Timberland Bancorp, Inc. (NASDAQ: TSBK) (“Timberland” or “the

Company”), the holding company for Timberland Bank (the “Bank”),

today announced its inclusion in the prestigious Piper Sandler Bank

and Thrift Sm-All Stars: Class of 2024. Piper Sandler has

identified Timberland Bank as one of the top performing, publicly

traded small-cap banks and thrifts in the nation.

In its “Bank and Thrift Sm-All Stars: Class of 2024” report,

Piper Sandler recognized Timberland among the top 30 best

performing small capitalization institutions from a list of

publicly traded banks and thrifts in the U.S. with market

capitalizations less than $2.5 billion. In making their selections,

Piper Sandler focused on growth, profitability, credit quality and

capital strength.

“It is an honor to be named one of the elite small-cap banks and

thrifts in the United States,” stated Dean Brydon, Chief Executive

Officer. “The receipt of this award is an honor and a testament to

the dedication and commitment of Timberland’s employees who

continue to work diligently to support those in the communities we

serve.”

About Timberland Bancorp, Inc. Timberland

Bancorp, Inc., a Washington corporation, is the holding company for

Timberland Bank. The Bank opened for business in 1915 and primarily

serves consumers and businesses across Grays Harbor, Thurston,

Pierce, King, Kitsap and Lewis counties, Washington with a full

range of lending and deposit services through its 23 branches

(including its main office in Hoquiam).

Disclaimer

Certain matters discussed in this press release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements relate

to our financial condition, results of operations, plans,

objectives, future performance or business. Forward-looking

statements are not statements of historical fact, are based on

certain assumptions and often include the words “believes,”

“expects,” “anticipates,” “estimates,” “forecasts,” “intends,”

“plans,” “targets,” “potentially,” “probably,” “projects,”

“outlook” or similar expressions or future or conditional verbs

such as “may,” “will,” “should,” “would” and “could.”

Forward-looking statements include statements with respect to our

beliefs, plans, objectives, goals, expectations, assumptions and

statements about future economic performance. These forward-looking

statements are subject to known and unknown risks, uncertainties

and other factors that could cause our actual results to differ

materially from the results anticipated or implied by our

forward-looking statements, including, but not limited to:

potential adverse impacts to economic conditions in our local

market areas, other markets where the Company has lending

relationships, or other aspects of the Company's business

operations or financial markets, including, without limitation, as

a result of employment levels, labor shortages and the effects of

inflation, a potential recession or slowed economic growth;

continuing elevated levels of inflation and the impact of current

and future monetary policies of the Board of Governors of the

Federal Reserve System ("Federal Reserve") in response thereto; the

effects of any federal government shutdown; credit risks of lending

activities, including any deterioration in the housing and

commercial real estate markets which may lead to increased losses

and non-performing loans in our loan portfolio resulting in our ACL

not being adequate to cover actual losses and thus requiring us to

materially increase our ACL through the provision for credit

losses; changes in general economic conditions, either nationally

or in our market areas; changes in the levels of general interest

rates, and the relative differences between short and long-term

interest rates, deposit interest rates, our net interest margin and

funding sources; fluctuations in the demand for loans, the number

of unsold homes, land and other properties and fluctuations in real

estate values in our market areas; secondary market conditions for

loans and our ability to sell loans in the secondary market;

results of examinations of us by the Federal Reserve and of our

bank subsidiary by the Federal Deposit Insurance Corporation

(“FDIC”), the Washington State Department of Financial

Institutions, Division of Banks or other regulatory authorities,

including the possibility that any such regulatory authority may,

among other things, institute a formal or informal enforcement

action against us or our bank subsidiary which could require us to

increase our ACL, write-down assets, change our regulatory capital

position or affect our ability to borrow funds or maintain or

increase deposits or impose additional requirements or restrictions

on us, any of which could adversely affect our liquidity and

earnings; the impact of bank failures or adverse developments at

other banks and related negative press about the banking industry

in general on investor and depositor sentiment; legislative or

regulatory changes that adversely affect our business including

changes in banking, securities and tax law, in regulatory policies

and principles, or the interpretation of regulatory capital or

other rules; our ability to attract and retain deposits; our

ability to control operating costs and expenses; the use of

estimates in determining fair value of certain of our assets, which

estimates may prove to be incorrect and result in significant

declines in valuation; difficulties in reducing risks associated

with the loans in our consolidated balance sheet; staffing

fluctuations in response to product demand or the implementation of

corporate strategies that affect our work force and potential

associated charges; disruptions, security breaches, or other

adverse events, failures or interruptions in, or attacks on, our

information technology systems or on the third-party vendors who

perform several of our critical processing functions; our ability

to retain key members of our senior management team; costs and

effects of litigation, including settlements and judgments; our

ability to implement our business strategies; our ability to manage

loan delinquency rates; increased competitive pressures among

financial services companies; changes in consumer spending,

borrowing and savings habits; the availability of resources to

address changes in laws, rules, or regulations or to respond to

regulatory actions; our ability to pay dividends on our common

stock; the quality and composition of our securities portfolio and

the impact if any adverse changes in the securities markets,

including on market liquidity; inability of key third-party

providers to perform their obligations to us; changes in accounting

policies and practices, as may be adopted by the financial

institution regulatory agencies or the Financial Accounting

Standards Board ("FASB"), including additional guidance and

interpretation on accounting issues and details of the

implementation of new accounting methods; the economic impact of

climate change, severe weather events, natural disasters,

pandemics, epidemics and other public health crises, acts of war or

terrorism, civil unrest and other external events on our business;

other economic, competitive, governmental, regulatory, and

technological factors affecting our operations, pricing, products

and services; and other risks described elsewhere in this press

release and in the Company's other reports filed with or furnished

to the Securities and Exchange Commission.

Any of the forward-looking statements that we make in this press

release and in the other public statements we make are based upon

management's beliefs and assumptions at the time they are made. We

do not undertake and specifically disclaim any obligation to

publicly update or revise any forward-looking statements included

in this press release to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements or to update the reasons why actual results could differ

from those contained in such statements, whether as a result of new

information, future events or otherwise. In light of these risks,

uncertainties and assumptions, the forward-looking statements

discussed in this document might not occur and we caution readers

not to place undue reliance on any forward-looking statements.

These risks could cause our actual results for fiscal 2024 and

beyond to differ materially from those expressed in any

forward-looking statements by, or on behalf of, us, and could

negatively affect the Company's consolidated financial condition

and results of operations as well as its stock price

performance.

Contact: Dean J. Brydon, CEOJonathan A.

Fischer, President & COOMarci A. Basich,

CFO(360)

533-4747www.timberlandbank.com

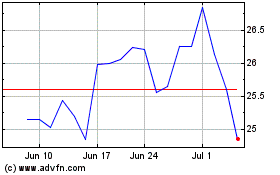

Timberland Bancorp (NASDAQ:TSBK)

Historical Stock Chart

From Jan 2025 to Feb 2025

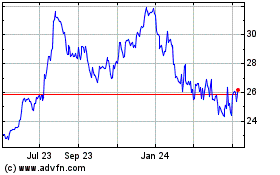

Timberland Bancorp (NASDAQ:TSBK)

Historical Stock Chart

From Feb 2024 to Feb 2025