0000764195

false

VBI Vaccines Inc/BC

0000764195

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): August 14, 2023

VBI

VACCINES INC.

(Exact

name of registrant as specified in its charter)

| British

Columbia, Canada |

|

001-37769 |

|

N/A |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

160

Second Street, Floor 3

Cambridge,

Massachusetts |

|

02142 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(617)

830-3031

(Registrant’s

telephone number, including area code)

N/A

(Former

Name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Shares, no par value per share |

|

VBIV |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 14, 2023, VBI Vaccines Inc. issued a press release announcing its financial results for the second fiscal quarter ending June

30, 2023 and provided a corporate update. A copy of this press release is furnished as Exhibit 99.1 hereto and is incorporated herein

by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, that

is furnished pursuant to this Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

*

This exhibit is furnished pursuant to Item 2.02 and shall not be deemed to be “filed.”

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VBI

Vaccines Inc. |

| |

|

|

| Date:

August 14, 2023 |

By:

|

/s/

Jeffrey R. Baxter |

| |

|

Jeffrey

R. Baxter |

| |

|

President

and Chief Executive Officer |

Exhibit

99.1

VBI

Vaccines Reports Second Quarter 2023 Financial Results

| |

● |

PreHevbrio

(Hepatitis B Vaccine [Recombinant]) global net revenue increased 48% quarter-over-quarter from Q1 to Q2 2023 - redefined, highly

targeted commercial field team deployed at the end of Q2 |

| |

● |

Expanded

hepatitis B collaboration with Brii Biosciences announced in July for $15 million upfront, including a $3 million equity investment,

and up to $422 million in potential additional milestones plus double-digit royalties |

| |

● |

Additional

$20.5 million gross proceeds from underwritten public offering added to balance sheet in July |

CAMBRIDGE,

Mass. (August 14, 2023) – VBI Vaccines Inc. (Nasdaq: VBIV) (VBI), a biopharmaceutical company driven by immunology in the pursuit

of powerful prevention and treatment of disease, today provided a business update and announced financial results for the quarter ended

June 30, 2023.

“Q2

was a period of transition for VBI as we worked to more efficiently align resource deployment and headcount with the opportunities for

value creation,” said Jeff Baxter, VBI’s President and CEO. “With, (i) the expansion of our hepatitis B partnership

with Brii Biosciences, (ii) our internal workforce reduction largely complete, (iii) the redefined, highly targeted U.S. commercial field

force now trained and deployed, and (iv) the additional cash we brought in from our expanded partnership with Brii and our concurrent

public offering, we believe we are well-positioned going into the second half of 2023 to execute on our corporate strategy and drive growth and value for key stakeholders – patients, healthcare providers, and shareholders.”

Recent

Key Program Achievements and Projected Upcoming Milestones

Hepatitis

B (HBV)

PreHevbrio

[Hepatitis B Vaccine (Recombinant)]

| |

● |

Global

access continues to expand with: |

| |

○ |

June

& July 2023: Launches in the U.K., Netherlands, and Belgium through our marketing and distribution partnership with Valneva

– brand name PreHevbri® [Hepatitis B Vaccine (Recombinant, Adsorbed)] |

| |

○ |

July

2023: Exclusive licensing deal with Brii Biosciences (Brii Bio) announced for the development and commercialization of PreHevbri

in the Asia Pacific region (APAC), excluding Japan |

| |

● |

Global

net product sales increased 48% from Q1 2023 with $0.7 million earned in Q2 2023 |

| |

○ |

Net

product sales are net of the provision for discounts, chargebacks, rebates, and fees – in the aggregate, these discounts reduced

sales by $0.5 million in Q2 2023, from $1.2 million gross sales to $0.7 million net sales |

| |

● |

June

2023: PreHevbrio was awarded part of the CDC 2023 Adult Vaccine contract for up to $25.4 million |

| |

○ |

The

CDC vaccine contract is established for the purchase of vaccines by immunization programs at the local, state, and national levels |

| |

● |

Through

our U.S. partnership with Syneos, work has been underway to redefine the U.S. commercial account targeting strategy to better

capitalize on the opportunities for, and access to, PreHevbrio, today – the transition to this new model started in February

and was completed in June, with the new highly trained and experienced team now fully deployed |

| |

● |

Continued

increase in use reflected among accounts that have made the switch to PreHevbrio, with a 46% increase in average order size from

Q1 to Q2 2023 among such accounts |

| |

● |

Contracting

platform across multiple market segments continues to grow, including with retail partners, Integrated Delivery Networks (IDNs) and

large hospital systems, military and federal facilities, prisons, and independent and public health clinics |

| |

● |

U.S.

coverage rates continue to be strong for PreHevbrio-specific Current Procedural Terminology (CPT) code across Medicare, commercial,

and state Medicaid plans |

| |

● |

Throughout

H2 2023: Additional European market launches expected through partnership with Valneva |

| |

● |

H1

2024: Availability expected in Canada under brand name PreHevbrio [3-Antigen Hepatitis B Vaccine (Recombinant)] |

VBI-2601

(BRII-179): HBV Immunotherapeutic Candidate

| |

● |

July

2023: Announced exclusive global licensing agreement with Brii Bio for the development and commercialization of VBI-2601 |

| |

○ |

This

expanded partnership adds VBI-2601 to Brii Bio’s HBV portfolio, which, through a series of strategic investments and partnerships

is among the most advanced in the chronic HBV field |

| |

○ |

VBI

will continue to share in the success of VBI-2601, with the potential to receive regulatory and commercial milestone payments, in

addition to potential double-digit royalties on global sales of VBI-2601 |

| |

● |

Additional

data from the two ongoing Phase 2 studies in China and Asia Pacific are expected to be announced by Brii Bio in H2 2023 |

Glioblastoma

(GBM)

VBI-1901:

Cancer Vaccine Immunotherapeutic Candidate

| |

● |

Q3

2023: First patients expected to be dosed in Phase 2b study of VBI-1901, an FDA Fast Track and Orphan Drug Designated cancer

vaccine candidate, in recurrent GBM patients |

| |

● |

Q4

2023: Expected initiation of VBI-1901 study arm, as part of the Individualized Screening Trial of Innovative Glioblastoma

Therapy (INSIGhT), a Phase 2 adaptive platform trial, in combination with Agenus’ anti-PD-1, balstilimab, in primary GBM patients |

COVID-19

& Coronaviruses

VBI-2901:

Multivalent Coronavirus Vaccine Candidate

| |

● |

Q3

2023: Interim data readout from Phase 1 study of VBI-2901 expected – VBI-2901 is a multivalent, broad-spectrum eVLP

vaccine candidate that expresses the SARS-CoV-2 (COVID-19), SARS-CoV-1 (SARS), and MERS-CoV (MERS) spike proteins, and was designed

to increase breadth of protection against COVID-19 and related coronaviruses. VBI-2901 has been developed in collaboration with the

National Research Council of Canada (NRC) and is supported by funding from the Canadian Government’s Innovation, Science and

Economic Development’s (ISED) Strategic Innovation Fund |

Second

Quarter 2023 Financial Results

| |

● |

Cash Position: VBI ended the second

quarter of 2023 with $20.8 million in cash as compared with $62.6 million in cash as of December 31, 2022. Cash position at June

30, 2023 does not include $15 million upfront payment, including $3 million equity investment, from the expanded Brii Bio

partnership or $20.5 million gross proceeds from the underwritten public offering, both of which occurred in July 2023. |

| |

● |

Revenues, net: Revenues, net for the second quarter of 2023 were $0.7 million as compared to $0.3 million for the same period in 2022. The revenue increase of 108% was a result of an increase in product sales of PreHevbrio in the U.S., in addition to initial European product sales of PreHevbri to our partner, Valneva. |

| |

● |

Cost of Revenues: Cost of revenues was $3.5 million in the second quarter of 2023 as compared to $2.5 million in the second quarter of 2022. The increase in the cost of revenues was due to increased product sales, direct labor costs, and inventory related costs for the Company’s 3-antigen HBV vaccine. |

| |

● |

Research and Development (R&D): R&D

expenses for the second quarter of 2023 were $3.3 million as compared to $5.6 million for the second quarter of 2022. R&D expenses

were offset by $2.3 million in the second quarter of 2023 and $1.0 million in the second quarter of 2022 from government grants

and funding arrangements. |

| |

● |

Sales, General, and Administrative (SG&A): SG&A expenses for the second quarter of 2023 were $10.9 million as compared to $15.1 million for the same period in 2022. The decrease in SG&A expenses, partially offset by government grants and funding arrangements, was mainly a result of recent organizational changes that reduced our internal workforce, as announced in April 2023, and the redefined deployment strategy of our U.S. commercial field force and activities related to PreHevbrio. |

| |

● |

Net Cash Used in Operating Activities: Net cash used in operating activities for the six months ended June 30, 2023 was $40.9 million compared to $37.4 million for the same period in 2022. The increase in cash outflows is largely a result of an increase in net loss, offset by non-cash reconciling items, mainly impairment charges and unrealized foreign exchange loss and the change in operating working capital, most notably in other current assets, accounts payable and other current liabilities. As announced on April 4, 2023, VBI continues to implement cost saving measures that are expected to reduce operating expenses from normal business in the second half of 2023 by 30-35% compared to the second half of 2022. |

| |

● |

Net Loss and Net Loss Per Share: Net loss and net loss per share for the second quarter of 2023 were $44.6 million and $5.18, respectively, compared to a net loss and net loss per share of $45.7 million and $5.31 for the second quarter of 2022, respectively. |

| |

● |

Net Loss and Net Loss Per Share, Excluding Impairment Charges and Foreign Exchange Loss: Net loss and net loss per share, excluding the non-cash impairment and foreign exchange loss, for the second quarter of 2023 were $18.7 million and $2.17, respectively, compared to $23.8 million and $2.77 for the second quarter of 2022, respectively. See “Non-GAAP Financial Information” below for additional information regarding this non-GAAP financial measure, and “GAAP to Non-GAAP Reconciliation” for a reconciliation of this non-GAAP financial measure to net loss and net loss per share. |

| |

○ |

Impairment for the second quarter of 2023 was $20.0 million as compared to $0 for the second quarter of 2022. |

| |

○ |

Foreign exchange loss for the second quarter of 2023 was $5.9 million as compared to $21.9 million for the second quarter of 2022. Certain intercompany loans between the Company and its subsidiaries are denominated in a currency other than the functional currency of each entity. The primary driver of the increase in foreign exchange loss was the impact of the relative strengthening of the U.S. and Canadian Dollars against the New Israeli Shekel upon translation of these intercompany loans. |

Use

of Non-GAAP Financial Measures

Net

Loss Excluding Foreign Exchange Loss and Impairment Charges and Net Loss per Share Excluding Foreign Exchange Loss and Impairment Charges

are non-GAAP financial measures and are defined as net loss excluding foreign exchange loss and impairment charges. Net Loss and Net

Loss Per Share, Excluding Impairment and Foreign Exchange Loss is not intended to replace net loss or net loss per share or other measures

of financial performance reported in accordance with generally accepted accounting principles (GAAP). VBI’s management believes

that the presentation of Net Loss Excluding Foreign Exchange Loss and Impairment Charges and Net Loss per Share Excluding Foreign Exchange

Loss and Impairment Charges are useful to investors because management does not consider foreign exchange loss, which is primarily driven

by changes in exchange rates related to certain intercompany loans, and impairment charges, which are non-recurring items, when evaluating

VBI’s operating performance. Non-GAAP financial measures are meant to supplement, and to be viewed in conjunction with, GAAP financial

results. The presentation of these non-GAAP financial measures should not be considered in isolation or as a substitute for comparable

GAAP financial measures and should be read only in conjunction with the Company’s financial statements prepared in accordance with

GAAP. Reconciliations of the Company’s non-GAAP measures are included below.

The

following represents a reconciliation of Net Loss to Net Loss Excluding Impairment Charges and Foreign Exchange Loss and Net Loss per

Share Excluding Foreign Exchange Loss. See “Non-GAAP Financial Information” below for additional information regarding this

non-GAAP financial measure, and “GAAP to Non-GAAP Reconciliation” for a reconciliation of this non-GAAP financial measure

to net loss and net loss per share.

| | |

Three Months Ended June 30 | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) (In

000’s except share and per share amounts) | |

| Net Loss | |

$ | (44,628 | ) | |

$ | (45,699 | ) |

| Impairment charges | |

| (20,000 | ) | |

| - | |

| Foreign exchange loss | |

| (5,948 | ) | |

| (21,895 | ) |

| Net loss excluding foreign exchange loss and impairment charges | |

$ | (18,680 | ) | |

$ | (23,804 | ) |

| | |

| | | |

| | |

| Weighted-average number of shares | |

| 8,608,539 | | |

| 8,608,539 | |

| Net loss per share excluding foreign exchange loss and impairment charges | |

$ | (2.17 | ) | |

$ | (2.77 | ) |

About

PreHevbrio [Hepatitis B Vaccine (Recombinant)]

PreHevbrio

is the only 3-antigen hepatitis B vaccine, comprised of the three surface antigens of the hepatitis B virus – S, pre-S1, and pre-S2.

It is approved for use in the U.S., European Union/European Economic Area, United Kingdom, Canada, and Israel. The brand names for this

vaccine are: PreHevbrio® (US/Canada), PreHevbri® (EU/EEA/UK), and Sci-B-Vac® (Israel).

Please

visit www.PreHevbrio.com for U.S. Important Safety Information for PreHevbrio [Hepatitis B Vaccine (Recombinant)], or please see

U.S. Full Prescribing Information.

U.S.

Indication

PreHevbrio

is indicated for prevention of infection caused by all known subtypes of hepatitis B virus. PreHevbrio is approved for use in adults

18 years of age and older.

U.S.

Important Safety Information (ISI)

Do

not administer PreHevbrio to individuals with a history of severe allergic reaction (e.g. anaphylaxis) after a previous dose of any hepatitis

B vaccine or to any component of PreHevbrio.

Appropriate

medical treatment and supervision must be available to manage possible anaphylactic reactions following administration of PreHevbrio.

Immunocompromised

persons, including those on immunosuppressant therapy, may have a diminished immune response to PreHevbrio.

PreHevbrio

may not prevent hepatitis B infection, which has a long incubation period, in individuals who have an unrecognized hepatitis B infection

at the time of vaccine administration.

The

most common side effects (> 10%) in adults age 18-44, adults age 45-64, and adults age 65+ were pain and tenderness at the injection

site, myalgia, fatigue, and headache.

There

is a pregnancy exposure registry that monitors pregnancy outcomes in women who received PreHevbrio during pregnancy. Women who receive

PreHevbrio during pregnancy are encouraged to contact 1-888-421-8808 (toll-free).

To

report SUSPECTED ADVERSE REACTIONS, contact VBI Vaccines at 1-888-421-8808 (toll-free) or VAERS at 1-800-822-7967 or www.vaers.hhs.gov.

Please

see Full Prescribing Information.

About

VBI Vaccines Inc.

VBI

Vaccines Inc. (“VBI”) is a biopharmaceutical company driven by immunology in the pursuit of powerful prevention and treatment

of disease. Through its innovative approach to virus-like particles (“VLPs”), including a proprietary enveloped VLP (“eVLP”)

platform technology, VBI develops vaccine candidates that mimic the natural presentation of viruses, designed to elicit the innate power

of the human immune system. VBI is committed to targeting and overcoming significant infectious diseases, including hepatitis B, coronaviruses,

and cytomegalovirus (CMV), as well as aggressive cancers including glioblastoma (GBM). VBI is headquartered in Cambridge, Massachusetts,

with research operations in Ottawa, Canada, and a research and manufacturing site in Rehovot, Israel.

Website

Home: http://www.vbivaccines.com/

News

and Resources: http://www.vbivaccines.com/news-and-resources/

Investors:

http://www.vbivaccines.com/investors/

Cautionary

Statement on Forward-looking Information

Certain

statements in this press release that are forward-looking and not statements of historical fact are forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are forward-looking information

within the meaning of Canadian securities laws (collectively, “forward-looking statements”). The Company cautions that such

forward-looking statements involve risks and uncertainties that may materially affect the Company’s results of operations. Such

forward-looking statements are based on the beliefs of management as well as assumptions made by and information currently available

to management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain

factors, including but not limited to, the impact of general economic, industry or political conditions in the United States or internationally;

the impact of the COVID-19 pandemic and the continuing effects of the COVID-19 pandemic on our clinical studies, manufacturing, business

plan, and the global economy; the ability to successfully manufacture and commercialize PreHevbrio/PreHevbri; the ability to establish

that potential products are efficacious or safe in preclinical or clinical trials; the ability to establish or maintain collaborations

on the development of pipeline candidates and the commercialization of PreHevbrio/PreHevbri; the ability to obtain appropriate or necessary

regulatory approvals to market potential products; the ability to obtain future funding for developmental products and working capital

and to obtain such funding on commercially reasonable terms; the Company’s ability to manufacture product candidates on a commercial

scale or in collaborations with third parties; changes in the size and nature of competitors; the ability to retain key executives and

scientists; and the ability to secure and enforce legal rights related to the Company’s products. A discussion of these and other

factors, including risks and uncertainties with respect to the Company, is set forth in the Company’s filings with the SEC and

the Canadian securities authorities, including its Annual Report on Form 10-K filed with the SEC on March 13, 2023, and filed with the

Canadian security authorities at sedar.com on March 13, 2023, as may be supplemented or amended by the Company’s Quarterly Reports

on Form 10-Q. Given these risks, uncertainties and factors, you are cautioned not to place undue reliance on such forward-looking statements,

which are qualified in their entirety by this cautionary statement. All such forward-looking statements made herein are based on our

current expectations and we undertake no duty or obligation to update or revise any forward-looking statements for any reason, except

as required by law.

VBI

Vaccines Inc. and Subsidiaries

Selected

Condensed Consolidated Balance Sheet

(In

Thousands)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Cash | |

$ | 20,840 | | |

$ | 62,629 | |

| Accounts receivable, net | |

| 79 | | |

| 94 | |

| Inventory, net | |

| 6,861 | | |

| 6,599 | |

| Prepaid expenses and other current assets | |

| 4,111 | | |

| 8,368 | |

| Total current assets | |

| 31,891 | | |

| 77,690 | |

| Property and equipment, net | |

| 10,104 | | |

| 12,253 | |

| Intangible assets, net | |

| 40,339 | | |

| 58,345 | |

| Goodwill | |

| 2,175 | | |

| 2,127 | |

| Other non-current assets | |

| 3,813 | | |

| 4,671 | |

| Total Assets | |

$ | 88,322 | | |

$ | 155,086 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Accounts payable | |

$ | 7,353 | | |

$ | 12,973 | |

| Other current liabilities | |

| 20,321 | | |

| 23,969 | |

| Total current liabilities | |

| 27,674 | | |

| 36,942 | |

| Total non-current liabilities | |

| 51,910 | | |

| 53,981 | |

| Total liabilities | |

| 79,584 | | |

| 90,923 | |

| Total stockholders’ equity | |

| 8,738 | | |

| 64,163 | |

| Total liabilities and stockholders’ equity | |

$ | 88,322 | | |

$ | 155,086 | |

| | |

| | | |

| | |

VBI

Vaccines Inc. and Subsidiaries

Condensed

Consolidated Statement of Operations and Comprehensive Loss

(In

Thousands Except Share and Per Share Amounts)

| | |

Three Months Ended June 30 | | |

Six Months Ended June 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

(Unaudited) | |

| Revenues, net | |

$ | 720 | | |

$ | 346 | | |

$ | 1,205 | | |

$ | 472 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 3,483 | | |

| 2,522 | | |

| 7,039 | | |

| 5,276 | |

| Research and development | |

| 3,292 | | |

| 5,643 | | |

| 6,446 | | |

| 8,005 | |

| Sales, general and administrative | |

| 10,917 | | |

| 15,084 | | |

| 24,201 | | |

| 26,014 | |

| Impairment charges | |

| 20,000 | | |

| - | | |

| 20,000 | | |

| - | |

| Total operating expenses | |

| 36,579 | | |

| 23,249 | | |

| 57,686 | | |

| 37,692 | |

| Loss from operations | |

| (36,972 | ) | |

| (22,903 | ) | |

| (56,481 | ) | |

| (38,823 | ) |

| Interest income (expense), net | |

| (1,708 | ) | |

| (901 | ) | |

| (3,137 | ) | |

| (1,841 | ) |

| Foreign exchange gain (loss) | |

| (5,948 | ) | |

| (21,895 | ) | |

| (12,761 | ) | |

| (26,289 | ) |

| Loss before income taxes | |

| (44,628 | ) | |

| (45,699 | ) | |

| (72,379 | ) | |

| (66,953 | ) |

| Income tax benefit | |

| - | | |

| - | | |

| - | | |

| - | |

| Net Loss | |

$ | (44,628 | ) | |

$ | (45,699 | ) | |

$ | (72,379 | ) | |

$ | (66,953 | ) |

| Basic and diluted net loss per share | |

$ | (5.05 | ) | |

$ | (5.31 | ) | |

$ | (8.41 | ) | |

$ | (5.18 | ) |

| Weighted-average number of shares used to compute basic and diluted net loss per share | |

| 8,608,539 | | |

| 8,608,539 | | |

| 8,608,539 | | |

| 8,608,526 | |

| Other comprehensive income (loss) - currency translation adjustments | |

| 6,670 | | |

| 19,236 | | |

| 13,269 | | |

| 24,339 | |

| Comprehensive Loss | |

$ | (37,958 | ) | |

$ | (26,463 | ) | |

$ | (59,110 | ) | |

$ | (42,614 | ) |

VBI

Contact

Nicole

Anderson

Director,

Corporate Communications & IR

Phone:

(617) 830-3031 x124

Email:

IR@vbivaccines.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

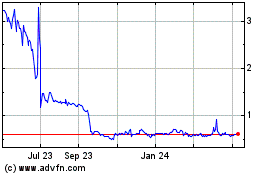

VBI Vaccines (NASDAQ:VBIV)

Historical Stock Chart

From Oct 2024 to Nov 2024

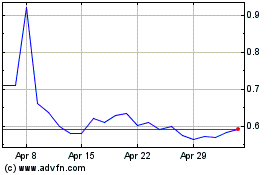

VBI Vaccines (NASDAQ:VBIV)

Historical Stock Chart

From Nov 2023 to Nov 2024