Air Lease Corporation Announces Pricing of Offering of C$400 Million of Senior Unsecured Medium-Term Notes

February 20 2024 - 11:01PM

Business Wire

Air Lease Corporation (NYSE: AL) (the “Company”) announced the

pricing on February 20, 2024 of its offering of C$400 million

aggregate principal amount of additional 5.40% senior unsecured

medium-term notes due June 1, 2028 (the “Notes”). The sale of the

Notes is expected to close on February 28, 2024, subject to

satisfaction of customary closing conditions.

The Notes will mature on June 1, 2028 and will bear interest at

a rate of 5.40% per annum, payable semi-annually in arrears on June

1 and December 1 of each year, commencing on June 1, 2024. Owners

of the Notes will receive payments relating to their Notes in

Canadian dollars.

The Company intends to use the net proceeds of the offering for

general corporate purposes, which may include, among other things,

the purchase of commercial aircraft and the repayment of existing

indebtedness.

The Notes will have the same terms as, and constitute a single

tranche with, the C$500 million aggregate principal amount of 5.40%

Medium-Term Notes, Series A, due June 1, 2028 (the “Existing

Notes”) that the Company originally issued on November 29, 2023.

The Notes will have the same CUSIP number as the Existing Notes and

will be issued as additional notes under the indenture governing

the Existing Notes. The Notes are expected to trade interchangeably

with the Existing Notes immediately upon settlement and be fungible

with the Existing Notes for U.S. federal income tax purposes. Upon

issuance of the Notes, the outstanding aggregate principal amount

of 5.40% Medium-Term Notes, Series A, due June 1, 2028 will be

C$900 million.

BofA Securities is acting as book-running manager for the

offering of the Notes.

The Notes are being offered pursuant to the Company’s effective

shelf registration statement, previously filed with the Securities

and Exchange Commission (the “SEC”) on May 7, 2021, and a pricing

supplement, dated February 20, 2024, supplementing the prospectus

supplement, dated May 7, 2021, supplementing the base prospectus,

dated May 7, 2021, as may be further supplemented by any free

writing prospectus and/or additional pricing supplements the

Company may file with the SEC, and in Canada on a private placement

basis pursuant to a Canadian offering memorandum to accredited

investors who are also permitted clients within the meaning of

Canadian securities laws. For more complete information about the

Company and this offering before you invest, you should read the

related base prospectus, related prospectus supplement, related

pricing supplement and the documents incorporated by reference in

each (which may be obtained for free by visiting EDGAR on the SEC’s

website at www.sec.gov), or if you are a Canadian investor, you

should read the Canadian offering memorandum. Copies of the related

base prospectus, related prospectus supplement and related pricing

supplement may be obtained by contacting: Merrill Lynch Canada Inc.

toll free at (800) 294-1322.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy the Notes, nor shall there be any

sale of the Notes in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction. The distribution of the Notes in Canada is being made

on a private placement basis only and is exempt from the

requirement that we prepare and file a prospectus with the relevant

Canadian securities regulatory authorities. Accordingly, any resale

of the Notes must be made in accordance with applicable Canadian

securities laws which may require resales to be made in accordance

with prospectus and dealer registration requirements or exemptions

from the prospectus and dealer registration requirements of

applicable Canadian securities laws.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements relating to the expected closing of the

offering and the intended use of proceeds. Such statements are

based on current expectations and projections about the Company’s

future results, prospects and opportunities and are not guarantees

of future performance. Such statements will not be updated unless

required by law. Actual results and performance may differ

materially from those expressed or forecasted in forward-looking

statements due to a number of factors, including but not limited

to, unexpected delays in the closing process for the Notes,

unanticipated cash needs, and those risks detailed in the Company’s

filings with the SEC, including the Company’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240220370152/en/

Investors:

Jason Arnold Vice President, Investor Relations

Phone: +1 310.553.0555 Email: investors@airleasecorp.com

Media:

Laura Woeste Senior Manager, Media & Investor Relations

Ashley Arnold Senior Manager, Media & Investor Relations

Phone: +1 310.553.0555 Email: press@airleasecorp.com

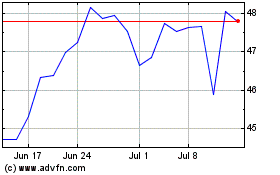

Air Lease (NYSE:AL)

Historical Stock Chart

From Jan 2025 to Feb 2025

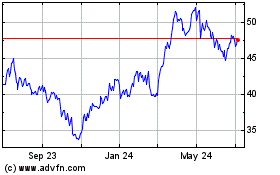

Air Lease (NYSE:AL)

Historical Stock Chart

From Feb 2024 to Feb 2025