UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

AGEAGLE

AERIAL SYSTEMS INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Dear

Fellow Shareholder:

I

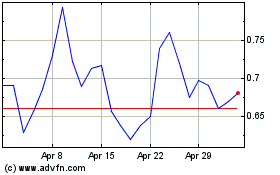

would like to directly address the decline in our current share price and the NYSE deficiency notice by sharing our current plan to resolve

the situation and improve the capital market positioning of AgEagle in anticipation of our projected growth in the upcoming year.

First,

I would like to thank you all for your continued support. I, along with the entire AgEagle team, have been working diligently towards

the much-anticipated commercial launch of our new eBee™ VISION, which we accomplished and announced on September 6, 2023.

Since

the launch, the eBee VISION attracted hundreds of prospective new customers to our exhibit at the recent Commercial UAV Expo in

Las Vegas. In addition, I had the pleasure of showcasing the eBee Vision on national television with two live interviews aired

on “Varney & Co.” and “The Big Money Show” on FOX Business News. This national and industry attention is

helping us to optimize the launch of the eBee VISION, which, in turn, is helping to drive strong sales queries and order flow.

We

are all aware that the capital markets have been highly and particularly volatile over the past year and have punished small cap companies

like AgEagle. As a result of the prevailing market conditions, AgEagle’s stock price has steadily fallen – a decline that

has been further exasperated by strong economic headwinds caused mainly by supply chain uncertainties and labor shortages that have impacted

our operations. Nonetheless, we have continued to face these challenges undeterred and managed to significantly reduce our expenses,

develop and engineer new products, and position the Company for long-term growth. Our efforts to effectively optimize our operations

through integration and consolidation of our offices are indeed yielding tangible results, including lowering our net loss, burning less

cash, and aligning our pricing, marketing and innovation strategies to grow revenue.

All

this has not stopped the stock price from falling, but it has catalyzed the team at AgEagle. Although today I cannot control the current

markets conditions that have led the sharp decline in our stock price, what I can do is continue to lead our team to execute the mission

we have set forward and achieve success with the sale of our UAVs, advanced camera systems and our advanced software solutions. On this

subject, I am confident in our growing ability to deliver consistent and predictable financial performance. I believe the stock price

does not reflect the strength and promise of AgEagle, so we are working very hard to show the world our true value.

Recently,

we issued an 8-K in connection with our receipt of a deficiency letter from the NYSE relating to low-priced security listing requirements.

Given the performance of our Common Stock as a low-priced security, the NYSE has granted us six months to bring the stock above the low-price

threshold or to have our Board effect a reverse stock split. For that reason alone, we have filed a proxy notice and statement for a

special shareholder meeting asking our shareholders to vote for a provision that will include a range for a reverse stock split to be

effected by the board, in the event it becomes necessary to do so. This split will allow us to better align the stock price with our

future performance, increase investor awareness, and set the stage for growth as we advance our innovative new platforms, like the new

MicaSense RedEdge Dual and eBee VISION.

The

eBee VISION, as well as our industry leading sensors and software, are critical tools for a variety of industries; and we are

implementing a campaign to increase global awareness to how AgEagle can help to better serve these industries through our pioneering

UAS solutions. Our recent media attention is the just the beginning of this campaign, and AgEagle’s team has been engaged in numerous

live demonstrations and intensive training sessions. It is our intention to demonstrate our advancements to the world. We will enhance

shareholder value through our efforts that bring awareness to innovative new products that we are bringing to market.

I

will close by asking for your continued support and encourage you to vote in favor of the proposals outlined in the proxy materials.

The past 12 months have been stressful, uncertain at times, but you’ve stood by AgEagle, and for that we are very grateful. At

our core, AgEagle is about continually innovating technologies focused on enabling our customers, and we could not achieve that mission

without your support.

Please

carefully consider the proposals and submit your vote as soon as possible.

Sincerely,

Barrett

Mooney,

Chairman

and CEO

AgEagle

Aerial Systems Inc.

AGEAGLE

AERIAL SYSTEMS INC.

8863

E. 34th Street North

Wichita, Kansas 67226

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

to be held on November 14, 2023

TO

THE SHAREHOLDERS OF AGEAGLE AERIAL SYSTEMS INC.:

This

Special Meeting of the Shareholders (the “Special Meeting”) of AgEagle Aerial Systems Inc., a Nevada corporation (the “Company”),

will be held on November 14, 2023, at 11:00 a.m., local time, 700 NW 1st Avenue, Ste. 1200, Miami, Florida 33136-4118, for the

following purposes:

(1)

To authorize the Board of Directors (the “Board”), at the discretion of the Board, to file an amendment to the Company’s

Articles of Incorporation, as amended to date, to authorize a reverse stock split of the Company’s Common Stock with a ratio in

the range between and including 1-for-10 shares and 1-for-20 shares, for the primary purpose of maintaining the Company’s listing

on NYSE American (the “Reverse Split Proposal”);

(2)

To amend the Company’s 2017 Omnibus Equity Incentive Plan to increase the number of shares of Common Stock authorized for issuance

under the plan from 10,000,000 shares to 15,000,000 shares before the Reverse Split (the “Plan Amendment Proposal”);

and

(3)

To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

foregoing Proposals (the “Adjournment Proposal”).

We

will also consider any other business that properly comes before the Special Meeting.

Shareholders

of record of the Company’s Common Stock at the close of business on October 6, 2023 are entitled to notice of, and to vote

at, the Special Meeting or any adjournment or postponement thereof.

Your

attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of matters to be considered at the

Special Meeting.

We

are pleased to take advantage of the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials primarily

over the Internet. We believe that it will expedite shareholders’ receipt of proxy materials, lower costs and reduce the environmental

impact of distributing proxy materials for our Special Meeting. It is anticipated that on or about October 11, 2023, we will commence

mailing to our shareholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability

of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials, including this Proxy Statement

over the Internet. The Notice also includes instructions on how you can receive a paper copy of the proxy materials by mail. If you receive

meeting materials by mail, the Notice, this Proxy Statement and proxy card will be enclosed. If you receive your proxy materials via

e-mail, the e-mail will contain voting instructions and links to this Proxy Statement on the Internet, which is available at https://web.viewproxy.com/uavs/2023.

All

shareholders are cordially invited to attend the meeting. Whether or not you plan to participate in this Special Meeting, your vote is

very important and we encourage you to vote promptly. After reading this Proxy Statement, please promptly mark, sign and date the enclosed

proxy card and return it by following the instructions on the proxy card or voting instruction card or vote by telephone or by Internet.

If you attend the Special Meeting, you will have the right to revoke the proxy and vote your shares in person. If you hold your shares

through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from your brokerage firm,

bank, or other nominee to vote your shares.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Barrett Mooney |

| |

Barrett

Mooney |

| |

Chairman

of the Board of Directors |

| |

|

| Dated:

October 10, 2023 |

|

AGEAGLE

AERIAL SYSTEMS INC.

8863

E. 34th Street North

Wichita,

Kansas 67226

PROXY

STATEMENT

for

Special

Meeting of Shareholders

to

be held November 14, 2023

PROXY

SOLICITATION

The

Company is soliciting proxies on behalf of the Board of Directors (the “Board”) in connection with the Special Meeting of

the shareholders (the “Special Meeting”) of AgEagle Aerial Systems Inc., a Nevada corporation (the “Company”),

which will be held on November 14, 2023, at 11:00 a.m., local time, at 700 NW 1st Avenue, Ste. 1200, Miami, Florida 33136-4118,

for the following purposes:

(1)

To authorize the Board of Directors (the “Board”), at the discretion of the Board, to file an amendment to the Company’s

Articles of Incorporation, as amended to date, to authorize a reverse stock split of the Company’s Common Stock with a ratio in

the range between and including 1-for-10 shares and 1-for-20 shares, for the primary purpose of maintaining the Company’s listing

on NYSE American (the “Reverse Split Proposal”);

(2)

To amend the Company’s 2017 Omnibus Equity Incentive Plan to increase the number of shares of Common Stock authorized for issuance

under the plan from 10,000,000 shares to 15,000,000 shares before the Reverse Split (the “Plan Amendment Proposal”);

and

(3)

To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

foregoing Proposals (the “Adjournment Proposal”).

We

will also consider any other business that properly comes before the Special Meeting.

The

Board has set October 6, 2023 as the record date (the “Record Date”) to determine those holders of the Common Stock

who are entitled to notice of, and to vote at, the Special Meeting. A list of the shareholders entitled to vote at the meeting may be

examined at the Company’s office at 8863 E. 34th Street North, Wichita, Kansas 67226 during the 10-day period preceding the Special

Meeting.

It

is anticipated that on or about October 11, 2023, the Company shall commence mailing to all shareholders of record, as of the

Record Date, a Notice of Availability of Proxy Materials (the “Notice”). Please carefully review the Notice for information

on how to access the Notice of Special Meeting and access the Proxy Statement on https://web.viewproxy.com/uavs/2023, in addition to

instructions on how you may request to receive a paper or email copy of these documents. There is no charge to you for requesting a paper

copy of these documents.

IMPORTANT:

Please mark, date, and sign the enclosed proxy card and promptly return it in the accompanying postage-paid envelope or vote by telephone

or by Internet to assure that your shares are represented at the meeting.

IMPORTANT

NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 14,

2023: Our Proxy Statement is enclosed. A complete set of proxy materials relating to our Special Meeting, consisting of the Notice

of the Special Meeting of Shareholders, the Proxy Statement is available on the Internet. The Proxy Statement may be viewed at https://web.viewproxy.com/uavs/2023.

GENERAL

INFORMATION ABOUT VOTING

Proxy

Materials

Why

am I receiving these materials?

The

Board of Directors (the “Board”) of AgEagle Aerial Systems Inc. (the “Company”) has made these proxy materials

available to you on the Internet, or, upon your request, has delivered printed versions of these materials to you by mail, in connection

with the solicitation of proxies for use at the Company’s Special Meeting, which will take place on November 14, 2023, at

11:00 a.m. local time at 700 NW 1st Avenue, Ste. 1200, Miami, Florida 33136-4118.

As

a shareholder, you are invited to participate in the Special Meeting and are requested to vote on the proposals described in this Proxy

Statement. This Proxy Statement includes information that we are required to provide to you under Securities and Exchange Commission

(“SEC”) rules and is designed to assist you in voting your shares.

What

is included in these materials?

The

proxy materials include:

| |

● |

this

Proxy Statement for the Special Meeting; and |

| |

|

|

| |

● |

the

proxy card or a voting instruction card for the Special Meeting. |

Why

did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

In

accordance with rules adopted by the SEC, we may furnish proxy materials, including this Proxy Statement, to our shareholders by providing

access to such documents over the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the

proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (“Notice”), which

was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the Internet.

If you would like to receive a paper copy of our proxy materials, you should follow the instructions for requesting such materials in

the Notice.

How

can I access the proxy materials over the Internet?

The

Notice of Internet Availability, proxy card or voting instructions card will contain instructions on how to:

| |

● |

access

and view our proxy materials for the Special Meeting over the Internet; and |

| |

|

|

| |

● |

how

to vote your shares. |

If

you choose to receive our future proxy materials electronically, it will save us the cost of printing and mailing documents to you and

will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials electronically,

you will receive an e-mail next year with instructions containing a link to the website where those materials are available. Your election

to receive proxy materials electronically will remain in effect until you terminate it.

How

may I obtain a paper copy of the proxy materials?

Shareholders

receiving a Notice will find instructions in that notice about how to obtain a paper copy of the proxy materials. Shareholders receiving

a Notice by e-mail will find instructions in that e-mail about how to obtain a paper copy of the proxy materials. Shareholders who have

previously submitted a standing request to receive paper copies of our proxy materials will receive a paper copy of the proxy materials

by mail.

What

shares are included on the proxy card?

If

you are a shareholder of record, you will receive only one proxy card for all the shares you hold of record in certificate form and in

book-entry form.

If

you are a beneficial owner, you will receive voting instructions from your broker, bank or other holder of record.

What

is “householding” and how does it affect me?

We

have adopted a procedure approved by the SEC called “householding.” Under this procedure, shareholders of record who have

the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Notice

of the Special Meeting of Stockholders and this Proxy Statement, unless we are notified that one or more of these stockholders wishes

to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Shareholders

who participate in householding will continue to receive separate proxy cards.

If

you are eligible for householding, but you and other shareholders of record with whom you share an address currently receive multiple

copies of the Notice the Special Meeting of Shareholders and the Proxy Statement, or if you hold stock of the Company in more than one

account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact the

Corporate Secretary of the Company by sending a written request to AgEagle Aerial Systems Inc., Corporate Secretary, 8863 E. 34th Street

North, Wichita, Kansas 67226.

If

you participate in householding and wish to receive, free of charge, a separate copy of the Notice of Special Meeting of Shareholders

and this Statement, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents

in the future, please contact the Corporate Secretary of the Company, as set forth above.

If

you are a beneficial owner, you can request information about householding from your broker, bank, or other holder of record.

Voting

Information

What

items of business will be voted on at the Special Meeting?

The

items of business scheduled to be voted on at the Special Meeting are:

(1)

To authorize the Board of Directors (the “Board”), at the discretion of the Board, to file an amendment to the Company’s

Articles of Incorporation, as amended to date, to authorize a reverse stock split of the Company’s Common Stock with a ratio in

the range between and including 1-for-10 shares and 1-for-20 shares, for the primary purpose of maintaining the Company’s listing

on NYSE American (the “Reverse Split Proposal”);

(2)

To amend the Company’s 2017 Omnibus Equity Incentive Plan to increase the number of shares of Common Stock authorized for issuance

under the plan from 10,000,000 shares to 15,000,000 shares before the Reverse Split (the “Plan Amendment Proposal”);

and

(3)

To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

foregoing Proposals (the “Adjournment Proposal”).

How

does the Board recommend that I vote?

The

Board unanimously recommends that you vote your shares:

| |

● |

“FOR”

authorizing the Board, at its discretion, to file an amendment to the Company’s Articles of Incorporation, as amended to date,

to authorize a reverse stock split of the Company’s Common Stock with a ratio in the range between and including 1-for-10 shares

and 1-for-20 shares, for the primary purpose of maintaining the Company’s listing on NYSE American (the “Reverse

Split Proposal”); |

| |

|

|

| |

● |

“FOR”

the amendment to 2017 Omnibus Equity Incentive Plan to increase the number of shares of Common Stock authorized for issuance under

the plan from 10,000,000 shares to 15,000,000 shares before the Reverse Split (the “Plan Amendment Proposal”); |

| |

|

|

| |

● |

“FOR”

adjourning the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based

upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the foregoing Proposals (the

“Adjournment Proposal”). |

Who

is entitled to vote at the Special Meeting?

Only

shareholders of record at the close of business on October 6, 2023 (the “Record Date”) will be entitled to vote at

the Special Meeting. As of the Record Date, 117,878,831 shares of the Common Stock were outstanding and entitled to vote. Each

share of Common Stock outstanding on the Record Date is entitled to one vote on each proposal.

Is

there a list of shareholders entitled to vote at the Special Meeting?

The

names of shareholders of record entitled to vote at the Special Meeting will be available for ten days prior to the Special Meeting at

our principal executive offices at 8863 E. 34th Street North, Wichita, Kansas 67226. If you would like to examine the list for any purpose

germane to the Special Meeting prior to the meeting date, please contact our Corporate Secretary.

How

can I vote if I own shares directly?

Most

shareholders do not own shares registered directly in their name, but rather are “beneficial holders” of shares held in a

stock brokerage account or by a bank or other nominee (that is, shares held “in street name”). Those shareholders should

refer to “How can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?” below for instructions

regarding how to vote their shares.

If,

however, your shares are registered directly in your name with our transfer agent, Equiniti Trust Company, you are considered, with respect

to those shares, the shareholder of record, and these proxy materials are being sent directly to you. You may vote in the following ways:

| |

● |

By

Mail: Votes may be cast by mail, as long as the proxy card or voting instruction card is delivered in accordance with its

instructions prior to 4:00 p.m., Eastern Time, on November 13, 2023. Shareholders who have received a paper copy of a proxy

card or voting instruction card by mail may submit proxies by completing, signing, and dating their proxy card or voting instruction

card and mailing it in the accompanying pre-addressed envelope. |

| |

|

|

| |

● |

By

Attending the Meeting: Please follow the instructions in the “How can I participate and vote in the Special Meeting”

section of this proxy statement. |

| |

|

|

| |

● |

By

Phone or Internet: Stockholders may vote by phone or Internet by following the instructions included in the proxy card they

received. Your vote must be received by 11:59 p.m., Eastern Time on November 13, 2023 to be counted. If you received a Notice

by mail, you may vote by proxy over the Internet by going to www.fcrvote.com/UAVS to complete an electronic proxy card or vote your

proxy by phone by calling 1 866-402-3905. Have your proxy card available when you access the website or when you call. We provide

Internet and telephone proxy voting to allow you to vote your shares on-line or by phone, with procedures designed to ensure the

authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs or usage charges

from Internet access providers and telephone companies. |

If

you vote by proxy, your vote must be received by 11:59 p.m. U.S. Eastern Time on November 13, 2023, to be counted.

Whichever

method you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions. If no

specific instructions are given, the shares will be voted in accordance with the recommendation of our Board and as the proxy holders

may determine in their discretion with respect to any other matters that properly come before the meeting.

How

can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?

If

your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner”

of shares held in “street name,” and your broker or nominee is considered the “stockholder of record” with respect

to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right

to direct your broker, bank, or other nominee how to vote, and you are also invited to participate in the Special Meeting. However, since

you are not the stockholder of record, you may not vote these shares in person unless you obtain a legal proxy from your brokerage firm

or bank. If a broker, bank, or other nominee holds your shares, you will receive instructions from them that you must follow in order

to have your shares voted.

What

is a quorum for the Special Meeting?

The

presence of the holders of 33-1/3% of the issued and outstanding shares of the Company’s Common Stock entitled to vote as

of the Record Date, represented in person or by proxy, is necessary to constitute a quorum for the transaction of business at the Special

Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your

broker) or if you participate in, and vote electronically at, the Special Meeting. Abstentions and broker non-votes will be counted as

present for purposes of determining a quorum.

What

is the voting requirement to approve each of the proposals?

| Proposal |

|

Vote

Required |

|

Broker

Discretionary Voting Allowed |

| No.

1 – Approval of a reverse stock split of the Company’s Common Stock with a ratio in the range between and including 1-for-10

shares and 1-for-20 shares, with the final ratio to be determined by the Company’s Board; |

|

Affirmative

vote of a majority of votes cast in person or by proxy |

|

Yes |

| |

|

|

|

|

| No.

2 – Approval of the amendment to the Company’s 2017 Omnibus Equity Incentive Plan to increase the number of shares of

Common Stock authorized for issuance under the plan from 10,000,000 shares to 15,000,000 shares before the Reverse

Split; and |

|

Affirmative

vote of a majority of votes cast in person or by proxy |

|

No |

| |

|

|

|

|

| No.

3 – Adjourn the Special Meeting to solicit more votes to approve the foregoing Proposals |

|

Affirmative

vote of a majority of shares present and entitled to vote in person or by proxy |

|

Yes |

What

is the effect of abstentions and broker non-votes?

For

the Reverse Stock Split Proposal and the Plan Amendment Proposal, abstentions and broker non-votes

will not be counted as votes cast and, accordingly, will not have an effect on such matters. For the Adjournment Proposal, abstentions will have the same effect as an “AGAINST” vote while broker

non-votes will not have any effect on the proposal.

If

you are a beneficial owner and hold your shares in “street name” in an account at a bank or brokerage firm, it is critical

that you cast your vote if you want it to count in the vote on the above proposals. Under the rules governing banks and brokers who submit

a proxy card with respect to shares held in “street name,” such banks and brokers have the discretion to vote on routine

matters, but not on non-routine matters. Banks and brokers may not vote any of the proposals being presented at the Special Meeting if

you do not provide specific voting instructions. Accordingly, we encourage you to vote promptly, even if you plan to participate in the

Special Meeting.

Can

I change my vote or revoke my proxy?

Subject

to any rules and deadlines your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy

is voted at the Special Meeting. If you are a shareholder of record, you may change your vote by (1) delivering to the Company’s

Corporate Secretary, prior to your shares being voted at Special Meeting, a written notice of revocation dated later than the prior proxy

card relating to the same shares, (2) delivering a valid, later-dated proxy in a timely manner, (3) attending the Special Meeting and

voting electronically (although attendance at the Special Meeting will not, by itself, revoke a proxy), or (4) voting again via phone

or Internet at a later date.

If

you are a beneficial owner of shares held in street name, you may change your vote (1) by submitting new voting instructions to your

broker, trustee or other nominee, or (2) if you have obtained a legal proxy from the broker, trustee or other nominee that holds your

shares giving you the right to vote the shares and provided a copy to our transfer agent and registrar, Equiniti, together with your

email address as described below, by attending the Special Meeting and voting electronically.

Any

written notice of revocation or subsequent proxy card must be received by the Company’s Corporate Secretary prior to the taking

of the vote at the Special Meeting.

Who

will bear the cost of soliciting votes for the Special Meeting?

The

Company will bear the cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes.

If you access the proxy materials over the Internet, you are responsible for Internet access charges you may incur. In addition, we will

request banks, brokers and other intermediaries holding shares of our Common Stock beneficially owned by others to obtain proxies from

the beneficial owners and will reimburse them for their reasonable expenses in so doing. Solicitation of proxies by mail may be supplemented

by telephone, by electronic communications and personal solicitation by our Executive Officers, Directors, and employees. No additional

compensation will be paid to our Executive Officers, Directors or employees for such solicitation.

Proxies

with respect to the Special Meeting may be solicited by telephone, by mail on the Internet or in person. AgEagle has engaged Alliance

Advisors to assist in the solicitation of proxies.

Who

Can Answer Your Questions About Voting Your Shares?

If

you are a holder of AgEagle’s shares and have any questions about how to vote or direct a vote in respect of your securities, you

may call Alliance Advisors, AgEagle’s proxy solicitor, at 866-620-1197 (toll free); or email at UAVS@AllianceAdvisors.com.

PROPOSAL

NO. 1

APPROVAL

TO EFFECT A REVERSE SPLIT OF THE COMPANY’S COMMON STOCK

Purpose

of the Reverse Split

On September 12, 2023, the

Company received written notice (the “Notice”) from the NYSE American LLC (the “NYSE American”) stating that

it is not in compliance with the continued listing standard set forth in Section 1003(f)(v) of the NYSE American Company Guide (the “Company

Guide”) because the Company’s shares of common stock have been selling for a substantial period of time at a low price per

share, which NYSE American determined to be a 30-trading day average of less than $0.20 per share.

The primary purpose of the

Reverse Split is to increase the per share price of our Common Stock in order to maintain the listing of our Common Stock on the NYSE

American. Our Board believes that, in addition to increasing the price of our common stock, the Reverse Split would make our Common Stock

more attractive to a broader range of institutional and other investors. Accordingly, for these and other reasons discussed below, we

believe that effecting the Reverse Split is in the Company’s and our stockholders’ best interests. We believe proposing multiple

ratios for the Reverse Split, rather than proposing that stockholders approve a specific ratio at this time, provides the Board with

the most flexibility to achieve the desired results of the Reverse Split. At this time, the Board is seeking approval from the shareholders

to authorize a reverse split in the range between and including 1-for-10 shares and 1-for-20 shares for all outstanding shares with all

fractional shares rounded up to the next whole share.

No further action on the part

of stockholders will be required to implement the Reverse Split, or to select the specific ratio for the Reverse Split. If the Reverse

Split Proposal is approved, the Board would make the determination as to the final ratio of the Reverse Split which will be accomplished

by amending the Company’s Articles of Incorporation (the “Charter Amendment”). See “Procedure for Effecting a

Reverse Split and Exchange of Stock Certificates” below.

Except for adjustments that

may result from the treatment of fractional shares as described below, each stockholder will hold the same percentage of Common Stock

outstanding immediately following the Reverse Split as that stockholder held immediately before the Reverse Split.

Certain

Risks Associated with the Reverse Split

While

the Board believes that the Company’s Common Stock would trade at higher prices after the consummation of the Reverse Split, there

can be no assurance that the increase in the trading price will occur, or, if it does occur, that it will equal or exceed 10 to 20 times

the market price of the Common Stock prior to the Reverse Split. In some cases, the total market value of a company following a reverse

stock split is lower, and may be substantially lower, than the total market value before the reverse stock split. In addition, the fewer

number of shares that will be available to trade could possibly cause the trading market of the Common Stock to become less liquid, which

could have an adverse effect on the price of the Common Stock. The market price of the Common Stock is based on our performance and other

factors, some of which may be unrelated to the number of our shares outstanding. In addition, there can be no assurance that the Reverse

Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stock.

Principal

Effects of the Reverse Split

The

Reverse Split would have the following effects based upon 117,878,831 shares of Common Stock issued and outstanding as of the

Record Date. In the following discussion, we provide examples of the effects of the Reverse Split at the lower-end of the Reverse Split

range and at the higher-end of the Reverse Split range.

If

the Reverse Split is approved at the lower end of the Reverse Split range:

| |

● |

in

a 1-for-10 Reverse Split, every ten shares of our Common Stock issued and outstanding immediately prior to the Reverse Split effective

date (the “Old Shares”) owned by a shareholder will automatically and without any action on the part of the shareholders

be converted into one (1) share of our Common Stock (the “New Shares”); and |

| |

|

|

| |

● |

the

number of shares of our Common Stock issued and outstanding will be reduced from 117,878,831 shares to approximately 11,787,883

shares. |

| |

If

the Reverse Split is approved at the higher end of the Reverse Split range: |

| |

● |

in

a 1-for-20 Reverse Split, every twenty of our Old Shares owned by a shareholder would be exchanged for one (1) New Share; and |

| |

|

|

| |

● |

the

number of shares of our Common Stock issued and outstanding will be reduced from 117,878,831 shares to approximately 5,893,942

shares. |

The

Reverse Split will be effected simultaneously for all of our outstanding Common Stock and the exchange ratio will be the same for all

of our outstanding Common Stock. The Reverse Split will affect all of our shareholders uniformly and will not affect any shareholder’s

percentage ownership interests in the Company, except to the extent that the Reverse Split results in any of our shareholders owning

a fractional share. As described below, shareholders and holders of options and warrants holding fractional shares will have their shares

rounded up to the nearest whole number. Common Stock issued pursuant to the Reverse Split will remain fully paid and non-assessable.

Fractional

Shares. No scrip or fractional share certificates will be issued in connection with the Reverse Split. Shareholders who otherwise

would be entitled to receive fractional shares because they hold a number of Old Shares not evenly divisible by 1-for-10 or by 1-for-20

Reverse Split ratio, will be entitled, upon surrender of certificate(s) representing these shares, to a number of shares of New Shares

rounded up to the nearest whole number. The ownership of a fractional interest will not give the shareholder any voting, dividend or

other rights except to have his or her fractional interest rounded up to the nearest whole number when the New Shares are issued.

Options

and Warrants. All outstanding options, warrants, notes, debentures and other securities convertible into Common Stock will be adjusted

as a result of the Reverse Split, as required by the terms of these securities. In particular, the conversion ratio for each instrument

will be reduced, and the conversion price or exercise price, if applicable, will be increased, in accordance with the terms of each instrument

and based on the ratio in the range between and including 1-for-10 shares and 1-for-20 shares, with the final ratio to be determined

by the Company’s Board.

Authorized

Shares. The Company is presently authorized under its Articles of Incorporation to issue 250,000,000 shares of Common Stock. Upon

effectiveness of the Reverse Split, the number of authorized shares of Common Stock would remain the same, although the number of shares

of Common Stock issued and outstanding will decrease. Because the number of issued and outstanding shares of Common Stock will decrease,

the number of shares of Common Stock remaining authorized and available for issuance will increase. The issuance in the future of additional

shares of our Common Stock may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership

and voting rights of the currently outstanding shares of our Common Stock. The effective increase in the number of authorized but unissued

and unreserved shares of the Company’s Common Stock may be construed as having an anti-takeover effect as further discussed below.

Authorized but unissued shares will be available for issuance, and we may issue such shares in future financings or otherwise. If we

issue additional shares, the ownership interest of holders of our Common Stock would be diluted. Also, the issued shares may have rights,

preferences or privileges senior to those of our Common Stock.

Impact

of the Reverse Split on Awards Issued under our 2017 Omnibus Equity Incentive Plan (the “Plan”). The Company currently

has reserved a total of 10,000,000 shares of Common Stock for issuance as awards to be made under the Plan. As of the date hereof, the

Company has 8,107,790 awards granted under the Plan, and has 1,892,210 shares of Common Stock remaining for future issuance

under the Plan. The aggregate number of shares of Common Stock available under the Plan will be appropriately reduced in the same Reverse

Split ratio as our Common Stock. The effect of the Reverse Split on the awards issued under the Plan based on the range is as follows:

| |

● |

in

a 1-for-10 Reverse Split, the number of shares previously issued under the award granted under the Plan will be reduced from 8,107,790

to 810,779 and |

| |

|

|

| |

● |

in

a 1-for-20 Reverse Split, the number of shares previously issued under the award granted under the Plan will be reduced from 8,107,790

to 405,390. |

The

effect of the Reverse Split on the shares of Common Stock reserved for issuance under the Plan based on the range is as follows:

| |

● |

in

a 1-for-10 Reverse Split, the number of shares of Common Stock reserved for issuance under the Plan will be reduced from 1,892,210

to 189,221 with 189,221 shares of Common Stock available for future issuance under the Plan; and |

| |

|

|

| |

● |

in

a 1-for-20 Reverse Split, the number of shares of Common Stock reserved for issuance under the Plan will be reduced from 1,892,210

to 94,611, with 94,611 shares of Common Stock available for future issuance under the Plan. |

If

the Reverse Split is approved, at the lower end of the Reverse Split range, the total authorized number of shares under the Plan will

represent approximately 8.5% of the issued and outstanding shares of Common Stock of the Company as of the date hereof.

If

the Reverse Split is approved, at the higher end of the Reverse Split range, the total authorized number of shares under the Plan will

represent approximately 8.5% of the issued and outstanding shares of Common Stock of the Company as of the date hereof.

Accounting

Matters. The Reverse Split will not affect the par value of our Common Stock. As a result, on the effective date of the Reverse Split,

the stated capital on our balance sheet attributable to our Common Stock will be reduced in proportion to the Reverse Split ratio (that

is, in a 1-for-10 Reverse Split, the stated capital attributable to our Common Stock will be reduced to one-tenth of its existing amount

and in a 1-for-20 Reverse Split, the stated capital attributable to our Common Stock will be reduced to one-twentieth of its existing

amount) and the additional paid-in capital account shall be credited with the amount by which the stated capital is reduced. The per

share net income or loss and net book value of our Common Stock will also be increased because there will be fewer shares of our Common

Stock outstanding.

Potential

Anti-Takeover Effect. Although the increased proportion of unissued authorized shares to issued shares could, under certain circumstances,

have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect

a change in the composition of our Board or contemplating a tender offer or other transaction for the combination of the Company with

another company), the Reverse Split was not proposed in response to any effort of which we are aware to accumulate our shares of Common

Stock or obtain control of us, nor is it part of a plan by management to recommend a series of similar actions having an anti-takeover

effect to our Board and shareholders. Other than the Reverse Split, our Board does not currently contemplate recommending the adoption

of any other corporate action that could be construed to affect the ability of third parties to take over or change control of the Company.

The

number of shares held by each individual shareholder will be reduced if the Reverse Split is implemented. This will increase the number

of shareholders who hold less than a “round lot,” or 100 shares. Typically, the transaction costs to shareholders selling

“odd lots” are higher on a per share basis. Consequently, the Reverse Split could increase the transaction costs to existing

shareholders in the event they wish to sell all or a portion of their shares.

The

Company is subject to the periodic reporting and other requirements of the Exchange Act. If the proposed Reverse Split is implemented,

our Common Stock will continue to be reported on The NYSE American under the symbol “UAVS.” We will continue to be subject

to the periodic reporting requirements of the Exchange Act.

Procedure

for Effecting a Reverse Split and Exchange of Stock Certificates

The

Reverse Split will be accomplished by amending the Company’s Articles of Incorporation to effect the split. The Reverse Split will

become effective at such future date and the exact ratio to be as determined by the Board, as evidenced by the filing of an amendment

to the Company’s Articles of Incorporation with the Secretary of State of the State of Nevada (which we refer to as the “Effective

Time”) following the affirmative vote of the Company’s shareholders at the Special Meeting. Beginning at the Effective Time,

each certificate representing Old Shares will be deemed for all corporate purposes to evidence ownership of New Shares. As soon as practicable

after the Effective Time, shareholders will be notified that the Reverse Split has been effected. The Company expects that its transfer

agent, Equiniti Trust, will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of Old Shares

will be asked to surrender to the exchange agent certificates representing Old Shares in exchange for certificates representing New Shares

in accordance with the procedures to be set forth in the letter of transmittal the Company sends to its shareholders. No new certificates

will be issued to any shareholder until such shareholder has surrendered such shareholder’s outstanding certificate(s), together

with the properly completed and executed letter of transmittal, to the exchange agent. Any Old Shares submitted for transfer, whether

pursuant to a sale, other disposition or otherwise, will automatically be exchanged for New Shares. Equiniti Trust, does not charge a

fee for each certificate issued representing New Shares.

SHAREHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S)

AND

SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Material

U.S. Federal Income Tax Consequences of the Reverse Split

The

following is a general discussion of the material U.S. federal income tax consequences of the Reverse Split to a current shareholder

of the Company that is a U.S. Holder (as defined below), and who holds stock of the Company as a “capital asset,” as defined

in Section 1221 of the Code (generally, property held for investment). This discussion does not purport to be a complete analysis of

all of the potential tax effects of the Reverse Split. Tax considerations applicable to a particular shareholder will depend on that

shareholder’s individual circumstances.

This

discussion is based on provisions of the Code, the Treasury Regulations promulgated thereunder (whether final, temporary, or proposed),

administrative rulings of the IRS, and judicial decisions, all as in effect on the date hereof, and all of which are subject to differing

interpretations or change, possibly with retroactive effect. This discussion does not purport to be a complete analysis or listing of

all potential U.S. federal income tax considerations that may apply to a holder as a result of the Reverse Split. In addition, this discussion

does not address all aspects of U.S. federal income taxation that may be relevant to particular holders nor does it take into account

the individual facts and circumstances of any particular holder that may affect the U.S. federal income tax consequences to such holder,

and accordingly, is not intended to be, and should not be construed as, tax advice. This discussion does not address the U.S. federal

3.8% Medicare tax imposed on certain net investment income or any aspects of U.S. federal taxation other than those pertaining to the

income tax, nor does it address any tax consequences arising under any tax laws other than the U.S. federal income tax law, such as gift

or estate tax laws, U.S. state and local, or non-U.S. tax laws.

This

discussion does not address all aspects of U.S. federal income taxation that may be important to holders in light of their individual

circumstances, including holders subject to special treatment under the U.S. tax laws, such as, for example:

| |

● |

banks

or other financial institutions, underwriters, or insurance companies; |

| |

|

|

| |

● |

traders

in securities who elect to apply a mark-to-market method of accounting; |

| |

|

|

| |

● |

real

estate investment trusts and regulated investment companies; |

| |

|

|

| |

● |

tax-exempt

organizations, qualified retirement plans, individual retirement accounts, or other tax- deferred accounts; |

| |

|

|

| |

● |

expatriates

or former long-term residents of the United States; |

| |

|

|

| |

● |

subchapter

S corporations, partnerships or other pass-through entities or investors in such entities; |

| |

|

|

| |

● |

dealers

or traders in securities, commodities or currencies; |

| |

|

|

| |

● |

grantor

trusts; |

| |

|

|

| |

● |

persons

subject to the alternative minimum tax; |

| |

|

|

| |

● |

U.S.

persons whose “functional currency” is not the U.S. dollar; |

| |

|

|

| |

● |

persons

who received stock of the Company through the issuance of restricted stock under an incentive plan or through a tax-qualified retirement

plan or otherwise as compensation; |

| |

|

|

| |

● |

persons

who own (directly or through attribution) 5% or more (by vote or value) of the outstanding stock of the Company; |

| |

● |

holders

who hold stock of the Company, as a position in a “straddle,” as part of a “synthetic security” or “hedge,”

as part of a “conversion transaction,” or other integrated investment or risk reduction transaction; or |

| |

|

|

| |

● |

controlled

foreign corporations, passive foreign investment companies, or foreign corporations with respect to which there are one or more United

States shareholders within the meaning of Treasury Regulation Section 1.367(b)-3(b)(1)(ii). |

As

used in this proxy statement/consent solicitation statement/prospectus, the term “U.S. Holder” means a beneficial owner of

stock of the Company that is, for U.S. federal income tax purposes:

| |

● |

an

individual who is a citizen or resident of the United States; |

| |

|

|

| |

● |

a

corporation (or other entity that is classified as a corporation for U.S. federal income tax purposes) that is created or organized

in or under the laws of the United States or any state thereof or the District of Columbia; |

| |

|

|

| |

● |

an

estate the income of which is subject to U.S. federal income tax regardless of its source; or |

| |

|

|

| |

● |

a

trust (i) if a court within the United States is able to exercise primary supervision over the administration of the trust and one

or more U.S. persons have the authority to control all substantial decisions of the trust, or (ii) that has a valid election in effect

under applicable Treasury Regulations to be treated as a U.S. person for U.S. federal income tax purposes. |

If

a partnership, including for this purpose any entity or arrangement that is treated as a partnership for U.S. federal income tax purposes,

holds stock of the Company, the U.S. federal income tax treatment of a partner in such partnership will generally depend on the status

of the partner and the activities of the partner and the partnership. A holder that is a partnership and the partners in such partnership

should consult their own tax advisors with regard to the U.S. federal income tax consequences of the Reverse Split.

The

Reverse Split should constitute a “recapitalization” for U.S. federal income tax purposes. As a recapitalization, no gain

or loss should be recognized by a U.S. Holder upon such shareholder’s deemed exchange of Old Shares for New Shares pursuant to

the Reverse Split. A U.S. Holder’s aggregate tax basis of the New Shares received in the Reverse Split should be the same as such

shareholder’s aggregate tax basis in the Old Shares being exchanged, and the holding period of the New Shares should include the

holding period of such shareholder in the Old Shares.

A

U.S. Holder whose fractional shares resulting from the Reverse Split are rounded up to the nearest whole share may recognize gain for

U.S. federal income tax purposes equal to the value of the additional fractional share. The treatment of the exchange of a fractional

share for a whole share in the Reverse Split is not clear under current law and a U.S. Holder may recognize gain for U.S. federal income

tax purposes equal to the value of the additional fraction of a share of Common Stock received by such U.S. Holder.

Because

of the complexity of the tax laws and because the tax consequences to the Company or to any particular shareholder may be affected by

matters not discussed herein, shareholders are urged to consult their own tax advisors as to the specific tax consequences to them in

connection with the Reverse Split, including tax reporting requirements, the applicability and effect of non-U.S., U.S. federal, state

and local and other applicable tax laws and the effect of any proposed changes in the tax laws.

Dissenters’

Rights of Appraisal

We

are a Nevada corporation and are governed by the Nevada Revised Statutes. Holders of the Company’s Common Stock will not have appraisal

or dissenter’s rights under Nevada law in connection with the Reverse Split.

Interest

of Certain Persons in Matters to be Acted Upon

No

director, executive officer, associate of any director or executive officer or any other person has any substantial interest, direct

or indirect, by security holdings or otherwise, in the Reverse Split that is not shared by all other shareholders of ours.

Approval

Required for Approval

The

affirmative vote of a majority of votes cast in person or represented by proxy at the Special Meeting is required to approve the

Reverse Split Proposal. Abstentions and broker non-votes will not be counted as votes cast and, accordingly, will have no effect

with respect to the approval of the Reverse Split Proposal.

THE

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE REVERSE SPLIT PROPOSAL.

PROPOSAL

NO. 2

AMENDMENT

TO AGEAGLE AERIAL SYSTEMS INC. 2017 OMNIBUS EQUITY INCENTIVE PLAN

Summary

and Purpose of the Amendment to AgEagle Aerial Systems Inc. 2017 Omnibus Equity Incentive Plan

The

Board of Directors has voted to amend the Company’s 2017 Omnibus Equity Incentive Plan (the “Plan”) to increase

the number of shares of Common Stock authorized for issuance under the Plan by 5,000,000 shares to 15,000,000 shares.

Increase

in Number of Authorized Shares

The

Plan has been in place since 2017. Currently, there are 10,000,000 shares of Common Stock authorized for issuance under the Plan. However,

as of the date hereof, the Company has 8,107,790 awards granted under the Plan, and only has 1,892,210 shares of Common

Stock remaining for future issuance under the Plan. After the effectiveness of the Reverse Split, there will be only 189,221 shares

of Common Stock available for future issuance under the Plan in the case of a 1-for-10 Reverse Split, and 94,611 shares in the

case of a 1-for-20 Reverse Split. The Board of Directors believes that the Company’s success depends in large part on its ability

to attract, retain, and motivate its executive officers and other key personnel and that grants of awards under the Plan may be a significant

element of compensation for such persons. In addition, as the Company considers future acquisitions it will need flexibility to grant

awards to employees of such companies. The Board of Directors believes that the proposed increase in the number of shares of Common Stock

available for issuance as provided in the Plan will provide the Compensation Committee with greater flexibility in the administration

of the Plan and is appropriate in light of the growth of the Company in order to attract and retain key individuals. Following the proposed

increase, the total authorized number of shares under the Plan will be 1,500,000 shares under the Plan in the case of a 1-for-10

Reverse Split, and 750,000 shares under the Plan in the case of a 1-for-20 Reverse Split which shall represent approximately 12.7%

of the issued and outstanding shares of Common Stock of the Company after the Reverse Split under both scenarios.

The

amendment to the Plan is attached as Appendix A to this Proxy Statement.

Company

2017 Omnibus Equity Incentive Plan

The

2017 Omnibus Equity Plan is a comprehensive incentive compensation plan under which the Company can grant equity-based and other incentive

awards to officers, employees and directors of, and consultants and advisers to, the Company The purpose of the Plan is to help the Company

attract, motivate and retain such persons and thereby enhance shareholder value. The Plan provides for the grant of awards which are

incentive stock options (“ISOs”), non-qualified stock options (“NQSOs”), unrestricted shares, restricted shares,

restricted stock units, performance stock, performance units, SARs, tandem stock appreciation rights, distribution equivalent rights,

or any combination of the foregoing, to key management employees, non-employee directors, and non-employee consultants of the Company

or any of its subsidiaries (each a “participant”) (however, solely Company employees or employees of the Company’s

subsidiaries are eligible for incentive stock option awards). The Company currently has reserved a total of 10,000,000 shares of common

stock for issuance as or under awards to be made under the Plan.

Types

of Stock Awards

The

Plan provides for the grant of incentive stock options and non-qualified stock options. Stock options may be granted to employees, including

officers, non-employee directors and consultants of the Company or its affiliates, except that incentive stock options may be granted

only to employees.

Share

Reserve

The

aggregate number of shares of Common Stock that have been reserved for issuance under the Plan is 10,000,000. As of the Record Date,

there are 8,107,790 awards granted under the Plan, and only has 1,892,210 shares of Common Stock remaining for future issuance

under the Plan. If a stock option award expires, terminates, is canceled or is forfeited for any reason, the number of shares subject

to the stock option award will again be available for issuance. In addition, if stock awards are settled in cash, the share reserve will

be reduced by the number of shares of common stock with a value equal to the amount of the cash distributions as of the time that such

amount was determined and if stock options are exercised using net exercise, the share reserve will be reduced by the gross number of

shares of common stock subject to the exercised portion of the option. We also had no underlying options that have been granted

outside of the Plan.

Administration

The

Board of Directors or a duly authorized committee thereof, has the authority to administer the Plan. Subject to the terms of the Plan,

the Board of Directors or the authorized committee, referred to herein as the committee, determines recipients, dates of grant, the numbers

and types of stock awards to be granted and the terms and conditions of the stock option awards, including the period of exercisability

and vesting schedule applicable to a stock option award. Subject to the limitations set forth below, the committee will also determine

the exercise price and the types of consideration to be paid for the award. The committee has the authority to modify outstanding awards

under the Plan. The committee has the authority to adopt, alter and repeal administrative rules, guidelines and practices governing the

Plan and to perform all other acts, including delegating administrative responsibilities, as it deems advisable to construe and interpret

the terms and provisions of the Plan and any stock option award granted under the Plan. Decisions and interpretations or other actions

by the committee are in the discretion of the committee and are final binding and conclusive on the company and all participants in the

Plan.

Stock

Options

Incentive

stock options and non-qualified stock options are granted pursuant to stock option award agreements adopted by the committee. The committee

determines the exercise price for a stock option, within the terms and conditions of the Plan, provided that the exercise price shall

not be less than (i) in the case of a grant of any NQSO or an ISO to a key employee who at the time of the grant does not own stock representing

more than ten percent (10%) of the total combined voting power of all classes of our stock or of any subsidiary, one hundred percent

(100%) of the fair market value of a share of common stock as determined on the date the stock option award is granted; (ii) in the case

of a grant of an ISO to a key employee who, at the time of grant, owns stock representing more than ten percent (10%) of the total combined

voting power of all classes of our stock or of any subsidiary, one hundred ten percent (110%) of the fair market value of a share of

common stock, as determined on the date the stock option award is granted. The fair market value of the common stock for purposes of

determining the exercise price shall be determined by the committee in accordance with any reasonable method of valuation consistent

with applicable requirements of Federal tax law, including, as applicable, the provisions of Code Section 422(c)(8) and 409A as applicable.

Stock options granted under the Plan will become exercisable at the rate specified by the committee and may be exercisable for restricted

stock, if determined by the committee.

The

committee determines the term of stock options granted under the Plan, up to a maximum of ten years. The option holder’s stock

option agreement shall provide the rights, if any, that such holder has to exercise the stock option at such time that such holder’s

service relationship with us, or any of our affiliates, ceases for any reason, including disability, death, with or without cause, or

voluntary resignation. All unvested stock option awards are forfeited if the participant’s employment or service is terminated

for any reason, unless our compensation committee determines otherwise.

Acceptable

consideration for the purchase of common stock issued upon the exercise of a stock option will be determined by the committee and may

include (i) check, bank draft or money order, or wire transfer, (ii) if the company’s common stock is publicly traded, a broker-assisted

cashless exercise, or (iii) such other methods as may be approved by the committee, including without limitation, the tender of shares

of our common stock previously owned by the option holder or a net exercise of the option.

Unless

the committee provides otherwise, options generally are not transferable except by will, the laws of descent and distribution. The committee

may provide that a non-qualified stock option may be transferred to a family member, as such term is defined under the applicable securities

laws.

Tax

Limitations on Incentive Stock Options

The

aggregate fair market value, determined at the time of grant, of our common stock with respect to incentive stock options that are exercisable

for the first time by an option holder during any calendar year may not exceed $100,000. Options or portions thereof that exceed such

limit will generally be treated as non-qualified stock options. No incentive stock option may be granted to any person who, at the time

of the grant, owns or is deemed to own stock possessing more than 10% of our total combined voting power or that of any of our affiliates

unless (i) the option exercise price is at least 110% of the fair market value of the stock subject to the option on the date of grant,

and (ii) the term of the incentive stock option does not exceed five years from the date of grant.

Adjustments

for Changes in Capital Structure and other Special Transactions

In

the event of a stock dividend, stock split, or recapitalization, or a corporate reorganization in which we are a surviving corporation

(and our shareholders prior to such transaction continue to own at least 50% of our capital stock after such transaction), including

without limitation a merger, consolidation, split-up or spin-off, or a liquidation, or distribution of securities or assets other than

cash dividends, the number or kinds of shares subject to the Plan or to any stock option award previously granted, and the exercise price,

shall be adjusted proportionately by the committee to reflect such event.

In

the event of a merger, consolidation, or other form of reorganization with or into another corporation (other than a merger, consolidation,

or other form of reorganization in which we are the surviving corporation and our shareholders prior to such transaction continue to

own at least 50% of the capital stock after such transaction), a sale or transfer of all or substantially all of the assets of the Company

or a tender or exchange offer made by any corporation, person or entity (other than an offer made by us), all stock options held by any

option holder shall be fully vested and exercisable by the option holder.

Furthermore,

the committee, either before or after the merger, consolidation or other form of reorganization, may take such action as it determines

in its sole discretion with respect to the number or kinds of shares subject to the Plan or any option under the Plan.

Amendment,

Suspension or Termination

The

committee may at any time amend, suspend, or terminate any and all parts of the Plan, any stock option award granted under the Plan,

or both in such respects as the committee shall deem necessary or desirable, except that no such action may be taken which would impair

the rights of any option holder with respect to any stock option award previously granted under the Plan without the option holder’s

consent.

Executive

Compensation Discussion and Analysis

This

Compensation Discussion and Analysis describes our executive compensation philosophy and objectives, provides context for the compensation

actions approved by the Compensation Committee, and explains the compensation of each of our NEOs. AgEagle’s Compensation Committee,

which is made up of entirely of independent directors, oversees AgEagle’s compensation plans and policies, approves the compensation

for executive officers and administers our equity compensation plans, as well as our organizational development activities and human

capital management.

Summary

Compensation Table (“SCT”)

The

following information is furnished for the Principal Executive Officer (“PEO”) of the Company or its subsidiaries and the

two most highly-compensated executive officers (other than the principal executive officer) of the Company and its subsidiaries whose

total compensation for the fiscal year ended December 31, 2022, exceeded $100,000. These individuals are sometimes referred to in this

proxy statement as the “Named Executive Officers (“NEOs”).

| Name

& Principal Position | |

Year | | |

Salary | | |

Bonus | | |

Stock

Awards (5) | | |

Option

Awards (7) | | |

All

Other Compensation (8) | | |

Total | |

| Barrett

Mooney (1) | |

2022 | | |

$ | 361,000 | | |

$ | - | | |

$ | - | | |

$ | 31,725 | | |

$ | 21,745 | | |

$ | 414,470 | |

| Chairman

and CEO | |

2021 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nicole

Fernandez-McGovern | |

2022 | | |

$ | 308,462 | | |

$ | 110,000 | | |

$ | 225,750 | | |

$ | 31,725 | | |

$ | 24,257 | | |

$ | 700,194 | |

| CFO

& EVP of Operations | |

2021 | | |

$ | 220,000 | | |

$ | 66,700 | | |

$ | 1,594,700 | | |

$ | 182,800 | (6) | |

$ | - | | |

$ | 2,064,200 | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Michael

O’Sullivan (2) | |

2022 | | |

$ | 259,372 | | |

$ | 110,233 | | |

$ | 93,661 | | |

$ | 7,070 | | |

$ | - | | |

$ | 470,336 | |

| Chief

Commercial Officer | |

2021 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Brandon

Torres Declet (3) | |

2022 | | |

$ | 23,726 | | |

$ | 5,000 | | |

$ | 173,025 | | |

$ | - | | |

$ | 119,380 | | |

$ | 321,131 | |

| Former

CEO | |

2021 | | |

$ | 157,211 | | |

$ | 10,000 | | |

$ | 895,500 | | |

$ | 132,325 | (6) | |

$ | - | | |

$ | 1,195,036 | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| J.

Michael Drozd (4) | |

2022 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Former

CEO | |

2021 | | |

$ | 103,044 | | |

$ | 49,130 | | |

$ | 1,220,763 | | |

$ | 50,475 | (6) | |

$ | 117,500 | | |

$ | 1,540,912 | |

| |

(1) |

Mr.

Mooney was reappointed by the Board of Director to serve as Chief Executive Officer of the Company on January 17, 2022. |

| |

(2) |

Mr.

O’Sullivan’s termination will be effective on September 20, 2023. He joined the Company in October 2021 upon the acquisition

of senseFly and thereafter served as Managing Director of AgEagle’s Swiss Operations, and was promoted to Chief Commercial

Officer on April 11, 2022. |

| |

(3) |

Mr.

Torres Declet served as the Company’s Chief Executive Officer between May 24, 2021 and January 17, 2022. In connection with

Mr. Torres Declet’s departure from AgEagle in January 2022, he received stock awards valued at $125,000 and other compensation

of $117,500 in severance considerations. |

| |

(4) |

Mr.

Drozd served as the Company’s Chief Executive Officer between May 1, 2020 and May 23, 2021. In connection with Mr. Drozd’s

departure from AgEagle in May 2021, he received stock awards valued at $125,000 and other compensation of $117,500 in severance considerations.

|

| |

(5) |

Represents

RSUs granted to Ms. Fernandez-McGovern, Mr. O’Sullivan, Mr. Torres Declet and Mr. Drozd. Reflects the aggregate grant date

fair value for restricted stock awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification

(“FASB ASC”) Topic 718 - Share Based Payment, based on the closing price of the Company’s common stock underlying

the respective RSU at the date of grant. Restricted stock awards were issued under AgEagle’s 2017 Omnibus Equity Plan (the

Plan”) and vest over one year of service or immediately if determined to be a performance-based award. |

| |

(6) |

The

Company had incorrectly reported the fair market value of the option awards in 2021. These amounts have been corrected to properly

reflect the fair market value in accordance with FASB ASC Topic 718 – Share Based Payment. |

| |

(7) |

Represents

options granted to Mr. Mooney, Ms. Fernandez-McGovern, Mr. O’Sullivan, Mr. Torres Declet and Mr. Drozd. The aggregate grant

date fair value of the options awarded to each executive officer is computed in accordance with FASB ASC Topic 718. The assumptions

used to calculate the fair value of stock option awards are based on the Black-Scholes option valuation model and excludes the effect

of forfeiture assumptions. These awards generally vest over a two-year period from the date of grant. Although the full grant date

fair value of the stock option awards are reflected in the above table, the actual value of the stock options, if any, realized by

the named executive officers will depend on the extent to which the market value of the Company common stock exceeds the exercise

price of the stock option on the date of exercise. Accordingly, there is no assurance that the option value realized by a named executive

officer will be at or near the estimated value reflected in the above table. |

| |

(8) |

All

Other Compensation includes health insurance premiums and employer contributions to 401(k) plan. |

Pay

Versus Performance

In

accordance with the SEC’s disclosure requirements pursuant to Item 402(v) of Regulation S-K promulgated under the Exchange Act,

regarding Pay Versus Performance (PVP), provided below is the Company’s PVP disclosures. As required by Item 402(v) for Smaller

Reporting Companies, we have included a table that compares the total compensation of our principal executive officer (“PEO”)

and average other named executive officers (“Non-PEO NEOs”), as presented in the Summary Compensation Table (“SCT”),

to Compensation Actually Paid (“CAP”). The table and disclosure below also compares CAP to our indexed TSR and GAAP Net Income.

This

disclosure has been prepared in accordance with Item 402(v) and does not necessarily reflect value actually realized by the executives

or how our Compensation Committee evaluates compensation decisions in light of Company or individual performance. In particular, our

Compensation Committee has not used CAP as a basis for making compensation decisions, nor does it use GAAP Net Income for purposes of

determining incentive compensation.

Pay

Versus Performance Table – Compensation Definitions

Salary,

Bonus, Stock Awards, and All Other Compensation are each calculated in the same manner for purposes of both CAP and SCT values. The primary

difference between the calculation of CAP and SCT total compensation is the calculation of the value of “Stock Awards,” with

the table below describing the differences in how these awards are valued for purposes of SCT total and CAP.

Pay

Versus Performance Table

In