US Futures Remain Steady Amid Wall Street Caution Ahead of April PPI Report

May 14 2024 - 7:18AM

IH Market News

U.S. index futures are almost unchanged in pre-market trading

this Tuesday, reflecting Wall Street’s caution ahead of key

inflation reports.

At 6:37 AM, the Dow Jones (DOWI:DJI) futures rose 4 points, or

+0.01%. S&P 500 futures advanced 0.01%, and Nasdaq-100 futures

dropped 0.01%. The yield on 10-year Treasury notes was at

4.477%.

In the commodities market, West Texas Intermediate crude oil for

July fell 0.02%, to $83.36 per barrel. Brent crude oil for July was

steady, near $83.36 per barrel. Iron ore traded on the Dalian

exchange dropped 0.75%, to $119.60 per metric ton.

On Tuesday’s economic agenda, the April Producer Price Index

will be released at 8:30 by the Labor Department. The LSEG

consensus projects a monthly rise of 0.3% and an annual base

increase of 2.2%.

European markets are mixed, with investors cautious ahead of

U.S. inflation data. Unemployment in the UK rose to 4.3%, while

wages, excluding bonuses, increased by 6.0%. Among individual

stocks, Delivery Hero (TG:DHER) jumped 22.1% after

selling Foodpanda to Uber (NYSE:UBER), while

Anglo American (LSE:AAL) fell 2.3% after

announcing a strategic review.

Stock markets in Asia and the Pacific closed with no clear

direction and modest variations this Tuesday, mirroring Wall

Street’s behavior, as investors await new U.S. inflation data. The

Shanghai SE Index (China) saw a slight decline of 0.07%, while the

Nikkei (Japan) recorded a gain of 0.46%. The Hang Seng Index (Hong

Kong) fell 0.22%, and the Kospi (South Korea) rose 0.11%. The ASX

200 (Australia) ended the day down 0.30%.

After a strong upward movement last week, U.S. stocks performed

mixed on Monday. The Dow Jones fell 0.21%, closing at 39,431.51

points. The S&P 500 retreated 0.02%, while the Nasdaq climbed

0.29%. The initial strength came from optimism about interest rate

cuts, but diminished after a New York Fed survey showed an increase

in short- and long-term inflation expectations. One-year inflation

expectations rose to 3.3%. The five-year outlook increased to 2.8%.

Among individual stocks, GameStop (NYSE:GME)

soared after “Roaring Kitty” posted on X for the first time in

three years. Squarespace (NYSE:SQSP) also rose

significantly after announcing a deal to go private in a cash

transaction valued at about $6.9 billion.

Scheduled to report quarterly results before the market opens

are Alibaba Group (NYSE:BABA),

Sony (NYSE:SONY), The Home Depot

(NYSE:HD), Sea (NYSE:SE), Ocugen

(NASDAQ:OCGN), Intuitive Machines (NASDAQ:LUNR),

Miniso Group Holding (NYSE:MNSO), On

Holding AG (NYSE:ONON), OrganiGram

(NASDAQ:OGI), Bakkt (NYSE:BKKT), among others.

After the close, earnings from Nu Holdings

(NYSE:NU), Nextracker (NASDAQ:NXT), Ontrak

Health (NASDAQ:OTRK), Dragonfly Energy

Holding (NASDAQ:DFLI), DHT Holdings

(NYSE:DHT), Rumble (NASDAQ:RUM),

Canoo (NASDAQ:GOEV), Arcutis

Biotherapeutics (NASDAQ:ARQT), SilverCrest

Metals (AMEX:SILV), Prestige Consumer

Healthcare (NYSE:PBH), and more will be awaited.

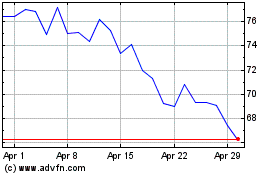

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2024 to May 2024

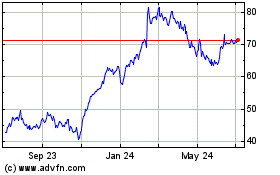

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From May 2023 to May 2024