false

0001108134

0001108134

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR

15(D) OF

THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of

earliest event reported): March 4, 2024

BERKSHIRE

HILLS BANCORP, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-15781 |

|

04-3510455 |

(State or

Other Jurisdiction)

of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification

No.) |

| 60

State Street, Boston,

Massachusetts |

|

02109 |

| (Address of Principal Executive

Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (800) 773-5601, ext. 133773

Not Applicable

(Former Name or Former Address,

if Changed Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of

each class |

|

Trading

symbol(s) |

|

Name of

each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

BHLB |

|

New

York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On March 4, 2024, Berkshire Hills Bancorp, Inc.

(the “Company”) announced that Berkshire Bank, the wholly owned subsidiary of the Company, has entered into definitive agreements

with three buyers to sell 10 of Berkshire Bank’s upstate and eastern New York branches, consisting of eight offices in Albany, Saratoga,

Schenectady and Columbia counties, one office in Whitehall and one office in East Syracuse.

A copy of the news release is attached as Exhibit

99.1 to this Current Report.

| Item 9.01 |

Financial Statements and Exhibits |

| |

(a) |

Financial statements of businesses acquired. Not Applicable. |

| |

|

|

| |

(b) |

Pro forma financial information. Not Applicable. |

| |

|

|

| |

(c) |

Shell company transactions: Not Applicable. |

| |

|

|

| |

(d) |

Exhibits: |

|

| |

|

|

|

| |

|

Exhibit No. |

Description |

| |

|

|

|

| |

|

99.1 |

News release dated March 4, 2024 |

| |

|

|

|

| |

|

104.1 |

Cover Page for this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

|

Berkshire Hills Bancorp, Inc. |

| |

|

|

| |

|

|

| DATE: March 4, 2024 |

By: |

/s/Nitin J. Mhatre |

| |

|

Nitin J. Mhatre

President and Chief Executive Officer |

Exhibit 99.1

Berkshire

Hills Bancorp to Sell Select

Upstate

and Eastern New York Branches

| · | Enhances efficiency and profitability of the overall branch network |

| · | Strengthens focus in core New York markets |

| · | Combined branch and securities sale is neutral to full year 2024 earnings

outlook |

BOSTON –

March 4, 2024 – Berkshire Hills Bancorp, Inc. (NYSE: BHLB) announced today that

its wholly owned subsidiary Berkshire Bank has entered into definitive agreements with three buyers to sell 10 of its upstate and eastern

New York branches, consisting of eight offices in Albany, Saratoga, Schenectady and Columbia counties, one office in Whitehall and one

office in East Syracuse.

The sales include approximately

$485.5 million in deposits, $60.5 million of related residential mortgage and consumer loans along with all branch premises and equipment.

The transactions exclude Berkshire’s commercial banking business.

Hudson Valley Credit Union is

purchasing eight locations in Albany, Saratoga, Schenectady, and Columbia counties, Glens Falls National Bank and Trust Company is purchasing

one location in Whitehall and Pathfinder Bank is purchasing one location in East Syracuse. The buyers intend to offer employment to all

associated staff. The sales are targeted for completion by the end of the third quarter of 2024 subject to customary regulatory approvals

and associated system conversions. They reduce Berkshire’s overall branch footprint from 96 to 86 locations.

CEO Nitin Mhatre stated, “Our

announcement today is another step in our continued efforts to create efficiencies in our branch network so we can continue to invest

in our bankers and client experience to further improve our long-term profitability. The proposed sales will concentrate our overall geographic

footprint and lower our expense run rate, while strengthening focus in our core New York markets. The branch sales combined with a future

securities sale will not materially increase borrowings and will be effectively neutral to full year 2024 earnings outlook.”

Berkshire remains committed to

the important core New York markets where it will continue to operate 16 branches. Berkshire clients at its remaining locations will continue

to work with the same bankers as they did prior to the announcement.

“We continue

to execute on opportunities to create efficiencies in our franchise,” stated CFO David Rosato. “These transactions

allow us to exit these branches without incurring severance or real estate costs while reducing expenses

and contributing positively to our long-term profitability.”

Berkshire's financial advisor

for the branch sale was RBC Capital Markets LLC and legal counsel was provided by Luse Gorman, PC.

ABOUT BERKSHIRE HILLS BANCORP

Berkshire Hills Bancorp, Inc. (NYSE: BHLB)

is the parent company of Berkshire Bank, a relationship-driven, community-focused bank that delivers industry-leading financial

expertise to clients in New England and New York. With $12.4 billion in assets and 96 branches, Berkshire is headquartered in Boston

and provides a full suite of tailored banking solutions through its Commercial Banking, Retail Banking, Consumer Lending, Private Banking

and Wealth Management divisions. For more than 175 years, the Bank has delivered strength, stability and trusted advice to empower the

financial potential of its clients and communities. Newsweek named Berkshire one of America’s Most Trusted Companies and one of

America’s Best Regional Banks. To learn more about Berkshire Hills Bancorp visit ir.berkshirebank.com.

FORWARD-LOOKING STATEMENTS

This document contains "forward-looking statements" within

the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended.

You can identify these statements from the use of the words "may," "will," "should," "could,"

"would," "plan," "potential," "estimate," "project," "believe," "intend,"

"anticipate," "expect," "remain," "target" and similar expressions. There are many factors that

could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of

such factors, please see Berkshire's most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and

available on the SEC's website at www.sec.gov.

The branch sale is subject to regulatory approval and other conditions. Targeted

financial benefits are subject to uncertainty and may be affected or offset by other conditions related to the Company's operations. You

should not place undue reliance on forward-looking statements, which reflect our expectations only as of the date of this document. Berkshire

does not undertake any obligation to update forward-looking statements.

Investor Contact

Kevin Conn, Investor Relations

617.641.9206

KAConn@berkshirebank.com

Media Contact

Alicia Jacobs, Corporate Communications

413.242.6540

Ajacobs1@berkshirebank.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

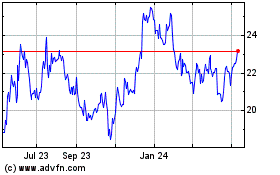

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jan 2025 to Feb 2025

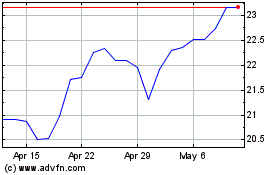

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Feb 2024 to Feb 2025