Telefonica in Restructure Mode - Analyst Blog

January 17 2013 - 12:10PM

Zacks

The Spanish telecom giant Telefonica S.A.

(TEF), or Telef, has declared that its desire to turnaround the

company’s struggling European operations is progressing as planned.

Additionally, the company is also showing marginal signs of

improvement in the Latin American market.

Telef has been struggling with rising debt amid Spain’s

macroeconomic concern. Domestic competition remains a major concern

as the unbundled local loop (“ULL”) regulation is forcing Telef to

open its network to alternative providers. Telefonica

Brazil S.A.’s (VIV) the Brazilian subsidiary of Telef –is

facing increased competition from rival America

Movil S.A.B. De C.V. (AMX) and discounted

calling plans from the national wireless operators.

The company has one of the highest debt burdens within the

industry and has an outstanding debt of Euro 56 billion ($72

billion). In order to come out of this difficult situation, the

telecom behemoth has stopped paying dividends and is planning a

widespread restructuring to considerably reduce its leverage. The

company raised Euro 1.45 billion ($1.93 billion) by listing its

German unit Telefonica Deutschland.

To revive its financial, the Spanish telecom company has been

disposing off its non-core assets for quite some time now. As part

of that effort, the company recently sold its call centre arm –

Atento to private equity firm Bain Capital for approximately Euro 1

billion ($1.3 billion). The company also sold a small stake in

China Unicom Limited (CHU) for Euro 1.13 billion

($1.47 billion) in June 2012. Furthermore, the company is also

planning to offload its stakes in Portugal Telecom and online

booking company Rumbo.

The initiatives taken by the company are yielding positive

results as its customer base and cash flow generation are

improving. At the end of the first nine months of 2012, customer

access reached approximately 308.1 million in Europe, representing

annualized growth of 4.6%. On a consolidated basis, nine months

operating cash flow jumped to Euro 10.1 billion ($12.5 billion)

from Euro 7.6 billion ($9.4 billion) in the year-ago period.

We believe offloading non-core assets along with raising further

capital will fulfill the company’s plans to raise Euro 7-8 billion

($9-$10.3 billion) every year till 2015, in order to deal with its

mounting debt. Moreover, as the highly competitive European market

is gradually heading towards its saturation point, the company will

require to venture into alternative markets for future expansion.

With a smartphone penetration of as low as 20% in Latin America

provides the best long-term opportunity for Telef.

Though the company remains bullish on its European revival, we

remain apprehensive that a double-dip Spanish recession along with

a decline in consumer spending in Europe remain the major concerns

for the company and could limit Telef’s future success. We thus

maintain a short-term Zacks Rank #5 (Strong Sell) on Telef.

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

CHINA UNICOM (CHU): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

TELEF BRASIL SA (VIV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

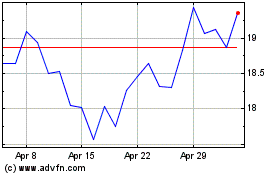

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Sep 2024 to Oct 2024

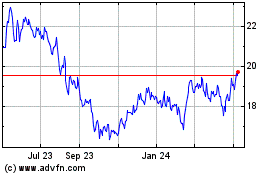

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Oct 2023 to Oct 2024