Eagle Point Credit Company Inc. (the “Company”) (NYSE: ECC,

ECCC, ECC PRD, ECCF, ECCV, ECCW, ECCX) today announced financial

results for the quarter ended September 30, 2024 and certain

additional activity through October 31, 2024.

“Our portfolio generated another quarter of strong recurring

cash flows, and we deployed $171.1 million of net capital into

investments with compelling risk-adjusted returns,” said Thomas P.

Majewski, Chief Executive Officer. “We actively managed our

portfolio, completing 14 reset actions in the third quarter alone,

and 23 reset and refinancing actions year-to-date. These actions

are laying the foundation for the portfolio to further enhance its

net investment income over time.”

THIRD QUARTER 2024 RESULTS

- Net asset value (“NAV”) per common share of $8.44 as of

September 30, 2024, compared to $8.75 as of June 30, 2024.

- Net investment income (“NII”) of $0.29 per weighted average

common share.1,2 NII less realized capital losses was $0.23 per

weighted average common share.

- Realized capital losses of $0.08 per weighted average common

share were a result of the writedown of amortized cost to fair

value for three late-in-life collateralized loan obligation (“CLO”)

equity positions. The writedowns were reclassifications of

unrealized depreciation to realized losses and did not have a

meaningful NAV impact. Excluding the reclassifications, the Company

realized capital gains of $0.02 per weighted average common share

from sales of appreciated investments and repayments.

- NII less realized capital losses of $0.23 per weighted average

common share compares to $0.16 of NII less realized capital losses

per weighted average common share for the quarter ended June 30,

2024, and $0.35 of NII and realized capital gains per weighted

average common share for the quarter ended September 30, 2023.

- GAAP net income (inclusive of unrealized mark-to-market

depreciation) of $3.9 million, or $0.04 per weighted average common

share.

- Received $68.2 million in recurring cash distributions3 from

the Company’s investment portfolio, or $0.66 per weighted average

common share, in line with the Company’s aggregate distributions on

its common stock and operating costs for the quarter.

- Deployed $171.1 million in net capital into CLO equity, CLO

debt, loan accumulation facilities and other investments. The

weighted average effective yield of new CLO equity investments made

by the Company during the quarter, which includes a provision for

credit losses, was 18.5% as measured at the time of

investment.

- As of September 30, 2024:

- The weighted average effective yield of the Company’s CLO

equity portfolio (excluding called CLOs), based on amortized cost,

was 14.61%. This compares to 15.28% as of June 30, 2024 and 16.29%

as of September 30, 2023.4

- The weighted average expected yield of the Company’s CLO equity

portfolio (excluding called CLOs), based on fair market value, was

21.21%. This compares to 22.36% as of June 30, 2024 and 27.38% as

of September 30, 2023.4

- Issued approximately 7.5 million shares of common stock,

approximately 1.5 million shares of 6.75% Series D Perpetual

Preferred Stock (the “Series D Preferred Stock”) and 228,509 shares

of 8.00% Series F Term Preferred Stock (the “Series F Term

Preferred Stock”) pursuant to the Company’s “at-the-market”

offering program for total net proceeds of approximately $107.1

million. The common stock issuance resulted in $0.08 per share of

NAV accretion during the quarter.

- Issued 422,842 shares of Series AA and 5,900 shares of Series

AB 7.00% Convertible and Perpetual Preferred Stock (the

“Convertible Perpetual Preferred Stock”) for total proceeds of $9.7

million pursuant to the Company’s continuous offering of

Convertible Perpetual Preferred Stock.

- As of September 30, 2024, the Company had debt and preferred

equity securities outstanding which totaled approximately 30.7% of

its total assets (less current liabilities).5

- As of September 30, 2024, on a look-through basis, and based on

the most recent CLO trustee reports received by such date:

- The Company, through its investments in CLO equity securities,

had indirect exposure to approximately 1,792 unique corporate

obligors.

- The largest look-through obligor represented 0.6% of the loans

underlying the Company’s CLO equity portfolio.

- The top-ten largest look-through obligors together represented

5.1% of the loans underlying the Company’s CLO equity

portfolio.

- The look-through weighted average spread of the loans

underlying the Company’s CLO equity portfolio was 3.54%, down 9

basis points from June 2024.

- GAAP net income was comprised of total investment income of

$47.1 million, offset by unrealized appreciation on certain

liabilities held at fair value of $9.8 million, total net

unrealized depreciation on investments of $6.8 million, realized

capital losses of $6.4 million, financing costs and operating

expenses of $17.0 million and distributions and amortization of

offering costs on temporary equity of $3.2 million.

- Recorded other comprehensive income of $4.4 million.

FOURTH QUARTER 2024 PORTFOLIO ACTIVITY THROUGH OCTOBER 31,

2024 AND OTHER UPDATES

- As previously published on the Company’s website, management’s

estimate of the range of the Company’s NAV per common share is

estimated to be between $8.55 and $8.65 as of October 31, 2024. At

the midpoint, this is a 1.9% increase from NAV per common share as

of September 30, 2024.

- Received $73.2 million of recurring cash distributions from the

Company’s investment portfolio. As of October 31, 2024, some of the

Company’s investments had not yet reached their payment date for

the quarter.

- Deployed $25.0 million of net capital into CLO equity, CLO

debt, loan accumulation facilities and other investments.

DISTRIBUTIONS

As previously announced, the Company has declared the following

monthly distributions on its common stock, 6.50% Series C Term

Preferred Stock due 2031 (the “Series C Term Preferred Stock”),

Series D Preferred Stock and Series F Term Preferred Stock.6

Security

Amount per Share

Record Dates

Payable Dates

Common Stock

$0.14

November 12, 2024,

December 11, 2024

January 13, 2025,

February 10, 2025,

March 11, 2025

November 29, 2024,

December 31, 2024

January 31, 2025,

February 28, 2025,

March 31, 2025

Series C Term Preferred Stock

$0.135417

Series D Preferred Stock

$0.140625

Series F Term Preferred Stock

$0.166667

The Company also declared supplemental monthly distributions on

its common stock of $0.02 per share payable on November 29, 2024

and December 31, 2024 to shareholders of record on November 12,

2024 and December 11, 2024. The Company’s current estimated taxable

income for the 2024 tax year is expected to be fully distributed to

common stockholders for the same tax year; as a result, the Company

will conclude its monthly variable supplemental distribution as of

December 31, 2024.

Additionally, as previously announced, the Company has declared

the following monthly distributions on its Convertible Preferred

Stock.

Security

Amount per Share

Record Dates

Payable Dates

Series AA Convertible and

Perpetual Preferred Stock

$0.145834

November 12, 2024,

December 11, 2024

January 13, 2025,

February 10, 2025,

March 11, 2025

November 29, 2024,

December 31, 2024

January 31, 2025,

February 28, 2025,

March 31, 2025

Series AB Convertible and

Perpetual Preferred Stock

$0.145834

The distributions on shares of the Convertible Perpetual

Preferred Stock reflect an annual distribution rate of 7.00% of the

$25 liquidation preference per share and accumulate from the date

of original issue.

CONFERENCE CALL

The Company will host a conference call at 10:00 a.m. (Eastern

Time) today to discuss the Company’s financial results for the

quarter ended September 30, 2024, as well as a portfolio

update.

All interested parties may participate in the conference call by

dialing (877) 407-0789 (toll-free) or (201) 689-8562

(international). Please reference Conference ID 13749061 when

calling, and the Company recommends dialing in approximately 10 to

15 minutes prior to the call.

A live webcast will also be available on the Company’s website

(www.eaglepointcreditcompany.com). Please go to the Investor

Relations section at least 15 minutes prior to the call to

register, download and install any necessary audio software.

An archived replay of the call will be available shortly

afterwards until December 13, 2024. To hear the replay, please dial

(844) 512-2921 (toll-free) or (412) 317-6671 (international). For

the replay, enter Conference ID 13749061.

ADDITIONAL INFORMATION

The Company has made available on the investor relations section

of its website, www.eaglepointcreditcompany.com (in the financial

statements and reports section), its unaudited consolidated

financial statements as of and for the period ended September 30,

2024. The Company has also filed this report with the Securities

and Exchange Commission. The Company also published on its website

(in the presentations and events section) an investor presentation,

which contains additional information about the Company and its

portfolio as of and for the quarter ended September 30, 2024.

ABOUT EAGLE POINT CREDIT COMPANY

The Company is a non-diversified, closed-end management

investment company. The Company’s primary investment objective is

to generate high current income, with a secondary objective to

generate capital appreciation, primarily by investing in equity and

junior debt tranches of CLOs. The Company is externally managed and

advised by Eagle Point Credit Management LLC.

The Company makes certain unaudited portfolio information

available each month on its website in addition to making certain

other unaudited financial information available on its website

(www.eaglepointcreditcompany.com). This information includes (1) an

estimated range of the Company’s NII and realized capital gains or

losses per share of common stock for each calendar quarter end,

generally made available within the first fifteen days after the

applicable calendar month end, (2) an estimated range of the

Company’s NAV per share of common stock for the prior month end and

certain additional portfolio-level information, generally made

available within the first fifteen days after the applicable

calendar month end and (3) during the latter part of each month, an

updated estimate of NAV, if applicable, and, with respect to each

calendar quarter end, an updated estimate of the Company’s NII and

realized capital gains or losses per share for the applicable

quarter, if available.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Statements other than statements of historical facts

included in this press release may constitute forward-looking

statements and are not guarantees of future performance or results

and involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described in the

prospectus and the Company’s other filings with the SEC. The

Company undertakes no duty to update any forward-looking statement

made herein. All forward-looking statements speak only as of the

date of this press release.

1 “Per weighted average common share” is based on the average

daily number of shares of common stock outstanding for the period

and “per common share” refers to per share of the Company’s common

stock. 2 NII does not reflect distributions and amortization of

offering costs on the Series D Preferred Stock and Series AA/AB

Convertible and Perpetual Preferred Stock (collectively with the

Series D Preferred Stock, the “temporary equity”) of $0.03 per

weighted average common share. 3 “Recurring cash distributions”

refers to the quarterly distributions received by the Company from

its CLO equity, CLO debt and other investments and distributions

from loan accumulation facilities in excess of capital invested and

excludes funds received from CLOs called. 4 “Weighted average

effective yield” is based on an investment’s amortized cost whereas

“weighted average expected yield” is based on an investment’s fair

market value as of the applicable period end as disclosed in the

Company’s financial statements, which is subject to change from

period to period. Please refer to the Company’s quarterly unaudited

financial statements for additional disclosures. 5 Over the

long-term, management expects to generally operate the Company with

leverage within a range of 25% to 35% of total assets under normal

market conditions. Based on applicable market conditions at any

given time, or should significant opportunities present themselves,

the Company may incur leverage outside of this range, subject to

applicable regulatory limits. 6 The ability of the Company to

declare and pay distributions on stock is subject to a number of

factors, including the Company’s results of operations.

Distributions on stock are generally paid from net investment

income (regular interest and dividends) and may also include

capital gains and/or a return of capital. The actual components of

the Company’s distributions for U.S. tax reporting purposes can

only be finally determined as of the end of each fiscal year of the

Company and are thereafter reported on Form 1099-DIV.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114931300/en/

Investor and Media Relations: ICR 203-340-8510

IR@EaglePointCredit.com www.eaglepointcreditcompany.com

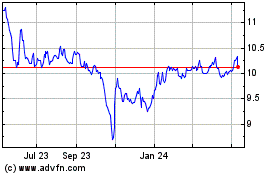

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

From Jan 2025 to Feb 2025

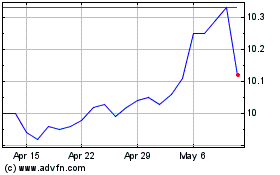

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

From Feb 2024 to Feb 2025