false0000897448AMARIN CORP PLCUK00-000000000008974482025-03-122025-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 12, 2025

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

England and Wales |

0-21392 |

Not applicable |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

Iconic Offices, The Greenway, Block C Ardilaun Court, One Central Plaza, 5th Floor, 36 Dame Street, Dublin 2, Ireland |

Not applicable |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: +353 1 6699 020

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

American Depositary Shares (ADS(s)), each ADS representing the right to receive one (1) Ordinary Share of Amarin Corporation plc |

AMRN |

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 12, 2025, Amarin Corporation plc (“Amarin”) issued a press release announcing its financial results for the three and twelve months ended December 31, 2024 and 2023 (the “Press Release”). A copy of the Press Release is furnished herewith as Exhibit 99.1.

The information in this report furnished pursuant to Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), if such subsequent filing specifically references the information furnished pursuant to Item 2.02 of this report.

Item 3.03 Material Modification to Rights of Security Holders.

On March 12, 2025, Amarin announced its intent to effect an adjustment in the ratio of its American depositary shares (“ADSs”) to its ordinary shares, £0.50 par value per share (“Ordinary Shares”) from one (1) ADS representing one (1) Ordinary Share to one (1) ADS representing twenty (20) Ordinary Shares (the “ADS Ratio Change”). The ADS Ratio Change will result in a one for twenty reverse split of issued and outstanding ADSs, and it will have no effect on the Ordinary Shares. The ADS Ratio Change is expected to become effective on or about April 11, 2025 (the “Effective Date”).

As a result of the ADS Ratio Change, the trading price of Amarin's ADSs is expected to increase proportionally, but Amarin can give no assurance that the trading price per ADS after the ADS Ratio Change will be equal to or greater than twenty (20) times the trading price per ADS before the change.

Item 7.01 Regulation FD

On March 12, 2025, Amarin issued a press release announcing the ADS Ratio Change. A copy of this press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this Item 7.01 and the attached Exhibit 99.1 are being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing of Amarin under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: March 12, 2025 |

|

Amarin Corporation plc |

|

|

|

|

|

|

By: |

/s/ Aaron Berg |

|

|

|

Aaron Berg |

|

|

|

President and Chief Executive Officer |

Exhibit 99.1

Amarin Reports Fourth Quarter Financial Results & Business Update and Announces Important Corporate Action

-- Company Reports Fourth Quarter 2024 Total Revenues of $62.3 Million, Operating Expenses of $43.0 Million and Year End 2024 Cash Position of $294.2 Million --

-- Fourth Quarter and Full-Year 2024 Performance Reflects Benefits of Commitment to Strategic Focus, Operational Streamlining, Prudent Cash Management, and Growing Global Momentum of VASCEPA®/VAZKEPA® (icosapent ethyl) Franchise --

-- Announces 1-For-20 ADS Ratio Change to Maintain Nasdaq Listing --

-- Company to Host Conference Call Today at 8:00 a.m. EDT --

DUBLIN, Ireland and BRIDGEWATER, N.J., March 12, 2025 -- Amarin Corporation plc (NASDAQ:AMRN), today announced financial results for the fourth quarter of 2024 and provided a review of fourth quarter and recent operational highlights.

“Since taking on the role of CEO of Amarin last year, I have worked with our leadership team and the Board of Directors to identify opportunities to leverage our unique assets, skills and resources to drive value,” said Aaron Berg, President & CEO, Amarin. “In 2024, while still progressing with the early launch in markets outside the U.S. and despite a dynamic generic market in the U.S., we generated more than $200 million in revenue and ended the year with nearly $300 million in cash and no debt -- all measures exemplifying the strength and resilience of our franchise and the impact of our disciplined approach to capital deployment. Specifically, we continued to capture efficient branded revenue in the U.S. market for VASCEPA, unlocked access to VASCEPA/VAZKEPA in six additional global markets -- including Italy, China and Australia -- both on our own and through partnerships, and progressed in an additional 16 countries at various stages towards commercialization. The global VASCEPA franchise remains poised to continue expanding its impact on cardiovascular disease for at-risk patients worldwide.”

In addition, Aaron Berg commented, “Building on our efforts and results in 2024, we continue to identify steps to advance the company. As a publicly traded company, there is considerable value in maintaining our Nasdaq listing. To this effect, today we announced our intent to initiate a ratio change to our ADS program.”

1-For-20 ADS Ratio Change

In a separate press release issued today, the Company announced its intent to effect a Ratio Change on its American Depositary Shares (“ADS”) from one (1) ADS representing one (1) ordinary share, to the new ratio of one (1) ADS representing twenty (20) ordinary shares (the "Ratio Change"). The effective date of the Ratio Change is expected to be on or about April 11, 2025. The objective of the Ratio Change is to maintain the Company’s listing on the Nasdaq Capital Market and to preserve the Company’s long-term access to the equity capital markets.

For further information, please refer to the press release issued on March 12, 2025. Additional questions and answers regarding the Ratio Change can be found under the Investor Relations section of Amarin’s corporate web site here: https://cms.amarincorp.com/sites/default/files/2025-03/e6713d4c-9083-4623-a9e9-6b13d8a4201b.pdf

Fourth Quarter 2024 & Recent Operational Highlights

The Company continued to advance commercialization and pricing and reimbursement efforts across European markets:

•In all European countries where VAZKEPA has launched, in-market demand grew in the fourth quarter versus the third quarter of 2024.

•In Italy, the Company secured national reimbursement. Access has already been unlocked in 9 (of 21) regions of this EU5 market, representing more than 50% of the total VAZKEPA eligible population. Based on recent scientific leader feedback, the appetite for the product is very strong across all regions in Italy.

•In Austria, national reimbursement for VAZKEPA was secured in late February; as of April 1, 2025, VAZKEPA will be included in Austria’s Code of Reimbursement (EKO).

Through partnerships, the Company continues to make progress towards regulatory approvals, access and commercialization in Rest of World (RoW) markets:

•Two of our partners launched in cardiovascular risk reduction, EddingPharm in China and CSL Seqirus in Australia.

•While early in the launch phase for a number of RoW markets, all partners saw growth in demand for VASCEPA/VAZKEPA in the fourth quarter.

•Amarin and its partners are continuing to advance regulatory processes in seven additional RoW markets.

The Company’s R&D Team and other investigators have continued to generate, present and publish important new data which add to the significant body of evidence demonstrating the unique benefits of VASCEPA/VAZKEPA. In 2024, a total of 45 additional publications including abstracts, posters, and manuscripts were presented or published that, both individually and in aggregate, helped to advance an ever-broadening understanding of the science and value of icosapent ethyl and EPA.

•In 2024, investigators presented additional subgroup analyses from the landmark REDUCE-IT® cardiovascular outcomes trial in patients with and without coronary artery disease (CAD) history and data on the mechanistic effects of eicosapentaenoic acid (EPA), including its antioxidant effects in endothelial cells and the ability of EPA to impact the oxidation of Lp(a) particles made of protein and fats (lipids) that carry cholesterol through the bloodstream, at the American Heart Association (AHA) Scientific Sessions. The medical community has increased its focus on Lp(a) as a key cardiovascular risk factor.

•A recent post hoc analysis of REDUCE-IT published in the Journal of the American Heart Association evaluated the impact of icosapent ethyl on patients with various LDL-C levels at baseline, including those with very well-controlled LDL-C (<55 mg/dL). The analysis showed consistent cardiovascular risk reduction benefit irrespective of baseline LDL-C level. This data reinforces the need to go beyond LDL lowering for greater cardiovascular risk reduction and supports that VASCEPA/VAZKEPA is a “complementary” therapy to current LDL-C lowering therapies.

•In March 2025, the Company will support the presentation of additional data at ACC.25, providing further evidence of the potential mechanistic activity of EPA, administered clinically in the form of VASCEPA/VAZKEPA (icosapent ethyl), to reduce cardiovascular (CV) events in at-risk patients -- specifically, the antioxidant effects of EPA on lipoprotein(a) [Lp(a)]-enriched human plasma and the effects of a GLP-1 receptor agonist in combination with EPA on the changes in antioxidant protein expression in human endothelial cells during inflammation in vitro. With widespread GLP-1 use, there are likely an increasing number of patients with lipid abnormalities requiring LDL-C lowering therapy and with other co-morbidities and risk characteristics that are in need of a complementary therapy like VASCEPA/VAZKEPA to further reduce cardiovascular events.

Fourth Quarter 2024 Financial Highlights

|

|

|

|

($ in millions) |

Three months ended December 31, 2024 |

Three months ended December 31, 2023 |

% Change |

Total Net Revenue |

$62.3 |

$74.7 |

-17% |

Operating Expenses |

$43.0 |

$49.7 |

-18% |

Cash |

$294.2 |

$320.7 |

-8% |

Total net revenue for the three months ended December 31, 2024 was $62.3 million, compared to $74.7 million in the corresponding period of 2023, a decrease of 17%. Net product revenue for the three months ended December 31, 2024 was $60.1 million, compared to $70.6 million in the corresponding period of 2023, a decrease of 15%. This decrease was driven primarily by a lower net selling price due to US generic competition as well as a reduction in volume primarily related to an exclusive account no longer covering VASCEPA.

•U.S. net product revenue was $44.2 million for the three months ended December 31, 2024 compared to $64.9 million in the corresponding period of 2023.

•European net product revenue was $4.0 million for the three months ended December 31, 2024 compared to $1.5 million in the corresponding period of 2023.

•Rest of World (RoW) net product revenue was $11.9 million for the three months ended December 31, 2024 compared to $4.2 million in the corresponding period of 2023.

Cost of goods sold, excluding non-cash inventory restructuring of $36.5 million, for the three months ended December 31, 2024 was $35.4 million, compared to $29.6 million in the corresponding period of 2023. Excluding the non-cash inventory restructuring charge in the three months ended December 31, 2024, gross margin was 41% and 58%, respectively.

Selling, general and administrative expenses for the three months ended December 31, 2024 were $37.0 million, compared to $43.9 million in the corresponding period of 2023. This decrease primarily reflects the impact of ongoing cost optimization efforts across the business, first initiated by the Company in 2023.

Research and development expenses for the three months ended December 31, 2024 were $6.0 million, compared to $5.8 million in the corresponding period of 2023.

Under U.S. GAAP, the Company reported net loss of $48.6 million for the three months ended December 31, 2024, or basic and diluted loss per share of $0.12. For the three months ended December 31, 2023, the Company reported net loss of $5.8 million, or basic and diluted loss per share of $0.01.

On a non-GAAP basis, excluding non-cash stock-based compensation expense and restructuring charges, adjusted net loss for the three months ended December 31, 2024 was $8.7 million or adjusted basic and diluted loss per share of $0.02, compared with an adjusted net loss of $0.9 million or adjusted basic and diluted loss per share of $0.00 for the three months ended December 31, 2023.

As of December 31, 2024, the Company reported aggregate cash and investments of $294.2 million, compared to aggregate cash and investment of $320.7 million as of December 31, 2023.

2025 Strategic Outlook

The Company is committed to capitalizing on the significant opportunity in Europe, while continuing to explore all strategies to accelerate growth in the region where there remains significant untapped potential, including more than 5 million high-risk patients with established cardiovascular disease in Europe, efficiently generating revenue and maximizing cash generation in the U.S., and from the RoW income stream. The Company continues to tightly manage its operating expenses and its cash position. The Company reaffirms its belief that current cash and investments and other assets are adequate to support continuing operations for the foreseeable future. The Company continues to explore and be open to all opportunities to get VASCEPA/VAZKEPA into the hands of as many at-risk patients as possible around the world.

Fourth Quarter & Full-Year 2024 Earnings Conference Call and Webcast Information

Amarin will host a conference call on March 12, 2025, at 8:00 a.m. ET to discuss this information. The conference call can be accessed on the investor relations section of the company's website at www.amarincorp.com, or via telephone by dialing 888-506-0062 within the United States, 973-528-0011 from outside the United States, and referencing conference ID 575561. A replay of the call will be made available for a period of two weeks following the conference call. To listen to a replay of the call, dial 877-481-4010 from within the United States and 919-882-2331 from outside of the United States, and reference conference ID 51859. A replay of the call will also be available through the company's website shortly after the call.

About Amarin

Amarin is an innovative pharmaceutical company leading a new paradigm in cardiovascular disease management. We are committed to increasing the scientific understanding of the cardiovascular risk that persists beyond traditional therapies and advancing the treatment of that risk for patients worldwide. Amarin has offices in Bridgewater, New Jersey in the United States, Dublin in Ireland, Zug in Switzerland, and other countries in Europe as well as commercial partners and suppliers around the world.

About VASCEPA®/VAZKEPA® (icosapent ethyl) Capsules

VASCEPA (icosapent ethyl) capsules are the first prescription treatment approved by the U.S. Food and Drug Administration (FDA) comprised solely of the active ingredient, icosapent ethyl (IPE), a unique form of eicosapentaenoic acid. VASCEPA was launched in the United States in January 2020 as the first drug approved by the U.S. FDA for treatment of the studied high-risk patients with persistent cardiovascular risk despite being on statin therapy. VASCEPA was initially launched in the United States in 2013 based on the drug’s initial FDA approved indication for use as an adjunct therapy to diet to reduce triglyceride levels in adult patients with severe (≥500 mg/dL) hypertriglyceridemia. Since launch, VASCEPA has been prescribed more than twenty-five million times. VASCEPA is covered by most major medical insurance plans. In addition to the United States, VASCEPA is approved and sold in Canada, China, Australia, Lebanon, the United Arab Emirates, Saudi Arabia, Qatar, Bahrain, and Kuwait. In Europe, in March 2021 marketing authorization was granted to icosapent ethyl in the European Union for the reduction of risk of cardiovascular events in patients at high cardiovascular risk, under the brand name VAZKEPA. In April 2021 marketing authorization for VAZKEPA (icosapent ethyl) was granted in Great Britain (applying to England, Scotland and Wales). VAZKEPA (icosapent ethyl) is currently approved and sold in Europe in Sweden, Finland, England/Wales, Spain, Netherlands, Scotland, Greece, Portugal, Italy and Denmark.

United States

Indications and Limitation of Use

VASCEPA is indicated:

•As an adjunct to maximally tolerated statin therapy to reduce the risk of myocardial infarction, stroke, coronary revascularization and unstable angina requiring hospitalization in adult patients with elevated triglyceride (TG) levels (≥ 150 mg/dL) and

•established cardiovascular disease or

•diabetes mellitus and two or more additional risk factors for cardiovascular disease.

•As an adjunct to diet to reduce TG levels in adult patients with severe (≥ 500 mg/dL) hypertriglyceridemia.

The effect of VASCEPA on the risk for pancreatitis in patients with severe hypertriglyceridemia has not been determined.

Important Safety Information

•VASCEPA is contraindicated in patients with known hypersensitivity (e.g., anaphylactic reaction) to VASCEPA or any of its components.

•VASCEPA was associated with an increased risk (3% vs 2%) of atrial fibrillation or atrial flutter requiring hospitalization in a double-blind, placebo-controlled trial. The incidence of atrial fibrillation was greater in patients with a previous history of atrial fibrillation or atrial flutter.

•It is not known whether patients with allergies to fish and/or shellfish are at an increased risk of an allergic reaction to VASCEPA. Patients with such allergies should discontinue VASCEPA if any reactions occur.

•VASCEPA was associated with an increased risk (12% vs 10%) of bleeding in a double-blind, placebo-controlled trial. The incidence of bleeding was greater in patients receiving concomitant antithrombotic medications, such as aspirin, clopidogrel or warfarin.

•Common adverse reactions in the cardiovascular outcomes trial (incidence ≥3% and ≥1% more frequent than placebo): musculoskeletal pain (4% vs 3%), peripheral edema (7% vs 5%), constipation (5% vs 4%), gout (4% vs 3%), and atrial fibrillation (5% vs 4%).

•Common adverse reactions in the hypertriglyceridemia trials (incidence >1% more frequent than placebo): arthralgia (2% vs 1%) and oropharyngeal pain (1% vs 0.3%).

•Adverse events may be reported by calling 1-855-VASCEPA or the FDA at 1-800-FDA-1088.

•Patients receiving VASCEPA and concomitant anticoagulants and/or anti-platelet agents should be monitored for bleeding.

FULL U.S. FDA-APPROVED VASCEPA PRESCRIBING INFORMATION CAN BE FOUND AT WWW.VASCEPA.COM.

Europe

For further information about the Summary of Product Characteristics (SmPC) for VAZKEPA® in Europe, please visit: https://www.medicines.org.uk/emc/product/12964/smpc.

Globally, prescribing information varies; refer to the individual country product label for complete information.

Use of Non-GAAP Adjusted Financial Information

Included in this press release are non-GAAP adjusted financial information as defined by U.S. Securities and Exchange Commission Regulation G. The GAAP financial measure most directly comparable to each non-GAAP adjusted financial measure used or discussed, and a reconciliation of the differences between each non-GAAP adjusted financial measure and the comparable GAAP financial measure, is included in this press release after the condensed consolidated financial statements.

Non-GAAP adjusted net (loss) income was derived by taking GAAP net loss and adjusting it for non-cash stock-based compensation expense, restructuring expense and other one-time expenses. Management uses these non-GAAP adjusted financial measures for internal reporting and forecasting purposes, when publicly providing its business outlook, to evaluate the company’s performance and to evaluate and compensate the company’s executives. The company has provided these non-GAAP financial measures in addition to GAAP financial results because it believes that these non-GAAP adjusted financial measures provide investors with a better understanding of the company’s historical results from its core business operations.

While management believes that these non-GAAP adjusted financial measures provide useful supplemental information to investors regarding the underlying performance of the company’s business operations, investors are reminded to consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures prepared in accordance with GAAP. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP. In addition, it should be noted that these non-GAAP financial measures may be different from non-GAAP measures used by other companies, and management may utilize other measures to illustrate performance in the future.

Forward-Looking Statements

This press release contains forward-looking statements which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including beliefs about Amarin’s key achievements in 2024 and the potential impact and outlook for achievements in 2025 and beyond; Amarin’s 2025 financial outlook and cash position; Amarin’s overall efforts to expand access and reimbursement to VAZKEPA across global markets; expectations regarding potential strategic collaboration and licensing agreements with third parties, including our ability to attract additional collaborators, as well as our plans and strategies for entering into potential strategic collaboration and licensing agreements and the overall potential and future success of VASCEPA/VAZKEPA and Amarin that are based on the beliefs and assumptions and information currently available to Amarin. All statements other than statements of historical fact contained in this press release are forward-looking statements, including statements regarding Amarin’s planned ratio adjustment and its potential impact on the ADS trading price and on liquidity of the ADSs, as well as Amarin’s ability to regain compliance with Nasdaq's minimum bid price requirement and other continued listing requirements. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin's filings with the U.S. Securities and Exchange Commission, including Amarin’s annual report on Form 10-K for the fiscal year ended 2024. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Amarin undertakes no obligation to update or revise the information contained in its forward-looking statements, whether as a result of new information, future events or circumstances or otherwise. Amarin’s forward-looking statements do not reflect the potential impact of significant transactions the company may enter into, such as mergers, acquisitions, dispositions, joint ventures or any material agreements that Amarin may enter into, amend or terminate.

Availability of Other Information About Amarin

Investors and others should note that Amarin communicates with its investors and the public using the company website (www.amarincorp.com), the investor relations website (www.amarincorp.com/investor-relations), including but not limited to investor presentations and investor FAQs, U.S. Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that Amarin posts on these channels and websites could be deemed to be material information. As a result, Amarin encourages investors, the media, and others interested in Amarin to review

the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on Amarin’s investor relations website and may include social media channels. The contents of Amarin’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Securities and Exchange Act of 1934, as amended.

Amarin Contact Information

Investor & Media Inquiries:

Mark Marmur

Amarin Corporation plc

PR@amarincorp.com

-Tables to Follow-

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEET DATA |

|

(U.S. GAAP) |

|

Unaudited * |

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

|

(in thousands) |

|

ASSETS |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

121,038 |

|

|

$ |

199,252 |

|

Restricted cash |

|

|

300 |

|

|

|

525 |

|

Short-term investments |

|

|

173,182 |

|

|

|

121,407 |

|

Accounts receivable, net |

|

|

122,279 |

|

|

|

133,563 |

|

Inventory |

|

|

166,048 |

|

|

|

258,616 |

|

Prepaid and other current assets |

|

|

12,552 |

|

|

|

11,618 |

|

Total current assets |

|

|

595,399 |

|

|

|

724,981 |

|

Property, plant and equipment, net |

|

|

16 |

|

|

|

114 |

|

Long-term inventory |

|

|

64,740 |

|

|

|

77,615 |

|

Operating lease right-of-use asset |

|

|

7,592 |

|

|

|

8,310 |

|

Other long-term assets |

|

|

1,213 |

|

|

|

1,360 |

|

Intangible asset, net |

|

|

16,389 |

|

|

|

19,304 |

|

TOTAL ASSETS |

|

$ |

685,349 |

|

|

$ |

831,684 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

40,366 |

|

|

$ |

52,762 |

|

Accrued expenses and other current liabilities |

|

|

139,583 |

|

|

|

204,174 |

|

Current deferred revenue |

|

|

— |

|

|

|

2,341 |

|

Total current liabilities |

|

|

179,949 |

|

|

|

259,277 |

|

Long-Term Liabilities: |

|

|

|

|

|

|

Long-term deferred revenue |

|

|

— |

|

|

|

2,509 |

|

Long-term operating lease liability |

|

|

7,723 |

|

|

|

8,737 |

|

Other long-term liabilities |

|

|

11,501 |

|

|

|

9,064 |

|

Total liabilities |

|

|

199,173 |

|

|

|

279,587 |

|

Stockholders’ Equity: |

|

|

|

|

|

|

Common stock |

|

|

305,298 |

|

|

|

302,756 |

|

Additional paid-in capital |

|

|

1,914,750 |

|

|

|

1,899,456 |

|

Treasury stock |

|

|

(65,326 |

) |

|

|

(63,752 |

) |

Accumulated deficit |

|

|

(1,668,546 |

) |

|

|

(1,586,363 |

) |

Total stockholders’ equity |

|

|

486,176 |

|

|

|

552,097 |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

685,349 |

|

|

$ |

831,684 |

|

|

|

|

|

|

|

|

* Unaudited as a standalone schedule; copied from consolidated financial statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS DATA |

|

(U.S. GAAP) |

|

Unaudited * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

(in thousands, except per share amounts) |

|

|

(in thousands, except per share amounts) |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

60,068 |

|

|

$ |

70,555 |

|

|

$ |

204,590 |

|

|

$ |

285,299 |

|

Licensing and royalty revenue |

|

2,238 |

|

|

|

4,158 |

|

|

|

24,024 |

|

|

|

21,612 |

|

Total revenue, net |

|

62,306 |

|

|

|

74,713 |

|

|

|

228,614 |

|

|

|

306,911 |

|

Less: Cost of goods sold |

|

35,399 |

|

|

|

29,589 |

|

|

|

110,758 |

|

|

|

102,142 |

|

Less: Cost of goods sold - restructuring inventory |

|

36,474 |

|

|

|

— |

|

|

|

36,474 |

|

|

|

39,228 |

|

Gross margin |

|

(9,567 |

) |

|

|

45,124 |

|

|

|

81,382 |

|

|

|

165,541 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative (1) |

|

36,970 |

|

|

|

43,941 |

|

|

|

152,310 |

|

|

|

199,938 |

|

Research and development (1) |

|

5,985 |

|

|

|

5,791 |

|

|

|

20,869 |

|

|

|

22,219 |

|

Restructuring |

|

— |

|

|

|

229 |

|

|

|

— |

|

|

|

10,972 |

|

Total operating expenses |

|

42,955 |

|

|

|

49,961 |

|

|

|

173,179 |

|

|

|

233,129 |

|

Operating loss |

|

(52,522 |

) |

|

|

(4,837 |

) |

|

|

(91,797 |

) |

|

|

(67,588 |

) |

Interest income |

|

3,371 |

|

|

|

3,419 |

|

|

|

13,403 |

|

|

|

11,863 |

|

Interest expense |

|

(3 |

) |

|

|

(2 |

) |

|

|

(7 |

) |

|

|

(8 |

) |

Other (expense) income, net |

|

(753 |

) |

|

|

(1,029 |

) |

|

|

1,201 |

|

|

|

2,063 |

|

Loss from operations before taxes |

|

(49,907 |

) |

|

|

(2,449 |

) |

|

|

(77,200 |

) |

|

|

(53,670 |

) |

Benefit from (provision for) income taxes |

|

1,289 |

|

|

|

(3,332 |

) |

|

|

(4,983 |

) |

|

|

(5,442 |

) |

Net loss |

$ |

(48,618 |

) |

|

$ |

(5,781 |

) |

|

$ |

(82,183 |

) |

|

$ |

(59,112 |

) |

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.12 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.15 |

) |

Diluted |

$ |

(0.12 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.15 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

411,293 |

|

|

|

408,485 |

|

|

|

410,937 |

|

|

|

407,655 |

|

Diluted |

|

411,293 |

|

|

|

408,485 |

|

|

|

410,937 |

|

|

|

407,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Unaudited as a standalone schedule; copied from consolidated financial statements |

|

(1) |

Excluding non-cash stock-based compensation, selling, general and administrative expenses were $138,144 and $187,445 for the years ended December 31, 2024 and 2023, respectively, and research and development expenses were $17,330 and $18,032, respectively, for the same periods. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NON-GAAP NET (LOSS) INCOME |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

Year Ended December 31, |

|

|

|

(in thousands, except per share amounts) |

|

|

(in thousands, except per share amounts) |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income for EPS - GAAP |

|

$ |

(48,618 |

) |

|

|

$ |

(5,781 |

) |

|

|

$ |

(82,183 |

) |

|

|

$ |

(59,112 |

) |

|

Stock-based compensation expense |

|

|

3,400 |

|

|

|

|

4,646 |

|

|

|

|

17,705 |

|

|

|

|

16,680 |

|

|

Restructuring Inventory |

|

|

36,474 |

|

|

|

|

— |

|

|

|

|

36,474 |

|

|

|

|

39,228 |

|

|

Restructuring expense |

|

— |

|

|

|

|

229 |

|

|

|

|

— |

|

|

|

|

10,972 |

|

|

Advisor Fees |

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

6,270 |

|

Adjusted net (loss) income for EPS - non-GAAP |

|

$ |

(8,744 |

) |

|

|

$ |

(906 |

) |

|

|

$ |

(28,004 |

) |

|

|

$ |

14,038 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic - non-GAAP |

|

$ |

(0.02 |

) |

|

|

$ |

(0.00 |

) |

|

|

$ |

(0.07 |

) |

|

|

$ |

0.03 |

|

Diluted - non-GAAP |

|

$ |

(0.02 |

) |

|

|

$ |

(0.00 |

) |

|

|

$ |

(0.07 |

) |

|

|

$ |

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

411,293 |

|

|

|

|

408,485 |

|

|

|

|

410,937 |

|

|

|

|

407,655 |

|

Diluted |

|

|

411,293 |

|

|

|

|

408,485 |

|

|

|

|

410,937 |

|

|

|

|

422,966 |

|

Exhibit 99.2

Amarin Announces Plan to Initiate a Ratio Change Under Its American Depository Receipt (ADR) Program

-- 1-For-20 Ratio Change Initiated to Increase Per Share Market Price of Amarin’s ADSs in Effort to Maintain Nasdaq Listing --

DUBLIN, Ireland and BRIDGEWATER, N.J., March 12, 2025 -- Amarin Corporation plc (NASDAQ: AMRN), today announced its intent to effect a ratio change on its American Depositary Shares (“ADS”) from one (1) ADS representing one (1) ordinary share, to the new ratio of one (1) ADS representing twenty (20) ordinary shares (the "Ratio Change"). The effective date of the Ratio Change is expected to be on or about April 11, 2025 (the “Effective Date”).

The ordinary shares of Amarin Corporation (the “Company”) will not be affected by this adjustment. The ADSs will continue to trade on The Nasdaq Capital Market under the symbol “AMRN”.

The objective of the Ratio Change is to increase the per share market price of the Company’s ADSs to comply with Nasdaq’s $1.00 minimum bid price per share requirement and maintain the Company’s listing on The Nasdaq Capital Market. On the Effective Date, holders of uncertificated ADSs in the Direct Registration System (“DRS”) and in the Depository Trust Company (“DTC”) do not need to take any action, as the exchange of every twenty (20) then-held (existing) ADSs for one (1) new ADS will occur automatically. Registered holders of certificated ADSs will be required to surrender their certificated ADSs to the depositary bank for cancellation and will receive one (1) new ADS for every twenty (20) existing ADS surrendered.

No fractional new ADSs will be issued in connection with the Ratio Change. Rather, fractional entitlements to new ADSs will be aggregated and sold by the depositary bank, and the net cash proceeds from the sale of the fractional ADS entitlements (after deduction of taxes) will be distributed to the applicable ADS holders by the depositary bank.

As a result of the Ratio Change, the trading price of the Company’s ADSs is expected to increase proportionally, but the Company can give no assurance that the trading price per ADS after the Ratio Change will be equal to or greater than twenty (20) times the trading price per ADS before the adjustment.

Additional questions and answers regarding the Ratio Change can be found under the Investor Relations section of Amarin’s corporate web site here: https://cms.amarincorp.com/sites/default/files/2025-03/e6713d4c-9083-4623-a9e9-6b13d8a4201b.pdf

***

About Amarin

Amarin is an innovative pharmaceutical company leading a new paradigm in cardiovascular disease management. We are committed to increasing the scientific understanding of the cardiovascular risk that persists beyond traditional therapies and advancing the treatment of that risk for patients worldwide.

Amarin has offices in Bridgewater, New Jersey in the United States, Dublin in Ireland, Zug in Switzerland, and other countries in Europe as well as commercial partners and suppliers around the world.

Forward-Looking Statements

This press release contains forward-looking statements which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, that are based on the beliefs and assumptions and information currently available to Amarin. All statements other than statements of historical fact contained in this press release are forward-looking statements, including statements regarding Amarin’s planned Ratio Change and its potential impact on the ADS trading price and on liquidity of the ADS, as well as Amarin’s ability to regain compliance with Nasdaq’s minimum bid price requirement and other continued listing requirements. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin's filings with the U.S. Securities and Exchange Commission, including Amarin’s annual report on Form 10-K for the fiscal year ended 2024.

Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Amarin undertakes no obligation to update or revise the information contained in its forward-looking statements, whether as a result of new information, future events or circumstances or otherwise. Amarin’s forward-looking statements do not reflect the potential impact of significant transactions the company may enter into, such as mergers, acquisitions, dispositions, joint ventures or any material agreements that Amarin may enter into, amend or terminate.

Availability of Other Information

Amarin communicates with its investors and the public using the company website (www.amarincorp.com) and the investor relations website (www.amarincorp.com/investor-relations), including but not limited to investor presentations and FAQs, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that Amarin posts on these channels and websites could be deemed to be material information. As a result, Amarin encourages investors, the media and others interested in Amarin to review the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on Amarin’s investor relations website and may include social media channels. The contents of Amarin’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Securities and Exchange Act of 1934, as amended.

Amarin Contact Information

Investor & Media Inquiries:

Mark Marmur

VP, Global Corporate Communications & Investor Relations

Amarin Corporation plc

PR@amarincorp.com

v3.25.0.1

Document and Entity Information

|

Mar. 12, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 12, 2025

|

| Entity Registrant Name |

AMARIN CORP PLCUK

|

| Entity Incorporation State Country Code |

X0

|

| Entity File Number |

0-21392

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

Iconic Offices, The Greenway

|

| Entity Address, Address Line Two |

Block C Ardilaun Court

|

| Entity Address, Address Line Three |

One Central Plaza, 5th Floor, 36 Dame Street

|

| Entity Address, City or Town |

Dublin

|

| Entity Address, Postal Zip Code |

2

|

| Entity Address, Country |

IE

|

| Country Region |

353

|

| City Area Code |

1

|

| Local Phone Number |

6699 020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Security 12b Title |

American Depositary Shares (ADS(s)), each ADS representing the right to receive one (1) Ordinary Share of Amarin Corporation plc

|

| Trading Symbol |

AMRN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000897448

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

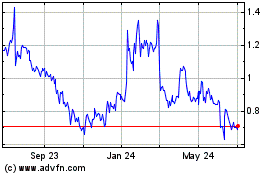

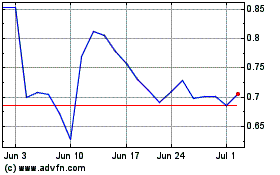

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Mar 2025