- Investment fully subscribed by Heights Capital Management

and Ophir Asset Management, creating for the first time in the

company’s history a group of cornerstone shareholders

- Investment combining a reserved capital increase of €15m and

a reserved issuance of convertible bonds of €50 million priced at a

c. 86% conversion premium

- Proceeds to be allocated to the acquisition of Avanquest’s

minority interests, to strengthen the Group’s capital

structure

- Binding agreement with minority shareholders providing a c.

€153 million equity valuation for the Avanquest division excluding

its fintech activities, or c. €98 million for all minority

interests, to be paid through a mix of cash and newly issued

Claranova shares

Regulatory News:

Claranova (Paris:CLA) (Euronext Paris: FR0013426004 – CLA) (the

“Company” or the “Group”), today announces an agreement with

institutional investors Heights Capital Management (“Heights”) and

Ophir Asset Management (“Ophir” and together with Heights, the

“Investors”), for a strategic investment of €65 million (the

“Investment”) to fund the acquisition of Avanquest’s minority

interests (the “Acquisition”).

The Investment hails a new major milestone in Claranova’s

development. Besides giving Claranova new substantial financial

resources to simplify its capital structure through the

Acquisition, it creates for the first time in the company’s history

a group of cornerstone shareholders to stabilize its shareholder

structure and support the Group’s long-term development. Through

this transaction, the Investors also demonstrate their confidence

in the Group’s fundamentals, strategy and potential.

The Investment will be carried out in the form of a reserved

capital increase of €15 million (the “Capital Increase”) and a

reserved issuance of €50 million of senior, unsecured bonds

convertible into new shares and/or exchangeable for existing shares

(obligations convertibles échangeables en actions nouvelles ou

existantes - OCEANE) (the “Convertible Bonds”).

The Capital Increase will be subscribed by Ophir for €10 million

and by Heights for €5 million. It will consist in the issuance of

2,142,857 new shares at €7.00 per share, representing 5.39% of the

Group’s current share capital (the "New Shares"). The Convertible

Bonds will be fully subscribed by Heights and will be issued at a

c. 86% conversion premium.

At this stage, the Investment does not change the guidance

previously announced for annual revenue of €700 million and

operating profitability above 10%1 by the end of fiscal year

2023.

Pierre Cesarini, CEO of Claranova, declared: “This new

record funding marks a major turning point in Claranova’s

development. Beyond strengthening our investment capacity and

enabling us to simplify the group structure, this transaction

demonstrates the confidence in the Group’s future perspectives, as

recognized by leading investment firms specialized in supporting

companies with a strong growth potential. Through this investment,

Claranova is partnering with long-term investors, able to support

the Group in pursuing its ambitious development plan. With still

considerable potential in each of our activities, an enhanced

investment capacity and the long-term support of major

international investment firms, Claranova has more than ever all

the assets to ensure its change in dimension.”

Use of proceeds of the Investment: buy-out of Avanquest’s

minority interests under the Acquisition

In conjunction with the Investment, the Company has entered into

a binding agreement with Avanquest’s minority shareholders in

relation to the acquisition of their interests in Claranova’s

Software Publishing division. The agreement provides a $1802

million equity valuation for the whole division excluding Lastcard,

Avanquest’s fintech activities, which will remain a separate

activity from the rest of Avanquest and under the joint ownership

of existing Avanquest shareholders.

The consideration for the Acquisition amounts to c. $115

million3, and will be paid through (i) the issuance4 of 4,100,000

new Claranova shares issued at €7.00 representing c. 9.79% of the

share capital of the Company after the completion of the Capital

Increase (ii) the payment of c. $55 million in cash and (iii) the

issuance of several promissory notes of c. $27 million of aggregate

principal amount with maturities ranging from 12 months to 10

years. An independent appraiser (commissaire aux apports) will be

appointed in accordance with French law to issue a report on the

value of the assets being contributed and on the fairness of the

consideration paid by Claranova.

The new Claranova shares will be subject to a 12-month lock-up

from the completion date of the Acquisition.

By holding the entire share capital of the entities comprising

the Avanquest’s division, Claranova will be able to benefit fully

from the ramp-up of its Software Publishing division and receive

the entire net income generated by their roll-out.

The implementation of the Acquisition is expected to be

finalized on or prior to September 30, 2021. Claranova will inform

the market of the Acquisition implementation progress.

Key Characteristics of the Investment

- Main Terms of the Capital Increase

The 2,142,857 New Shares will be issued for €15 million in

total, representing 5.39% of the number of shares outstanding prior

to the Investment as of June 30, 2021. The subscription price of

the New Shares was set at €7.00, corresponding to the closing price

(no discount) of August 10th, 2021. The Capital Increase will be

subscribed by Ophir for €10 million and Heights for €5 million,

which will hold respectively 3.41% and 1.71% of the share capital,

and 3.29% and 1.65% of the voting rights post-Investment and prior

to the execution of the Acquisition (on a non-diluted basis).

The New Shares will be issued through a capital increase without

shareholders’ preferential subscription right pursuant to the 16th

resolution of the Extraordinary General Shareholders’ Meeting of 17

December 2020 granting a delegation to the Board of Directors of

the Company to implement a capital increase reserved to a category

of beneficiaries in accordance with article L.225-138 of the French

Commercial Code.

The New Shares will carry dividend rights, and will give right,

from their issuance, to all distributions decided by the Company as

of that date, will be admitted to trading on Euronext under the

same ISIN code FR0013426004 – CLA on or about August 13, 2021, and

will be fully fungible with the Company’s existing shares.

- Main Terms of the Convertible Bonds

The Convertible Bonds will be issued for €50 million in total

and will bear interest at 4.5% per annum, payable in cash

semi-annually in arrears on January 30th and July 30th each year,

commencing on January 30th, 2022.

The par value of the Convertible Bonds will be set at €13.00,

corresponding to a conversion premium of 85.7% to the closing price

of August 10, 2021. The Convertible Bonds will be fully subscribed

by Heights. 3,846,154 Convertible Bonds will be issued,

corresponding to up to 3,846,154 new shares which may be issued

upon conversion/exchange of the Convertible Bonds, representing

9.68% of the number of shares outstanding prior to the Investment

as of June 30, 2021.

The Convertible Bonds will be issued at par and will be

redeemable at par on the fifth (5th) anniversary date of the

issuance date (the “Maturity Date”) unless previously converted,

exchanged, redeemed or purchased and cancelled.

The Convertible Bonds holder will be granted a

conversion/exchange right of the Convertible Bonds into new and/or

existing shares of the Company (the “Conversion/Exchange Right”)

which they may exercise at any time after the second (2nd)

anniversary date of the issuance date (inclusive) up to the seventh

(7th) business day (inclusive) preceding the Maturity Date or the

relevant early redemption date, as the case may be. The initial

conversion/exchange ratio is set at one share per Convertible Bond,

subject to standard adjustments, including anti-dilution and

dividend protections, as detailed in the terms and conditions of

the Convertible Bonds. Upon exercise of their Conversion/Exchange

Right, the Convertible Bonds holder will receive at the option of

the Company new and/or existing Company’s shares carrying all

rights attached to the existing shares as from the date of

delivery.

The Convertible Bonds holder will also be granted an option to

require the Company to redeem all, but not less, of its Convertible

Bonds at any time after the third (3rd) anniversary date of the

issuance date (inclusive) up to the seventh (7th) business day

(inclusive) preceding the Maturity Date for a total redemption

amount generating a maximum overall investment return of 2.00x for

the Convertible Bonds holder (the "Maximum Return"), such

redemption amount being in any event capped in order for the

Company to remain within the limits of a financial debt to EBITDA

ratio of 3.5x.

Upon a change of control of the Company, certain significant

evolutions of the free-float shareholding or a delisting of the

shares of the Company (each, a "Liquidity Event"), the Convertible

Bonds holder will have the option to require the Company to redeem

all, but not less, of its Convertible Bonds for a total redemption

amount corresponding to the Maximum Return.

The Company may force the conversion of the Convertible Bonds

from the third (3rd) anniversary date of the issuance date until

Maturity Date, for all Convertible Bonds outstanding, provided that

for 30 consecutive trading days, the closing price of the shares

multiplied by the conversion ratio in effect at each date exceeds

€27.00.

The Company may also require the early redemption of the

Convertible Bonds at a redemption amount equal to the maximum of

(i) the principal amount plus any accrued and unpaid interests as

of the early redemption date and (ii) 1.75x, 2.00x or 2.25x the

initial principal amount for any early redemption effected,

respectively, prior to the second anniversary date of the issuance

date, between the second and the third anniversary date of the

issuance date, or after the third anniversary date of the issuance

date.

The issue of the Convertible Bonds will be carried out without

preferential subscription rights or shareholders’ subscription

priority periods pursuant to the 16th resolution of the

Extraordinary General Shareholders’ Meeting of 17 December 2020

granting a delegation to the Board of Directors of the Company to

implement a capital increase reserved to a category of persons in

accordance with article L.225-138 of the French Commercial

Code.

The Convertible Bonds will not be subject of an application for

admission to trading on any market and will not be listed.

The new shares resulting from the Convertible Bonds will carry

current dividend rights, give right, from their issuance, to all

distributions decided by the Company as of that date and will be

admitted to trading on Euronext under the same ISIN code

FR0013426004 – CLA.

The Company has agreed to a lock-up undertaking on the issuance

or sale of shares or of securities giving access to the share

capital, for a period of 90 calendar days from the

delivery-settlement of the Capital Increase, subject to certain

customary exceptions.

Impact of the Investment and the Acquisition on the share

capital5

Following settlement and delivery, the New Shares resulting from

the Capital Increase will represent 5.1% of the share capital of

the Company and the Company’s total share capital will be EUR

41,871,511 divided into 41,871,511 shares. For illustration

purposes, a shareholder holding 1.00% of the Company's share

capital prior to the Capital Increase, will hold 0.95% of the

Company’s share capital upon completion of the Capital Increase (or

0.94% on a fully diluted basis).

(%) Ownership interest(1)

On a non-diluted basis

On a fully diluted

basis

Before the Capital Increase, the

conversion of the Convertible Bonds and the issuance of the New

Shares under the Acquisition

1.00%

0.99%

After the Capital Increase only

0.95%

0.94%

After conversion of the Convertible Bonds

only

0.91%

0.90%

After issuance of the new shares under the

Acquisition only

0.91%

0.90%

After the Capital Increase, the conversion

of the Convertible Bonds and the issuance of the new shares under

the Acquisition

0.80%

0.79%

(1) Assuming the issuance of 2,142,857 New Shares under the

Capital Increase and of 3,846,154 new shares upon conversion of the

Convertible Bonds (based on the initial conversion/exchange

ratio)

Evolution of the shareholding structure following the

Investment and the Acquisition

The shareholding structure of the Company prior to the Capital

Increase, the issuance of the Convertible Bonds and the Acquisition

is set forth below.

Shareholders

Number of shares on a

non-diluted basis1

% of capital on a non diluted

basis

% of voting rights on a

non-diluted | basis

% of capital on a

fully-diluted basis

% of voting rights on a

fully-diluted basis

Executives, managers and directors

2,636,773

6.6%

8.7%

7.6%

9.6%

Free Float2

36,849,756

92.8%

91.3%

91.8%

90.4%

Treasury shares

242,125

0.6%

0.00%

0.6%

0.0%

Total

39,728,654

100.0%

100.0%

100.0%

100.0%

Following the Capital Increase, the issuance of the Convertible

Bonds and the Acquisition, the share capital and voting rights of

the Company will be as follows:

Shareholders

Number of shares on a

non-diluted basis

% of capital on a non diluted

basis

% of voting rights on a

non-diluted basis

% of capital on a

fully-diluted basis

% of voting rights on a

fully-diluted basis

Executives, managers and directors

2,636,773

5.7%

7.6%

6.1%

7.8%

New Institutional funds

2,142,857

4.6%

4.5%

11.9%8

11.6%8

Avanquest minority shareholders

4,100,000

8.9%

8.6%

8.2%

7.9%

Free Float

36,849,756

80.1%

79.3%

73.3%

72.7%

Treasury shares

242,125

0.5%

0.00%

0.5%

0.0%

Total

45,971,511

100.0%

100.0%

100.0%

100.0%

Information available to the public and risk factors

- Risk factors relating to the Investment

The main risk factors in relation to the Investment are the

following:

The Company could face cash-flow difficulties which would

prevent it from facing its payment obligations under the terms and

conditions of the Convertible Bonds.

The Company shareholders participation would incur a dilution in

case of exercise of the bondholder's conversion right, should the

Company decide to issue new Company shares in this context.

The Convertible Bonds conversion, as the case may be, may have

an adverse impact on the Company shares stock price and their

volatility and liquidity could also be affected.

Detailed information regarding the Company, including its

business, financial information, results, prospects and related

risk factors are contained in the Company’s 2019-2020 Universal

Registration Document filed with the French Autorité des marchés

financiers (“AMF”) on October 21, 2020 under number D. 20-0890.

This document, as well as other regulated information and all of

the Company’s press releases, are available on the website of the

Company (www.claranova.com).

Your attention is drawn to the risk factors related to the

Company and its activities presented in chapter 4 of its 2019-2020

Universal Registration Document. The 2019-2020 Universal

Registration Document is available on the websites of the Company

(www.claranova.com) and the AMF (www.amf-france.org).

The Investment will not give rise to the filing of a prospectus

with the Autorités des Marchés Financiers.

This press release does not constitute a prospectus under the

Prospectus Regulation (as defined below) or an offer of securities

to the public.

Indicative timetable and Legal Information regarding the

Investment

- August 11, 2021 – Publication of the press release announcing

the Investment

- August 13, 2021 – Settlement and delivery of the Capital

Increase

Advisors

Bryan, Garnier & Co. is acting as Sole Financial Advisor to

Claranova and Sole Global Coordinator in connection with the

Investment. Hogan Lovells LLP is acting as Legal Advisor to

Claranova in connection with the Investment. Jeantet is acting as

Legal Advisor to Heights Capital Management in connection with the

Investment. Baker McKenzie is acting as Legal Advisor to Claranova

in connection with the Acquisition.

About Claranova

Claranova is a global technology company, home of digital brands

and services acclaimed by millions of users across the world. With

average annual growth of more than 40% over the last three years

and revenue of 472 million euros in FY2020-2021, Claranova has

proven its capacity to turn a simple idea into a worldwide success

in just a few short years. Present in 15 countries and leveraging

the technology expertise of its 700+ employees across North America

and Europe, Claranova is a truly international company, with 95% of

its revenue derived from international markets.

As a leader in personalized e-commerce, Claranova also stands

out for its technological expertise in software publishing and the

Internet of Things, through its businesses PlanetArt, Avanquest and

myDevices. These three technology platforms share a common vision:

empowering people through innovation by providing simple and

intuitive digital solutions that facilitate everyday access to the

very best of technology.

For more information on Claranova group:

https://www.claranova.com or

https://twitter.com/claranova_group

Forward Looking Statements

This press release may contain certain forward-looking

statements. Although the Company believes its expectations are

based on reasonable assumptions, all statements other than

statements of historical fact included in this press release about

future events are subject to, without limitation, (i) change

without notice, (ii) factors beyond the Company’s control, (iii)

clinical trial results, (iv) regulatory requirements, (v) increased

manufacturing costs, (vi) market access, (vii) competition and

(viii) potential claims on its products or intellectual property.

These statements may include, without limitation, any statements

preceded by, followed by or including words such as “target,”

“believe,” “expect,” “aim,” “intend,” “may,” “anticipate,”

“estimate,” “plan,” “objective,” “project,” “will,” “can have,”

“likely,” “should,” “would,” “could” and other words and terms of

similar meaning or the negative thereof. Forward-looking statements

are subject to inherent risks and uncertainties beyond the

Company’s control that could cause the Company’s actual results,

performance or achievements to be materially different from the

expected results, performance or achievements expressed or implied

by such forward-looking statements. A description of these risks,

contingencies and uncertainties can be found in the documents filed

by the Company with the AMF, including the 2019-2020 Universal

Registration Document, as well as in the documents that may be

published in the future by the Company. Furthermore, these

forward-looking statements, forecasts and estimates are made only

as of the date of this press release. Readers are cautioned not to

place undue reliance on these forward-looking statements. The

Company disclaims any obligation to update any forward-looking

statements, forecasts or estimates to reflect any subsequent

changes that the Company becomes aware of, except as required by

law.

This press release has been prepared in French and English. In

the event of any differences between the texts, the French language

version shall supersede.

Disclaimer

This press release may not be released, published or

distributed, directly or indirectly, in or into the United States

of America, Australia, Canada or Japan. This press release and the

information contained herein do not constitute either an offer to

sell or purchase, or the solicitation of an offer to sell or

purchase, securities of Claranova (the “Company”).

No communication or information in respect of the offering by

the Company of any securities mentioned in this press release may

be distributed to the public in any jurisdiction where registration

or approval is required. No steps have been taken or will be taken

in any jurisdiction where such steps would be required. The

offering or subscription of the Company’s securities may be subject

to specific legal or regulatory restrictions in certain

jurisdictions. None of the Company and Bryan, Garnier & Co (the

“Sole Global Coordinator”) takes any responsibility for any

violation of any such restrictions by any person.

This press release does not, and shall not, in any

circumstances, constitute a public offering, a sale offer nor an

invitation to the public in connection with any offer. The

distribution of this document may be restricted by law in certain

jurisdictions. Persons into whose possession this document comes

are required to inform themselves about and to observe any such

restrictions.

This announcement is an advertisement and not a prospectus

within the meaning of the Regulation (EU) 2017/1129, as amended

(the “Prospectus Regulation”).

With respect to the Member States of the European Economic Area

(including France) (the “Member States”), no action has been or

will be undertaken to make an offer to the public of the securities

referred to herein requiring a publication of a prospectus in any

Member State. As a result, the securities of the Company may not

and will not be offered in any Member State except in accordance

with the exemptions set forth in Article 1(4) of the Prospectus

Regulation, or under any other circumstances which do not require

the publication by the Company of a prospectus pursuant to Article

1 of the Prospectus Regulation and/or to applicable regulations of

that relevant Member State.

For the purposes of the provision above, the expression “offer

to the public” in relation to any shares of the Company in any

Member State means the communication in any form and by any means

of sufficient information on the terms of the offer and any

securities to be offered so as to enable an investor to decide to

purchase any securities, as the same may be varied in that Member

State.

This document does not constitute an offer to the public in

France and the securities referred to in this press release can

only be offered or sold in France pursuant to Article L. 411-2, 1°

of the French Monetary and Financial Code (Code monétaire et

financier) to qualified investors (investisseurs qualifiés) acting

for their own account, as defined in Article 2 point (e) of the

Prospectus Regulation. In addition, in accordance with the

authorization granted by the general meeting of the Company’s

shareholders dated 17 December 2020, only the persons pertaining to

the categories specified in the 16th resolution of such general

meeting may subscribe to the offering of New Shares.

This document may not be distributed, directly or indirectly, in

or into the United States. This document does not constitute an

offer of securities for sale nor the solicitation of an offer to

purchase securities in the United States or any other jurisdiction

where such offer may be restricted. Securities may not be offered

or sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended (the “Securities Act”). The

securities of the Company have not been and will not be registered

under the Securities Act, and the Company does not intend to make a

public offering of its securities in the United States.

The distribution of this document (which term shall include any

form of communication) is restricted pursuant to Section 21

(Restrictions on "financial promotion") of Financial Services and

Markets Act 2000 (“FSMA”). This document is only being distributed

to and directed at qualified investors as defined in Article 2

point (e) of the Prospectus Regulation as it forms part of the

domestic law by virtue of the European Union (Withdrawal) Act 2018

who (i) are outside the United Kingdom, (ii) have professional

experience in matters relating to investments and who fall within

the definition of investment professionals in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended) (the “Financial Promotion Order”), (iii) are

persons falling within Article 49(2)(a) to (d) (high net worth

companies, unincorporated associations, etc.) of the Financial

Promotion Order or (iv) are persons to whom this communication may

otherwise lawfully be communicated (all such persons referred to in

(i), (ii), (iii) and (iv) above together being referred to as

“Relevant Persons”). This document must not be acted on or relied

on in the United Kingdom by persons who are not Relevant Persons.

Any investment or investment activity to which this document

relates is available only to Relevant Persons, and will be engaged

in only with such persons in the United Kingdom.

The securities referred to in this press release may not and

will not be offered, sold or purchased in Australia, Canada or

Japan. The information contained in this press release does not

constitute an offer of securities for sale in Australia, Canada or

Japan.

Prohibition of sales to European Economic

Area retail investors

No action has been undertaken or will be undertaken to make

available any securities to any retail investor in the European

Economic Area. For the purposes of this provision:

a) the expression "retail investor" means a person who is one

(or more) of the following:

i. a retail client as defined in point

(11) of Article 4(1) of Directive 2014/65/EU (as amended, "MiFID

II"); or ii. a customer within the meaning of Directive (EU)

2016/97, as amended, where that customer would not qualify as a

professional client as defined in point (10) of Article 4(1) of

MiFID II; or iii. not a “qualified investor” as defined in the

Prospectus Regulation; and

b) the expression “offer" includes the communication in any form

and by any means of sufficient information on the terms of the

offer and the securities to be offered so as to enable an investor

to decide to purchase or subscribe the securities.

Consequently, no key information document required by Regulation

(EU) No 1286/2014 (as amended, the "PRIIPs Regulation") for

offering or selling the securities or otherwise making them

available to retail investors in the European Economic Area has

been prepared and therefore offering or selling the securities or

otherwise making them available to any retail investor in the

European Economic Area may be unlawful under the PRIIPS

Regulation.

Prohibition of sales to UK retail

Investors

No action has been undertaken or will be undertaken to make

available any securities to any retail investor in the United

Kingdom (“UK”). For the purposes of this provision:

a) the expression “retail investor” means a person who is one

(or more) of the following:

i. a retail client, as defined in point (8)

of Article 2 of Regulation (EU) No 2017/565 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

(“EUWA”); or ii. a customer within the meaning of the provisions of

the FSMA and any rules or regulations made under the FSMA to

implement Directive (EU) 2016/97, where that customer would not

qualify as a professional client, as defined in point (8) of

Article 2(1) of Regulation (EU) No 600/2014 as it forms part of

domestic law by virtue of the EUWA; or iii. not a qualified

investor as defined in Article 2 of Regulation (EU) 2017/1129 as it

forms part of domestic law by virtue of the EUWA; and

b) the expression an “offer” includes the communication in any

form and by any means of sufficient information on the terms of the

offer and the securities to be offered so as to enable an investor

to decide to purchase or subscribe for the securities.

Consequently, no key information document required by Regulation

(EU) No 1286/2014 as it forms part of domestic law by virtue of the

EUWA (the “UK PRIIPs Regulation”) for offering or selling the

securities or otherwise making them available to retail investors

in the UK has been prepared and therefore offering or selling the

securities or otherwise making them available to any retail

investor in the UK may be unlawful under the UK PRIIPs

Regulation.

1 In terms of EBITDA margin. 2 Circa €153 million, converted at

a EUR/USD rate of 1.1722 as of August 10, 2021. 3 Circa €98 million

on the basis of the above conversion rate. 4 These 4,100,000 new

shares will be issued in accordance with the 18th resolution of the

Extraordinary General Shareholders’ Meeting of 17 December 2020,

pursuant to which the Shareholders have granted to the Company

board of directors the authority to increase the company's share

capital in consideration for asset contributions. 5 The dilution

impacts presented in this section do not take into account the June

2018 ORNANE bond issue, the redemption modalities of which have not

been decided yet by the Company. These 26,363,636 ORNANE bonds

(among which 455,000 are held by the Company) mature on July 1st,

2023. As of June 30, 2021, no ORNANE bond has been converted. 6 As

at June 30, 2021. 7 Including some institutional investors with

individual holdings below 5% of the total share capital. 8 Taking

into account the conversion of €50m Convertible Bonds for a maximum

of 3,846,154 new shares.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210810006062/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74 ir@claranova.com

FINANCIAL COMMUNICATIONS +33 1 75 77 54 65

ir@claranova.com

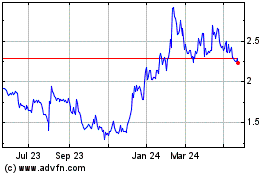

Claranova (EU:CLA)

Historical Stock Chart

From Dec 2024 to Jan 2025

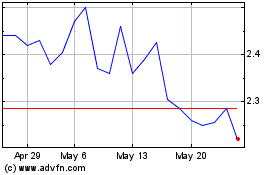

Claranova (EU:CLA)

Historical Stock Chart

From Jan 2024 to Jan 2025