Q30001493761false--12-31truehttp://fasb.org/us-gaap/2024#OtherAssetshttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrent00014937612024-09-300001493761us-gaap:CommonStockMember2023-03-310001493761hear:EuropeAndMiddleEastMember2023-07-012023-09-300001493761hear:VTBHoldingsIncMemberhear:MergerOfVTBHoldingsIncAndParametricSoundCorporationMember2013-08-050001493761us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberhear:TermLoanFacilityMembersrt:MinimumMember2024-03-132024-03-130001493761us-gaap:CommonStockMember2023-01-012023-03-310001493761us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001493761us-gaap:DevelopedTechnologyRightsMember2024-09-300001493761us-gaap:BaseRateMemberhear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-01-012024-09-300001493761us-gaap:FurnitureAndFixturesMember2023-12-310001493761us-gaap:CommonStockMember2024-01-012024-03-3100014937612024-06-3000014937612024-01-012024-03-310001493761us-gaap:BaseRateMembersrt:MinimumMemberhear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-01-012024-09-300001493761us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001493761us-gaap:SalesReturnsAndAllowancesMember2024-09-3000014937612023-12-310001493761hear:FourthAmendmentMemberus-gaap:BaseRateMembersrt:MinimumMemberhear:PdpMergerAgreementMember2024-03-132024-03-130001493761hear:TermLoanFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMember2024-03-132024-03-130001493761hear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMemberhear:UKBorrowerMember2018-03-050001493761us-gaap:TradeNamesMember2023-12-310001493761hear:EuropeAndMiddleEastMember2023-01-012023-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001493761srt:MaximumMemberhear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-01-012024-09-300001493761us-gaap:CostOfSalesMember2024-01-012024-09-3000014937612023-04-012023-06-300001493761us-gaap:DevelopedTechnologyRightsMember2023-12-310001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001493761hear:PerformanceBasedRestrictedStockMember2024-04-012024-04-010001493761srt:WeightedAverageMember2024-09-300001493761us-gaap:CommonStockMember2024-09-300001493761us-gaap:MachineryAndEquipmentMember2024-09-300001493761us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001493761us-gaap:RetainedEarningsMember2022-12-310001493761us-gaap:BaseRateMemberhear:FourthAmendmentMemberhear:PdpMergerAgreementMembersrt:MaximumMember2024-03-132024-03-130001493761us-gaap:FurnitureAndFixturesMember2024-09-300001493761hear:PerformanceDesignedProductsLlcMember2023-01-012023-09-300001493761us-gaap:RetainedEarningsMember2023-01-012023-03-310001493761hear:PerformanceDesignedProductsLlcMember2023-07-012023-09-300001493761us-gaap:SalesReturnsAndAllowancesMember2023-06-300001493761us-gaap:SalesReturnsAndAllowancesMember2024-07-012024-09-300001493761us-gaap:StockOptionMember2023-07-012023-09-3000014937612021-04-012021-04-010001493761us-gaap:AdditionalPaidInCapitalMember2023-09-300001493761us-gaap:RestrictedStockMember2023-01-012023-09-300001493761hear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2018-03-052018-03-050001493761hear:PerformanceBasedRestrictedStockMember2024-01-012024-09-300001493761hear:BloombergShortTermBankYieldIndexRateLoansBloombergShortTermBankYieldIndexDailyFloatingRateLoansMemberhear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-01-012024-09-300001493761srt:AsiaPacificMember2023-07-012023-09-300001493761hear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2018-03-050001493761us-gaap:AdditionalPaidInCapitalMember2023-06-3000014937612024-03-310001493761country:US2023-01-012023-09-300001493761us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300001493761us-gaap:RetainedEarningsMember2024-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001493761us-gaap:LeaseholdImprovementsMember2023-12-310001493761us-gaap:CostOfSalesMember2024-07-012024-09-300001493761us-gaap:SalesReturnsAndAllowancesMember2023-07-012023-09-300001493761hear:PerformanceBasedRestrictedStockMember2024-09-300001493761srt:ExecutiveOfficerMember2024-01-012024-09-300001493761hear:TermLoanFacilityMembersrt:MaximumMember2024-03-132024-03-130001493761us-gaap:ToolsDiesAndMoldsMember2023-12-310001493761us-gaap:RetainedEarningsMember2023-07-012023-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001493761us-gaap:RetainedEarningsMember2023-09-300001493761us-gaap:RestrictedStockMember2024-07-012024-09-300001493761hear:PerformanceDesignedProductsLlcMemberus-gaap:CustomerRelationshipsMember2024-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001493761us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001493761hear:FourthAmendmentMemberhear:PdpMergerAgreementMember2024-03-132024-03-130001493761srt:MaximumMember2021-04-010001493761hear:PerformanceDesignedProductsLlcMemberus-gaap:DevelopedTechnologyRightsMember2024-09-300001493761us-gaap:RestrictedStockMember2024-01-012024-09-300001493761us-gaap:CommonStockMember2024-06-300001493761us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001493761us-gaap:RestrictedStockMember2023-12-310001493761us-gaap:CommonStockMember2023-09-300001493761us-gaap:PerformanceSharesMember2024-01-012024-09-300001493761us-gaap:AdditionalPaidInCapitalMember2023-03-310001493761us-gaap:RetainedEarningsMember2023-03-310001493761hear:FourthAmendmentMemberhear:PdpMergerAgreementMember2024-03-122024-03-120001493761us-gaap:AdditionalPaidInCapitalMember2022-12-310001493761srt:AsiaPacificMember2023-01-012023-09-3000014937612019-04-090001493761hear:NonExecutivesMember2024-01-012024-09-300001493761us-gaap:SellingAndMarketingExpenseMember2024-01-012024-09-300001493761us-gaap:EmployeeStockOptionMember2024-01-012024-09-3000014937612023-06-300001493761srt:AsiaPacificMember2024-01-012024-09-300001493761us-gaap:CommonStockMember2023-04-012023-06-300001493761us-gaap:TradeNamesMember2024-09-300001493761country:US2023-07-012023-09-300001493761us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-3100014937612020-05-220001493761us-gaap:SalesReturnsAndAllowancesMember2024-01-012024-09-3000014937612024-10-310001493761us-gaap:RetainedEarningsMember2024-01-012024-03-310001493761srt:MaximumMember2024-09-300001493761hear:TermLoanFacilityMember2024-03-132024-03-130001493761us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-09-300001493761srt:MaximumMember2024-04-090001493761srt:AsiaPacificMember2024-07-012024-09-3000014937612024-04-012024-06-300001493761hear:PerformanceDesignedProductsLlcMember2024-09-300001493761hear:FourthAmendmentMemberhear:SofrSoniaAndEuiborLoansMembersrt:MinimumMemberhear:PdpMergerAgreementMember2024-03-132024-03-130001493761us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001493761us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-09-300001493761hear:MarketingAndTradeShowEquipmentMember2023-12-310001493761srt:MinimumMember2024-09-3000014937612023-09-3000014937612022-12-310001493761hear:TermLoanFacilityMember2024-03-130001493761us-gaap:SalesReturnsAndAllowancesMember2022-12-310001493761hear:ParametricSoundCorporationMemberhear:MergerOfVTBHoldingsIncAndParametricSoundCorporationMember2013-08-050001493761us-gaap:SalesReturnsAndAllowancesMember2024-06-300001493761us-gaap:AdditionalPaidInCapitalMember2023-12-310001493761us-gaap:AdditionalPaidInCapitalMember2024-06-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001493761us-gaap:CommonStockMember2024-07-012024-09-300001493761hear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-09-300001493761us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001493761hear:PerformanceDesignedProductsLlcMember2024-07-012024-09-300001493761us-gaap:RetainedEarningsMember2023-04-012023-06-300001493761us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001493761hear:DirectorsOrExecutiveOfficersMember2024-07-012024-09-300001493761us-gaap:SalesReturnsAndAllowancesMember2023-01-012023-09-300001493761hear:PerformanceDesignedProductsLlcMember2024-01-012024-09-300001493761us-gaap:WarrantMember2023-07-012023-09-300001493761hear:PerformanceBasedRestrictedStockMember2023-04-012023-04-010001493761us-gaap:CommonStockMember2024-01-012024-09-300001493761hear:TermLoanFacilityMembersrt:MaximumMember2024-08-070001493761hear:FourthAmendmentMemberhear:SofrSoniaAndEuiborLoansMemberhear:PdpMergerAgreementMembersrt:MaximumMember2024-03-132024-03-130001493761us-gaap:RetainedEarningsMember2024-03-310001493761us-gaap:StockOptionMember2023-01-012023-09-300001493761us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001493761hear:TermLoanFacilityMember2024-09-300001493761us-gaap:SellingAndMarketingExpenseMember2024-07-012024-09-300001493761hear:PerformanceDesignedProductsLlcMember2024-03-130001493761us-gaap:CommonStockMember2024-04-012024-06-300001493761us-gaap:PreferredStockMember2024-01-012024-09-300001493761us-gaap:ToolsDiesAndMoldsMember2024-09-300001493761us-gaap:AdditionalPaidInCapitalMember2024-03-310001493761us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001493761us-gaap:WarrantMember2023-01-012023-09-300001493761us-gaap:RetainedEarningsMember2024-04-012024-06-300001493761us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-3000014937612023-03-032023-03-030001493761us-gaap:WarrantMember2024-07-012024-09-300001493761hear:EuropeAndMiddleEastMember2024-07-012024-09-300001493761us-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-300001493761us-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-300001493761us-gaap:SalesReturnsAndAllowancesMember2023-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001493761us-gaap:BaseRateMemberhear:TermLoanFacilityMembersrt:MinimumMember2024-03-132024-03-130001493761us-gaap:SalesReturnsAndAllowancesMember2023-12-310001493761us-gaap:RetainedEarningsMember2023-12-310001493761us-gaap:ShareBasedCompensationAwardTrancheTwoMemberhear:PerformanceBasedRestrictedStockMember2021-04-012021-04-0100014937612024-01-012024-09-300001493761us-gaap:CustomerRelationshipsMember2023-12-310001493761us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-09-300001493761us-gaap:StockOptionMember2024-07-012024-09-300001493761us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001493761us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001493761us-gaap:RestrictedStockMember2024-01-012024-09-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001493761us-gaap:RetainedEarningsMember2023-06-300001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001493761hear:MarketingAndTradeShowEquipmentMember2024-09-300001493761us-gaap:StockOptionMember2024-01-012024-09-300001493761hear:AlternativeCurrencyLoansMemberhear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-01-012024-09-300001493761us-gaap:CommonStockMember2023-06-300001493761us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001493761us-gaap:RestrictedStockMember2024-09-300001493761hear:PerformanceDesignedProductsLlcMemberus-gaap:TradeNamesMember2024-09-300001493761us-gaap:RetainedEarningsMember2024-07-012024-09-300001493761country:US2024-07-012024-09-300001493761us-gaap:CommonStockMember2023-07-012023-09-300001493761us-gaap:AdditionalPaidInCapitalMember2024-09-3000014937612023-03-3100014937612023-01-012023-03-3100014937612024-07-012024-09-300001493761us-gaap:WarrantMember2024-01-012024-09-300001493761us-gaap:ShareBasedCompensationAwardTrancheOneMemberhear:PerformanceBasedRestrictedStockMember2021-04-012021-04-010001493761us-gaap:BaseRateMemberhear:TermLoanFacilityMembersrt:MaximumMember2024-03-132024-03-130001493761us-gaap:CommonStockMember2022-12-310001493761us-gaap:CustomerRelationshipsMember2024-09-300001493761srt:MaximumMemberhear:PerformanceBasedRestrictedStockMember2024-01-012024-09-300001493761us-gaap:RestrictedStockMember2023-07-012023-09-300001493761us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001493761us-gaap:CommonStockMember2024-03-310001493761hear:EuropeAndMiddleEastMember2024-01-012024-09-300001493761us-gaap:CostOfSalesMember2023-01-012023-09-300001493761us-gaap:RevolvingCreditFacilityMember2024-01-012024-09-300001493761hear:FourthAmendmentMemberhear:PdpMergerAgreementMember2024-03-130001493761hear:PerformanceDesignedProductsLlcMember2024-03-132024-03-130001493761us-gaap:CommonStockMember2023-12-310001493761us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001493761us-gaap:CostOfSalesMember2023-07-012023-09-300001493761us-gaap:BaseRateMembersrt:MaximumMemberhear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-01-012024-09-3000014937612023-07-012023-09-300001493761us-gaap:LeaseholdImprovementsMember2024-09-300001493761country:US2024-01-012024-09-3000014937612023-01-012023-12-310001493761hear:TermLoanFacilityMembersrt:MinimumMember2024-03-132024-03-130001493761us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001493761us-gaap:MachineryAndEquipmentMember2023-12-310001493761hear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-09-300001493761us-gaap:RetainedEarningsMember2024-06-3000014937612023-01-012023-09-300001493761srt:MinimumMemberhear:RevolvingCreditFacilityMaturingMarchThirteenTwoThousandTwentySevenMember2024-01-012024-09-300001493761srt:MinimumMemberhear:PerformanceBasedRestrictedStockMember2024-01-012024-09-30xbrli:purexbrli:shareshear:Claimiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35465

TURTLE BEACH CORPORATION

(Exact name of registrant as specified in its charter)

|

|

Nevada |

27-2767540 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

44 South Broadway, 4th Floor White Plains, New York |

10601 |

(Address of principal executive offices) |

(Zip Code) |

(888) 496-8001

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbols |

Name of each exchange on which registered |

Common Stock, par value $0.001 |

HEAR |

The Nasdaq Global Market |

Preferred Stock Purchase Rights |

N/A |

The Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The number of shares of the registrant’s Common Stock, par value $0.001 per share, outstanding on October 31, 2024 was 20,079,323

INDEX

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

Turtle Beach Corporation

Condensed Consolidated Statements of Operations

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands, except per-share data) |

|

Net revenue |

|

$ |

94,363 |

|

|

$ |

59,158 |

|

|

$ |

226,689 |

|

|

$ |

158,584 |

|

Cost of revenue |

|

|

60,232 |

|

|

|

41,469 |

|

|

|

151,696 |

|

|

|

114,884 |

|

Gross profit |

|

|

34,131 |

|

|

|

17,689 |

|

|

|

74,993 |

|

|

|

43,700 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing |

|

|

13,535 |

|

|

|

10,583 |

|

|

|

36,289 |

|

|

|

30,457 |

|

Research and development |

|

|

4,311 |

|

|

|

4,380 |

|

|

|

12,802 |

|

|

|

12,670 |

|

General and administrative |

|

|

6,352 |

|

|

|

5,243 |

|

|

|

19,489 |

|

|

|

25,375 |

|

Acquisition-related cost |

|

|

3,510 |

|

|

|

— |

|

|

|

9,814 |

|

|

|

— |

|

Total operating expenses |

|

|

27,708 |

|

|

|

20,206 |

|

|

|

78,394 |

|

|

|

68,502 |

|

Operating income (loss) |

|

|

6,423 |

|

|

|

(2,517 |

) |

|

|

(3,401 |

) |

|

|

(24,802 |

) |

Interest expense |

|

|

2,712 |

|

|

|

107 |

|

|

|

5,082 |

|

|

|

253 |

|

Other non-operating expense, net |

|

|

252 |

|

|

|

481 |

|

|

|

974 |

|

|

|

799 |

|

Income (loss) before income tax |

|

|

3,459 |

|

|

|

(3,105 |

) |

|

|

(9,457 |

) |

|

|

(25,854 |

) |

Income tax expense (benefit) |

|

|

46 |

|

|

|

501 |

|

|

|

(5,501 |

) |

|

|

377 |

|

Net income (loss) |

|

$ |

3,413 |

|

|

$ |

(3,606 |

) |

|

$ |

(3,956 |

) |

|

$ |

(26,231 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.17 |

|

|

$ |

(0.21 |

) |

|

$ |

(0.20 |

) |

|

$ |

(1.54 |

) |

Diluted |

|

$ |

0.16 |

|

|

$ |

(0.21 |

) |

|

$ |

(0.20 |

) |

|

$ |

(1.54 |

) |

Weighted average number of shares: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

20,553 |

|

|

|

17,345 |

|

|

|

20,050 |

|

|

|

17,029 |

|

Diluted |

|

|

21,501 |

|

|

|

17,345 |

|

|

|

20,050 |

|

|

|

17,029 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Statements of Comprehensive Income (Loss)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30,

2024 |

|

|

September 30,

2023 |

|

|

September 30,

2024 |

|

|

September 30,

2023 |

|

|

|

(in thousands) |

|

Net income (loss) |

|

$ |

3,413 |

|

|

$ |

(3,606 |

) |

|

$ |

(3,956 |

) |

|

$ |

(26,231 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

1,718 |

|

|

|

(16 |

) |

|

|

1,536 |

|

|

|

394 |

|

Other comprehensive income (loss) |

|

|

1,718 |

|

|

|

(16 |

) |

|

|

1,536 |

|

|

|

394 |

|

Comprehensive income (loss) |

|

$ |

5,131 |

|

|

$ |

(3,622 |

) |

|

$ |

(2,420 |

) |

|

$ |

(25,837 |

) |

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

(in thousands, except par value and share amounts) |

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

13,803 |

|

|

$ |

18,726 |

|

Accounts receivable, net |

|

|

70,703 |

|

|

|

54,390 |

|

Inventories |

|

|

102,263 |

|

|

|

44,019 |

|

Prepaid expenses and other current assets |

|

|

9,686 |

|

|

|

7,720 |

|

Total Current Assets |

|

|

196,455 |

|

|

|

124,855 |

|

Property and equipment, net |

|

|

5,753 |

|

|

|

4,824 |

|

Goodwill |

|

|

56,700 |

|

|

|

10,686 |

|

Intangible assets, net |

|

|

44,544 |

|

|

|

1,734 |

|

Other assets |

|

|

9,749 |

|

|

|

7,868 |

|

Total Assets |

|

$ |

313,201 |

|

|

$ |

149,967 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Revolving credit facility |

|

$ |

58,626 |

|

|

$ |

— |

|

Accounts payable |

|

|

66,394 |

|

|

|

26,908 |

|

Other current liabilities |

|

|

30,689 |

|

|

|

29,424 |

|

Total Current Liabilities |

|

|

155,709 |

|

|

|

56,332 |

|

Debt, non-current |

|

|

45,696 |

|

|

|

— |

|

Income tax payable |

|

|

1,489 |

|

|

|

1,546 |

|

Other liabilities |

|

|

8,488 |

|

|

|

7,012 |

|

Total Liabilities |

|

|

211,382 |

|

|

|

64,890 |

|

Commitments and Contingencies |

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

Common stock, $0.001 par value - 25,000,000 shares authorized; 20,079,323 and 17,531,702 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively |

|

|

20 |

|

|

|

18 |

|

Additional paid-in capital |

|

|

239,345 |

|

|

|

220,185 |

|

Accumulated deficit |

|

|

(138,233 |

) |

|

|

(134,277 |

) |

Accumulated other comprehensive income (loss) |

|

|

687 |

|

|

|

(849 |

) |

Total Stockholders’ Equity |

|

|

101,819 |

|

|

|

85,077 |

|

Total Liabilities and Stockholders’ Equity |

|

$ |

313,201 |

|

|

$ |

149,967 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Statements of Cash Flows

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

|

(in thousands) |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

Net loss |

|

$ |

(3,956 |

) |

|

$ |

(26,231 |

) |

Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,261 |

|

|

|

2,912 |

|

Costs recognized on sale of acquired inventory |

|

|

2,085 |

|

|

|

— |

|

Amortization of intangible assets |

|

|

4,843 |

|

|

|

761 |

|

Amortization of debt financing costs |

|

|

625 |

|

|

|

108 |

|

Stock-based compensation |

|

|

3,447 |

|

|

|

8,554 |

|

Deferred income taxes |

|

|

(6,739 |

) |

|

|

(178 |

) |

Change in sales returns reserve |

|

|

1,369 |

|

|

|

(2,473 |

) |

Provision for obsolete inventory |

|

|

4,690 |

|

|

|

200 |

|

Loss on impairment of assets |

|

|

753 |

|

|

|

— |

|

Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

|

4,344 |

|

|

|

12,563 |

|

Inventories |

|

|

(43,597 |

) |

|

|

(4,986 |

) |

Accounts payable |

|

|

30,050 |

|

|

|

19,072 |

|

Prepaid expenses and other assets |

|

|

127 |

|

|

|

385 |

|

Income taxes payable |

|

|

485 |

|

|

|

126 |

|

Other liabilities |

|

|

(10,340 |

) |

|

|

(2,869 |

) |

Net cash provided (used for) by operating activities |

|

|

(8,553 |

) |

|

|

7,944 |

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(3,392 |

) |

|

|

(1,924 |

) |

Acquisition of a business, net of cash acquired |

|

|

(77,294 |

) |

|

|

— |

|

Net cash used for investing activities |

|

|

(80,686 |

) |

|

|

(1,924 |

) |

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

Borrowings on revolving credit facilities |

|

|

242,609 |

|

|

|

149,995 |

|

Repayment of revolving credit facilities |

|

|

(183,983 |

) |

|

|

(155,787 |

) |

Proceeds of term loan |

|

|

50,000 |

|

|

|

— |

|

Repayment of term loan |

|

|

(729 |

) |

|

|

— |

|

Proceeds from exercise of stock options and warrants |

|

|

3,004 |

|

|

|

1,718 |

|

Repurchase of common stock |

|

|

(25,339 |

) |

|

|

(974 |

) |

Debt issuance costs |

|

|

(2,897 |

) |

|

|

(80 |

) |

Net cash provided by (used for) financing activities |

|

|

82,665 |

|

|

|

(5,128 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

1,651 |

|

|

|

52 |

|

Net increase (decrease) in cash and cash equivalents |

|

|

(4,923 |

) |

|

|

944 |

|

Cash and cash equivalents - beginning of period |

|

|

18,726 |

|

|

|

11,396 |

|

Cash and cash equivalents - end of period |

|

$ |

13,803 |

|

|

$ |

12,340 |

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF INFORMATION |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

4,521 |

|

|

$ |

283 |

|

Cash paid (received) for income taxes |

|

$ |

70 |

|

|

$ |

175 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Statement of Stockholders’ Equity

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Additional

Paid-In |

|

|

Accumulated |

|

|

Accumulated

Other

Comprehensive |

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Income (Loss) |

|

|

Total |

|

|

|

(in thousands) |

|

Balance at December 31, 2023 |

|

|

17,532 |

|

|

$ |

18 |

|

|

$ |

220,185 |

|

|

$ |

(134,277 |

) |

|

$ |

(849 |

) |

|

$ |

85,077 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

155 |

|

|

|

— |

|

|

|

155 |

|

Other comprehensive loss, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(418 |

) |

|

|

(418 |

) |

Issuance of acquisition-related stock |

|

|

3,450 |

|

|

|

3 |

|

|

|

38,047 |

|

|

|

— |

|

|

|

— |

|

|

|

38,050 |

|

Issuance of restricted stock |

|

|

12 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock options exercised |

|

|

171 |

|

|

|

— |

|

|

|

1,257 |

|

|

|

— |

|

|

|

— |

|

|

|

1,257 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

1,105 |

|

|

|

— |

|

|

|

— |

|

|

|

1,105 |

|

Balance at March 31, 2024 |

|

|

21,165 |

|

|

$ |

21 |

|

|

$ |

260,594 |

|

|

$ |

(134,122 |

) |

|

$ |

(1,267 |

) |

|

$ |

125,226 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,524 |

) |

|

|

— |

|

|

|

(7,524 |

) |

Other comprehensive income, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

236 |

|

|

|

236 |

|

Issuance of restricted stock |

|

|

365 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock options exercised |

|

|

176 |

|

|

|

1 |

|

|

|

1,683 |

|

|

|

— |

|

|

|

— |

|

|

|

1,684 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

846 |

|

|

|

— |

|

|

|

— |

|

|

|

846 |

|

Repurchase of common stock |

|

|

(952 |

) |

|

|

(1 |

) |

|

|

(15,206 |

) |

|

|

— |

|

|

|

— |

|

|

|

(15,207 |

) |

Balance at June 30, 2024 |

|

|

20,754 |

|

|

$ |

21 |

|

|

$ |

247,917 |

|

|

$ |

(141,646 |

) |

|

$ |

(1,031 |

) |

|

$ |

105,261 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,413 |

|

|

|

— |

|

|

|

3,413 |

|

Other comprehensive income, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,718 |

|

|

|

1,718 |

|

Issuance of restricted stock |

|

|

6 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock options exercised |

|

|

8 |

|

|

|

— |

|

|

|

63 |

|

|

|

— |

|

|

|

— |

|

|

|

63 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

1,496 |

|

|

|

— |

|

|

|

— |

|

|

|

1,496 |

|

Repurchase of common stock |

|

|

(689 |

) |

|

|

(1 |

) |

|

|

(10,131 |

) |

|

|

— |

|

|

|

— |

|

|

|

(10,132 |

) |

Balance at September 30, 2024 |

|

|

20,079 |

|

|

$ |

20 |

|

|

$ |

239,345 |

|

|

$ |

(138,233 |

) |

|

$ |

687 |

|

|

$ |

101,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Additional

Paid-In |

|

|

Accumulated |

|

|

Accumulated

Other

Comprehensive |

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Income (Loss) |

|

|

Total |

|

|

|

(in thousands) |

|

Balance at December 31, 2022 |

|

|

16,569 |

|

|

$ |

17 |

|

|

$ |

206,916 |

|

|

$ |

(116,598 |

) |

|

$ |

(1,394 |

) |

|

$ |

88,941 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,705 |

) |

|

|

— |

|

|

|

(6,705 |

) |

Other comprehensive income, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

445 |

|

|

|

445 |

|

Issuance of restricted stock |

|

|

14 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock options exercised |

|

|

21 |

|

|

|

— |

|

|

|

124 |

|

|

|

— |

|

|

|

— |

|

|

|

124 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

1,959 |

|

|

|

— |

|

|

|

— |

|

|

|

1,959 |

|

Balance at March 31, 2023 |

|

|

16,604 |

|

|

$ |

17 |

|

|

$ |

208,999 |

|

|

$ |

(123,303 |

) |

|

$ |

(949 |

) |

|

$ |

84,764 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(15,920 |

) |

|

|

— |

|

|

|

(15,920 |

) |

Other comprehensive loss, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(35 |

) |

|

|

(35 |

) |

Issuance of restricted stock |

|

|

469 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock options exercised |

|

|

322 |

|

|

|

— |

|

|

|

1,234 |

|

|

|

— |

|

|

|

— |

|

|

|

1,234 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

4,986 |

|

|

|

— |

|

|

|

— |

|

|

|

4,986 |

|

Repurchase of common stock |

|

|

(86 |

) |

|

|

— |

|

|

|

(974 |

) |

|

|

— |

|

|

|

— |

|

|

|

(974 |

) |

Balance at June 30, 2023 |

|

|

17,309 |

|

|

$ |

17 |

|

|

$ |

214,245 |

|

|

$ |

(139,223 |

) |

|

$ |

(984 |

) |

|

$ |

74,055 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,606 |

) |

|

|

— |

|

|

|

(3,606 |

) |

Other comprehensive loss, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(16 |

) |

|

|

(16 |

) |

Issuance of restricted stock |

|

|

24 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock options exercised |

|

|

76 |

|

|

|

— |

|

|

|

360 |

|

|

|

— |

|

|

|

— |

|

|

|

360 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

1,609 |

|

|

|

— |

|

|

|

— |

|

|

|

1,609 |

|

Balance at September 30, 2023 |

|

|

17,409 |

|

|

$ |

17 |

|

|

$ |

216,214 |

|

|

$ |

(142,829 |

) |

|

$ |

(1,000 |

) |

|

$ |

72,402 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 1. Background and Basis of Presentation

Organization

Turtle Beach Corporation (“Turtle Beach” or the “Company”), headquartered in White Plains, New York and incorporated in the state of Nevada in 2010, is a premier audio and gaming technology company with expertise and experience in developing, commercializing, and marketing innovative products across a range of large addressable markets under the Turtle Beach®, PDP® and ROCCAT® brands. Turtle Beach is a worldwide leader of feature-rich headset solutions for use across multiple platforms, including video game and entertainment consoles, handheld consoles, personal computers (“PC”), tablets and mobile devices. ROCCAT is a gaming keyboards, mice and other accessories brand focused on the PC peripherals market. Acquired in March 2024, Performance Designed Products, LLC (“PDP”), a wholly-owned subsidiary of Turtle Beach Corporation incorporated in the state of California in 1997, is a gaming accessories leader that designs and distributes video game accessories, including controllers, headsets, power supplies, cases, and other accessories.

VTB Holdings, Inc. (“VTBH”), a wholly-owned subsidiary of Turtle Beach Corporation and the owner of Voyetra Turtle Beach, Inc. (“VTB”), was incorporated in the state of Delaware in 2010. VTB, the owner of Turtle Beach Europe Limited (“TB Europe”), was incorporated in the state of Delaware in 1975 with operations principally located in White Plains, New York.

Basis of Presentation

The accompanying interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) and, in the opinion of management, reflect all adjustments (which include normal recurring adjustments) considered necessary for a fair presentation of the financial position, results of operations, and cash flows for the periods presented. All intercompany accounts and transactions have been eliminated in consolidation. Certain information and footnote disclosures, normally included in annual financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), have been condensed or omitted pursuant to those rules and regulations. The Company believes that the disclosures made are adequate to make the information presented not misleading. The results of operations for the interim periods are not necessarily indicative of the results of operations for the entire fiscal year.

The December 31, 2023 Condensed Consolidated Balance Sheet has been derived from the Company’s audited financial statements included in its Annual Report on Form 10-K filed with the SEC on March 13, 2024 (“Annual Report”).

These financial statements should be read in conjunction with the annual financial statements and the notes thereto included in the Annual Report that contains information useful to understanding the Company’s businesses and financial statement presentations.

Use of estimates: The preparation of financial statements in conformity with generally accepted accounting principles requires management to use estimates and assumptions that affect the reported amount of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenue and expenses during the reporting period. The significant estimates and assumptions used by management affect: sales return reserve, allowances for cash discounts, warranty reserve, valuation of inventory, valuation of long-lived assets, goodwill and other intangible assets, depreciation and amortization of long-lived assets, valuation of deferred tax assets, probability of performance shares vesting and forfeiture rates utilized in issuing stock-based compensation awards. The Company evaluates estimates and assumptions on an ongoing basis using historical experience and other factors and adjusts those estimates and assumptions when facts and circumstances dictate. As future events and their effects cannot be determined with precision, actual results could differ from these estimates, and those differences could be material to the consolidated financial statements.

Note 2. Summary of Significant Accounting Policies

The preparation of consolidated annual and quarterly financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the Company’s consolidated financial statements, and the reported amounts of revenue and expenses during the reporting periods. The Company can give no assurance that actual results will not differ from those estimates.

There have been no material changes to the significant accounting policies and estimates from the information provided in Note 1 of the notes to our consolidated financial statements in our Annual Report.

Note 3. Acquisitions

On March 13, 2024, the Company acquired all the issued and outstanding equity of Performance Designed Products, LLC (“PDP”) for consideration that included cash and common stock. PDP was a privately held gaming accessories leader that designs and distributes video game accessories, including controllers, headsets, power supplies, cases, and other accessories. As a result of the acquisition, the Company will strengthen its leadership position in hardware gaming accessories and expand its product portfolio.

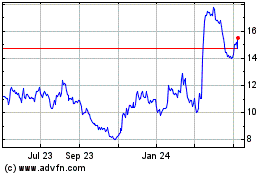

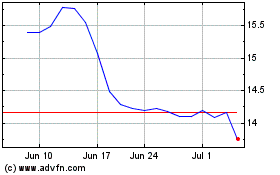

Consideration for the Transaction consisted of the issuance of 3.45 million shares of Company common stock and approximately $78.9 million in cash, subject to customary post-closing adjustments for working capital, closing cash, closing debt and closing third party expenses. On a fully-diluted basis, issued stock represented approximately 16.4% of the total issued and outstanding shares of the Company as of the closing date. The fair value of the 3.45 million common shares issued as part of the consideration was determined on the basis of the closing market price of the Company’s common shares on the acquisition date, or $11.03 per share. As a result, the total preliminary purchase consideration was $116.9 million, partially funded by borrowing on the new term loan facility (see Note 8). Additionally, the Company recognized $9.8 million of acquisition-related costs that were expensed during the nine months ended September 30, 2024.

The following table summarizes preliminary allocation of the consideration transferred to the assets acquired and liabilities assumed at the acquisition date:

|

|

|

|

|

(In thousands) |

|

Amount |

|

Cash |

|

|

1,562 |

|

Accounts Receivable |

|

|

22,026 |

|

Inventory |

|

|

21,423 |

|

Prepaid and Other Current Assets |

|

|

2,168 |

|

Property, Plant & Equipment |

|

|

1,161 |

|

Other Assets |

|

|

3,478 |

|

Intangible Assets |

|

|

47,769 |

|

Accounts Payable |

|

|

(12,716 |

) |

Accrued Liabilities |

|

|

(6,352 |

) |

Lease Payable |

|

|

(2,726 |

) |

Deferred Tax Liability |

|

|

(6,898 |

) |

Total identifiable net assets |

|

|

70,895 |

|

Goodwill |

|

|

46,014 |

|

Total consideration paid |

|

$ |

116,909 |

|

The fair values assigned to PDP’s assets and liabilities are provisional and were determined based on preliminary estimates and assumptions that management believes are reasonable. The preliminary purchase price allocation is subject to further refinement and may require significant adjustments to arrive at the final purchase price allocation. The final determination of the fair value of certain assets and liabilities will be completed as soon as the necessary information is available, but no later than one year from the acquisition date.

During the three months ended September 30, 2024, the Company recognized measurement period adjustments primarily to establish preliminary values for the opening balance sheet of the net assets acquired including intangibles assets, which also resulted in a reduction in goodwill from the previously reported preliminary amount.

The goodwill from the acquisition, which is fully deductible for tax purposes, consists largely of synergies and economies of scale expected from adding the operations of PDP's and the Company’s existing business and supply channels.

The preliminary fair value of PDP’s identifiable intangible assets was determined primarily using the “income approach,” which requires a forecast of all expected future cash flows either through the use of the multi-period excess earnings method or the relief-from-royalty method. Such forecasts are based on inputs that are unobservable and significant to the overall fair value measurement, and as such, are classified as

Level 3 inputs (see Note 4). Some of the more significant assumptions inherent in the development of intangible asset values include: the amount and timing of projected future cash flows, the discount rate selected to measure the risks inherent in the future cash flows, the assessment of the intangible asset’s life cycle, as well as other factors. The following table summarizes the preliminary allocation of purchase consideration to identifiable intangible assets:

|

|

|

|

|

|

|

(In thousands) |

|

Life |

|

Amount |

|

Tradenames |

|

7 Years |

|

$ |

15,607 |

|

Customer relationships |

|

6 Years |

|

|

4,456 |

|

Developed technology |

|

6 Years |

|

|

27,706 |

|

Total |

|

|

|

$ |

47,769 |

|

PDP's net revenue included in the Company’s consolidated results was $26.7 million and $54.4 million for the three and nine months ended September 30, 2024, respectively. PDP’s net income included in the Company’s consolidated results for the same period was not material.

Pro Forma Financial Information (Unaudited)

The following table reflects the unaudited pro forma operating results of the Company for the three and nine months ended September 30, 2024 and 2023, which give effect to the acquisition of PDP as if it had occurred on January 1, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Net revenue |

|

$ |

94,363 |

|

|

$ |

81,410 |

|

|

$ |

246,707 |

|

|

$ |

219,724 |

|

Net income (loss) |

|

$ |

3,153 |

|

|

$ |

(12,052 |

) |

|

$ |

(3,912 |

) |

|

$ |

(44,817 |

) |

The pro forma results are based on assumptions that the Company believes are reasonable under the circumstances. The pro forma results are not necessarily indicative of the operating results that would have occurred had the acquisition been effective January 1, 2023, nor are they intended to be indicative of results that may occur in the future.

Note 4. Fair Value Measurement

The Company follows a three-level fair value hierarchy that prioritizes the inputs used to measure fair value. This hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

•Level 1 — Quoted prices in active markets for identical assets or liabilities.

•Level 2 — Observable inputs other than quoted prices included in Level 1, such as quoted prices for markets that are not active, or other inputs that are observable or can be corroborated by observable market data.

•Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. This includes certain pricing models, discounted cash flow methodologies and similar techniques that use significant unobservable inputs.

Financial instruments consist of cash and cash equivalents, accounts receivable, accounts payable, debt instruments and certain warrants. As of September 30, 2024 and December 31, 2023, the Company had not elected the fair value option for any financial assets and liabilities for which such an election would have been permitted. The following is a summary of the carrying amounts and estimated fair values of our financial instruments as of September 30, 2024 and December 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

|

Reported |

|

|

Fair Value |

|

|

Reported |

|

|

Fair Value |

|

|

|

(in thousands) |

|

Financial Assets and Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

13,803 |

|

|

$ |

13,803 |

|

|

$ |

18,726 |

|

|

$ |

18,726 |

|

Term Loan |

|

$ |

49,271 |

|

|

$ |

49,271 |

|

|

$ |

— |

|

|

$ |

— |

|

Revolving credit facility |

|

$ |

58,626 |

|

|

$ |

58,626 |

|

|

$ |

— |

|

|

$ |

— |

|

Cash equivalents are stated at amortized cost, which approximates fair value as of the consolidated balance sheet dates, due to the short period of time to maturity; and accounts receivable and accounts payable are stated at their carrying value, which approximates fair value due to the short time to the expected receipt or payment. The carrying value of the Credit Facility and Term Loan due 2027 equals fair value as the stated interest rate approximates market rates currently available to the Company. The carrying value of the Credit Facility approximates fair value, due to the variable rate nature of the debt, as of September 30, 2024 and December 31, 2023.

Note 5. Allowance for Sales Returns

The following table provides the changes in our sales return reserve, which is classified as a reduction of accounts receivable:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Balance, beginning of period |

|

$ |

5,240 |

|

|

$ |

5,398 |

|

|

$ |

8,449 |

|

|

$ |

7,817 |

|

Reserve accrual |

|

|

4,392 |

|

|

|

3,566 |

|

|

|

9,825 |

|

|

|

9,817 |

|

Recoveries and deductions, net |

|

|

(2,552 |

) |

|

|

(3,620 |

) |

|

|

(11,194 |

) |

|

|

(12,290 |

) |

Balance, end of period |

|

$ |

7,080 |

|

|

$ |

5,344 |

|

|

$ |

7,080 |

|

|

$ |

5,344 |

|

Note 6. Composition of Certain Financial Statement Items

Inventories

Inventories consist of the following:

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

|

|

(in thousands) |

|

Finished goods |

|

$ |

95,016 |

|

|

$ |

43,579 |

|

Raw materials |

|

|

7,247 |

|

|

|

440 |

|

Total inventories |

|

$ |

102,263 |

|

|

$ |

44,019 |

|

Property and Equipment, net

Property and equipment, net, consists of the following:

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

|

|

(in thousands) |

|

Machinery and equipment |

|

$ |

2,808 |

|

|

$ |

2,597 |

|

Software and software development |

|

|

2,861 |

|

|

|

2,438 |

|

Furniture and fixtures |

|

|

1,709 |

|

|

|

1,700 |

|

Tooling |

|

|

14,056 |

|

|

|

11,250 |

|

Leasehold improvements |

|

|

2,372 |

|

|

|

1,988 |

|

Demonstration units and convention booths |

|

|

16,617 |

|

|

|

15,767 |

|

Total property and equipment, gross |

|

|

40,423 |

|

|

|

35,740 |

|

Less: accumulated depreciation and amortization |

|

|

(34,670 |

) |

|

|

(30,916 |

) |

Total property and equipment, net |

|

$ |

5,753 |

|

|

$ |

4,824 |

|

Other Current Liabilities

Other current liabilities consist of the following:

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

|

|

(in thousands) |

|

Accrued employee expenses |

|

$ |

3,432 |

|

|

$ |

3,944 |

|

Accrued royalty |

|

|

6,059 |

|

|

|

5,275 |

|

Accrued tax-related payables |

|

|

4,815 |

|

|

|

5,206 |

|

Accrued freight |

|

|

2,705 |

|

|

|

2,917 |

|

Accrued marketing |

|

|

1,992 |

|

|

|

3,335 |

|

Accrued expenses |

|

|

11,686 |

|

|

|

8,747 |

|

Total other current liabilities |

|

$ |

30,689 |

|

|

$ |

29,424 |

|

Note 7. Goodwill and Other Intangible Assets

Acquired Intangible Assets

Acquired identifiable intangible assets, and related accumulated amortization, as of September 30, 2024 and December 31, 2023 consisted of:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

|

Gross

Carrying

Value |

|

|

Accumulated

Amortization |

|

|

Net Book

Value |

|

|

|

(in thousands) |

|

Customer relationships |

|

$ |

12,541 |

|

|

$ |

8,053 |

|

|

$ |

4,488 |

|

Tradenames |

|

|

18,673 |

|

|

|

4,178 |

|

|

|

14,495 |

|

Developed technology |

|

|

29,590 |

|

|

|

4,066 |

|

|

|

25,524 |

|

Foreign currency |

|

|

(932 |

) |

|

|

(969 |

) |

|

|

37 |

|

Total Intangible Assets (1) |

|

$ |

59,872 |

|

|

$ |

15,328 |

|

|

$ |

44,544 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

|

Gross

Carrying

Value |

|

|

Accumulated

Amortization |

|

|

Net Book

Value |

|

|

|

(in thousands) |

|

Customer relationships |

|

$ |

8,085 |

|

|

$ |

7,214 |

|

|

$ |

871 |

|

Tradenames |

|

|

3,066 |

|

|

|

2,607 |

|

|

|

459 |

|

Developed technology |

|

|

1,884 |

|

|

|

1,613 |

|

|

|

271 |

|

Foreign currency |

|

|

(1,159 |

) |

|

|

(1,292 |

) |

|

|

133 |

|

Total Intangible Assets (1) |

|

$ |

11,876 |

|

|

$ |

10,142 |

|

|

$ |

1,734 |

|

(1) The accumulated amortization includes $1.9 million of accumulated impairment charges as of September 30, 2024 and December 31, 2023.

In May 2019, the Company completed its acquisition of the business and assets of ROCCAT. The acquired intangible assets relating to developed technology, customer relationships, and trade name are subject to amortization. In January 2021, the Company completed its acquisition of the business and assets relating to the Neat Microphones business. The acquired intangible assets relating to developed technology, customer relationships, and trade name are subject to amortization.

In March 2024, the Company completed its acquisition of the business and assets of PDP. The acquired intangible assets relating to developed technology, customer relationships, and trade name are subject to amortization. Refer to Note 3, “Acquisitions” for additional information related to PDP’s identifiable intangible assets.

Amortization expense related to definite lived intangible assets of $2.1 million and $4.8 million was recognized for the three and nine months ended September 30, 2024, respectively, and $0.2 million and $0.8 million was recognized for the three and nine months ended September 30, 2023, respectively.

As of September 30, 2024, estimated annual amortization expense related to definite lived intangible assets in future periods was as follows:

|

|

|

|

|

|

|

(in thousands) |

|

2024 |

|

$ |

2,146 |

|

2025 |

|

|

8,016 |

|

2026 |

|

|

7,761 |

|

2027 |

|

|

7,591 |

|

Thereafter |

|

|

18,993 |

|

Total |

|

$ |

44,507 |

|

Changes in the carrying values of goodwill for the nine months ended September 30, 2024 from the balance as of December 31, 2023.

|

|

|

|

|

|

|

(in thousands) |

|

Balance as of January 1, 2024 |

|

$ |

10,686 |

|

PDP acquisition |

|

|

46,014 |

|

Balance as of September 30, 2024 |

|

$ |

56,700 |

|

Note 8. Revolving Credit Facility and Long-Term Debt

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

|

|

(in thousands) |

|

Revolving credit facility, maturing March 2027 |

|

$ |

58,626 |

|

|

$ |

— |

|

Term loan Due 2027 |

|

$ |

49,271 |

|

|

$ |

— |

|

Total interest expense, inclusive of amortization of deferred financing costs, on long-term debt obligations was $2.7 million and $5.4 million for the three and nine months ended September 30, 2024, respectively, and $0.1 million and $0.4 million for the three and nine months ended September 30, 2023, respectively.

Amortization of deferred financing costs was $0.3 million and $0.6 million for the three and nine months ended September 30, 2024, respectively, and $33 thousand and $0.1 million for the three and nine months ended September 30, 2023, respectively.

Revolving Credit Facility

On March 5, 2018, Turtle Beach and certain of its subsidiaries entered into an amended and restated loan, guaranty and security agreement (the “Credit Facility”) with Bank of America, N.A. (“Bank of America”), as administrative agent, collateral agent and security trustee for Lenders (as defined therein), which replaced the then existing asset-based revolving loan agreement. The Credit Facility was amended on each of December 17, 2018, May 31, 2019, and March 10, 2023. The Credit Facility, as amended, expires on March 13, 2027 and provides for a line of credit of up to $50 million inclusive of a sub-facility limit of $10 million for TB Europe, a wholly-owned subsidiary of Turtle Beach.

On March 13, 2024, the Company entered into a Fourth Amendment, dated as of March 13, 2024 (the “Fourth Amendment”), by and among the Company, VTB, TBC Holding Company LLC, TB Europe, VTBH, the financial institutions party thereto from time to time and Bank of America, as administrative agent, collateral agent and security trustee for the lenders.

The Fourth Amendment provided for, among other things: (i) the acquisition of PDP; (ii) revised the calculation of the U.S. Borrowing Base to include certain acquired assets of PDP equal to the lesser of (a) the sum of the accounts formula amount and the inventory formula amount (each as defined in the Fourth Amendment), (b) $15,000,000, and (c) 30% of the aggregate Revolver Commitments; (iii) extending the maturity date of the Credit Facility from April 1, 2025 to March 13, 2027; and (iv) updated the interest rate and margin terms such that the loans will bear interest at a rate equal to (1) SOFR, (2) the U.S. Base Rate, (3) the Sterling Overnight Index Average Reference Rate (“SONIA”) for loans denominated in Sterling, and (4) the Euro Interbank Offered Rate (“EUIBOR”) for loans denominated in Euros, plus in each case, an applicable margin, which is between 0.50% and 2.50% for Base Rate Loans and 1.75% and 3.50% for Term SOFR Loans, SONIA Rate Loans and EUIBOR Loans.

The maximum credit availability for loans and letters of credit under the Credit Facility is governed by a borrowing base determined by the application of specified percentages to certain eligible assets, primarily eligible trade accounts receivable and inventories, and is subject to discretionary reserves and revaluation adjustments. The Credit Facility may be used for working capital, the issuance of bank guarantees, letters of credit and other corporate purposes.

Amounts outstanding under the Credit Facility bear interest at a rate equal to (i) a rate published by Bank of America or the U.S. Bloomberg Short-Term Bank Yield Index (“BSBY”) rate for loans denominated in U.S. Dollars, (ii) the Sterling Overnight Index Average Reference Rate (“SONIA”) for loans denominated in Sterling, (iii) and the Euro Interbank Offered Rate (“EUIBOR”) for loans denominated in Euros, plus in each case, an applicable margin, which is between 0.50% to 2.50% for base rate loans and UK base rate loans, and 1.75% to 3.50% for U.S. BSBY rate loans, U.S. BSBY daily floating rate loans and UK alternative currency loans. In addition, Turtle Beach is required to pay a commitment fee on the unused revolving loan commitment at a rate ranging from 0.375% to 0.50% and letter of credit fees and agent fees. As of September 30, 2024, interest rates for outstanding borrowings were 8.60% for base rate loans and 6.70% for Term SOFR loans.

The Company is subject to quarterly financial covenant testing if certain availability thresholds are not met or certain other events occur (as set forth in the Credit Facility). At such times, the Credit Facility requires the Company and its restricted subsidiaries to maintain a fixed charge coverage ratio of at least 1.00 to 1.00 as of the last day of each fiscal quarter.

The Credit Facility also contains affirmative and negative covenants that, subject to certain exceptions, limit our ability to take certain actions, including the Company’s ability to incur debt, pay dividends and repurchase stock, make certain investments and other payments, enter into certain mergers and consolidations, engage in sale leaseback transactions and transactions with affiliates, and encumber and dispose of assets. Obligations under the Credit Facility are secured by a security interest and lien upon substantially all of the Company’s assets.

As of September 30, 2024, the Company was in compliance with all financial covenants under the Credit Facility, as amended, and excess borrowing availability was approximately $21.1 million.

Term Loan

On March 13, 2024, Turtle Beach and certain of its subsidiaries entered into a new financing agreement with Blue Torch Finance, LLC, (“Blue Torch”), pursuant to which Blue Torch for an aggregate amount of $50 million (the “Term Loan Facility”), the proceeds of which were used to (i) fund a portion of the PDP acquisition purchase price; (ii) repay certain existing indebtedness of the acquired business; (iii) to pay fees and expenses related to such transactions and (iv) for general corporate purposes. The Term Loan Facility will amortize in a monthly amount equal to 0.208333% during the first two years and 0.416667% during the third year and may be prepaid at any time subject to a prepayment premium during the first year of the interest payments payable during the first year plus 3.00%. The Term Loan Facility is secured by substantially all of the assets of the Company and its subsidiaries which are party to the Term Loan Facility.

The Term Loan Facility (a) matures on March 13, 2027; (b) bears interest at a rate equal to (i) a base rate plus 7.25% per annum for Reference Rate Loans and Secured Overnight Financing Rate (“SOFR”) plus 8.25% per annum for SOFR Loans if the total net leverage ratio is greater than or equal to 2.25x and (ii) a base rate plus 6.75% per annum for Reference Rate Loans and SOFR plus 7.75% per annum for SOFR Loans if the total net leverage ratio is less than 2.25x; and (c) is subject to certain affirmative, negative and financial covenants, including a minimum liquidity covenant and a quarterly total net leverage ratio covenant. As of September 30, 2024, interest rates for outstanding borrowings was 13.11%.

On August 7, 2024, the Company and Blue Torch amended the Term Loan Facility to, among other things, permit the Company to repurchase Company common stock in an aggregate amount not to exceed $30 million prior to March 31, 2025, subject to the satisfaction of certain conditions. The other material terms of the Term Loan Facility were unchanged.

As of September 30, 2024, the Company was in compliance with all financial covenants under the Term Loan Facility.

Note 9. Income Taxes