0001750153

false

0001750153

2023-10-12

2023-10-12

0001750153

us-gaap:CommonStockMember

2023-10-12

2023-10-12

0001750153

us-gaap:WarrantMember

2023-10-12

2023-10-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

October 12, 2023

CANOO INC.

(Exact name of registrant as specified in its

charter)

Delaware

(State

or Other Jurisdiction

of Incorporation) |

001-38824

(Commission

File Number) |

82-1476189

(I.R.S. Employer

Identification Number) |

19951 Mariner Avenue

Torrance,

California |

90503 |

| (Address of principal executive offices) |

(Zip Code) |

(424) 271-2144

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each

class |

|

Trading

symbol(s) |

|

Name of each

exchange

on which

registered |

| Common Stock, $0.0001 par value per share |

|

GOEV |

|

The Nasdaq Capital Market |

| |

|

|

|

|

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

GOEVW |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 3.03 |

Material Modification to Rights of Security Holders. |

On

October 12, 2023, Canoo Inc., a Delaware corporation (the “Company”) filed the Certificate of Designation for the Company’s

7.5% Series B Cumulative Perpetual Redeemable Preferred Stock (the “Preferred Shares”). The Certificate of Designation

designates, creates, authorizes and provides for the issue of the Preferred Shares as contemplated by the previously disclosed Purchase

Agreement, by and between the Company and an institutional investor relating to the acquisition by such investor of the Preferred Shares

and warrants.

The

terms of the Preferred Shares were described in the Current Report on Form 8-K filed by the Company on October 2, 2023, and

such description is incorporated herein by reference. Such description does not purport to be complete and is qualified in its entirety

by the full text of the Certificate of Designation, which is filed herewith as Exhibit 3.1 and is incorporated herein by reference.

On

October 12, 2023 the Company closed its previously announced sale to an institutional investor of Preferred Shares and warrants.

The Company received net proceeds of approximately $44.8 million after deducting

expenses. The Company intends to use the net proceeds for working capital and general corporate purposes.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 12,

2023 |

CANOO INC. |

| |

|

|

| |

By: |

/s/ Hector Ruiz |

| |

Name: |

Hector Ruiz |

| |

Title: |

General Counsel and Corporate Secretary |

Exhibit 3.1

CERTIFICATE OF DESIGNATION OF

SERIES B CUMULATIVE PERPETUAL REDEEMABLE

PREFERRED STOCK,

PAR VALUE $0.0001 PER SHARE, OF

CANOO INC.

_______________________

Pursuant to Sections 151 and 103 of the

General Corporation Law of the State of Delaware

_______________________

CANOO

INC., a corporation organized and existing under the laws of the State of Delaware (the “Company”), certifies

that pursuant to the authority contained in its Certificate of Incorporation, and in accordance with the provisions of Section 151

of the General Corporation Law of the State of Delaware, the Board of Directors of the Company has duly approved and adopted the following

resolution on September 29, 2023, and the resolution was adopted by all necessary action on the part of the Company:

WHEREAS,

the Certificate of Incorporation of the Company provides for a class of its authorized stock known as Preferred Stock, consisting of

10,000,000 shares, $0.0001 par value per share, issuable from time to time in one or more series;

WHEREAS,

the Board of Directors is authorized to provide for the issue of all or any number of the shares of the Preferred Stock in one or more

series, and to fix the number of shares and to determine or alter for each such series, such voting powers, full or limited, or no voting

powers, and such designation, preferences, and relative, participating, optional, or other rights and such qualifications, limitations,

or restrictions thereof; and

WHEREAS,

it is the desire of the Board of Directors, pursuant to its authority as aforesaid, to provide for the issue of shares of the Preferred

Stock in one or more series, and to fix the number of shares and to determine or alter for each such series, such voting powers, full

or limited, or no voting powers, and such designation, preferences, and relative, participating, optional, or other rights and such qualifications,

limitations, or restrictions thereof.

NOW,

THEREFORE, BE IT RESOLVED, that pursuant to the authority vested in the Board of Directors by the Certificate of Incorporation

and Section 151 of the General Corporation Law of the State of Delaware, the Board of Directors does hereby designate, create, authorize

and provide for the issue of a series of 45,000 shares of Preferred Stock, par value $0.0001 per share, having the voting powers and

such designations, preferences and relative, participating, optional and other special rights, and qualifications, limitations and restrictions

that are set forth in this resolution of the Board of Directors pursuant to authority expressly vested in it by the provisions of the

Certificate of Incorporation and hereby constituting an amendment to the Certificate of Incorporation as follows:

Section 1. Designation.

The designation of the series of preferred stock of the Company is “Series B Cumulative Perpetual Redeemable”, par value

$0.0001 per share (the “Series B Preferred Stock”). Each share of the Series B Preferred Stock shall be

identical in all respects to every other share of the Series B Preferred Stock. Each share of Series B Preferred Stock shall

have a stated value equal to $1,000.00 (the “Stated Value”).

Section 2. Number

of Shares. The authorized number of shares of Series B Preferred Stock is 45,000. Shares

of Series B Preferred Stock that are redeemed, purchased or otherwise acquired by the Company, or converted into another series

of Preferred Stock, shall revert to authorized but unissued shares of Preferred Stock (provided that any such cancelled shares of Series B

Preferred Stock may be reissued only as shares of any series other than Series B Preferred Stock).

Section 3. Defined

Terms and Rules of Construction.

(a) Definitions.

As used herein with respect to the Series B Preferred Stock:

“Accrued Dividends” shall

mean, as of any date, with respect to any share of Series B Preferred Stock, all dividends that have accrued pursuant to Section 4(a)(i) but

that have not been paid in cash or, at the option of the Holder, in shares of Common Stock as of such date.

“Affiliate” shall mean any

Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with

a Person, as such terms are used in and construed under Rule 405 of the Securities Act.

“Alternate Consideration”

shall have the meaning set forth in Section 9(c).

“Average Common Stock Price”

shall mean (i) the average of the closing sale prices per share of the Common Stock (or, if no closing sale price is reported, the

average of the closing bid and ask prices per share or, if more than one in either case, the average of the average closing bid and the

average closing ask prices per share) for the ten consecutive Trading Days immediately preceding, but not including, the Determination

Date as reported on the principal national securities exchange on which the Common Stock is then traded, or (ii) the average of

the last quoted bid prices for the Common Stock in the over-the-counter market as reported by OTC Markets Group Inc. or similar organization

for the ten consecutive Trading Days immediately preceding, but not including, the Determination Date, if the Common Stock is not then

listed for trading on a U.S. securities exchange; provided that in no event shall the Average Common Stock Price be less than the Floor

Price.

“Board of Directors” shall

mean the board of directors of the Company.

“Business Day” shall mean

any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions

in the State of New York are authorized or required by law or other governmental action to close.

“Bylaws” shall mean the Amended

and Restated Bylaws of the Company in effect on the date hereof, as they may be amended from time to time.

“Certificate of Designation”

shall mean this Certificate of Designation relating to the Series B Preferred Stock, as it may be amended from time to time.

“Certificate of Incorporation”

shall mean the Second Amended and Restated Certificate of Incorporation of the Company, as amended from time to time, including by this

Certificate of Designation.

“Change of Control” is deemed

to occur when, after the original issuance of the Series B Preferred Stock, the following have occurred and are continuing: (i) the

acquisition by any person, including any syndicate or group deemed to be a “person” under Section 13(d)(3) of the

Exchange Act, of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or series

of purchases, mergers or other acquisition transactions of the Company’s capital stock entitling that person to exercise more than

50% of the total voting power of all capital stock of the Company entitled to vote generally in elections of directors (except that such

person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is

currently exercisable or is exercisable only upon the occurrence of a subsequent condition); and (ii) following the closing of any

transaction referred to in clause (i) above, neither the Company nor the acquiring or surviving entity has a class of common securities

(or American Depositary Receipts representing such securities) listed on the Trading Market.

“Change of Control Conversion Date”

shall mean the date the Series B Preferred Stock is to be converted, which will be a Business Day selected by the Company that is

no fewer than 20 days nor more than 35 days after the date on which the Company provides the required notice of the occurrence of a Change

of Control to the Holders; provided that the foregoing 35 day limitation shall not apply to any Change of Control Notice issued prior

to the occurrence of such Change of Control if the Change of Control Conversion Date specified therein is fixed relative to the consummation

of such Change of Control; provided, further that the Change of Control Conversion Date with respect to any shares of Series B Preferred

Stock whose conversion is delayed by operation of Section 7(d)(ii) shall be a Business Day selected by the Company within

15 days after the date on which Section 7(d)(ii) no longer applies.

“Change of Control Conversion Right”

shall have the meaning set forth in Section 7(a).

“Change of Control Notice”

shall have the meaning set forth in Section 8(c).

“Close of Business” shall

mean 5:00 p.m., New York City time.

“Code” shall mean the Internal

Revenue Code of 1986, as amended.

“Commission” shall mean the

U.S. Securities and Exchange Commission, including the staff thereof.

“Common Stock” shall mean

the common stock, par value $0.0001 per share, of the Company.

“Common Stock Equivalents”

shall mean any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire at any time Common Stock,

including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible

into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Company” shall mean Canoo

Inc., a corporation organized and existing under the laws of the State of Delaware, and any successor thereof.

“Conversion Notice” shall

have the meaning assigned to it in Section 7(a).

“Conversion Price” means 120%

of the applicable Average Common Stock Price.

“Conversion Shares” shall

mean, collectively, the shares of Common Stock issuable upon conversion of the shares of Series B Preferred Stock in accordance

with the terms hereof.

“Determination

Date” shall mean (i) with respect to a Change of Control, the date on which such Change of Control occurred or October 12,

2023, whichever date shall result in a greater number of shares of Common Stock to be issued to the Holders upon conversion, and (ii) with

respect to the Optional Conversion Right, October 12, 2023.

“Dividend Nonpayment” shall

have the meaning set forth in Section 4(b).

“Dividend Payment Date” shall

mean November 30, February 28, May 30, and August 30 of each year (each, a “Quarterly Date”),

commencing on the first Quarterly Date immediately following the Original Issue Date; provided, that if any such Quarterly Date is not

a Business Day then the “Dividend Payment Date” shall be the next Business Day immediately following such Quarterly

Date.

“Dividend Payment Record Date”

shall have the meaning set forth in Section 4(a)(iii).

“Dividend Rate” shall have

the meaning set forth in Section 4(a)(i), subject to adjustments set forth in Section 4(a)(i) and Section 4(b).

“Dividends” shall have the

meaning set forth in Section 4(a)(i).

“Exchange Act” shall mean

the Securities Exchange Act of 1934, as amended.

“Exchange

Cap” shall mean 19.99% of the aggregate number of shares of the Company’s Common Stock issued and outstanding as of September 29,

2023. The Exchange Cap shall be appropriately adjusted for any stock dividend, stock split, reverse stock split or similar transaction.

“Exchange Cap Approval” shall

mean the receipt of approval by the Company’s stockholders with respect to the Exchange Cap Proposal.

“Exchange Cap Proposal” shall

mean the proposal required to be approved by the Company’s stockholders pursuant to the applicable rules and regulations of

Nasdaq (or any successor entity), including Nasdaq Listing Standard Rule 5635, prior to further issuances of the Company’s

Common Stock upon (i) the conversion of the Series B Preferred Stock, (ii) the exercise of warrants issued pursuant to

the Purchase Agreement or (iii) payment of Dividends hereunder, at the option of the Holder, in shares of Common Stock where, in

aggregate, the issuance of such shares of Common Stock under (i), (ii) or (iii) would exceed the Exchange Cap.

“First Reset Date” shall have

the meaning set forth in Section 4(a)(i).

“Floor Price” shall mean $0.10.

“Fundamental Transaction”

shall have the meaning set forth in Section 9(c).

“Holders” shall mean, collectively,

the holders of the Series B Preferred Stock.

“Liquidation” shall have the

meaning set forth in Section 6.

“Liquidation Preference” shall

have the meaning set forth in Section 6.

“Nasdaq” shall mean the Nasdaq

Stock Market.

“Optional Conversion Date”

shall mean any date on which Series B Preferred Stock is to be converted, which shall be a Business Day selected by the Company

that is no fewer than 20 days nor more than 35 days after the date on which any Holder provides notice of its intent to convert some

or all of the Preferred Stock; provided, that the Optional Conversion Date with respect to any shares of Series B Preferred Stock

whose conversion is delayed by operation of Section 7(d)(ii) shall be a Business Day selected by the Company within

15 days after the date on which Section 7(d)(ii) no longer applies.

“Optional Conversion Right”

shall have the meaning set forth in Section 7(a).

“Optional Redemption Date”

shall have the meaning set forth in Section 8(a).

“Optional Redemption Right”

shall have the meaning set forth in Section 8(a).

“Original Issue Date” shall

mean, with respect to a share of Series B Preferred Stock, the date of the first issuance of any such share of Series B Preferred

Stock regardless of the number of transfers of any such share of Series B Preferred Stock and regardless of the number of certificates

which may be issued to evidence such Series B Preferred Stock.

“Payment Period” shall mean,

with respect to a share of Series B Preferred Stock, the period beginning on the day after the preceding Dividend Payment Date (or

if no Dividend Payment Date has occurred since the Original Issue Date of such share of Series B Preferred Stock, the Original Issue

Date) to and including the next Dividend Payment Date; provided that, for the purpose of determining the amount of Accrued Dividends

for any Payment Period, the Payment Period shall be calculated based on the actual number of days elapsed during such Payment Period

on a 360-day year consisting of twelve 30-day months.

“Person” shall mean any individual,

company, partnership, limited liability company, joint venture, association, joint stock company, trust, unincorporated organization,

government or agency or political subdivision thereof or any other entity.

“Preferred Stock” shall mean

any and all series of preferred stock of the Company, including the Series B Preferred Stock.

“Purchase Agreement” shall

mean the Securities Purchase Agreement, dated on or about September 29, 2023, among the Company and the Holders, as amended, modified

or supplemented from time to time in accordance with its terms.

“Purchase Rights” shall have

the meaning set forth in Section 9(b).

“Register” shall mean the

securities register maintained in respect of the Series B Preferred Stock by the Company.

“Securities Act” shall mean

the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Series B Preferred Stock”

shall have the meaning set forth in Section 1.

“Special Optional Redemption Right”

shall have the meaning set forth in Section 8(b).

“Stated Value” shall have

the meaning set forth in Section 1.

“Subsidiary” shall mean any

direct or indirect subsidiary of the Company formed or acquired before or after the date of the Purchase Agreement.

“Successor Entity” shall have

the meaning set forth in Section 9(c).

“Trading Day” shall mean any

Business Day on which the Common Stock is traded, or able to be traded, on the Trading Market.

“Trading Market” means any

of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the relevant date: New York Stock

Exchange, NYSE American LLC, or any national exchange operated by Nasdaq, or listed or quoted on an exchange or quotation system that

is a successor to the New York Stock Exchange, NYSE American LLC or Nasdaq.

“Transaction Documents” means

the Purchase Agreement, this Certificate of Designation and all exhibits and schedules thereto and hereto and any other documents or

agreements executed in connection with the transactions contemplated hereunder.

(b) Rules of

Construction. Unless the context otherwise requires: (i) a term has the meaning assigned to it herein; (ii) an accounting

term not otherwise defined herein has the meaning accorded to it in accordance with generally accepted accounting principles in effect

from time to time in the United States, applied on a consistent basis; (iii) words in the singular include the plural, and in the

plural include the singular; (iv) “or” is not exclusive; (v) “will” shall be interpreted to express

a command; (vi) “including” means including without limitation; (vii) provisions apply to successive events and

transactions; (viii) references to any Section or clause refer to the corresponding Section or clause, respectively, of

this Certificate of Designation; (ix) any reference to a day or number of days, unless expressly referred to as a Business Day or

Trading Day, shall mean the respective calendar day or number of calendar days; (x) references to sections of or rules under

the Exchange Act shall be deemed to include substitute, replacement or successor sections or rules, and any term defined by reference

to a section of or rule under the Exchange Act shall include Commission and judicial interpretations of such section or rule; (xi) references

to sections of the Code shall be deemed to include any substitute, replacement or successor sections as well as the Treasury Regulations

promulgated thereunder from time to time; and (xii) headings are for convenience only.

Section 4. Dividends.

(a) Holders

shall be entitled to receive, out of the assets of the Company, Dividends on the terms described below:

(i) For

each period from and including the Original Issue Date, but excluding, October 12, 2028 (the “First Reset Date”),

the Company shall pay, subject to Section 4(c), if, as and when declared by the Board of Directors, out of funds of the Company,

on each Dividend Payment Date for the applicable Payment Period or Payment Periods dividends on each outstanding share of Series B

Preferred Stock (the “Dividends”) at a rate per annum equal to 7.50% of the Liquidation Preference per share of Series B

Preferred Stock (the “Dividend Rate”), payable in accordance with Section 4(a)(ii) below. For each

Payment Period beginning on the First Reset Date, the Dividend Rate shall be equal to the prior Payment Period’s Dividend Rate,

plus 1.50%. Subject to Section 4(c), to the extent not paid in cash, whether or not the Company has earnings, whether or

not the payment of such dividends is then permitted under Delaware law, whether or not such dividends are authorized or declared, and

whether or not any agreements to which the Company is a party prohibit the current payment of dividends, including any agreement relating

to the Company’s indebtedness, Dividends on each share of Series B Preferred Stock shall accrue daily from and after the Original

Issue Date of such share and shall compound on a quarterly basis on each Dividend Payment Date (i.e., no dividends shall accrue

on other dividends unless and until the first Dividend Payment Date for such other dividends has passed). The Accrued Dividends, to the

extent unpaid, shall in all cases be payable upon a Liquidation pursuant to Section 6 or upon any conversion of the Series B

Preferred Stock pursuant to Section 7. Dividend payments shall be aggregated per Holder and shall be made to the nearest

cent (with $0.005 being rounded upward).

(ii) Each

Dividend if, as and when such Dividends are declared by the Board of Directors, shall be paid to the Holders in cash or, at the option

of the Holder, in shares of Common Stock. Any shares of Common Stock issued in payment of a Dividend on Preferred Stock shall be valued

at the closing price of the last Trading Day preceding the record date designated by the Board of Directors relating to such Dividends.

Notwithstanding anything in this Certificate of Designation to the contrary, until the Company has obtained the Exchange Cap Approval,

the Company may not issue shares of Common Stock in payment of a Dividend to the extent such payment would result in an issuance of shares

of Common Stock in excess of the Exchange Cap.

(iii) Each

Dividend shall be paid pro rata to the Holders. Each Dividend shall be payable to the Holders as they appear on the Register at the Close

of Business on the date which is 15 days preceding the applicable Dividend Payment Date (such date, an “Dividend Payment Record

Date”).

(b) (a) If

the Holders elect to receive a cash dividend payment and the Company fails to make the corresponding cash dividend payment (a “Dividend

Nonpayment”) with respect to three or more consecutive or non-consecutive Payment Periods, the Dividend Rate on the Preferred

Stock will increase an additional 0.25% per annum commencing immediately following the third Payment Period for which there has been

a Dividend Nonpayment and will increase an additional 0.25% per annum every third succeeding Dividend Nonpayment (whether the Payment

Periods to which such Dividend Nonpayments relate are consecutive or non-consecutive); provided, however, the maximum Dividend Rate on

the Preferred Stock (after giving effect to Section 4(a)(i) and this Section 4(b)) shall be capped at 12.0%

per annum.

(c) If

the date relating to a Liquidation pursuant to Section 6, upon any conversion of the Series B Preferred Stock pursuant

to Section 7, or upon any redemption of the Series B Preferred Stock pursuant to Section 8, respectively,

is after a Dividend Payment Record Date for a declared Dividend on the Series B Preferred Stock but occurs on or prior to the next

Dividend Payment Date, then the Holder of such share of Series B Preferred Stock at the Close of Business on such Dividend Payment

Record Date will be entitled, notwithstanding the related Liquidation, conversion or redemption, as applicable, to receive, on or, at

the Company’s election, before such Dividend Payment Date, such declared Dividend on such share of Series B Preferred Stock.

Except as provided in this Section 4(c), Dividends on any share of Preferred Stock will cease to accumulate from and after

the date relating to a Liquidation pursuant to Section 6, upon any conversion of the Series B Preferred Stock pursuant

to Section 7, or upon any redemption of the Series B Preferred Stock pursuant to Section 8, as applicable.

Section 5. Voting

Rights. Except as otherwise provided herein or as otherwise required by applicable law, the

Series B Preferred Stock shall have no voting rights. Pursuant to Nasdaq Listing Rules, the Series B Preferred Stock may not

be voted on matters presented to the stockholders of the Company for a vote until such shares of Series B Preferred Stock are converted

into shares of Common Stock. The Holders shall be entitled to notice of any meeting of stockholders of the Company. As long as any shares

of Series B Preferred Stock are outstanding, the Company shall not, without the affirmative vote of the Holders of a majority of

the then outstanding shares of Series B Preferred Stock, (i) alter or change adversely the powers, preferences or rights given

to the Series B Preferred Stock or alter or amend this Certificate of Designation, (ii) amend or repeal any provision of, or

add any provision to, the Certificate of Incorporation or Bylaws, or file any articles of amendment, certificate of designations, preferences,

limitations and relative rights of any series of Preferred Stock, if such action would materially and adversely alter or change the preferences,

rights, privileges or powers of, or restrictions provided for the benefit of the Series B Preferred Stock, or (iii) declare

or pay any junior dividends or repurchase any junior securities during any time that all Accrued Dividends on the Series B Preferred

Stock have not been paid in full in cash or, at the option of the Holder, in shares of Common Stock.

Section 6. Liquidation.

Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary (a “Liquidation”),

each Holder will be entitled to payment out of the assets of the Company, prior and in preference to holders of Common Stock of the Company,

in an amount per share equal to the Stated Value (the “Liquidation Preference”) plus any accumulated and unpaid Dividends

thereon.

Section 7. Conversion.

(a) Conversion Upon

Change of Control. Upon the occurrence of a Change of Control, each Holder will have the right (subject to the Special Optional

Redemption Right) to convert some or all of the Series B Preferred Stock held by such Holder (the “Change of Control

Conversion Right”) on the Change of Control Conversion Date specified in the applicable Change of Control Notice into a

number of shares of Common Stock per share of the Preferred Stock to be converted equal to (x) the Liquidation Preference of

such Series B Preferred Stock plus any accumulated and unpaid Dividends thereon (whether or not authorized or declared) to, but

excluding, the Change of Control Conversion Date (unless the Change of Control Conversion Date is after a Dividend Payment Record

Date and prior to the corresponding Dividend Payment Date, in which case no additional amount for such accumulated and unpaid

Dividends to be paid on such Dividend Payment Date shall be included) divided by (y) the Conversion Price. A Holder shall

exercise its Change of Control Conversion Right by providing the Company with a written response to the applicable Change of Control

Notice, which response shall specify the number of shares to be converted and otherwise comply with any reasonable procedures

specified by the Company in the Change of Control Notice. For the avoidance of doubt, if, prior to the Change of Control Conversion

Date, the Company has provided notice of its election to redeem some or all of the shares of Series B Preferred Stock (whether

pursuant to its Optional Redemption Right or its Special Optional Redemption Right), the Holders will not have the Change of Control

Conversion Right with respect to such shares of Preferred Stock.

(c) Optional

Conversion. Each Holder will have the right (subject to the Special Optional Redemption Right) to convert some or all of the Series B

Preferred Stock held by such Holder (the “Optional Conversion Right”) at any time and from time to time into a number

of shares of the Common Stock per share of the Preferred Stock to (x) the Liquidation Preference of such Series B Preferred

Stock plus any accumulated and unpaid Dividends thereon (whether or not authorized or declared) to, but excluding, the Optional Conversion

Date (unless the Optional Conversion Date is after a Dividend Payment Record Date and prior to the corresponding Dividend Payment Date

for the Series B Preferred Stock, in which case no additional amount for such accumulated and unpaid dividends to be paid on such

Dividend Payment Date shall be included) divided by (y) the Conversion Price. A Holder shall exercise its Optional Conversion Right

by providing written notice to the Company of its intent to convert and the number of shares of Series B Preferred Stock to be converted

(the “Conversion Notice”). The Company shall fix the Optional Conversion Date in accordance with the terms of this

Certificate of Designation and notify the converting Holder within a reasonable amount of time following the receipt of such Holder’s

notice of conversion. For the avoidance of doubt, if, prior to the Optional Conversion Date, the Company has provided notice of its election

to redeem some or all of the shares of Series B Preferred Stock (whether pursuant to its Optional Redemption Right or its Special

Optional Redemption Right), the Holders will not have the Optional Conversion Right with respect to such shares of Preferred Stock.

(d) Conversion

and Issuance Limitations.

(i) Notwithstanding

anything in this Certificate of Designation to the contrary, until the Company has obtained the Exchange Cap Approval, the Series B

Preferred Stock shall not be convertible into Conversion Shares to the extent such conversion would result in an issuance of shares of

Common Stock in excess of the Exchange Cap.

(ii) No

Holder shall be permitted to effect any conversion of shares of Series B Preferred Stock or receive Conversion Shares hereunder

to the extent that after giving effect to such conversion or receipt of such Conversion Shares, the Holder, in the aggregate and together

with any affiliate of such Holder, would beneficially own (as determined in accordance with Section 13(d) of the Exchange Act

and the rules promulgated thereunder) in excess of 4.99% of the number of shares of Common Stock outstanding immediately after giving

effect to such conversion or receipt of shares. In connection with the submission of any Conversion Notice, the Holder shall furnish

such information as the Company may reasonably request to assist it in determining the Holder’s beneficial ownership pursuant to

this Section 7(d)(ii). The provisions of this Section 7(d)(ii) may be waived by a Holder (but only as to

itself and not to any other Holder) upon not less than 61 days prior notice to the Company. Other Holders shall be unaffected by any

such waiver.

(e) Common

Stock Issuance. Any shares of Common Stock issued upon conversion of Series B Preferred Stock shall be (i) duly authorized,

validly issued and fully paid and nonassessable and (ii) shall rank pari passu with the other shares of Common Stock outstanding

from time to time.

(f) Mechanics

of Conversion.

(i) Delivery

of Book-Entry Statement Upon Conversion. Not later than three (3) Trading Days after the date of the conversion, the Company

shall deliver, or cause to be delivered, to the converting Holder a book-entry statement evidencing the number of Conversion Shares being

acquired upon the conversion.

(ii) Fractional

Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of the Series B Preferred

Stock. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such conversion, the Company shall

pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the applicable Average Common

Stock Price.

(g) Transfer

Taxes and Expenses. The issuance of certificates or book-entry statements for shares of the Common Stock on conversion of the Series B

Preferred Stock shall be made without charge to any Holder for any documentary stamp or similar taxes that may be payable in respect

of the issue or delivery of such certificates, provided that the Company shall not be required to pay any tax that may be payable in

respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the

Holders of such shares of Series B Preferred Stock and the Company shall not be required to issue or deliver such certificates unless

or until the Person or Persons requesting the issuance thereof shall have paid to the Company the amount of such tax or shall have established

to the satisfaction of the Company that such tax has been paid.

Section 8. Redemption.

(a) Optional

Redemption. On or after October 12, 2028 (“Optional Redemption Date”), the Company may, at its option,

redeem the Series B Preferred Stock, in whole or in part, at any time or from time to time, for cash at a redemption price equal

to 103% of the Liquidation Preference, plus any accumulated and unpaid Dividends thereon (whether or not authorized or declared) to,

but excluding, the date of such redemption, without interest (the “Optional Redemption Right”). The Company shall

exercise its Optional Redemption Right by mailing written notice to each Holder, which notice shall specify: (i) the number of shares

of Series B Preferred Stock to be redeemed and the amount to be paid therefor; and (ii) the date on which such redemption shall

occur, which shall be a Business Day not less than 20 days and not more than 60 days from the date on which such notice is mailed. If

less than all outstanding shares of Series B Preferred Stock are to be redeemed, the Company shall redeem the shares pro rata amongst

all Holders according to the number of shares held by each Holder. Notwithstanding the foregoing, if, pursuant to Section 7(d)(i),

the Series B Preferred Stock is not convertible in whole or in part on the Optional Redemption Date, the Optional Redemption Date

shall be extended to a Business Day selected by the Company that is not less than 20 days and not more than 35 days from the date on

which Section 7(d)(i) no longer applies.

(b) Special

Optional Redemption. Upon the occurrence of a Change of Control, the Company may, at its option, redeem the Series B Preferred

Stock, in whole or in part, within 120 days after the closing date relating to such Change of Control, for cash at a redemption price

equal to 103% of the Liquidation Preference, plus any accumulated and unpaid Dividends thereon (whether or not authorized or declared)

to, but excluding, the date of such redemption, without interest (the “Special Optional Redemption Right”). The Company

may exercise its Special Optional Redemption Right by notifying holders of such redemption in any Change of Control Notice complying

with the requirements of Section 8(c). In the event the Company issues a Change of Control Notice in which it does not elect

to redeem all outstanding Series B Preferred Stock pursuant to its Special Optional Redemption Right and the Change of Control to

which such notice relates has been consummated, the Company may exercise its Special Option Redemption Right with respect to any shares

of Series B Preferred Stock that are not converted pursuant to the initial Change of Control Notice, provided that such redemption

is completed within 120 days of the closing date relating to such Change of Control.

(c) Change

of Control Notice. Promptly following the later of (x) the occurrence of a Change of Control or (y) the Company becoming

aware of such Change of Control, the Company shall mail written notice (a “Change of Control Notice”) to each Holder

specifying:

(i) the

date on which such Change of Control occurred;

(ii) the

total purchase price (if any) associated with the Change of Control;

(iii) whether

the Company intends to exercise its Special Optional Redemption Right and if so, the number of shares of Series B Preferred Stock

to be redeemed, the amount to be paid therefor, and the date on which such securities are to be redeemed; and

(iv) the

applicable Change of Control Conversion Date (if the Company does not intend to redeem all outstanding Series B Preferred Stock

pursuant to its Special Optional Redemption Right).

Notwithstanding the foregoing, the

Company shall, to the extent permissible, issue a Change of Control Notice prior to the occurrence of an anticipated Change of Control

to each Holder specifying:

(i) the

date on which such Change of Control is anticipated to occur;

(ii) the

anticipated total purchase price (if any) associated with the Change of Control;

(iii) whether

the Company intends to exercise its Special Optional Redemption Right and if so, the number of shares of Series B Preferred Stock

to be redeemed, the amount to be paid therefor, and the date on which such securities are to be redeemed; any Special Optional Redemption

may be made contingent upon the consummation of such Change of Control and any transactions related thereto and the date for redemption

may be fixed relative to such consummation, provided that no redemption shall occur prior to 20 days after the mailing of such Change

of Control Notice unless the Holder subject to such redemption shall have consented thereto in writing; and

(iv) the

applicable Change of Control Conversion Date (if the Company does not intend to redeem all outstanding Series B Preferred Stock

pursuant to its Special Optional Redemption Right); the Change of Control Conversion Date may be fixed relative to the date on which

such Change of Control and any transactions related thereto are consummated.

In the event the Company issues a Change

of Control Notice prior to an anticipated Change of Control, and the Company subsequently determines that such Change of Control will

not occur on substantially the terms set forth in such Change of Control Notice, or at all, the Company shall be entitled to revoke or

revise such Change of Control Notice in its reasonable discretion.

Section 9. Certain

Adjustments.

(a) Stock

Dividends and Stock Splits. If the Company, at any time while this Series B Preferred Stock is outstanding: (i) pays a

stock dividend or otherwise makes a distribution or distributions payable in shares of Common Stock or any other Common Stock Equivalents

(which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Company upon conversion of this Series B

Preferred Stock or any Dividend paid in shares of Common Stock pursuant to Section 4(a)(ii)), (ii) subdivides outstanding

shares of Common Stock into a larger number of shares, (iii) combines (including by way of a reverse stock split) outstanding shares

of Common Stock into a smaller number of shares, or (iv) issues, in the event of a reclassification of shares of the Common Stock,

any shares of capital stock of the Company, then the Conversion Shares underlying the Series B Preferred Stock shall be multiplied

by a fraction of which the numerator shall be the number of shares of Common Stock (excluding any treasury shares of the Company) outstanding

immediately before such event, and of which the denominator shall be the number of shares of Common Stock outstanding immediately after

such event. Any adjustment made pursuant to this Section 9(a) shall become effective immediately after the record date

for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after

the effective date in the case of a subdivision, combination or reclassification.

(b) Subsequent

Rights Offerings. In addition to any adjustments pursuant to Section 9(a) above, if at any time subsequent to the

applicable Original Issue Date the Company grants, issues or sells any Common Stock Equivalents or rights to purchase stock, warrants,

securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”),

then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the

Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of such Holder’s

Series B Preferred Stock (without regard to any limitations on exercise hereof) immediately before the date on which a record is

taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders

of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights.

(c) Fundamental

Transaction. If, at any time while this Series B Preferred Stock is outstanding, (i) the Company, directly or indirectly,

in one or more related transactions effects any merger or consolidation of the Company with or into another Person, (ii) the Company,

directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially

all of its assets in one or a series of related transactions, (iii) any, direct or indirect, purchase offer, tender offer or exchange

offer (whether by the Company or another Person) is completed pursuant to which holders of Common Stock are permitted to sell, tender

or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding

Common Stock, (iv) the Company, directly or indirectly, in one or more related transactions effects any reclassification, reorganization

or recapitalization of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted

into or exchanged for other securities, cash or property, or (v) the Company, directly or indirectly, in one or more related transactions

consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization,

spin-off or scheme of arrangement) with another Person whereby such other Person acquires more than 50% of the outstanding shares of

Common Stock (not including any shares of Common Stock held by the other Person or other Persons making or party to, or associated or

affiliated with the other Persons making or party to, such stock or share purchase agreement or other business combination) (each a “Fundamental

Transaction”), then, upon any subsequent conversion of this Series B Preferred Stock, the Holder shall have the right

to receive, for each Conversion Share that would have been issuable upon such conversion immediately prior to the occurrence of such

Fundamental Transaction, the number of shares of Common Stock of the successor or acquiring corporation or of the Company, if it is the

surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of

such Fundamental Transaction by a holder of the number of shares of Common Stock for which this Series B Preferred Stock is convertible

immediately prior to such Fundamental Transaction. For purposes of any such conversion, the determination of the Conversion Price shall

be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect

of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Conversion Price among the Alternate

Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders

of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder

shall be given the same choice as to the Alternate Consideration it receives upon any conversion of this Series B Preferred Stock

at the time of such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Company

or surviving entity in such Fundamental Transaction shall file a new Certificate of Designation with the same terms and conditions and

issue to the Holders new preferred stock consistent with the foregoing provisions and evidencing the Holders’ right to convert

such preferred stock into Alternate Consideration. The Company shall cause any successor entity in a Fundamental Transaction in which

the Company is not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Company

under this Certificate of Designation and the other Transaction Documents in accordance with the provisions of this Section 9(c) pursuant

to written agreements in form and substance reasonably satisfactory to the Holder and approved by the Holder (without unreasonable delay)

prior to such Fundamental Transaction and shall, at the option of the Holder, deliver to the Holder in exchange for this Series B

Preferred Stock a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to this

Series B Preferred Stock which is convertible for a corresponding number of shares of capital stock of such Successor Entity (or

its parent entity) equivalent to the shares of Common Stock acquirable and receivable upon conversion of this Series B Preferred

Stock (without regard to any limitations on the conversion of this Series B Preferred Stock) prior to such Fundamental Transaction,

and with a Conversion Price which applies the Conversion Price hereunder to such shares of capital stock (but taking into account the

relative value of the shares of Common Stock pursuant to such Fundamental Transaction and the value of such shares of capital stock,

such number of shares of capital stock and such Conversion Price being for the purpose of protecting the economic value of this Series B

Preferred Stock immediately prior to the consummation of such Fundamental Transaction), and which is reasonably satisfactory in form

and substance to the Holder. Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted

for (so that from and after the date of such Fundamental Transaction, the provisions of this Certificate of Designation and the other

Transaction Documents referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right

and power of the Company and shall assume all of the obligations of the Company under this Certificate of Designation and the other Transaction

Documents with the same effect as if such Successor Entity had been named as the Company herein.

(d) Calculations.

All calculations under this Section 9 shall be made to the nearest cent or the nearest 1/100th of a share, as the case

may be. For purposes of this Section 9, the number of shares of Common Stock deemed to be issued and outstanding as of a

given date shall be the sum of the number of shares of Common Stock (excluding any treasury shares of the Company) issued and outstanding.

Section 10. Information

Rights. During any period in which the Company is not subject to the reporting requirements

of Section 13 or 15(d) of the Exchange Act and any shares of the Series B Preferred Stock are outstanding, the

Company will (i) transmit by mail to all Holders, copies of the annual reports and quarterly reports that would have been filed

with the Commission pursuant to Section 13 or 15(d) of the Exchange Act and (ii) promptly upon written request, make

available copies of such reports to any prospective holder of the Series B Preferred Stock. The Company will mail the reports

to the Holders within 15 days after the respective dates by which such reports would have been filed with the Commission.

Section 11. Miscellaneous.

(a) Notices.

Any and all notices or other communications or deliveries to be provided by the Holders hereunder shall be in writing and delivered personally

or by e-mail, or sent by a nationally recognized overnight courier service, addressed to the Company, at 15520 Highway 114, Justin, Texas

76247, Attention: General Counsel and Corporate Secretary, e-mail address [*****], or such other e-mail address or address

as the Company may specify for such purposes by notice to the Holders delivered in accordance with this Section 11. Any and

all notices or other communications or deliveries to be provided by the Company hereunder shall be in writing and delivered by e-mail

to each Holder at the e-mail address appearing on the books of the Company, or if no such e-mail address appears on the books of the

Company, at the principal place of business of such Holder, as set forth in the Purchase Agreement. Any notice or other communication

or deliveries hereunder shall be deemed given and effective on the earliest of the date of transmission, if such notice or communication

is delivered via e-mail at the e-mail address set forth prior to 5:30 p.m. (New York City time) on any date.

(b) Book-Entry;

Certificates. The Series B Preferred Stock will be issued in book-entry form; provided that, if a Holder requests that such

Holder’s shares of Series B Preferred Stock be issued in certificated form, the Company will instead issue a stock certificate

to such Holder representing such Holder’s shares of Series B Preferred Stock. To the extent that any shares of Series B

Preferred Stock are issued in book-entry form, references herein to “certificates” shall instead refer to the book-entry

notation relating to such shares.

(c) Lost

or Mutilated Preferred Stock Certificate. If a Holder’s Series B Preferred Stock certificate shall be mutilated, lost,

stolen or destroyed, the Company shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated certificate,

or in lieu of or in substitution for a lost, stolen or destroyed certificate, a new certificate for the shares of Series B Preferred

Stock so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of such loss, theft or destruction of such certificate,

and of the ownership hereof reasonably satisfactory to the Company.

(d) Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of this Certificate of Designation shall

be governed by and construed and enforced in accordance with the internal laws of the State of Delaware, without regard to the principles

of conflict of laws thereof.

(e) Waiver.

Any waiver by the Company or a Holder of a breach of any provision of this Certificate of Designation shall not operate as or be

construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation

or a waiver by any other Holders. The failure of the Company or a Holder to insist upon strict adherence to any term of this Certificate

of Designation on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter

to insist upon strict adherence to that term or any other term of this Certificate of Designation on any other occasion. Any waiver by

the Company or a Holder must be in writing.

(f) Severability.

If any provision of this Certificate of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation

shall remain in effect, and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to

all other Persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder violates the

applicable law governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum rate

of interest permitted under applicable law.

(g) Headings.

The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designation and shall not

be deemed to limit or affect any of the provisions hereof.

(h) Status

of Converted or Redeemed Preferred Stock. Shares of Series B Preferred Stock may only be issued pursuant to the Purchase Agreement.

If any shares of Series B Preferred Stock shall be converted, or reacquired by the Company, such shares shall resume the status

of authorized but unissued shares of Preferred Stock and shall no longer be designated as Series B Preferred Stock.

IN

WITNESS WHEREOF, the Company has caused this Certificate of Designation to be duly executed

and acknowledged by its undersigned duly authorized officer this 12th day of October, 2023.

| |

CANOO INC.

|

| |

|

|

| |

|

|

| |

By: |

/s/ Tony Aquila |

| |

Name: |

Tony Aquila |

| |

Title: |

Chief Executive Officer |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

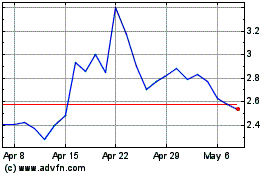

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Nov 2023 to Nov 2024