0001819516

false

0001819516

2023-09-14

2023-09-14

0001819516

us-gaap:CommonClassAMember

2023-09-14

2023-09-14

0001819516

us-gaap:WarrantMember

2023-09-14

2023-09-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 14, 2023

WHEELS

UP EXPERIENCE INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39541 |

98-1617611 |

| (State or other jurisdiction |

(Commission |

(I.R.S. Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 601

West 26th Street, Suite 900 |

|

| New York,

New York |

10001 |

| (Address of principal executive offices) |

(Zip Code) |

(212)

257-5252

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which

registered |

| Class

A common stock, par value $0.0001 per share |

|

UP |

|

New

York Stock Exchange |

| |

|

|

|

|

| Redeemable

warrants, each warrant exercisable for 1/10th of one share of Class A common stock at an exercise price of $115.00 per

whole share of Class A common stock |

|

UP WS |

|

OTCPK* |

| * | On July 7, 2023, the New

York Stock Exchange filed a Form 25 with the U.S. Securities and Exchange Commission to delist the redeemable publicly-traded warrants. |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

As previously disclosed by Wheels Up Experience Inc.

(the “Company” or “Wheels Up”) in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”)

on September 8, 2023, the Company entered into the Third Amendment to Secured Promissory Note, dated as of September 6, 2023

(the “Note Third Amendment”), with Delta Air Lines, Inc., as payee (“Delta”), which amended the Secured Promissory

Note, dated August 8, 2023 (as amended through September 8, 2023, the “Note”), with Delta. On September 14, 2023,

the Company and Delta entered into the Fourth Amendment to Secured Promissory Note (the “Note Fourth Amendment” and together

with the Note, the “Amended Note”), to increase the aggregate principal amount of the Note by up to an additional $10.0 million,

of which the additional $10.0 million was received by the Company on September 14, 2023. The Note Third Amendment brought the

total principal amount under the Amended Note up to $70.0 million. The Fourth Amendment does not contain any additional material

covenants or terms or amend any material covenants or terms set forth in the Note.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth under Item 1.01 above

is incorporated herein by reference.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

(b)&(c) On September 14, 2023,

the Company announced that the Board of Directors of the

Company appointed George N. Mattson to serve as Chief Executive Officer of Wheels Up Partners LLC, an indirect subsidiary of

the Company (“WUP”), and the principal executive officer of the Company. Mr. Mattson is expected to join the

Company in early October 2023. Todd Smith, who has been serving as WUP’s interim Chief Executive Officer and Chief

Financial Officer since May 9, 2023, will continue to serve as the Company’s interim Chief Executive Officer and

principal executive officer until Mr. Mattson first date of employment. Thereafter, Mr. Smith will continue to serve as

WUP’s Chief Financial Officer and the Company’s principal financial officer and principal accounting officer.

George N. Mattson, age 57, currently serves as

President of Star Mountain Capital, a specialized private investment firm, a role that he has held since February 2023 and anticipates

stepping down from prior to beginning employment with Wheels Up. Prior to joining Star Mountain Capital, Mr. Mattson was a private investor

and corporate board member from 2012 to February 2023. Prior to his years as a private investor, Mr. Mattson held various positions at

Goldman, Sachs & Co. from 1994 to 2012, including most recently as a partner and co-head of the Global Industrials Group in Investment

Banking from 2002 to 2012, and prior to that time, held various sales and marketing positions at IBM Corp. from 1987 to 1993. Mr. Mattson

has also served as a director of Delta Air Lines, Inc. (NYSE: DAL) since October 2012, and Xos, Inc. since August 2021. He formerly served

as a director of Virgin Galactic Holdings, Inc. (NYSE: SPCE) from October 2019 to June 2023, Virgin Orbit Holdings, Inc. from December

2021 to August 2023, NextGen Acquisition Corp II from January 2021 to December 2021, NextGen Acquisition Corp from July 2020 to August

2021, and Air France-KLM S.A. (PAR: AF) from 2017 until 2021. Mr. Mattson holds a Bachelor of Science degree in Electrical Engineering

from Duke University and Master of Business Administration degree from the Wharton School of the University of Pennsylvania.

There are no family relationships between

Mr. Mattson and any director, executive officer or person nominated or chosen by the Company to become a director or executive

officer of the Company and there are no arrangements or understandings between Mr. Mattson and any other person pursuant to

which he was selected as Chief Executive Officer of WUP and the principal executive officer of the Company. Mr. Mattson holds

equity interests in and serves as Chairman of the Board of Managers of Tropic Ocean Investors LLC (“Tropic Ocean”),

which owns Tropic Ocean Airways, an amphibious airline and leading provider of last-mile private charter and scheduled service in

Florida, the Northeastern U.S., the Bahamas and the Caribbean. The Company, through its indirect subsidiary, owns approximately

14.56% of Tropic Ocean and has also entered into a multiyear commercial cooperation agreement (the “CCA”) with Tropic

Ocean. Total payments to Tropic Ocean under the CCA since January 1, 2022 were approximately $249,800 and consist of

payments to Tropic Ocean as a third-party operator for Wheels Up member flights. Because Mr. Mattson holds an equity interest

in Tropic Ocean in excess of the threshold identified under the applicable rules of the SEC, the amount of his interest in these

transactions may be deemed to be approximately $249,800. Otherwise, there are no transactions in which Mr. Mattson has an

interest requiring disclosure under Item 404(a) of Regulation S-K.

The details of Mr. Mattson’s compensation

in connection with his appointment as Chief Executive Officer will be determined by the Compensation Committee of the Board of Directors

at a later date.

| Item 7.01 | Regulation FD Disclosure. |

On September 14, 2023, the Company issued

a press release regarding the appointment of Mr. Mattson as Chief Executive Officer, a copy of which is furnished as Exhibit 99.1

respectively, and incorporated by reference herein.

The information in Item 7.01 of this Current

Report on Form 8-K and Exhibit 99.1 is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities

Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains

certain “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are predictions,

projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject

to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside of the control of Wheels Up

that could cause actual results to differ materially from the results discussed in the forward-looking statements. These forward-looking

statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions or strategies of Wheels

Up regarding the future, including, without limitation, statements regarding the start date of any new personnel or expected personnel

transitions, if at all, any expected impacts from personnel changes and the ability of Wheels Up to execute and realize the anticipated

benefits from, and the degree of market acceptance and adoption of, any new services or partnership experiences in the future. The words

“anticipate,” “believe,” continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the

absence of these words does not mean that statement is not forward-looking. These forward-looking statements are subject to a number of

risks, uncertainties and assumptions that could cause actual events and results to differ materially from those contained in such forward-looking

statements. Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements

can be found in Wheels Up’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on

March 31, 2023 and Wheels Up’s other filings with the SEC. Moreover, Wheels Up operates in a very competitive

and rapidly changing environment. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events

or how they may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the

date made, and Wheels Up undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information,

changes in expectations, future events or otherwise. Although Wheels Up believes that the expectations reflected in the forward-looking

statements are reasonable, Wheels Up cannot guarantee future results, levels of activity, performance or achievements. Except as required

by law, Wheels Up does not intend to update any of these forward-looking statements after the date of this Current Report on Form 8-K

or to conform these statements to actual results or revised expectations.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

WHEELS UP EXPERIENCE

INC. |

| |

|

|

|

| |

|

|

|

| Date: September 18,

2023 |

By: |

/s/

Todd Smith |

| |

|

Name: |

Todd

Smith |

| |

|

Title: |

Interim Chief Executive Officer

and Chief Financial Officer |

Exhibit 99.1

Wheels Up appoints George N. Mattson as CEO

Leadership and financial stability to underpin

a new era of operational excellence and customer experience, setting the standard for private aviation with a seamless connection to

premium commercial travel

Wheels Up today

announced George N. Mattson as its new Chief Executive Officer, as the company charts its future as a leader in private jet travel. Mattson

brings 25 years of aviation experience to the role, as a strategic advisor, financier, business owner/operator and director.

“In 10 years, Wheels Up has grown from

a startup into a global leader in private aviation, with a strong consumer brand and loyal member community,” Mattson said. “I

look forward to leading the Wheels Up team, with the operational, commercial, strategic and financial support of Delta and our other

new investors. Delivering best-in-class operating performance and exceptional customer experiences, consistently and profitably, will

attract more members to our community as we begin the next chapter of the Wheels Up story.”

“George is an exceptional business leader

whose background will be instrumental to the continued success of Wheels Up,” said Delta CEO Ed Bastian. “With new leadership

in place, Wheels Up is well-positioned to drive strategic, operational and financial improvements for its customers and stakeholders

in the months and years ahead.”

Mattson is a longstanding

member of Delta’s Board of Directors. He previously served as a partner and co-head of the Global Industrials Group in Investment

Banking at Goldman, Sachs & Co. from 2002 to 2012, during which time his responsibilities included oversight of the Transportation

and Airline practices. Since 2014, he has been the lead investor and Chairman of Tropic Ocean Airways, the nation’s second-largest

operator of seaplanes. Tropic Ocean Airways is a Wheels Up partner.

“I look forward to working with George

as he brings his expertise and leadership to Wheels Up,” said Dan Janki, Wheels Up Chairman and Delta’s Chief Financial Officer.

“I would also like to thank interim CEO Todd Smith for his leadership through this period of transition at Wheels Up. The changes

made during his tenure are expected to stabilize the business and will help drive future profitability and an elevated experience for

our members. Todd will continue his work as Wheels Up CFO.”

Mattson will be based in Atlanta, home to the

recently opened Wheels Up state-of-the-art Member Operations Center, which centralizes all of the company’s operational functions.

Mattson’s first official day is expected to be in early October.

“Our alignment with Delta provides an incredible

opportunity for the first time in aviation history to create seamless experiences between the separate ecosystems of private and commercial

travel,” Mattson said. “I’m thrilled to be working with our world class team and our great partners to realize this

tremendous potential in the years to come.”

"I am very enthusiastic about the future

of Wheels Up. George is an exceptional choice to lead the company through this important time. He will serve customers, employees,

and stakeholders consistent with the elevated experiences that have always defined Wheels Up,” said Kenny Dichter, Founder. “The

entire Wheels Up community has my unwavering support on the journey ahead.”

Wheels Up previously announced a non-binding agreement in principle

for an up to $500 million facility, which is expected to include funds contributed by Delta Air Lines, CK Opportunities Fund I, LP,

which is co-managed by affiliates of Certares Management LLC and Knighthead Capital Management LLC, and certain other lenders.

The transaction is subject to completing definitive documentation, as well as customary closing conditions and other approvals.

Wheels Up, which offers membership-based and

on-demand private jet services, is a meaningful part of Delta’s broad portfolio of premium partners. The relationship dates to

2020, when Delta Private Jets combined with Wheels Up. Delta provides Wheels Up members with an array of benefits, including access to

Delta flights, the opportunity to earn Delta SkyMiles and the ability to earn toward Medallion Status through spend on Wheels Up flights.

Contacts:

Wheels Up:

Media Relations:

press@wheelsup.com

Investor Relations:

ir@wheelsup.com

Wheels Up Experience Inc. Cautionary Note Regarding Forward-Looking

Statements

This press release contains certain "forward-looking statements"

within the meaning of the federal securities laws. Forward-looking statements are predictions, projections and other statements about

future events that are based on current expectations and assumptions and, as a result, are subject to known and unknown risks, uncertainties,

assumptions, and other important factors, many of which are outside of the control of Wheels Up Experience Inc. (“Wheels Up”).

These forward-looking statements include, but are not limited to, statements regarding: (i) the impact of new strategic initiatives

on Wheels Up’s business and results of operations, including the expected impacts from personnel changes and the ability of Wheels

Up to execute and realize the anticipated benefits from, and the degree of market acceptance and adoption of, any new services or partnership

experiences, including member program changes implemented in June 2023 and any future member program changes; (ii) Wheels Up’s

ability to continue as a going concern absent receipt of the funding from the proposed transactions previously announced and described

in this press release; (iii) the terms of, the ability to sign and close, and the impact of, any potential investments, financings

(including the financing discussed in this press release), restructurings or other strategic transactions involving Wheels Up or its

subsidiaries or affiliates, including the ability to realize anticipated benefits relating to any such transactions and any potential

impacts on the trading prices and trading market for Wheels Up’s Class A common stock, par value $0.0001 per share; (iv) the

impact of Wheels Up’s cost reduction efforts and measures intended to increase Wheels Up’s operational efficiency on its

business, results of operations, cash flows and liquidity, including the timing and magnitude of such expected reductions and any associated

expenses in relation to liquidity levels and working capital needs; (v) Wheels Up’s ability to perform under its contractual

obligations, including to its members and customers, and maintain or establish relationships with third-party vendors and suppliers;

(vi) the competition in, size, demands and growth potential of the markets for Wheels Up’s products and services and Wheels

Up’s ability to serve those markets; and (vii) general economic and geopolitical conditions, including due to fluctuations

in interest rates, inflation, foreign currencies, consumer and business spending decisions, and general levels of economic activity.

The words "anticipate," "believe," continue," "could," "estimate," "expect," "intend,"

"may," "might," "plan," "possible," "potential," "predict," "project,"

"should," "strive," "would" and similar expressions may identify forward-looking statements, but the absence

of these words does not mean that statement is not forward-looking. Factors that could cause actual results to differ materially from

those expressed or implied in forward-looking statements can be found in Wheels Up's Annual Report on Form 10-K for the year ended

December 31, 2022 filed with the U.S. Securities and Exchange Commission (the "SEC") on March 31, 2023,

Wheels Up’s Quarterly Report on Form 10-Q for the three months ended June 30, 2023 filed with the SEC on August 14, 2023,

and Wheels Up's other filings with the SEC from time to time. You are cautioned not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. Except as required by law, Wheels Up does not intend to update any of these forward-looking

statements after the date of this press release or to conform these statements to actual results or revised expectations.

v3.23.3

Cover

|

Sep. 14, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 14, 2023

|

| Entity File Number |

001-39541

|

| Entity Registrant Name |

WHEELS

UP EXPERIENCE INC.

|

| Entity Central Index Key |

0001819516

|

| Entity Tax Identification Number |

98-1617611

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

601

West 26th Street, Suite 900

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

257-5252

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class

A common stock, par value $0.0001 per share

|

| Trading Symbol |

UP

|

| Security Exchange Name |

NYSE

|

| Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable

warrants, each warrant exercisable for 1/10th of one share of Class A common stock at an exercise price of $115.00

|

| Trading Symbol |

UP WS

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

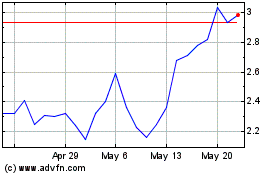

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

From Apr 2024 to May 2024

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

From May 2023 to May 2024