MARCH 2020 INVESTOR PRESENTATION Financial Data as of: Third Quarter 2023 NASDAQ: FGBI www.fgb.net

2 CERTAIN IMPORTANT INFORMATION CAUTION REGARDING FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended with respect to the financial condition, liquidity, results of operations, and future performance of the business of First Guaranty Bancshares, Inc. (“First Guaranty,” the “Company” or “FGBI”). These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors (some of which are beyond our control). Forward-looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would” and “could.” We caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. These forward-looking statements are subject to a number of factors and uncertainties, including, changes in general economic conditions, either nationally or in our market areas, that are worse than expected; competition among depository and other financial institutions; inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; adverse changes in the securities markets; changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to successfully integrate acquired entities; changes in consumer spending, borrowing and savings habits; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission and the Public Company Accounting Oversight Board; changes in our organization, compensation and benefit plans; changes in our financial condition or results of operations that reduce capital available to pay dividends; increases in our provision for loan losses and changes in the financial condition or future prospects of issuers of securities that we own, which could cause our actual results and experience to differ from the anticipated results and expectations, expressed in such forward-looking statements. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. NON-GAAP FINANCIAL MEASURES Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables under the section titled “Non-GAAP Reconciliations.” The Company uses non-GAAP financial measures to analyze its performance. Management believes that non-GAAP financial measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company and provide meaningful comparison to its peers. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP.

3

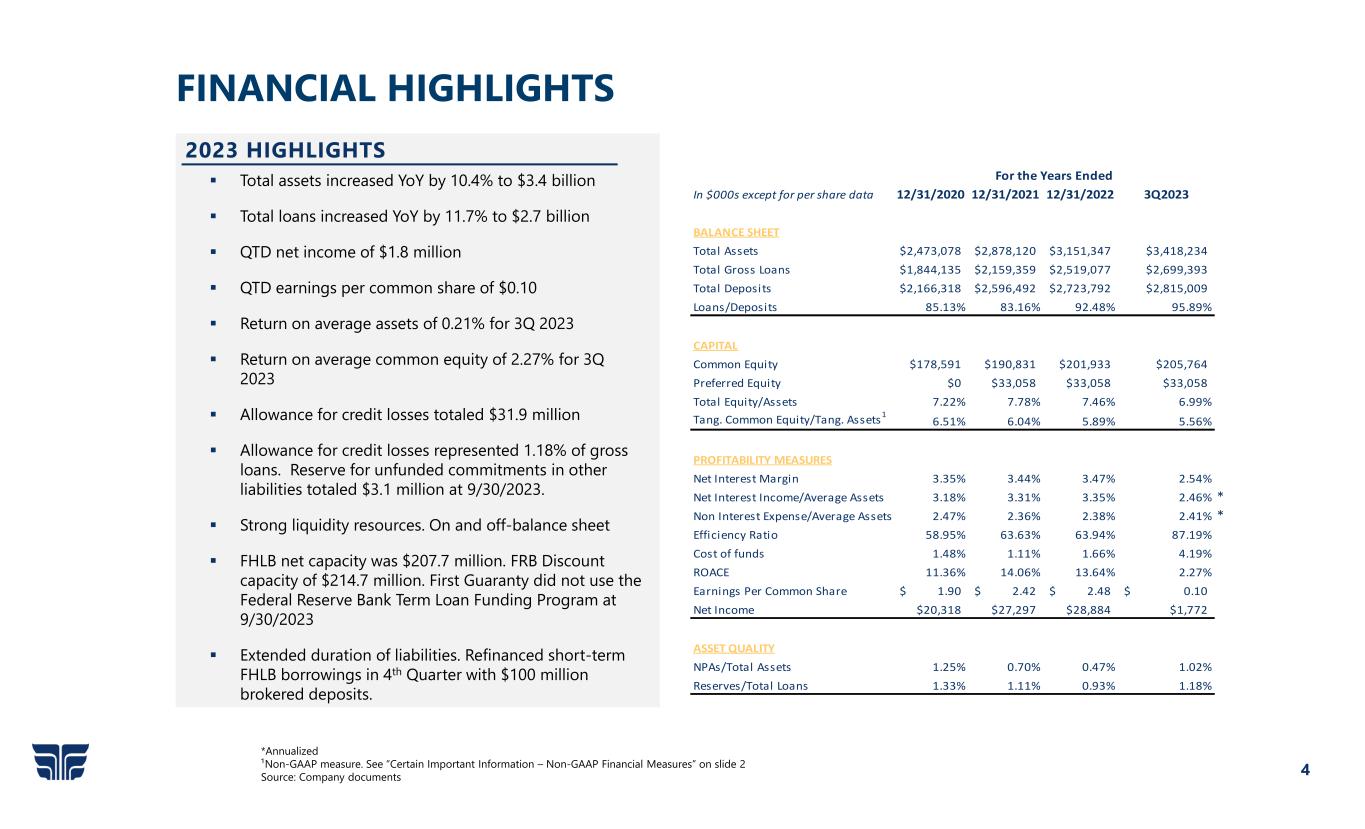

4 FINANCIAL HIGHLIGHTS Total assets increased YoY by 10.4% to $3.4 billion Total loans increased YoY by 11.7% to $2.7 billion QTD net income of $1.8 million QTD earnings per common share of $0.10 Return on average assets of 0.21% for 3Q 2023 Return on average common equity of 2.27% for 3Q 2023 Allowance for credit losses totaled $31.9 million Allowance for credit losses represented 1.18% of gross loans. Reserve for unfunded commitments in other liabilities totaled $3.1 million at 9/30/2023. Strong liquidity resources. On and off-balance sheet FHLB net capacity was $207.7 million. FRB Discount capacity of $214.7 million. First Guaranty did not use the Federal Reserve Bank Term Loan Funding Program at 9/30/2023 Extended duration of liabilities. Refinanced short-term FHLB borrowings in 4th Quarter with $100 million brokered deposits. 2023 HIGHLIGHTS *Annualized ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 2 Source: Company documents In $000s except for per share data 12/31/2020 12/31/2021 12/31/2022 3Q2023 BALANCE SHEET Total Assets $2,473,078 $2,878,120 $3,151,347 $3,418,234 Total Gross Loans $1,844,135 $2,159,359 $2,519,077 $2,699,393 Total Deposits $2,166,318 $2,596,492 $2,723,792 $2,815,009 Loans/Deposits 85.13% 83.16% 92.48% 95.89% CAPITAL Common Equity $178,591 $190,831 $201,933 $205,764 Preferred Equity $0 $33,058 $33,058 $33,058 Total Equity/Assets 7.22% 7.78% 7.46% 6.99% Tang. Common Equity/Tang. Assets1 6.51% 6.04% 5.89% 5.56% PROFITABILITY MEASURES Net Interest Margin 3.35% 3.44% 3.47% 2.54% Net Interest Income/Average Assets 3.18% 3.31% 3.35% 2.46% * Non Interest Expense/Average Assets 2.47% 2.36% 2.38% 2.41% * Efficiency Ratio 58.95% 63.63% 63.94% 87.19% Cost of funds 1.48% 1.11% 1.66% 4.19% ROACE 11.36% 14.06% 13.64% 2.27% Earnings Per Common Share 1.90$ 2.42$ 2.48$ 0.10$ Net Income $20,318 $27,297 $28,884 $1,772 ASSET QUALITY NPAs/Total Assets 1.25% 0.70% 0.47% 1.02% Reserves/Total Loans 1.33% 1.11% 0.93% 1.18% For the Years Ended

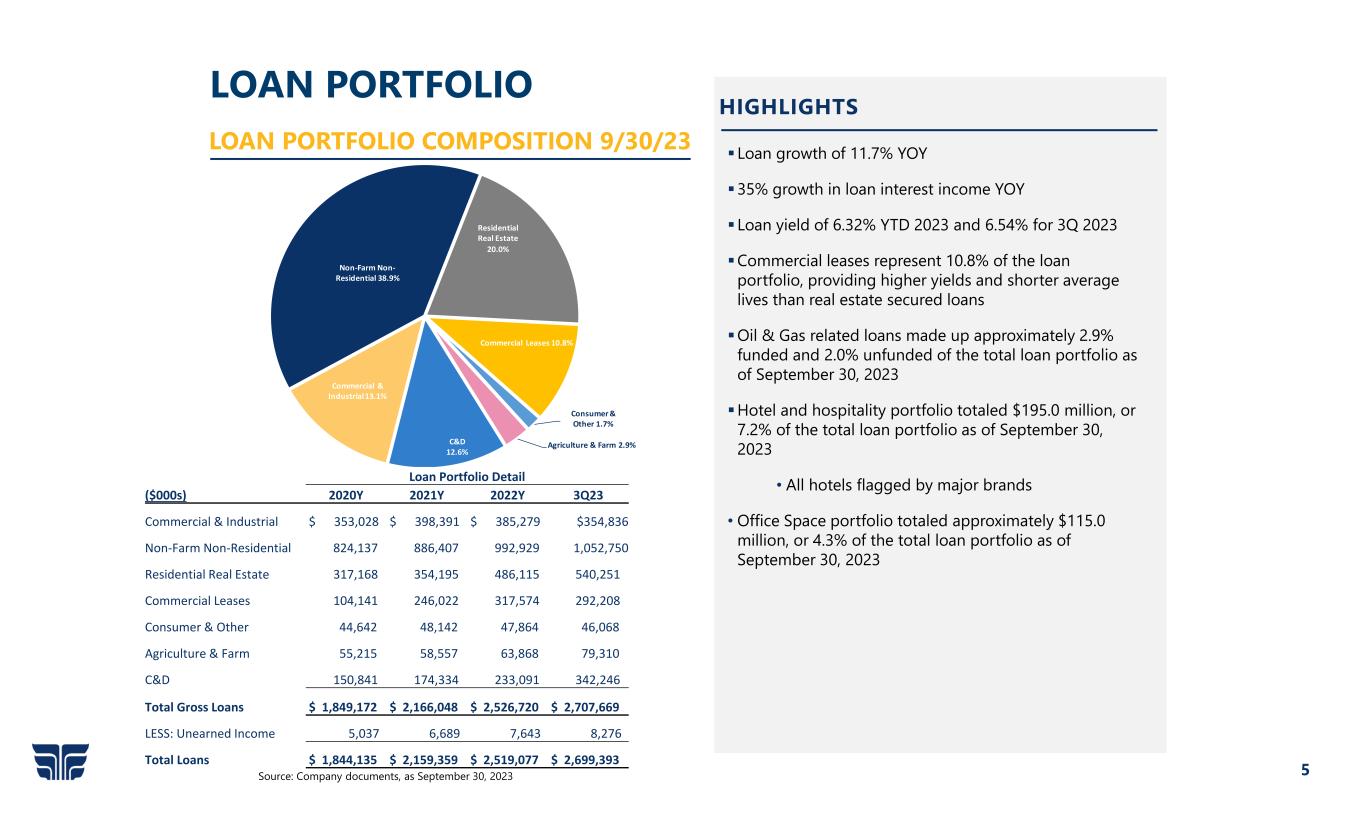

5 LOAN PORTFOLIO Source: Company documents, as September 30, 2023 Loan growth of 11.7% YOY 35% growth in loan interest income YOY Loan yield of 6.32% YTD 2023 and 6.54% for 3Q 2023 Commercial leases represent 10.8% of the loan portfolio, providing higher yields and shorter average lives than real estate secured loans Oil & Gas related loans made up approximately 2.9% funded and 2.0% unfunded of the total loan portfolio as of September 30, 2023 Hotel and hospitality portfolio totaled $195.0 million, or 7.2% of the total loan portfolio as of September 30, 2023 • All hotels flagged by major brands • Office Space portfolio totaled approximately $115.0 million, or 4.3% of the total loan portfolio as of September 30, 2023 HIGHLIGHTS Commercial & Industrial13.1% Non‐Farm Non‐ Residential 38.9% Residential Real Estate 20.0% Commercial Leases 10.8% Consumer & Other 1.7% Agriculture & Farm 2.9%C&D 12.6% LOAN PORTFOLIO COMPOSITION 9/30/23 Loan Portfolio Detail ($000s) 2020Y 2021Y 2022Y 3Q23 Commercial & Industrial $ 353,028 $ 398,391 $ 385,279 $354,836 Non‐Farm Non‐Residential 824,137 886,407 992,929 1,052,750 Residential Real Estate 317,168 354,195 486,115 540,251 Commercial Leases 104,141 246,022 317,574 292,208 Consumer & Other 44,642 48,142 47,864 46,068 Agriculture & Farm 55,215 58,557 63,868 79,310 C&D 150,841 174,334 233,091 342,246 Total Gross Loans $ 1,849,172 $ 2,166,048 $ 2,526,720 $ 2,707,669 LESS: Unearned Income 5,037 6,689 7,643 8,276 Total Loans $ 1,844,135 $ 2,159,359 $ 2,519,077 $ 2,699,393

6 143.76% 173.36% 124.97% 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% 140.00% 160.00% 180.00% 200.00% 2021 2022 2023 CREDIT SUMMARY Source: Company documents, as of and for the nine months ended September 30, 2023 ACL/NONACCRUALS HISTORICAL ASSET QUALITY 0.70% 0.47% 1.02% 0.13% 0.18% 0.05% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2021 2022 2023 NPAs/Total Assets NCOs/Average Loans NPAs/TOTAL ASSETS & NCOs/AVG LOANS (dollars in thousands) 12/31/2021 12/31/2022 9/30/2023 NONACCRUAL LOANS $16,715 $13,566 $25,555 90 DAY LOANS AND GREATER BUT STILL ACCRUING $1,245 $1,142 $8,144 OREO $2,072 $113 $1,135 NONPERFORMING ASSETS $20,032 $14,821 $34,834 QTD LOAN CHARGEOFFS $1,663 $1,007 $498 YTD LOAN CHARGEOFFS $3,122 $6,086 $2,045 NPAs / TOTAL ASSETS 0.70% 0.47% 1.02% NONACCRUAL LOANS / TOTAL ASSETS 0.58% 0.43% 0.75% ACL / TOTAL LOANS 1.11% 0.93% 1.18% TEXAS RATIO 6.63% 4.48% 9.83%

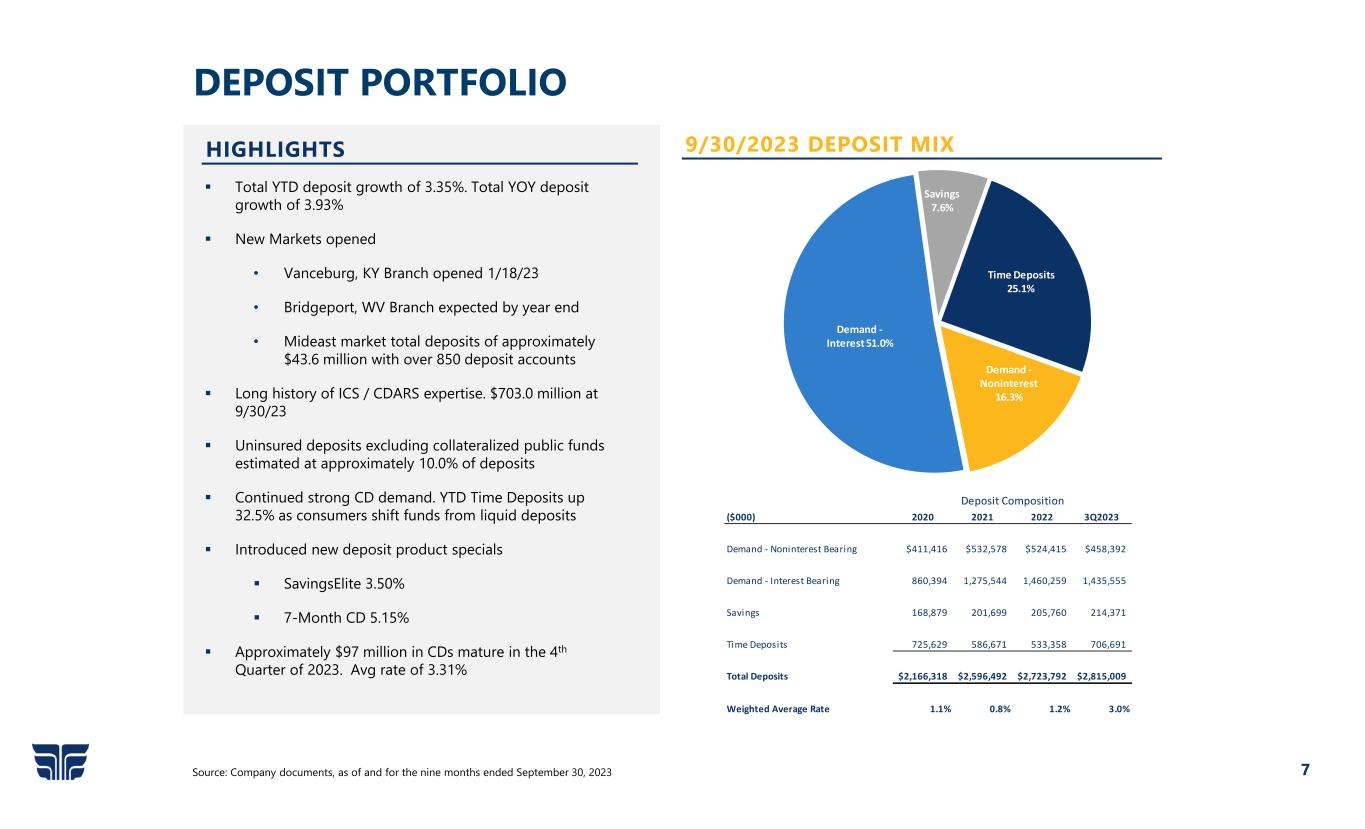

7 Demand ‐ Noninterest 16.3% Demand ‐ Interest51.0% Savings 7.6% Time Deposits 25.1% HIGHLIGHTS Total YTD deposit growth of 3.35%. Total YOY deposit growth of 3.93% New Markets opened • Vanceburg, KY Branch opened 1/18/23 • Bridgeport, WV Branch expected by year end • Mideast market total deposits of approximately $43.6 million with over 850 deposit accounts Long history of ICS / CDARS expertise. $703.0 million at 9/30/23 Uninsured deposits excluding collateralized public funds estimated at approximately 10.0% of deposits Continued strong CD demand. YTD Time Deposits up 32.5% as consumers shift funds from liquid deposits Introduced new deposit product specials SavingsElite 3.50% 7-Month CD 5.15% Approximately $97 million in CDs mature in the 4th Quarter of 2023. Avg rate of 3.31% DEPOSIT PORTFOLIO Source: Company documents, as of and for the nine months ended September 30, 2023 9/30/2023 DEPOSIT MIX ($000) 2020 2021 2022 3Q2023 Demand ‐ Noninterest Bearing $411,416 $532,578 $524,415 $458,392 Demand ‐ Interest Bearing 860,394 1,275,544 1,460,259 1,435,555 Savings 168,879 201,699 205,760 214,371 Time Deposits 725,629 586,671 533,358 706,691 Total Deposits $2,166,318 $2,596,492 $2,723,792 $2,815,009 Weighted Average Rate 1.1% 0.8% 1.2% 3.0% Deposit Composition

BIGGER | STRONGER | MORE PROFITABLE FIRST GUARANTY BANCSHARES, INC.