All-Remote-GitLab Inc. (NASDAQ: GTLB), the most

comprehensive AI-powered DevSecOps platform, today reported

financial results for its second quarter fiscal year 2025, ended

July 31, 2024.

“Organizations need to deliver software faster

to accelerate performance and respond to intense competition,” said

Sid Sijbrandij, GitLab CEO and co-founder. “Our results show the

combination of our end-to-end platform and AI solutions are driving

results for our customers by aligning to business goals, providing

measurable benefits, and improving security.”

“Our second quarter fiscal year 2025 results

validate the value that customers gain from GitLab’s integrated

platform,” said Brian Robins, GitLab chief financial officer. “We

delivered another quarter of better than 30% top-line growth and

significant year-over-year operating margin expansion. As we enter

the second half of fiscal year 2025, I'm confident in our ability

to continue to exceed customer expectations and in the opportunity

we have with AI to further accelerate tangible business

outcomes.”

Second Quarter Fiscal

Year 2025 Financial

Highlights (in millions, except per share data and

percentages):

|

|

Q2 FY 2025 |

|

Q2 FY 2024 |

|

Y/Y Change |

|

Revenue |

$ |

182.6 |

|

|

$ |

139.6 |

|

|

|

31 |

% |

|

GAAP Gross margin |

|

88 |

% |

|

|

89 |

% |

|

|

|

Non-GAAP Gross margin |

|

91 |

% |

|

|

91 |

% |

|

|

|

GAAP Operating margin |

|

(22 |

)% |

|

|

(39 |

)% |

|

|

|

Non-GAAP Operating margin |

|

10 |

% |

|

|

(3 |

)% |

|

|

|

GAAP Operating loss |

$ |

(41.0 |

) |

|

$ |

(54.1 |

) |

|

$ |

13.1 |

|

|

Non-GAAP Operating income (loss) |

$ |

18.2 |

|

|

$ |

(4.3 |

) |

|

$ |

22.5 |

|

|

GAAP Net Income (loss) attributable to GitLab |

$ |

12.9 |

|

|

$ |

(50.1 |

) |

|

$ |

63.0 |

|

|

Non-GAAP Net income attributable to GitLab |

$ |

24.5 |

|

|

$ |

1.9 |

|

|

$ |

22.6 |

|

|

GAAP Net income (loss) per share attributable to GitLab |

$ |

0.08 |

|

|

$ |

(0.33 |

) |

|

$ |

0.41 |

|

|

Non-GAAP Net income per share attributable to GitLab |

$ |

0.15 |

|

|

$ |

0.01 |

|

|

$ |

0.14 |

|

|

GAAP net cash provided by operating activities |

$ |

11.7 |

|

|

$ |

27.1 |

|

|

$ |

(15.4 |

) |

|

Non-GAAP adjusted free cash flow |

$ |

10.8 |

|

|

$ |

26.8 |

|

|

$ |

(16.0 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

A reconciliation between GAAP and non-GAAP

financial measures is contained in this release under the section

titled “Non-GAAP Financial Measures.”

Additional Financial

Highlights:

- Customers with more than $5,000 of

ARR reached 9,314, an increase of 19% year-over-year.

- Customers with more than $100,000

of ARR reached 1,076, an increase of 33% year-over-year.

- Dollar-Based Net Retention Rate was

126%.

- Total RPO grew 51% year-over-year

to $747.9 million, while cRPO grew 42% to

$475.0 million.

Business Highlights:

- Named a Leader in the first-ever

2024 Gartner® Magic Quadrant™ for AI Code Assistants.

- Announced the general availability

of GitLab Duo Enterprise, our end-to-end AI add-on that supports

DevSecOps teams at every stage of the software development

lifecycle, for $39 per user per month.

- Achieved “In Process” designation

at the Moderate impact level from the Federal Risk and

Authorization Management Program (FedRAMP), enabling public sector

agencies and customers in highly regulated industries to meet

stringent security and compliance requirements.

- Released the 8th annual Global

DevSecOps Report, which revealed that growing investments in

security, AI, and automation are improving developer experiences,

highlighting critical areas like AI risk and software supply chain

security.

Third Quarter and

Fiscal Year 2025 Financial

Outlook

For the third quarter and fiscal year 2025, GitLab

Inc. expects (in millions, except share and per share data):

|

|

|

Q3 FY 2025 Guidance |

|

|

|

FY 2025 Guidance |

|

|

Revenue |

|

$187.0 - $188.0 |

|

|

|

$742.0 - $744.0 |

|

|

Non-GAAP operating income |

|

$19.0 - $20.0 |

|

|

|

$55.0 - $58.0 |

|

|

Non-GAAP diluted net income per share assuming approximately 168

million and 168 million weighted average shares outstanding during

Q3 FY 2025 and FY 2025, respectively. |

|

$0.15 - $0.16 |

|

|

|

$0.45 - $0.47 |

|

|

|

|

|

|

|

|

|

|

These statements are forward-looking and actual

results may differ materially as a result of many factors. Refer to

the Forward-Looking Statements safe harbor below for information on

the factors that could cause our actual results to differ

materially from these forward-looking statements.

A reconciliation of GAAP to non-GAAP financial

measures has been provided in the financial statement tables

included in this press release. An explanation of these measures is

also included below in Non-GAAP Financial Measures. We have not

provided the most directly comparable GAAP financial guidance

measures because certain items are out of our control or cannot be

reasonably predicted. Accordingly, a reconciliation of non-GAAP

guidance for operating income (loss) and net income (loss) per

share to the corresponding GAAP measures is not available.

Conference Call Information

GitLab will host a conference call today,

September 3, 2024, at 1:30 p.m. (PT) / 4:30 p.m. (ET) to

discuss its second quarter fiscal year 2025 financial results and

its guidance for the third quarter and fiscal year 2025. Interested

parties may register for the call in advance by visiting

https://bit.ly/3WxrJdE. A live webcast of this conference call will

be available on GitLab’s investor relations website

(ir.gitlab.com), and a replay will also be archived on the website

for one year.

About GitLab

GitLab is the most comprehensive AI-powered

DevSecOps platform for software innovation. GitLab enables

organizations to increase developer productivity, improve

operational efficiency, reduce security and compliance risk, and

accelerate digital transformation. More than 40 million registered

users and more than 50% of the Fortune 100 trust GitLab to ship

better, more secure software faster.

Non-GAAP Financial Measures

GitLab believes non-GAAP measures are useful in

evaluating its operating performance. GitLab uses this supplemental

information to evaluate its ongoing operations and for internal

planning and forecasting purposes. GitLab believes that non-GAAP

financial information, when taken collectively with its GAAP

financial information, may be helpful to investors because it

provides consistency and comparability with past financial

performance. However, non-GAAP financial information is presented

for supplemental informational purposes only, has limitations as an

analytical tool, and should not be considered in isolation or as a

substitute for financial information presented in accordance with

GAAP. Reconciliations of non-GAAP financial measures to the most

directly comparable financial results as determined in accordance

with GAAP are included at the end of this press release following

the accompanying financial data. We define non-GAAP financial

measures as GAAP measures, excluding certain items such as

stock-based compensation expense, amortization of acquired

intangible assets, foreign exchange (gain) loss, equity method

investment loss and impairment, acquisition related expenses,

changes in the fair value of acquisition related contingent

consideration, charitable donation of common stock, restructuring

charges, a non-recurring income tax adjustment related to bilateral

advance pricing agreement (“BAPA”) negotiations, and other expenses

that the Company believes are not indicative of its ongoing

operations. Shares used for net income per share on a non-GAAP

basis include incremental dilutive shares related to restricted

stock units, options, and shares issuable under GitLab Inc.’s 2021

Employee Stock Purchase Plan that are anti-dilutive on a GAAP

basis. A reconciliation of non-GAAP guidance measures to

corresponding GAAP measures is not available on a forward-looking

basis without unreasonable effort due to the uncertainty of

expenses that may be incurred in the future. Investors are

encouraged to review the related GAAP financial measures and the

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP financial measures and not rely on any

single financial measure to evaluate our business.

Adjusted Free Cash Flow

Adjusted free cash flow is a non-GAAP financial

measure that we calculate as net cash provided by operating

activities less cash used for purchases of property and equipment,

plus any non-recurring income tax payments related to BAPA. We

believe that adjusted free cash flow is a useful indicator of

liquidity that provides information to management and investors

about the amount of cash generated from our operations that, after

the investments in property and equipment and any non-recurring

income tax payments related to BAPA, can be used for strategic

initiatives, including investing in our business, and strengthening

our financial position. One limitation of adjusted free cash flow

is that it does not reflect our future contractual commitments.

Additionally, adjusted free cash flow does not represent the total

increase or decrease in our cash balance for a given period.

Forward-Looking Statements

This press release and the accompanying earnings

call contain “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934. Although we believe

that the expectations reflected in the forward-looking statements

contained in this release and the accompanying earnings call are

reasonable, they are subject to known and unknown risks,

uncertainties, assumptions and other factors that may cause actual

results or outcomes to be materially different from any future

results or outcomes expressed or implied by the forward-looking

statements. These risks, uncertainties, assumptions, and other

factors include, but are not limited to the following:

- our ability to effectively manage our growth;

- our revenue growth rate in the future;

- our ability to achieve and sustain profitability, our business,

financial condition, and operating results;

- security and privacy breaches;

- intense competition in our markets and loss of market share to

our competitors;

- our ability to respond to rapid technological changes;

- the market for our services may not grow;

- a decline in our customer renewals and expansions;

- fluctuations in our operating results;

- our incorporation of artificial intelligence features into our

products;

- our transparency;

- our publicly available company Handbook;

- customers staying on our free self-managed or SaaS product

offering;

- our ability to accurately predict the long-term rate of

customer subscription renewals or adoption, or the impact of these

renewals and adoption;

- our hiring model;

- the effects of ongoing armed conflict in different regions of

the world on our business; and

- general economic conditions (including changes in interest

rates, inflation, uncertainty of the federal budget, increased

volatility in the capital markets and instability in the global

banking sector) and slow or negative growth of our markets.

Further information on these and additional

risks, uncertainties, and other factors that could cause actual

outcomes and results to differ materially from those included in or

contemplated by the forward-looking statements contained in this

release are included under the caption “Risk Factors” and elsewhere

in the filings and reports we make with the Securities and Exchange

Commission. We do not undertake any obligation to update or release

any revisions to any forward-looking statement or to report any

events or circumstances after the date of this press release or to

reflect the occurrence of unanticipated events, except as required

by law.

Operating Metrics

Annual Recurring Revenue (“ARR”): We define

annual recurring revenue as the annual run-rate revenue of

subscription agreements, including our self-managed and SaaS

offerings but excluding professional services, from all customers

as measured on the last day of a given month. We calculate ARR by

taking the monthly recurring revenue (“MRR”) and multiplying it by

12. MRR for each month is calculated by aggregating, for all

customers during that month, monthly revenue from committed

contractual amounts of subscriptions, including our self-managed

license, self-managed subscription, and SaaS subscription offerings

but excluding professional services.

Dollar-Based Net Retention Rate: We calculate

Dollar-Based Net Retention Rate as of a period end by starting with

our customers as of the 12 months prior to such period end (“Prior

Period ARR”). We then calculate the ARR from these customers as of

the current period end (“Current Period ARR”). The calculation of

Current Period ARR includes any upsells, price adjustments, user

growth within a customer, contraction, and attrition. We then

divide the total Current Period ARR by the total Prior Period ARR

to arrive at the Dollar-Based Net Retention Rate.

|

GitLab Inc.Condensed Consolidated Balance

Sheets(in thousands, except per share

data)(unaudited) |

|

|

|

|

July 31, 2024(1) |

|

January 31, 2024(1) |

|

ASSETS |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

438,616 |

|

|

$ |

287,996 |

|

|

Short-term investments |

|

644,488 |

|

|

|

748,289 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $679

and $673 as of July 31, 2024 and January 31, 2024,

respectively |

|

165,001 |

|

|

|

166,731 |

|

|

Deferred contract acquisition costs, current |

|

33,841 |

|

|

|

32,300 |

|

|

Prepaid expenses and other current assets |

|

32,410 |

|

|

|

45,601 |

|

|

Total current assets |

|

1,314,356 |

|

|

|

1,280,917 |

|

|

Property and equipment, net |

|

2,899 |

|

|

|

2,954 |

|

|

Operating lease right-of-use assets |

|

482 |

|

|

|

405 |

|

|

Goodwill |

|

16,017 |

|

|

|

8,145 |

|

|

Intangible assets, net |

|

21,867 |

|

|

|

1,733 |

|

|

Deferred contract acquisition costs, non-current |

|

15,753 |

|

|

|

19,317 |

|

|

Other non-current assets |

|

4,888 |

|

|

|

4,390 |

|

|

TOTAL ASSETS |

$ |

1,376,262 |

|

|

$ |

1,317,861 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Accounts payable |

$ |

3,219 |

|

|

$ |

1,738 |

|

|

Accrued expenses and other current liabilities |

|

272,164 |

|

|

|

286,178 |

|

|

Accrued compensation and benefits |

|

29,117 |

|

|

|

35,809 |

|

|

Deferred revenue, current |

|

362,348 |

|

|

|

338,348 |

|

|

Total current liabilities |

|

666,848 |

|

|

|

662,073 |

|

|

Deferred revenue, non-current |

|

14,732 |

|

|

|

23,794 |

|

|

Other non-current liabilities |

|

6,678 |

|

|

|

14,060 |

|

|

TOTAL LIABILITIES |

|

688,258 |

|

|

|

699,927 |

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

Preferred stock, $0.0000025 par value; 50,000 shares

authorized as of July 31, 2024 and January 31, 2024; no

shares issued and outstanding as of July 31, 2024 and

January 31, 2024 |

|

— |

|

|

|

— |

|

|

Class A Common stock, $0.0000025 par value; 1,500,000 shares

authorized as of July 31, 2024 and January 31, 2024;

136,462 and 114,670 shares issued and outstanding as of

July 31, 2024 and January 31, 2024, respectively |

|

— |

|

|

|

— |

|

|

Class B Common stock, $0.0000025 par value; 250,000 shares

authorized as of July 31, 2024 and January 31, 2024;

23,963 and 42,887 shares issued and outstanding as of July 31,

2024 and January 31, 2024, respectively |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

1,833,786 |

|

|

|

1,718,661 |

|

|

Accumulated deficit |

|

(1,191,517 |

) |

|

|

(1,149,822 |

) |

|

Accumulated other comprehensive income |

|

570 |

|

|

|

2,335 |

|

|

Total GitLab stockholders’ equity |

|

642,839 |

|

|

|

571,174 |

|

|

Noncontrolling interests |

|

45,165 |

|

|

|

46,760 |

|

|

TOTAL STOCKHOLDERS’ EQUITY |

|

688,004 |

|

|

|

617,934 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

1,376,262 |

|

|

$ |

1,317,861 |

|

__________(1) As of July 31, 2024 and

January 31, 2024, the consolidated balance sheet includes

assets of the consolidated variable interest entity, GitLab

Information Technology (Hubei) Co., LTD (“JiHu”), of $45.0 million

and $47.6 million, respectively, and liabilities of $6.5

million and $6.1 million, respectively. The assets of JiHu can

be used only to settle obligations of JiHu and creditors of JiHu do

not have recourse against the general credit of GitLab Inc.

|

GitLab Inc.Condensed Consolidated

Statements of Operations(in thousands, except per

share data)(unaudited) |

|

|

|

|

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

Subscription—self-managed and SaaS |

$ |

163,181 |

|

|

$ |

122,096 |

|

|

$ |

314,360 |

|

|

$ |

233,287 |

|

|

License—self-managed and other |

|

19,403 |

|

|

|

17,485 |

|

|

|

37,411 |

|

|

|

33,172 |

|

|

Total revenue |

|

182,584 |

|

|

|

139,581 |

|

|

|

351,771 |

|

|

|

266,459 |

|

|

Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription—self-managed and SaaS |

|

16,630 |

|

|

|

10,871 |

|

|

|

30,469 |

|

|

|

21,762 |

|

|

License—self-managed and other |

|

4,740 |

|

|

|

3,825 |

|

|

|

9,677 |

|

|

|

6,873 |

|

|

Total cost of revenue |

|

21,370 |

|

|

|

14,696 |

|

|

|

40,146 |

|

|

|

28,635 |

|

|

Gross profit |

|

161,214 |

|

|

|

124,885 |

|

|

|

311,625 |

|

|

|

237,824 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

|

97,778 |

|

|

|

92,116 |

|

|

|

190,202 |

|

|

|

178,653 |

|

|

Research and development |

|

61,273 |

|

|

|

49,007 |

|

|

|

115,413 |

|

|

|

99,394 |

|

|

General and administrative |

|

43,168 |

|

|

|

37,819 |

|

|

|

100,655 |

|

|

|

72,067 |

|

|

Total operating expenses |

|

202,219 |

|

|

|

178,942 |

|

|

|

406,270 |

|

|

|

350,114 |

|

|

Loss from operations |

|

(41,005 |

) |

|

|

(54,057 |

) |

|

|

(94,645 |

) |

|

|

(112,290 |

) |

|

Interest income |

|

12,827 |

|

|

|

9,112 |

|

|

|

24,857 |

|

|

|

16,427 |

|

|

Other income (expense), net |

|

1,032 |

|

|

|

(1,330 |

) |

|

|

465 |

|

|

|

(1,077 |

) |

|

Loss before income taxes and loss from equity method

investment |

|

(27,146 |

) |

|

|

(46,275 |

) |

|

|

(69,323 |

) |

|

|

(96,940 |

) |

|

Loss from equity method investment, net of tax |

|

— |

|

|

|

(917 |

) |

|

|

— |

|

|

|

(1,665 |

) |

|

Provision for (benefit from) income taxes |

|

(39,420 |

) |

|

|

4,016 |

|

|

|

(26,710 |

) |

|

|

5,502 |

|

|

Net income (loss) |

$ |

12,274 |

|

|

$ |

(51,208 |

) |

|

$ |

(42,613 |

) |

|

$ |

(104,107 |

) |

|

Net loss attributable to noncontrolling interest |

|

(675 |

) |

|

|

(1,128 |

) |

|

|

(918 |

) |

|

|

(1,558 |

) |

|

Net income (loss) attributable to GitLab |

$ |

12,949 |

|

|

$ |

(50,080 |

) |

|

$ |

(41,695 |

) |

|

$ |

(102,549 |

) |

|

Net income (loss) per share attributable to GitLab Class A and

Class B common stockholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.08 |

|

|

$ |

(0.33 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.67 |

) |

|

Diluted |

$ |

0.08 |

|

|

$ |

(0.33 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.67 |

) |

|

Weighted-average shares used to compute net income (loss) per share

attributable to GitLab Class A and Class B common

stockholders: |

|

|

|

|

|

|

|

|

Basic |

|

159,677 |

|

|

|

153,644 |

|

|

|

158,973 |

|

|

|

152,683 |

|

|

Diluted |

|

166,346 |

|

|

|

153,644 |

|

|

|

158,973 |

|

|

|

152,683 |

|

|

GitLab Inc.Condensed Consolidated

Statements of Cash Flows(in

thousands)(unaudited) |

|

|

|

|

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

Net income (loss), including amounts attributable to noncontrolling

interest |

$ |

12,274 |

|

|

$ |

(51,208 |

) |

|

$ |

(42,613 |

) |

|

$ |

(104,107 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

48,969 |

|

|

|

46,368 |

|

|

|

91,221 |

|

|

|

78,698 |

|

|

Change in fair value of acquisition related contingent

consideration |

|

3,750 |

|

|

|

— |

|

|

|

3,750 |

|

|

|

— |

|

|

Charitable donation of common stock |

|

2,957 |

|

|

|

2,675 |

|

|

|

5,914 |

|

|

|

5,350 |

|

|

Amortization of intangible assets |

|

2,333 |

|

|

|

546 |

|

|

|

3,420 |

|

|

|

1,125 |

|

|

Depreciation expense |

|

744 |

|

|

|

1,114 |

|

|

|

1,681 |

|

|

|

2,206 |

|

|

Amortization of deferred contract acquisition costs |

|

11,837 |

|

|

|

10,070 |

|

|

|

22,946 |

|

|

|

20,619 |

|

|

Loss from equity method investment |

|

— |

|

|

|

1,161 |

|

|

|

— |

|

|

|

2,108 |

|

|

Net amortization of premiums or discounts on short-term

investments |

|

(4,241 |

) |

|

|

(4,898 |

) |

|

|

(9,141 |

) |

|

|

(8,494 |

) |

|

Unrealized foreign exchange loss (gain), net |

|

(803 |

) |

|

|

1,087 |

|

|

|

(258 |

) |

|

|

825 |

|

|

Other non-cash expense (income), net |

|

(111 |

) |

|

|

(44 |

) |

|

|

301 |

|

|

|

(103 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

(29,847 |

) |

|

|

20,441 |

|

|

|

1,225 |

|

|

|

25,281 |

|

|

Prepaid expenses and other current assets |

|

2,917 |

|

|

|

(2,161 |

) |

|

|

13,271 |

|

|

|

(4,248 |

) |

|

Deferred contract acquisition costs |

|

(12,415 |

) |

|

|

(9,640 |

) |

|

|

(20,955 |

) |

|

|

(18,137 |

) |

|

Other non-current assets |

|

(78 |

) |

|

|

(419 |

) |

|

|

(497 |

) |

|

|

(721 |

) |

|

Accounts payable |

|

14 |

|

|

|

1,135 |

|

|

|

1,350 |

|

|

|

(1,023 |

) |

|

Accrued expenses and other current liabilities |

|

(41,250 |

) |

|

|

(1,606 |

) |

|

|

(21,633 |

) |

|

|

1,183 |

|

|

Accrued compensation and benefits |

|

6,250 |

|

|

|

7,732 |

|

|

|

(6,902 |

) |

|

|

2,611 |

|

|

Deferred revenue |

|

19,286 |

|

|

|

1,964 |

|

|

|

14,838 |

|

|

|

11,175 |

|

|

Other non-current liabilities |

|

(10,889 |

) |

|

|

2,792 |

|

|

|

(8,083 |

) |

|

|

1,800 |

|

|

Net cash provided by operating activities |

|

11,697 |

|

|

|

27,109 |

|

|

|

49,835 |

|

|

|

16,148 |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Purchases of short-term investments |

|

(118,866 |

) |

|

|

(276,132 |

) |

|

|

(263,258 |

) |

|

|

(334,996 |

) |

|

Proceeds from maturities of short-term investments |

|

121,412 |

|

|

|

189,484 |

|

|

|

376,099 |

|

|

|

272,984 |

|

|

Purchases of property and equipment |

|

(851 |

) |

|

|

(277 |

) |

|

|

(1,551 |

) |

|

|

(533 |

) |

|

Payments for business combination, net of cash acquired |

|

— |

|

|

|

— |

|

|

|

(20,210 |

) |

|

|

— |

|

|

Payments for asset acquisition |

|

(7,314 |

) |

|

|

— |

|

|

|

(7,314 |

) |

|

|

— |

|

|

Escrow payment related to business combination, after acquisition

date |

|

— |

|

|

|

(2,500 |

) |

|

|

— |

|

|

|

(2,500 |

) |

|

Other investing activities |

|

457 |

|

|

|

— |

|

|

|

457 |

|

|

|

— |

|

|

Net cash provided by (used in) investing

activities |

|

(5,162 |

) |

|

|

(89,425 |

) |

|

|

84,223 |

|

|

|

(65,045 |

) |

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from the issuance of common stock upon exercise of stock

options, including early exercises, net of repurchases |

|

4,980 |

|

|

|

10,264 |

|

|

|

10,073 |

|

|

|

17,777 |

|

|

Issuance of common stock under employee stock purchase plan |

|

7,932 |

|

|

|

7,751 |

|

|

|

7,932 |

|

|

|

7,751 |

|

|

Net cash provided by financing activities |

|

12,912 |

|

|

|

18,015 |

|

|

|

18,005 |

|

|

|

25,528 |

|

|

Impact of foreign exchange on cash and cash equivalents |

|

(1,153 |

) |

|

|

(907 |

) |

|

|

(1,443 |

) |

|

|

(1,308 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

18,294 |

|

|

|

(45,208 |

) |

|

|

150,620 |

|

|

|

(24,677 |

) |

|

Cash and cash equivalents at beginning of period |

|

420,322 |

|

|

|

318,433 |

|

|

|

287,996 |

|

|

|

297,902 |

|

|

Cash and cash equivalents at end of period |

$ |

438,616 |

|

|

$ |

273,225 |

|

|

$ |

438,616 |

|

|

$ |

273,225 |

|

|

GitLab Inc.Reconciliation of GAAP to

Non-GAAP(in thousands, except per share

data)(unaudited) |

|

|

|

|

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Gross profit on GAAP basis |

$ |

161,214 |

|

|

$ |

124,885 |

|

|

$ |

311,625 |

|

|

$ |

237,824 |

|

|

Gross margin on GAAP basis |

|

88 |

% |

|

|

89 |

% |

|

|

89 |

% |

|

|

89 |

% |

|

Stock-based compensation expense |

|

2,076 |

|

|

|

1,698 |

|

|

|

3,931 |

|

|

|

3,112 |

|

|

Amortization of acquired intangibles |

|

2,333 |

|

|

|

521 |

|

|

|

3,420 |

|

|

|

1,025 |

|

|

Restructuring charges |

|

— |

|

|

|

46 |

|

|

|

— |

|

|

|

463 |

|

|

Gross profit on non-GAAP basis |

$ |

165,623 |

|

|

$ |

127,150 |

|

|

$ |

318,976 |

|

|

$ |

242,424 |

|

|

Gross margin on non-GAAP basis |

|

91 |

% |

|

|

91 |

% |

|

|

91 |

% |

|

|

91 |

% |

|

|

|

|

|

|

|

|

|

|

Sales and marketing on GAAP basis |

$ |

97,778 |

|

|

$ |

92,116 |

|

|

$ |

190,202 |

|

|

$ |

178,653 |

|

|

Stock-based compensation expense |

|

(19,881 |

) |

|

|

(21,295 |

) |

|

|

(37,278 |

) |

|

|

(35,059 |

) |

|

Restructuring charges |

|

(266 |

) |

|

|

(118 |

) |

|

|

(996 |

) |

|

|

(3,677 |

) |

|

Sales and marketing on non-GAAP basis |

$ |

77,631 |

|

|

$ |

70,703 |

|

|

$ |

151,928 |

|

|

$ |

139,917 |

|

|

|

|

|

|

|

|

|

|

|

Research and development on GAAP basis |

$ |

61,273 |

|

|

$ |

49,007 |

|

|

$ |

115,413 |

|

|

$ |

99,394 |

|

|

Stock-based compensation expense |

|

(16,114 |

) |

|

|

(12,477 |

) |

|

|

(28,450 |

) |

|

|

(24,179 |

) |

|

Restructuring charges |

|

(393 |

) |

|

|

12 |

|

|

|

(393 |

) |

|

|

(2,047 |

) |

|

Research and development on non-GAAP basis |

$ |

44,766 |

|

|

$ |

36,542 |

|

|

$ |

86,570 |

|

|

$ |

73,168 |

|

|

|

|

|

|

|

|

|

|

|

General and administrative on GAAP basis |

$ |

43,168 |

|

|

$ |

37,819 |

|

|

$ |

100,655 |

|

|

$ |

72,067 |

|

|

Stock-based compensation expense |

|

(10,898 |

) |

|

|

(10,898 |

) |

|

|

(21,562 |

) |

|

|

(16,348 |

) |

|

Amortization of acquired intangibles |

|

— |

|

|

|

(25 |

) |

|

|

— |

|

|

|

(100 |

) |

|

Restructuring charges |

|

(112 |

) |

|

|

(20 |

) |

|

|

(388 |

) |

|

|

(1,638 |

) |

|

Charitable donation of common stock |

|

(2,957 |

) |

|

|

(2,675 |

) |

|

|

(5,914 |

) |

|

|

(5,350 |

) |

|

Changes in the fair value of acquisition related contingent

consideration |

|

(3,750 |

) |

|

|

— |

|

|

|

(3,750 |

) |

|

|

— |

|

|

Acquisition related expenses |

|

(658 |

) |

|

|

— |

|

|

|

(2,709 |

) |

|

|

— |

|

|

Other non-recurring charges |

|

261 |

|

|

|

— |

|

|

|

(212 |

) |

|

|

— |

|

|

General and administrative on non-GAAP basis |

$ |

25,054 |

|

|

$ |

24,201 |

|

|

$ |

66,120 |

|

|

$ |

48,631 |

|

|

|

|

|

|

|

|

|

|

|

Loss from operations on GAAP basis |

$ |

(41,005 |

) |

|

$ |

(54,057 |

) |

|

$ |

(94,645 |

) |

|

$ |

(112,290 |

) |

|

Stock-based compensation expense |

|

48,969 |

|

|

|

46,368 |

|

|

|

91,221 |

|

|

|

78,698 |

|

|

Amortization of acquired intangibles |

|

2,333 |

|

|

|

546 |

|

|

|

3,420 |

|

|

|

1,125 |

|

|

Restructuring charges |

|

771 |

|

|

|

172 |

|

|

|

1,777 |

|

|

|

7,825 |

|

|

Charitable donation of common stock |

|

2,957 |

|

|

|

2,675 |

|

|

|

5,914 |

|

|

|

5,350 |

|

|

Changes in the fair value of acquisition related contingent

consideration |

|

3,750 |

|

|

|

— |

|

|

|

3,750 |

|

|

|

— |

|

|

Acquisition related expenses |

|

658 |

|

|

|

— |

|

|

|

2,709 |

|

|

|

— |

|

|

Other non-recurring charges |

|

(261 |

) |

|

|

— |

|

|

|

212 |

|

|

|

— |

|

|

Income (loss) from operations on non-GAAP basis |

$ |

18,172 |

|

|

$ |

(4,296 |

) |

|

$ |

14,358 |

|

|

$ |

(19,292 |

) |

|

|

|

|

|

|

|

|

|

|

Other income (expense), net on GAAP basis |

$ |

1,032 |

|

|

$ |

(1,330 |

) |

|

$ |

465 |

|

|

$ |

(1,077 |

) |

|

Foreign exchange gains (losses), net |

|

(867 |

) |

|

|

1,268 |

|

|

|

(230 |

) |

|

|

994 |

|

|

Other income (expense), net on non-GAAP basis |

$ |

165 |

|

|

$ |

(62 |

) |

|

$ |

235 |

|

|

$ |

(83 |

) |

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to GitLab common stockholders on GAAP basis |

$ |

12,949 |

|

|

$ |

(50,080 |

) |

|

$ |

(41,695 |

) |

|

$ |

(102,549 |

) |

|

Stock-based compensation expense |

|

48,969 |

|

|

|

46,368 |

|

|

|

91,221 |

|

|

|

78,698 |

|

|

Amortization of acquired intangibles |

|

2,333 |

|

|

|

546 |

|

|

|

3,420 |

|

|

|

1,125 |

|

|

Restructuring charges |

|

771 |

|

|

|

172 |

|

|

|

1,777 |

|

|

|

7,825 |

|

|

Charitable donation of common stock |

|

2,957 |

|

|

|

2,675 |

|

|

|

5,914 |

|

|

|

5,350 |

|

|

Changes in the fair value of acquisition related contingent

consideration |

|

3,750 |

|

|

|

— |

|

|

|

3,750 |

|

|

|

— |

|

|

Acquisition related expenses |

|

658 |

|

|

|

— |

|

|

|

2,709 |

|

|

|

— |

|

|

Loss from equity method investment, net of tax |

|

— |

|

|

|

917 |

|

|

|

— |

|

|

|

1,665 |

|

|

Foreign exchange gains (losses), net |

|

(867 |

) |

|

|

1,268 |

|

|

|

(230 |

) |

|

|

994 |

|

|

Income tax adjustment |

|

(46,737 |

) |

|

|

— |

|

|

|

(38,082 |

) |

|

|

— |

|

|

Other non-recurring charges |

|

(261 |

) |

|

|

— |

|

|

|

212 |

|

|

|

— |

|

| Net income (loss) attributable

to GitLab common stockholders on non-GAAP basis |

$ |

24,522 |

|

|

$ |

1,866 |

|

|

$ |

28,996 |

|

|

$ |

(6,892 |

) |

|

|

|

|

|

|

|

|

|

| GAAP net income (loss) per

share, basic |

$ |

0.08 |

|

|

$ |

(0.33 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.67 |

) |

| GAAP net income (loss) per

share, diluted |

$ |

0.08 |

|

|

$ |

(0.33 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.67 |

) |

|

|

|

|

|

|

|

|

|

| Non-GAAP net income (loss) per

share, basic |

$ |

0.15 |

|

|

$ |

0.01 |

|

|

$ |

0.18 |

|

|

$ |

(0.05 |

) |

| Non-GAAP net income (loss) per

share, diluted |

$ |

0.15 |

|

|

$ |

0.01 |

|

|

$ |

0.17 |

|

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

| Shares used in per share

calculation - basic on GAAP basis |

|

159,677 |

|

|

|

153,644 |

|

|

|

158,973 |

|

|

|

152,683 |

|

|

Effect of dilutive securities |

|

6,669 |

|

|

|

7,473 |

|

|

|

7,925 |

|

|

|

— |

|

| Shares used in per share

calculation - diluted on non-GAAP basis |

|

166,346 |

|

|

|

161,117 |

|

|

|

166,898 |

|

|

|

152,683 |

|

|

GitLab Inc.Reconciliation of GAAP Cash

Flow from Operating Activities to Adjusted Free Cash

Flow(in

thousands)(unaudited) |

|

|

|

|

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Computation of adjusted free cash

flow(1) |

|

|

|

|

|

|

|

|

GAAP net cash provided by operating activities |

$ |

11,697 |

|

|

$ |

27,109 |

|

|

$ |

49,835 |

|

|

$ |

16,148 |

|

|

Less: Purchases of property and equipment |

|

(851 |

) |

|

|

(277 |

) |

|

|

(1,551 |

) |

|

|

(533 |

) |

|

Non-GAAP adjusted free cash flow |

$ |

10,846 |

|

|

$ |

26,832 |

|

|

$ |

48,284 |

|

|

$ |

15,615 |

|

(1) No income tax payments related to the BAPA were

recorded during the periods presented.

Media Contact: Lisa BoughnerVP,

Global Communications GitLab Inc. press@gitlab.com

Investor Contact: Kelsey

TurcotteVP, Investor RelationsGitLab Inc.ir@gitlab.com

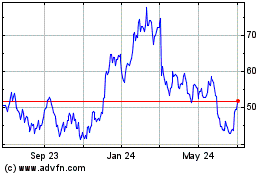

GitLab (NASDAQ:GTLB)

Historical Stock Chart

From Dec 2024 to Jan 2025

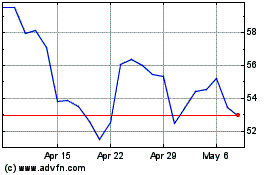

GitLab (NASDAQ:GTLB)

Historical Stock Chart

From Jan 2024 to Jan 2025