Form 8-K - Current report

November 14 2024 - 7:34AM

Edgar (US Regulatory)

0001034670false00-000000000010346702024-11-112024-11-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 11, 2024 |

Autoliv, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-12933 |

Not applicable |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Klarabergsviadukten 70, Section B 7th Floor, Box 70381, |

|

Stockholm, Sweden |

|

SE-107 24 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

+46 8 587 20 600 |

(Registrant’s Telephone Number, Including Area Code) |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock (par value $1.00 per share) |

|

ALV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Fourth Quarter Dividend

In a press release dated November 11, 2024, the Company announced that the Board declared a quarterly dividend of $0.70 cents per share for the fourth quarter of 2024. The dividend will be payable on Thursday, December 19, 2024 to the holders of Company common stock and on Friday, December 20, 2024 to the holders of the Company's Swedish Depository Receipts (SDRs). The dividend payments will be made to holders of record on the close of business on Tuesday, December 3, 2024.

Share Repurchase Program Extension

In the same press release dated November 11, 2024, the Company announced that the Board has approved an extension of the current share repurchase program which had been scheduled to expire at the end of 2024. The Board has approved an extension of the program until the end of 2025 with no other changes to the authorization.

The portions of the Press Release attached as Exhibit 99.1 to this Form 8-K relating to the fourth quarter dividend and the stock repurchase program extension are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

AUTOLIV, INC |

|

|

|

|

|

By: |

|

/s/ Anthony J. Nellis |

|

Name: |

|

Anthony J. Nellis |

|

Title: |

|

Executive Vice President, Legal Affairs and General Counsel |

Date: November 14, 2024

PRESS RELEASE

Exhibit 99.1

Autoliv Announces Dividend Increase, Share Repurchase Program Extension, Treasury Shares Retirement, and 2025 Capital Markets Day

(Stockholm, Sweden, November 11, 2024) – Autoliv, Inc. (NYSE: ALV and SSE: ALIVsdb), the worldwide leader in automotive safety systems, today announced an increase of its quarterly dividend and extension of its current share repurchase program. Autoliv will cancel two million treasury shares in December 2024. Autoliv plans to hold its next Capital Markets Day on June 3rd, 2025.

Quarterly Dividend

Autoliv’s quarterly dividend is increased by 3% to 70 cents per share, from 68 cents, for the fourth quarter of 2024. Assuming today’s number of shares outstanding, this equals an annualized total dividend of approximately $220 million.

To holders of record on the close of business on Tuesday, December 3, the dividend will be payable on: Thursday, December 19, 2024 to holders of Autoliv common stock listed on the New York Stock Exchange (Common Stock); and Friday, December 20, 2024 to holders of Autoliv Swedish Depository Receipts listed on Nasdaq Stockholm (SDRs). The ex-date is: Tuesday, December 3, for holders of Common Stock; and Monday, December 2, for holders of SDRs.

Share Repurchase Program Extension

Since 2021, Autoliv has returned over $1.6 billion to shareholders through dividends and share repurchases in a challenging market environment. Approximately $950 million of this value has been for the repurchase of 9.5 million shares, representing 11% of our outstanding shares at the time the program began, as part of our current 3-year share repurchase program set to expire at year-end.

With only the current quarter remaining under the current share repurchase program, the Autoliv Board of Directors has now approved an extension of the program until the end of 2025 with no other changes to the authorization. Under the extended repurchase program, up to 7.5 million shares or up to $550 million, whichever comes first, remain authorized for potential repurchase from today through 2025. Autoliv management can initiate repurchases opportunistically at its discretion, subject to applicable legal requirements.

Retirement of Treasury Shares

The Autoliv Board of Directors also approved the retirement this quarter of 2,000,000 shares of common stock that have been held in treasury. The retirement of these shares in December, together with the retirement of shares repurchased in the quarter, will result in the decrease in the issued shares of common stock.

Capital Markets Day

Autoliv plans to host a Capital Markets Day on Tuesday June 3rd, 2025. Autoliv will invite investors, analysts, media, and other stakeholders to attend. More details will be provided in early 2025.

|

|

|

Autoliv Inc. Box 70381, 107 24 Stockholm, Sweden Visiting address: World Trade Center, Klarabergsviadukten 70, B7, 111 64 Stockholm Phone: +46 (0)8 587 20600 E-mail: gabriella.etemad@autoliv.com |

|

|

Comments by the Chairman

“Autoliv aims to consistently create competitive shareholder value through our purpose-led strategy and operations. Our strong balance sheet and positive cash flow trend support increased shareholder returns. The Board of Directors is pleased to approve a higher dividend payout, extend the share repurchase program, and reduce number of treasury shares in line with our commitment to return value to our shareholders,” says Jan Carlson, Chairman of the Board of Directors. “This is the fourth consecutive annual 3% increase since we re-instated our dividend in Q2 2021,” continued Mr. Carlson.

Inquiries:

Investors & Analysts: Anders Trapp, Tel +46 (0)8 587 206 71

Investors & Analysts: Henrik Kaar, Tel +46 (0)8 587 206 14

Media: Gabriella Etemad, Tel +46 (70) 612 64 24

This information is information that Autoliv, Inc. is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the contact person set out above, at 23:50 CET on November 11, 2024.

About Autoliv

Autoliv, Inc. (NYSE: ALV; Nasdaq Stockholm: ALIV.sdb) is the worldwide leader in automotive safety systems. Through our group companies, we develop, manufacture and market protective systems, such as airbags, seatbelts, and steering wheels for all major automotive manufacturers in the world as well as mobility safety solutions, such as pedestrian protection, connected safety services and safety solutions for riders of powered two wheelers. At Autoliv, we challenge and re-define the standards of mobility safety to sustainably deliver leading solutions. In 2023, our products saved 35,000 lives and reduced more than 450,000 injuries.

Our 70,000 associates in 25 countries are passionate about our vision of Saving More Lives and quality is at the heart of everything we do. We drive innovation, research, and development at our 14 technical centers, with their 20 test tracks. Sales in 2023 amounted to US $ 10.5 billion. For more information go to www.autoliv.com.

Safe Harbor Statement

This report contains statements that are not historical facts but rather forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those that address activities, events or developments that Autoliv, Inc. or its management believes or anticipates may occur in the future. All forward-looking statements are based upon our current expectations, various assumptions and data available from third parties. Our expectations and assumptions are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that such forward-looking statements will materialize or prove to be correct as forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors which may cause actual future results, performance or achievements to differ materially from the future results, performance or achievements expressed in or implied by such forward-looking statements. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those set out in the forward-looking statements, including general economic conditions and fluctuations in the global automotive market. For any forward-looking statements contained in this or any other document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we assume no obligation to update publicly or revise any such statements in light of new information or future events, except as required by law.

|

|

|

Autoliv Inc. Box 70381, 107 24 Stockholm Visiting address: World Trade Center, Klarabergsviadukten 70, B7, 111 64 Stockholm Phone: +46 (0)8 58720600 |

|

|

v3.24.3

Document And Entity Information

|

Nov. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 11, 2024

|

| Entity Registrant Name |

Autoliv, Inc.

|

| Entity Central Index Key |

0001034670

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-12933

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

Klarabergsviadukten 70, Section B

|

| Entity Address, Address Line Two |

7th Floor,

|

| Entity Address, Address Line Three |

Box 70381,

|

| Entity Address, City or Town |

Stockholm,

|

| Entity Address, Country |

SE

|

| Entity Address, Postal Zip Code |

SE-107 24

|

| City Area Code |

+46 8

|

| Local Phone Number |

587 20 600

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock (par value $1.00 per share)

|

| Trading Symbol |

ALV

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

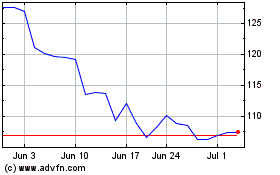

Autoliv (NYSE:ALV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Autoliv (NYSE:ALV)

Historical Stock Chart

From Nov 2023 to Nov 2024