ID Logistics: +18.3% Growth in Q1 2023

April 24 2023 - 11:45AM

Business Wire

- Q1 2023 revenues: €630.4 million, up 18.3% (up 5.4%

like-for-like)

- International (68% of revenues): Continued good momentum at

€430.4m, up 30.9% (up 10.1% like-for-like)

- France (32% of revenues): Sales down slightly by 2.1% to €200.0

million

- Acquisition of Spedimex (Poland) being finalized

Regulatory News:

ID Logistics (ISIN: FR0010929125, Mnemo: IDL) (Paris:IDL), a

European leader in contract logistics, today announced its revenues

for the first quarter of 2023.

Eric Hémar, Chairman and CEO of ID Logistics, comments: "The

first quarter of 2023 was marked by the continuation of our growth

dynamic with the Group recording a strong increase in its

international revenues. This development is combined with the

strengthening of our activities in Poland with the acquisition of

100% of Spedimex, a major player in contract logistics and

specialist in the fashion and e-commerce sectors. The closing of

the deal is expected by the end of the first half of 2023.”

Revenues, in €m

2023

2022

Change

Change on a like-for-like

basis

1st quarter

International

430.4

328.8

+30.9%

+10.1%

France

200.0

204.2

-2.1%

-2.1%

Total

630.4

533.0

+18.3%

+5.4%

*see definition in appendices

GOOD GROWTH IN 1ST QUARTER 2023: +18.3% (+5.4% ON A LIKE FOR

LIKE BASIS WITH A HIGH BASE EFFECT)

ID Logistics recorded a good level of revenue growth in the 1st

quarter of 2023, reaching €630.4 million, up 18.3% and 5.4% on a

like-for-like basis compared to the 1st quarter of 2022, which

already showed strong growth of 15.1% on a like-for-like basis.

- In international markets, the good growth in revenues

continued during the 1st quarter of 2023, reaching €430.4 million,

or +30.9%. This increase includes the revenues of Kane Logistics, a

company acquired in the United States and consolidated from 1st

April 2022. Adjusted for this perimeter effect and a generally

unfavorable exchange rate effect during the past quarter, growth

was +10.1% compared with the 1st quarter of 2022, which had already

recorded a significant increase of +20.3%.

- In France, revenues fell by 2.1% to €200.0 million, due

to the high level of the first quarter of 2022 (+7.9%) and the

social context linked to the retirement reform.

During this 1st quarter of 2023, the group has started 5 new

operations.

NEW CONTRACTS

ID Logistics continued to respond to a sustained number of

tenders during the 1st quarter of 2023, as clients and prospects

have now integrated the impacts of the new economic environment

into their forecasts.

For example, the Group won or started the following new

contracts during this quarter:

- In Romania, ID Logistics has signed a contract with a new

customer, Selgros Cash & Carry Romania, a subsidiary of

Transgourmet Holding AG. The logistics services provided include

storage operations in a temperature-controlled warehouse of 8,500

sqm and transport to their stores.

- In Germany, ID Logistics started up an operation for its new

customer Enpal, a fast-growing player in the field of solar energy

with headquarters in Berlin, in a record time of 8 weeks. The new

site located in Philippsburg, in the south of Germany, has 35,000

sqm of warehouses and employs 70 people.

- In the United States, ID Logistics adds Wisconsin to its

geographical coverage. The Group is starting up a 28,000 sq. m.

site in the Kenosha area, strategically located 100 km from

Chicago. This site manages the logistics operations of a leading

tableware company for the entire US territory.

- In France, ID Logistics is starting a new activity for KSGB, a

leader in footwear with the Palladium and K-Swiss brands in

particular. The operations will cover both the BtoB activity,

e-commerce and the management of returns for all distribution

channels at the European level.

ACQUISITION OF SPEDIMEX IN POLAND

ID Logistics announced on March 22, 2023 the signing of an

agreement to acquire 100% of the Spedimex group, a major player in

contract logistics in Poland and a specialist in the fashion and

e-commerce sectors, for major international and Polish brands, as

well as in cosmetics.

In addition to contract logistics, Spedimex offers a strong

distribution and transport network, value-added logistics services

or retail preparation. Spedimex has developed an asset-light model

and operates 15 sites across the country representing 230,000 sqm

of warehouse surface. The Company has implemented state-of-the-art

mechanization and technology solutions capable of handling large

and complex flows such as e-commerce and store returns from more

than 15 European countries.

The transaction remains subject to the approval of the relevant

Polish antitrust authorities. Spedimex's sales (EUR 109 million in

2022) are not yet consolidated in ID Logistics' activities. The

acquisition is expected to be completed by June 2023.

OUTLOOK

After the first quarter of 2023, ID Logistics is well positioned

to continue its profitable development, relying in particular on

its growth drivers in Europe (especially in Poland and Italy) and

the United States. The Group remains vigilant with regard to the

evolution of the macro-economic situation and attentive to the

support needs of its customers.

NEXT PUBLICATION

Sales for the 2nd quarter of 2023: July 24, 2023, after market

close.

ABOUT ID LOGISTICS:

ID Logistics, managed by Eric Hémar, is an international

contract logistics group with revenue of €2.5 billion in 2022. ID

Logistics manages 365 sites across 17 countries representing more

than 8 million square meters of warehousing facilities in Europe,

America, Asia and Africa, with 30,000 employees.

With a client portfolio balanced between retail, e-commerce and

consumer goods, ID Logistics is characterized by offers involving a

high level of technology. Developing a social and environmental

approach through a number of original projects since its creation

in 2001, the Group is today resolutely committed to an ambitious

CSR policy. ID Logistics shares are listed on the regulated market

of Euronext Paris, compartment A (ISIN code: FR0010929125, Ticker:

IDL).

APPENDIX

CHANGE ON A COMPARABLE BASIS

The like-for-like changes in revenues reflect the organic

performance of the ID Logistics Group, excluding the impact of:

- changes in the scope of consolidation: the contribution to

revenues of companies acquired during the period is excluded from

this period, and the contribution to revenues of companies disposed

of during the previous period is excluded from this period; -

changes in the applicable accounting principles; - changes in

exchange rates by calculating revenues for the various periods on

the basis of identical exchange rates: thus, published data for the

previous period are converted using the exchange rate for the

current period.

Reconciliation of reported revenues to

revenues on a like-for-like basis

in €M

2022

Scope effects

Effect of exchange rate

fluctuations

Effect of adoption of IAS 29*

% Like-for-like change

2023

1st quarter

533.0

+13.6%

-0.8%

+0.1%

+5.4%

630.4

*Application of the hyperinflation accounting treatment for

Argentina

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230424005628/en/

Yann Perot - CFO Tel : +33 (0)4 42 11 06 00

yperot@id-logistics.com

Investor Relations Contact NewCap Tel. 33 (0)1 44 71 94

94

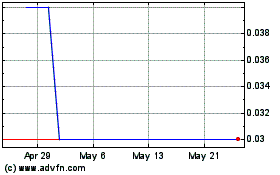

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From Apr 2024 to May 2024

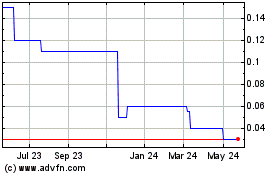

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From May 2023 to May 2024