Range Production Reaches New High - Analyst Blog

January 18 2012 - 5:30AM

Zacks

In an interim update, independent

oil and gas operator, Range Resources Corporation

(RRC) announced that it achieved record production in the fourth

quarter of 2011. The production increased 16% on both a

year-over-year as well as sequential basis to reach an average

production volume of 625 million cubic feet of gas equivalent

(Mmcfe) per day.

Production for full-year 2011

climbed 12% compared to 14% in 2010 and averaged 554 Mmcfe per day.

Despite the sale of Barnett assets in April 2011, Range saw the

eighth consecutive year of double-digit production growth. The 12%

production growth in 2011 would have been 36%, adjusting for the

sale of the Barnett properties.

Range also declared its preliminary

natural gas, natural gas liquids (NGL’s) and oil price realizations

(including the impact of cash-settled hedges and derivative

settlements) for fourth quarter 2011. The average price realization

of $5.44 per thousand cubic feet of gas equivalent (Mcfe) grew 2%

from prior-year period.

Production of natural gas, natural

gas liquids and crude oil averaged 491 Mmcfe, 16,931 barrels per

day and 5,409 barrels per day, respectively. The price realized by

natural gas, natural gas liquids and crude oil were $4.14, $54.31

and $83.71, respectively.

The company increased its commodity

hedge position during the fourth quarter, with approximately 75% of

its estimated natural gas production for 2012 hedged at a weighted

average floor of $4.45 per million British thermal units (Mmbtu).

Range has also hedged the majority of its 2013 projected natural

gas production at a floor price of $4.73 per Mmbtu.

However, considering the company’s

exposure to volatile natural gas fundamentals, interest rate risks

and an uncertain macro backdrop, we maintain our long-term

Underperform recommendation. Headquartered in Fort Worth, Texas,

Range Resources competes with EQT Corporation

(EQT), SM Energy Company (SM) and Ultra

Petroleum Corp. (UPL).

Range holds a Zacks #4 Rank, which

translates into a Sell rating for a period of one to three

months.

EQT CORP (EQT): Free Stock Analysis Report

RANGE RESOURCES (RRC): Free Stock Analysis Report

SM ENERGY CO (SM): Free Stock Analysis Report

ULTRA PETRO CP (UPL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

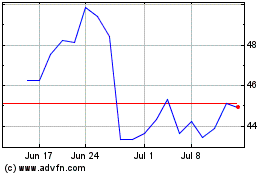

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

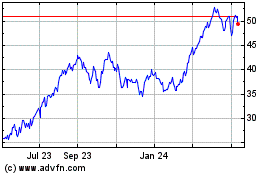

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024