- +3.0% growth in net recurrent earnings (NRE) per

share, with this trend higher than the full-year target of

at least +2.0%.

- Finalization of the transfer of hypermarket operations from

Casino to Auchan, Intermarché and Carrefour in progress. Banner

changes recognized with excellent footfall performance levels when

the stores reopened.

- Invoiced rents up +4.1% like-for-like.

- Positive operational trends: clear outperformance for

Mercialys centers in terms of footfall (+70bp versus the national

index at end-June) and retailer sales (+170bp versus the national

index at end-May). This success, established over the long

run, reflects Mercialys’ objective to shape its sites to cater

to the needs of peri-urban populations: offering retailers that are

affordable and meet a demand for “spending better” and more

sustainably among consumers who still want shopping for pleasure,

while adapting to inflation.

- Moderate current financial vacancy rate of 3.0%

highlighting the effectiveness of Mercialys’ rental policy, the

relevant positioning of its sites and the underlying resilience of

consumption segments in France and particularly health / beauty and

culture / gifts / sport.

- +0.4% upturn in the like-for-like portfolio value for

the first half of 2024, factoring in the favorable impact of the

increase in rents and reflecting an average appraisal rate of

6.68%.

- Continued portfolio rotation, demonstrating the liquidity of

the assets: disposal of four hypermarkets that were 51% owned

by Mercialys and operated by Auchan, as well as ancillary lots

owned by Mercialys, for a total net sales price of Euro 117.5

million on a 100% basis. This operation, completed in July

2024, contributes to the Company’s balanced rental mix, while

supporting its potential for investment.

- LTV including transfer taxes of 36.9% at June 30,

2024 factoring in the disposal of the four hypermarkets. The

average cost of drawn debt remains under control at

2.2%. The Company does not have any debt installments due

before February 2026, with the exception of a limited amount of

commercial paper for Euro 42 million. Supported by a solid balance

sheet, the Company will be able to position itself on operations

for investments or acquisitions either directly or through

partnerships.

- 2024 objectives confirmed: NRE per share growth to reach

at least +2.0% versus 2023. Dividend to range from 75% to 95% of

2024 NRE.

Regulatory News:

Mercialys (Paris:MERY):

Jun 30, 2023

Jun 30, 2024

Change (%)

Organic growth in invoiced rents including

indexation

+4.2%

+4.1%

-

EBITDA (€m)

72.3

76.1

+5.2%

EBITDA margin

82.0%

83.1%

-

Net recurrent earnings (NRE)

(€m)

57.5

59.3

+3.3%

ICR (EBITDA / net finance costs)

5.2x

5.5x

-

LTV (excluding transfer taxes)

38.6%

39.4%1

-

LTV (including transfer taxes)

36.1%

36.9%1

-

Portfolio value including transfer taxes

(€m)

2,987.0

2,879.4

-3.4% 2 (H1 +0.3%)

EPRA NTA (€/share)

16.99

15.85

-6.7% (H1 -2.7%)

I. Mercialys, the leading REIT for

accessible retail: meeting a demand for “shopping for pleasure”

combined with price constraints

72% of Mercialys’ shopping centers are positioned in out-of-town

areas, which are home to 44%3 of the French population. Since 2005,

the Company has recalibrated its portfolio to keep the assets with

leading positions in their catchment areas, located around mid-size

cities with the best demographic and purchasing power trends.

While the latest economic cycles since the Company was founded

in 2005 have been marked by various determining factors, one

pivotal element has become established as a permanent feature:

price-consciousness among consumers. This focus has been

particularly strong since inflation picked up again in 2022.

Alongside this, another constant feature of consumer behavior is

the concept of “shopping for pleasure”: going shopping is still a

source of satisfaction. This need to accumulate goods is

illustrated by the fact that 71%4 of respondents said that they

enjoy making purchases either systematically, often or occasionally

(compared with 66% in March 2022).

Caught between this desire to consume and the need to control

their spending, with 41% of households saying that they base

their decisions primarily on their purchasing power5, shopping

center visitors are adapting. Firstly, their preferred retailers

include brands with a very clear price positioning: Action,

Décathlon and Leroy Merlin are respectively the top three preferred

retailers among French consumers5. Secondly, they are adapting

their behavior, as indicated by 85%5 of households looking for

promotional offers or switching to less expensive items.

This price-consciousness is also having an impact on French

aspirations to consume in a better way. While 95%6 of French

people would like to consume more responsibly, only 13% say that

they have actually changed their habits to move in this direction,

primarily due to their financial constraints. Faced with this

dilemma, consumers would like brands to adopt better practices on

sustainable development issues: for instance, 27%5 of French people

say that they base their decisions primarily on CSR issues.

Lastly, French people’s concerns about their purchasing power

are also marking the political context: ahead of the legislative

elections, 58% of the people surveyed said that purchasing power

was a decisive factor behind their votes7.

Within this paradigm, Mercialys aims to continually adapt its

retail mix and establish itself as the real estate market leader

for affordable retail across all consumption segments.

Illustrating this trend, the opening of the Action store in

Aix-en-Provence led to a +29% increase in footfall for this center

from December 2023 to June 2024; the inauguration of the Normal

store in Annecy is reflected in a +26% increase in this site’s

footfall since May 2024; lastly, 4,200 visits over two days

highlight the success of the operations carried out with the

low-price brands Plantes Pour Tous and Le Goût des Plantes at the

Grenoble and Toulouse sites.

Lastly, the takeover of hypermarkets previously operated by the

Casino group by Intermarché, Carrefour and Auchan (ranking 2nd, 4th

and 8th respectively in the top 100 leading retail brands in

France8) fully supports this offering of affordable local services.

Hypermarkets play a key role in limiting the impact of food costs

on household budgets, thanks in particular to their own private

labels.

II. Finalization of hypermarket takeovers in

progress: enhanced sites’ attractiveness and risk profile for

Mercialys

The changes to the hypermarket banners anchoring Mercialys’

shopping centers, which began in the fourth quarter of 2023, were

successfully completed during the first half of 2024.

On June 22, 2024, the Casino group indicated that it had signed

a unilateral preliminary purchase agreement concerning the sale of

the subsidiary operating its activities in Corsica,

including the stores owned by Mercialys, with Auchan Retail France

and the Rocca group. The completion of this operation remains

subject to various administrative procedures, including approval

from the competition authorities.

On July 2, 2024, Mercialys announced the disposal of four

hypermarkets in which it had a 51% interest, with the remaining

49% owned by a fund managed by BNP Paribas REIM, as well as

ancillary lots belonging to the Company, for a total net sales

price of Euro 117.5 million. These hypermarkets were operated by

Auchan.

Thus, at end-June 2024, proforma for the sale of business

operations to Auchan in Corsica and the disposal of the four

hypermarkets, Mercialys’ rental exposure9 shows a weighting of

15.9% for large food stores, representing a foundation of

revenues indexed against a recurrent consumption segment making

a positive contribution to the Company’s risk profile. This risk

profile also benefits from limited exposure of around 5% of

economic rental income to the individual retailers making the

biggest contributions, i.e. Intermarché and Auchan. This breakdown

could see minor changes depending on the decisions taken by the

competition authorities.

Retailer – mass food retail

Ranking – main retailers in

France 8

Dec 31, 2023 % of rental

revenues (economic vision)

Jun 30, 2024 % of rental

revenues (economic vision)

Jun 30, 2024 % of rental

revenues (economic vision - proforma)

Intermarché

2nd

0.7%

5.4%

5.6%

Auchan

8th

0.0%

4.3%

5.1%

Carrefour Hypermarchés

4th

0.0%

2.1%

2.1%

Monoprix

14th

1.5%

1.6%

1.6%

Casino Hypermarchés

34th

15.3%

4.7%

1.2%

Aldi

11th

0.2%

0.2%

0.2%

Lidl

6th

0.1%

0.1%

0.1%

TOTAL

17.8%

18.4%

15.9%

These new food anchors will consolidate the overall strong

positioning of Mercialys’ sites in their catchment areas and could

generate interest from non-food retailers looking for new

locations. Through the footfall generated, they will also help

improve the outlook for Mercialys’ Casual Leasing business. Lastly,

the Company will hold discussions with the operators to explore the

possibility of reducing the size of their hypermarkets to further

strengthen the sites by creating mid-size stores and achieving

rental reversion.

III. Operational performance reflecting a

solid retail sector in France

For the year to end-June 2024, footfall10 at Mercialys shopping

centers is up +2.0%, outperforming the Quantaflow national index

(+1.3%) by +70bp.

This excellent trend is particularly satisfactory considering

the number of disruptive factors that affected footfall during the

first half of 2024: the attrition affecting supplies for the

hypermarkets operated by Casino prior to the transfer of business

operations, the organization of liquidation sales, and the

subsequent closure of these hypermarkets for two to three

weeks.

The opening of these stores under their new banners, primarily

in May and June 2024, was recognized with strong footfall levels,

driven specifically by the proactive price reduction policies

applied by the three retailers, as well as their more attractive

and well-stocked supplies.

The following table illustrates, through a few examples, the new

dynamics for hypermarkets:

Sites

New food retailer

Change in hypermarket footfall

between their reopening date and June 30, 2024

Fréjus

Auchan

+31.5%

Istres

Auchan

+38.4%

Lanester

Carrefour

+13.9%

Narbonne

Auchan

+35.2%

Quimper

Intermarché

+36.4%

Annecy

Auchan

+50.6%

Marseille La Valentine

Auchan

+36.1%

Saint Etienne

Auchan

+25.8%

Alongside this, for the year to end-May 2024, retailer sales in

the Company’s shopping centers saw +3.4% growth, outpacing the FACT

national index’s +1.7% increase by 170bp.

The occupancy cost ratio11 shows a very sustainable level

of 10.9% at end-June 2024, slightly higher than December 31, 2023

(10.7%), linked to the impact of indexation on rents, and identical

to the level from June 30, 2023 (10.9%).

The current financial vacancy rate12 - which excludes

strategic vacancies following decisions to facilitate the

deployment of extension and redevelopment plans - came to 3.0% for

the first half of 2024, showing an improvement compared with

end-June 2023 (3.3%) and virtually stable in relation to December

31, 2023 (2.9%).

The first half of 2024 saw a sustained level of lettings

activity, contributing to this limited vacancy rate. Against a

backdrop of sustained indexation, the reversion rate on renewals

and relettings came to -0.2%. This rate does not take into account

the reletting of a mid-size unit, previously leased to H&M, in

Marseille La Valentine to Intersport, which had an impact of -2.7%.

This operation contributes to this shopping center’s repositioning

around sport, further strengthening the selection of retailers

available in this segment, which already includes Sport 2000, the

official Olympique de Marseille football club store, Foot Locker

and Courir.

In the consumption environment described above, the beauty /

health and culture / gifts / sports sectors continue to be

particularly buoyant, once again thanks to the momentum generated

by affordable retailers in particular. Mercialys has continued to

adapt its retail mix in line with these underlying trends,

illustrated by the relettings secured during the first half of this

year. Out of the 40 transactions completed during this period,

sectors covering discretionary spending - personal items and

household equipment - accounted for 12 of the leases signed (30%),

compared with 28 for day-to-day retailers (70%). 50% of the retail

mix prior to these relettings was made up of discretionary

spending-related retailers, with a 20% reduction in the weighting

for these segments.

IV. Half-year results in line with the

Company’s steady long-term growth trajectory

Invoiced rents climbed to Euro 91.4 million, up +4.0% on

a current basis. Organic growth 13 in rental income came to

+4.1% for the first half of 2024, benefiting from a still

sustained indexation effect of +4.4% and the contribution by

variable rents for +0.2%.

Year to end-June 2023

Year to end-June 2024

Indexation

+3.8 pp

+€3.2m

+4.4 pp

+€3.9m

Contribution by Casual Leasing

-0.2 pp

-€0.2m

-0.2 pp

-€0.1m

Contribution by variable rents

+1.7 pp

+€1.4m

+0.2 pp

+€0.2m

Actions carried out on the portfolio

-1.5 pp

-€1.3m

-0.5 pp

-€0.4m

Accounting impact of “Covid-19 rent

relief” granted to retailers

+0.5 pp

+€0.4m

+0.1 pp

+€0.1m

Like-for-like growth

+4.2 pp

+€3.6m

+4.1 pp

+€3.6m

Asset acquisition and sales

-2.0 pp

-€1.7m

0.0 pp

€0.0m

Other effects

-0.1 pp

-€0.1m

-0.1 pp

-€0.1m

Growth on a current basis

+2.1 pp

+€1.8m

+4.0 pp

+€3.5m

Rental revenues came to Euro 91.6 million, up +3.9% from

the first half of 2023, reflecting the changes in invoiced rents

and the contraction in lease rights and despecialization

indemnities.

Net rental income is up +5.9% to Euro 87.4 million,

reflecting the growth in rental revenues and the good control over

the ratio of non-recovered service charges.

EBITDA came to Euro 76.1 million, up +5.2% from June 30,

2023. The EBITDA margin represents 83.1% (vs. 82.0% at June 30,

2023 and 83.9% at December 31, 2023).

The net financial expenses used to calculate net

recurrent earnings14 totaled Euro -14.4 million at June 30, 2024,

compared with Euro -13.7 million at end-June 2023. This limited

increase takes into account the fixed/floating rate products

extinguished, while the higher cost of commercial paper is more

than offset by the proceeds from cash investments. As a result, the

real average cost of drawn debt remained under control at

2.2% for the first half of 2024, down -10bp from end-December 2023

and up +10bp over 12 months (2.1% at end-June 2023).

Other operating income and expenses (excluding capital

gains or losses on disposals and impairment) represent Euro 1.2

million of income (versus Euro 3.4 million of net income for the

first half of 2023), linked primarily to the impact of the net

reversals of provisions.

Tax represents a Euro -0.2 million expense at end-June

2024, compared with Euro -0.3 million for the first half of 2023.

This amount corresponds primarily to a CVAE corporate value-added

tax expense.

The share of net income from associates and joint

ventures (excluding capital gains or losses, amortization and

impairment) totaled Euro 1.7 million at June 30, 2024, down -3.8%

from June 30, 2023, linked in particular to the change in financing

conditions for the SCI AMR scope, offsetting the positive impact of

indexation on rental income for these companies.

Non-controlling interests (excluding capital gains or

losses, amortization and impairment) came to Euro -5.7 million at

June 30, 2024, compared with Euro -5.4 million for the first half

of 2023.

In view of these items, net recurrent earnings (NRE

14) are up +3.3% from June 30, 2023 to Euro 59.3 million,

with a +3.0% increase to Euro 0.63 per share 15.

(In thousands of euros)

Jun 30, 2023

Jun 30, 2024

Change (%)

Invoiced rents

87,910

91,385

+4.0%

Lease rights and despecialization

indemnities

254

175

-31.0%

Rental revenues

88,164

91,560

+3.9%

Non-recovered building service charges and

property taxes and other net property operating expenses

-5,599

-4,152

-25.8%

Net rental income

82,564

87,408

+5.9%

Management, administrative and other

activities income

1,412

1,526

+8.1%

Other income and expenses

-1,904

-3,380

+77.5%

Personnel expenses

-9,789

-9,496

-3.0%

EBITDA

72,284

76,059

+5.2%

EBITDA margin (% of rental revenues)

82.0%

83.1%

-

Net financial items (excluding

non-recurring items 16)

-13,698

-14,441

+5.4%

Reversals of / (Allowances for)

provisions

-658

761

na

Other operating income and expenses

(excluding capital gains or losses on

disposals and impairment)

3,396

1,152

-66.1%

Tax expense

-265

-203

-23.6%

Share of net income from associates and

joint ventures (excluding capital gains or losses on disposals,

amortization and impairment)

1,799

1,730

-3.8%

Non-controlling interests

(excluding capital gains or losses on

disposals, amortization and impairment)

-5,404

-5,737

+6.2%

Net recurrent earnings (NRE)

57,453

59,322

+3.3%

Net recurrent earnings (NRE) per

share 15 (in euros)

0.62

0.63

+3.0%

V. Slight upturn in the portfolio value and

financial structure supporting a resumption of investments

At end-June 2024, Mercialys’ portfolio mainly comprised 47

shopping centers 17, with an average size of 16,220 sq.m and

average value of Euro 61.0 million.

Mercialys’ portfolio value came to Euro 2,879.4 million

including transfer taxes, up +0.3% like-for-like over the first

half of 2024. The appraisal value excluding transfer taxes is up

+0.4% like-for-like, with the positive impact of rental income

(+2.3%) offsetting the impact of a slight increase in rates.

Current basis

Like-for-like 18

Appraisal value at Jun 30,

2024

Change over last 6 months

Change over last 12 months

Change over last 6 months

Change over last 12 months

Value excluding transfer taxes

2,700.0

+0.3%

-3.6%

+0.4%

-3.4%

Value including transfer taxes

2,879.4

+0.3%

-3.6%

+0.3%

-3.4%

The average appraisal yield rate was 6.68% at June 30,

2024, showing a limited increase of +7bp compared with end-December

2023 (6.61%) and up +47bp from June 30, 2023 (6.21%). This average

rate shows a positive yield spread of over 340bp compared with the

risk-free rate (10-year OAT) at end-June.

The EPRA net asset value indicators are as follows:

EPRA NRV

EPRA NTA

EPRA NDV

Jun 30, 2023

Dec 31, 2023

Jun 30, 2024

Jun 30, 2023

Dec 31, 2023

Jun 30, 2024

Jun 30, 2023

Dec 31, 2023

Jun 30, 2024

€/share

19.03

18.25

17.80

16.99

16.29

15.85

18.80

17.10

16.53

Change over 6 months

-7.4%

-4.1%

-2.5%

-7.8%

-4.1%

-2.7%

-10.2%

-9.1%

-3.3%

Change over 12 months

-6.5%

-11.2%

-6.5%

-6.9%

-11.6%

-6.7%

-4.3%

-18.4%

-12.0%

EPRA NDV (Net Disposal Value) down -3.3% over six months to

Euro 16.53.

The Euro -0.57 per share change for the first half of this year

takes into account the following impacts:

- Dividend payment: Euro -0.99; - Net

recurrent earnings: Euro +0.63; - Change in unrealized capital

gains19: Euro -0.04, including a yield effect for Euro -0.57, a

rent effect for Euro +0.67 and other effects20 for Euro -0.14; -

Change in fair value of fixed-rate debt: Euro -0.13; - Change in

fair value of derivatives and other items: Euro -0.04.

Alongside this, Mercialys continues to benefit from a very solid

financial structure, with an LTV ratio excluding transfer

taxes21 of 40.0% at June 30, 2024 (compared with 38.9% at

December 31, 2023 and 38.6% at June 30, 2023) and an LTV ratio

including transfer taxes of 37.4% (versus 36.4% at December 31,

2023 and 36.1% at June 30, 2023). Proforma for the sale of the

hypermarkets as presented above, the LTV excluding transfer taxes

would come to 39.4%, while the ratio including transfer taxes would

come to 36.9%.

The ICR was 5.5x 22 at June 30, 2024, compared with 5.1x

at December 31, 2023 and 5.2x at June 30, 2023.

No drawn financing lines are due to mature before February 2026,

with the exception of Euro 42 million of commercial paper (out of a

total program with Euro 500 million to potentially be used).

Mercialys also has Euro 385 million of undrawn financial

resources, enabling it to benefit from a very satisfactory

level of liquidity. The maturity of 57% of these lines was extended

during the first half of 2024. Over the coming months, and subject

to market conditions, Mercialys aims to finalize the early

refinancing of the bond maturity due in July 2027, either through

the exercise of its make-whole call option or by other means, which

would require the issuance of new financing.

The Company is capitalizing on this very healthy

financial structure to invest, either through its development

pipeline (as detailed below), or through targeted asset

acquisitions. A highly selective approach will be applied to

trigger these investments, in terms of both real estate

fundamentals (location, rental exposure, potential energy

consumption optimization) and financial fundamentals, requiring a

minimum yield of 7%.

Over the past few months, the Company’s projects have made

progress with pre-lettings. In Saint-André (Reunion Island),

the 13,000 sq.m retail park to potentially be developed on

Mercialys’ land reserve sites is 63% pre-let, with this progress

supporting the target to submit a building permit application

during the fourth quarter of 2024. Similarly, in Sainte-Marie

(Reunion Island), the pre-letting of the extension offering over

11,000 sq.m of space in the shopping center has only just begun,

but is already up to 12%, while advanced expressions of interest

have been received representing 35% of the expected rental income,

and the building permit application is also scheduled to be

submitted by the first quarter of 2025. The Valence 2 center

redevelopment project is 47% pre-let, with the application for

administrative approvals expected to be submitted during the fourth

quarter of 2024. Lastly, the project to redevelop the older section

of the Toulouse shopping center has also been launched and the

requests for administrative approvals are expected to be submitted

during the fourth quarter of 2024.

(In millions of euros)

Total investment

Investment still to be

committed

Completion date

COMMITTED PROJECTS23

18.9

18.3

2024/2027

Tertiary activities

18.4

17.9

2024/2027

Dining and leisure

0.5

0.4

2024

CONTROLLED PROJECTS

186.2

176.7

2025/2028

Retail

160.6

151.5

2025/2028

Dining and leisure

14.3

14.2

2025/2026

Tertiary activities

11.3

11.1

2025/2026

IDENTIFIED PROJECTS

227.0

226.6

2025/>2028

Retail

152.5

152.1

2025/>2028

Dining and leisure

54.4

54.4

>2028

Tertiary activities

20.1

20.1

2026/>2028

Total

432.0

421.6

2024/>2028

- Committed projects: projects fully secured

in terms of land management, planning and related development

permits - Controlled projects: projects effectively under control

in terms of land management, with various points to be finalized

for regulatory urban planning (constructability), planning or

administrative permits - Identified projects: projects currently

being structured, in emergence phase

VI. 2024 objectives confirmed

Mercialys’ first-half performance levels enable it to confirm

its objectives for 2024:

- Growth in net recurrent earnings (NRE) per share to reach at

least +2.0% vs. 2023;

- Dividend to range from 75% to 95% of 2024 NRE.

* * *

This press release is available on

www.mercialys.com. A presentation of these results is also

available online, in the following section: Investors / News and

Press Releases / Presentations and Investor Days

About Mercialys Mercialys is one of France’s leading real

estate companies. It is specialized in the holding, management and

transformation of retail spaces, anticipating consumer trends, on

its own behalf and for third parties. At June 30, 2024, Mercialys

had a real estate portfolio valued at Euro 2.9 billion (including

transfer taxes). Its portfolio of 1,955 leases represents an

annualized rental base of Euro 178.3 million. Mercialys has been

listed on the stock market since October 12, 2005 (ticker: MERY)

and has “SIIC” real estate investment trust (REIT) tax status. Part

of the SBF 120 and Euronext Paris Compartment B, it had 93,886,501

shares outstanding at June 30, 2024.

IMPORTANT INFORMATION This press release contains certain

forward-looking statements regarding future events, trends,

projects or targets. These forward-looking statements are subject

to identified and unidentified risks and uncertainties that could

cause actual results to differ materially from the results

anticipated in the forward-looking statements. Please refer to

Mercialys’ Universal Registration Document available at

www.mercialys.com for the year ended December 31, 2023 for more

details regarding certain factors, risks and uncertainties that

could affect Mercialys’ business. Mercialys makes no undertaking in

any form to publish updates or adjustments to these forward-looking

statements, nor to report new information, new future events or any

other circumstances that might cause these statements to be

revised.

APPENDIX TO THE PRESS RELEASE FINANCIAL

STATEMENTS

Consolidated income statement

(In thousands of euros)

Jun 30, 2024

Jun 30, 2023

Rental revenues

91,560

88,164

Service charges and property tax

-32,391

-33,471

Charges and taxes billed to tenants

28,069

28,418

Net property operating expenses

171

-546

Net rental income

87,408

82,564

Management, administrative and other

activities income

1,526

1,412

Other income

0

0

Other expenses

-3,380

-1,904

Personnel expenses

-9,496

-9,789

Depreciation and amortization

-19,097

-18,926

Reversals of / (Allowances for)

provisions

761

-658

Other operating income

10,635

5,399

Other operating expenses

-9,289

-20,219

Operating income

59,069

37,879

Income from cash and cash equivalents

2,210

1,296

Gross finance costs

-19,800

-17,846

(Expenses) / Income from net financial

debt

-17,590

-16,550

Other financial income

755

382

Other financial expenses

-1,812

-4,252

Net financial items

-18,647

-20,420

Tax expense

-400

-196

Share of net income from associates and

joint ventures

1,466

1,040

Consolidated net income

41,488

18,304

Attributable to non-controlling

interests

5,236

-12,137

Attributable to owners of the parent

36,251

30,441

Earnings per share 24

Net income attributable to owners of the

parent (€)

0.39

0.33

Diluted net income attributable to owners

of the parent (in euros)

0.39

0.33

Consolidated statement of financial position

ASSETS (in thousands of euros)

Jun 30, 2024

Dec 31, 2023

Intangible assets

3,220

3,144

Property, plant and equipment other than

investment property

7,192

5,825

Investment property

1,734,533

1,864,950

Right-of-use assets

10,573

10,615

Investments in associates

39,385

39,557

Other non-current assets

36,560

37,577

Deferred tax assets

1,444

1,614

Non-current assets

1,832,907

1,963,282

Trade receivables

36,757

35,936

Other current assets

30,538

31,902

Cash and cash equivalents

88,202

118,155

Investment property held for sale

121,889

1,400

Current assets

277,386

187,393

Total assets

2,110,293

2,150,676

EQUITY AND LIABILITIES (in thousands of

euros)

Jun 30, 2024

Dec 31, 2023

Share capital

93,887

93,887

Additional paid-in capital, treasury

shares and other reserves

529,704

583,337

Equity attributable to owners of the

parent

623,591

677,224

Non-controlling interests

187,908

188,871

Shareholders’ equity

811,499

866,095

Non-current provisions

1,340

1,406

Non-current financial liabilities

1,136,925

1,131,627

Deposits and guarantees

31,601

24,935

Non-current lease liabilities

9,465

9,529

Other non-current liabilities

2,725

4,834

Non-current liabilities

1,182,056

1,172,332

Trade payables

18,133

9,265

Current financial liabilities

49,924

53,037

Current lease liabilities

1,438

1,331

Current provisions

13,257

15,581

Other current liabilities

33,981

32,940

Current tax liabilities

5

95

Current liabilities

116,737

112,249

Total equity and liabilities

2,110,293

2,150,676

1 Proforma for the sale of four hypermarkets in July 2024 2

Like-for-like change 3 INSEE in La Ville au miroir des microcosmes

(R. Oudghiri) 4 Opinionway survey for Bonial (June 2024) 5 Annual

study of France’s favorite retailers – EY Parthenon 2024 6 Kantar

Insight 7 Elabe survey published on June 26, 2024 8 Top 100 LSA

list of leading retail brands in France in 2023 9 Consolidated

rental income adjusted (i) downwards for the 49% minority interest

held by BNP Paribas REIM in SAS Hyperthetis Participations and SAS

Immosiris, which together own a total of six hypermarkets following

the sale completed in July 2024, and (ii) upwards for Mercialys’

25% minority interest in SCI AMR, which owns three Monoprix stores

and two hypermarkets 10 Mercialys’ large centers and main

convenience shopping centers based on a constant surface area,

representing around 80% of the value of the Company’s shopping

centers 11 Ratio between rent, charges (included marketing funds)

and invoiced work (including tax) paid by retailers and their sales

revenue (including tax), excluding large food stores 12 The

occupancy rate, as with Mercialys’ vacancy rate, does not include

agreements relating to the Casual Leasing business. 13 Assets enter

the like-for-like scope used to calculate organic growth after

being held for 12 months 14 NRE: Net recurrent earnings = Net

income attributable to owners of the parent before amortization,

gains or losses on disposals net of associated fees, any asset

impairment and other non-recurring effects 15 Calculated based on

the average undiluted number of shares (basic), i.e. 93,483,692

shares 16 Impact of hedging ineffectiveness, banking default risk,

premiums, non-recurring amortization and costs relating to bond

redemptions, proceeds and costs from unwinding hedging operations

17 Added to these are two geographically dispersed assets with a

total appraisal value including transfer taxes of Euro 12.9

million. 18 Sites on a constant scope and a constant surface area

basis 19 Difference between the net book value of assets on the

balance sheet and their appraisal value excluding transfer taxes 20

Including impact of revaluation of assets outside of organic scope,

equity associates, maintenance capex and capital gains or losses on

asset disposals 21 LTV (Loan To Value): Net financial debt /

(market value of the portfolio excluding transfer taxes + market

value of investments in associates for Euro 44.3 million at June

30, 2024, Euro 45.1 million at December 31, 2023 and Euro 48.3

million at June 30, 2023, since the value of the portfolio held by

associates is not included in the appraisal value) 22 ICR (Interest

Coverage Ratio): EBITDA / net finance costs 23 investments to be

committed for the pipeline primarily correspond to the Saint-Denis

mixed-use project, north of Paris, as well as coworking spaces 24

Based on the weighted average number of shares over the period

adjusted for treasury shares: - Undiluted weighted average number

of shares for the first half of 2024 = 93,483,692 shares - Fully

diluted weighted average number of shares for the first half of

2024 = 93,483,692 shares

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724121586/en/

Analysts / investors / media: Olivier Pouteau Tel: +33

(0)6 30 13 27 31 Email: opouteau@mercialys.com

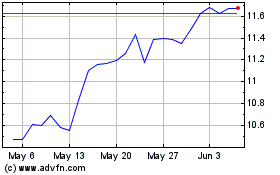

Mercialys (EU:MERY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mercialys (EU:MERY)

Historical Stock Chart

From Nov 2023 to Nov 2024