UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: February 27, 2025

Commission File Number: 001-33414

Denison Mines Corp.

(Name of

registrant)

1100-40 University Avenue

Toronto Ontario

M5J 1T1 Canada

(Address of

principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form

40-F.

Form

20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(1): ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

DENISON MINES

CORP.

|

|

|

|

|

|

|

|

|

|

/s/ Amanda Willett

|

|

Date:

February 27, 2025

|

|

|

|

Amanda

Willett

|

|

|

|

|

|

Vice

President Legal and Corporate Secretary

|

FORM 6-K

EXHIBIT INDEX

Exhibit 99.1

|

|

Denison Mines

Corp.

1100 – 40

University Ave

Toronto, ON M5J

1T1

www.denisonmines.com

|

PRESS RELEASE

Denison Reports CNSC Hearing Dates for Phoenix ISR

Project

Toronto,

ON – February 27, 2025. Denison Mines Corp.

(“Denison” or the “Company”) (TSX: DML, NYSE American: DNN) is pleased

to announce that the Canadian Nuclear Safety Commission

(“CNSC”) Registrar has set the schedule for the

CNSC public hearing (“Hearing”) for the Wheeler River Uranium Project

(“Wheeler

River”, or the

“Project”). The Hearing is scheduled to be held in

two parts (October 8, 2025, and December 8 to 12, 2025) and

represents the final step in the federal approval process for the

Project’s Environmental Assessment

(“EA”)

and Licence to Prepare and Construct a Uranium Mine and Mill

(“Licence”).

Based on this

schedule, if the CNSC makes a prompt decision to approve the

Project following the completion of the Hearing, the Company

expects to be able to commence site preparation and construction

activities for the Phoenix In-Situ Recovery

(“ISR”) project in early

2026.

The announcement

of the Hearing schedule follows the successful completion of

multiple key regulatory milestones in late 2024, including (i)

completion of the technical review phase of the federal EA approval

process in November, (ii) acceptance by the CNSC of the

Company’s final Environmental Impact Statement

(“EIS”) for the Project in December, and (iii)

the CNSC’s determination of the sufficiency of

Denison’s Licence application, also in November.

These accomplishments indicate

that the CSNC staff support the advancement of the Project

and are transitioning their efforts to prepare an evidence-based

summary report for the Commission members that will govern the

Hearing and render their decision on the EA and Licence once the

Hearing is complete.

David Cates,

President and CEO of Denison commented, “The

scheduling of the Hearing and acceptance of the final federal EIS

by the CNSC represent significant additional achievements for

Denison in our efforts to obtain the regulatory approvals necessary

to commence construction of the Phoenix ISR uranium mining

operation. Importantly, obtaining clarity on the Hearing schedule

significantly reduces uncertainty regarding the timeline for

Federal project approvals and allows our operations team to

finalize our construction planning efforts with greater precision.

With the potential to commence construction in early 2026, we

expect to be able to maintain our target of achieving first

production from Phoenix by the first half of

2028.”

About Denison

Denison is a leading

uranium mining, development, and exploration company with interests

focused in the Athabasca Basin region of northern Saskatchewan,

Canada. Denison has an effective 95% interest in its flagship

Wheeler River Uranium Project, which is the largest undeveloped

uranium project in the infrastructure rich eastern portion of the

Athabasca Basin region of northern Saskatchewan. In mid-2023, the

Phoenix feasibility study was completed for the Phoenix deposit as

an ISR mining operation, and an update to the previously prepared

2018 Pre-Feasibility Study ('PFS') was completed for Wheeler

River's Gryphon deposit as a conventional underground mining

operation. Based on the respective studies, both deposits have the

potential to be competitive with the lowest cost uranium mining

operations in the world. Permitting efforts for the planned Phoenix

ISR operation commenced in 2019 and several notable milestones were

achieved in 2024 with the submission of federal licensing documents

and the acceptance of the final form of the project’s

Environmental Impact Statement by the Province of Saskatchewan and

the Canadian Nuclear Safety Commission.

Denison's interests in

Saskatchewan also include a 22.5% ownership interest in the McClean

Lake Joint Venture ('MLJV'), which includes unmined uranium

deposits (planned for extraction via the MLJV's SABRE mining method

starting in 2025) and the McClean Lake uranium mill (currently

utilizing a portion of its licensed capacity to process the ore

from the Cigar Lake mine under a toll milling agreement), plus a

25.17% interest in the Midwest Joint Venture ('MWJV')'s Midwest

Main and Midwest A deposits, and a 69.44% interest in the Tthe

Heldeth Túé ('THT') and Huskie deposits on the Waterbury

Lake Property ('Waterbury'). The Midwest Main, Midwest A, THT and

Huskie deposits are located within 20 kilometres of the McClean

Lake mill. Taken together, Denison has direct ownership interests

in properties covering ~384,000 hectares in the Athabasca Basin

region.

Additionally, through its

50% ownership of JCU (Canada) Exploration Company, Limited ('JCU'),

Denison holds interests in various uranium project joint ventures

in Canada, including the Millennium project (JCU, 30.099%), the

Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU,

34.4508%).

In 2024, Denison celebrated its 70th year in uranium mining,

exploration, and development, which began in 1954 with

Denison’s first acquisition of mining claims in the Elliot

Lake region of northern Ontario.

For more information, please contact

|

David Cates

|

(416) 979-1991 ext.

362

|

|

President and Chief Executive

Officer

|

|

|

|

|

|

Geoff Smith

|

(416) 979-1991 ext. 358

|

|

Vice President Corporate Development &

Commercial

|

|

|

|

|

|

Follow Denison on

Twitter

|

@DenisonMinesCo

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain

information contained in this press release constitutes

‘forward-looking information’, within the meaning of

the applicable United States and Canadian legislation concerning

the business, operations and financial performance and condition of

Denison. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as

‘plans’, ‘expects’, ‘budget’,

‘scheduled’, ‘estimates’,

‘forecasts’, ‘intends’,

‘anticipates’, or ‘believes’, or the

negatives and/or variations of such words and phrases, or state

that certain actions, events or results ‘may’,

‘could’, ‘would’, ‘might’ or

‘will be taken’, ‘occur’, ‘be

achieved’ or ‘has the potential to’.

In particular,

this press release contains forward-looking information pertaining

to the Company’s expectations with respect to the Hearing and

the EA and Licensing process, development plans for Wheeler River

and the proposed ISR operation for the Phoenix deposit;

expectations regarding Denison’s joint venture ownership

interests; and expectations regarding the objectives and continuity

of its agreements with third parties. Statements relating to

‘mineral reserves’ or ‘mineral resources’

are deemed to be forward-looking information, as they involve the

implied assessment, based on certain estimates and assumptions that

the mineral reserves and mineral resources described can be

profitably produced in the future.

Forward looking

statements are based on the opinions and estimates of management as

of the date such statements are made, and they are subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results, level of activity, performance or achievements

of Denison to be materially different from those expressed or

implied by such forward-looking statements. For example, the

results of the Hearing may not be as anticipated. In addition,

Denison may decide or otherwise be required to discontinue

development work if it is unable to maintain or otherwise secure

the necessary approvals or resources (such as testing facilities,

capital funding, etc.). Denison believes that the expectations

reflected in this forward-looking information are reasonable, but

no assurance can be given that these expectations will prove to be

accurate and results may differ materially from those anticipated

in this forward-looking information. For a discussion in respect of

risks and other factors that could influence forward-looking

events, please refer to the factors discussed in the

Company’s Annual Information Form dated March 28, 2024 under

the heading ‘Risk Factors’. These factors are not, and

should not be, construed as being exhaustive.

Accordingly,

readers should not place undue reliance on forward-looking

statements. The forward-looking information contained in this press

release is expressly qualified by this cautionary statement. Any

forward-looking information and the assumptions made with respect

thereto speaks only as of the date of this press release. Denison

does not undertake any obligation to publicly update or revise any

forward-looking information after the date of this press release to

conform such information to actual results or to changes in

Denison's expectations except as otherwise required by applicable

legislation.

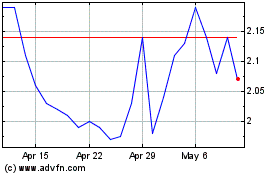

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Feb 2025 to Mar 2025

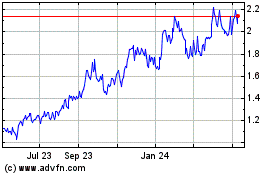

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Mar 2024 to Mar 2025