Amplify Energy Corp. (NYSE: AMPY) (“Amplify” or the “Company”)

announced today its operating and financial results for the third

quarter of 2023 and additional disclosures.

Strategic Updates

As Amplify continues to evolve, we are pleased

to announce the following near-term strategic initiatives:

1) Bairoil Marketing Process - Amplify has

engaged an investment banking firm to conduct a market test of its

Bairoil assets. The Company will pursue a complete sale of the

assets while also considering alternative monetization structures

that would maximize the value of the assets for Amplify’s

shareholders. The marketing process will commence in the first

quarter of 2024.

2) Beta

Development Program - Amplify has conducted an in-depth

technical review of the undeveloped potential in the Beta field and

has decided to commence a Beta development program in the first

half of 2024. The Company estimates it can drill and complete wells

for approximately $5 – 6 million with IRRs that exceed 100% at

current oil pricing.

3) Magnify Energy Services - The Company has

created a wholly owned subsidiary, Magnify Energy Services, to

provide a variety of oilfield services to Amplify-operated wells.

Beginning in East Texas and Oklahoma, Magnify is providing

compression, well-testing and other well maintenance services. Over

time, Amplify may expand Magnify’s capabilities into other service

lines and operating areas. Amplify believes Magnify will improve

the Company’s profitability by providing services at a lower cost

than current alternatives, while allowing the Company to have

greater access to and control over these critical services.

Martyn Willsher, President and Chief Executive

Officer, commented, “Amplify has made tremendous strides in 2023 in

laying the foundation for unlocking substantial value from our

mature, diversified portfolio of cash-flow generating assets. The

return of production at Beta, substantial reduction in debt

outstanding, and our new credit facility have enabled us to pursue

additional opportunities to greatly enhance shareholder value. To

that end, we are excited to announce several strategic

initiatives.

First, we intend to commence a development

program in the Beta field, which retains significant upside for the

Company and is expected to increase profitability and operating

margins in the coming years. Second, the Company intends to launch

a marketing process for its low-decline oil-producing assets in

Bairoil, Wyoming while also exploring alternative monetization

structures to maximize value potential. Portfolio optimization will

enable the Company to further reduce leverage and potentially

accelerate Amplify’s ability to return capital to shareholders.

Third, we have created a wholly owned subsidiary to insource

certain field compressors and service equipment, which will allow

us to capture value through efficiencies, reduced costs and greater

control over operating expenses.”

Key Highlights

-

During the third quarter of 2023, the Company:

-

Achieved average total production of 20.6 Mboepd, while

successfully implementing the planned turnaround at Bairoil

-

Generated net cash provided by operating activities of $18.0

million and a net loss of $13.4 million

-

Delivered Adjusted EBITDA of $19.5 million

-

Generated $6.1 million of free cash flow

-

On October 5, 2023, the Company announced the appointment of

Vidisha Prasad to its Board of Directors

-

As of October 31, 2023, net debt was $104 million, consisting of

$120 million outstanding under the revolving credit facility and

$16 million of cash on hand

-

Net Debt to Last Twelve Months (“LTM”) Adjusted EBITDA of

1.2x1

-

The Company is reaffirming full-year 2023 guidance

-

The Company has issued its inaugural sustainability report which is

now available on its website

(1) Net debt as of October 31,

2023, and LTM Adjusted EBITDA as of the third quarter of 2023

Mr. Willsher commented, “Amplify’s third quarter

results were in line with internal projections and included the

impact of the planned Bairoil turnaround in September. The Company

was able to accelerate the first phase of cost saving initiatives

at Beta which should materially reduce future operating expenses.

We believe these efforts, in addition to our low leverage, further

cost savings initiatives and accretive asset investments, will

bolster profitability and enhance our cash-flow generation, which

we expect to materially increase in 2024 and beyond.”

Mr. Willsher concluded, “We are also pleased to

present Amplify Energy’s inaugural sustainability report, which

provides increased transparency to our stakeholders regarding our

business and operating practices. This report details our safety

procedures, environmental performance, efforts to enhance the

long-term sustainability of our business, and dedication to sound

corporate governance. We are committed to continuing to improve our

disclosures and providing updates on our sustainability

milestones.”

Key Financial Results

During the third quarter of 2023, the Company

reported a net loss of approximately $13.4 million compared to $9.8

million of net income in the prior quarter. The decrease was

primarily attributable to non-cash unrealized losses on commodity

derivatives from rising commodity prices during the period.

Amplify generated $19.5 million of Adjusted

EBITDA for the third quarter, an increase of approximately $1.9

million from $17.6 million in the prior quarter. The increase was

primarily attributable to higher realized commodity prices.

Free cash flow, defined as Adjusted EBITDA less

cash interest and capital spending, was $6.1 million for the third

quarter of 2023.

| |

|

|

|

| |

|

Third

Quarter |

Second

Quarter |

|

$ in millions |

|

2023 |

2023 |

|

Net income (loss) |

|

($13.4) |

$9.8 |

|

Net cash provided by operating activities |

|

$18.0 |

$4.9 |

|

Average daily production (MBoe/d) |

|

20.6 |

21.2 |

|

Total revenues excluding hedges |

|

$76.8 |

$72.0 |

|

Adjusted EBITDA (a non-GAAP financial measure) |

$19.5 |

$17.6 |

|

Total capital |

|

$9.7 |

$7.9 |

|

Free Cash Flow (a non-GAAP financial measure) |

$6.1 |

$6.1 |

| |

|

|

|

Inaugural Sustainability

Report

The Company issued its inaugural sustainability

report, which is available on its website, www.amplifyenergy.com,

under the “Sustainability” tab.

The report provides information about Amplify’s

environmental, social and governance (“ESG”) initiatives, practices

and related metrics.

Revolving Credit Facility

On October 19, 2023, Amplify completed the

regularly scheduled semi-annual redetermination of its borrowing

base, which was reaffirmed at $150 million with elected commitments

of $135 million. The next regularly scheduled borrowing base

redetermination is expected to occur in the second quarter of

2024.

As of October 31, 2023, Amplify had net debt of

$104 million, consisting of $120 million outstanding under its

revolving credit facility and $16 million of cash on hand. Net Debt

to LTM Adjusted EBITDA was 1.2x (net debt as of October 31, 2023

and 3Q23 LTM Adjusted EBITDA).

Corporate Production and Pricing

Update

During the third quarter of 2023, average daily

production was approximately 20.6 MBoepd, a decrease of 3% from

21.2 MBoepd in the second quarter. This decrease was primarily due

the planned turnaround at Bairoil (where the field was shut-in for

10 days to perform maintenance and facility improvements),

significant flash flooding at Bairoil that impacted operations for

several days, and short-term production interruptions at Beta to

implement cost savings initiatives. The Company’s product mix for

the quarter was 38% crude oil, 18% NGLs, and 44% natural gas.

| |

|

|

|

|

|

| |

|

Three

Months |

|

Three

Months |

|

| |

|

Ended |

|

Ended |

|

| |

|

September 30, 2023 |

|

June 30, 2023 |

|

| |

|

|

|

|

|

|

Production volumes - MBOE: |

|

|

|

|

|

|

|

Oklahoma |

|

536 |

|

542 |

|

| |

Rockies (Bairoil) |

|

263 |

|

315 |

|

| |

Southern California (Beta) |

|

246 |

|

158 |

|

| |

East Texas / North Louisiana |

|

754 |

|

792 |

|

| |

Eagle Ford (Non-Op) |

|

98 |

|

121 |

|

| |

Total - MBoe |

|

1,897 |

|

1,928 |

|

| |

Total - MBoe/d |

|

20.6 |

|

21.2 |

|

| |

%

- Liquids |

|

56% |

|

55% |

|

|

|

|

|

|

|

|

|

Total oil, natural gas and NGL revenues for the

third quarter of 2023 were approximately $76.4 million, before the

impact of derivatives, compared to $67.4 million in the prior

quarter. The Company realized a loss on commodity derivatives of

$3.9 million during the quarter, compared to a $1.5 million gain in

the previous quarter. Oil and gas revenues, net of realized hedges,

increased $3.6 million for the third quarter compared to the second

quarter.

The following table sets forth information

regarding average realized sales prices for the periods

indicated:

| |

|

Crude Oil ($/Bbl) |

NGLs ($/Bbl) |

Natural Gas ($/Mcf) |

|

| |

|

Three Months Ended September 30, 2023 |

|

Three Months Ended June 30, 2023 |

|

Three Months Ended September 30, 2023 |

|

Three Months Ended June 30, 2023 |

|

Three Months Ended September 30, 2023 |

|

Three Months Ended June 30, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average sales price exclusive of realized derivatives and certain

deductions from revenue |

|

$ |

78.45 |

|

|

$ |

69.86 |

|

|

$ |

24.89 |

|

|

$ |

21.25 |

|

|

$ |

2.27 |

|

$ |

1.93 |

|

| Realized

derivatives |

|

|

(9.89 |

) |

|

|

(4.57 |

) |

|

|

- |

|

|

|

- |

|

|

|

0.66 |

|

|

0.92 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

sales price with realized derivatives exclusive of certain

deductions from revenue |

|

$ |

68.56 |

|

|

$ |

65.29 |

|

|

$ |

24.89 |

|

|

$ |

21.25 |

|

|

$ |

2.93 |

|

$ |

2.85 |

|

| Certain

deductions from revenue |

|

|

- |

|

|

|

- |

|

|

|

(1.55 |

) |

|

|

(1.46 |

) |

|

|

0.01 |

|

|

0.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

sales price inclusive of realized derivatives and certain

deductions from revenue |

|

$ |

68.56 |

|

|

$ |

65.29 |

|

|

$ |

23.33 |

|

|

$ |

19.80 |

|

|

$ |

2.94 |

|

$ |

2.86 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

Lease operating expenses in the third quarter of

2023 were approximately $37.1 million, or $19.55 per Boe. Operating

expenses were $2.2 million higher than second-quarter operating

expenses, primarily due to returning the Beta field to production

and increased costs associated with the flooding event at

Bairoil.

Severance and Ad Valorem taxes in the third

quarter were approximately $4.9 million, a decrease of $0.3 million

compared to $5.2 million in the prior quarter. Severance and Ad

Valorem taxes as a percentage of revenue were approximately 6.5%

this quarter compared to 7.7% in the previous quarter.

Amplify incurred $5.0 million, or $2.63 per Boe,

of gathering, processing and transportation expenses in the third

quarter, compared to $5.1 million, or $2.67 per Boe, in the

previous quarter.

Third quarter cash G&A expenses were $6.5

million, an increase of $0.3 million from $6.2 million in the

second quarter. We expect cash G&A to remain flat in the fourth

quarter.

Depreciation, depletion and amortization expense

for the third quarter totaled $7.5 million, or $3.95 per Boe,

compared to $7.1 million, or $3.67 per Boe, in the prior

quarter.

Net interest expense was $4.5 million this

quarter, an increase of $0.8 million from $3.7 million in the

second quarter. This increase was primarily due to writing off $0.7

million associated with the prior credit facility.

Amplify recorded a current income tax expense of

$1.4 million for the third quarter.

Capital Investment Update

Cash capital investment during the third quarter

of 2023 was approximately $9.7 million, a $1.8 million increase

from $7.9 million in the prior quarter. The majority of capital

investment this quarter was related to workover and facility

projects at Beta and the planned turnaround at Bairoil.

The following table details Amplify’s capital

incurred during the quarter:

| |

|

Third

Quarter |

|

Year to

Date |

| |

|

2023

Capital |

|

Capital |

| |

|

Spend ($ MM) |

|

Spend ($ MM) |

|

Oklahoma |

|

$ |

1.0 |

|

$ |

4.2 |

| Rockies

(Bairoil) |

|

$ |

3.3 |

|

$ |

3.6 |

| Southern

California (Beta) |

|

$ |

4.7 |

|

$ |

11.4 |

| East Texas /

North Louisiana |

|

$ |

0.3 |

|

$ |

0.6 |

| Eagle Ford

(Non-Op) |

|

$ |

0.4 |

|

$ |

6.9 |

|

Total Capital Invested |

|

$ |

9.7 |

|

$ |

26.6 |

| |

|

|

|

|

The Company’s capital investments for the

remainder of 2023 will focus primarily on well workovers in

addition to facility projects at Beta which will improve

operational efficiencies, reduce power expenses and significantly

reduce emissions.

Hedging Update

The following table reflects the hedged volumes

under Amplify’s commodity derivative contracts and the average

fixed, floor and ceiling prices at which production is hedged for

October 2023 through December 2026, as of November 6, 2023:

| |

|

|

|

|

|

|

|

|

| |

|

2023 |

|

2024 |

|

2025 |

|

2026 |

| |

|

|

|

|

|

|

|

|

|

Natural Gas Swaps: |

|

|

|

|

|

|

|

|

| Average

Monthly Volume (MMBtu) |

|

|

|

|

662,500 |

|

|

675,000 |

|

|

291,667 |

| Weighted

Average Fixed Price ($) |

|

|

|

$ |

3.72 |

|

$ |

3.74 |

|

$ |

3.72 |

| |

|

|

|

|

|

|

|

|

|

Natural Gas Collars: |

|

|

|

|

|

|

|

|

| Two-way

collars |

|

|

|

|

|

|

|

|

|

Average Monthly Volume (MMBtu) |

|

|

1,336,000 |

|

|

627,083 |

|

|

500,000 |

|

|

291,667 |

|

Weighted Average Ceiling Price ($) |

|

$ |

5.22 |

|

$ |

4.32 |

|

$ |

4.10 |

|

$ |

4.10 |

|

Weighted Average Floor Price ($) |

|

$ |

3.35 |

|

$ |

3.43 |

|

$ |

3.50 |

|

$ |

3.50 |

| |

|

|

|

|

|

|

|

|

| Oil

Swaps: |

|

|

|

|

|

|

|

|

| Average

Monthly Volume (Bbls) |

|

|

113,333 |

|

|

61,333 |

|

|

53,000 |

|

|

30,917 |

| Weighted

Average Fixed Price ($) |

|

$ |

66.91 |

|

$ |

73.55 |

|

$ |

70.68 |

|

$ |

70.68 |

| |

|

|

|

|

|

|

|

|

| Oil

Collars: |

|

|

|

|

|

|

|

|

| Two-way

collars |

|

|

|

|

|

|

|

|

|

Average Monthly Volume (Bbls) |

|

|

15,000 |

|

|

102,000 |

|

|

59,500 |

|

|

|

Weighted Average Ceiling Price ($) |

|

$ |

76.16 |

|

$ |

80.20 |

|

$ |

80.20 |

|

|

|

Weighted Average Floor Price ($) |

|

$ |

65.00 |

|

$ |

70.00 |

|

$ |

70.00 |

|

|

| |

|

|

|

|

|

|

|

|

| Three-way

collars |

|

|

|

|

|

|

|

|

|

Average Monthly Volume (Bbls) |

|

|

50,000 |

|

|

|

|

|

|

|

Weighted Average Ceiling Price ($) |

|

$ |

74.54 |

|

|

|

|

|

|

|

Weighted Average Floor Price ($) |

|

$ |

58.00 |

|

|

|

|

|

|

|

Weighted Average Sub-Floor Price ($) |

|

$ |

43.00 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Amplify posted an updated investor presentation

containing additional hedging information on its website,

www.amplifyenergy.com, under the Investor Relations section.

Quarterly Report on Form

10-Q

Amplify’s financial statements and related

footnotes will be available in its Quarterly Report on Form 10-Q

for the quarter ended September 30, 2023, which Amplify expects to

file with the SEC on November 6, 2023.

About Amplify Energy

Amplify Energy Corp. is an independent oil and

natural gas company engaged in the acquisition, development,

exploitation and production of oil and natural gas properties.

Amplify’s operations are focused in Oklahoma, the Rockies

(Bairoil), federal waters offshore Southern California (Beta), East

Texas / North Louisiana, and the Eagle Ford (Non-op). For more

information, visit www.amplifyenergy.com.

Conference Call

Amplify will host an investor teleconference

tomorrow at 10:00 a.m. Central Time to discuss these operating and

financial results. Interested parties may join the call by dialing

(800) 343-5172 at least 15 minutes before the call begins and

providing the Conference ID: AEC3Q23. A telephonic replay will be

available for fourteen days following the call by dialing (800)

654-1563 and providing the Conference ID: 10190845.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

historical fact, included in this press release that address

activities, events or developments that the Company expects,

believes or anticipates will or may occur in the future are

forward-looking statements. Terminology such as “may,” “will,”

“would,” “should,” “expect,” “plan,” “project,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“pursue,” “target,” “outlook,” “continue,” the negative of such

terms or other comparable terminology are intended to identify

forward-looking statements. These statements include, but are not

limited to, statements about the Company’s expectations of plans,

goals, strategies (including measures to implement strategies),

objectives and anticipated results with respect thereto. These

statements address activities, events or developments that we

expect or anticipate will or may occur in the future, including

things such as projections of results of operations, plans for

growth, goals, future capital expenditures, competitive strengths,

references to future intentions and other such references. These

forward-looking statements involve risks and uncertainties and

other factors that could cause the Company’s actual results or

financial condition to differ materially from those expressed or

implied by forward-looking statements. These include risks and

uncertainties relating to, among other things: the ongoing impact

of the Incident, the Company’s evaluation and implementation of

strategic alternatives; the Company’s ability to satisfy debt

obligations; the Company’s need to make accretive acquisitions or

substantial capital expenditures to maintain its declining asset

base, including the existence of unanticipated liabilities or

problems relating to acquired or divested business or properties;

volatility in the prices for oil, natural gas and NGLs; the

Company’s ability to access funds on acceptable terms, if at all,

because of the terms and conditions governing the Company’s

indebtedness, including financial covenants; general political and

economic conditions, globally and in the jurisdictions in which we

operate, including conflicts in the Middle East and escalating

tensions between Russia and Ukraine and the potential destabilizing

effect such conflicts may pose for the global oil and natural gas

markets and effects of inflation; the impact of legislation and

governmental regulations, including those related to climate change

and hydraulic fracturing; and the occurrence or threat of epidemic

or pandemic diseases, including the COVID-19 pandemic, or any

government response to such occurrence or threat. Please read the

Company’s filings with the SEC, including “Risk Factors” in the

Company’s Annual Report on Form 10-K, and if applicable, the

Company’s Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, which are available on the Company’s Investor Relations

website at

https://www.amplifyenergy.com/investor-relations/sec-filings/default.aspx

or on the SEC’s website at http://www.sec.gov, for a discussion of

risks and uncertainties that could cause actual results to differ

from those in such forward-looking statements. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this press release. All

forward-looking statements in this press release are qualified in

their entirety by these cautionary statements. Except as required

by law, the Company undertakes no obligation and does not intend to

update or revise any forward-looking statements, whether as a

result of new information, future results or otherwise.

Use of Non-GAAP Financial

Measures

This press release and accompanying schedules

include the non-GAAP financial measures of Adjusted EBITDA, free

cash flow and net debt. The accompanying schedules provide a

reconciliation of these non-GAAP financial measures to their most

directly comparable financial measures calculated and presented in

accordance with GAAP. Amplify’s non-GAAP financial measures should

not be considered as alternatives to GAAP measures such as net

income, operating income, net cash flows provided by operating

activities, standardized measure of discounted future net cash

flows, or any other measure of financial performance calculated and

presented in accordance with GAAP. Amplify’s non-GAAP financial

measures may not be comparable to similarly titled measures of

other companies because they may not calculate such measures in the

same manner as Amplify does.

Adjusted EBITDA. Amplify

defines Adjusted EBITDA as net income or loss, plus interest

expense; income tax expenses; depreciation, depletion and

amortization; accretion of asset retirement obligations; losses on

commodity derivative instruments; cash settlements received on

expired commodity derivative instruments; share-based compensation

expenses; exploration costs; loss on settlement of AROs; bad debt

expense; pipeline incident loss; acquisition and divestiture

related costs; and LOPI-timing differences. Adjusted EBITDA is

commonly used as a supplemental financial measure by management and

external users of Amplify’s financial statements, such as

investors, research analysts and rating agencies, to assess: (1)

its operating performance as compared to other companies in

Amplify’s industry without regard to financing methods, capital

structures or historical cost basis; (2) the ability of its assets

to generate cash sufficient to pay interest and support Amplify’s

indebtedness; and (3) the viability of projects and the overall

rates of return on alternative investment opportunities. Since

Adjusted EBITDA excludes some, but not all, items that affect net

income or loss and because these measures may vary among other

companies, the Adjusted EBITDA data presented in this press release

may not be comparable to similarly titled measures of other

companies. The GAAP measures most directly comparable to Adjusted

EBITDA are net income and net cash provided by operating

activities.

Free cash flow. Amplify defines

free cash flow as Adjusted EBITDA, less cash interest expense and

capital expenditures. Free cash flow is an important non-GAAP

financial measure for Amplify’s investors since it serves as an

indicator of the Company’s success in providing a cash return on

investment. The GAAP measures most directly comparable to free cash

flow are net income and net cash provided by operating

activities.

Net debt. Amplify defines net

debt as the total principal amount drawn on the revolving credit

facility less cash and cash equivalents. The Company uses net debt

as a measure of financial position and believes this measure

provides useful additional information to investors to evaluate the

Company's capital structure and financial leverage.

Contacts

Jim Frew -- Senior Vice President and Chief

Financial Officer(832) 219-9044jim.frew@amplifyenergy.com

Michael Jordan -- Director, Finance and

Treasurer(832) 219-9051michael.jordan@amplifyenergy.com

Selected Operating and Financial Data

(Tables)

|

Amplify Energy Corp. |

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Statements of Operations Data |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

|

(Amounts in $000s, except per share data) |

|

September 30, 2023 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

Oil and natural gas sales |

|

$ |

76,403 |

|

|

$ |

67,393 |

|

| |

Other revenues |

|

|

367 |

|

|

|

4,578 |

|

| |

Total revenues |

|

|

76,770 |

|

|

|

71,971 |

|

| |

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

| |

Lease operating expense |

|

|

37,083 |

|

|

|

34,903 |

|

| |

Pipeline incident loss |

|

|

559 |

|

|

|

6,844 |

|

| |

Gathering, processing and transportation |

|

|

4,984 |

|

|

|

5,149 |

|

| |

Exploration |

|

|

- |

|

|

|

14 |

|

| |

Taxes other than income |

|

|

4,942 |

|

|

|

5,205 |

|

| |

Depreciation, depletion and amortization |

|

|

7,489 |

|

|

|

7,072 |

|

| |

General and administrative expense |

|

|

8,255 |

|

|

|

7,778 |

|

| |

Accretion of asset retirement obligations |

|

|

2,005 |

|

|

|

1,975 |

|

| |

Realized (gain) loss on commodity derivatives |

|

3,232 |

|

|

|

(1,517 |

) |

| |

Unrealized (gain) loss on commodity derivatives |

|

20,096 |

|

|

|

(2,281 |

) |

| |

Other, net |

|

|

449 |

|

|

|

239 |

|

| |

Total costs and expenses |

|

|

89,094 |

|

|

|

65,381 |

|

| |

|

|

|

|

|

|

Operating Income (loss) |

|

|

(12,324 |

) |

|

|

6,590 |

|

| |

|

|

|

|

|

|

Other Income (Expense): |

|

|

|

|

| |

Interest expense, net |

|

|

(4,470 |

) |

|

|

(3,701 |

) |

| |

Other income (expense) |

|

|

124 |

|

|

|

122 |

|

| |

Total Other Income (Expense) |

|

|

(4,346 |

) |

|

|

(3,579 |

) |

| |

|

|

|

|

|

| |

Income (loss) before reorganization items, net and income

taxes |

|

(16,670 |

) |

|

|

3,011 |

|

| |

|

|

|

|

|

|

Income tax benefit (expense) - current |

|

|

(1,441 |

) |

|

|

6,853 |

|

|

Income tax benefit (expense) - deferred |

|

|

4,708 |

|

|

|

(48 |

) |

| |

|

|

|

|

|

| |

Net income (loss) |

|

$ |

(13,403 |

) |

|

$ |

9,816 |

|

| |

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

| |

Basic and diluted earnings (loss) per share |

|

$ |

(0.34 |

) |

|

$ |

0.24 |

|

| |

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Operating Statistics |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

|

(Amounts in $000s, except per share data) |

|

September 30, 2023 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

Oil and natural gas revenue: |

|

|

|

|

|

|

Oil Sales |

|

$ |

57,214 |

|

$ |

50,750 |

| |

NGL Sales |

|

|

7,777 |

|

|

6,411 |

| |

Natural Gas Sales |

|

|

11,412 |

|

|

10,232 |

| |

Total oil and natural gas sales - Unhedged |

$ |

76,403 |

|

$ |

67,393 |

| |

|

|

|

|

|

|

Production volumes: |

|

|

|

|

| |

Oil Sales - MBbls |

|

|

729 |

|

|

727 |

| |

NGL Sales - MBbls |

|

|

334 |

|

|

324 |

| |

Natural Gas Sales - MMcf |

|

|

5,006 |

|

|

5,263 |

| |

Total - MBoe |

|

|

1,897 |

|

|

1,928 |

| |

Total - MBoe/d |

|

|

20.6 |

|

|

21.2 |

| |

|

|

|

|

|

|

Average sales price (excluding commodity

derivatives): |

|

|

|

| |

Oil - per Bbl |

|

$ |

78.45 |

|

$ |

69.86 |

| |

NGL - per Bbl |

|

$ |

23.33 |

|

$ |

19.80 |

| |

Natural gas - per Mcf |

|

$ |

2.28 |

|

$ |

1.94 |

| |

Total - per Boe |

|

$ |

40.28 |

|

$ |

34.97 |

| |

|

|

|

|

|

|

Average unit costs per Boe: |

|

|

|

|

| |

Lease operating expense |

|

$ |

19.54 |

|

$ |

18.10 |

| |

Gathering, processing and transportation |

|

$ |

2.63 |

|

$ |

2.67 |

| |

Taxes other than income |

|

$ |

2.60 |

|

$ |

2.70 |

| |

General and administrative expense |

|

$ |

4.35 |

|

$ |

4.03 |

| |

Depletion, depreciation, and amortization |

|

$ |

3.95 |

|

$ |

3.67 |

| |

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Asset Operating Statistics |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

| |

|

|

September 30, 2023 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

Production volumes - MBOE: |

|

|

|

|

|

|

Oklahoma |

|

|

536 |

|

|

|

542 |

|

| |

Rockies (Bairoil) |

|

|

263 |

|

|

|

315 |

|

| |

Southern California (Beta) |

|

|

246 |

|

|

|

158 |

|

| |

East Texas / North Louisiana |

|

|

754 |

|

|

|

792 |

|

| |

Eagle Ford (Non-Op) |

|

|

98 |

|

|

|

121 |

|

| |

Total - MBoe |

|

|

1,897 |

|

|

|

1,928 |

|

| |

Total - MBoe/d |

|

|

20.6 |

|

|

|

21.2 |

|

| |

% - Liquids |

|

|

56% |

|

|

|

55% |

|

| |

|

|

|

|

|

|

Lease operating expense - $M: |

|

|

|

|

| |

Oklahoma |

|

$ |

5,022 |

|

|

$ |

4,709 |

|

| |

Rockies (Bairoil) |

|

|

12,107 |

|

|

|

12,316 |

|

| |

Southern California (Beta) |

|

|

11,902 |

|

|

|

10,271 |

|

| |

East Texas / North Louisiana |

|

|

6,397 |

|

|

|

6,151 |

|

| |

Eagle Ford (Non-Op) |

|

|

1,655 |

|

|

|

1,457 |

|

| |

Total Lease operating expense: |

|

$ |

37,083 |

|

|

$ |

34,904 |

|

| |

|

|

|

|

|

|

Capital expenditures - $M: |

|

|

|

|

| |

Oklahoma |

|

$ |

955 |

|

|

$ |

1,379 |

|

| |

Rockies (Bairoil) |

|

|

3,340 |

|

|

|

346 |

|

| |

Southern California (Beta) |

|

|

4,742 |

|

|

|

4,718 |

|

| |

East Texas / North Louisiana |

|

|

293 |

|

|

|

134 |

|

| |

Eagle Ford (Non-Op) |

|

|

368 |

|

|

|

1,371 |

|

| |

Total Capital expenditures: |

|

$ |

9,698 |

|

|

$ |

7,948 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Balance Sheet Data |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(Amounts in $000s, except per share data) |

|

September 30, 2023 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Assets |

|

|

|

|

| |

Cash and Cash Equivalents |

|

$ |

6,387 |

|

|

$ |

1,865 |

|

| |

Accounts Receivable |

|

|

47,864 |

|

|

|

63,021 |

|

| |

Other Current Assets |

|

|

24,003 |

|

|

|

23,452 |

|

|

|

|

Total Current Assets |

|

$ |

78,254 |

|

|

$ |

88,338 |

|

| |

|

|

|

|

|

|

| |

Net Oil and Gas Properties |

|

$ |

346,896 |

|

|

$ |

345,023 |

|

| |

Other Long-Term Assets |

|

|

291,955 |

|

|

|

282,119 |

|

| |

|

Total

Assets |

|

$ |

717,105 |

|

|

$ |

715,480 |

|

| |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

| |

Accounts Payable |

|

$ |

18,708 |

|

|

$ |

23,382 |

|

| |

Accrued Liabilities |

|

|

55,354 |

|

|

|

55,387 |

|

| |

Other Current Liabilities |

|

|

34,195 |

|

|

|

22,231 |

|

| |

|

Total

Current Liabilities |

|

$ |

108,257 |

|

|

$ |

101,000 |

|

| |

|

|

|

|

|

|

| |

Long-Term Debt |

|

$ |

120,000 |

|

|

$ |

120,000 |

|

| |

Asset Retirement Obligation |

|

|

119,856 |

|

|

|

118,627 |

|

| |

Other Long-Term Liabilities |

|

|

22,955 |

|

|

|

17,709 |

|

| |

|

Total

Liabilities |

|

$ |

371,068 |

|

|

$ |

357,336 |

|

| |

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

| |

Common Stock & APIC |

|

$ |

434,067 |

|

|

$ |

432,771 |

|

| |

Accumulated Earnings (Deficit) |

|

|

(88,030 |

) |

|

|

(74,627 |

) |

| |

|

Total

Shareholders' Equity |

|

$ |

346,037 |

|

|

$ |

358,144 |

|

| |

|

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Statements of Cash Flows Data |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

Three

Months |

|

Three

Months |

| |

|

Ended |

|

Ended |

|

(Amounts in $000s, except per share data) |

|

September 30, 2023 |

|

June 30, 2023 |

| |

|

|

|

|

| |

|

|

|

|

|

Net cash provided by (used in) operating activities |

$ |

18,007 |

|

|

$ |

4,908 |

|

|

Net cash provided by (used in) investing activities |

|

(8,816 |

) |

|

|

(10,732 |

) |

|

Net cash provided by (used in) financing activities |

|

(4,669 |

) |

|

|

(5,066 |

) |

| |

|

|

|

|

|

Selected Operating and Financial Data (Tables) |

|

|

|

|

Reconciliation of Unaudited GAAP Financial Measures to Non-GAAP

Financial Measures |

|

|

|

Adjusted EBITDA and Free Cash Flow |

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

Three

Months |

|

Three

Months |

| |

|

Ended |

|

Ended |

|

(Amounts in $000s, except per share data) |

September 30, 2023 |

|

June 30, 2023 |

| |

|

|

|

|

|

Reconciliation of Adjusted EBITDA to Net Cash Provided from

Operating Activities: |

|

|

|

|

Net cash provided by operating activities |

$ |

18,007 |

|

|

$ |

4,908 |

|

| |

Changes in working capital |

|

(4,985 |

) |

|

|

13,168 |

|

| |

Interest expense, net |

|

4,470 |

|

|

|

3,701 |

|

| |

Cash settlements received on terminated commodity derivatives |

|

(658 |

) |

|

|

- |

|

| |

Amortization and write-off of deferred financing fees |

|

(908 |

) |

|

|

(310 |

) |

| |

Exploration costs |

|

- |

|

|

|

14 |

|

| |

Acquisition and divestiture related costs |

|

216 |

|

|

|

- |

|

| |

Plugging and abandonment cost |

|

1,153 |

|

|

|

528 |

|

| |

Current income tax expense (benefit) |

|

1,441 |

|

|

|

(6,853 |

) |

| |

Pipeline incident loss |

|

559 |

|

|

|

6,844 |

|

| |

LOPI - timing differences |

|

- |

|

|

|

(4,636 |

) |

| |

Other |

|

188 |

|

|

|

188 |

|

|

Adjusted EBITDA: |

$ |

19,483 |

|

|

$ |

17,552 |

|

| |

|

|

|

|

|

Reconciliation of Free Cash Flow to Net Cash Provided from

Operating Activities: |

|

|

|

Adjusted EBITDA: |

$ |

19,483 |

|

|

$ |

17,552 |

|

| |

Less: Cash interest expense |

|

(3,642 |

) |

|

|

(3,525 |

) |

| |

Less: Capital expenditures |

|

(9,698 |

) |

|

|

(7,947 |

) |

|

Free Cash Flow: |

$ |

6,143 |

|

|

$ |

6,080 |

|

| |

|

|

|

|

|

Selected Operating and Financial Data (Tables) |

|

|

|

|

|

Reconciliation of Unaudited GAAP Financial Measures to Non-GAAP

Financial Measures |

|

|

|

Adjusted EBITDA and Free Cash Flow |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

|

(Amounts in $000s, except per share data) |

|

September 30, 2023 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA to Net Income

(Loss): |

|

|

|

|

|

Net income (loss) |

|

$ |

(13,403 |

) |

|

$ |

9,816 |

|

| |

Interest expense, net |

|

|

4,470 |

|

|

|

3,701 |

|

| |

Income tax expense (benefit) - current |

|

|

1,441 |

|

|

|

(6,853 |

) |

| |

Income tax expense (benefit) - deferred |

|

|

(4,708 |

) |

|

|

48 |

|

| |

Depreciation, depletion and amortization |

|

|

7,489 |

|

|

|

7,072 |

|

| |

Accretion of asset retirement obligations |

|

|

2,005 |

|

|

|

1,975 |

|

| |

(Gains) losses on commodity derivatives |

|

|

23,328 |

|

|

|

(3,798 |

) |

| |

Cash

settlements received (paid) on expired commodity derivative

instruments |

|

|

(3,890 |

) |

|

|

1,517 |

|

| |

Acquisition and divestiture related costs |

|

|

216 |

|

|

|

- |

|

| |

Share-based compensation expense |

|

|

1,327 |

|

|

|

1,340 |

|

| |

Exploration costs |

|

|

- |

|

|

|

14 |

|

| |

Loss on settlement of AROs |

|

|

449 |

|

|

|

239 |

|

| |

Bad debt expense |

|

|

12 |

|

|

|

85 |

|

| |

Pipeline incident loss |

|

|

559 |

|

|

|

6,844 |

|

| |

LOPI - timing differences |

|

|

- |

|

|

|

(4,636 |

) |

| |

Other |

|

|

188 |

|

|

|

188 |

|

| |

Adjusted EBITDA: |

|

$ |

19,483 |

|

|

$ |

17,552 |

|

| |

|

|

|

|

|

| |

Reconciliation of Free Cash Flow to Net Income

(Loss): |

|

|

|

| |

Adjusted EBITDA: |

|

$ |

19,483 |

|

|

$ |

17,552 |

|

| |

Less: Cash interest expense |

|

|

(3,642 |

) |

|

|

(3,525 |

) |

| |

Less: Capital expenditures |

|

|

(9,698 |

) |

|

|

(7,947 |

) |

| |

Free Cash Flow: |

|

$ |

6,143 |

|

|

$ |

6,080 |

|

| |

|

|

|

|

|

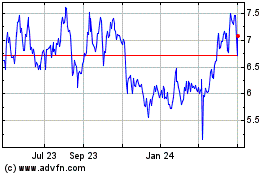

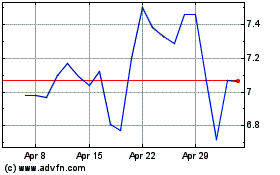

Amplify Energy (NYSE:AMPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Amplify Energy (NYSE:AMPY)

Historical Stock Chart

From Feb 2024 to Feb 2025