Altcoins, or alternative cryptocurrencies, have become a buzzword

in the digital currency landscape, offering a world beyond Bitcoin

(BTC). This guide explores the essence of altcoins, answering the

pivotal question: What are altcoins? From the historical rise of

altcoins to the exciting phenomenon of altcoin season, we delve

into the intricacies that define this dynamic market. What Are

Altcoins? Understanding The Basics Altcoins, short for “alternative

coins,” encompass a diverse range of cryptocurrencies that have

emerged following the success of Bitcoin. They are not simply

imitations of Bitcoin but represent a broad spectrum of digital

currencies with unique attributes, purposes, and technological

innovations. Characteristics Of Altcoins Each altcoin is

distinguished by its unique blockchain technology and consensus

mechanism. For instance, Ethereum, one of the most prominent

altcoins, utilizes a Proof-of-Stake (PoS) consensus mechanism,

which is less energy-intensive compared to Bitcoin’s Proof-of-Work

(PoW) system. XRP operates on a consensus protocol known as the

Ripple Protocol Consensus Algorithm, designed for high-speed and

energy-efficient transactions. Cardano employs the Ouroboros PoS

algorithm, acclaimed for its security and scalability. These

varying consensus mechanisms reflect the diverse goals and

technological advancements of altcoins, ranging from enhancing

transaction efficiency to ensuring greater security and

sustainability. Altcoins also vary significantly in their market

capitalization, liquidity, community support, and real-world

applications. For example, Litecoin, often referred to as the

silver to Bitcoin’s gold, offers faster transaction confirmation

times, making it suitable for smaller, everyday transactions.

Meanwhile, Binance Coin (BNB) is intricately linked to the Binance

exchange ecosystem, providing utility within that specific

platform. Differences Between Altcoins And Bitcoin One of the stark

contrasts between Bitcoin and many altcoins is their development

and governance structure. Bitcoin, created by the pseudonymous

Satoshi Nakamoto, who has since left the project in December 2010,

operates in a decentralized and open-source manner without a

central authority. In contrast, many altcoins have identifiable

founding teams or organizations overseeing their development. For

example, Ethereum is backed by the Ethereum Foundation, Solana is

developed by Solana Labs, and Cardano is spearheaded by IOG (Input

Output Global). Another key difference lies in their transaction

speeds and capabilities. Bitcoin, primarily designed as a digital

store of value and medium of exchange, processes transactions

approximately every 10 minutes. In contrast, altcoins like Ripple’s

XRP have a much-shorter block time and can process transactions in

seconds, making it a preferred choice for cross-border money

transfers. Ethereum, with its smart contract functionality, enables

a wide range of decentralized applications (dapps) beyond simple

monetary transactions. Furthermore, while Bitcoin’s maximum supply

is capped at 21 million coins, altcoins have varied approaches to

supply. For example, Ethereum initially had no cap. With the

introduction of EIP-1559, Ethereum developers have introduced a

mechanism that burns a portion of the supply with each transaction,

potentially making its supply deflationary over time. XRP – like

many other altcoins – was premined and has a capped total supply of

100 billion XRP. The Rise Of Altcoins: A History The history of

altcoins is a captivating narrative of innovation, market dynamics,

and the continuous pursuit of refining digital currency technology.

Since the inception of Bitcoin, the first decentralized

cryptocurrency, there has been a surge in the creation of

alternative cryptocurrencies, each seeking to address perceived

limitations of Bitcoin or to introduce new features and use cases.

The First Altcoins Gaining Traction The journey of altcoins began

soon after the establishment of Bitcoin, with the creation of

Namecoin in April 2011. Namecoin aimed to decentralize domain-name

registration, making internet censorship more difficult. Following

Namecoin, Litecoin was launched in October 2011, envisioned as the

“silver” to Bitcoin’s “gold.” Litecoin offered faster transaction

confirmation times and a different hashing algorithm (Scrypt).

Following these, another notable early altcoin included Peercoin,

introduced in 2012, which was the first to implement a

Proof-of-Stake/Proof-of-Work hybrid system. Another significant

early player was XRP which was created in 2012. The XRP Ledger was

launched in June 2012 by the founders of Ripple Labs, including

Chris Larsen and Jed McCaleb. Shortly after that, Dogecoin was

launched in December 2013, initially created as a light-hearted

take on cryptocurrency. Remarkably, not all early altcoins

sustained their momentum. Many, like Feathercoin and Terracoin,

which gained attention initially, saw their influence wane over the

years. These coins, while innovative in their time, couldn’t keep

up with the rapidly evolving cryptocurrency market or build a

lasting community and development ecosystem. Evolution Of The

Altcoin Market The altcoin market has evolved significantly over

the years, expanding beyond simple variations of Bitcoin’s

technology. The introduction of Ethereum in 2015 was a watershed

moment. Ethereum’s innovation was not just in creating a new

cryptocurrency but in introducing a platform for decentralized

applications (dApps) through smart contracts. This breakthrough

opened the doors for a new era of blockchain technology, where

altcoins could serve various purposes beyond mere currency, from

powering decentralized finance (DeFi) to non-fungible tokens

(NFTs). The market saw an influx of diverse altcoins based on

Ethereum, each catering to specific niches and use cases. Key

Milestones In Altcoin History Several key milestones mark the

history of altcoins. The Initial Coin Offering (ICO) boom in 2017

was one such significant event. ICOs became a popular method for

new cryptocurrency projects to raise funds, leading to the launch

of thousands of new altcoins. However, this period also saw

increased regulatory scrutiny and instances of fraud, leading to a

more cautious market approach. Another major development was the

rise of DeFi in 2020, where altcoins played a central role in

enabling decentralized lending, borrowing, and trading, independent

of traditional financial institutions. This era also witnessed the

surge in popularity of NFTs, with altcoins like Ethereum being at

the forefront of this new digital asset class. These milestones

highlight the dynamic nature of the altcoin market, continuously

shaped by technological advancements and shifting market

sentiments. Top Altcoins To Watch As the crypto market continues to

evolve, a number of altcoins have risen to prominence, each

offering unique advantages and innovations. This section highlights

some of the top altcoins that have captured the market’s attention

due to their technological advancements, community support, and

potential for future growth. Overview of Top Altcoins Ethereum

(ETH): Often regarded as the leading altcoin, Ethereum is renowned

for its smart contract functionality, which has paved the way for

decentralized applications (dApps) and decentralized finance (DeFi)

ecosystems. Solana (SOL): Solana has gained popularity for its

incredibly fast and low-cost transactions, leveraging a unique

combination of proof-of-history (PoH) and proof-of-stake (PoS)

consensus mechanisms. XRP: Despite legal challenges in the United

States, Ripple has established itself and the XRP token as a

significant player, primarily for its use in fast and efficient

cross-border money transfers. Binance Coin (BNB): Originally

created as a utility token for the Binance cryptocurrency exchange,

BNB has expanded its use cases to include transaction fee

discounts, token sales, and more within the Binance ecosystem.

Cardano (ADA): Known for its strong focus on sustainability and

scientific philosophy, Cardano offers a third-generation blockchain

that promises more scalability and security through its unique

Ouroboros proof-of-stake algorithm. Polkadot (DOT): Polkadot stands

out for its interoperability, enabling different blockchains to

transfer messages and value in a trust-free fashion; it’s also

scalable and customizable. These are just a few examples of the

numerous altcoins in the market, each contributing to the diverse

landscape of cryptocurrency in their unique ways. Features That

Make Altcoins Stand Out Altcoins distinguish themselves through

various features that cater to specific needs and use cases: Smart

Contract Capabilities: Ethereum’s introduction of smart contracts

revolutionized the blockchain space, enabling the creation of

complex, programmable transactions and applications. Scalability

And Speed: Altcoins like Solana and Cardano have focused on solving

scalability issues, offering faster transaction speeds and lower

fees compared to older blockchain networks like Bitcoin and

Ethereum. Interoperability: Projects like Polkadot and Cosmos

address the issue of blockchain interoperability, allowing

different networks to communicate and exchange information

seamlessly. Niche Applications: Some altcoins target specific

sectors or use cases, such as Chainlink’s focus on providing

real-world data to blockchain networks through oracles, or Monero’s

emphasis on privacy and anonymity. What Is Altcoin Season? Altcoin

season or “altseason” is a term that describes a period in the

crypto market when altcoins significantly outperform Bitcoin. It’s

a phase where investors’ appetite for riskier assets grows, and

capital flows from Bitcoin into altcoins, often resulting in

substantial price surges for these alternative coins. Understanding

when an altcoin season is on the horizon can be crucial for

cryptocurrency traders and investors looking to capitalize on

market trends. Indicators Of An Upcoming Altcoin Season A key

indicator of an impending altcoin season can be the Bitcoin

Dominance (BTC.D) chart, which tracks the percentage of the total

cryptocurrency market capitalization contributed by Bitcoin.

Technical analysts scrutinize this chart for signs of decreasing

dominance, which may suggest that altcoins are starting to take up

a larger share of the market. Support and resistance levels on this

chart can indicate potential shifts in market dynamics. For

instance, a sustained fall below a major support level could signal

the beginning of altcoin season. Remarkably, the market often moves

in cycles which can be broken down into four distinct phases, as

illustrated in the image provided by crypto analyst Ted

(@tedtalksmacro): Phase 1: Bitcoin – The cycle often starts with

Bitcoin’s price surging as money flows into Bitcoin, causing

significant price increases. Phase 2: Ethereum – Money begins to

flow into Ethereum, which might struggle to keep up initially but

then starts to outperform Bitcoin, leading to discussions about

‘the flippening’ (where Ethereum’s market cap could surpass

Bitcoin’s). Phase 3: Large Caps – As Ethereum starts outperforming

Bitcoin, investors begin to venture into large-cap altcoins, which

then start to see large buy-ups and price increases. Phase 4:

“Altseason” – In this final phase, enthusiasm spreads across the

market; large caps have gone full vertical, and attention turns to

mid and small-cap altcoins. All categories, regardless of

fundamentals, tend to pump around the same time, leading to a

parabolic increase in altcoin prices. This phase is marked by high

levels of excitement and media attention. How to Buy Altcoins: A

Step-by-Step Guide Purchasing altcoins can seem daunting for

newcomers to the cryptocurrency space, but by following a clear

step-by-step process, it can be straightforward and secure. Here’s

a simplified guide to help you through the process: Research:

Before anything else, conduct thorough research to determine which

altcoins align with your investment goals and risk tolerance.

Choose A Wallet: Select a digital wallet that supports the altcoin

you wish to purchase. Wallets can be software-based (like mobile or

desktop applications) or hardware-based for added security. Select

A Cryptocurrency Exchange: Choose an altcoin exchange that lists

the altcoin you’re interested in and is known for its reliability,

security, and ease of use. Register And Secure Your Account: Create

an account on the chosen exchange and set up strong authentication

measures, including two-factor authentication (2FA). Fund Your

Account: Deposit funds into your exchange account. This can often

be done via bank transfer, credit card, or by depositing other

cryptocurrencies. Place An Order: Navigate to the market or trading

pair for your chosen altcoin and place a buy order. You can opt for

a market order for an immediate purchase at current prices or a

limit order to specify a price at which you’re willing to buy.

Store Your Altcoins Securely: After the purchase, transfer your

altcoins to your personal wallet for safekeeping, especially if

you’re planning on holding them for the long term. Where to Buy

Altcoins You can purchase altcoins on a variety of platforms, each

offering its own set of features, fees, and security measures. Here

are some of the most common places where you can buy altcoins:

Centralized Exchanges: These are the most common platforms for

buying altcoins and include well-known exchanges like Binance,

Coinbase, and Kraken. They offer a wide range of altcoins and are

typically user-friendly. Decentralized Exchanges (DEXs): DEXs like

Uniswap and SushiSwap allow for peer-to-peer transactions without

the need for an intermediary. They offer a higher degree of privacy

and direct wallet-to-wallet trades. Cryptocurrency Brokers:

Platforms like eToro and Robinhood act as brokers, offering an easy

entry point for buying cryptocurrencies. However, they may have a

more limited selection of altcoins compared to dedicated exchanges.

Peer-to-Peer (P2P) Platforms: Websites like OKX P2P or Remitano

connect buyers and sellers directly. While they offer flexibility

in payment methods, they require a higher degree of trust between

parties. When choosing where to buy altcoins, consider factors such

as security, fees, the variety of available altcoins, and the user

experience of the platform. Always ensure that the platform you

choose complies with the regulatory standards in your jurisdiction.

Are Altcoins A Good Investment? The question of whether altcoins

are a good investment depends on various factors, including market

conditions, the specific altcoin’s potential for growth, and the

investor’s risk tolerance and investment strategy. Pros Of

Investing In Altcoins: High Growth Potential: Some altcoins have

shown the capacity for high returns on investment, outperforming

traditional assets in their best periods. Diversification: Altcoins

can diversify an investment portfolio, potentially reducing risk by

spreading exposure across different asset classes. Innovation:

Investing in altcoins can be a way to support and be part of

innovative blockchain projects that may transform various

industries. Cons Of Investing In Altcoins: Volatility: Altcoins can

be highly volatile, with the potential for significant price swings

that can lead to substantial gains or losses. Market Maturity:

Compared to more established markets, the cryptocurrency market is

relatively young and can be unpredictable. Regulatory Uncertainty:

Altcoins face regulatory challenges that can impact their value and

legality. Investors considering altcoins should conduct thorough

research, understand the risks involved, and consider speaking with

a financial advisor. Investment decisions should be based on an

individual’s financial situation, investment objectives, and risk

tolerance. Are Altcoins Dead Or Thriving? The altcoin market is a

diverse ecosystem with a wide range of projects boasting various

levels of innovation, utility, and community support. Similar to

the early days of the internet which led to the Dot-Com bubble, the

cryptocurrency space is experiencing its own form of natural

selection where not all projects will survive in the long term. The

Reality Of Altcoin Longevity: Oversaturation: The market has seen

an explosion of altcoins, with thousands currently in existence.

Many of these coins serve similar functions or aim to solve the

same problems, leading to an oversaturated market where only the

strongest or most unique can survive. User And Company Adoption:

For an altcoin to thrive, it must gain widespread adoption among

users and businesses. However, with so many options available, not

every altcoin will achieve the necessary adoption rate to sustain

its network. Innovation And Continuous Development: The technology

underlying altcoins is rapidly evolving. Projects that fail to

innovate or adapt to new advancements are likely to fall behind and

eventually become obsolete. Survival Of The Fittest: The ‘Amazon’

Of Altcoins: There will be altcoins that manage to carve out a

niche for themselves and become integral to the crypto economy,

much like Amazon did for e-commerce. These projects typically have

strong fundamentals, clear use cases, active development teams, and

robust community support. The ‘Pets.com’ Of Altcoins: Conversely,

some altcoins will fade into obscurity, similar to the fate of

Pets.com and other failed Dot-Com ventures. Reasons for this

include poor management, lack of clear use cases, failure to

deliver on promises, or simply the inability to compete with more

successful projects. Market Dynamics And Speculation: Speculative

Bubbles: The altcoin market is not immune to hype and speculation,

which can lead to bubbles. Projects that rise rapidly on

speculation rather than solid fundamentals are at risk of crashing

just as quickly. Regulatory Challenges: Authorities are still

defining the regulatory landscape for cryptocurrencies. Altcoins

that fall foul of future regulations or fail to navigate the

complex legal environment may face challenges that could impede

their growth or lead to their demise. In conclusion, while the

altcoin market as a whole shows signs of thriving, with continuous

innovation and increasing integration into the broader financial

system, it’s clear that not every altcoin will survive the test of

time. Investors should be discerning, focusing on projects with

solid fundamentals, active development, and real-world utility to

identify those with the potential to succeed in the long term. FAQ

What Are Altcoins? Altcoins, short for “alternative coins,” are

cryptocurrencies other than Bitcoin. Who Is Altcoin Daily? Twin

brothers Aaron and Austin Arnold founded Altcoin Daily, a prominent

cryptocurrency YouTube channel. With over 1.34 million followers,

it covers daily updates on Bitcoin, altcoins, NFTs, and more. What

Is Altcoin Alert? Altcoin Alert refers to a software and service

that tracks and analyzes sentiment on a large scale in the

cryptocurrency market. It predicts coin prices based on extensive

data. How Many Altcoins Are There? The number of altcoins

constantly changes with the creation of new ones and the

obsolescence of others. As of the last known count, there are ten

thousands of altcoins, each with its own value proposition and

community, but also a lot of scam projects. Are Altcoins Worth

Investing In? Altcoins can be worth investing in, but they carry

their own sets of risks and potential rewards. Their worth as an

investment will depend on individual risk tolerance, market

research, and investment goals. Can You Short Altcoins? Yes, it is

possible to short altcoins on many cryptocurrency exchanges. In

short selling, an investor borrows a cryptocurrency and sells it on

the market, anticipating a decrease in its price. How Do Altcoins

Work? Altcoins work using blockchain technology, which is a

decentralized ledger that records all transactions across a network

of computers. Many alternative cryptocurrencies have different

features and operate on various consensus mechanisms, such as Proof

of Work, Proof of Stake, or others. How Are Altcoins Created?

Creating altcoins often involves forking from an existing

blockchain or developing a new blockchain and its underlying

technology from scratch. The process includes designing the coin’s

protocol, creating its blockchain, and launching it for public use.

What Is An Altcoin? An altcoin is any cryptocurrency other than

Bitcoin. The term “altcoin” encompasses a broad range of

cryptocurrencies with various functions and underlying

technologies. Featured image from Shutterstock

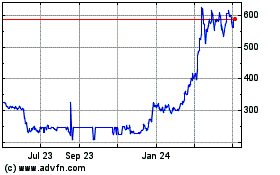

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024