0001043277false00010432772024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: January 30, 2024

(Date of earliest event reported)

C.H. ROBINSON WORLDWIDE, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-23189 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 41-1883630 | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

14701 Charlson Road

Eden Prairie, Minnesota 55347

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code: 952-937-8500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

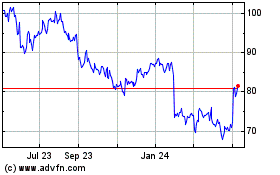

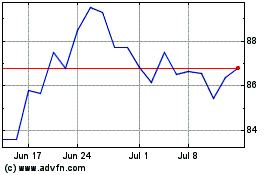

| Common Stock, $0.10 par value | CHRW | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The following information is being "furnished" in accordance with the General Instruction B.2 of Form 8-K and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Furnished herewith as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein are the text of the Company's announcement regarding its financial results for the quarter ended December 31, 2023 and its earnings conference call slides.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 30, 2024, the Company appointed Michael Castagnetto, the Company’s Vice President of Customer Success, to serve as President of NAST, effective February 1, 2024. Mr. Castagnetto will succeed Mac Pinkerton who will remain a non-executive employee through February 29, 2024 to transition his responsibilities, at which time he will depart the Company.

The Talent & Compensation Committee of the Board of Directors approved the payment to Mr. Pinkerton of severance benefits in accordance with the terms of the Company’s Executive Separation and Change in Control Plan in connection with his separation.

A copy of the press release announcing this transition is filed as Exhibit 99.3 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Number | Description |

| 99.1 | |

| |

| 99.2 | |

| |

| 99.3 | |

| |

| 104 | The cover page from the Current Report on Form 8-K formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| C.H. ROBINSON WORLDWIDE, INC. |

| | |

| By: | /s/ Ben G. Campbell |

| | Ben G. Campbell |

| | Chief Legal Officer and Secretary |

| | |

Date: January 31, 2024 | | |

| | | | | |

| C.H. Robinson 14701 Charlson Rd. Eden Prairie, MN 55347 www.chrobinson.com

|

| FOR IMMEDIATE RELEASE | FOR INQUIRIES, CONTACT: Chuck Ives, Director of Investor Relations Email: chuck.ives@chrobinson.com |

C.H. Robinson Reports 2023 Fourth Quarter Results

Eden Prairie, MN, January 31, 2024 - C.H. Robinson Worldwide, Inc. (“C.H. Robinson”) (Nasdaq: CHRW) today reported financial results for the quarter ended December 31, 2023.

Fourth Quarter Key Metrics:

•Gross profits decreased 20.0% to $609.3 million

•Income from operations decreased 34.5% to $107.4 million

•Adjusted operating margin(1) decreased 400 basis points to 17.4%

•Diluted earnings per share (EPS) decreased 67.5% to $0.26

•Adjusted EPS(1) decreased 52.8% to $0.50

•Cash generated by operations decreased by $726.1 million to $47.3 million

Full-Year Key Metrics:

•Gross profits decreased 27.9% to $2.6 billion

•Income from operations decreased 59.4% to $514.6 million

•Adjusted operating margin(1) decreased 1,550 basis points to 19.8%

•Diluted EPS decreased 63.2% to $2.72

•Adjusted EPS(1) decreased 56.2% to $3.30

•Cash generated by operations decreased by $918.2 million to $731.9 million

(1) Adjusted operating margin and adjusted EPS are non-GAAP financial measures. The same factors described in this release that impacted these non-GAAP measures also impacted the comparable GAAP measures. Refer to pages 11 through 13 for further discussion and GAAP to Non-GAAP Reconciliations.

"Our fourth quarter results did not meet our expectations as we continue to battle through a poor demand and pricing environment. Weak freight demand in an elongated market trough, combined with excess carrier capacity, continued to result in a very competitive market," said C.H. Robinson's President and Chief Executive Officer, Dave Bozeman. "With this environment in play, we targeted more truckload volume in the spot market, where we could capture more profit due to seasonal market tension. This led to a sequential improvement in our overall truckload profit per load in October and November. However, in December, our profit per load declined as the cost of purchased transportation moved seasonally higher. In Global Forwarding, we increased our ocean shipments on a year-over-year basis, but they were down sequentially, as they typically are in a fourth quarter."

"As the global freight market fluctuates due to seasonal, cyclical and geopolitical factors, we remain focused on what we can control, by providing superior service to our customers and carriers, streamlining our processes by removing waste and manual touches, and delivering tools that enable our customer and carrier-facing employees to allocate their time to relationship building, value-added solutioning and exception management. Our 17% improvement in NAST shipments per person per day in the fourth quarter exceeded our stated 15% target and is an indicator of the progress that we’ve made on removing waste and manual touches. These efforts are also bearing fruit in other key areas of our business, as Global Forwarding achieved a 20% year-over-year improvement in their shipments per person per month in the fourth quarter. Our continued focus on productivity improvements is one part of our plan to address and optimize our enterprise-wide structural costs," added Bozeman. "As we continue to improve the customer experience and our cost to serve, I’m focused on ensuring that we’ll be ready for the eventual freight market rebound, with a durable cost structure that decouples volume growth from headcount growth and drives operating leverage."

"We share the sentiment of some of our peers, in that we’re happy to say goodbye to 2023. And although 2024 still presents some of the same challenges and headwinds, I’m excited about the work that we’re doing to reinvigorate Robinson’s winning culture and unlock the power of our portfolio. I continue to see an opportunity for the company to reach its full potential and create more shareholder value by improving our value proposition, increasing our market share, accelerating growth, further reducing our structural costs, and improving our efficiency, operating margins and profitability. I’m confident that together we will win for our customers, carriers, employees and shareholders, and I’m incredibly excited about our future," Bozeman concluded.

Summary of Fourth Quarter of 2023 Results Compared to the Fourth Quarter of 2022

•Total revenues decreased 16.7% to $4.2 billion, primarily driven by lower pricing in our truckload and ocean services.

•Gross profits decreased 20.0% to $609.3 million. Adjusted gross profits decreased 19.5% to $618.6 million, primarily driven by lower adjusted gross profit per transaction in truckload.

•Operating expenses decreased 15.4% to $511.2 million. Personnel expenses decreased 15.3% to $361.8 million, primarily due to cost optimization efforts and lower variable compensation. Average headcount declined 13.3%. Other selling, general and administrative (“SG&A”) expenses decreased 15.5% to $149.4 million, primarily due to an impairment of internally developed software recorded in the prior year and a decrease in purchased and contracted services in the current year.

•Income from operations totaled $107.4 million, down 34.5% due to the decrease in adjusted gross profits, partially offset by the decline in operating expenses. Adjusted operating margin(1) of 17.4% declined 400 basis points.

•Interest and other income/expense, net totaled $38.1 million of expense, consisting primarily of $21.6 million of interest expense, which decreased $3.1 million versus last year, due to a lower average debt balance, and an $18.5 million net loss from foreign currency revaluation and realized foreign currency gains and losses.

•The effective tax rate in the quarter was 55.3%, compared to 20.9% in the fourth quarter last year. The higher rate in the fourth quarter of this year was driven by one-time impacts of a settlement with the IRS related to tax incentives for domestic investments in the years 2014 through 2017 and the tax effects of the divestiture of our Argentina operations, partially offset by lower income before taxes.

•Net income totaled $31.0 million, down 67.8% from a year ago. Diluted EPS of $0.26 decreased 67.5%. Adjusted EPS(1) of $0.50 decreased 52.8%.

(1) Adjusted operating margin and adjusted EPS are non-GAAP financial measures. The same factors described in this release that impacted these non-GAAP measures also impacted the comparable GAAP measures. Refer to pages 11 through 13 for further discussion and GAAP to Non-GAAP Reconciliations.

Summary of 2023 Year-to-Date Results Compared to 2022

•Total revenues decreased 28.7% to $17.6 billion, primarily driven by lower pricing in our ocean and truckload services.

•Gross profits decreased 27.9% to $2.6 billion. Adjusted gross profits decreased 27.5% to $2.6 billion, primarily driven by lower adjusted gross profit per transaction in truckload and ocean.

•Operating expenses decreased 10.2% to $2.1 billion. Personnel expenses decreased 14.9% to $1.5 billion, primarily due to cost optimization efforts and lower variable compensation. Average headcount declined 8.9%. Other SG&A expenses increased 3.5% to $624.3 million, primarily due to a $25.3 million gain on the sale-leaseback of our Kansas City regional center recorded in the prior year, partially offset by decreased purchased and contracted services in the current year.

•Income from operations totaled $514.6 million, down 59.4% from last year, due to the decrease in adjusted gross profits, partially offset by the decline in operating expenses. Adjusted operating margin(1) of 19.8% decreased 1,550 basis points.

•Interest and other income/expense, net totaled $105.4 million of expense, primarily consisting of $90.2 million of interest expense, which increased $13.1 million versus last year due to higher average variable interest rates. The year-to-date results also include a $24.4 million net loss from foreign currency revaluation and realized foreign currency gains and losses.

•The effective tax rate for the full year ended December 31, 2023 was 20.5% compared to 19.4% in the year-ago period. The higher rate in the current period was driven by one-time impacts of a settlement with the IRS related to tax incentives for domestic investments in the years 2014 through 2017, the tax effects of the divestiture of our Argentina operations, and lower U.S. tax credits and incentives, partially offset by lower income before taxes.

•Net income totaled $325.1 million, down 65.4% from a year ago. Diluted EPS of $2.72 decreased 63.2%. Adjusted EPS(1) of $3.30 decreased 56.2%.

(1) Adjusted operating margin and adjusted EPS are non-GAAP financial measures. The same factors described in this release that impacted these non-GAAP measures also impacted the comparable GAAP measures. Refer to pages 11 through 13 for further discussion and GAAP to Non-GAAP Reconciliations.

North American Surface Transportation (“NAST”) Results

Summarized financial results of our NAST segment are as follows (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

| Total revenues | $ | 3,000,650 | | | $ | 3,563,071 | | | (15.8) | % | | $ | 12,471,075 | | | $ | 15,827,467 | | | (21.2) | % |

Adjusted gross profits(1) | 380,157 | | | 502,266 | | | (24.3) | % | | 1,593,854 | | | 2,196,704 | | | (27.4) | % |

| Income from operations | 95,958 | | | 162,550 | | | (41.0) | % | | 459,960 | | | 833,302 | | | (44.8) | % |

| | | | | | | | | | | |

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

Fourth quarter total revenues for the NAST segment totaled $3.0 billion, a decrease of 15.8% over the prior year, primarily driven by lower truckload pricing, reflecting an oversupply of truckload capacity compared to soft freight demand. NAST adjusted gross profits decreased 24.3% in the quarter to $380.2 million. Adjusted gross profits in truckload decreased 30.8% due to a 29.5% decrease in adjusted gross profit per shipment and a 1.5% decline in truckload shipments. Our average truckload linehaul rate per mile charged to our customers, which excludes fuel surcharges, decreased approximately 13.5% in the quarter compared to the prior year, while truckload linehaul cost per mile, excluding fuel surcharges, decreased approximately 10.5%, resulting in a 28.0% decrease in truckload adjusted gross profit per mile. LTL adjusted gross profits decreased 9.0% versus the year-ago period, as adjusted gross profit per order decreased 8.5% and LTL shipments decreased 0.5%. NAST overall volume growth was down 1.0% for the quarter. Operating expenses decreased 16.3%, primarily due to cost optimization efforts, including lower average employee headcount, lower variable compensation, and lower technology expenses. NAST average employee headcount was down 15.8% in the quarter. Income from operations decreased 41.0% to $96.0 million, and adjusted operating margin declined 720 basis points to 25.2%.

Global Forwarding Results

Summarized financial results of our Global Forwarding segment are as follows (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

| Total revenues | $ | 708,814 | | | $ | 1,013,306 | | | (30.0) | % | | $ | 2,997,704 | | | $ | 6,812,008 | | | (56.0) | % |

Adjusted gross profits(1) | 162,322 | | | 188,749 | | | (14.0) | % | | 689,365 | | | 1,083,473 | | | (36.4) | % |

| Income from operations | 22,576 | | | 28,216 | | | (20.0) | % | | 85,830 | | | 449,364 | | | (80.9) | % |

| | | | | | | | | | | |

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

Fourth quarter total revenues for the Global Forwarding segment decreased 30.0% to $708.8 million, primarily driven by lower pricing in our ocean service, reflecting an oversupply of vessel capacity compared to soft freight demand. Adjusted gross profits decreased 14.0% in the quarter to $162.3 million. Ocean adjusted gross profits decreased 17.2%, driven by a 20.5% decrease in adjusted gross profit per shipment, partially offset by a 4.0% increase in shipments. Air adjusted gross profits decreased 11.5%, driven by a 9.0% decrease in adjusted gross profit per metric ton shipped and a 2.5% decline in metric tons shipped. Customs adjusted gross profits decreased 3.1%, driven primarily by a 7.5% decrease in adjusted gross profit per transaction, partially offset by a 4.5% increase in transaction volume. Operating expenses decreased 12.9%, primarily due to lower restructuring expenses, cost optimization efforts, including lower average employee headcount, and lower variable compensation. Fourth quarter average employee headcount decreased 12.6%. Income from operations decreased 20.0% to $22.6 million, and adjusted operating margin declined 100 basis points to 13.9% in the quarter.

All Other and Corporate Results

Total revenues and adjusted gross profits for Robinson Fresh, Managed Services and Other Surface Transportation are summarized as follows (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

| Total revenues | $ | 512,423 | | | $ | 490,444 | | | 4.5 | % | | $ | 2,127,664 | | | $ | 2,057,150 | | | 3.4 | % |

Adjusted gross profits(1): | | | | | | | | | | | |

| Robinson Fresh | $ | 31,093 | | | $ | 28,476 | | | 9.2 | % | | $ | 131,216 | | | $ | 121,639 | | | 7.9 | % |

| Managed Services | 28,846 | | | 29,799 | | | (3.2) | % | | 116,196 | | | 115,094 | | | 1.0 | % |

| Other Surface Transportation | 16,205 | | | 18,884 | | | (14.2) | % | | 73,977 | | | 76,267 | | | (3.0) | % |

| | | | | | | | | | | |

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

Fourth quarter Robinson Fresh adjusted gross profits increased 9.2% to $31.1 million, due to a 4.5% increase in case volume and integrated supply chain solutions for foodservice and wholesale customers. Managed Services adjusted gross profits decreased 3.2%, primarily due to a reduction in freight under management related to lower freight rates. Other Surface Transportation adjusted gross profits decreased 14.2% to $16.2 million, primarily due to a 16.6% decrease in Europe truckload adjusted gross profits.

Other Income Statement Items

The fourth quarter effective tax rate was 55.3%, up from 20.9% last year. The higher rate in the fourth quarter of this year was driven by one-time impacts of a settlement with the IRS related to tax incentives for domestic investments in the years 2014 through 2017, the tax effects from the divestiture of our Argentina business, and higher foreign taxes, partially offset by lower income before taxes and higher foreign tax credits. For 2024, we expect our full-year effective tax rate to be 17% to 19%.

Interest and other income/expense, net totaled $38.1 million of expense, consisting primarily of $21.6 million of interest expense, which decreased $3.1 million versus the fourth quarter of 2022 due to a lower average debt balance, and an $18.5 million net loss from foreign currency revaluation and realized foreign currency gains and losses.

Diluted weighted average shares outstanding in the quarter were down 0.7% due to share repurchases over the past twelve months.

Cash Flow Generation and Capital Distribution

Cash generated from operations totaled $47.3 million in the fourth quarter, compared to $773.4 million of cash generated from operations in the fourth quarter of 2022. The $726.1 million decrease was primarily related to a $657.3 million decline in cash provided by changes in net operating working capital, due to a $7.4 million sequential increase in net operating working capital in the fourth quarter of 2023 compared to a $649.9 million sequential decrease in the fourth quarter of 2022.

In the fourth quarter of 2023, cash returned to shareholders totaled $74.1 million, with $72.6 million in cash dividends and $1.5 million in repurchases of common stock.

Capital expenditures totaled $16.1 million in the quarter. Capital expenditures for 2024 are expected to be $85 million to $95 million.

About C.H. Robinson

C.H. Robinson solves logistics problems for companies across the globe and across industries, from the simple to the most complex. With $22 billion in freight under management and 19 million shipments annually, we are one of the world’s largest logistics platforms. Our global suite of services accelerates trade to seamlessly deliver the products and goods that drive the world’s economy. With the combination of our multimodal transportation management system and expertise, we use our information advantage to deliver smarter solutions for more than 90,000 of our customers and the more than 450,000 contract carriers on our platform. Our technology is built by and for supply chain experts to bring faster, more meaningful improvements to our customers’ businesses. As a responsible global citizen, we are also proud to contribute millions of dollars to support causes that matter to our company, our Foundation and our employees. For more information, visit us at www.chrobinson.com (Nasdaq: CHRW).

Except for the historical information contained herein, the matters set forth in this release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to, factors such as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; fuel price increases or decreases, or fuel shortages; competition and growth rates within the global logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; risks associated with significant disruptions in the transportation industry; risks associated with identifying and completing suitable acquisitions; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; risks associated with reliance on technology to operate our business; cyber-security related risks; our ability to staff and retain employees; risks associated with operations outside of the U.S.; our ability to successfully integrate the operations of acquired companies with our historic operations; climate change related risks; risks associated with our indebtedness; risks associated with interest rates; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with the potential impact of changes in government regulations; risks associated with the changes to income tax regulations; risks associated with the produce industry, including food safety and contamination issues; the impact of war on the economy; changes to our capital structure; changes due to catastrophic events; risks associated with the usage of artificial intelligence technologies; and other risks and uncertainties detailed in our Annual and Quarterly Reports.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update such statement to reflect events or circumstances arising after such date. All remarks made during our financial results conference call will be current at the time of the call, and we undertake no obligation to update the replay.

Conference Call Information:

C.H. Robinson Worldwide Fourth Quarter 2023 Earnings Conference Call

Wednesday, January 31, 2024; 5:00 p.m. Eastern Time

Presentation slides and a simultaneous live audio webcast of the conference call may be accessed through the Investor Relations link on C.H. Robinson’s website at www.chrobinson.com.

To participate in the conference call by telephone, please call ten minutes early by dialing: 877-269-7756

International callers dial +1-201-689-7817

Adjusted Gross Profit by Service Line

(in thousands)

This table of summary results presents our service line adjusted gross profits on an enterprise basis. The service line adjusted gross profits in the table differ from the service line adjusted gross profits discussed within the segments as our segments may have revenues from multiple service lines.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

Adjusted gross profits(1): | | | | | | | | | | | |

| Transportation | | | | | | | | | | | |

| Truckload | $ | 243,839 | | | $ | 346,845 | | | (29.7) | % | | $ | 1,039,079 | | | $ | 1,561,310 | | | (33.4) | % |

| LTL | 136,602 | | | 149,376 | | | (8.6) | % | | 550,373 | | | 632,116 | | | (12.9) | % |

| Ocean | 99,191 | | | 120,296 | | | (17.5) | % | | 420,883 | | | 729,839 | | | (42.3) | % |

| Air | 28,224 | | | 32,030 | | | (11.9) | % | | 123,470 | | | 198,166 | | | (37.7) | % |

| Customs | 23,730 | | | 24,495 | | | (3.1) | % | | 97,096 | | | 107,691 | | | (9.8) | % |

| Other logistics services | 59,402 | | | 68,909 | | | (13.8) | % | | 255,735 | | | 251,547 | | | 1.7 | % |

| Total transportation | 590,988 | | | 741,951 | | | (20.3) | % | | 2,486,636 | | | 3,480,669 | | | (28.6) | % |

| Sourcing | 27,635 | | | 26,223 | | | 5.4 | % | | 117,972 | | | 112,508 | | | 4.9 | % |

| Total adjusted gross profits | $ | 618,623 | | | $ | 768,174 | | | (19.5) | % | | $ | 2,604,608 | | | $ | 3,593,177 | | | (27.5) | % |

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

GAAP to Non-GAAP Reconciliation

(unaudited, in thousands)

Our adjusted gross profit is a non-GAAP financial measure. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. We believe adjusted gross profit is a useful measure of our ability to source, add value, and sell services and products that are provided by third parties, and we consider adjusted gross profit to be a primary performance measurement. Accordingly, the discussion of our results of operations often focuses on the changes in our adjusted gross profit. The reconciliation of gross profit to adjusted gross profit is presented below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

| Revenues: | | | | | | | | | | | |

| Transportation | $ | 3,930,461 | | | $ | 4,798,027 | | | (18.1) | % | | $ | 16,372,660 | | | $ | 23,516,384 | | | (30.4) | % |

| Sourcing | 291,426 | | | 268,794 | | | 8.4 | % | | 1,223,783 | | | 1,180,241 | | | 3.7 | % |

| Total revenues | 4,221,887 | | | 5,066,821 | | | (16.7) | % | | 17,596,443 | | | 24,696,625 | | | (28.7) | % |

| Costs and expenses: | | | | | | | | | | | |

| Purchased transportation and related services | 3,339,473 | | | 4,056,076 | | | (17.7) | % | | 13,886,024 | | | 20,035,715 | | | (30.7) | % |

| Purchased products sourced for resale | 263,791 | | | 242,571 | | | 8.7 | % | | 1,105,811 | | | 1,067,733 | | | 3.6 | % |

| Direct internally developed software amortization | 9,320 | | | 6,656 | | | 40.0 | % | | 33,620 | | | 25,487 | | | 31.9 | % |

| Total direct expenses | 3,612,584 | | | 4,305,303 | | | (16.1) | % | | 15,025,455 | | | 21,128,935 | | | (28.9) | % |

| Gross profit | $ | 609,303 | | | $ | 761,518 | | | (20.0) | % | | $ | 2,570,988 | | | $ | 3,567,690 | | | (27.9) | % |

| Plus: Direct internally developed software amortization | 9,320 | | | 6,656 | | | 40.0 | % | | 33,620 | | | 25,487 | | | 31.9 | % |

| Adjusted gross profit | $ | 618,623 | | | $ | 768,174 | | | (19.5) | % | | $ | 2,604,608 | | | $ | 3,593,177 | | | (27.5) | % |

Our adjusted operating margin is a non-GAAP financial measure calculated as operating income divided by adjusted gross profit. Our adjusted operating margin - excluding restructuring and gain on sale of property is a similar non-GAAP financial measure as adjusted operating margin, but also excludes the impact of restructuring and the gain on sale and leaseback of our Kansas City regional center in 2022 (the “gain on sale of property”). We believe adjusted operating margin and adjusted operating margin - excluding restructuring and gain on sale of property are useful measures of our profitability in comparison to our adjusted gross profit, which we consider a primary performance metric as discussed above. The comparisons of operating margin to adjusted operating margin and adjusted operating margin - excluding restructuring and gain on sale of property are presented below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

| | | | | | | | | | | |

| Total revenues | $ | 4,221,887 | | | $ | 5,066,821 | | | (16.7 | %) | | $ | 17,596,443 | | | $ | 24,696,625 | | | (28.7 | %) |

| Income from operations | 107,429 | | | 164,034 | | | (34.5 | %) | | 514,607 | | | 1,266,782 | | | (59.4 | %) |

| Operating margin | 2.5 | % | | 3.2 | % | | (70) bps | | 2.9 | % | | 5.1 | % | | (220) bps |

| | | | | | | | | | | |

| Adjusted gross profit | $ | 618,623 | | | $ | 768,174 | | | (19.5 | %) | | $ | 2,604,608 | | | $ | 3,593,177 | | | (27.5 | %) |

| Income from operations | 107,429 | | | 164,034 | | | (34.5 | %) | | 514,607 | | | 1,266,782 | | | (59.4 | %) |

| Adjusted operating margin | 17.4 | % | | 21.4 | % | | (400) | bps | | 19.8 | % | | 35.3 | % | | (1,550) | bps |

| | | | | | | | | | | |

| Adjusted gross profit | $ | 618,623 | | | $ | 768,174 | | | (19.5 | %) | | $ | 2,604,608 | | | $ | 3,593,177 | | | (27.5 | %) |

| Adjusted income from operations | 103,153 | | | 200,718 | | | (48.6 | %) | | 552,648 | | | 1,278,170 | | | (56.8 | %) |

| Adjusted operating margin - excluding restructuring and gain on sale of property | 16.7 | % | | 26.1 | % | | (940) | bps | | 21.2 | % | | 35.6 | % | | (1,440) | bps |

GAAP to Non-GAAP Reconciliation

(unaudited, in thousands)

Our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and adjusted net income per share (diluted) are non-GAAP financial measures. Adjusted income (loss) from operations and adjusted net income per share (diluted) is calculated as income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and net income per share (diluted) excluding the impact of restructuring and gain on sale of property. The adjustments to net income per share (diluted) include restructuring-related costs, gain on sale of property, a foreign currency loss on divested operations, and an income tax settlement. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and adjusted net income per share (diluted). The reconciliation of income (loss) from operations to adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and net income per share (diluted) to adjusted income (loss) from operations and adjusted net income per share (diluted) is presented below (in thousands except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| NAST | | Global Forwarding | | All

Other and Corporate | | Consolidated |

| Three Months Ended December 31, 2023 | | | | | | | |

| Non-GAAP Reconciliation: | | | | | | | |

| Income (loss) from operations | $ | 95,958 | | | $ | 22,576 | | | $ | (11,105) | | | $ | 107,429 | |

| Severance and other personnel expenses | — | | | (925) | | | (409) | | | (1,334) | |

| Other selling, general, and administrative expenses | — | | | (3,084) | | | 142 | | | (2,942) | |

Total adjustments to operating income (loss)(1) | — | | | (4,009) | | | (267) | | | (4,276) | |

| Adjusted income (loss) from operations | $ | 95,958 | | | $ | 18,567 | | | $ | (11,372) | | | $ | 103,153 | |

| | | | | | | |

| Adjusted gross profit | $ | 380,157 | | | $ | 162,322 | | | $ | 76,144 | | | $ | 618,623 | |

| Adjusted income (loss) from operations | 95,958 | | | 18,567 | | | (11,372) | | | 103,153 | |

| Adjusted operating margin - excluding restructuring | 25.2 | % | | 11.4 | % | | N/M | | 16.7 | % |

| | | | | | | |

| NAST | | Global Forwarding | | All

Other and Corporate | | Consolidated |

| Twelve Months Ended December 31, 2023 | | | | | | | |

| Income (loss) from operations | $ | 459,960 | | | $ | 85,830 | | | $ | (31,183) | | | $ | 514,607 | |

| Severance and other personnel expenses | 1,083 | | | 3,817 | | | 13,509 | | | 18,409 | |

| Other selling, general, and administrative expenses | 8 | | | 18,158 | | | 1,466 | | | 19,632 | |

Total adjustments to operating income (loss)(2) | 1,091 | | | 21,975 | | | 14,975 | | | 38,041 | |

| Adjusted income (loss) from operations | $ | 461,051 | | | $ | 107,805 | | | $ | (16,208) | | | $ | 552,648 | |

| | | | | | | |

| Adjusted gross profit | $ | 1,593,854 | | | $ | 689,365 | | | $ | 321,389 | | | $ | 2,604,608 | |

| Adjusted income (loss) from operations | 461,051 | | | 107,805 | | | (16,208) | | | 552,648 | |

| Adjusted operating margin - excluding restructuring | 28.9 | % | | 15.6 | % | | N/M | | 21.2 | % |

| | | | | | | |

| Three Months Ended

December 31, 2023 | | Twelve Months Ended

December 31, 2023 |

| $ in 000's | | per share | | $ in 000's | | per share |

| Net income and per share (diluted) | $ | 30,973 | | | $ | 0.26 | | | $ | 325,129 | | | $ | 2.72 | |

Restructuring and related costs, pre-tax(1)(2) | (2,856) | | | (0.02) | | | 39,461 | | | 0.32 | |

| | | | | | | |

| Foreign currency loss on divested operations, pre-tax | 7,454 | | | 0.06 | | | 16,375 | | | 0.14 | |

| Income tax settlement and tax effect of adjustments | 23,928 | | | 0.20 | | | 14,172 | | | 0.12 | |

| Adjusted net income and per share (diluted) | $ | 59,499 | | | $ | 0.50 | | | $ | 395,137 | | | $ | 3.30 | |

____________________________________________

(1) The three months ended December 31, 2023 include restructuring expense adjustments of $4.3 million related to the divestiture of our operations in Argentina.

(2) The twelve months ended December 31, 2023 include restructuring expenses of $18.4 million related to workforce reductions in addition to $19.6 million of asset impairment and other charges related to the divestiture of our operations in Argentina.

| | | | | | | | | | | | | | | | | | | | | | | |

| NAST | | Global Forwarding | | All

Other and Corporate | | Consolidated |

| Three Months Ended December 31, 2022 | | | | | | | |

| Non-GAAP Reconciliation: | | | | | | | |

| Income (loss) from operations | $ | 162,550 | | | $ | 28,216 | | | $ | (26,732) | | | $ | 164,034 | |

| Severance and other personnel expenses | 6,323 | | | 3,831 | | | 11,380 | | | 21,534 | |

| Other selling, general, and administrative expenses | 3,175 | | | 3,174 | | | 8,801 | | | 15,150 | |

Total adjustments to operating income (loss)(1) | 9,498 | | | 7,005 | | | 20,181 | | | 36,684 | |

| Adjusted income (loss) from operations | $ | 172,048 | | | $ | 35,221 | | | $ | (6,551) | | | $ | 200,718 | |

| | | | | | | |

| Adjusted gross profit | $ | 502,266 | | | $ | 188,749 | | | $ | 77,159 | | | $ | 768,174 | |

| Adjusted income (loss) from operations | 172,048 | | | 35,221 | | | (6,551) | | | 200,718 | |

| Adjusted operating margin - excluding restructuring | 34.3 | % | | 18.7 | % | | N/M | | 26.1 | % |

| | | | | | | |

| NAST | | Global Forwarding | | All

Other and Corporate | | Consolidated |

| Twelve Months Ended December 31, 2022 | | | | | | | |

| Income (loss) from operations | $ | 833,302 | | | $ | 449,364 | | | $ | (15,884) | | | $ | 1,266,782 | |

| Severance and other personnel expenses | 6,323 | | | 3,831 | | | 11,380 | | | 21,534 | |

| Other selling, general, and administrative expenses | 3,175 | | | 3,174 | | | (16,495) | | | (10,146) | |

Total adjustments to operating income (loss)(1)(2) | 9,498 | | | 7,005 | | | (5,115) | | | 11,388 | |

| Adjusted income (loss) from operations | $ | 842,800 | | | $ | 456,369 | | | $ | (20,999) | | | $ | 1,278,170 | |

| | | | | | | |

| Adjusted gross profit | $ | 2,196,704 | | | $ | 1,083,473 | | | $ | 313,000 | | | $ | 3,593,177 | |

| Adjusted income (loss) from operations | 842,800 | | | 456,369 | | | (20,999) | | | 1,278,170 | |

| Adjusted operating margin - excluding restructuring and gain on sale of property | 38.4 | % | | 42.1 | % | | N/M | | 35.6 | % |

| | | | | | | |

| Three Months Ended

December 31, 2022 | | Twelve Months Ended

December 31, 2022 |

| $ in 000's | | per share | | $ in 000's | | per share |

| Net income and per share (diluted) | $ | 96,193 | | | $ | 0.80 | | | $ | 940,524 | | | $ | 7.40 | |

Restructuring and related costs, pre-tax(1) | 36,684 | | | 0.30 | | | 36,684 | | | 0.29 | |

Gain on sale of property, pre-tax(2) | — | | | — | | | (25,296) | | | (0.20) | |

| Foreign currency loss on divested operations, pre-tax | 3,407 | | | 0.03 | | | 9,268 | | | 0.07 | |

| Tax effect of adjustments | (8,804) | | | $ | (0.07) | | | (2,733) | | | $ | (0.02) | |

| Adjusted net income and per share (diluted) | $ | 127,480 | | | $ | 1.06 | | | $ | 958,447 | | | $ | 7.54 | |

____________________________________________

(1) The three and twelve months ended December 31, 2022 include restructuring expenses of $21.5 million related to workforce reductions and $15.2 million of other charges, primarily related to an impairment of internally developed software due to reprioritizing our investments in technology to accelerate our digital transformation and productivity initiatives.

(2) The twelve months ended December 31, 2022 include a gain on sale of property and equipment of $25.3 million related to the sale-leaseback of our Kansas City regional center.

Condensed Consolidated Statements of Income

(unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| |

| 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

| | | | | | | | | | | |

| Revenues: | | | | | | | | | | | |

| Transportation | $ | 3,930,461 | | | $ | 4,798,027 | | | (18.1) | % | | $ | 16,372,660 | | | $ | 23,516,384 | | | (30.4) | % |

| Sourcing | 291,426 | | | 268,794 | | | 8.4 | % | | 1,223,783 | | | 1,180,241 | | | 3.7 | % |

| Total revenues | 4,221,887 | | | 5,066,821 | | | (16.7) | % | | 17,596,443 | | | 24,696,625 | | | (28.7) | % |

| Costs and expenses: | | | | | | | | | | | |

| Purchased transportation and related services | 3,339,473 | | | 4,056,076 | | | (17.7) | % | | 13,886,024 | | | 20,035,715 | | | (30.7) | % |

| Purchased products sourced for resale | 263,791 | | | 242,571 | | | 8.7 | % | | 1,105,811 | | | 1,067,733 | | | 3.6 | % |

| Personnel expenses | 361,820 | | | 427,310 | | | (15.3) | % | | 1,465,735 | | | 1,722,980 | | | (14.9) | % |

| Other selling, general, and administrative expenses | 149,374 | | | 176,830 | | | (15.5) | % | | 624,266 | | | 603,415 | | | 3.5 | % |

| Total costs and expenses | 4,114,458 | | | 4,902,787 | | | (16.1) | % | | 17,081,836 | | | 23,429,843 | | | (27.1) | % |

| Income from operations | 107,429 | | | 164,034 | | | (34.5) | % | | 514,607 | | | 1,266,782 | | | (59.4) | % |

| Interest and other income/expense, net | (38,149) | | | (42,476) | | | (10.2) | % | | (105,421) | | | (100,017) | | | 5.4 | % |

| Income before provision for income taxes | 69,280 | | | 121,558 | | | (43.0) | % | | 409,186 | | | 1,166,765 | | | (64.9) | % |

| Provision for income taxes | 38,307 | | | 25,365 | | | 51.0 | % | | 84,057 | | | 226,241 | | | (62.8) | % |

| Net income | $ | 30,973 | | | $ | 96,193 | | | (67.8) | % | | $ | 325,129 | | | $ | 940,524 | | | (65.4) | % |

| | | | | | | | | | | |

| Net income per share (basic) | $ | 0.26 | | | $ | 0.81 | | | (67.9) | % | | $ | 2.74 | | | $ | 7.48 | | | (63.4) | % |

| Net income per share (diluted) | $ | 0.26 | | | $ | 0.80 | | | (67.5) | % | | $ | 2.72 | | | $ | 7.40 | | | (63.2) | % |

| | | | | | | | | | | |

| Weighted average shares outstanding (basic) | 118,605 | | | 119,212 | | | (0.5) | % | | 118,551 | | | 125,743 | | | (5.7) | % |

| Weighted average shares outstanding (diluted) | 119,613 | | | 120,472 | | | (0.7) | % | | 119,677 | | | 127,150 | | | (5.9) | % |

Business Segment Information

(unaudited, in thousands, except average employee headcount)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | NAST | | Global Forwarding | | | All Other and Corporate | | | | Consolidated |

| Three Months Ended December 31, 2023 | | | | | | | | | | | |

| Total revenues | | $ | 3,000,650 | | | $ | 708,814 | | | | $ | 512,423 | | | | | $ | 4,221,887 | |

Adjusted gross profits(1) | | 380,157 | | | 162,322 | | | | 76,144 | | | | | 618,623 | |

| Income (loss) from operations | | 95,958 | | | 22,576 | | | | (11,105) | | | | | 107,429 | |

| Depreciation and amortization | | 5,638 | | | 2,915 | | | | 14,533 | | | | | 23,086 | |

Total assets(2) | | 3,008,459 | | | 1,094,895 | | | | 1,121,926 | | | | | 5,225,280 | |

| Average employee headcount | | 6,103 | | | 5,021 | | | | 4,195 | | | | | 15,319 | |

| | | | | | | | | | | |

| | NAST | | Global Forwarding | | | All Other and Corporate | | | | Consolidated |

| Three Months Ended December 31, 2022 | | | | | | | | | | | |

| Total revenues | | $ | 3,563,071 | | | $ | 1,013,306 | | | | $ | 490,444 | | | | | $ | 5,066,821 | |

Adjusted gross profits(1) | | 502,266 | | | 188,749 | | | | 77,159 | | | | | 768,174 | |

| Income (loss) from operations | | 162,550 | | | 28,216 | | | | (26,732) | | | | | 164,034 | |

| Depreciation and amortization | | 5,542 | | | 5,441 | | | | 13,070 | | | | | 24,053 | |

Total assets(2) | | 3,304,480 | | | 1,507,913 | | | | 1,142,171 | | | | | 5,954,564 | |

| Average employee headcount | | 7,251 | | | 5,745 | | | | 4,676 | | | | | 17,672 | |

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained above. The difference between adjusted gross profits and gross profits is not material.

(2) All cash and cash equivalents are included in All Other and Corporate.

Business Segment Information

(unaudited, in thousands, except average employee headcount)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | NAST | | Global Forwarding | | All Other and Corporate | | | | Consolidated |

| Twelve Months Ended December 31, 2023 | | | | | | | | | | |

| Total revenues | | $ | 12,471,075 | | | $ | 2,997,704 | | | $ | 2,127,664 | | | | | $ | 17,596,443 | |

Adjusted gross profits(1) | | 1,593,854 | | | 689,365 | | | 321,389 | | | | | 2,604,608 | |

| Income (loss) from operations | | 459,960 | | | 85,830 | | | (31,183) | | | | | 514,607 | |

| Depreciation and amortization | | 23,027 | | | 19,325 | | | 56,633 | | | | | 98,985 | |

Total assets(2) | | 3,008,459 | | | 1,094,895 | | | 1,121,926 | | | | | 5,225,280 | |

| Average employee headcount | | 6,469 | | | 5,222 | | | 4,350 | | | | | 16,041 | |

| | | | | | | | | | |

| | NAST | | Global Forwarding | | All Other and Corporate | | | | Consolidated |

| Twelve Months Ended December 31, 2022 | | | | | | | | | | |

| Total revenues | | $ | 15,827,467 | | | $ | 6,812,008 | | | $ | 2,057,150 | | | | | $ | 24,696,625 | |

Adjusted gross profits(1) | | 2,196,704 | | | 1,083,473 | | | 313,000 | | | | | 3,593,177 | |

| Income (loss) from operations | | 833,302 | | | 449,364 | | | (15,884) | | | | | 1,266,782 | |

| Depreciation and amortization | | 23,643 | | | 21,835 | | | 47,298 | | | | | 92,776 | |

Total assets(2) | | 3,304,480 | | | 1,507,913 | | | 1,142,171 | | | | | 5,954,564 | |

| Average employee headcount | | 7,365 | | | 5,712 | | | 4,524 | | | | | 17,601 | |

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained above. The difference between adjusted gross profits and gross profits is not material.

(2) All cash and cash equivalents are included in All Other and Corporate.

Condensed Consolidated Balance Sheets

(unaudited, in thousands)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 145,524 | | | $ | 217,482 | |

| Receivables, net of allowance for credit loss | 2,381,963 | | | 2,991,753 | |

| Contract assets, net of allowance for credit loss | 189,900 | | | 257,597 | |

| Prepaid expenses and other | 163,307 | | | 122,406 | |

| Total current assets | 2,880,694 | | | 3,589,238 | |

| | | | |

| Property and equipment, net of accumulated depreciation and amortization | 144,718 | | | 159,432 | |

| Right-of-use lease assets | 353,890 | | | 372,141 | |

| Intangible and other assets, net of accumulated amortization | 1,845,978 | | | 1,833,753 | |

| Total assets | $ | 5,225,280 | | | $ | 5,954,564 | |

| | | |

| Liabilities and stockholders’ investment | | | |

| Current liabilities: | | | |

| Accounts payable and outstanding checks | $ | 1,370,334 | | | $ | 1,570,559 | |

| Accrued expenses: | | | |

| Compensation | 135,104 | | | 242,605 | |

| Transportation expense | 147,921 | | | 199,092 | |

| Income taxes | 4,748 | | | 15,210 | |

| Other accrued liabilities | 159,435 | | | 168,009 | |

| Current lease liabilities | 74,451 | | | 73,722 | |

| Current portion of debt | 160,000 | | | 1,053,655 | |

| Total current liabilities | 2,051,993 | | | 3,322,852 | |

| | | |

| Long-term debt | 1,420,487 | | | 920,049 | |

| Noncurrent lease liabilities | 297,563 | | | 313,742 | |

| Noncurrent income taxes payable | 21,289 | | | 28,317 | |

| Deferred tax liabilities | 13,177 | | | 14,256 | |

| Other long-term liabilities | 2,074 | | | 1,926 | |

| Total liabilities | 3,806,583 | | | 4,601,142 | |

| | | |

| Total stockholders’ investment | 1,418,697 | | | 1,353,422 | |

| Total liabilities and stockholders’ investment | $ | 5,225,280 | | | $ | 5,954,564 | |

Condensed Consolidated Statements of Cash Flow

(unaudited, in thousands, except operational data)

| | | | | | | | | | | |

| Twelve Months Ended December 31, |

| Operating activities: | 2023 | | 2022(1) |

| | | |

| Net income | $ | 325,129 | | | $ | 940,524 | |

| Adjustments to reconcile net income to net cash provided by (used for) operating activities: | | | |

| Depreciation and amortization | 98,985 | | | 92,776 | |

| Provision for credit losses | (6,047) | | | (4,476) | |

| Stock-based compensation | 58,169 | | | 90,677 | |

| Deferred income taxes | (37,746) | | | (58,566) | |

| Excess tax benefit on stock-based compensation | (11,319) | | | (13,662) | |

| Loss on disposal group held for sale | 17,698 | | | — | |

| Other operating activities | 5,541 | | | (6,627) | |

| Changes in operating elements, net of acquisitions: | | | |

| Receivables | 607,259 | | | 923,524 | |

| Contract assets | 68,041 | | | 197,097 | |

| Prepaid expenses and other | (39,048) | | | (28,495) | |

| Right of use asset | 19,255 | | | (82,754) | |

| Accounts payable and outstanding checks | (200,843) | | | (307,266) | |

| Accrued compensation | (108,084) | | | 42,266 | |

| Accrued transportation expenses | (51,171) | | | (143,686) | |

| Accrued income taxes | (2,284) | | | (69,817) | |

| Other accrued liabilities | (11,991) | | | 2,371 | |

| Lease liability | (16,500) | | | 83,084 | |

| Other assets and liabilities | 16,902 | | | (6,799) | |

| Net cash provided by operating activities | 731,946 | | | 1,650,171 | |

| | | |

| Investing activities: | | | |

| Purchases of property and equipment | (29,989) | | | (61,915) | |

| Purchases and development of software | (54,122) | | | (66,582) | |

| | | |

| Proceeds from sale of property and equipment | 1,324 | | | 63,579 | |

| Net cash used for investing activities | (82,787) | | | (64,918) | |

| | | |

| Financing activities: | | | |

| Proceeds from stock issued for employee benefit plans | 56,914 | | | 100,059 | |

| Stock tendered for payment of withholding taxes | (25,294) | | | (28,388) | |

| Repurchases of common stock | (63,884) | | | (1,459,900) | |

| Cash dividends | (291,569) | | | (285,317) | |

| Proceeds from long-term borrowings | — | | | 200,000 | |

| | | |

| Proceeds from short-term borrowings | 3,893,750 | | | 4,500,000 | |

| Payments on short-term borrowings | (4,287,750) | | | (4,646,000) | |

| Net cash used for financing activities | (717,833) | | | (1,619,546) | |

| Effect of exchange rates on cash and cash equivalents | (3,284) | | | (5,638) | |

| | | |

| Net change in cash and cash equivalents | (71,958) | | | (39,931) | |

| Cash and cash equivalents, beginning of period | 217,482 | | | 257,413 | |

| Cash and cash equivalents, end of period | $ | 145,524 | | | $ | 217,482 | |

| | | |

| As of December 31, |

| Operational Data: | 2023 | | 2022 |

| Employees | 15,246 | | | 17,399 | |

____________________________________________

(1) The Twelve Months Ended December 31, 2022 has been adjusted to conform to current year presentation.

Source: C.H. Robinson

CHRW-IR

1 Q4 2023 January 31, 2024 Earnings Presentation Dave Bozeman, President & CEO Arun Rajan, Chief Operating Officer Mike Zechmeister, Chief Financial Officer Chuck Ives, Director of Investor Relations

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to factors such as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; fuel price increases or decreases, or fuel shortages; competition and growth rates within the global logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; risks associated with significant disruptions in the transportation industry; risks associated with identifying and completing suitable acquisitions; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; risks associated with reliance on technology to operate our business; cyber-security related risks; our ability to staff and retain employees; risks associated with operations outside of the U.S.; our ability to successfully integrate the operations of acquired companies with our historic operations; climate change related risks; risks associated with our indebtedness; risks associated with interest rates; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with the potential impact of changes in government regulations; risks associated with the changes to income tax regulations; risks associated with the produce industry, including food safety and contamination issues; the impact of war on the economy; changes to our capital structure; changes due to catastrophic events; risks associated with the usage of artificial intelligence technologies; and other risks and uncertainties detailed in our Annual and Quarterly Reports. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update such statement to reflect events or circumstances arising after such date. 2©2024 C.H. Robinson Worldwide, Inc. All Rights Reserved.

Thoughts from President & CEO, Dave Bozeman 3 ■ My initial diagnosis of the company is complete, we're charting our path forward, and we're taking action on the items below to unlock the power of our portfolio. ■ Our structural cost base grew too much during the pandemic. We made significant progress on reducing our cost structure in 2023, but it needs to continue to improve, by embedding Lean practices, removing waste and expanding our digital capabilities. This will enable us to be the most efficient operator, in addition to the highest value provider. ■ Customers' logistics needs are becoming increasingly complex, and we can better leverage our unique expertise and information advantage and advance our cutting-edge technology to deliver more robust capabilities and market-leading outcomes. ■ We need to drive focus on profitable growth in our four core modes - North American truckload and LTL and global ocean and air - as the engines to ignite growth, by reclaiming market share in eroded segments and expanding our addressable market through value-added services and solutions that drive new volume to the core modes. ■ We can drive better synergies across our portfolio of services to accelerate profitable growth, by improving how we go to market as one company with unified account management versus showing up as distinct business units. ■ Our people are our greatest strength, and I'm confident we will win for our customers, carriers, employees and shareholders.

Q4 Highlights 4 ■ Experienced normal seasonal declines in shipments ■ Global freight markets continue to be impacted by weak demand and excess capacity, resulting in a loose market and suppressed transportation rates ■ Providing superior service to our customers and carriers, as reflected in our 2023 net promoter scores that were the highest on record for the company ■ Focused on continuing to remove waste and manual touches from our processes and ensuring readiness for the eventual freight market rebound ■ 17% Y/Y improvement in Q4 NAST shipments/person/day against a goal of 15%, and 20% Y/Y improvement in Q4 Global Forwarding shipments/person/month, with the compounded benefits of additional productivity improvements expected beyond 2023 ■ Continuing to invest through cycles in improving the customer and carrier experience and in decoupling volume growth from headcount growth $4.2B Total Revenues -16.7% Y/Y $619M Adj. Gross Profits(1) -19.5% Y/Y $107M Income from Ops. -34.5% Y/Y $0.26 Net Income/Share -67.5% Y/Y Q4 2023 1. Adjusted gross profits and adjusted net income per share are non-GAAP financial measures. Refer to pages 20 through 23 for further discussion and a GAAP to Non-GAAP reconciliation. $0.50 of adjusted net income per share(1)

All Other & Corporate ■ Robinson Fresh integrated supply chain solutions generating increased AGP ■ Managed Services Q4 AGP down 3.2% Y/Y ■ Other Surface Transportation AGP decreased 14.2% Y/Y Global Forwarding (GF) ■ Reduced global demand and excess capacity has led to declining prices Y/Y for ocean and air freight, but the ongoing conflict in the Red Sea is now putting a strain on ocean capacity ■ Ocean volume grew Y/Y ■ Continuing to diversify our trade lane and industry vertical exposure North American Surface Transportation (NAST) ■ Adjusted gross profit (AGP) per load/order declined Y/Y in both TL and LTL ■ Load-to-truck ratios indicate the truckload market remains soft by historical standards ■ Significant opportunities for profitable growth remain in a highly fragmented market ■ Focused on initiatives that improve the customer and carrier experience and lower our cost to serve ■ 17% Y/Y improvement in productivity driven by removing waste and increasing automation Complementary Global Suite of Services 5 Q4 2023 Adjusted Gross Profits(2) -24.3% Y/Y -1.3% Y/Y -14.0% Y/Y 1. Measured over trailing twelve months. 2. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. Over half of total revenues came from customers to whom we provide both surface transportation and global forwarding services.(1)

NAST Q4’23 Results by Service 6 ■ Truckload volume down 1.5% year-over-year(2) ■ Truckload AGP per shipment decreased 29.5% due to declining profit per shipment on contractual volume(2) ■ LTL volume down 0.5% and AGP per order decreased 8.5%(2) ■ Other AGP decreased primarily due to a decrease in warehousing and intermodal services 4Q23 4Q22 %▲ Truckload (“TL”) $223.1 $322.3 (30.8)% Less than Truckload (“LTL”) $134.8 $148.2 (9.0)% Other $22.3 $31.8 (29.9)% Total Adjusted Gross Profits $380.2 $502.3 (24.3)% Adjusted Gross Profit Margin % 12.7% 14.1% (140 bps) Adjusted Gross Profits(1) ($ in millions) 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent.

Truckload Price and Cost Change (1)(2)(3) 7 Truckload Q4 Volume(2)(4) -1.5 % Price/Mile(1)(2)(3) -13.5 % Cost/Mile(1)(2)(3) -10.5 % Adjusted Gross Profit(4) -30.8 % 1. Price and cost change represents YoY change for North America truckload shipments across all segments. 2. Growth rates are rounded to the nearest 0.5 percent. 3. Pricing and cost measures exclude fuel surcharges and costs. 4. Truckload volume and adjusted gross profit growth represents YoY change for NAST truckload. ■ 65% / 35% truckload contractual / transactional volume mix in Q4 ■ Average routing guide depth of 1.16 in Managed Services business vs. 1.22 in Q4 last year Yo Y % C ha ng e in P ric e an d C os t p er M ile YoY Price Change YoY Cost Change 2016 2017 2018 2019 2020 2021 2022 2023 -30% -20% -10% 0% 10% 20% 30% 40% 50%

Truckload AGP $ per Shipment Trend 8 ■ AGP $ per Truckload shipment reflects market conditions better than AGP Margin % (1) ■ Targeted more volume in the spot market in Q4, where we could capture more profit due to seasonal market tension ■ Profit per load rose in October and November, but declined in December as the cost of purchased transportation moved seasonally higher. N A ST A dj us te d G ro ss P ro fit $ p er T ru ck lo ad Sh ip m en t N A ST A djusted G ross Profit M argin % NAST Adjusted Gross Profit $ per Truckload Shipment (left axis) NAST Adjusted Gross Profit Margin % (right axis) Average NAST AGP $ per Truckload Shipment (left axis) 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

Global Forwarding Q4’23 Results by Service 9 4Q23 4Q22 %▲ Ocean $99.5 $120.2 (17.2)% Air $27.9 $31.5 (11.5)% Customs $23.7 $24.5 (3.1)% Other $11.2 $12.5 (10.9)% Total Adjusted Gross Profits $162.3 $188.7 (14.0)% Adjusted Gross Profit Margin % 22.9% 18.6% 430 bps Adjusted Gross Profits (1) ($ in millions) ■ Reduced global demand and excess capacity impacted ocean and air pricing and volumes on a year-over-year basis ■ Ocean AGP decreased due to a 20.5% decrease in AGP per shipment, partially offset by a 4.0% increase in shipments(2) ■ Air AGP decreased due to a 9.0% decrease in AGP per metric ton shipped and a 2.5% decline in metric tons shipped(2) ■ Customs AGP decreased due to a 7.5% decrease in AGP per transaction, partially offset by a 4.5% increase in volume(2) 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent.

All Other & Corporate Q4’23 Results 10 Robinson Fresh ■ Increased AGP due to a 4.5%(2) increase in case volume and integrated supply chain solutions for foodservice and wholesale customers Managed Services ■ Total freight under management of $1.5B in Q4 down Y/Y due to declining freight rates Other Surface Transportation ■ Decline in AGP driven by a 16.6% decrease in Europe truckload AGP 4Q23 4Q22 %▲ Robinson Fresh $31.1 $28.5 9.2% Managed Services $28.8 $29.8 (3.2)% Other Surface Transportation $16.2 $18.9 (14.2)% Total $76.1 $77.2 (1.3)% Adjusted Gross Profits (1) ($ in millions) 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent.

Streamlining & Automating Processes to Drive Profitable Growth 11 11

New Carrier & Customer Experiences Driving Digital Adoption 12 ■ Improving customer outcomes with technology that supports our people and processes ■ Q4 NAST shipments per person per day increased 17% year-over- year vs our goal of 15% ■ Q4 Global Forwarding shipments per person per month increased 20% year-over-year – Accelerating the digital execution of critical touch points in the lifecycle of a load: • Reducing manual tasks per shipment • Reducing time per task 12

Pillars of Our Customer Promise ■ Diversified, global suite of servicesTM - we can reliably meet all logistics services needs today and in the future ■ An information advantage driving smarter solutionsTM and better outcomes through our experience, data and scale ■ Solutions delivered through people you can rely onTM as an extension of your team ■ Technology built by and for supply chain expertsTM - tailored, market-leading solutions that drive better supply chain outcomes 13 Best-in-class solutions delivered through a global network of experts you can rely on

Capital Allocation Priorities: Balanced and Opportunistic 14 Cash Flow from Operations & Capital Distribution ($M) ■ $74 million of cash returned to shareholders in Q4 2023 ■ Q4 2023 capital distribution declined 85% Y/Y due to the decrease in cash from operations ■ More than 25 years of annually increasing dividends, on a per share basis ■ 18K shares repurchased at an average price of $83.60 ■ The decline in the cost and price of purchased transportation (inclusive of fuel surcharges) has slowed year-over-year, resulting in less benefit to net operating working capital and cash flow. ■ We'll continue to manage our capital structure to maintain our investment grade credit rating.

15 Appendix

Q4 2023 Transportation Results(1) 16 Three Months Ended December 31 Twelve Months Ended December 31 $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $ 3,930,461 $ 4,798,027 (18.1) % $ 16,372,660 $ 23,516,384 (30.4) % Total Adjusted Gross Profits(2) $ 590,988 $ 741,951 (20.3) % $ 2,486,636 $ 3,480,669 (28.6) % Adjusted Gross Profit Margin % 15.0% 15.5% (50 bps) 15.2% 14.8% 40 bps Transportation Adjusted Gross Profit Margin % 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q1 15.3% 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% 14.9% 13.5% 15.2% Q2 16.0% 17.5% 19.3% 16.2% 16.2% 18.3% 17.5% 13.8% 15.4% 15.5% Q3 16.2% 18.4% 17.6% 16.4% 16.6% 16.9% 14.4% 13.7% 15.1% 15.1% Q4 15.9% 19.0% 17.2% 16.6% 17.7% 15.6% 14.3% 13.3% 15.5% 15.0% Total 15.9% 17.9% 18.4% 16.6% 16.7% 17.3% 15.3% 13.8% 14.8% 15.2% 1. Includes results across all segments. 2. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

Q4 2023 NAST Results 17 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $1.1 million of restructuring charges in the Twelve Months Ended December 31, 2023 mainly related to workforce reductions. Includes $9.5 million of restructuring charges related to workforce reductions and asset impairment charges related to reprioritizing our technology investments in the Three and Twelve Months Ended December 31, 2022. Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $ 3,000,650 $ 3,563,071 (15.8) % $ 12,471,075 $ 15,827,467 (21.2) % Total Adjusted Gross Profits(1) $ 380,157 $ 502,266 (24.3) % $ 1,593,854 $ 2,196,704 (27.4) % Adjusted Gross Profit Margin % 12.7% 14.1% (140 bps) 12.8% 13.9% (110 bps) Income from Operations(2) $ 95,958 $ 162,550 (41.0) % $ 459,960 $ 833,302 (44.8) % Adjusted Operating Margin % 25.2% 32.4% (720 bps) 28.9% 37.9% (900 bps) Depreciation and Amortization $ 5,638 $ 5,542 1.7 % $ 23,027 $ 23,643 (2.6) % Total Assets $ 3,008,459 $ 3,304,480 (9.0) % $ 3,008,459 $ 3,304,480 (9.0) % Average Headcount 6,103 7,251 (15.8) % 6,469 7,365 (12.2) %

Q4 2023 Global Forwarding Results 18 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $4.0 million of favorable restructuring expense adjustments due to amounts settling for an amount different than originally estimated related to divesting our operations in Argentina in the Three Months Ended December 31, 2023 and $22.0 million of restructuring charges in the Twelve Months Ended December 31, 2023 mainly related to divesting our operations in Argentina. Includes $7.0 million of restructuring charges related to workforce reductions and reprioritizing our technology investments in the Three and Twelve Months Ended December 31, 2022. Three Months Ended December 31 Twelve Months Ended December 31 $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $ 708,814 $ 1,013,306 (30.0) % $ 2,997,704 $ 6,812,008 (56.0) % Total Adjusted Gross Profits(1) $ 162,322 $ 188,749 (14.0) % $ 689,365 $ 1,083,473 (36.4) % Adjusted Gross Profit Margin % 22.9% 18.6% 430 bps 23.0% 15.9% 710 bps Income from Operations(2) $ 22,576 $ 28,216 (20.0) % $ 85,830 $ 449,364 (80.9) % Adjusted Operating Margin % 13.9% 14.9% (100 bps) 12.5% 41.5% (2,900 bps) Depreciation and Amortization $ 2,915 $ 5,441 (46.4) % $ 19,325 $ 21,835 (11.5) % Total Assets $ 1,094,895 $ 1,507,913 (27.4) % $ 1,094,895 $ 1,507,913 (27.4) % Average Headcount 5,021 5,745 (12.6) % 5,222 5,712 (8.6) %

Q4 2023 All Other and Corporate Results 19 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $0.3 million of favorable restructuring expense adjustments due to amounts settling for an amount different than originally estimated in the Three Months Ended December 31, 2023 and $15.0 million of restructuring charges in the Twelve Months Ended December 31, 2023 mainly related to workforce reductions. Includes $20.2 million of restructuring charges related to workforce reductions and reprioritizing our technology investments in the Three and Twelve Months Ended December 31, 2022 and a $25.3 million gain on the sale and leaseback of a facility in Kansas City in the Twelve Months Ended December 31, 2022. Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $ 512,423 $ 490,444 4.5% $ 2,127,664 $ 2,057,150 3.4% Total Adjusted Gross Profits(1) $ 76,144 $ 77,159 (1.3%) $ 321,389 $ 313,000 2.7% Income (loss) from Operations(2) $ (11,105) $ (26,732) 58.5% $ (31,183) $ (15,884) 96.3% Depreciation and Amortization $ 14,533 $ 13,070 11.2% $ 56,633 $ 47,298 19.7% Total Assets $ 1,121,926 $ 1,142,171 (1.8%) $ 1,121,926 $ 1,142,171 (1.8%) Average Headcount 4,195 4,676 (10.3%) 4,350 4,524 (3.8%)

20 Our adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. Adjusted gross profit margin is calculated as adjusted gross profit divided by total revenues. We believe adjusted gross profit and adjusted gross profit margin are useful measures of our ability to source, add value, and sell services and products that are provided by third parties, and we consider adjusted gross profit to be a primary performance measurement. The reconciliation of gross profit to adjusted gross profit and gross profit margin to adjusted gross profit margin are presented below: Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2023 2022 2023 2022 Revenues: Transportation $ 3,930,461 $ 4,798,027 $ 16,372,660 $ 23,516,384 Sourcing 291,426 268,794 1,223,783 1,180,241 Total Revenues $ 4,221,887 $ 5,066,821 $ 17,596,443 $ 24,696,625 Costs and expenses: Purchased transportation and related services 3,339,473 4,056,076 13,886,024 20,035,715 Purchased produced sourced for resale 263,791 242,571 1,105,811 1,067,733 Direct internally developed software amortization 9,320 6,656 33,620 25,487 Total direct costs $ 3,612,584 $ 4,305,303 $ 15,025,455 $ 21,128,935 Gross profit & Gross profit margin $ 609,303 14.4% $ 761,518 15.0% $ 2,570,988 14.6% $ 3,567,690 14.4% Plus: Direct internally developed software amortization 9,320 6,656 33,620 25,487 Adjusted gross profit/Adjusted gross profit margin $ 618,623 14.7% $ 768,174 15.2% $ 2,604,608 14.8% $ 3,593,177 14.5% Non-GAAP Reconciliations

Non-GAAP Reconciliations 21 Our adjusted operating margin is a non-GAAP financial measure calculated as operating income divided by adjusted gross profit. Our adjusted operating margin - excluding restructuring and gain on sale of property is a similar non-GAAP financial measure as adjusted operating margin, but also excludes the impact of restructuring and the gain on sale and leaseback of our Kansas City regional center in 2022 (the “gain on sale of property”). We believe adjusted operating margin and adjusted operating margin - excluding restructuring and gain on sale of property are useful measures of our profitability in comparison to our adjusted gross profit, which we consider a primary performance metric as discussed above. The comparisons of operating margin to adjusted operating margin and adjusted operating margin - excluding restructuring and gain on sale of property are presented below: Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2023 2022 2023 2022 Total Revenues $ 4,221,887 $ 5,066,821 $ 17,596,443 $ 24,696,625 Income from operations 107,429 164,034 514,607 1,266,782 Operating margin 2.5% 3.2% 2.9% 5.1% Adjusted gross profit $ 618,623 $ 768,174 $ 2,604,608 $ 3,593,177 Income from operations 107,429 164,034 514,607 1,266,782 Adjusted operating margin 17.4% 21.4% 19.8% 35.3% Adjusted gross profit $ 618,623 $ 768,174 $ 2,604,608 $ 3,593,177 Adjusted income from operations(1) 103,153 200,718 552,648 1,278,170 Adjusted operating margin - excluding restructuring and gain on sale of property 16.7% 26.1% 21.2% 35.6% 1. In the Three Months ended December 31, 2023, we incurred favorable restructuring expense adjustments of $4.3 million due to amounts settling for an amount different than originally estimated related to divesting our operations in Argentina. In the Twelve Months ended December 31, 2023, we incurred restructuring expenses of $18.4 million related to workforce reductions and $19.6 million of asset impairment and other charges. In the Three and Twelve Months ended December 31, 2022, we incurred restructuring expenses of $21.5 million related to workforce reductions and $15.2 million of other charges, primarily related to an impairment of internally developed software due to reprioritizing our investments in technology to accelerate our digital transformation and productivity initiatives. In the Twelve Months ended December 31, 2022, we also recognized a gain on sale of property and equipment of $25.3 million related to the sale-leaseback of our Kansas City regional center.

Non-GAAP Reconciliations 22 Our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and adjusted net income per share (diluted) are non-GAAP financial measures. Adjusted income (loss) from operations and adjusted net income per share (diluted) is calculated as income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and net income per share (diluted) excluding the impact of restructuring and gain on sale of property. The adjustments to net income per share (diluted) include restructuring-related costs, gain on sale of property, a foreign currency loss on divested operations, and an income tax settlement. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and adjusted net income per share (diluted). The reconciliation of income (loss) from operations to adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and gain on sale of property, and net income per share (diluted) to adjusted income (loss) from operations and adjusted net income per share (diluted) is presented below (in thousands except per share data): Three Months Ended December 31, 2023 Twelve Months Ended December 31, 2023 NAST Global Forwarding All Other and Corporate Consolidated NAST Global Forwarding All Other and Corporate Consolidated Income (loss) from operations $ 95,958 $ 22,576 $ (11,105) $ 107,429 $ 459,960 $ 85,830 $ (31,183) $ 514,607 Severance and other personnel expenses — (925) (409) (1,334) 1,083 3,817 13,509 18,409 Other selling, general, and administrative expenses — (3,084) 142 (2,942) 8 18,158 1,466 19,632 Total adjustments to operating income (loss)(1)(2) — (4,009) (267) (4,276) 1,091 21,975 14,975 38,041 Adjusted income (loss) from operations $ 95,958 $ 18,567 $ (11,372) $ 103,153 $ 461,051 $ 107,805 $ (16,208) $ 552,648 Adjusted gross profit $ 380,157 $ 162,322 $ 76,144 $ 618,623 $ 1,593,854 $ 689,365 $ 321,389 $ 2,604,608 Adjusted income (loss) from operations 95,958 18,567 (11,372) 103,153 461,051 107,805 (16,208) 552,648 Adjusted operating margin - excluding restructuring 25.2% 11.4% N/M 16.7% 28.9% 15.6% N/M 21.2% $ in 000's per share $ in 000's per share Net income and per share (diluted) $ 30,973 $ 0.26 $ 325,129 $ 2.72 Restructuring and related costs, pre-tax(1)(2) (2,856) (0.02) 39,461 0.32 Foreign currency loss on divested operations, pre-tax 7,454 0.06 16,375 0.14 Income tax settlement and tax effect of adjustments 23,928 0.20 14,172 0.12 Adjusted net income and per share (diluted) $ 59,499 $ 0.50 $ 395,137 $ 3.30 1. The Three Months Ended December 31, 2023 includes restructuring adjustments of $4.3 million related to the divestiture of our operations in Argentina. 2. The Twelve Months Ended December 31, 2023 includes restructuring expenses of $18.4 million related to workforce reductions in additions to $19.6 million of asset impairment and other charges related to the divestiture of our operations in Argentina.