CBR Gold Corp. Announces Spin-Out Transaction

February 04 2010 - 7:30AM

Marketwired Canada

CBR Gold Corp. (TSX VENTURE:CBG)(FRANKFURT:C3M) ("CBG") (the "Company") is

pleased to announce that its Board of Directors ("Board") has approved in

principle, a spin-out (the "Transaction") of its Canadian and Australian gold

assets.

"Niblack and Three Bluffs are outstanding exploration projects, each with

potential to produce in the near to medium term. Our joint venture partner,

Heatherdale Resources Ltd., is sole funding exploration at Niblack and has the

right to earn up to a 70% interest by funding it through to feasibility. Three

Bluffs, on the other hand, is 100% owned by us and requires significant

exploration to advance the project. Therefore, we feel that it would maximize

shareholders' value to spin-out our other assets so that shareholders hold an

equal number of shares in two reporting issuers with distinct flagship projects

that have unique prospects and requirements for success," said John Williamson,

President and CEO of the Company.

CBG intends to change its name to Niblack Mineral Development Inc. ("NIB"),

which will retain its interests in the Alaskan VMS exploration properties

located in Southeastern Alaska (Niblack, Ruby Tuesday and Khayyam) as well as an

extensive proprietary database focused on this region. CBG will transfer its

100% owned Canadian and Australian assets, including the high-grade Three Bluffs

deposit in Nunavut, Canada; the Jaurdi Hills project in Western Australia; and

Toro Drilling Services Pty. Ltd. to the newly formed subsidiary North Country

Gold Corp. ("NCG") in exchange for NCG shares, which CBG will then distribute to

CBG shareholders on a 1:1 basis. CBG currently holds approximately $9 million in

working capital, marketable securities and equipment, which will be allocated

between NIB and NCG pursuant to the Transaction.

The Company is working with its financial and legal advisors to finalize the

structure and feasibility of the Transaction. If the Board determines to

proceed, the Transaction and name change will be subject to regulatory and

Shareholder approval. If the Transaction proceeds as a statutory arrangement,

Court approval will also be required. If the requisite approvals for the

Transaction are obtained, CBR will reduce its share capital in an amount equal

to the NCG Shares owned by CBR and will distribute such NCG Shares to

Shareholders as a return of capital. Details of the Transaction will be set out

in the proxy circular to be provided to Shareholders in connection with the

special meeting at which approval for the Transaction will be sought, which is

presently scheduled for March 24, 2010.

Alaskan Assets

Niblack Project:

The Niblack Project, held by CBG and joint venture partner Heatherdale Resources

Ltd., is an advanced stage copper-gold-zinc-silver project located on the

southern tip of the Alaskan panhandle on Prince of Wales Island in Alaska, USA.

The Project comprises an NI 43-101 compliant resource and contiguous land

package comprising 3,300 acres with excellent potential to expand the current

resource base. The current mineral inventory at Niblack includes an Indicated

Resource of 2,588,000 tonnes grading 2.33 g/t gold, 33.18 g/t silver, 1.18%

copper and 2.19% zinc and an Inferred Resource of 1,712,000 tonnes grading 2.08

g/t gold, 32.56 g/t silver, 1.55% copper and 3.17% zinc based on a US$50 NSR

block cut-off. Ongoing drilling undertaken by Heatherdale Resources Ltd.

continues to produce excellent results (See press releases dated August 17,

2009, December 17, 2009 and January 18, 2010).

Khayyam and Ruby Tuesday Properties:

The Khayyam and Ruby Tuesday Properties are historic mining operations 100%

owned by CBG located on Prince of Wales Island between 20 and 30 km NNW of the

Niblack Project. The Properties are located within highly prospective geological

corridor hosting significant VMS occurrences at Niblack, Copper City, Corbin and

Big Harbour, and have excellent potential to be developed. Rock samples have

returned values up to 6.9g/t gold, 8.93% copper, 3.61% zinc and 43.7g/t silver

at Khayyam. Results from Ruby Tuesday include rock samples to 16.52% zinc, 8.41%

lead, 1.36% copper and 27.3g/t silver.

Canadian Assets

Management believes that Canada, and Nunavut in particular, offers the best

value for long term exploration success. As such, the goal of NCG is to

concentrate on its activities in Canada.

Three Bluffs Project:

The Three Bluffs Deposit, located within the Committee Bay Greenstone Belt in

Nunavut, Canada, comprises a current NI 43-101 compliant resource of 2.7Mt at

5.85g/t gold for 508,000 oz gold (Indicated) and 1.27Mt at 5.98g/t gold for

244,000oz gold (inferred). The Deposit is hosted within a approx.50m wide,

steeply dipping Banded Iron Formation unit which can be traced for over 10 km.

Gold mineralisation at the Three Bluffs Deposit has presently been delineated

over nearly 1 km of strike to an average depth of 100 m. Significant potential

exists to expand the current resource inventory by continued exploration

targeting mineralized shoot plunge extensions and strike continuity. Current

drilling includes an intercept of 23.53g/t gold over 13.59 m, within the same

iron formation, 400 m west of the current resource shell.

Regional Nunavut Projects:

The Committee Bay Greenstone Belt is 300 km long, 5 to 50 km wide package of

highly prospective lithologies geologically comparable to the significant gold

bearing belts hosting the Meadowbank and Meliadine deposits currently being

developed in eastern Nunavut. The Committee Bay Greenstone Belt currently hosts

more than 40 high-grade gold occurrences but remains one of the longest and

least explored greenstone belts in Canada. NCG will hold a 100% interest in

approximately 567,000 acres of land with prospective geology along the Committee

Bay Belt.

Australian Assets

Management believes that the value of its Australian interests will be maximized

by advancing these assets and operations through sale or joint venture

transactions. Pursuant to the Transaction, the Australian assets will be

transferred to NCG.

Jaurdi Hills Project:

The Jaurdi Hills Project encompasses in excess of 8,500 hectares within the

prolific gold producing Norseman-Wiluna greenstone belt of Western Australia's

Yilgarn Craton. The Project includes the historic Jaurdi and Wealth of Nations

mining areas and contains numerous drill ready targets in close proximity to

excellent infrastructure.

Toro Drilling:

Toro Drilling Services Pty. Ltd. ("Toro") is a wholly owned subsidiary of CBG

with operations based in Coolgardie, Western Australia. Toro has had an

exclusive contract to perform the exploration drilling for Focus Minerals Ltd.

on the Coolgardie Gold Project, formerly the subject of CBG's Redemption Joint

Venture. The estimated value of Toro's operating assets is approximately AUD 2

million, including surface, underground and hand-held diamond drills, as well as

a reverse circulation (RC) rig, support vehicles and related inventory. Since

the formation of Toro in February 2008, it has generated more than AUD 2 million

in drilling revenue.

CBR Gold Corp. is a member of the Discovery Group of companies, for more

information on the group visit www.discoveryexp.com.

On behalf of the Board

CBR Gold Corp.

John Williamson, President, CEO & Director

For further information about CBR Gold Corp., please visit www.cbrgoldcorp.com.

The program is supervised by Peter Kleespies, M.Sc., P. Geol. who is the

Qualified Person as defined by NI 43-101. A detailed description of CBR Gold

Corp.'s QA/QC program is provided on the Company's website at

www.cbrgoldcorp.com.

This release includes certain statements that may be deemed "forward-looking

statements". All statements in this release, other than statements of historical

facts, that address exploration drilling, exploitation activities and events or

developments that the company expects are forward looking statements. Although

the company believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are not

guarantees of future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors that could

cause actual results to differ materially from those in forward-looking

statements include market prices, exploitation and exploration successes,

continuity of mineralization, uncertainties related to the ability to obtain

necessary permits, licenses and title and delays due to third party opposition,

changes in government policies regarding mining and natural resource exploration

and exploitation, and continued availability of capital and financing, and

general economic, market or business conditions. Investors are cautioned that

any such statements are not guarantees of future performance and actual results

or developments may differ materially from those projected in the

forward-looking statements. For more information, investors should review the

Company's continuous disclosure filings at www.sedar.com.

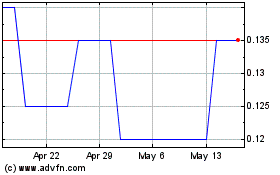

Chibougamau Independent ... (TSXV:CBG)

Historical Stock Chart

From Apr 2024 to May 2024

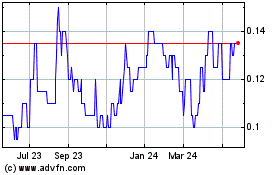

Chibougamau Independent ... (TSXV:CBG)

Historical Stock Chart

From May 2023 to May 2024