- Introduces 2025 full year revenue guidance of $180 million to

$200 million, a 17% increase in revenue growth over 2024, and core

adjusted earnings per diluted share of $6.00 to $6.25

- Twelve commercial-stage programs and late-stage pipeline are

expected to drive strong revenue growth over the next five

years

- Long-term royalty receipts expected to deliver at least a 22%

compound annual growth rate

Ligand Pharmaceuticals Incorporated (Nasdaq: LGND) will host its

Investor and Analyst Day in Boston today. The event will feature

presentations from Ligand CEO Todd Davis, CFO Tavo Espinoza, and

other members of the senior management team who will provide an

in-depth review of the company’s growth strategy, portfolio,

platform technologies, and long-term financial outlook.

“2023 marked the beginning of a new chapter in Ligand's history,

and I could not be prouder of our team and their incredible

accomplishments over the past two years. We set ambitious yet

attainable goals, and I am confident that we have the right people,

processes, and infrastructure in place to continue executing our

strategy. We are focused on investing in highly differentiated

assets and operating royalty-generating platform technologies that

we believe will generate significant long-term shareholder value,”

said Todd Davis, CEO of Ligand.

At today’s event, Ligand’s senior management team will

highlight:

- Ligand’s transformation over the past two years into a

profitable, diversified, and infrastructure light organization that

enables investors to participate in the innovation and promise of

the biotech industry while avoiding concentrated binary risk

- The company’s robust financial performance in 2024, driven by

an expected 27% increase in full year royalty revenue and a 38%

increase in full year core adjusted earnings per diluted share;

Ligand increased guidance twice this year based on the strength of

new and existing commercial-stage assets

- Filspari (Travere Therapeutics), Capvaxive (Merck), Ohtuvayre

(Verona Pharma plc), Qarziba (Recordati S.p.A.), and Veklury

(Gilead Sciences, Inc.) as key drivers of royalty revenue growth in

2025

- Ligand has had the most active dealmaking years in its recent

history, deploying $192 million across eight investments, and is

currently evaluating more than $1 billion in actionable

opportunities

- The company’s royalty-generating technology platforms—Captisol®

and NITRICIL™— that Ligand believes offer broad applicability and

significant revenue growth

Financial Overview and Outlook

Today, Ligand will reiterate its 2024 guidance outlined in

November:

- Total revenue of $160 million to $165 million comprised of $105

million to $108 million in royalty revenue, $27 million to $29

million of Captisol sales, and $28 million of contract

revenue1

- Core adjusted earnings per diluted share of $5.50 to $5.70

Ligand will also introduce its 2025 guidance:

- Total revenue of $180 million to $200 million, comprised of

$135 million to $140 million in royalty revenue, $35 million to $40

million of Captisol sales, and $10 million to $20 million of

contract revenue

- Core adjusted earnings per diluted share of $6.00 to $6.25

Ligand will also provide an updated 5-year outlook:

- Long–term royalty receipts expected to deliver at least a 22%

compound annual growth rate (CAGR)

- Existing commercial programs and late-stage pipeline (“Pharm

Team”) support royalty revenue CAGR of 18%

- Total royalty receipts of approximately $285 million in

2029

Event Webcast

The event will be broadcast live starting at 10:30 a.m. Eastern

Time. The webcast and today’s presentation can be accessed at:

https://investor.ligand.com/news-and-events/events-and-presentations/default.aspx.

A replay of the webcast will be available on the website after the

event.

Adjusted Financial Measures

Ligand reports adjusted net income and adjusted net income per

diluted share in addition to, and not as a substitute for, or

superior to, financial measures calculated in accordance with GAAP.

The company’s financial measures under GAAP include share-based

compensation expense, amortization of debt-related costs,

amortization related to acquisitions and intangible assets,

amortization of financial royalty assets, changes in contingent

liabilities, mark-to-market adjustments for amounts relating to its

equity investments in public companies, excess tax benefit from

share-based compensation, Pelthos operating loss, impairment of

financial royalty assets, loss from equity method investment in

Primrose Bio, income tax effect of adjusted reconciling items and

others that are listed in the itemized reconciliations between GAAP

and adjusted financial measures included in its prior earnings

releases. A reconciliation of forward-looking non-GAAP core

adjusted earnings per diluted share to the most directly comparable

GAAP measures is not available without unreasonable effort, as

certain items cannot be reasonably predicted because of their high

variability, complexity and low visibility. Specifically, non-cash

adjustments that could be made for changes in contingent

liabilities, changes in the market value of its investments in

public companies, share-based compensation expense and the effects

of any discrete income tax items, directly impact the calculations

of our core adjusted earnings per diluted share, which we expect to

have a significant impact on our future GAAP financial results.

About Ligand Pharmaceuticals

Ligand is a biopharmaceutical company enabling scientific

advancement through supporting the clinical development of

high-value medicines. Ligand does this by providing financing,

licensing our technologies or both. Its business model seeks to

generate value for stockholders by creating a diversified portfolio

of biopharmaceutical product revenue streams that are supported by

an efficient and low corporate cost structure. Ligand’s goal is to

offer investors an opportunity to participate in the promise of the

biotech industry in a profitable and diversified manner. Its

business model focuses on funding programs in mid- to late-stage

drug development in return for economic rights, purchasing royalty

rights in development stage or commercial biopharmaceutical

products and licensing its technology to help partners discover and

develop medicines. Ligand partners with other pharmaceutical

companies to leverage what they do best (late-stage development,

regulatory management and commercialization) in order to generate

its revenue. Ligand’s Captisol® platform technology is a chemically

modified cyclodextrin with a structure designed to optimize the

solubility and stability of drugs. Ligand has established multiple

alliances, licenses and other business relationships with the

world’s leading biopharmaceutical companies including Amgen, Merck,

Pfizer, Jazz, Takeda, Gilead Sciences, and Baxter International.

For more information, please visit www.ligand.com. Follow Ligand on

X @Ligand_LGND.

We use our investor relations website and X as a means of

disclosing material non-public information and for complying with

our disclosure obligations under Regulation FD. Investors should

monitor our website and our X account, in addition to following our

press releases, SEC filings, public conference calls and

webcasts.

Forward-Looking Statements

This news release contains forward-looking statements, as

defined in Section 21E of the Securities Exchange Act of 1934, by

Ligand that involve risks and uncertainties and reflect Ligand's

judgment as of the date of this release. All statements, other than

statements of historical fact, could be deemed to be

forward-looking statements. In some instances, words such as

“plans,” “believes,” “expects,” “anticipates,” and “will,” and

similar expressions, are intended to identify forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which reflect our good faith

beliefs (or those of the indicated third parties) and speak only as

of the date hereof. These forward-looking statements include,

without limitation, statements regarding the outlook or guidance

regarding the final 2024 financial results and expectations for

near-term and future revenue and expenses, and the breakdown of

such revenue, growth in revenue and adjusted earnings; outlooks or

guidance regarding the financial results and guidance for fiscal

2025 as well as potential growth over the next five years;

statements regarding market position and competition for royalty

transactions; expectations regarding internal and partners’

research and development programs, including the timing of the

initiation or completion of clinical trials, the potential for and

timing of regulatory approval and product launch by Ligand and its

partners; expectations regarding future sales of products by

Ligand's partners and the durability of Ligand's royalties; the

ability for current and future technology platforms to generate

license deals and royalties; Ligand's strategy to deploy capital

including the size of the potential pipeline of transactions; and

anticipated near-term milestones. Actual events or results may

differ from Ligand's expectations due to risks and uncertainties

inherent in Ligand’s business, including, without limitation: the

inherent risks of clinical development and regulatory approval of

product candidates, including that the total addressable market for

our partner’s products may be smaller than estimated; Ligand faces

competition including with respect to royalty acquisition

transactions, which may result in fewer transactions projected or

may increase the cost of acquiring new programs, and our technology

platforms, which may demonstrate greater market acceptance or

superiority; partnered commercial products may not perform as

expected; Ligand relies on collaborative partners for milestone

payments, royalties, materials revenue, contract payments and other

revenue projections; the possibility that Ligand’s and its

partners’ drug candidates might not be proved to be safe and

efficacious and FDA may not agree with our or our partners’

conclusions regarding the results of clinical trials; uncertainty

regarding the commercial performance of Ligand’s and/or its

partners’ products; Ligand may not achieve its guidance for 2024,

2025 or beyond; disruption to Ligand's and its partners' business,

including delaying manufacturing, preclinical studies and clinical

trials and product sales, and impairing global economic activity,

all of which could materially and adversely impact Ligand's results

of operations and financial condition; changes in general economic

conditions, including as a result of geopolitical events (including

the U.S. 2024 presidential and congressional elections); there may

not be a market for the product(s) even if successfully developed

and approved; Ligand is currently dependent on a sole supplier for

Captisol® and failures by such supplier may result in delays or

inability to meet the Captisol demands of its partners; Ligand's

partners may terminate their agreements in certain circumstances or

discontinue development or commercialization of any of their

products; Ligand or its partners may not be able to protect their

intellectual property and patents covering certain products and

technologies may be challenged or invalidated; and ongoing or

future litigation could expose Ligand to significant liabilities

and have a material adverse effect on the company; and other risks

and uncertainties described in its public filings with the

Securities and Exchange Commission, available at www.sec.gov. The

failure to meet expectations with respect to any of the foregoing

matters may reduce Ligand's stock price. Ligand disclaims any

intent or obligation to update these forward-looking statements

beyond the date of this release, including the possibility of

additional license fees and milestone revenues we may receive. This

caution is made under the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995.

Information regarding partnered products and programs comes from

information publicly released by Ligand partners. Ligand’s

trademarks, trade names, and service marks referenced herein

include Ligand and Captisol. Each other trademark, trade name or

service mark appearing in this press release belongs to its

owner.

1 2024 guidance excludes the $60 million realized gain from

short-term investments on the sale of Viking Therapeutics

stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210440572/en/

Investors: Melanie Herman investors@ligand.com (858)

550-7761

Media: Kellie Walsh media@ligand.com (914) 315-6072

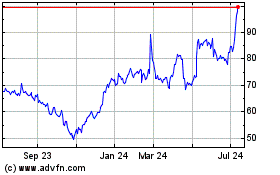

Ligand Pharmaceuticals (NASDAQ:LGND)

Historical Stock Chart

From Jan 2025 to Feb 2025

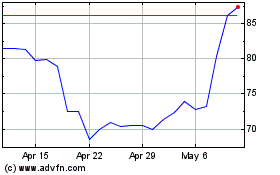

Ligand Pharmaceuticals (NASDAQ:LGND)

Historical Stock Chart

From Feb 2024 to Feb 2025