Form N-CSRS - Certified Shareholder Report, Semi-Annual

September 08 2023 - 9:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: |

811-05770 |

| |

|

| Exact name of registrant as specified in charter: |

abrdn Emerging Markets Equity Income Fund, Inc. |

| |

|

| Address of principal executive offices: |

1900 Market Street, Suite 200

Philadelphia, PA 19103 |

| |

|

| Name and address of agent for service: |

Ms. Sharon Ferrari

abrdn Inc.

1900 Market Street, Suite 200

Philadelphia, PA 19103 |

| |

|

| Registrant’s telephone number, including area code: |

800-522-5465 |

| |

|

| Date of fiscal year end: |

December 31 |

| |

|

| Date of reporting period: |

June 30, 2023 |

Item 1 - Reports to Stockholders.

(a) A copy of the report transmitted

to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith.

abrdn Emerging Markets

Equity Income Fund, Inc. (AEF)

Semi-Annual Report

June 30, 2023

Letter to Shareholders (unaudited)

Dear Shareholder,

We present the Semi-Annual

Report, which covers the activities of abrdn Emerging Markets Equity Income Fund, Inc. (the “Fund”), for the six-month period ended June 30, 2023. The Fund’s investment objective is to seek to

provide both current income and long-term capital appreciation.

Total Investment Return1

For the six-month period

ended June 30, 2023, the total return to shareholders of the Fund based on the net asset value (“NAV”) and market price of the Fund, respectively, compared to the Fund’s benchmark is as follows:

| NAV2,3

| 7.78%

|

| Market Price2

| 4.64%

|

| MSCI Emerging Markets Index (Net Daily Total Return)4

| 4.89%

|

For more information about

Fund performance, please visit the Fund on the web at www.abrdnaef.com. Here, you can view quarterly commentary on the Fund's performance, monthly fact sheets, distribution and performance information, and other Fund

literature.

NAV, Market Price and

Premium(+)/Discount(-)

The below table represents

comparison from current six-month period end to prior fiscal year end of market price to NAV and associated Premium(+) and Discount(-).

|

|

|

|

| NAV

| Closing

Market

Price

| Premium(+)/

Discount(-)

|

| 6/30/2023

| $6.00

| $5.19

| -13.50%

|

| 12/31/2022

| $5.78

| $5.15

| -10.90%

|

During the six-month period

ended June 30, 2023, the Fund’s NAV was within a range of $5.72 to $6.61 and the Fund’s market price traded within a range of $4.90 to $5.78. During the six-month period ended June 30, 2023, the

Fund’s shares traded within a range of a premium(+)/discount(-) of -9.10% to -15.08%.

Distribution Policy

The Fund has a managed

distribution policy of paying quarterly distributions at an annual rate, set once a year, as a percentage of the rolling average of the Fund’s NAVs over the preceding three month period ending on the last day of

the month immediately preceding the distribution’s declaration date. In March 2023, the Board of Directors of the Fund (the “Board”) determined the rolling distribution rate to be 6.5% for the

12-month period commencing with the distribution payable in June 2023. This policy will be subject to regular review by the Board.

The policy is expected to

provide a steady and sustainable quarterly cash distribution to Fund shareholders that may help reduce any discount to NAV at which the Fund’s shares trade. There is no assurance that the Fund will achieve these

results.

The distributions will be

made from net investment income generated by dividends paid from the Fund’s underlying securities and return of capital. As net assets of the Fund may vary from quarter to quarter, the quarterly distribution may

represent more or less than one quarter of 6.5% of the Fund’s net assets at the time of distribution. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of

the distributions or the terms of the Fund’s policy.

Conditional Tender Offer

In May 2023 the Board adopted

a policy pursuant to which it will cause the Fund to conduct a one-time tender offer for twenty percent (20%) of its then issued and outstanding shares of common stock on or before December 31, 2025, if the Fund's

total return investment performance measured on a NAV basis does not equal or exceed the total return investment performance of the MSCI Emerging Markets Index (Net Daily Total Return) during the period commencing on

October 1, 2022 and ending on September 30, 2025.

Credit Facility

On June 20, 2023, the Fund

renewed its revolving credit facility for a 1-year period with The Bank of Nova Scotia with a committed facility of $40,000,000. The outstanding balance on the loan as of June 30,

{foots1}

| 1

| Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be

lower or higher than the performance quoted. Net asset value return data include investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of

all distributions.

|

{foots1}

| 2

| Assuming the reinvestment of all dividends and distributions.

|

{foots1}

| 3

| The Fund’s total return is based on the reported NAV for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments.

|

{foots1}

| 4

| The MSCI Emerging Markets Index (Net Daily Total Return) (the "Index") captures large and mid-cap representation across 24 Emerging Markets (EM) countries. With 1,377 constituents, the Index covers

approximately 85% of the free float-adjusted market capitalization in each country. EM countries in the Index are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea,

Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The Index is calculated net of withholding taxes to which the Fund is

generally subject. The Index is unmanaged and has been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index. Index performance is not an indication of the

performance of the Fund itself. For complete Fund performance, please visit http://www.abrdnaef.com.

|

Letter to Shareholders (unaudited) (concluded)

2023 was $35,000,000. Under the terms of the

loan facility and applicable regulations, the Fund is required to maintain certain asset coverage ratios for the amount of its outstanding borrowings. The Board regularly reviews the use of leverage by the Fund.

Unclaimed Share Accounts

Please be advised that

abandoned or unclaimed property laws for certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed

property, and Fund shares could be considered “unclaimed property” due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to

a shareholder is returned to the Fund’s transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Fund’s

transfer agent will follow the applicable state’s statutory requirements to contact you, but if unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will

have to contact the state to recover your property, which may involve time and expense. For more information on unclaimed property and how to maintain an active account, please contact your financial adviser or the

Fund’s transfer agent.

Open Market Repurchase Program

The Fund’s Board

approved an open market repurchase and discount management policy (the “Program”). The Program allows the Fund to purchase, in the open market, its outstanding common shares, with the amount and timing of

any repurchase determined at the discretion of the Fund’s investment adviser. Such purchases may be made opportunistically at certain discounts to NAV per share in the reasonable judgment of management based on

historical discount levels and current market conditions. If shares are repurchased, the Fund reports repurchase activity on the Fund's website on a monthly basis. For the six-month period ended June 30, 2023,

the Fund did not repurchase any shares through the Program.

Portfolio Holdings Disclosure

The Fund’s complete

schedule of portfolio holdings for the second and fourth quarters of each fiscal year are included in the Fund’s semi-annual and annual reports to shareholders. The Fund files its complete schedule of portfolio

holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. These reports are available on the

SEC’s website at http://www.sec.gov. The Fund makes the information available to shareholders upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465.

Proxy Voting

A description of the policies

and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month

period ended June 30 is available by August 31 of the relevant year: (1) upon request without charge by calling Investor Relations toll-free at 1-800-522-5465; and (2) on the SEC’s website at

http://www.sec.gov.

Investor Relations Information

As part of abrdn’s

commitment to shareholders, we invite you to visit the Fund on the web at www.abrdnaef.com. There, you can view monthly fact sheets, quarterly commentary, distribution and performance information, and other Fund

literature.

Enroll in abrdn’s email

services and be among the first to receive the latest closed-end fund news, announcements, videos, and other information. In addition, you can receive electronic versions of important Fund documents, including annual

reports, semi-annual reports, prospectuses and proxy statements. Sign up today at https://www.abrdn.com/en-us/cefinvestorcenter/contact-us/preferences

Contact Us:

| •

| Visit: https://www.abrdn.com/en-us/cefinvestorcenter

|

| •

| Email: Investor.Relations@abrdn.com; or

|

| •

| Call: 1-800-522-5465 (toll free in the U.S.).

|

Yours sincerely,

/s/ Christian Pittard

Christian Pittard

President

{foots1}

All amounts are U.S.

Dollars unless otherwise stated.

Total Investment Return (unaudited)

The following table summarizes

the average annual Fund performance compared to the Fund’s primary benchmark and Custom Index (as defined below) for the six-month (not annualized), 1-year, 3-year, 5-year and 10-year periods ended

June 30, 2023.

|

| 6 Months

| 1 Year

| 3 Years

| 5 Years

| 10 Years

|

| Net Asset Value (NAV)

| 7.78%

| 4.31%

| 0.94%

| -0.27%

| -0.24%

|

| Market Price

| 4.64%

| 1.34%

| 1.54%

| -0.63%

| -0.84%

|

| MSCI Emerging Markets Index (Net Daily Total Return)

| 4.89%

| 1.75%

| 2.32%

| 0.93%

| 2.95%

|

| Custom AEF Emerging Markets Index1

| 4.89%

| 1.75%

| 2.32%

| 0.93%

| 0.44%

|

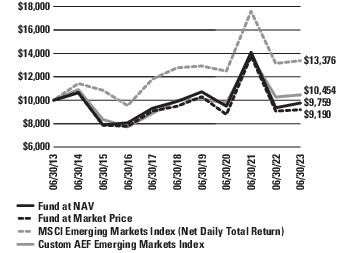

Performance of a $10,000

Investment (as of June 30, 2023)

This graph shows the change in

value of a hypothetical investment of $10,000 in the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

All performance information

for the periods prior to April 30, 2018 are for the Aberdeen Latin American Equity Fund, Inc. (“LAQ”), the performance and accounting survivor of the reorganizations of seven closed-end funds into the

Fund. Performance information for periods prior to April 30, 2018 do not reflect the Fund’s current investment strategy. Returns prior to April 30, 2018 reflect the impact of any contractual waivers in effect

for LAQ, without which performance would be lower. Effective April 30, 2018, abrdn Investments Limited (formerly known as Aberdeen Asset Managers Limited) (the "Investment Adviser" or the "Adviser"), the Fund’s

Adviser, entered into an expense limitation agreement with the Fund that is effective through June 30, 2024. Without such waivers and limitation agreements, performance would be lower.

abrdn Inc. has entered into

an agreement with the Fund to limit investor relations services fees,without which performance would be lower if the Fund’s investor services fees exceeded such limit during the relevant period. This agreement

aligns with the term of the advisory agreement and may not be terminated prior to the end of the current term of the advisory agreement. See Note 3 in the Notes to Financial Statements.

{foots1}

| 1

| The Custom Index reflects the returns of the MSCI Emerging Markets Latin America Index (Net Daily Total Return) for periods prior to April 27, 2018 and the returns of

the MSCI Emerging Markets Index (Net Daily Total Return) for periods subsequent to April 30, 2018. The indices and time periods for the Custom Index align with the strategies utilized and benchmark for the

Fund during the same time periods.

|

Total Investment Return (unaudited) (concluded)

Returns represent past

performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program

sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment

return at market value is based on changes in the market price at which the Fund’s shares traded on the New York Stock Exchange ("NYSE") American during the period and assumes reinvestment of dividends and

distributions, if any, at market prices pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV during the

six-month period ended June 30, 2023. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are

calculated based on both market price and NAV. Past performance is no guarantee of future results.The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions

received from the Fund.The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the

most recent month-end is available at www.abrdnaef.com or by calling 800-522-5465.

The annualized net operating

expense ratio excluding fee waivers based on the six-month period ended June 30, 2023 was 2.38%. The annualized net operating expense ratio net of fee waivers based on the six-month period ended June 30, 2023 was

2.26%. The annualized net operating expenses net of fee waivers and excluding interest expense based on the six-month period ended June 30, 2023 was 1.20%.

Portfolio Summary (as a percentage of net assets) (unaudited)

As of June 30, 2023

The following table summarizes

the sector composition of the Fund’s portfolio, in S&P Global Inc.’s Global Industry Classification Standard (“GICS”) Sectors. Industry allocation is shown below for any sector

representing more than 25% of net assets.

| Sectors

|

|

| Information Technology

| 29.2%

|

| Semiconductors & Semiconductor Equipment

| 13.2%

|

| Technology Hardware, Storage & Peripherals

| 6.7%

|

| IT Services

| 4.4%

|

| Electronic Equipment, Instruments & Components

| 3.6%

|

| Software

| 1.3%

|

| Financials

| 24.8%

|

| Consumer Discretionary

| 14.0%

|

| Communication Services

| 9.2%

|

| Consumer Staples

| 8.8%

|

| Materials

| 8.5%

|

| Industrials

| 7.0%

|

| Energy

| 3.1%

|

| Health Care

| 2.2%

|

| Real Estate

| 2.1%

|

| Utilities

| 2.1%

|

| Private Equity

| 0.1%

|

| Short-Term Investment

| 0.9%

|

| Liabilities in Excess of Other Assets

| (12.0%)

|

|

| 100.0%

|

The following chart summarizes

the composition of the Fund’s portfolio by geographic classification.

| Countries

|

|

| China

| 26.4%

|

| India

| 16.6%

|

| Taiwan

| 14.8%

|

| South Korea

| 10.5%

|

| Brazil

| 7.8%

|

| Mexico

| 6.2%

|

| Indonesia

| 4.6%

|

| Hong Kong

| 3.7%

|

| Saudi Arabia

| 2.7%

|

| Netherlands

| 2.0%

|

| Other, less than 2% each

| 15.8%

|

| Short-Term Investment

| 0.9%

|

| Liabilities in Excess of Other Assets

| (12.0%)

|

|

| 100.0%

|

Portfolio Summary (as a percentage of net assets) (unaudited) (concluded)

As of June 30, 2023

| Currency Composition

|

|

| Hong Kong Dollar

| 20.7%

|

| Indian Rupee

| 16.6%

|

| New Taiwan Dollar

| 14.8%

|

| South Korean Won

| 10.5%

|

| U.S. Dollar

| 10.1%

|

| Chinese Yuan Renminbi

| 8.4%

|

| Brazilian Real

| 6.6%

|

| Euro Currency

| 5.0%

|

| Indonesian Rupiah

| 4.6%

|

| Saudi Arabia Riyal

| 4.2%

|

| South African Rand

| 3.7%

|

| Mexican Peso

| 2.0%

|

| Viet Nam Dong

| 1.9%

|

| Thai Baht

| 1.3%

|

| Polish Zloty

| 0.7%

|

| Russian Ruble

| -

|

| Short-Term Investment

| 0.9%

|

| Liabilities in Excess of Other Assets

| (12.0%)

|

|

| 100.0%

|

The following were the

Fund’s top ten holdings as of June 30, 2023:

| Top Ten Holdings

|

|

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR

| 9.8%

|

| Samsung Electronics Co. Ltd.

| 6.7%

|

| Tencent Holdings Ltd.

| 6.4%

|

| Alibaba Group Holding Ltd.

| 4.0%

|

| Housing Development Finance Corp. Ltd.

| 3.4%

|

| SBI Life Insurance Co. Ltd.

| 2.3%

|

| LG Chem Ltd.

| 2.1%

|

| Bank Rakyat Indonesia Persero Tbk PT

| 2.1%

|

| Power Grid Corp. of India Ltd.

| 2.1%

|

| AIA Group Ltd.

| 2.0%

|

|

| Amounts listed as “–” are 0% or round to 0%.

|

Portfolio of Investments (unaudited)

As of June 30, 2023

|

| Shares

| Value

|

| COMMON STOCKS—102.2%

|

|

| AUSTRALIA—1.0%

|

| Materials—1.0%

|

|

|

|

| BHP Group Ltd.

|

| 103,781

| $ 3,102,046

|

| AUSTRIA—0.9%

|

| Materials—0.9%

|

|

|

|

| Mondi PLC

|

| 184,633

| 2,822,723

|

| BRAZIL—7.8%

|

| Consumer Discretionary—1.2%

|

|

|

|

| MercadoLibre, Inc.(a)

|

| 3,091

| 3,661,599

|

| Consumer Staples—1.6%

|

|

|

|

| Raia Drogasil SA

|

| 771,635

| 4,770,142

|

| Financials—2.9%

|

|

|

|

| B3 SA - Brasil Bolsa Balcao

|

| 1,719,064

| 5,245,296

|

| Banco Bradesco SA

|

| 1,138,401

| 3,480,680

|

|

|

|

| 8,725,976

|

| Industrials—1.5%

|

|

|

|

| Rumo SA

|

| 536,447

| 2,487,182

|

| WEG SA

|

| 262,089

| 2,066,300

|

|

|

|

| 4,553,482

|

| Information Technology—0.6%

|

|

|

|

| TOTVS SA

|

| 319,021

| 1,997,462

|

| Total Brazil

|

| 23,708,661

|

| CHILE—0.7%

|

| Materials—0.7%

|

|

|

|

| Sociedad Quimica y Minera de Chile SA, ADR

|

| 29,360

| 2,132,123

|

| CHINA—26.4%

|

| Communication Services—7.4%

|

|

|

|

| Autohome, Inc., ADR

|

| 106,485

| 3,105,103

|

| Tencent Holdings Ltd.

|

| 458,800

| 19,453,657

|

|

|

|

| 22,558,760

|

| Consumer Discretionary—9.6%

|

|

|

|

| Alibaba Group Holding Ltd.(a)

|

| 1,165,900

| 12,136,818

|

| China Tourism Group Duty Free Corp. Ltd., A Shares (Stock Connect)(b)

|

| 105,800

| 1,614,825

|

| China Tourism Group Duty Free Corp. Ltd., Shares H(a)(c)

|

| 102,200

| 1,386,644

|

| Li Auto, Inc., A Shares(a)(b)

|

| 181,000

| 3,133,830

|

| Meituan, Class B(a)(c)

|

| 222,050

| 3,481,948

|

| Midea Group Co. Ltd., A Shares (Stock Connect)(b)

|

| 579,286

| 4,708,841

|

| Tongcheng Travel Holdings Ltd.(a)

|

| 723,200

| 1,519,050

|

| Zhongsheng Group Holdings Ltd.

|

| 332,000

| 1,274,513

|

|

|

|

| 29,256,469

|

| Consumer Staples—2.5%

|

|

|

|

| Foshan Haitian Flavouring & Food Co. Ltd., A Shares(b)

|

| 390,733

| 2,524,533

|

| Kweichow Moutai Co. Ltd., A Shares (Stock Connect)(b)

|

| 22,297

| 5,197,521

|

|

|

|

| 7,722,054

|

| Financials—0.9%

|

|

|

|

| China International Capital Corp. Ltd., H Shares(a)(c)

|

| 1,638,400

| 2,888,359

|

| Health Care—2.2%

|

|

|

|

| Shenzhen Mindray Bio-Medical Electronics Co. Ltd., A Shares (Stock Connect)(b)

|

| 112,055

| 4,637,049

|

| Wuxi Biologics Cayman, Inc.(a)(c)

|

| 402,500

| 1,934,435

|

|

|

|

| 6,571,484

|

| Industrials—1.6%

|

|

|

|

| Centre Testing International Group Co. Ltd., A Shares(b)

|

| 545,000

| 1,463,811

|

| NARI Technology Co. Ltd., A Shares (Stock Connect)(b)

|

| 1,032,411

| 3,287,541

|

|

|

|

| 4,751,352

|

Portfolio of Investments (unaudited) (continued)

As of June 30, 2023

|

| Shares

| Value

|

| COMMON STOCKS (continued)

|

|

| CHINA (continued)

|

| Information Technology—0.7%

|

|

|

|

| Yonyou Network Technology Co. Ltd., A Shares(b)

|

| 815,828

| $ 2,304,904

|

| Real Estate—1.5%

|

|

|

|

| China Resources Land Ltd.

|

| 1,051,500

| 4,474,829

|

| Total China

|

| 80,528,211

|

| FRANCE—1.9%

|

| Energy—1.9%

|

|

|

|

| TotalEnergies SE

|

| 102,498

| 5,883,859

|

| HONG KONG—3.7%

|

| Consumer Staples—0.5%

|

|

|

|

| Budweiser Brewing Co. APAC Ltd.(c)

|

| 534,000

| 1,381,810

|

| Financials—3.2%

|

|

|

|

| AIA Group Ltd.

|

| 604,800

| 6,142,649

|

| Hong Kong Exchanges & Clearing Ltd.

|

| 94,832

| 3,593,091

|

|

|

|

| 9,735,740

|

| Total Hong Kong

|

| 11,117,550

|

| INDIA—16.6%

|

| Communication Services—0.7%

|

|

|

|

| Info Edge India Ltd.

|

| 36,435

| 1,996,359

|

| Consumer Discretionary—1.3%

|

|

|

|

| Maruti Suzuki India Ltd.

|

| 34,449

| 4,115,829

|

| Consumer Staples—1.9%

|

|

|

|

| Hindustan Unilever Ltd.

|

| 176,064

| 5,751,893

|

| Financials—7.1%

|

|

|

|

| Housing Development Finance Corp. Ltd.

|

| 297,395

| 10,254,751

|

| Kotak Mahindra Bank Ltd.

|

| 185,206

| 4,169,008

|

| SBI Life Insurance Co. Ltd.(c)

|

| 441,925

| 7,066,900

|

|

|

|

| 21,490,659

|

| Information Technology—1.4%

|

|

|

|

| Infosys Ltd.

|

| 263,942

| 4,306,622

|

| Materials—1.5%

|

|

|

|

| UltraTech Cement Ltd.

|

| 44,787

| 4,531,659

|

| Real Estate—0.6%

|

|

|

|

| Godrej Properties Ltd.(a)

|

| 96,996

| 1,860,948

|

| Utilities—2.1%

|

|

|

|

| Power Grid Corp. of India Ltd.

|

| 2,065,239

| 6,409,238

|

| Total India

|

| 50,463,207

|

| INDONESIA—4.6%

|

| Communication Services—1.1%

|

|

|

|

| Telkom Indonesia Persero Tbk PT

|

| 12,578,800

| 3,365,113

|

| Consumer Discretionary—0.4%

|

|

|

|

| Sepatu Bata Tbk PT(a)(d)

|

| 36,207,500

| 1,304,122

|

| Financials—3.1%

|

|

|

|

| Bank Central Asia Tbk PT

|

| 4,373,300

| 2,682,137

|

| Bank Rakyat Indonesia Persero Tbk PT

|

| 18,025,186

| 6,580,843

|

|

|

|

| 9,262,980

|

| Total Indonesia

|

| 13,932,215

|

| KAZAKHSTAN—1.2%

|

| Financials—1.2%

|

|

|

|

| Kaspi.KZ JSC, GDR(c)

|

| 35,766

| 2,853,106

|

| Kaspi.KZ JSC, GDR

|

| 8,417

| 669,993

|

|

|

|

| 3,523,099

|

Portfolio of Investments (unaudited) (continued)

As of June 30, 2023

|

| Shares

| Value

|

| COMMON STOCKS (continued)

|

|

| MEXICO—6.2%

|

| Consumer Staples—1.6%

|

|

|

|

| Fomento Economico Mexicano SAB de CV, ADR

|

| 45,406

| $ 5,032,801

|

| Financials—2.0%

|

|

|

|

| Grupo Financiero Banorte SAB de CV, Class O

|

| 725,234

| 5,966,434

|

| Industrials—1.1%

|

|

|

|

| Grupo Aeroportuario del Centro Norte SAB de CV, ADR

|

| 38,924

| 3,302,312

|

| Materials—1.5%

|

|

|

|

| Southern Copper Corp.

|

| 63,270

| 4,538,990

|

| Total Mexico

|

| 18,840,537

|

| NETHERLANDS—2.0%

|

| Information Technology—2.0%

|

|

|

|

| ASM International NV

|

| 7,966

| 3,382,397

|

| ASML Holding NV

|

| 3,759

| 2,726,511

|

|

|

|

| 6,108,908

|

| PERU—0.6%

|

| Financials—0.6%

|

|

|

|

| Credicorp Ltd.

|

| 12,526

| 1,849,339

|

| POLAND—1.8%

|

| Consumer Staples—0.7%

|

|

|

|

| Dino Polska SA(a)(c)

|

| 17,837

| 2,083,958

|

| Industrials—1.1%

|

|

|

|

| InPost SA(a)

|

| 314,504

| 3,413,205

|

| Total Poland

|

| 5,497,163

|

| RUSSIA—0.0%

|

| Energy—0.0%

|

|

|

|

| LUKOIL PJSC, ADR(d)(e)

|

| 106,851

| –

|

| Novatek PJSC(d)(e)

|

| 314,849

| –

|

|

|

|

| –

|

| Financials—0.0%

|

|

|

|

| Sberbank of Russia PJSC(d)(e)

|

| 730,234

| –

|

| Total Russia

|

| –

|

| SAUDI ARABIA—2.7%

|

| Energy—1.2%

|

|

|

|

| Saudi Arabian Oil Co.(c)

|

| 417,426

| 3,615,764

|

| Financials—1.5%

|

|

|

|

| Al Rajhi Bank

|

| 232,042

| 4,541,564

|

| Total Saudi Arabia

|

| 8,157,328

|

| SOUTH AFRICA—1.8%

|

| Financials—1.0%

|

|

|

|

| Sanlam Ltd.

|

| 959,001

| 2,973,113

|

| Materials—0.8%

|

|

|

|

| Anglo American Platinum Ltd.

|

| 57,333

| 2,591,652

|

| Total South Africa

|

| 5,564,765

|

| SOUTH KOREA—1.7%

|

| Industrials—1.7%

|

|

|

|

| Samsung Engineering Co. Ltd.

|

| 244,442

| 5,271,455

|

| TAIWAN—14.8%

|

| Information Technology—14.8%

|

|

|

|

| Chroma ATE, Inc.

|

| 531,000

| 4,285,295

|

| Delta Electronics, Inc.

|

| 190,000

| 2,105,642

|

| Hon Hai Precision Industry Co. Ltd.

|

| 1,268,000

| 4,610,115

|

Portfolio of Investments (unaudited) (continued)

As of June 30, 2023

|

| Shares

| Value

|

| COMMON STOCKS (continued)

|

|

| TAIWAN (continued)

|

| MediaTek, Inc.

|

| 193,000

| $ 4,272,218

|

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR

|

| 1,615,000

| 29,834,406

|

|

|

|

| 45,107,676

|

| THAILAND—1.3%

|

| Financials—1.3%

|

|

|

|

| Kasikornbank PCL, Foreign Shares

|

| 1,051,700

| 3,849,350

|

| UNITED ARAB EMIRATES—1.5%

|

| Consumer Discretionary—1.5%

|

|

|

|

| Americana Restaurants International PLC

|

| 4,026,269

| 4,606,204

|

| UNITED STATES—1.1%

|

| Information Technology—1.1%

|

|

|

|

| Globant SA(a)

|

| 18,982

| 3,411,445

|

| VIETNAM—1.9%

|

| Information Technology—1.9%

|

|

|

|

| FPT Corp.

|

| 1,614,700

| 5,898,069

|

| Total Common Stocks

|

| 311,375,933

|

| PREFERRED STOCKS—8.8%

|

|

| SOUTH KOREA—8.8%

|

| Information Technology—6.7%

|

|

|

|

| Samsung Electronics Co. Ltd., Preferred Shares

|

| 449,040

| 20,377,105

|

| Materials—2.1%

|

|

|

|

| LG Chem Ltd.

|

| 24,603

| 6,609,491

|

| Total South Korea

|

| 26,986,596

|

| Total Preferred Stocks

|

| 26,986,596

|

| PRIVATE EQUITY—0.1%

|

|

| GLOBAL*—0.0%

|

| Private Equity —0.0%

|

|

|

|

| Emerging Markets Ventures I LP, H Shares(d)(f)(g)(h)(i)

|

| 11,723,413(j)

| 8,324

|

| ISRAEL—0.0%

|

| Private Equity —0.0%

|

|

|

|

| BPA Israel Ventures LLC(d)(f)(g)(h)(i)(k)

|

| 3,349,175(j)

| 38,382

|

| UNITED STATES—0.1%

|

| Private Equity —0.1%

|

|

|

|

| Neuron VC I LP(d)(f)(g)(i)(k)

|

| 1,522,368(j)

| 13,838

|

| Telesoft Partners II LP(d)(f)(i)(k)

|

| 2,400,000(j)

| 162,480

|

|

|

|

| 176,318

|

| Total Private Equity

|

| 223,024

|

| SHORT-TERM INVESTMENT—0.9%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.03%(l)

|

| 2,723,173

| 2,723,173

|

| Total Short-Term Investment

|

| 2,723,173

|

Total Investments

(Cost $366,213,633)—112.0%

| 341,308,726

|

| Liabilities in Excess of Other Assets—(12.0%)

| (36,562,154)

|

| Net Assets—100.0%

| $304,746,572

|

Portfolio of Investments (unaudited) (concluded)

As of June 30, 2023

| (a)

| Non-income producing security.

|

| (b)

| China A Shares. These shares are issued in local currency, traded in the local stock markets and are held through either a Qualified Foreign Institutional Investor (QFII) license or

the Shanghai or Shenzhen Hong-Kong Stock Connect program.

|

| (c)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (d)

| Illiquid security.

|

| (e)

| Level 3 security. See Note 2(a) of the accompanying Notes to Financial Statements.

|

| (f)

| Fair Value is determined pursuant to procedures approved by the Fund’s Board of Directors. Unless otherwise noted, securities are valued by applying valuation factors to the

exchange traded price. See Note 2(a) of the accompanying Notes to Financial Statements for inputs used.

|

| (g)

| Considered in liquidation by the Fund's Adviser.

|

| (h)

| As of June 30, 2023, the aggregate amount of open commitments for the Fund is $2,806,782.

|

| (i)

| Restricted security, not readily marketable. See Note 2(b) of the accompanying Notes to Financial Statements.

|

| (j)

| Represents contributed capital.

|

| (k)

| Fund of Fund investment.

|

| (l)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of June 30, 2023.

|

| *

| “Global” is the percentage attributable to the Fund’s holdings in a private equity fund which invests globally and is not categorized under

a particular country.

|

| ADR

| American Depositary Receipt

|

| GDR

| Global Depositary Receipt

|

| PLC

| Public Limited Company

|

See Notes to Financial

Statements.

Statement of Assets and Liabilities (unaudited)

As of June 30, 2023

| Assets

|

|

| Investments, at value (cost $363,490,460)

| $338,585,553

|

| Short-term investments, at value (cost $2,723,173)

| 2,723,173

|

| Foreign currency, at value (cost $111,550)

| 111,437

|

| Receivable for investments sold

| 368,225

|

| Interest and dividends receivable

| 1,155,220

|

| Tax reclaim receivable

| 44,678

|

| Prepaid expenses in connection with revolving credit facility (Note 7)

| 11,061

|

| Prepaid expenses

| 81,736

|

| Total assets

| 343,081,083

|

| Liabilities

|

|

| Revolving credit facility payable (Note 7)

| 35,000,000

|

| Deferred foreign capital gains tax (Note 2h)

| 1,452,870

|

| Investment advisory fees payable (Note 3)

| 1,182,819

|

| Interest payable on revolving credit facility

| 69,693

|

| Director fees payable

| 61,903

|

| Administration fees payable (Note 3)

| 60,815

|

| Investor relations fees payable (Note 3)

| 56,813

|

| Other accrued expenses

| 449,598

|

| Total liabilities

| 38,334,511

|

|

|

| Net Assets

| $304,746,572

|

| Composition of Net Assets

|

|

| Common stock (par value $0.001 per share) (Note 5)

| $50,752

|

| Paid-in capital in excess of par

| 418,367,290

|

| Distributable accumulated loss

| (113,671,470)

|

| Net Assets

| $304,746,572

|

| Net asset value per share based on 50,751,778 shares issued and outstanding

| $6.00

|

See Notes to Financial

Statements.

Statement of Operations (unaudited)

For the Six-Month Period Ended June 30, 2023

| Net Investment Income

|

|

| Investment Income:

|

|

| Dividends and other income (net of foreign withholding taxes of $710,784)

| $6,939,601

|

| Total investment income

| 6,939,601

|

| Expenses:

|

|

| Investment management fee (Note 3)

| 1,344,614

|

| Custodian’s fees and expenses

| 150,231

|

| Administration fee (Note 3)

| 122,064

|

| Directors' fees and expenses

| 120,965

|

| Investor relations fees and expenses (Note 3)

| 51,351

|

| Legal fees and expenses

| 50,126

|

| Reports to shareholders and proxy solicitation

| 39,599

|

| Insurance expense

| 39,108

|

| Independent auditors’ fees and expenses

| 36,935

|

| Transfer agent’s fees and expenses

| 16,596

|

| Miscellaneous

| 37,323

|

| Total operating expenses, excluding interest expense

| 2,008,912

|

| Interest expense (Note 7)

| 1,622,875

|

| Total operating expenses before reimbursed/waived expenses

| 3,631,787

|

| Expenses waived (Note 3)

| (177,949)

|

| Net expenses

| 3,453,838

|

|

|

| Net Investment Income/(Loss)

| 3,485,763

|

| Net Realized/Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions:

|

|

| Net realized gain/(loss) from:

|

|

| Investment transactions (including $276,731 capital gains tax)

| (5,412,799)

|

| Foreign currency transactions

| (65,931)

|

|

| (5,478,730)

|

| Net change in unrealized appreciation/(depreciation) on:

|

|

| Investments (including change in deferred capital gains tax of $143,171)

| 23,733,322

|

| Foreign currency translation

| (10,655)

|

|

| 23,722,667

|

| Net realized and unrealized gain from investments and foreign currencies

| 18,243,937

|

| Change in Net Assets Resulting from Operations

| $21,729,700

|

See Notes to Financial

Statements.

Statements of Changes in Net Assets

|

| For the

Six-Month

Period Ended

June 30, 2023

(unaudited)

| For the

Year Ended

December 31, 2022

|

| Increase/(Decrease) in Net Assets:

|

|

|

| Operations:

|

|

|

| Net investment income

| $3,485,763

| $6,144,846

|

| Net realized loss from investments and foreign currency transactions

| (5,478,730)

| (21,228,855)

|

| Net change in unrealized appreciation/(depreciation) on investments and foreign

currency translation

| 23,722,667

| (110,994,235)

|

| Net increase/(decrease) in net assets resulting from operations

| 21,729,700

| (126,078,244)

|

| Distributions to Shareholders From:

|

|

|

| Distributable earnings

| (10,150,356)

| (6,410,460)

|

| Return of capital

| –

| (15,920,323)

|

| Net decrease in net assets from distributions

| (10,150,356)

| (22,330,783)

|

| Change in net assets

| 11,579,344

| (148,409,027)

|

| Net Assets:

|

|

|

| Beginning of period

| 293,167,228

| 441,576,255

|

| End of period

| $304,746,572

| $293,167,228

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Financial

Statements.

Statement of Cash Flows (unaudited)

For the Six-Month Period Ended June 30,

2023

| Cash flows from operating activities:

|

|

| Net increase/(decrease) in net assets resulting from operations

| $21,729,700

|

Adjustments to reconcile net increase in net assets resulting

from operations to net cash provided by operating activities:

|

|

| Investments purchased

| (51,259,213)

|

| Investments sold and principal repayments

| 80,934,261

|

| Decrease in short-term investments, excluding foreign government

| 1,290,940

|

| Increase in interest and dividends receivable

| (999,038)

|

| Increase in prepaid expenses

| (10,161)

|

| Decrease in interest payable on bank loan

| (29,928)

|

| Increase in accrued investment management fees payable

| 681,161

|

| Increase in other accrued expenses

| 207,681

|

| Net change in unrealized appreciation of investments

| (23,733,322)

|

| Net change in unrealized depreciation on foreign currency translations

| 10,655

|

| Net realized loss on investments transactions

| 5,412,799

|

| Total Cash flows from operating activities

| 34,235,535

|

| Cash flows from financing activities:

|

|

| Repayment of revolving credit facility

| $(20,000,000)

|

| Distributions paid to shareholders

| (14,718,016)

|

| Net cash used in financing activities

| (34,718,016)

|

| Effect of exchange rate on cash

| (11,621)

|

| Net change in cash

| (494,102)

|

| Unrestricted and restricted cash and foreign currency, beginning of period

| 605,539

|

| Unrestricted and restricted cash and foreign currency, end of period

| $111,437

|

| Supplemental disclosure of cash flow information:

|

|

| Cash paid for interest and fees on borrowing

| 1,652,803

|

See Notes to Financial

Statements.

Statement of Cash Flows (unaudited) (concluded)

For the Six-Month Period Ended June 30,

2023

| Reconciliation of unrestricted and restricted cash to the statements of assets and liabilities

|

|

|

|

| Six-Month

Period Ended

June 30, 2023

(unaudited)

| Year Ended

December 31, 2022

|

| Foreign currency, at value

| $111,437

| $346,873

|

| Due from broker

| –

| 258,666

|

|

| $111,437

| $605,539

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Financial

Statements.

|

| For the

Six-Month

Period Ended

June 30,

| For the Fiscal Years Ended December 31,

|

|

| 2023

(unaudited)

| 2022

| 2021

| 2020

| 2019

| 2018

(a)(b)

|

| PER SHARE OPERATING PERFORMANCE(c):

|

|

|

|

|

|

|

| Net asset value per common share, beginning of period

| $5.78

| $8.70

| $9.41

| $8.66

| $7.37

| $9.99

|

| Net investment income

| 0.07

| 0.12

| 0.16

| 0.23

| 0.23

| 0.19

|

Net realized and unrealized gains/(losses) on

investments and foreign currency transactions

| 0.35

| (2.60)

| (0.34)

| 0.79

| 1.21

| (1.36)

|

| Total from investment operations applicable to common shareholders

| 0.42

| (2.48)

| (0.18)

| 1.02

| 1.44

| (1.17)

|

| Distributions to common shareholders from:

|

|

|

|

|

|

|

| Net investment income

| (0.20)

| (0.13)

| (0.22)

| (0.27)

| (0.17)

| (0.13)

|

| Net realized gains

| –

| –

| –

| –

| –

| (1.36)

|

| Return of capital

| –

| (0.31)

| (0.31)

| –

| –

| (–)

|

| Total distributions

| (0.20)

| (0.44)

| (0.53)

| (0.27)

| (0.17)

| (1.49)

|

| Capital Share Transactions:

|

|

|

|

|

|

|

| Impact of open market repurchase program

| –

| –

| –

| –

| –

| 0.01

|

| Impact due to tender offer

| –

| –

| –

| –

| 0.02

| 0.03

|

| Total capital share transactions

| –

| –

| –

| –

| 0.02

| 0.04

|

| Net asset value per common share, end of period

| $6.00

| $5.78

| $8.70

| $9.41

| $8.66

| $7.37

|

| Market price, end of period

| $5.19

| $5.15

| $7.92

| $8.16

| $7.62

| $6.35

|

| Total Investment Return Based on(d):

|

|

|

|

|

|

|

| Market price

| 4.64%

| (29.76%)

| 3.27%

| 11.42%

| 22.80%

| (16.72%)

|

| Net asset value

| 7.78%

| (28.23%)

| (1.63%)

| 13.06%

| 20.25%

| (10.38%)

|

| Ratio to Average Net Assets/Supplementary Data:

|

|

|

|

|

|

|

| Net assets, end of period (000 omitted)

| $304,747

| $293,167

| $441,576

| $477,473

| $439,330

| $440,819

|

| Average net assets applicable to common shareholders (000 omitted)

| $307,689

| $335,898

| $492,593

| $390,881

| $442,354

| $445,001

|

| Total expenses, net of fee waivers(d)

| 2.26%(e)

| 1.65%

| 1.31%

| 1.44%

| 1.54%

| 1.55%(f)(g)

|

| Total expenses, excluding fee waivers(d)

| 2.38%(e)

| 1.74%

| 1.27%

| 1.44%

| 1.57%

| 1.56%(f)(g)

|

| Total expenses, excluding taxes net of fee waivers

| 2.26%(e)

| 1.65%

| 1.31%

| 1.44%

| 1.54%

| 1.45%(f)

|

| Total expenses, excluding taxes and interest and revolving credit facility expenses, net of fee

waivers

| 1.20%(e)

| 1.20%

| 1.21%

| 1.27%

| 1.19%

| 1.25%(f)

|

| Net Investment income(d)

| 2.28%(e)

| 1.83%

| 1.61%

| 2.96%

| 2.92%

| 2.24%(g)

|

| Portfolio turnover

| 14%(h)

| 32%

| 50%

| 21%

| 13%

| 145%(i)

|

| Senior securities (loan facility) outstanding (000 omitted)

| $35,000

| $55,000

| $55,000

| $40,900

| $40,900

| $49,000

|

| Asset coverage ratio on revolving credit facility at period end

| 971%

| 633%

| 903%

| 1,267%

| 1,174%

| 1,000%

|

See

Notes to Financial Statements.

Financial Highlights (concluded)

|

| For the

Six-Month

Period Ended

June 30,

| For the Fiscal Years Ended December 31,

|

|

| 2023

(unaudited)

| 2022

| 2021

| 2020

| 2019

| 2018

(a)(b)

|

| Asset coverage per $1,000 on revolving credit facility at period

end(j)

| $9,707

| $6,330

| $9,029

| $12,674

| $11,742

| $9,996

|

| (a)

| Historical net asset value and per share amounts for the accounting survivor of the reorganizations have been recasted to reflect the conversion ratio of 2.9187 in effect on the date of reorganization

of April 27, 2018. Ratios to Average Net Assets were not impacted.

|

| (b)

| Seven abrdn Funds reorganized into abrdn Emerging Markets Equity Income Fund on April 27, 2018.

|

| (c)

| Based on average shares outstanding.

|

| (d)

| Total investment return based on market value is calculated assuming that shares of the Fund’s common stock were purchased at the closing market price as of the beginning of the period, dividends,

capital gains and other distributions were reinvested as provided for in the Fund’s dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation

does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund’s net

asset value is substituted for the closing market value.

|

| (e)

| Annualized.

|

| (f)

| Effective April 30, 2018, the Fund entered into an expense limitation agreement to limit total ordinary operating expenses of the Fund (excluding any interest, taxes, brokerage fees, short sale dividend

and interest expenses and non-routine expenses) from exceeding 1.20% of the average daily Net Assets of the Fund on an annualized basis. (Note 3) Prior to this, there was no expense limitation agreement in

place.

|

| (g)

| Ratios include the effect of Chilean taxes.

|

| (h)

| Not annualized.

|

| (i)

| The variation in the Fund’s turnover rate in 2018 was primarily due to the reorganization of the Fund and change in investment strategy.

|

| (j)

| Asset coverage ratio is calculated by dividing net assets plus the amount of any borrowings, for investment purposes by the amount of the Revolving Credit Facility.

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Financial

Statements.

Notes to Financial Statements (unaudited)

June 30, 2023

1. Organization

abrdn Emerging Markets

Equity Income Fund, Inc. (the “Fund”) was incorporated in Maryland on January 30, 1989 and commenced investment operations on September 27, 1989. The Fund is registered under the Investment Company Act of

1940, as amended (the “1940 Act”), as a non-diversified closed-end, management investment company. The Fund trades on the NYSE American under the ticker symbol “AEF”.

2. Summary of Significant

Accounting Policies

The Fund is an investment

company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial

Services-Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to generally accepted accounting

principles ("GAAP") in the United States of America. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure

of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The accounting records of

the Fund are maintained in U.S. Dollars and the U.S. Dollar is used as both the functional and reporting currency.

a. Security Valuation:

The Fund values its

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset

or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the 1940 Act, the Board of Directors

(the "Board") designated abrdn Investments Limited (the "Adviser") as the valuation designee ("Valuation Designee") for the Fund to perform the fair value determinations relating to Fund investments for which

market quotations are not readily available.

In accordance with the

authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments using a three-level hierarchy that classifies the inputs to valuation techniques used

to measure the fair value. The hierarchy assigns Level 1, the highest level, measurements to valuations based upon unadjusted quoted prices in active markets for identical assets, Level 2 measurements to valuations

based upon other significant observable inputs, including adjusted quoted prices in active markets for similar assets, and Level 3, the lowest level, measurements to valuations based upon unobservable inputs that are

significant to the valuation. Inputs refer broadly to the assumptions

that market participants would use in

pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the

inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, which are based

on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in

pricing the asset or liability developed based on the best information available in the circumstances. A financial instrument’s level within the fair value hierarchy is based upon the lowest level of any input

that is significant to the fair value measurement. Open-end mutual funds are valued at the respective net asset value (“NAV”) as reported by such company. The prospectuses for the registered open-end

management investment companies in which the Fund invests explain the circumstances under which those companies will use fair value pricing and the effects of using fair value pricing. Closed-end funds and

exchange-traded funds (“ETFs”) are valued at the market price of the security at the Valuation Time (as defined below). A security using any of these pricing methodologies is determined to be a Level 1

investment.

Equity securities that are

traded on an exchange are valued at the last quoted sale price or the official close price on the principal exchange on which the security is traded at the “Valuation Time” subject to application, when

appropriate, of the valuation factors described in the paragraph below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the NYSE (usually 4:00 p.m. Eastern Time). In the absence

of a sale price, the security is valued at the mean of the bid/ask price quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are valued at the NASDAQ official

closing price.

Foreign equity securities

that are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an

independent pricing service provider. These valuation factors are used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such

foreign securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When

prices with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that

applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price has been adjusted. Valuation factors are not utilized if the independent pricing service

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

provider is unable to provide a valuation

factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

Short-term investments are

comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund,

which has elected to qualify as a “government money market fund” pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Registered

investment companies are valued at their NAV as reported by such company. Generally, these investment types are categorized as Level 1 investments.

In the event that a

security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation Time), the security is valued

at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. A security that has been

fair valued by the Valuation Designee may be classified as Level 2 or Level 3 depending on the nature of the inputs.

The three-level hierarchy of

inputs is summarized below:

Level 1 - quoted prices in

active markets for identical investments;

Level 2 - other significant observable

inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk); or

Level 3 - significant unobservable inputs

(including the Fund’s own assumptions in determining the fair value of investments).

The Fund may also invest in

private equity private placement securities, which represented 0.1% of the net assets of the Fund as of June 30, 2023. The private equity private placement securities in which the Fund is invested are deemed to be

restricted securities. In the absence of readily ascertainable market values, these securities are valued at fair value as determined in good faith by, or under the direction of the Board, pursuant to valuation

policies and procedures established by the Board. The Fund’s estimate of fair value assumes a willing buyer and a willing seller neither of whom are acting under the compulsion to buy or sell. Although these

securities may be resold in privately negotiated transactions, the prices realized on such sales could differ from the prices originally paid by the Fund or the current carrying values, and the difference could be

material. These securities are stated at fair value by utilizing the net asset valuations provided by the underlying funds as a practical expedient. In determining the fair value of these investments, management uses

the market approach which includes as the primary input the capital balance reported; however, adjustments to the reported capital balance may be made based on various factors, including, but not limited to, the

attributes of the interest held, including the rights and obligations, and any restrictions or illiquidity of such interests, and the fair value of these private equity investments. No such adjustments were made to

the NAVs provided by the underlying funds.

A summary of standard

inputs is listed below:

| Security Type

| Standard Inputs

|

| Foreign equities utilizing a fair value factor

| Depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local

exchange opening and closing prices of each security.

|

The following is a

summary of the inputs used as of June 30, 2023 in valuing the Fund's investments at fair value. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with

investing in those securities. Please refer to the Portfolio of Investments for a detailed breakout of the security types:

| Investments, at Value

| Level 1 – Quoted

Prices

| Level 2 – Other Significant

Observable Inputs

| Level 3 – Significant

Unobservable Inputs

| Total

|

| Assets

|

|

|

| Investments in Securities

|

|

|

|

| Common Stocks

| $57,994,436

| $253,381,497

| $–

| $311,375,933

|

| Preferred Stocks

| –

| 26,986,596

| –

| 26,986,596

|

| Short-Term Investment

| 2,723,173

| –

| –

| 2,723,173

|

| Total

| $60,717,609

| $280,368,093

| $–

| $341,085,702

|

| Private Equity(a)

|

|

|

| 223,024

|

| Total Investments in Securities

|

|

|

| $341,308,726

|

Amounts listed as

“–” are $0 or round to $0.

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

| (a)

| Private Equity investments are measured at the net asset valuations provided by the underlying funds as a practical expedient and have not been classified in the

fair value levels. The fair value amounts presented are intended to permit reconciliation to the total investment amount presented in the Portfolio of Investments.

|

During the six-month period ended June 30,

2023, there have been no transfers between levels and no significant changes to the fair valuation methodologies. Level 3 investments held during and at the end of the six-month period in relation to net assets

were not significant (0.0% of total net assets) and accordingly, a reconciliation of Level 3 assets for the six-month period ended June 30, 2023 is not presented. The valuation technique used at June 30, 2023 was fair

valuation at zero pursuant to procedures approved by the Board.

b. Restricted

Securities:

Restricted securities are

privately-placed securities whose resale is restricted under U.S. securities laws. The Fund may invest in restricted securities, including unregistered securities eligible for resale without registration pursuant to

Rule 144A and privately-placed securities of U.S. and non-U.S. issuers offered outside the U.S. without registration pursuant to Regulation S under the Securities Act of 1933, as amended (the "1933 Act"). Rule 144A

securities may be freely traded among certain qualified institutional investors, such as the Fund, but resale of such securities in the U.S. is permitted only in limited circumstances.

c. Foreign Currency

Translation:

Foreign securities,

currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. Dollars at the exchange rate of said currencies against the U.S. Dollar, as of the Valuation Time, as provided by

an independent pricing service approved by the Board.

Foreign currency amounts are

translated into U.S. Dollars on the following basis:

(i) market value of investment

securities, other assets and liabilities – at the current daily rates of exchange at the Valuation Time; and

(ii) purchases and sales of

investment securities, income and expenses – at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate

that portion of gains and losses on investments in equity securities due to changes in the foreign exchange rates from the portion due to changes in market prices of equity securities. Accordingly, realized and

unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain

foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign

currency related transactions are treated as

ordinary income for U.S. federal income tax purposes.

Net unrealized currency gains

or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation

of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange

gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date

on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund’s books and the U.S. Dollar equivalent of the amounts actually received.

Foreign security and currency

transactions may involve certain considerations and risks not typically associated with those of domestic origin, including unanticipated movements in the value of the foreign currency relative to the U.S. Dollar.

Generally, when the U.S. Dollar rises in value against foreign currency, the Fund’s investments denominated in that foreign currency will lose value because the foreign currency is worth fewer U.S. Dollars; the

opposite effect occurs if the U.S. Dollar falls in relative value.

d. Rights Issues and

Warrants:

Rights issues give the

right, normally to existing shareholders, to buy a proportional number of additional securities at a given price (generally at a discount) within a fixed period (generally a short-term period) and are offered at the

company’s discretion. Warrants are securities that give the holder the right to buy common stock at a specified price for a specified period of time. Rights issues and warrants are speculative and have no value

if they are not exercised before the expiration date. Rights issues and warrants are valued at the last sale price on the exchange on which they are traded.

e. Security Transactions,

Investment Income and Expenses:

Security transactions are

recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date except for

certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Interest income and expenses are recorded on an accrual basis.

Certain distributions

received by the Fund could represent a return of capital or capital gain. The Fund determines the components of these

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

distributions subsequent to the ex-dividend

date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain.

f. Distributions:

The Fund records dividends

and distributions payable to its shareholders on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal

income tax regulations, which may differ from GAAP. These book basis/tax basis differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts

are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net

realized capital gains for tax purposes are reported as return of capital.

g. Federal Income Taxes:

The Fund intends to

continue to qualify as a “regulated investment company” by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal Revenue Code of 1986, as

amended the ("Code"), and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all federal income taxes. Therefore, no federal income tax provision is

required.

The Fund recognizes the tax

benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has concluded that there are no

significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund’s U.S. federal and state tax returns for

each of the most recent four fiscal years up to the most recent fiscal year ended December 31, 2022 are subject to such review.

h. Foreign Withholding

Tax:

Dividend and interest

income from non-U.S. sources received by the Fund are generally subject to non-U.S. withholding taxes and are recorded on the Statement of Operations. The Fund files for tax reclaims for the refund of such

withholdings taxes according to tax treaties. Tax reclaims that are deemed collectible are booked as tax reclaim receivable on the Statement of Assets and Liabilities. In addition, the Fund may be subject to capital

gains tax in certain countries in which it invests. The above taxes may be reduced or eliminated under the terms of applicable U.S. income tax treaties with some of these countries. The Fund accrues such taxes when

the related income is earned.

In addition, when the Fund sells securities

within certain countries in which it invests, the capital gains realized may be subject to tax. Based on these market requirements and as required under GAAP, the Fund accrues deferred capital gains tax on securities

currently held that have unrealized appreciation within these countries. The amount of deferred capital gains tax accrued is reported on the Statement of Assets and Liabilities.

i. Partnership Accounting

Policy:

The Fund records its

pro-rata share of the income/(loss) and capital gains/(losses) allocated from the private equity investments, which are classified as partnerships, and adjusts the cost of the underlying partnerships accordingly.

These amounts are included in the appropriate line items on the Fund’s Statement of Operations.

3. Agreements and Transactions

with Affiliates

a. Investment Adviser:

abrdn Investments Limited

serves as the Fund’s investment adviser with respect to all investments. The Adviser is an indirect wholly-owned subsidiary of abrdn plc. The Adviser receives an annual fee, calculated weekly and paid quarterly,

equal to 0.90% of the first $250 million, 0.80% of amounts $250-$500 million and 0.75% of amounts over $500 million. For the six-month period ended June 30, 2023, the Adviser earned $1,344,614 for advisory

services.

The Adviser entered into a

written contract (the “Expense Limitation Agreement”) with the Fund that is effective through June 30, 2024. The Expense Limitation Agreement limits the total ordinary operating expenses of the Fund

(excluding any interest, taxes, brokerage fees, short sale dividend and interest expenses and non-routine expenses) from exceeding 1.20% of the average daily Net Assets of the Fund on an annualized basis. Through

June 30, 2023, the Adviser waived a total of $177,949 pursuant to the Expense Limitation Agreement. The Adviser may request and receive reimbursement of the advisory fees waived and other expenses reimbursed

pursuant to the Expense Limitation Agreement as of a date not more than three years after the date when the Adviser limited the fees or reimbursed the expenses; provided that the following requirements are met: the

reimbursements do not cause the Fund to exceed the lesser of the applicable expense limitation in the contract at the time the fees were limited or expenses are paid or the applicable expense limitation in effect at

the time the expenses are being recouped by the Adviser (the “Reimbursement Requirements”).

As of June 30, 2023, to the

extent the Reimbursement Requirements are met, the cumulative potential reimbursements to the Adviser for the Fund, based on expenses reimbursed by the Adviser, including adjustments described above, would be:

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

| Amount Fiscal Year 2022 (Expires 12/31/25)

|

| $309,304

|

| Amount Fiscal Year 2023 (Expires 12/31/26)

|

| $177,949

|

| Total*

|

| $487,253

|

| *

| Amounts reported are due to expire throughout the respective 3-year expiration period presented above.

|

b. Fund Administration:

abrdn Inc., an affiliate of

the Adviser, is the Fund’s Administrator, pursuant to an agreement under which abrdn Inc. receives a fee paid by the Fund, at an annual fee rate of 0.08% of the Fund’s average monthly net assets. For the

six-month period ended June 30, 2023, abrdn Inc. earned $122,064 from the Fund for administration services.

c. Investor Relations:

Under the terms of the

Investor Relations Services Agreement, abrdn Inc. provides and/or engages third parties to provide investor relations services to the Fund and certain other funds advised by the Adviser or its affiliates as part of an

Investor Relations Program. Under the Investor Relations Services Agreement, the Fund owes a portion of the fees related to the Investor Relations Program (the “Fund’s Portion”). However, investor

relations services fees are limited by abrdn Inc. so that the Fund will only pay up to an annual rate of 0.05% of the Fund’s average weekly net assets. Any difference between the capped rate of 0.05% of the

Fund’s average weekly net assets and the Fund’s Portion is paid for by abrdn Inc.

Pursuant to the terms of the

Investor Relations Services Agreement, abrdn Inc. (or third parties hired by abrdn Inc.), among other things, provides objective and timely information to shareholders based on publicly-available information; provides

information efficiently through the use of technology while offering shareholders immediate access to knowledgeable investor relations representatives; develops and maintains effective communications with investment

professionals from a wide variety of firms; creates and maintains investor relations communication materials such as fund manager interviews, films and webcasts, publishes white papers, magazine articles and other

relevant materials discussing the Fund’s investment results, portfolio positioning and outlook; develops and maintains effective communications with large institutional shareholders; responds to specific