Algorand (ALGO) Price Turns Positive, Bulls Eyeing Further Gains?

May 16 2023 - 3:30PM

NEWSBTC

Algorand (ALGO) has recovered from the bearish trend seen at the

end of February 2023. From February 21 till May 8, ALGO

recorded a loss of 45.13%, dropping to a low of $1.592. Despite the

crash, buyers still pushed up the price of ALGO by more than 6% in

the past few days. Traders are optimistic and are eyeing the next

move in the current trend, while the bears are slowing building

momentum by holding their strong short position. Will The Bulls

Maintain This Current Bullish Momentum? The sustainability of

ALGO’s current price trend relies on several factors. Market

conditions, such as supply and demand dynamics, overall economic

factors, and external events, can generally influence the price.

However, the current market sentiment is bullish, while the Fear

& Greed Index is 45, indicating neutral. This means the

market’s state is stable, and the volatility is not high. Within

the last 24 hours, Algo’s general market cap gained 1.57%, rising

to over $1 billion. The 24-hour trading volume surged by 15%

overnight, rising to about $33 million. Related Reading: US Banking

Crisis Worsens With Half Of America’s Banks On the Verge Of Failure

Notably, at the time of writing, the ALGO token is trading at

$0.1683 as bulls continue to have a good day with gains of

2.50%. However, the recent increase in ALGO’s general market

suggests increased demand for the asset. As more investors and

traders buy the asset, the increased buying pressure can lead to a

rise in its price. The increase in trading volume suggests improved

liquidity for the asset, which tend to attract more investor to the

market. ALGO Technical Analysis The price is below the

200-Day and 50-Day Simple Moving Averages (SMA). This suggests that

ALGO market sentiment is still bearish; the selling momentum is

stronger than the bull’s buying momentum. However, the asset might

rebound if the bulls increase their momentum, as green candles are

showing today in the chart. The Relative Strength Index oscillator

is showing 40.18. This means the asset is currently at neutral

levels; the pressure from bulls and bears is normal. Related

Reading: Crypto Firms Should Ditch Banks To De-risk From Volatile

Systems, Says Cardano Founder Also, MACD is currently above the

signal indicating a potential uptrend. The histogram confirms the

bullish sentiment as its showing green candles and also above zero.

ALGO trades between its primary support and resistance levels of

$0.1587 and $0.1853, respectively. The next key zones are the

support level – $0.0992 and the resistance level – $0.2427. Recent

Development In The Algorand Ecosystem Alogrand recently introduced

a new plugin-based tool for enhancing Blockchain Data Access named

Conduit. Conduit aims at providing improved access to blockchain

data. It is an upgrade to the conventional one-size-fits-all

Indexer, designed as a modular plugin-based tool. This plugin

empowers decentralized applications (DApps) by offering precise and

tailored data retrieval capabilities, all while maintaining

cost-effective deployment options. Such developments on the network

could increase adoption and utility and, in time, boost ALGO’s

price. Featured image from Pixabay and chart from Tradingview.com

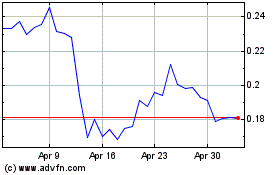

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025