to-date earnings of $0.9 billion decreased from $1.3

billion in the first half of 2021, primarily due to lower basestock

industry margins driven by higher feed costs.

Corporate and Financing

2Q22

1Q22

2Q21

Dollars in millions (unless otherwise

noted)

YTD 2022

YTD 2021

(286)

(694)

(588)

Earnings/(Loss) (U.S. GAAP)

(980)

(1,437)

(286)

(596)

(576)

Earnings/(Loss) Excluding Identified

Items

(882)

(1,394)

- Corporate and Financing reported net charges of $0.3 billion in

the second quarter of 2022 compared with $0.7 billion in the first

quarter. Excluding a first-quarter identified items charge of $0.1

billion related to Russia, net charges were down $0.3 billion as a

result of favorable one-time tax impacts.

- Net charges of $0.3 billion in the second quarter of 2022

compared with $0.6 billion in the second quarter of 2021.

CASH FLOW FROM OPERATIONS AND ASSET

SALES EXCLUDING WORKING CAPITAL

2Q22

1Q22

2Q21

Dollars in millions

YTD 2022

YTD 2021

18,574

5,750

4,781

Net income including noncontrolling

interests

24,324

7,577

4,451

8,883

4,952

Depreciation

13,334

9,956

(2,747)

1,086

(380)

Changes in operational working capital

(1,661)

1,573

(315)

(931)

297

Other

(1,246)

(192)

19,963

14,788

9,650

Cash Flow from Operating Activities

(U.S. GAAP)

34,751

18,914

939

293

250

Proceeds associated with asset sales

1,232

557

20,902

15,081

9,900

Cash Flow from Operations and Asset

Sales

35,983

19,471

2,747

(1,086)

380

Changes in operational working capital

1,661

(1,573)

23,649

13,995

10,280

Cash Flow from Operations and Asset

Sales excluding Working Capital

37,644

17,898

FREE CASH FLOW

2Q22

1Q22

2Q21

Dollars in millions

YTD 2022

YTD 2021

19,963

14,788

9,650

Cash Flow from Operating Activities

(U.S. GAAP)

34,751

18,914

(3,837)

(3,911)

(2,747)

Additions to property, plant and

equipment

(7,748)

(5,147)

(226)

(417)

(264)

Additional investments and advances

(643)

(613)

60

90

45

Other investing activities including

collection of advances

150

132

939

293

250

Proceeds from asset sales and returns of

investments

1,232

557

16,899

10,843

6,934

Free Cash Flow

27,742

13,843

ExxonMobil will discuss financial and operating results and

other matters during a webcast at 8:30 a.m. Central Time on July

29, 2022. To listen to the event or access an archived replay,

please visit www.exxonmobil.com.

Cautionary Statement

Outlooks; projections; descriptions of strategic, operating, and

financial plans and objectives; statements of future ambitions and

plans; and other statements of future events or conditions in this

release, are forward-looking statements. Similarly, discussion of

future carbon capture, biofuel and hydrogen plans to drive towards

net zero emissions are dependent on future market factors, such as

continued technological progress and policy support, and represent

forward-looking statements. Actual future results, including

financial and operating performance; total capital expenditures and

mix, including allocations of capital to low carbon solutions; cost

reductions and efficiency gains, including the ability to offset

inflationary pressure; plans to reduce future emissions and

emissions intensity; timing and outcome of projects to capture and

store CO2, produced biofuels, and use of plastic waste as recycling

feedstock; timing and outcome of hydrogen projects; cash flow,

dividends and shareholder returns, including the timing and amounts

of share repurchases; future debt levels and credit ratings;

business and project plans, timing, costs, capacities and returns;

achievement of ambitions to reach Scope 1 and Scope 2 net zero from

operated assets by 2050; achievement of plans to reach Scope 1 and

2 net zero in Upstream Permian Basin operated assets by 2030; and

resource recoveries and production rates could differ materially

due to a number of factors. These include global or regional

changes in the supply and demand for oil, natural gas,

petrochemicals, and feedstocks and other market conditions that

impact prices and differentials for our products; variable impacts

of trading activities on our margins and results each quarter;

actions of competitors and commercial counterparties; the outcome

of commercial negotiations, including final agreed terms and

conditions; the ability to access debt markets; the ultimate

impacts of COVID-19, including the extent and nature of further

outbreaks and the effects of government responses on people and

economies; reservoir performance, including variability and timing

factors applicable to unconventional resources; the outcome of

exploration projects and decisions to invest in future reserves;

timely completion of development and other construction projects;

final management approval of future projects and any changes in the

scope, terms, or costs of such projects as approved; changes in

law, taxes, or regulation including environmental regulations,

trade sanctions, and timely granting of governmental permits and

certifications; government policies and support and market demand

for low carbon technologies; war, and other political or security

disturbances; opportunities for potential investments or

divestments and satisfaction of applicable conditions to closing,

including regulatory approvals; the capture of efficiencies within

and between business lines and the ability to maintain near-term

cost reductions as ongoing efficiencies; unforeseen technical or

operating difficulties and unplanned maintenance; the development

and competitiveness of alternative energy and emission reduction

technologies; the results of research programs and the ability to

bring new technologies to commercial scale on a cost-competitive

basis; and other factors discussed under Item 1A. Risk Factors of

ExxonMobil’s 2021 Form 10-K.

Forward-looking and other statements regarding our

environmental, social and other sustainability efforts and

aspirations are not an indication that these statements are

necessarily material to investors or requiring disclosure in our

filing with the SEC. In addition, historical, current, and

forward-looking environmental, social and sustainability-related

statements may be based on standards for measuring progress that

are still developing, internal controls and processes that continue

to evolve, and assumptions that are subject to change in the

future, including future rule-making.

Frequently Used Terms and Non-GAAP

Measures

This press release includes cash flow from operations and asset

sales. Because of the regular nature of our asset management and

divestment program, the company believes it is useful for investors

to consider proceeds associated with the sales of subsidiaries,

property, plant and equipment, and sales and returns of investments

together with cash provided by operating activities when evaluating

cash available for investment in the business and financing

activities. A reconciliation to net cash provided by operating

activities for 2021 and 2022 periods is shown on page 7.

This press release also includes cash flow from operations and

asset sales excluding working capital. The company believes it is

useful for investors to consider these numbers in comparing the

underlying performance of the company's business across periods

when there are significant period-to-period differences in the

amount of changes in working capital. A reconciliation to net cash

provided by operating activities for 2021 and 2022 periods is shown

on page 7.

This press release also includes earnings/(loss) excluding

identified items, which are earnings/(loss) excluding individually

significant non-operational events with an absolute corporate total

earnings impact of at least $250 million in a given quarter. The

earnings/(loss) impact of an identified item for an individual

segment may be less than $250 million when the item impacts several

periods or several segments. Earnings/(loss) excluding identified

items does include non-operational earnings events or impacts that

are below the $250 million threshold utilized for identified items.

When the effect of these events are material in aggregate, they are

indicated in analysis of period results as part of quarterly

earnings press release and teleconference materials. Management

uses these figures to improve comparability of the underlying

business across multiple periods by isolating and removing

significant non-operational events from business results. The

Corporation believes this view provides investors increased

transparency into business results and trends and provides

investors with a view of the business as seen through the eyes of

management. Earnings excluding Identified Items is not meant to be

viewed in isolation or as a substitute for net income/(loss)

attributable to ExxonMobil as prepared in accordance with U.S.

GAAP. A reconciliation to earnings is shown for 2022 and 2021

periods in Attachments II-a and II-b. Corresponding per share

amounts are shown on page 1 and in Attachment II-a, including a

reconciliation to earnings/(loss) per common share – assuming

dilution (U.S. GAAP).

This press release also includes total taxes including

sales-based taxes. This is a broader indicator of the total tax

burden on the corporation’s products and earnings, including

certain sales and value-added taxes imposed on and concurrent with

revenue-producing transactions with customers and collected on

behalf of governmental authorities (“sales-based taxes”). It

combines “Income taxes” and “Total other taxes and duties” with

sales-based taxes, which are reported net in the income statement.

The company believes it is useful for the corporation and its

investors to understand the total tax burden imposed on the

corporation’s products and earnings. A reconciliation to total

taxes is shown in Attachment I-a.

This press release also references free cash flow. Free cash

flow is the sum of net cash provided by operating activities and

net cash flow used in investing activities. This measure is useful

when evaluating cash available for financing activities, including

shareholder distributions, after investment in the business. Free

cash flow is not meant to be viewed in isolation or as a substitute

for net cash provided by operating activities. A reconciliation to

net cash provided by operating activities for 2021 and 2022 periods

is shown on page 7.

References to the resource base and other quantities of oil,

natural gas or condensate may include estimated amounts that are

not yet classified as “proved reserves” under SEC definitions, but

which are expected to be ultimately recoverable. A reconciliation

of production excluding divestments, entitlements, and government

mandates to actual production is contained in the Supplement to

this release included as Exhibit 99.2 to the Form 8-K filed the

same day as this news release. The term “project” as used in this

release can refer to a variety of different activities and does not

necessarily have the same meaning as in any government payment

transparency reports.

Reference to Earnings

References to corporate earnings mean net income attributable to

ExxonMobil (U.S. GAAP) from the consolidated income statement.

Unless otherwise indicated, references to earnings, Upstream,

Energy Products, Chemical Products, Specialty Products and

Corporate and Financing segment earnings, and earnings per share

are ExxonMobil’s share after excluding amounts attributable to

noncontrolling interests.

Exxon Mobil Corporation has numerous affiliates, many with names

that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For

convenience and simplicity, those terms and terms such as

corporation, company, our, we, and its are sometimes used as

abbreviated references to specific affiliates or affiliate groups.

Similarly, ExxonMobil has business relationships with thousands of

customers, suppliers, governments, and others. For convenience and

simplicity, words such as venture, joint venture, partnership,

co-venturer, and partner are used to indicate business and other

relationships involving common activities and interests, and those

words may not indicate precise legal relationships. ExxonMobil's

ambitions, plans and goals do not guarantee any action or future

performance by its affiliates or Exxon Mobil Corporation's

responsibility for those affiliates' actions and future

performance, each affiliate of which manages its own affairs.

Throughout this press release, both Exhibit 99.1 as well as

Exhibit 99.2, due to rounding, numbers presented may not add up

precisely to the totals indicated.

ATTACHMENT I-a

CONDENSED CONSOLIDATED STATEMENT OF

INCOME

(Preliminary)

Three Months Ended June 30,

Six Months Ended

June 30,

Dollars in millions (unless otherwise

noted)

2022

2021

2022

2021

Revenues and other income

Sales and other operating revenue

111,265

65,943

198,999

123,495

Income from equity affiliates

3,688

1,436

6,226

2,909

Other income

728

363

956

485

Total revenues and other income

115,681

67,742

206,181

126,889

Costs and other deductions

Crude oil and product purchases

65,613

37,329

118,001

69,930

Production and manufacturing expenses

10,686

8,471

20,927

16,533

Selling, general and administrative

expenses

2,530

2,345

4,939

4,773

Depreciation and depletion (includes

impairments)

4,451

4,952

13,334

9,956

Exploration expenses, including dry

holes

286

176

459

340

Non-service pension and postretirement

benefit expense

120

162

228

540

Interest expense

194

254

382

512

Other taxes and duties

6,868

7,746

14,422

14,406

Total costs and other deductions

90,748

61,435

172,692

116,990

Income before income taxes

24,933

6,307

33,489

9,899

Income tax expense

6,359

1,526

9,165

2,322

Net income including noncontrolling

interests

18,574

4,781

24,324

7,577

Net income attributable to noncontrolling

interests

724

91

994

157

Net income attributable to

ExxonMobil

17,850

4,690

23,330

7,420

OTHER FINANCIAL DATA

Three Months Ended June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Earnings per common share (U.S.

dollars)

4.21

1.10

5.49

1.74

Earnings per common share - assuming

dilution (U.S. dollars)

4.21

1.10

5.49

1.74

Dividends on common stock

Total

3,727

3,721

7,487

7,441

Per common share (U.S. dollars)

0.88

0.87

1.76

1.74

Millions of common shares outstanding

Average - assuming dilution

4,233

4,276

4,248

4,274

Income taxes

6,359

1,526

9,165

2,322

Total other taxes and duties

7,779

8,441

16,228

15,724

Total taxes

14,138

9,967

25,393

18,046

Sales-based taxes

6,857

5,448

12,957

10,110

Total taxes including sales-based

taxes

20,995

15,415

38,350

28,156

ExxonMobil share of income taxes of equity

companies

2,133

525

3,180

1,125

ATTACHMENT I-b

CONDENSED CONSOLIDATED BALANCE

SHEET

(Preliminary)

Dollars in millions (unless otherwise

noted)

June 30, 2022

December 31, 2021

ASSETS

Current assets

Cash and cash equivalents

18,861

6,802

Notes and accounts receivable – net

48,063

32,383

Inventories

Crude oil, products and merchandise

19,580

14,519

Materials and supplies

4,005

4,261

Other current assets

2,654

1,189

Total current assets

93,163

59,154

Investments, advances and long-term

receivables

46,820

45,195

Property, plant and equipment – net

209,159

216,552

Other assets, including intangibles –

net

18,632

18,022

Total assets

367,774

338,923

LIABILITIES

Current liabilities

Notes and loans payable

7,367

4,276

Accounts payable and accrued

liabilities

67,958

50,766

Income taxes payable

4,785

1,601

Total current liabilities

80,110

56,643

Long-term debt

39,516

43,428

Postretirement benefits reserves

17,408

18,430

Deferred income tax liabilities

20,807

20,165

Long-term obligations to equity

companies

2,617

2,857

Other long-term obligations

22,808

21,717

Total liabilities

183,266

163,240

EQUITY

Common stock without par value

(9,000 million shares authorized, 8,019

million shares issued)

16,018

15,746

Earnings reinvested

407,902

392,059

Accumulated other comprehensive income

(15,017)

(13,764)

Common stock held in treasury

(3,851 million shares at June 30, 2022,

and 3,780 million shares at December 31, 2021)

(231,587)

(225,464)

ExxonMobil share of equity

177,316

168,577

Noncontrolling interests

7,192

7,106

Total equity

184,508

175,683

Total liabilities and equity

367,774

338,923

ATTACHMENT I-c

CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS

(Preliminary)

Six Months Ended

June 30,

Dollars in millions (unless otherwise

noted)

2022

2021

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income including noncontrolling

interests

24,324

7,577

Depreciation and depletion (includes

impairments)

13,334

9,956

Changes in operational working capital,

excluding cash and debt

(1,661)

1,573

All other items – net

(1,246)

(192)

Net cash provided by operating

activities

34,751

18,914

CASH FLOWS FROM INVESTING

ACTIVITIES

Additions to property, plant and

equipment

(7,748)

(5,147)

Proceeds from asset sales and returns of

investments

1,232

557

Additional investments and advances

(643)

(613)

Other investing activities including

collection of advances

150

132

Net cash used in investing

activities

(7,009)

(5,071)

CASH FLOWS FROM FINANCING

ACTIVITIES

Additions to short-term debt

—

9,662

Reductions in short-term debt

(2,336)

(18,000)

Additions in debt with three months or

less maturity

1,303

1,320

Contingent consideration payments

(58)

(28)

Cash dividends to ExxonMobil

shareholders

(7,487)

(7,441)

Cash dividends to noncontrolling

interests

(123)

(112)

Changes in noncontrolling interests

(697)

(207)

Common stock acquired

(5,986)

(1)

Net cash used in financing

activities

(15,384)

(14,807)

Effects of exchange rate changes on

cash

(299)

65

Increase/(decrease) in cash and cash

equivalents

12,059

(899)

Cash and cash equivalents at beginning of

period

6,802

4,364

Cash and cash equivalents at end of

period

18,861

3,465

ATTACHMENT II-a

KEY FIGURES: IDENTIFIED ITEMS

2Q22

1Q22

2Q21

Dollars in Millions

YTD 2022

YTD 2021

17,850

5,480

4,690

Earnings (U.S. GAAP)

23,330

7,420

Identified Items

—

(2,975)

—

Impairments

(2,975)

—

299

—

—

Gain on sale of assets

299

—

—

—

(12)

Severance

—

(43)

—

(378)

—

Other (first quarter 2022 includes

Russia-related items)

(378)

—

299

(3,353)

(12)

Total Identified Items

(3,054)

(43)

17,551

8,833

4,702

Earnings (U.S. GAAP) Excluding

Identified Items

26,384

7,463

2Q22

1Q22

2Q21

Dollars Per Common Share

YTD 2022

YTD 2021

4.21

1.28

1.10

Earnings Per Common Share ¹

5.49

1.74

Identified Items Per Common Share

¹

—

(0.70)

—

Impairments

(0.70)

—

0.07

—

—

Gain on sale of assets

0.07

—

—

—

—

Severance

—

(0.01)

—

(0.09)

—

Other (first quarter 2022 includes

Russia-related items)

(0.09)

—

0.07

(0.79)

—

Total Identified Items Per Common Share

¹

(0.72)

(0.01)

4.14

2.07

1.10

Earnings (U.S. GAAP) Excluding

Identified Items Per Common Share ¹

6.21

1.75

¹ Assuming dilution

ATTACHMENT II-b

KEY FIGURES: IDENTIFIED ITEMS BY

SEGMENT

Second Quarter 2022

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate & Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

3,749

7,622

2,655

2,617

625

450

232

185

(286)

17,850

Identified Items

Gain on sale of assets

299

—

—

—

—

—

—

—

—

299

Total Identified Items

299

—

—

—

—

—

—

—

—

299

Earnings/(Loss) Excluding Identified

Items

3,450

7,622

2,655

2,617

625

450

232

185

(286)

17,551

First Quarter 2022

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate & Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

2,376

2,112

489

(684)

770

636

246

230

(694)

5,480

Identified Items

Impairments

—

(2,877)

—

—

—

—

—

—

(98)

(2,975)

Other

—

(378)

—

—

—

—

—

—

—

(378)

Total Identified Items

—

(3,255)

—

—

—

—

—

—

(98)

(3,353)

Earnings/(Loss) Excluding Identified

Items

2,376

5,367

489

(684)

770

636

246

230

(596)

8,833

Second Quarter 2021

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate & Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

663

2,522

(278)

(578)

1,149

1,051

262

487

(588)

4,690

Identified Items

Severance

—

—

—

—

—

—

—

—

(12)

(12)

Total Identified Items

—

—

—

—

—

—

—

—

(12)

(12)

Earnings/(Loss) Excluding Identified

Items

663

2,522

(278)

(578)

1,149

1,051

262

487

(576)

4,702

YTD 2022

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate & Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

6,125

9,734

3,144

1,933

1,395

1,086

478

415

(980)

23,330

Identified Items

Impairments

—

(2,877)

—

—

—

—

—

—

(98)

(2,975)

Gain on sale of assets

299

—

—

—

—

—

—

—

—

299

Other

—

(378)

—

—

—

—

—

—

—

(378)

Total Identified Items

299

(3,255)

—

—

—

—

—

—

(98)

(3,054)

Earnings/(Loss) Excluding Identified

Items

5,826

12,989

3,144

1,933

1,395

1,086

478

415

(882)

26,384

YTD 2021

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate & Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

1,026

4,713

(510)

(1,267)

1,803

1,788

442

862

(1,437)

7,420

Identified Items

Severance

—

—

—

—

—

—

—

—

(43)

(43)

Total Identified Items

—

—

—

—

—

—

—

—

(43)

(43)

Earnings/(Loss) Excluding Identified

Items

1,026

4,713

(510)

(1,267)

1,803

1,788

442

862

(1,394)

7,463

ATTACHMENT III

KEY FIGURES: UPSTREAM VOLUMES

2Q22

1Q22

2Q21

Net production of crude oil, natural gas

liquids, bitumen and synthetic oil, thousand barrels per day

(kbd)

YTD 2022

YTD 2021

777

753

687

United States

765

676

556

474

529

Canada / Other Americas

516

552

4

4

16

Europe

4

25

224

257

254

Africa

240

254

691

738

669

Asia

714

680

46

40

45

Australia / Oceania

43

42

2,298

2,266

2,200

Worldwide

2,282

2,229

2Q22

1Q22

2Q21

Natural gas production available for sale,

million cubic feet per day (mcfd)

YTD 2022

YTD 2021

2,699

2,777

2,804

United States

2,738

2,786

180

182

189

Canada / Other Americas

180

203

825

770

654

Europe

798

1,026

67

58

46

Africa

63

35

3,320

3,340

3,433

Asia

3,330

3,515

1,515

1,325

1,168

Australia / Oceania

1,421

1,166

8,606

8,452

8,294

Worldwide

8,530

8,731

3,732

3,675

3,582

Oil-equivalent production (koebd)¹

3,704

3,684

1 Natural gas is converted to an

oil-equivalent basis at six million cubic feet per one thousand

barrels.

ATTACHMENT IV

KEY FIGURES: MANUFACTURING

THROUGHPUT AND SALES

2Q22

1Q22

2Q21

Refinery throughput, thousand barrels per

day (kbd)

YTD 2022

YTD 2021

1,686

1,685

1,532

United States

1,686

1,532

413

399

332

Canada

406

348

1,164

1,193

1,223

Europe

1,179

1,188

532

537

607

Asia Pacific

534

576

193

169

164

Other

180

161

3,988

3,983

3,858

Worldwide

3,985

3,805

2Q22

1Q22

2Q21

Energy Products sales, thousand barrels

per day (kbd)

YTD 2022

YTD 2021

2,452

2,262

2,230

United States

2,358

2,153

2,858

2,849

2,776

Non-U.S.

2,853

2,766

5,310

5,111

5,006

Worldwide

5,211

4,920

2,208

2,114

2,117

Gasolines, naphthas

2,161

2,057

1,755

1,722

1,704

Heating oils, kerosene, diesel

1,739

1,698

350

289

201

Aviation fuels

319

192

228

249

275

Heavy fuels

238

266

769

737

709

Other energy products

753

707

5,310

5,111

5,006

Worldwide

5,211

4,920

2Q22

1Q22

2Q21

Chemical Products sales, thousand metric

tons (kt)

YTD 2022

YTD 2021

1,998

2,032

1,782

United States

4,030

3,403

2,812

2,986

2,949

Non-U.S.

5,798

6,093

4,811

5,018

4,731

Worldwide

9,829

9,496

2Q22

1Q22

2Q21

Specialty Products sales, thousand metric

tons (kt)

YTD 2022

YTD 2021

590

522

495

United States

1,111

1,005

1,511

1,484

1,447

Non-U.S.

2,995

2,932

2,100

2,006

1,942

Worldwide

4,107

3,936

ATTACHMENT V

KEY FIGURES: CAPITAL AND EXPLORATION

EXPENDITURES

2Q22

1Q22

2Q21

Dollars in millions

YTD 2022

YTD 2021

Upstream

1,644

1,369

925

United States

3,013

1,735

1,983

2,510

1,892

Non-U.S.

4,493

3,439

3,627

3,879

2,817

Total

7,506

5,174

Energy Products

300

392

188

United States

692

457

206

174

241

Non-U.S.

380

421

506

566

429

Total

1,072

878

Chemical Products

250

231

310

United States

481

517

169

205

202

Non-U.S.

374

294

419

436

512

Total

855

811

Specialty Products

14

5

8

United States

19

11

42

18

36

Non-U.S.

60

61

56

23

44

Total

79

72

Other

1

—

1

Other

1

1

4,609

4,904

3,803

Worldwide

9,513

6,936

CASH CAPITAL EXPENDITURES

2Q22

1Q22

2Q21

Dollars in millions

YTD 2022

YTD 2021

3,837

3,911

2,747

Additions to property, plant and

equipment

7,748

5,147

166

327

219

Net investments and advances

493

481

4,003

4,238

2,966

Total Cash Capital Expenditures

8,241

5,628

ATTACHMENT VI

KEY FIGURES: YEAR-TO-DATE

EARNINGS/(LOSS)

Results Summary

2Q22

1Q22

Change

vs

1Q22

2Q21

Change

vs

2Q21

Dollars in millions (except per

share data)

YTD 2022

YTD 2021

Change

vs

YTD 2021

17,850

5,480

+12,370

4,690

+13,160

Earnings (U.S. GAAP)

23,330

7,420

+15,910

17,551

8,833

+8,718

4,702

+12,849

Earnings Excluding Identified Items

26,384

7,463

+18,921

4.21

1.28

+2.93

1.10

+3.11

Earnings Per Common Share ¹

5.49

1.74

+3.75

4.14

2.07

+2.07

1.10

+3.04

Earnings Excluding Identified Items Per

Common Share ¹

6.21

1.75

+4.46

4,609

4,904

-295

3,803

+806

Capital and Exploration Expenditures

9,513

6,936

+2,577

¹ Assuming dilution

ATTACHMENT VII

KEY FIGURES: EARNINGS/(LOSS) BY

QUARTER

Dollars in millions

2022

2021

2020

2019

2018

First Quarter

5,480

2,730

(610)

2,350

4,650

Second Quarter

17,850

4,690

(1,080)

3,130

3,950

Third Quarter

—

6,750

(680)

3,170

6,240

Fourth Quarter

—

8,870

(20,070)

5,690

6,000

Full Year

—

23,040

(22,440)

14,340

20,840

Dollars per common share ¹

2022

2021

2020

2019

2018

First Quarter

1.28

0.64

(0.14)

0.55

1.09

Second Quarter

4.21

1.10

(0.26)

0.73

0.92

Third Quarter

—

1.57

(0.15)

0.75

1.46

Fourth Quarter

—

2.08

(4.70)

1.33

1.41

Full Year

—

5.39

(5.25)

3.36

4.88

1 Computed using the average number of shares outstanding

during each period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220729005045/en/

Media Relations 972-940-6007

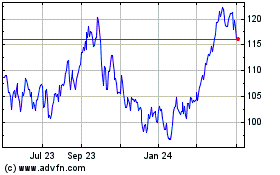

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Feb 2025 to Mar 2025

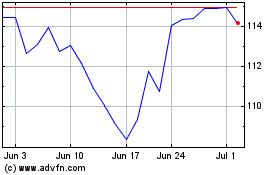

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Mar 2025