false

0001681903

0001681903

2025-03-12

2025-03-12

--12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): March 12, 2025

ICC Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Pennsylvania |

1-68190 |

81-3359049 |

| (State or other jurisdiction of |

(Commission |

(IRS Employer |

| incorporation or organization) |

File No.) |

Identification No.) |

| 225 20th Street |

|

| Rock Island, Illinois |

61201 |

| (Address of principal executive offices) |

(Zip Code) |

(309) 793-1700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General InstructionA.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the SecuritiesAct (17 CFR 230.425)

|

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the ExchangeAct (17 CFR 240.14a- 12)

|

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the ExchangeAct (17 CFR 240.14d-2(b))

|

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the ExchangeAct (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of theAct:

| Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which registered |

| Common Stock, par value $0.01 per share |

|

ICCH |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the SecuritiesAct of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities ExchangeAct of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the ExchangeAct. ☐

Introductory Note.

This Current Report on Form 8-K is being filed in connection with the completion on March 13, 2025 (such date, the “Closing Date”) of the previously announced transactions contemplated by that certainAgreement and Plan of Merger (as amended, the “MergerAgreement”), dated as of June 8, 2024, by and among Mutual Capital Holdings, Inc., a Pennsylvania corporation (“MCH”), ICC Holdings, Inc., a Pennsylvania corporation (“ICCH”), and Mutual Capital Merger Sub, Inc., a Pennsylvania corporation and wholly owned subsidiary of MCH (“Merger Sub”).

|

Item 2.01.

|

Completion ofAcquisition or Disposition ofAssets.

|

Pursuant to the MergerAgreement, on the Closing Date, Merger Sub merged with and into ICCH (the “Merger”), with ICCH surviving the Merger as a wholly owned subsidiary of MCH (the “Surviving Entity”).

Pursuant to the MergerAgreement, at the effective time of the Merger (the “Effective Time”), each share of common stock, par value $0.01 per share, of ICCH (“ICCH Common Stock”) issued and outstanding immediately prior to the Effective Time, other than certain shares held by ICCH, was converted into the right to receive $23.50 in cash (the “Merger Consideration”).

Upon the terms and subject to the conditions set forth in the MergerAgreement, at the Effective Time, each restricted stock unit of ICCH that was outstanding immediately prior to the Effective Time became fully vested and was cancelled and converted automatically into the right to receive the Merger Consideration, less any required payroll and withholding taxes.

The foregoing description of the Merger and the MergerAgreement does not purport to be complete and is qualified in its entirety by reference to the full text of the MergerAgreement, a copy of which are filed hereto as Exhibits 2.1, 2.2, 2.3 and 2.4 and incorporated herein by reference.

The total aggregate consideration payable in the Merger was approximately $73.8 million in cash. The proxy statement, dated October 28, 2024, mailed to ICCH’s shareholders contains additional information about the MergerAgreement and the transactions contemplated thereby.

The information set forth in the Introductory Note is incorporated by reference into this Item 2.01.

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On March 12, 2025, The NASDAQ Stock Market LLC (“NASDAQ”) was notified that the Merger would be effective as of March 13, 2025, and it was requested that NASDAQ (1) suspend trading of ICCH Common Stock after the close of trading on March 12, 2025, (2) withdraw ICCH Common Stock from listing on NASDAQ prior to the open of trading on March 13, 2025, and (3) file with the Securities and Exchange Commission (the “SEC”) a notification of delisting of ICCH Common Stock under Section 12(b) of the Securities ExchangeAct of 1934, as amended (the “ExchangeAct”). As a result, ICCH Common Stock are no longer listed on NASDAQ.

In furtherance of the foregoing, ICCH intends to file with the SEC certifications on Form 15 under the ExchangeAct requesting the deregistration of ICCH Common Stock under Section 12(g) of the ExchangeAct, and the corresponding immediate suspension of ICCH’s reporting obligations under Sections 13 and 15(d) of the ExchangeAct as promptly as practicable, and to cease filing any further periodic reports with respect to ICCH.

The information set forth in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

|

Item 3.03.

|

Material Modifications to Rights of Security Holders.

|

As set forth under Item 2.01 of this Current Report on Form 8-K, at the Effective Time, each holder of ICCH Common Stock immediately prior to the Effective Time ceased to have any rights with respect thereto, except the right to receive the Merger Consideration as described above and subject to the terms and conditions set forth in the MergerAgreement.

The information set forth in the Introductory Note and under Items 2.01, 3.01, 5.01 and 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

|

Item 5.01.

|

Changes in Control of Registrant.

|

Pursuant to the MergerAgreement, at the Effective Time, ICCH was merged with and into Merger Sub, with ICCH surviving the Merger as a wholly owned subsidiary of MCH.

The information set forth in the Introductory Note and under Items 2.01, 3.01, 3.03 and 5.02 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors;Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

As of the Effective Time, and pursuant to the terms of the MergerAgreement, each of James Dingman, Joel Heriford, Daniel Portes, Christine Schmitt, and Mark Schwab ceased serving as directors of ICCH.

|

Item 5.03.

|

Amendments toArticles of Incorporation.

|

At the Effective Time, ICCH’s articles of incorporation and bylaws were amended and restated to be in the form of (except with respect to the name of ICCH) the articles of incorporation and the bylaws of Merger Sub, and as so amended became the articles of incorporation (the “Amended and Restated Articles of Incorporation”) and the bylaws (the “Amended and Restated Bylaws”) of the Surviving Entity. Copies of the Amended and RestatedArticles of Incorporation and the Amended and Restated Bylaws are filed as Exhibits 3.1 and 3.2 of this Current Report on Form 8-K, respectively, and are incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

No.

|

|

Description |

| 2.1 |

|

Agreement and Plan of Merger, dated as of June 8, 2024, among Mutual Capital Holdings, Inc., Mutual Capital Merger Sub, Inc., and ICC Holdings, Inc. (incorporated by reference to Exhibit 2.1 to ICCH’s Current Report on Form 8-K filed with the SEC on June 10, 2024).* |

| |

|

|

| 2.2 |

|

Amendment to Merger Agreement, dated as of October 11, 2024, among Mutual Capital Holdings, Inc., Mutual Capital Merger Sub, Inc. and ICC Holdings, Inc. (incorporated by reference to Exhibit 2.2 to ICCH’s Current Report on Form 8-K filed with the SEC on October 16, 2024). |

| |

|

|

| 2.3 |

|

Second Amendment to Merger Agreement, dated as of December 31, 2024, among Mutual Capital Holdings, Inc., Mutual Capital Merger Sub, Inc. and ICC Holdings, Inc. (incorporated by reference to Exhibit 2.3 to ICCH’s Current Report on Form 8-K filed with the SEC on December 31, 2024). |

| |

|

|

| 2.4 |

|

Third Amendment to Merger Agreement, dated as of January 31, 2025, among Mutual Capital Holdings, Inc., Mutual Capital Merger Sub, Inc. and ICC Holdings, Inc. (incorporated by reference to Exhibit 2.4 to ICCH’s Current Report on Form 8-K filed with the SEC on January 31, 2025). |

| |

|

|

| 3.1 |

|

Amended and Restated Articles of Incorporation of ICC Holdings, Inc. |

| |

|

|

| 3.2 |

|

Amended and Restated Bylaws of ICC Holdings, Inc. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted as inline XBRL document) |

* Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules and similar attachments have been omitted. The registrant hereby agrees to furnish supplementally a copy of any omitted schedule or similar attachment to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities ExchangeAct of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ICC HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Arron K. Sutherland

|

|

|

|

Name:

|

Arron K. Sutherland

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

Date: March 17, 2025

Exhibit 3.1

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

ICC Holdings, Inc.

The Articles of Incorporation of ICC Holdings, Inc., a Pennsylvania business corporation, are hereby amended and restated to read in their entirety as follows:

FIRST: The name of the corporation is: ICC Holdings, Inc. (the “Corporation”).

SECOND: The location and address of the Corporation’s registered office in this Commonwealth of Pennsylvania and the county of venue is 41908 Route 6, PO Box 7, Wyalusing, Bradford County, Pennsylvania 18853.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the Pennsylvania Business Corporation Law of 1988, as amended, (15 Pa. C.S. §§ 1101, et seq.) (the “Business Corporation Law”).

FOURTH: The total number of shares of stock which the Corporation shall have the authority to issue is 100 shares of common stock.

FIFTH: These Amended and Restated Articles of Incorporation shall be effective upon filing.

SIXTH: These Amended and Restated Articles of Incorporation were adopted by the Board of Directors of the Corporation pursuant to 15 Pa.C.S. §1914(c.1).

IN WITNESS WHEREOF, ICC Holdings, Inc. caused these Amended and Restated Articles of Incorporation to be executed in its name by its duly authorized officer as of March 13, 2025.

|

|

|

/s/ Arron K. Sutherland

|

|

|

|

|

Name: Arron K. Sutherland

|

|

|

|

|

Title: President and Chief Executive Officer

|

|

Exhibit 3.2

BYLAWS

OF

ICC HOLDINGS, INC.

ARTICLE I

OFFICES AND RECORDS

Section 1.1. REGISTERED OFFICE. The registered office of the Corporation shall be located within the Commonwealth of Pennsylvania as set forth in the Corporation’s Articles of Incorporation. The Board of Directors may at any time change the registered office by making the appropriate filing with the Secretary of the Commonwealth as provided by the Pennsylvania Business Corporation Law of 1988 (the “BCL”).

Section 1.2. PRINCIPAL PLACE OF BUSINESS AND OTHER OFFICES. The principal place of business of the Corporation may be designated by Board of Directors within or without the Commonwealth of Pennsylvania, and may be changed at any time by the Board of Directors. The Corporation may also have other offices at any places, within or without the Commonwealth of Pennsylvania, as the Board of Directors may designate, as the business of the Corporation may require, or as may be desirable.

Section 1.3. BOOKS AND RECORDS. Any records maintained by the Corporation in the regular course of its business, including its share ledger, books of account, and minute books, may be maintained on any information storage device or method; provided that the records so kept can be converted into clearly legible paper form within a reasonable time. The Corporation shall so convert any records so kept upon the request of any person entitled to inspect such records pursuant to applicable law.

ARTICLE II

SHAREHOLDERS

Section 2.1. PLACE OF MEETING. Meetings of the shareholders may be held at any place, either within or without the Commonwealth of Pennsylvania, as shall be fixed by the Board of Directors and designated in the notice of the meeting or executed waiver of notice. The Board of Directors may determine that any meeting of the shareholders may be held solely by means of conference telephone or other electronic technology in accordance with Section 2.2 of these Bylaws, without designating a place for a physical assembly of shareholders.

Section 2.2. MEETINGS OF SHAREHOLDERS BY REMOTE COMMUNICATION. If authorized by the Board of Directors, shareholders not physically present at a shareholders’ meeting held at a designated place or solely by conference telephone or other electronic technology may participate in, be considered present in person, and vote at the meeting, subject to the conditions imposed by applicable law and any guidelines and procedures adopted by the Board of Directors.

Section 2.3. ANNUAL MEETING. An annual meeting of shareholders, for the purpose of electing directors and transacting any other business as may be brought before the meeting, shall be held on the date and time fixed by the Board of Directors and stated in the notice of the meeting. Failure to hold the annual meeting of shareholders at the designated time shall not affect the validity of any action taken by the Corporation. If the Board of Directors fails to call the annual meeting of shareholders as required by these Bylaws, any shareholder may make a demand in writing to any officer of the Corporation that an annual meeting be held.

Section 2.4. SPECIAL MEETINGS. Special meetings of the shareholders may be called by:

(a) the President;

(b) the Board of Directors;

(c) any officer or shareholder, or a fiduciary for a shareholder, solely for the purpose of electing directors, if all positions for directors on the Board of Directors are vacant; or

(d) the shareholders entitled to cast at least twenty percent (20%) of the votes that all shareholders are entitled to cast at the proposed special meeting. For shareholders to demand a special meeting, the shareholders of the required percentage of shares must sign, date, and deliver to the Corporation’s Secretary one or more written demands for the meeting, describing the purpose or purposes for which the meeting is to be held.

Only business within the purpose or purposes described in the Corporation’s meeting notice may be conducted at a special meeting of the shareholders.

Section 2.5. RECORD DATE FOR SHAREHOLDER ACTION. For the purpose of determining shareholders entitled to notice of and to vote at any regular or special meeting of shareholders or any adjournment thereof, the record date shall be:

(a) the date or dates specified by the Board of Directors in the notice of the meeting;

(b) the close of business on the day before the notice of the meeting is mailed to shareholders, if no date is specified by the Board of Directors; or

(c) the date set by the law applying to the type of action to be taken for which a record date must be set, if no notice of meeting is mailed to shareholders.

A determination of shareholders entitled to notice of or to vote at a shareholders’ meeting is effective for any adjournment of the meeting unless the Board of Directors fixes a new record date.

For the purpose of determining shareholders entitled to (w) express consent or dissent to corporate action in writing without a meeting, when prior action by the Board of Directors is not necessary, (x) call a special shareholders’ meeting, (y) propose an amendment to the Articles of Incorporation, or (z) proposing a director nomination or issue for consideration at a special meeting, the record date shall be at the close of business on the day on which the first written consent, dissent, meeting request, or proposal is filed with the Secretary of the Corporation, unless the record date is otherwise fixed by the Board of Directors by prior action or notice.

A record date fixed under this Section 2.5 may not be more than ninety (90) days before the meeting or action requiring a determination of shareholders.

Section 2.6. NOTICE OF SHAREHOLDERS’ MEETING. Written or printed notice of any annual or special meeting of shareholders shall be given to any shareholder entitled to notice not less than five (5) days before the date of the meeting, unless a greater period of notice is required by law. Such notice shall state:

(a) the date and time of the meeting;

(b) the place of the meeting, if any;

(c) the means of conference telephone or other electronic technology by which shareholders and proxy holders may be considered present and may vote at the meeting, and the information required for such shareholders to access the voting list as provided by Section 2.7;

(d) the general nature of the business to be transacted at the meeting if a special meeting; and

(e) the meeting’s purpose or purposes and any other information if required by the BCL.

Upon the written request of any person entitled to call a special meeting to the Secretary of the Corporation, it shall be the duty of the Secretary to fix the date of the meeting not more than sixty (60) days after the receipt of the request and give notice thereof.

Notice as provided by this Section 2.6 or otherwise under the BCL shall be given to a shareholder in record form: (x) by first class or express mail, by bulk mail with at least 20 days’ notice before the meeting, or by courier service, to the shareholder’s postal address appearing on the books of the Corporation; or (y) by facsimile transmission, email, or other electronic communication, to the number or address supplied by the shareholder to the Corporation for the purpose of notice.

Any person entitled to notice of a meeting may file a written waiver of notice with the Secretary either before or after the time of the meeting. The participation or attendance at a meeting of a person entitled to notice constitutes waiver of notice, except where the person attends for the specific purpose of objecting to the lawfulness of the convening of the meeting.

Section 2.7. VOTING LISTS. The officer or agent having charge of the share transfer records for shares of the Corporation shall prepare an alphabetical list of all shareholders entitled to notice of the meeting, with the address of and the number of shares held by each shareholder. The list shall be produced and kept open at the time and place of the meeting and shall be subject to the inspection of any shareholder during the whole time of the meeting. The original share register or transfer book, or a duplicate thereof kept in the Commonwealth of Pennsylvania, shall be prima facie evidence as to the identify of shareholders entitled to (a) examine the list, share register, or transfer book or (b) to vote at any meeting of shareholders.

If any shareholders are participating in the meeting by means of conference telephone or other electronic technology, the list must be open to examination by the shareholders for the duration of the meeting on a reasonably accessible electronic network, and the information required to access the list must be provided to shareholders with the notice of the meeting as provided by Section 2.6.

Section 2.8. QUORUM OF SHAREHOLDERS. A quorum shall be present for action on any matter at a shareholder meeting if a majority of the votes entitled to be cast on the matter are represented at the meeting in person or by proxy. Once a quorum has been established at a meeting, the shareholders present can continue to do business until adjournment of the meeting notwithstanding the withdrawal of enough shareholders to leave less than a quorum.

Shareholders entitled to vote that attend a meeting of shareholders at which directors are to be elected that was previously adjourned for lack of a quorum, even if less than a quorum, shall nevertheless constitute a quorum for the purpose of electing directors.

Those shareholders entitled to vote who attend a meeting of shareholders for a purpose other than the election of directors that was previously adjourned for one or more periods aggregating at least fifteen (15) days for lack of a quorum, even if less than a quorum, shall nevertheless constitute a quorum for the purposes of acting upon any matter set forth in the notice of the meeting if the notice states that the shareholders who attend the adjourned meeting shall constitute a quorum for the purpose of acting upon the matter.

Section 2.9. CONDUCT OF MEETINGS. The Board of Directors may adopt by resolution rules and regulations for the conduct of meetings of the shareholders, as it deems appropriate. At every meeting of the shareholders, the Chair of the Board, or in their absence or inability to act, a director or officer designated by the Board of Directors, shall serve as the presiding officer of the meeting. The Secretary or, in their absence or inability to act, the person whom the presiding officer of the meeting shall appoint secretary of the meeting, shall act as secretary of the meeting and keep the minutes thereof.

The presiding officer shall determine the order of business and, in the absence of a rule adopted by the Board of Directors, shall establish rules for the conduct of the meeting. The presiding officer shall announce the close of the polls for each matter voted upon at the meeting, after which no ballots, proxies, votes, changes, or revocations will be accepted. Polls for all matters before the meeting will be deemed to be closed upon final adjournment of the meeting.

Section 2.10. JUDGES OF ELECTION. The Board of Directors may appoint a judge of election in advance of any shareholders’ meeting to act at the meeting or any adjournment thereof. If a judge of election is not so appointed, the presiding officer of the meeting may, and on the request of any shareholder shall, appoint a judge of election at the meeting. One judge shall be appointed. Judges need not be shareholders, but no candidate for director shall serve as a judge.

The judge of election shall determine the number of shares outstanding and the voting power of each, the shares represented at the meeting, the existence of a quorum, the authenticity, validity, and effect of proxies, receive votes or ballots, hear and determine all challenges and questions in any way arising in connection with the right to vote, count and tabulate all votes, determine the result, and do such acts as may be proper to conduct the election or vote with fairness to all shareholders. The judges of election shall perform their duties impartially, in good faith, to the best of their ability, and as expeditiously as is practical.

On request of the presiding officer or any shareholder or shareholders’ proxy, the judge shall make a report in record form of any challenge or question or matter determined by the judge and execute a certificate of any fact found by the judge.

Section 2.11. VOTING OF SHARES. Each outstanding share shall be entitled to one vote on each matter submitted to a vote at a meeting of shareholders, except to the extent that the Articles of Incorporation provide for more or less than one vote per share or limits or denies voting rights to the holders of the shares. The shareholders of the Corporation shall not have the power or right to cumulate their votes unless the BCL or the Articles of Incorporation provide otherwise.

If a quorum of a voting group exists, favorable action on a matter, other than the election of directors, will be approved by a voting group if the votes cast within the group favoring the action exceed the votes cast opposing the action, unless a greater or lesser number of votes is required by law or a greater number of votes is required by the Articles of Incorporation, these Bylaws or a resolution of the Board of Directors requiring receipt of a greater affirmative vote of the shareholders, including more separate voting groups.

Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present.

Section 2.12. VOTING BY PROXY OR NOMINEE. A shareholder may vote either in person or by proxy executed in record form by the shareholder or the shareholder’s attorney-in-fact. An appointment of a proxy is effective when received by the Secretary or other officer or agent authorized to tabulate votes. No proxy shall be valid after three years from the date of its execution unless otherwise provided in the proxy.

A proxy shall be revocable unless the proxy form conspicuously states that the proxy is irrevocable and the proxy is coupled with an interest as defined by Pennsylvania law. An appointment made irrevocable is revoked when the interest with which it is coupled is extinguished. The death or incapacity of the shareholder appointing a proxy shall not affect the right of the Corporation to accept the proxy’s authority unless notice of the death or incapacity is received by the Secretary or other officer or agent authorized to tabulate votes before the proxy exercises its authority under the appointment.

A person holding shares in a representative or fiduciary capacity may vote such shares without a transfer of such shares into such person’s name. However, the Corporation may (a) request that the person provide evidence of this capacity acceptable to the Corporation or (b) establish a procedure by which the beneficial owner of shares that are registered in the name of a nominee is recognized by the Corporation as the shareholder. The Board of Directors may alternatively establish by resolution a procedure by which a shareholder may certify in record form that all or a portion of the shares registered in the name of the shareholder are held for the account of a specified person to be recognized by the Corporation as the shareholder.

Section 2.13. ACTION BY SHAREHOLDERS WITHOUT A MEETING. Any action required or permitted to be taken at an annual or special meeting of the shareholders may be taken without a meeting if, prior to or after the action, a consent or consents thereto are signed by shareholders that would have been entitled to cast at least the minimum number of votes required to take the action at a meeting at which all shareholders entitled to vote thereon were present and voting.

The consent or consents shall be filed with the Secretary of the Corporation for inclusion with the records of meetings of shareholders of the Corporation.

ARTICLE III

DIRECTORS

Section 3.1. BOARD OF DIRECTORS. All corporate power shall be exercised by or under the authority of, and the business and affairs of the Corporation shall be managed under the direction of, the Board of Directors, except for such powers expressly conferred upon or reserved to the shareholders, and subject to any limitations set forth by law, the Articles of Incorporation, or these Bylaws.

Directors must be natural persons at least 18 years of age and need not be shareholders of the Corporation.

Section 3.2. NUMBER OF DIRECTORS. The number of directors shall be nine, provided that the number may be increased or decreased from time to time by an amendment to these Bylaws.

No decrease in the number of directors shall have the effect of shortening the term of any incumbent director.

Section 3.3. TERM OF OFFICE. At the first annual meeting of shareholders and at each annual meeting thereafter, the holders of shares entitled to vote in the election of directors shall elect directors to hold office until the next succeeding annual meeting, the director’s successor has been selected and qualified, or the director’s earlier death, resignation, or removal. The term of a director elected by the board of directors to fill a vacancy expires at the next shareholders’ meeting at which directors are elected.

Section 3.4. REMOVAL. Any or all of the directors may be removed from office at any time with or without cause by a vote of the shareholders entitled to elect them. If one or more directors are so removed at a meeting of shareholders, the shareholders may elect new directors at the same meeting.

Section 3.5. RESIGNATION. A director may resign at any time by giving notice in record form or by electronic transmission to the Corporation. A resignation is effective when the notice is received by the Corporation unless the notice specifies a future date. Acceptance of the resignation shall not be required to make the resignation effective. The pending vacancy may be filled in accordance with Section 3.6 of these Bylaws before the effective date, but the successor shall not take office until the effective date.

Section 3.6. VACANCIES. A vacancy on the Board of Directors resulting from the removal of a director in accordance with Section 3.4 of these Bylaws may be filled by the shareholders at an annual or special meeting of shareholders. A director elected by the shareholders to fill a vacancy which resulted from the removal of a director shall hold office for the remaining term of the predecessor and until a successor is elected and qualified.

A vacancy on the Board of Directors resulting from any cause other than an increase in the number of directors may be filled by a majority of the remaining directors, whether or not sufficient to constitute a quorum. A vacancy on the Board of Directors resulting from an increase in the number of directors may be filled by a majority of the entire Board of Directors. A director elected by the board of directors to fill a vacancy serves until the next annual meeting of shareholders and until a successor is elected and qualified.

Section 3.7. MEETINGS OF DIRECTORS. An annual meeting of directors shall be held immediately and without notice after and at the place of the annual meeting of shareholders. Other regular meetings of the directors may be held at such times and places within or outside Pennsylvania as the directors may fix by resolution.

Special meetings of the Board of Directors may be called by the President, by the Chair of the Board, if any, by the Secretary, by any two directors, or by one director if there is only one director.

Section 3.8. REMOTE COMMUNICATION. The Board of Directors may permit any or all directors to participate in any meeting by, or conduct the meeting through the use of, any means of conference telephone or other electronic technology by which all directors participating may simultaneously hear each other during the meeting. A director participating in a meeting by this means is considered to be present in person at the meeting.

Section 3.9. NOTICE OF DIRECTORS’ MEETINGS. Regular meetings of the Board of Directors may be held without notice of the date, time, place, or purpose of the meeting. All special meetings of the Board of Directors shall be held upon not less than five (5) days’ notice. Such notice shall state:

(a) the time and date of the meeting;

(b) the place of the meeting; and

(c) the means of any conference telephone or other electronic technology by which directors may participate at the meeting; and

(d) the business to be transacted at the meeting or the purpose or purposes for which the meeting is called, if the meeting is a special meeting.

Notice as provided by this Section 3.9 or otherwise under the BCL shall be given to a director in record form: (x) personally, by first class or express mail, or by messenger or delivery service; or (y) by facsimile transmission, email, or other electronic communication if the number or address has been supplied by the director to the Corporation for the purpose of notice.

A director entitled to notice of a meeting may deliver a waiver of notice to the Corporation in record form or by electronic transmission either before or after the time of the meeting. A director’s participation or attendance at a meeting shall constitute a waiver of notice, except where the director attends for the specific purpose of objecting to the transaction of any business on the grounds that the meeting is not lawfully called or convened.

Section 3.10. QUORUM AND ACTION OF DIRECTORS. A majority of the number of directors as fixed in these bylaws shall constitute a quorum for the transaction of business. The act of a majority of the directors present and voting at a meeting at which a quorum is present at the time of the act shall be the act of the Board of Directors, unless the act of a greater number is required by applicable law, the Articles of Incorporation, or these Bylaws.

The directors at a meeting for which a quorum is not present may adjourn the meeting until a time and place as may be determined by a vote of the directors present at that meeting. When a meeting is adjourned, it shall not be necessary to give any notice of the adjourned meeting, or of the business to be transacted at an adjourned meeting, other than by announcement at the meeting at which the adjournment is taken.

Section 3.11. COMPENSATION. Directors shall not receive any stated salary for their services, but the Board of Directors may provide, by resolution, a fixed sum and expenses of attendance, if any, for attendance at any meeting of the Board of Directors or a committee thereof. A director shall not be precluded from serving the Corporation in any other capacity and receiving compensation for services in that capacity.

Section 3.12. ACTION BY DIRECTORS WITHOUT A MEETING. Any action required or permitted to be taken at a meeting of the Board of Directors or any committee thereof may be taken without a meeting if, before or after the action, a consent or consents in record form or electronically are signed by all of the directors in office (or by persons who are directors as of the effective time of the consent), or all the committee members then appointed. The written consents must be filed with the minutes of the proceedings of the Board of Directors.

Section 3.13. COMMITTEES OF THE BOARD OF DIRECTORS. The Board of Directors, by resolution adopted by a majority, may designate one or more directors to constitute one or more committees to serve at the pleasure of the Board and to exercise the authority of the Board of Directors to the extent provided in the resolution establishing the committee and permitted by law. A committee of the Board of Directors shall not have the authority to:

(a) submit to shareholders any action requiring the approval of shareholders under the BCL, the Articles of Incorporation, or these Bylaws, other than election or removal of directors;

(b) create a vacancy, either by removing a director or increasing the number of directors, or fill a vacancy on the Board of Directors;

(c) adopt, amend, or repeal any provision of these Bylaws;

(d) amend or repeal any resolution of the Board of Directors that by its terms may only be amended or repealed by the Board of Directors; or

(e) take action on matters to which exclusive authority is given to another committee by these Bylaws or resolution of the Board of Directors.

The designation of a committee of the Board of Directors and the delegation thereto of authority shall not operate to relieve the Board of Directors, or any member thereof, of any responsibility imposed by law.

ARTICLE IV

OFFICERS

Section 4.1. POSITIONS AND ELECTION. The officers of the Corporation shall be elected by the Board of Directors and shall be a President, a Treasurer, and a Secretary and any other officers, including assistant officers and agents, as may be deemed necessary by the Board of Directors. Any two or more offices may be held by the same person.

Officers shall be elected annually at the meeting of the Board of Directors held after each annual meeting of shareholders. Each officer shall serve until a successor is elected and qualified or until the death, resignation, or removal of that officer. Vacancies or new offices shall be filled at the next regular or special meeting of the Board of Directors. Election or appointment of an officer or agent shall not of itself create contract rights.

Section 4.2. REMOVAL AND RESIGNATION. Any officer elected by the Board of Directors may be removed, with or without cause, at any regular or special meeting of the Board of Directors by the affirmative vote of the majority of the directors in attendance where a quorum is present. Removal shall be without prejudice to the contract rights, if any, of the officer so removed.

Any officer may resign at any time by delivering notice in writing or by electronic transmission to the Secretary of the Corporation. Resignation is effective when the notice is delivered unless the notice provides a later effective date. Any vacancies may be filled in accordance with Section 4.1 of these Bylaws.

Section 4.3. POWERS AND DUTIES OF OFFICERS. The powers and duties of the officers of the Corporation shall be as provided from time to time by resolution of the Board of Directors or by direction of an officer authorized by the Board of Directors to prescribe the duties of other officers. In the absence of such resolution, the respective officers shall have the powers and shall discharge the duties customarily and usually held and performed by like officers of corporations similar in organization and business purposes to the Corporation subject to the control of the Board of Directors.

ARTICLE V

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 5.1. MANDATORY INDEMNIFICATION. The Corporation shall indemnify any present or former director or officer of the Corporation as provided by the BCL against actual and reasonable expenses incurred in connection with an action or proceeding, to the extent the director or officer is successful, on the merits or otherwise, in the defense of any action or proceeding to which the person (a) was a party by reason of being a representative of the Corporation or (b) is or was serving at the request of the Corporation as a representative of another corporation or other enterprise.

Section 5.2. PERMISSIVE INDEMNIFICATION. The Corporation may, to the fullest extent permitted by law, indemnify any person made or threatened to be made a party to any threatened, pending, or completed action or proceeding because the person is or was a representative of the Corporation or is or was serving at the request of the Corporation as a representative of another corporation or other enterprise, against expenses, including counsel fees, actually and reasonably incurred by such person in connection with the action or proceeding if the person:

(a) acted in good faith and in a manner the person reasonably believed to be in, or not opposed to, the best interests of the Corporation; and

(b) had no reasonable cause to believe the person’s conduct was unlawful in the case of a criminal proceeding.

Notwithstanding any other provision of this Article V, the Corporation may advance expenses, including counsel fees, to a representative, in the manner and to the extent provided by the BCL. For purposes of this Section 5.2, a “representative” is a director, officer, trustee, fiduciary, employee, or agent of the Corporation.

Section 5.3. NON-EXCLUSIVITY OF INDEMNIFICATION RIGHTS. The foregoing rights of indemnification and advancement of expenses shall be in addition to and not exclusive of any other rights to which any person may be entitled pursuant to any agreement with the Corporation or any action taken by the directors or shareholders of the Corporation.

ARTICLE VI

SHARE CERTIFICATES AND TRANSFER

Section 6.1. CERTIFICATES REPRESENTING SHARES. Certificates representing shares of the Corporation shall state:

(a) the name of the Corporation and that it is organized under the laws of the Commonwealth of Pennsylvania;

(b) the name of the person to whom issued; and

(c) the number and class of shares and the designation of the series, if any, which the certificate represents.

No share shall be issued until the consideration therefor, fixed as provided by law, has been fully paid.

Section 6.2. TRANSFERS OF SHARES. Shares of the Corporation shall be transferable in the manner prescribed by law and in these Bylaws. Transfers of shares shall be made on the books of the Corporation only by the holder of record thereof, by such person’s attorney lawfully made in record form and, upon the surrender of the certificate thereof, which shall be cancelled before a new certificate or uncertificated shares shall be issued. No transfer of shares shall be valid as against the Corporation for any purpose until it shall have been entered in the share records of the Corporation by an entry showing from and to whom the shares were transferred.

Section 6.3. REGISTERED SHAREHOLDERS. The Corporation may treat the holder of record of any shares issued by the Corporation as the holder in fact thereof, for purposes of voting those shares, receiving distributions thereon or notices in respect thereof, transferring those shares, exercising rights of dissent with respect to those shares, exercising or waiving any preemptive right with respect to those shares, entering into agreements with respect to those shares in accordance with the laws of the Commonwealth of Pennsylvania, or giving proxies with respect to those shares.

Section 6.4. LOST OR REPLACEMENT CERTIFICATES. The Board of Directors may direct a new certificate to be issued in place of any certificate it previously issued, upon receiving notice from a person claiming the certificate to be lost, destroyed, or wrongfully taken, before the Corporation receives notice that the certificate has been acquired by a protected purchaser. As a condition precedent to the issuance of a new certificate, the owner of the lost, destroyed, or wrongfully taken certificate must file a sufficient indemnity bond with the Corporation and satisfy any other reasonable requirements set by Corporation.

ARTICLE VII

DISTRIBUTIONS

Section 7.1. DECLARATION. The Board of Directors may authorize, and the Corporation may make, distributions to its shareholders in cash, property (other than shares of the Corporation), or a dividend of shares of the Corporation to the extent permitted by the Articles of Incorporation and the BCL.

Section 7.2. RECORD DATE FOR DISTRIBUTIONS AND SHARE DIVIDENDS. For the purpose of determining shareholders entitled to receive a distribution by the Corporation (other than a distribution involving a purchase or redemption by the Corporation of any of its own shares) or a share dividend, the Board of Directors may, at the time of declaring the distribution or share dividend, set a date no more than sixty (60) days prior to the date of the distribution or share dividend. If no record date is fixed, the record date shall be the date on which the resolution of the Board of Directors authorizing the distribution or share dividend is adopted.

ARTICLE VIII

GENERAL PROVISIONS

Section 8.1. CHECKS, DRAFTS, ETC. All checks, drafts, or other instruments for payment of money or notes of the Corporation shall be signed by an officer or officers or any other person or persons as shall be determined from time to time by resolution of the Board of Directors.

Section 8.2. FISCAL YEAR. The fiscal year of the Corporation shall be as determined by the Board of Directors.

Section 8.3. CONFLICT WITH APPLICABLE LAW OR ARTICLES OF INCORPORATION. Unless the context requires otherwise, the general provisions, rules of construction, and definitions of the BCL shall govern the construction of these Bylaws. These Bylaws are adopted subject to any applicable law and the Articles of Incorporation. Whenever these Bylaws may conflict with any applicable law or the Articles of Incorporation, such conflict shall be resolved in favor of such law or the Articles of Incorporation.

Section 8.4. INVALID PROVISIONS. If any one or more of the provisions of these Bylaws, or the applicability of any provision to a specific situation, shall be held invalid or unenforceable, the provision shall be modified to the minimum extent necessary to make it or its application valid and enforceable, and the validity and enforceability of all other provisions of these Bylaws and all other applications of any provision shall not be affected thereby.

ARTICLE IXF

AMENDMENT OF BYLAWS

Section 9.1. SHAREHOLDERS. These Bylaws may be amended, repealed, or otherwise altered at any regular or special meeting of the shareholders at which a quorum is present, by a majority vote of shareholders entitled to vote at such meeting. The notice of any meeting, at which action shall be taken to alter the bylaws, shall include a copy of the proposed amendment or a summary of the changes proposed to be made.

Section 9.2. BOARD OF DIRECTORS. The Board of Directors may also make, amend, or repeal these Bylaws at any regular or special meeting of the Board of Directors at which a quorum is present, by a majority vote of the members attending, except with respect to any provision that the Articles of Incorporation, these Bylaws, or the BCL requires action by the shareholders and is subject to the power of the shareholders to change such action.

v3.25.1

Document And Entity Information

|

Mar. 12, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ICC Holdings, Inc.

|

| Current Fiscal Year End Date |

--12-31

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 12, 2025

|

| Entity, Incorporation, State or Country Code |

PA

|

| Entity, File Number |

1-68190

|

| Entity, Tax Identification Number |

81-3359049

|

| Entity, Address, Address Line One |

225 20th Street

|

| Entity, Address, City or Town |

Rock Island

|

| Entity, Address, State or Province |

IL

|

| Entity, Address, Postal Zip Code |

61201

|

| City Area Code |

309

|

| Local Phone Number |

793-1700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ICCH

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001681903

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

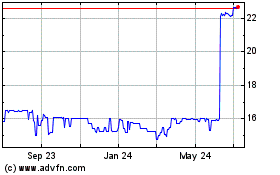

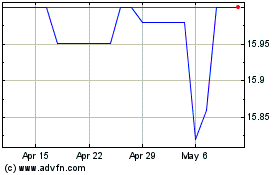

ICC (NASDAQ:ICCH)

Historical Stock Chart

From Feb 2025 to Mar 2025

ICC (NASDAQ:ICCH)

Historical Stock Chart

From Mar 2024 to Mar 2025