0001040130FALSE00010401302025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 10, 2025

PetMed Express, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Florida | | 000-28827 | | 65-0680967 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

420 South Congress Avenue, Delray Beach, Florida 33445

(Address of principal executive offices) (Zip Code)

(561) 526-4444

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $.001 per share | PETS | NASDAQ Global Select Market |

| Preferred Stock Purchase Rights | N/A | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 10, 2025, PetMed Express, Inc. (the “Company”) issued a press release announcing its December 31, 2024 third quarter of fiscal year 2025 financial results and other financial information, and that management would review these results in a conference call at 4:30 pm Eastern time on February 10, 2025. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 and the information contained in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference in any Company filing under the Securities Act of 1933, as amended (“Securities Act”), or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in such filing.

The Company is making reference to non-GAAP financial information in both the press release and the conference call. A reconciliation of these non-GAAP financial measures to the nearest comparable GAAP financial measures is contained in the attached press release.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

99.1 – Press release dated February 10, 2025.

104 – Cover Page Interactive Data File (formatted as Inline XBRL).

EXHIBIT INDEX

| | | | | | | | |

Exhibit No. | | Description |

| | |

99.1 | | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 10, 2025

| | | | | | | | |

| PETMED EXPRESS, INC. |

| | |

| By: | /s/ Sandra Y. Campos |

| Name: | Sandra Y. Campos |

| Title: | Chief Executive Officer and President |

Exhibit 99.1

PetMeds® Announces Third Quarter Fiscal 2025 Financial Results

Delray Beach, Florida, February 10, 2025, PetMed Express, Inc. dba PetMeds and parent company of PetCareRx (NASDAQ: PETS) today announced its financial results for its third quarter ended December 31, 2024.

Third Quarter Fiscal 2025 Financial Highlights

•Net sales of $53.0 million.

•Gross margin rate of 28.1%, an increase of 80 basis points compared to the prior year period.

•Adjusted EBITDA of $2.0 million compared to Adjusted EBITDA of $0.9 million in the prior year period.

•Continued progress on key initiatives supporting the transformation of the business.

“In just nine months, we have made significant strides in our transformation journey, and I am pleased to report that we have delivered meaningful progress across our strategic priorities. Our focused execution is already yielding results, validating our direction and setting the foundation for long-term success. For the third quarter, we achieved $2 million in Adjusted EBITDA, a $1.1 million improvement year-over-year, while successfully reducing G&A expenses by $2.6 million compared to last year. As we continue to build a stronger, more efficient organization, our commitment remains unwavering—to drive differentiation, sustainable growth, and increased shareholder value through operational excellence and financial discipline,” said Sandra Campos, CEO & President.

This afternoon the Company will host a conference call to review the quarter’s financial results.

Time: 4:30 P.M. Eastern Time, February 10, 2025

Public call dial in (877) 407-0789 (toll free) or (201) 689-8562.

Webcast stream link: https://investors.petmeds.com for those who wish to stream the call via webcast.

Replay: Available until February 24, 2025, at 11:59 P.M Eastern Time.

To access the replay, call (844) 512-2921 (toll free) or (412) 317-6671 and enter passcode 13750886.

About PetMed Express, Inc.

Founded in 1996, PetMeds is a leader in the consumer pet healthcare sector. As a national online retailer with expert pharmacists and licenses across fifty states, PetMeds.com and PetCareRx.com deliver top branded pharmaceuticals, generics, compounded prescription medications and OTC supplements and vitamins that help pets live longer, healthier lives. Leveraging telehealth and insurance partnerships, they offer unparalleled value and convenience that enhance wellness and longevity for dogs, cats, and horses. PetMeds and PetCareRx provides essential pet health offerings through their websites, www.PetMeds.com and www.PetCareRx.com.

Forward Looking Statement

This press release may contain “forward-looking statements”, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve a number of risks and uncertainties, including the Company’s ability to meet the objectives included in its business plan. Important factors that could cause results to differ materially from those indicated by such forward-looking statements are set forth in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections in the Company’s Annual Report on Form 10-K for the year ended March 31, 2024. The Company’s future results may also be impacted by other risk factors listed from time to time in the Company’s filings with the Securities and Exchange Commission, including, but not limited to, the Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and periodic filings on Form 8-K. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this press release and should not be relied upon as representing the Company’s views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements, other than as may be required by law. If the Company does update one or more forward-looking statements, no inference should be made that the Company will make additional updates with respect to those or other forward-looking statements.

PETMEDS INVESTOR RELATIONS CONTACT

ICR, LLC

John Mills

(646) 277-1254

Reed Anderson

(646) 277-1260

investor@petmeds.com

PETMED EXPRESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data) | | | | | | | | | | | |

| December 31,

2024 | | March 31,

2024 |

| (Unaudited) | | |

ASSETS | | | |

| | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 50,101 | | | $ | 55,296 | |

Accounts receivable, less allowance for credit losses of $88 and $273, respectively | 2,259 | | | 3,283 | |

| Inventories, net | 11,795 | | | 28,556 | |

| Prepaid expenses and other current assets | 3,888 | | | 6,325 | |

| Prepaid income taxes | 340 | | | 188 | |

| Total current assets | 68,383 | | | 93,648 | |

| | | |

| Noncurrent assets: | | | |

| Property and equipment, net | 28,425 | | | 26,657 | |

| Intangible and other assets, net | 15,035 | | | 16,503 | |

| Goodwill | 26,658 | | | 26,658 | |

| Operating lease right-of-use assets | 1,077 | | | 1,432 | |

| Deferred tax assets, net | 5,217 | | | 4,986 | |

| Total noncurrent assets | 76,412 | | | 76,236 | |

| | | |

| Total assets | $ | 144,795 | | | $ | 169,884 | |

| | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| | | |

| Current liabilities: | | | |

| Accounts payable | $ | 10,945 | | | $ | 37,024 | |

| Sales tax payable | 24,483 | | | 25,012 | |

| Accrued expenses and other current liabilities | 10,922 | | | 7,060 | |

| Current operating lease liabilities | 453 | | | 459 | |

| Deferred revenue | 1,156 | | | 2,603 | |

| | | |

| Total current liabilities | 47,959 | | | 72,158 | |

| | | |

| | | |

| Operating lease liabilities, net of current lease liabilities | 652 | | | 995 | |

| | | |

| | | |

| Total liabilities | 48,611 | | | 73,153 | |

| | | |

| Commitments and contingencies (Note 7) | | | |

| | | |

| Shareholders' equity: | | | |

Preferred stock, $.001 par value, 5,100,000 shares and 5,000,000 authorized; 2,500 convertible shares issued and outstanding with a liquidation preference of $4 per share | 9 | | | 9 | |

Common stock, $.001 par value, 40,000,000 shares authorized; 20,656,457 and 21,148,692 shares issued and outstanding, respectively | 21 | | | 21 | |

| Additional paid-in capital | 17,967 | | | 25,146 | |

| Retained earnings | 78,187 | | | 71,555 | |

| | | |

| Total shareholders' equity | 96,184 | | | 96,731 | |

| | | |

| Total liabilities and shareholders' equity | $ | 144,795 | | | $ | 169,884 | |

PETMED EXPRESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for share and per share amounts) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Nine Months Ended

December 31, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | |

| Net sales | $ | 52,984 | | | $ | 65,317 | | | $ | 180,506 | | | $ | 214,560 | | | | | |

| Cost of sales | 38,075 | | | 47,434 | | | 130,315 | | | 154,089 | | | | | |

| | | | | | | | | | | |

| Gross profit | 14,909 | | | 17,883 | | | 50,191 | | | 60,471 | | | | | |

| | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | |

| General and administrative | 10,786 | | | 13,425 | | | 26,153 | | | 41,098 | | | | | |

| Advertising | 2,987 | | | 5,762 | | | 14,583 | | | 18,539 | | | | | |

| Depreciation and amortization | 1,586 | | | 1,770 | | | 4,965 | | | 5,161 | | | | | |

| Total operating expenses | 15,359 | | | 20,957 | | | 45,701 | | | 64,798 | | | | | |

| | | | | | | | | | | |

| (Loss) income from operations | (450) | | | (3,074) | | | 4,490 | | | (4,327) | | | | | |

| | | | | | | | | | | |

| Other income: | | | | | | | | | | | |

| Interest income, net | 28 | | | 136 | | | 308 | | | 481 | | | | | |

| Other, net | 180 | | | 293 | | | 597 | | | 1,053 | | | | | |

| Total other income | 208 | | | 429 | | | 905 | | | 1,534 | | | | | |

| | | | | | | | | | | |

| (Loss) income before provision (benefit) for income taxes | (242) | | | (2,645) | | | 5,395 | | | (2,793) | | | | | |

| | | | | | | | | | | |

| Provision (benefit) for income taxes | 465 | | | (618) | | | 22 | | | (345) | | | | | |

| | | | | | | | | | | |

| Net (loss) income | $ | (707) | | | $ | (2,027) | | | $ | 5,373 | | | $ | (2,448) | | | | | |

| | | | | | | | | | | |

| Net (loss) income per common share: | | | | | | | | | | | |

| Basic | $ | (0.03) | | | $ | (0.10) | | | $ | 0.26 | | | $ | (0.12) | | | | | |

| Diluted | $ | (0.03) | | | $ | (0.10) | | | $ | 0.26 | | | $ | (0.12) | | | | | |

| | | | | | | | | | | |

| Weighted average number of common shares outstanding: | | | | | | | | | | | |

| Basic | 20,634,651 | | 20,425,282 | | 20,581,913 | | 20,380,262 | | | | |

| Diluted | 20,634,651 | | 20,425,282 | | 20,987,260 | | 20,380,262 | | | | |

| | | | | | | | | | | |

| Cash dividends declared per common share | $ | — | | | $ | — | | | $ | — | | $ | — | | $ | 0.60 | | | | | |

PETMED EXPRESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

| | | | | | | | | | | |

| Nine Months Ended

December 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 5,373 | | | $ | (2,448) | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | |

| Depreciation and amortization | 4,965 | | | 5,161 | |

| Share based compensation | (7,179) | | | 5,196 | |

| Deferred income taxes | (231) | | | (436) | |

| Bad debt expense | 324 | | | 53 | |

| (Increase) decrease in operating assets and increase (decrease) in operating liabilities: | | | |

| Accounts receivable | 700 | | | (119) | |

| Inventories, net | 16,761 | | | (12,438) | |

| Prepaid income taxes | (152) | | | 65 | |

| Prepaid expenses and other current assets | 2,437 | | | (2,664) | |

| Operating lease right-of-use assets, net | 355 | | | 594 | |

| Accounts payable | (26,078) | | | 7,929 | |

| Sales tax payable | (529) | | | (1,942) | |

| Accrued expenses and other current liabilities | 2,756 | | | (1,258) | |

| Lease liabilities | (349) | | | (577) | |

| Deferred revenue | (1,447) | | | 75 | |

| | | |

| Net cash used in operating activities | $ | (2,294) | | | $ | (2,808) | |

| | | |

| Cash flows from investing activities: | | | |

| Purchase of minority interest investment in Vetster | — | | | (300) | |

| Acquisition of PetCareRx, net of cash acquired | — | | | (35,859) | |

| Purchases of property and equipment | (2,725) | | | (3,260) | |

| Net cash used in investing activities | $ | (2,725) | | | $ | (39,419) | |

| | | |

| Cash flows from financing activities: | | | |

| Dividends paid | (176) | | | (12,419) | |

| Net cash used in financing activities | $ | (176) | | | $ | (12,419) | |

| | | |

| Net decrease in cash and cash equivalents | (5,195) | | | (54,646) | |

| Cash and cash equivalents, at beginning of period | 55,296 | | | 104,086 | |

| | | |

| Cash and cash equivalents, at end of period | $ | 50,101 | | | $ | 49,440 | |

| | | |

| Supplemental disclosure of cash flow information: | | | |

| | | |

| Cash paid for income taxes | $ | 474 | | | $ | 43 | |

| | | |

| Dividends payable in accrued expenses and other current liabilities | $ | 32 | | | $ | 1,498 | |

| | | |

| Non-cash investing activity for PPE additions | $ | 2,539 | | | $ | — | |

Non-GAAP Financial Measures

To provide investors and the market with additional information regarding our financial results, we have disclosed (see below) adjusted EBITDA, a non-GAAP financial measure that we calculate as net income excluding share-based compensation expense; depreciation and amortization; income tax provision; interest income (expense); and other non-operational expenses. We have provided reconciliations below of adjusted EBITDA to net income, the most directly comparable GAAP financial measures.

We have included adjusted EBITDA, herein, because it is a key measure used by our management and Board of Directors to evaluate our operating performance, generate future operating plans, and make strategic decisions regarding the allocation of capital. In particular, the exclusion of certain expenses in calculating adjusted EBITDA facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and other expenses. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and Board of Directors.

We believe it is useful to exclude non-cash charges, such as share-based compensation expense, depreciation and amortization from our adjusted EBITDA because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude income tax provision and interest income (expense), as neither are components of our core business operations. We also believe that it is useful to exclude other expenses, including the investment banking fee related to the Vetster partnership, acquisition costs related to PetCareRx, employee severance and estimated state sales tax accrual as these items are not indicative of our ongoing operations. Adjusted EBITDA has limitations as a financial measure, and these non-GAAP measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future and adjusted EBITDA does not reflect capital expenditure requirements for such replacements or for new capital expenditures;

•Adjusted EBITDA does not reflect share-based compensation. Share-based compensation has been, and will continue to be for the foreseeable future, a material recurring expense in our business and an important part of our compensation strategy;

•Adjusted EBITDA does not reflect interest income (expense), net; or changes in, or cash requirements for, our working capital;

•Adjusted EBITDA does not reflect transaction related costs and other items which are either not representative of our underlying operations or are incremental costs that result from an actual or planned transaction and include litigation matters, integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems;

•Adjusted EBITDA does not reflect certain non-operating expenses including the employee severance which reduces cash available to us;

•Adjusted EBITDA does not reflect certain expenses including the estimated state sales tax accrual which reduces cash available to us.

•Other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces the measures usefulness as comparative measures.

Because of these and other limitations, adjusted EBITDA should only be considered as supplemental to, and alongside with other GAAP based financial performance measures, including various cash flow metrics, net income, net margin, and our other GAAP results.

The following table presents a reconciliation of net income, the most directly comparable GAAP measure to adjusted EBITDA for each of the periods indicated:

Reconciliation of Non-GAAP Measures

PetMed Express, Inc.

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Increase (Decrease) |

| ($ in thousands, except percentages) | December 31,

2024 | | December 31,

2023 | | $ | | % |

| | | | |

| |

|

Consolidated Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA: |

| | | | |

| |

|

| Net loss | $ | (707) | | | $ | (2,027) | | | $ | 1,320 | | | (65) | % |

| | | | | | | |

| Add (subtract): | | | | | | | |

| Stock-based Compensation | $ | 452 | | | $ | 1,708 | | | $ | (1,256) | | | (74) | % |

| Income Taxes | $ | 465 | | | $ | (618) | | | $ | 1,083 | | | (175) | % |

| Depreciation and Amortization | $ | 1,586 | | | $ | 1,770 | | | $ | (184) | | | (10) | % |

Interest Income, Net (1) | $ | (28) | | | $ | (136) | | | $ | 108 | | | (79) | % |

| Acquisition/Partnership Transactions and Other Items | $ | 25 | | | $ | — | | | $ | 25 | | | n/m |

| Employee Severance | $ | 209 | | | $ | — | | | $ | 209 | | | n/m |

| Sales Tax Expense | $ | — | | | $ | 228 | | | $ | (228) | | | (100) | % |

| | | | | | | |

| Adjusted EBITDA | $ | 2,002 | | | $ | 925 | | | $ | 1,077 | | | 116 | % |

| | | | | | | |

(1) Included in interest income, net is $0.4 million of interest expense related to the sales tax liability and $0.5 million of interest income for the three months ended December 31, 2024. This compares to $0.4 million of interest expense related to the sales tax liability and $0.6 million of interest income for the three months ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | | Increase (Decrease) |

| ($ in thousands, except percentages) | December 31,

2024 | | December 31,

2023 | | $ | | % |

|

| |

| |

| |

|

Consolidated Reconciliation of GAAP Net Income to Adjusted EBITDA: |

|

| |

| |

| |

|

| Net income (loss) | $ | 5,373 | | | $ | (2,448) | | | $ | 7,821 | | | n/m |

| | | | | | | |

| Add (subtract): | | | | | | | |

| Stock-based Compensation | $ | (7,179) | | | $ | 5,196 | | | $ | (12,375) | | | n/m |

| Income Taxes | $ | 22 | | | $ | (345) | | | $ | 367 | | | n/m |

| Depreciation and Amortization | $ | 4,965 | | | $ | 5,161 | | | $ | (196) | | | (4) | % |

| Interest Income, Net (1) | $ | (308) | | | $ | (481) | | | $ | 173 | | | (36) | % |

| Acquisition/Partnership Transactions and Other Items | $ | 205 | | | $ | 1,294 | | | $ | (1,089) | | | (84) | % |

| Employee Severance | $ | 663 | | | $ | 408 | | | $ | 255 | | | 63 | % |

| Sales Tax (Income) | $ | (1,178) | | | $ | (1,088) | | | $ | (90) | | | 8 | % |

| | | | | | | |

| Adjusted EBITDA | $ | 2,563 | | | $ | 7,697 | | | $ | (5,134) | | | (67) | % |

(1) Included in interest income, net is $1.2 million of interest expense related to the sales tax liability and $1.5 million of interest income for the nine months ended December 31, 2024. This compares to $1.3 million of interest expense related to the sales tax liability and $1.7 million of interest income for the nine months ended December 31, 2023.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

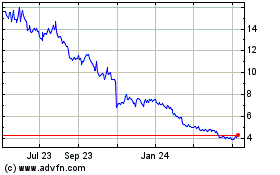

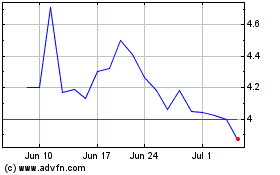

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Feb 2025 to Mar 2025

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Mar 2024 to Mar 2025