OceanPal Inc. Reports Financial Results for the First Quarter Ended March 31, 2023

June 13 2023 - 9:10AM

OceanPal Inc. (NASDAQ: OP) (the “Company”), a global shipping

company specializing in the ownership of vessels, today reported

net income of $88 thousand and net loss attributed to common

stockholders of $472 thousand for the first quarter of 2023. Time

charter revenues for the same period were $3.9 million. This

compares to net income of $414 thousand and net loss attributed to

common stockholders of $510 thousand for the first quarter of 2022.

Time charter revenues for the same period were $3.7 million.

| |

Fleet Employment Profile (As of June 12,

2023) |

| |

OceanPal Inc.’s fleet is employed as follows: |

|

|

VesselBUILT DWT |

Sister Ships* |

Gross Rate (USD/Day) |

Com** |

Charterers |

Delivery Date to Charterers*** |

Redelivery Date to Owners**** |

Notes |

| |

|

|

|

|

|

|

|

|

| |

3 Panamax Bulk Carriers |

|

1 |

PROTEFS |

A |

$7,000 |

5.00% |

GUO LONG XIANG LIMITED |

18-Dec-22 |

24-Jan-23 |

|

|

|

2004 73,630 |

$11,640 |

5.00% |

LOUIS DREYFUS COMPANY FREIGHT ASIA PTE LTD |

24-Jan-23 |

30-May-23 |

1 |

|

|

|

$7,000 |

5.00% |

REFINED SUCCESS LIMITED |

30-May-23 |

29-Jun-23 - 3-Aug-23 |

|

|

2 |

CALIPSO |

A |

$15,250 |

5.00% |

Al Ghurair Resources International LLC |

03-Nov-22 |

25-Jan-23 |

|

|

|

2005 73,691 |

$8,000 |

5.00% |

NORVIC SHIPPING ASIA PTE. LTD. |

26-Jan-23 |

02-Mar-23 |

2 |

|

|

|

$11,000 |

5.00% |

LIANYI SHIPPING LIMITED |

26-Mar-23 |

26-Apr-23 |

|

|

|

|

$11,000 |

5.00% |

CAMBRIAN BULK LIMITED |

26-Apr-23 |

07-Jun-23 |

|

|

|

|

$6,250 |

5.00% |

ORIENTAL PAL SHIPPING PTE., LTD |

07-Jun-23 |

07-Jul-23 - 12-Jul-23 |

3 |

|

3 |

MELIA |

|

$6,300 |

5.00% |

GUO LONG XIANG LIMITED |

10-Feb-23 |

18-Mar-23 |

|

|

|

2005 76,225 |

|

$13,800 |

5.00% |

TRANSPOWER MARINE PTE. LTD. |

18-Mar-23 |

09-Apr-23 |

|

|

|

|

|

$14,000 |

5.00% |

LOUIS DREYFUS COMPANY FREIGHT ASIA PTE LTD |

09-Apr-23 |

07-Aug-23 - 24-Oct-23 |

|

|

|

2 Capesize Bulk Carriers |

|

4 |

SALT LAKE CITY |

|

$10,000 |

5.00% |

Oldendorff GmbH & Co. KG |

20-Dec-22 |

26-Feb-23 |

|

|

|

2005 171,810 |

|

$5,100 |

5.00% |

RICHLAND BULK PTE. LTD. |

26-Feb-23 |

24-Apr-23 |

|

|

|

|

|

$15,400 |

5.00% |

PACBULK SHIPPING PTE. LTD. |

24-Apr-23 |

23-Jun-23 - 29-Jul-23 |

|

|

5 |

BALTIMORE |

|

$12,900 |

5.00% |

Enesel Bulk Logistics DMCC |

03-Nov-22 |

07-Feb-23 |

|

|

|

2005 177,243 |

|

$13,300 |

5.00% |

Koch Shipping Pte. LTD., Singapore |

08-Feb-23 |

08-Jul-23 - 23-Oct-23 |

|

|

|

| * Each dry bulk

carrier is a “sister ship”, or closely similar, to other dry bulk

carriers that have the same letter. |

| ** Total commission

percentage paid to third parties. |

| *** In case of

newly acquired vessel with new time charter attached, this date

refers to the expected/actual date of delivery of the vessel to the

Company. |

| **** Range of

redelivery dates, with the actual date of redelivery being at the

Charterers’ option, but subject to the terms, conditions, and

exceptions of the particular charterparty. |

| 1 The charter rate

is US$5,500 per day for the first 32 days of the charter

period. |

| 2 Vessel on

scheduled drydocking from March 05, 2023 to March 22, 2023. |

| 3 Redelivery date

based on an estimated time charter trip duration of about 30-35

days. |

|

Summary of Selected Financial & Other

Data |

|

|

|

|

Three months

ended March 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

STATEMENT OF OPERATIONS DATA (in thousands of US

Dollars) |

|

|

Time charter revenues |

$ |

3,888 |

|

|

$ |

3,680 |

|

|

|

Voyage expenses |

|

572 |

|

|

|

207 |

|

|

|

Vessel operating expenses |

|

2,551 |

|

|

|

1,285 |

|

|

|

Net income and comprehensive income |

|

88 |

|

|

|

414 |

|

|

|

Net loss attributed to common stockholders |

|

(472 |

) |

|

|

(510 |

) |

|

FLEET DATA |

|

| |

Average number of vessels |

|

4.6 |

|

|

|

3.0 |

|

| |

Number of vessels |

|

5.0 |

|

|

|

3.0 |

|

| |

Weighted average age of vessels |

|

18.0 |

|

|

|

16.9 |

|

| |

Ownership days |

|

412 |

|

|

|

270 |

|

| |

Available days |

|

392 |

|

|

|

270 |

|

| |

Operating days |

|

385 |

|

|

|

257 |

|

| |

Fleet utilization |

|

98.2 |

% |

|

|

95.1 |

% |

|

AVERAGE DAILY RESULTS (in US Dollars) |

| |

Time charter equivalent (TCE) rate (1) |

$ |

8,459 |

|

|

$ |

12,863 |

|

| |

Daily vessel operating expenses (2) |

$ |

6,192 |

|

|

$ |

4,759 |

|

| |

|

|

|

|

|

|

|

|

Non-GAAP Measures

|

(1) |

|

Time charter equivalent rates, or TCE rates, are defined as our

time charter revenues less voyage expenses during a period divided

by the number of our Available days during the period, which is

consistent with industry standards. Voyage expenses include port

charges, bunker (fuel) expenses, canal charges and commissions. TCE

is a non-GAAP measure. TCE rate is a standard shipping industry

performance measure used primarily to compare daily earnings

generated by vessels on time charters with daily earnings generated

by vessels on voyage charters, because charter hire rates for

vessels on voyage charters are generally not expressed in per day

amounts while charter hire rates for vessels on time charters are

generally expressed in such amounts. |

| |

|

|

| (2) |

|

Daily vessel operating expenses, which include crew wages and

related costs, the cost of insurance, expenses relating to repairs

and maintenance, the costs of spares and consumable stores, tonnage

taxes and other miscellaneous expenses, are calculated by dividing

vessel operating expenses by ownership days for the relevant

period. |

| |

|

|

About the Company

OceanPal Inc. is a global provider of shipping

transportation services through its ownership of vessels. The

Company’s vessels currently transport a range of dry bulk cargoes,

including such commodities as iron ore, coal, grain and other

materials along worldwide shipping routes and it is expected that

the Company’s vessels will be primarily employed on short term time

and voyage charters following the completion of their current

employments.

Forward Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements.

The Company desires to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and is including this cautionary statement in

connection with this safe harbor legislation. The words “believe,”

“anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,”

“potential,” “may,” “should,” “expect,” “pending” and similar

expressions identify forward-looking statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, Company management’s examination of historical

operating trends, data contained in the Company’s records and other

data available from third parties. Although the Company believes

that these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies that are difficult or impossible to predict and are

beyond the Company’s control, the Company cannot assure you that it

will achieve or accomplish these expectations, beliefs or

projections.

In addition to these important factors, other

important factors that, in the Company’s view, could cause actual

results to differ materially from those discussed in the

forward-looking statements include the continuing impacts of the

COVID-19 pandemic, the strength of world economies and currencies,

general market conditions, including fluctuations in charter rates

and vessel values, changes in demand for dry bulk shipping

capacity, changes in the Company’s operating expenses, including

bunker prices, drydocking and insurance costs, the market for the

Company’s vessels, availability of financing and refinancing,

changes in governmental rules and regulations or actions taken by

regulatory authorities, potential liability from pending or future

litigation, general domestic and international political

conditions, including risks associated with the continuing conflict

between Russia and Ukraine and related sanctions, potential

disruption of shipping routes due to accidents or political events,

vessel breakdowns and instances of off-hires and other factors.

Please see the Company’s filings with the U.S. Securities and

Exchange Commission for a more complete discussion of these and

other risks and uncertainties. The Company undertakes no obligation

to revise or update any forward-looking statement, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

(See financial tables attached)

|

OCEANPAL INC. |

|

|

|

|

|

|

FINANCIAL TABLES |

|

|

|

|

|

| Expressed in

thousands of U.S. Dollars, except share and per share data |

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME/(LOSS) |

|

|

| |

Three months

ended March 31, |

| |

|

2023 |

|

|

2022 |

| |

|

(unaudited) |

|

|

(unaudited) |

|

REVENUES: |

|

|

|

|

|

|

Time charter revenues |

$ |

3,888 |

|

|

$ |

3,680 |

|

|

EXPENSES: |

|

|

|

|

|

| Voyage

expenses |

|

572 |

|

|

|

207 |

|

| Vessel

operating expenses |

|

2,551 |

|

|

|

1,285 |

|

| Depreciation

and amortization of deferred charges |

|

1,893 |

|

|

|

1,006 |

|

| General and

administrative expenses |

|

1,225 |

|

|

|

558 |

|

| Management

fees to related parties |

|

291 |

|

|

|

210 |

|

| Other

operating loss |

|

3 |

|

|

|

- |

|

|

Operating (loss)/income |

$ |

(2,647 |

) |

|

$ |

414 |

|

| Change in

fair value of warrant liability |

|

3,578 |

|

|

|

- |

|

| Finance

costs |

|

(911 |

) |

|

|

- |

|

| Interest

income |

|

68 |

|

|

|

- |

|

| Net

income and comprehensive income |

$ |

88 |

|

|

$ |

414 |

|

| Less:

Dividends on series C preferred shares |

|

(269 |

) |

|

|

(200 |

) |

| Less:

Dividends on series D preferred shares |

|

(291 |

) |

|

|

- |

|

| Less:

Dividends on class A warrants |

|

- |

|

|

|

(724 |

) |

| Net

loss attributed to common stockholders |

$ |

(472 |

) |

|

$ |

(510 |

) |

| Loss

per common share, basic* |

$ |

(0.51 |

) |

|

$ |

(4.74 |

) |

| Loss

per common share, diluted* |

$ |

(0.51 |

) |

|

$ |

(4.74 |

) |

|

Weighted average number of common shares,

basic* |

|

925,866 |

|

|

|

107,536 |

|

|

Weighted average number of common shares,

diluted* |

|

925,866 |

|

|

|

107,536 |

|

* Financial information adjusted to give effect

to the 1-for-10 and the 1-for-20 reverse stock splits that

became effective on December 22, 2022, and June 8, 2023,

respectively.

| |

| CONDENSED

CONSOLIDATED BALANCE SHEET DATA |

|

(in thousands of U.S. Dollars) |

|

|

|

|

March 31, 2023 |

|

|

December 31, 2022** |

|

ASSETS |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

18,357 |

|

$ |

8,454 |

|

Other current assets |

|

4,637 |

|

|

5,717 |

|

Vessels, net |

|

75,923 |

|

|

63,672 |

|

Other non-current assets |

|

1,271 |

|

|

1,175 |

|

Total assets |

$ |

100,188 |

|

$ |

79,018 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

$ |

6,938 |

|

$ |

2,459 |

|

Total stockholders' equity |

|

93,250 |

|

|

76,559 |

|

Total liabilities and stockholders' equity |

$ |

100,188 |

|

$ |

79,018 |

**The balance sheet data have been derived from

the audited consolidated financial statements at that date.

| |

| OTHER

FINANCIAL DATA (unaudited) |

|

|

|

|

|

|

Three months ended March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

Net cash (used in)/provided by operating activities |

$ |

(265 |

) |

|

$ |

2,012 |

|

|

Net cash used in investing activities |

$ |

(4,057 |

) |

|

$ |

- |

|

|

Net cash provided by financing activities |

$ |

14,225 |

|

|

$ |

14,626 |

Corporate Contact:

Margarita Veniou

Chief Corporate Development & Governance Officer

and Secretary

Telephone: +30-210-9485-360

Email:mveniou@oceanpal.com

Website:www.oceanpal.com

Twitter:@OceanPal_Inc

Investor and Media Relations:

Edward Nebb

Comm-Counsellors, LLC

Telephone: + 1-203-972-8350

Email:enebb@optonline.net

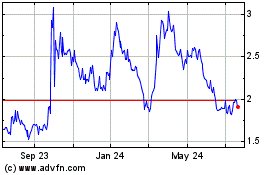

OceanPal (NASDAQ:OP)

Historical Stock Chart

From Jun 2024 to Jul 2024

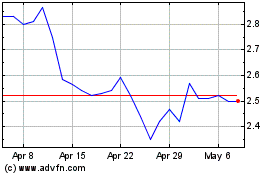

OceanPal (NASDAQ:OP)

Historical Stock Chart

From Jul 2023 to Jul 2024