FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

January 29, 2024

Date of Report (date of earliest event reported)

Pegasus Digital Mobility Acquisition Corp.

(Exact name of Registrant as specified in its

charter)

| Cayman Islands |

|

001-40945 |

|

98-1596591 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

71 Fort Street

George Town

Grand Cayman

Cayman Islands |

|

KY1-1106 |

| (Address of principal executive offices) |

|

(Zip Code) |

+1345 769-4900

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A Ordinary Share and one-half of one redeemable Warrant |

|

PGSS.U |

|

New York Stock Exchange |

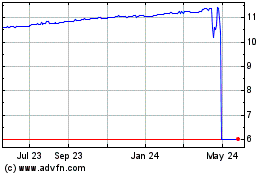

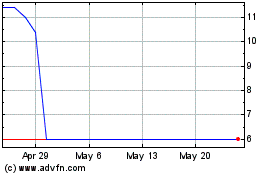

| Class A Ordinary Shares, par value $0.0001 per share |

|

PGSS |

|

New York Stock Exchange |

| Redeemable Warrants, each exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share |

|

PGSS.WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry Into A Material Definitive Agreement. |

Second Amendment to the Business Combination

Agreement

As

previously disclosed, on May 31, 2023, Pegasus Digital Mobility Acquisition Corp., a

Cayman Islands exempted company ("Pegasus"), entered into a Business Combination Agreement (as it may be amended, supplemented,

or otherwise modified from time to time, the "Business Combination Agreement"), by and among Pegasus, Gebr. Schmid GmbH,

a German limited liability company ("Schmid"), Pegasus Topco B.V., a Dutch private limited liability company and wholly-owned

subsidiary of Pegasus ("TopCo") and Pegasus MergerSub Corp., a Cayman Islands exempted company and wholly-owned subsidiary

of TopCo ("Merger Sub"). Capitalized terms used but not defined herein have the meaning given to them in the Business

Combination Agreement.

On September 25,

2023, Pegasus, Schmid, TopCo and Merger Sub entered into an amendment to the Business Combination Agreement (the "First Amendment

to the Business Combination Agreement"), pursuant to which, among other things, the parties thereto have agreed to update certain

aspects of the transaction structuring as outlined in further detail therein.

On January 29,

2024, Pegasus, Schmid, TopCo and Merger Sub entered into a second amendment to the Business Combination Agreement (the "Second

Amendment to the Business Combination Agreement"), pursuant to which, among other things, the parties have agreed to (i) extend

the timeline until April 30, 2024 when the business combination has to be completed, and (ii) reduced the number of shares that

the shareholders of Schmid (Anette Schmid and Christian Schmid) will receive in the business combination to 28,725,000 TopCo shares.

A copy of the Second Amendment to the Business

Combination Agreement is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated by reference, and the

foregoing description is qualified in its entirety by reference to the full text of the Second Amendment to the Business Combination Agreement.

First Amendment to the Schmid Shareholders'

Undertaking

Concurrently with the execution of the Second

Amendment to the Business Combination Agreement, each of the Schmid Shareholders and Pegasus entered into a modified Shareholders' Undertaking

Agreement on January 29, 2024 to reflect the changes agreed in the Business Combination Agreement (the "First Amendment to

the Schmid Shareholders' Undertaking")

A copy of the First Amendment to the Schmid Shareholders'

Undertakings is filed with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated by reference, and the foregoing

description is qualified in its entirety by reference to the full text of the Schmid Shareholders' Undertakings.

Private Warrants Transfer Agreement

Concurrently with the execution of the Second

Amendment to the Business Combination Agreement, Pegasus Digital Mobility Sponsor LLC, a Cayman Islands limited liability company (the

"Sponsor") entered into an agreement with Anette Schmid and Christian Schmid pursuant to which the Sponsor committed to transfer

2,000,000 private warrants of Pegasus to Anette Schmid (1,000,000 private warrants) and Christian Schmid (1,000,000 private warrants)

subject to the closing of the Business Combination (the "Private Warrants Transfer Agreement").

A copy of the form of the Private Warrants Transfer

Agreement is filed with this Current Report on Form 8-K as Exhibit 10.2 and is incorporated herein by reference, and the foregoing

description is qualified in its entirety by reference to the full text of the Private Warrants Transfer Agreement.

Private Warrants Undertaking Agreement

Concurrently with the execution of the Second

Amendment of the Business Combination Agreement, the Sponsor, Pegasus, Schmid and certain individuals party thereto (comprising the officers

and directors of Pegasus) (each, an "Insider") have entered into a Private Warrants Undertaking Agreement, pursuant to

which, among other things, the Sponsor and the Insiders agreed to (i) only exercise their private warrants on a "cashless basis"

in accordance with the terms of the private warrants, (ii) in case the reference price of the TopCo shares subsequently to the business

combination closing reach USD 18.00 to, on a "cashless basis" exercise their warrants in accordance with terms of the private

warrants unless such warrants have been previously redeemed or exercised (the "Private Warrants Undertaking Agreement").

A copy of the form of the Private Warrants Undertaking

Agreement is filed with this Current Report on Form 8-K as Exhibit 10.3 and is incorporated herein by reference, and the foregoing

description is qualified in its entirety by reference to the full text of the Private Warrants Undertaking Agreement.

Earn-out Agreement

Concurrently with the execution of the Second

Amendment to the Business Combination Agreement, Pegasus, TopCo and Anette Schmid and Christian Schmid entered into an earn-out agreement

pursuant to which (i) 2,500,000 TopCo shares will be issued to Anette Schmid and Christian Schmid (in equal parts) if the share

price of TopCo following the completion of the business combination reaches USD 15.00 and (ii) 2,500,000 TopCo shares will be issued

to Anette Schmid and Christian Schmid (in equal parts) if the share price of TopCo following the completion of the business combination

reaches USD 18.00 (the "Earn-out Agreement"). The Earn-out Agreement expires after three (3) years from the date

of the completion of the business combination.

A copy of the form of the Earn-out Agreement is

filed with this Current Report on Form 8-K as Exhibit 10.4 and is incorporated herein by reference, and the foregoing description

is qualified in its entirety by reference to the full text of the Earn-out Agreement.

XJ Subscription Agreement

Pegasus, Schmid and TopCo entered into a subscription

agreement with XJ Harbour HK Limited ("XJ") (the "XJ Subscription Agreement") according to which XJ

agreed to in stages transfer its 24.1% equity interest in Schmid Technology (Guangdong) Co., Ltd., a subsidiary of Schmid, to TopCo

for consideration amounting to (i) 1,406,361 TopCo shares to be allotted to XJ at the time of the completion of the business combination,

(ii) a EUR 10 million payment to XJ from TopCo at the completion of the business combination, (iii) a EUR 5 million payment

to XJ from TopCo within 270 days from the day of the completion of the business combination and (iv) a EUR 15 million payment (plus

an interest in respect thereof at an annual rate of 6% from the completion of the business combination to the date of payment) to XJ from

TopCo within 455 days from the day of the completion of the business combination.

A copy of the form of a XJ Subscription Agreement

is filed with this Current Report on Form 8-K as Exhibit 10.5 and is incorporated herein by reference, and the foregoing description

is qualified in its entirety by reference to the full text of the XJ Subscription Agreement.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure set forth above in Item 1.01 of

this Current Report on Form 8-K is incorporated by reference herein. Any Subscribed Shares to be offered and sold in connection with

investment in TopCo shares have not been registered under the Securities Act of 1933, as amended (the "Securities Act"),

in reliance upon the exemption provided in Section 4(a)(2) thereof.

Item 7.01 Regulation FD Disclosure.

On January 29, 2024, Pegasus and Schmid issued

a press release announcing their entry into the Second Amendment of the Business Combination Agreement and the related agreements set

out in his Current Report on Form 8-K. The press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

The foregoing (including Exhibit 99.1) is

being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise

be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities

Act or the Exchange Act.

The Company further announced

the publication of a presentation prepared by Schmid in connection with the possible business combination.

A copy of the investor

presentation is attached to this Current Report on Form 8-K as Exhibit 99.2 and are incorporated herein

by reference.

Additional Information

In connection with the

proposed Business Combination, (i) Pegasus TopCo B.V. is expected to file with the SEC an amended registration statement on Form F-4/A containing

a preliminary proxy statement of Pegasus and a preliminary prospectus (the "Registration/Proxy Statement"),

and (ii) Pegasus will file a definitive proxy statement relating to the proposed Business Combination (the "Definitive

Proxy Statement") and will mail the Definitive Proxy Statement and other relevant materials to its shareholders after the Registration/Proxy

Statement is declared effective. The Registration/Proxy Statement will contain important information about the proposed Business Combination

and the other matters to be voted upon at a meeting of Pegasus shareholders to be held to approve the proposed Business Combination.

This press release does not contain all the information that should be considered concerning the proposed Business Combination and is

not intended to form the basis of any investment decision or any other decision in respect of the Business Combination.

Before

making any voting or other investment decisions, securityholders of Pegasus and other interested persons are advised to read,

when available, the Registration/Proxy Statement and the amendments thereto and the Definitive Proxy Statement and other documents filed

in connection with the proposed Business Combination, as these materials will contain important information about Pegasus, Schmid

and the Business Combination. When available, the Definitive Proxy Statement and other relevant materials for the proposed Business

Combination will be mailed to shareholders of Pegasus as of a record date to be established for voting on the proposed Business

Combination. Shareholders will also be able to obtain copies of the Registration/Proxy Statement, the Definitive Proxy Statement and

other documents filed with the SEC, without charge, once available, at the SEC's website at www.sec.gov, or by directing

a request to: Robert Bruce at rbruce@scfundmanagement.com.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE OFFERING OR THE ACCURACY OR ADQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

Pegasus, Schmid, Strategic Capital and their respective

directors, executive officers and other members of their management and employees may, under SEC rules, be deemed to be participants in

the solicitations of proxies from Pegasus's shareholders in connection with the proposed Business Combination. Information regarding the

persons who may, under SEC rules, be deemed participants in the solicitation of Pegasus's shareholders in connection with the proposed

Business Combination will be set forth in Registration Statement/Proxy Statement and Definitive Proxy Statement when such are filed with

the SEC. Shareholders, potential investors and other interested person should read the Registration Statement/Proxy Statement and Definitive

Proxy Statement carefully when such becomes available before making any voting or investment decisions.

Forward-Looking Statements

This communication includes "forward-looking

statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform

Act of 1995. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not

be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Pegasus's and

Schmid's actual results may differ from their expectations, estimates, and projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project,"

"budget," "forecast," "anticipate," "intend," "plan,"

"may," "will," "could," "should," "believes," "predicts,"

"potential," "continue," and similar expressions (or the negative versions of such words or expressions)

are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Pegasus's and

Schmid's expectations with respect to future performance and anticipated financial impacts of the proposed business combination, the satisfaction

or waiver of the closing conditions to the proposed business combination, and the timing of the completion of the proposed business combination.

These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially, and potentially adversely, from those expressed or implied

in the forward-looking statements. Most of these factors are outside Pegasus's and Schmid's control and are difficult to predict. Factors

that may cause such differences include, but are not limited to: (i) the occurrence of any event, change, or other circumstances

that could give rise to the termination of the Business Combination Agreement; (ii) the outcome of any legal proceedings that may

be instituted against Pegasus, TopCo and/or Schmid following the announcement of the Business Combination Agreement and the Transactions;

(iii) the inability to complete the proposed business combination, including due to failure to obtain approval of the stockholders

of Pegasus, certain regulatory approvals, or the satisfaction of other conditions to closing in the Agreement; (iv) the occurrence

of any event, change, or other circumstance that could give rise to the termination of the Agreement or could otherwise cause the transaction

to fail to close; (v) the inability to obtain or maintain the listing of the post-acquisition company's securities on the NYSE following

the proposed business combination; (vi) the risk that the proposed business combination disrupts current plans and operations as

a result of the announcement and consummation of the proposed business combination; (vii) failure to realize the anticipated benefits

of the proposed business combination, which may be affected by, among other things, competition, the ability of Schmid to grow and manage

growth profitably, and retain its key employees; (viii) costs related to the proposed business combination; (ix) changes in

applicable laws or regulations; and (x) the possibility that Schmid, Pegasus or TopCo may be adversely affected by other economic,

business, and/or competitive factors. The foregoing list of factors is not exclusive. Additional information concerning certain of these

and other risk factors is contained in Pegasus's most recent filings with the SEC and will be contained in the Form F-4/A, including

the Registration/Proxy Statement expected to be filed in connection with the proposed business combination. All subsequent written and

oral forward-looking statements concerning Pegasus, Schmid, TopCo, the transactions described herein or other matters, and attributable

to Pegasus, Schmid, TopCo or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements

above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Each

of Pegasus, Schmid and TopCo expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in their expectations with respect to events, conditions, or circumstances on which

any statement is based, except as required by law.

No Offer

or Solicitation

This communication is for informational purposes

only and is neither an offer to purchase, sell or exchange nor a solicitation of an offer to sell, subscribe for or buy or exchange any

securities or the solicitation of any vote in any jurisdiction pursuant to the Transactions or otherwise, nor will there be any sale,

issuance or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities will be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 29, 2024 |

Pegasus Digital Mobility Acquisition Corp. |

| |

|

|

| |

By: |

/s/ F. Jeremey Mistry |

| |

Name: |

F.

Jeremey Mistry |

| |

Title: |

Chief Financial Officer and Secretary |

Exhibit 2.1

|

Clifford

Chance

PARTNERSCHAFT

MIT

BESCHRÄNKTER

BERUFSHAFTUNG |

Pegasus Digital Mobility

Acquisition Corp.,

GEBR. SCHMID GMBH,

PEGASUS TOPCO B.V.,

AND

PEGASUS MERGERSUB CORP.

SECOND AMENDMENT TO BUSINESS

COMBINATION AGREEMENT

SECOND AMENDMENT TO

BUSINESS COMBINATION AGREEMENT

THIS

SECOND AMENDMENT TO BUSINESS COMBINATION AGREEMENT (this "Amendment"), dated as of January 29, 2024 (the "Effective

Date"), is by and among (i) Pegasus Digital Mobility Acquisition Corp., a Cayman Islands exempted company ("Pegasus"),

(ii) Gebr. Schmid GmbH, a German limited liability company (the "Company"), (iii) Pegasus TopCo B.V., a Dutch

private limited liability company ("TopCo") and (iv) Pegasus MergerSub Corp., a Cayman Islands exempted company

("Merger Sub") (collectively, the "Parties" and each, a "Party"). Capitalized terms

used but not otherwise defined in this Amendment shall have respective meanings ascribed to such terms in the Business Combination Agreement

(as defined below).

RECITALS

WHEREAS,

the Parties previously entered into the Business Combination Agreement, dated as of May 31, 2023 as amended by the first amendment

to the Business Combination Agreement dated September 26, 2023 (together, the "Business Combination Agreement").

WHEREAS,

the Parties desire to amend certain provisions and references within the Business Combination Agreement (pursuant to and in accordance

with Clause 12.10 of the Business Combination Agreement), on the terms and subject to the conditions set forth in this Amendment.

WHEREAS,

the Parties desire to agree to extend the relevant termination long-stop date provisions from December 31, 2023 to April 30,

2024, subject to an approval of the Registration Statement/Proxy Statement on Form F-4 by the Securities and Exchange Commission

("SEC") by March 31, 2024.

NOW,

THEREFORE, in consideration of the mutual covenants, agreements and understandings herein contained, the receipt and sufficiency of which

are acknowledged, on the terms and subject to the conditions set forth in this Amendment, the Parties, intending to be legally bound,

agree as follows:

| 1. |

Amendments to the Business Combination Agreement. Effective as of the Effective Date: |

| (a) | The definition of "Equity Value of the Company" in Clause 1.1 is hereby amended and restated

in its entirety as follows (specific amended language is included in underlined and bolded text below solely for

presentation purposes): |

""Equity Value of the Company"

means the price per share of Pegasus Class A Shares five trading days prior to the Closing multiplied by 28,725,000

(the number of TopCo Ordinary Shares to be received by the Company Shareholders at Closing)."

| (b) | The definition of "Exchange Consideration" in Clause 1.1 is hereby amended and restated in its

entirety as follows (specific amended language is included in underlined and bolded text below solely for presentation

purposes): |

""Exchange Consideration"

means 28,725,000 TopCo Ordinary Shares."

| (c) | The definition of "Exchange Ratio" in Clause 1.1 is hereby amended and restated in its entirety

as follows (specific amended language is included in underlined and bolded text below solely for presentation

purposes): |

""Exchange Ratio"

means (a) the Equity Value Per Share, divided by (b) the price per share of Pegasus Class A Shares five

trading days prior to the Closing."

| (d) | Clause 10.1 (e) is hereby amended and restated in its entirety as follows (specific amended language

is included in underlined and bolded text below solely for presentation purposes): |

"(i) the aggregate amount

of cash held in the Trust Account (after giving effect to redemptions after the final redemption option before Closing Date) and received

from PIPE investors or other investors in connection with the consummation of the Business Combination for investments in TopCo shares,

shall be no less than an amount equal to $ 35,000,000 (i.e. cash received from entering into convertible loans or other loans or

debt instruments shall not count towards the aggregate amount of cash) and additionally (ii) an aggregate amount of cash equal to

at least $ 10,000,000 is raised in connection with the consummation of the Business Combination through investments in TopCo shares

(from the Trust Account or otherwise) and/or debt instruments with standard market terms and a maturity of at least three years, which

shall include, inter alia, a potential (partial) deferral by three years of cost reimbursement payments owed by TopCo or Pegasus

and otherwise due at Closing (for the avoidance of doubt, both the waiver from Pegasus and the Company are required to waive these conditions

(i) and (ii));"

| (e) | The first paragraph of Clause 11.1 is hereby amended and restated in its entirety as follows (specific

amended language is included in underlined and bolded text below solely for presentation purposes): |

"This Agreement will

be terminated and the transactions contemplated by this Agreement will be abandoned without further notice, if the Registration

Statement/Proxy Statement on Form F-4 has not been approved by the SEC by midnight (Eastern Standard Time) on March 31, 2024

or the Closing has not occurred by midnight (Eastern Standard Time) on April 30, 2024 (the "Termination Date").

Prior to the Termination Date and the Closing, this Agreement may be terminated in accordance with the other conditions in this Agreement

and the transactions contemplated by this Agreement may be abandoned as follows:"

| (f) | Clause 11.1 (d) is hereby deleted in its entirety and replaced with [Reserved.]. |

| (g) | Clause 11.3 is hereby amended and restated in its entirety as follows (specific amended language is included

in underlined and bolded text below solely for presentation purposes): |

"In the event of a termination

of this Agreement prior to the Termination Date by the Company not in accordance with the rights for termination by the

Company as set out in Clause 11.1, the Company shall be required to reimburse Pegasus (i) an amount of USD 7,000,000 plus any

funds paid into the Pegasus Trust Account on or about April 26, 2023 to effect the second three-month extension if the termination

by the Company is notified to Pegasus on or after April 23, 2023, and (ii) in addition to the sum payable according to (i) an

additional amount of EUR 600,000 per each full month lapsed after July 23, 2023, i.e. a total amount of up to USD 10,000,000 (plus

any funds paid into the Pegasus Trust Account on or about April 26, 2023), if the termination by the Company is notified to Pegasus

on or after July 23, 2023 until April 30, 2024. Such reimbursement shall allow Pegasus to repay its incurred indebtedness

including any promissory notes outstanding with the Sponsor at the time of the termination. In such case, this entire Agreement shall

forthwith become void (and there shall be no Liability or obligation on the part of the Parties and their respective Representatives)

with the exception of (a) Clause 7.2 (Trust Account Waiver), Clause 9.6 (Confidentiality; Access to Information; Publicity),

this Clause 11.3 (Termination Fee in case of a Termination by the Company outside of the termination provisions set out in Clause

11.1), Clause 12 (Miscellaneous) and Clause 1.1 (Definitions) (to the extent related to the foregoing), each

of which shall survive such termination and remain valid and binding obligations of the Parties and (b) the Confidentiality Agreement,

which shall survive such termination and remain valid and binding obligations of the parties thereto in accordance with its terms. Notwithstanding

the foregoing or anything to the contrary herein, the termination of this Agreement pursuant to this Clause 11.3 shall not affect any

Liability on the part of any Party for a willful and material breach of any covenant or agreement set forth in this Agreement prior to

such termination or actual fraud with respect to the representations and warranties in Clause 4, Clause 5 and Clause 6."

| 2. |

Termination

of this Amendment. Pegasus, in its sole discretion, may terminate this Amendment by written notice to the Company, with the

effect that together with this Amendment also the Agreement will terminate with immediate effect without any penalty, cost or Liability

in case (i) the amended fairness opinion to be provided to Pegasus does not, in the view of the Pegasus Board (in its sole discretion),

support the decision by the Pegasus Board to enter into the modified terms set out in this Amendment, in particular the revised Equity

Value of the Company and number of TopCo Ordinary Shares to be issued to the Company Shareholders, and/or (ii) in case the ongoing

financial due diligence by Pegasus and Pegasus' advisors, in the view of Pegasus Board (in its sole discretion), does not support the

financial projections for the fiscal years 2023 and 2024 of the Company provided by the Company to Pegasus.

|

| 3. |

Miscellaneous.

The terms, conditions and provisions of the Business Combination Agreement, as amended by this Amendment, remain in full force and effect.

The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of any Party under

the Business Combination Agreement, nor constitute a waiver or amendment of any provision of the Business Combination Agreement.

The Parties further agree that should the risk

of a material adverse tax consequence develop or become known as a result of the currently envisioned transaction structure to one or

more of the Parties, they will in good faith negotiate any further amendments to the Business Combination Agreement that may be needed

in order to mitigate such consequence.

|

| |

This Amendment shall be governed by, and otherwise

construed in accordance with, the terms of the Business Combination Agreement, as though the other provisions of this Amendment were set

forth in the Business Combination Agreement. For the avoidance of doubt, any proceeding or Actions arising out of or relating to this

Amendment shall be heard and determined exclusively in any state or federal court located in New York, New York (or in any appellate court

therefrom) and each of the parties irrevocably (a) submits to the exclusive jurisdiction of each such court in any such proceeding

or Action, (b) waives any objection it may now or hereafter have to personal jurisdiction, venue or to convenience of forum, (c) agrees

that all claims in respect of the proceeding or Action shall be heard and determined only in any such court and (d) agrees not to

bring any proceeding or Action arising out of or relating to this Amendment or the transactions contemplated hereby in any other court.

This Amendment may be executed in counterparts

(including by means of facsimile or scanned and emailed signature pages), any one of which need not contain the signatures of more than

one Party, but all such counterparts taken together shall constitute one and the same agreement. |

[Signature

pages follow]

IN

WITNESS WHEREOF, the parties hereto have hereunto caused this Amendment to be duly executed as of the date hereof.

| PEGASUS DIGITAL MOBILITY ACQUISITION CORP. |

|

| |

|

| By: |

/s/ F. Jeremey Mistry |

|

| |

|

| Name: |

|

|

| |

|

| Title: |

|

|

[Signature Page of the Business Combination

Agreement – Second Amendment]

| GEBR. SCHMID GMBH |

|

| |

|

| By: |

/s/ Christian Schmid |

|

| |

|

| Name: |

|

|

| |

|

| Title: |

|

|

| By: |

/s/ Anette Schmid |

|

| |

|

| Name: |

|

|

| |

|

| Title: |

|

|

[Signature Page of the Business Combination

Agreement – Second Amendment]

| PEGASUS MERGERSUB CORP. |

|

| |

|

| By: |

/s/ Stefan Berger |

|

| |

|

| Name: |

|

|

| |

|

| Title: |

|

|

| PEGASUS TOPCO B.V. |

|

| |

|

| By: |

/s/ Stefan Berger |

|

| |

|

| Name: |

|

|

| |

|

| Title: |

|

|

[Signature Page of the Business Combination

Agreement – Second Amendment]

Exhibit 10.1

|

Clifford

Chance

PARTNERSCHAFT

MIT

BESCHRÄNKTER

BERUFSHAFTUNG |

ANETTE

SCHMID,

CHRISTIAN

SCHMID

AND

PEGASUS

DIGITAL MOBILITY ACQUISITION CORP.

FIRST AMENDMENT TO SHAREHOLDERS'

UNDERTAKING

FIRST AMENDMENT TO

SHAREHOLDERS' UNDERTAKING

THIS

FIRST AMENDMENT TO THE SHAREHOLDERS' UNDERTAKING (this "Amendment"), dated as of January 29, 2024 is by and among

(i) Pegasus Digital Mobility Acquisition Corp., a Cayman Islands exempted company ("Pegasus"), (ii) Anette

Schmid and (iii) Christian Schmid (collectively, the "Parties" and each, a "Party"). Capitalized

terms used but not otherwise defined in this Amendment shall have respective meanings ascribed to such terms in the Shareholders' Undertaking

Agreement (as defined below).

RECITALS

WHEREAS,

Pegasus, Gebr. Schmid GmbH and other parties previously entered into a business combination agreement dated as of May 31, 2023, as

amended from time to time (together, the "Business Combination Agreement").

WHEREAS,

Pegasus, Anette Schmid and Christian Schmid previously entered into a shareholders' undertaking agreement dated as of May 31, 2023

in connection with the Business Combination Agreement (the "Shareholders' Undertaking Agreement").

WHEREAS,

the Parties desire to amend certain provisions and references within the Shareholders' Undertaking Agreement on the terms and subject

to the conditions set forth in this Amendment.

NOW,

THEREFORE, in consideration of the mutual covenants, agreements and understandings herein contained, the receipt and sufficiency of which

are acknowledged, on the terms and subject to the conditions set forth in this Amendment, the Parties, intending to be legally bound,

agree as follows:

| 1. |

Amendments to the Equity Value. Effective as of the date hereof: |

| (a) | Recital (F) in the Preamble of the Shareholders Undertaking Agreement is hereby amended and restated

in its entirety as follows (specific amended language is included in underlined and bolded text below solely for

presentation purposes): |

"Pegasus MergerSub Corp.,

a newly formed and wholly owned subsidiary of TopCo, incorporated as a Cayman Islands exempted company ("Merger Sub"), will

merge with and into Pegasus with Pegasus surviving the merger and the shareholders of Pegasus receiving the merger consideration set out

in the Business Combination Agreement, resulting in eligible shareholders of Pegasus being issued TopCo Shares.

On or about the closing date of the

Business Combination (the "Closing Date"), the TopCo Shares will be listed on the NYSE. The (pre-closing) equity valuation

of the Company, on the basis of which the Transaction is to be consummated, is a USD-equivalent of 28,725,000 shares times the price

per share of Pegasus’ Class A ordinary shares five trading days before the completion of the Business Combination (the

"Equity Value") (as also set forth in the exchange table exhibited as Exhibit 2 to this Agreement

(the "Exchange Table" and in the BCA)."

| (b) | Section 4.1 is hereby amended and restated in its entirety as follows (specific amended language

is included in underlined and bolded text below solely for presentation purposes): |

"This Agreement shall have effect

as from the date of the amendment to this Agreement to (i) the expiry of April 30, 2024 (unless all Parties agree

to extend this deadline), (ii) the termination of the BCA in accordance with its terms, or (iii) the consummation of all transactions

contemplated under the BCA, whichever occurs earlier; a regular termination (ordentliche Kündigung) of this

Agreement and any other right to leave the Agreement for any other reason shall be excluded to the extent legally possible."

| (c) | A new Section 6 is inserted which shall read as follows (specific amended language is included in underlined

and bolded text below solely for presentation purposes): |

"6. Potential

transfer of Company Shares by Christian Schmid to a third party

Christian Schmid is permitted

to transfer up to 1.5% of the Company Shares (the "Transfer Shares") to a third party (the "Permitted Transferee")

provided that the Permitted Transferee will assume all obligations currently applying to Christian Schmid with respect to the Transfer

Shares under the relevant Transaction documents, including, in particular, this Agreement and the lock-up letter of Christian Schmid and

Anette Schmid dated May 31, 2023, and will accede to the relevant agreements and other documents if requested by Pegasus."

| (d) | Section 6 and Sections 6.1 to 6.8 are renumbered as Section 7 and Sections 7.1 to

7.8. |

| (e) | Exhibit 2 is hereby amended and restated in its entirety as follows (specific amended language is

included in underlined and bolded text below solely for presentation purposes): |

"Equity Value at Closing

(illustrative at a USD 11.12 TopCo Share price times 28,725,000 TopCo Shares): USD 319.4 million.

Consideration

to the Shareholders: 28,725,000 TopCo Shares, thereof (i) Anette Schmid: 24% of the Company Shares transferable into 6,894,000 TopCo

Shares, (ii) Christian Schmid 24% of the Company Shares transferable into 6,894,000 TopCo Shares and (iii) Community of Heirs

(Erbengemeinschaft): 52% of the Company Shares transferable into 14,937,000 TopCo Shares."

| 2. |

Miscellaneous.

The terms, conditions and provisions of the Shareholders'

Undertaking Agreement, as amended by this Amendment, remain in full force and effect. The execution, delivery and effectiveness of this

Amendment shall not operate as a waiver of any right, power or remedy of any Party under the Shareholders' Undertaking Agreement, nor

constitute a waiver or amendment of any provision of the Shareholders' Undertaking Agreement.

The Parties further agree that should the risk

of a material adverse tax consequence develop or become known as a result of the currently envisioned transaction structure to one or

more of the Parties, they will in good faith negotiate any further amendments to the Shareholders'

Undertaking Agreement that may be needed in order

to mitigate such consequence.

|

| |

This Amendment may be executed in counterparts

(including by means of facsimile or scanned and emailed signature pages), any one of which need not contain the signatures of more than

one Party, but all such counterparts taken together shall constitute one and the same agreement. |

[Signature

pages follow]

IN

WITNESS WHEREOF, the parties hereto have hereunto caused this Amendment to be duly executed as of the date hereof.

| PEGASUS DIGITAL MOBILITY ACQUISITION

CORP. |

| |

| By: |

/s/ F. Jeremey Mistry |

|

| |

| Name: |

|

|

| |

| Title: |

|

|

[Signature Page of the Shareholders' Undertaking

Agreement – First Amendment]

| ANETTE SCHMID |

| |

| By: |

/s/ Anette Schmid |

|

| |

| Name: |

|

|

| |

| Title: |

|

|

| CHRISTIAN SCHMID |

| |

| By: |

/s/ Christian Schmid |

|

| |

| Name: |

|

|

| |

| Title: |

|

|

[Signature Page of the Shareholders' Undertaking

Agreement – First Amendment]

Exhibit 10.2

PEGASUS DIGITAL MOBILITY ACQUISITION CORP.

Warrant

transfer AGREEMENT

Preamble

THIS WARRANT TRANSFER AGREEMENT

(this "Agreement") is entered into as of January 29, 2024, by and between Pegasus Digital Mobility Sponsor LLC,

a Cayman Islands limited liability company (the "Transferor" or the "Sponsor"), and Christian Schmid

and Anette Schmid, the shareholders of Gebr. Schmid GmbH (together, the "Transferees" and each a "Transferee").

WHEREAS,

Pegasus Digital Mobility Acquisition Corp., a Cayman Islands exempted company ("Pegasus"), is a special purpose acquisition

company that completed its initial public offering in October 2021, and, based on its third amended and restated memorandum and

articles of association, can complete an initial business combination until April 30, 2024;

WHEREAS,

as of the date of this Agreement, Pegasus has announced that it today has entered into a second amendment to the Business Combination

Agreement dated as of May 31, 2023, previously amended by the First Amendment to the Business Combination Agreement dated as of

September 26, 2023 (all three together the "Business Combination Agreement");

WHEREAS,

there are 9,750,000 private warrants outstanding which were issued by Pegasus in connection with its initial public offering in 2021,

such warrants being governed by the warrant agreement between Pegasus and Continental Stock Transfer & Trust Company (the "Warrant

Agent") dated October 21, 2021 (the "Warrant Agreement");

WHEREAS,

Sponsor owns 7,000,000 private placement warrants (the "Warrants"), which under specified conditions grants the right

to acquire one share of Class A ordinary shares of Pegasus (the "Class A Shares"); and

WHEREAS, the Sponsor has

determined to transfer 2,000,000 Warrants (the "Transfer Warrants") to the Transferees, in the amount of 1,000,000 Transfer

Warrants to Christian Schmid and 1,000,000 Transfer Warrants to Anette Schmid as part of the consideration in relation to the business

combination between Pegasus and Gebr. Schmid GmbH contemplated by the Business Combination Agreement, as further described below.

NOW,

THEREFORE, in consideration of the premises set forth above, which are incorporated in this Agreement as if fully set forth below, and

the representations, warranties, covenants and agreements contained in this Agreement, and intending to be legally bound hereby, the

parties hereby agree as follows:

1.

Transfer.

Upon

the closing of the business combination, as defined by the Business Combination Agreement, the Transferor shall transfer, deliver, and

assign the Transfer Warrants to the Transferees, free and clear of all liens and encumbrances in the amount of 1,000,000 Transfer Warrants

to Christian Schmid and 1,000,000 Transfer Warrants to Anette Schmid. The Transfer Warrants are subject to the transfer limitations set

out in Section 2, but have no other limitations. The Transferor shall cause the transfer to be recorded in the warrant register

of the Warrant Agent in accordance with the Warrant Agreement.

2. Limitation

on Transfer.

Each

Transferee acknowledges and agrees that the Transfer Warrants are subject to the same limitations on transfer as outlined in the S-1

filed by Pegasus with the US Securities and Exchange Commission on September 28, 2021 and subsequently amended and filed with the

US Securities and Exchange Commission on October 8, 2021.

3. Title.

The Transferor represents

and warrants to each of the Transferees that the Transferor has good and marketable title to the Transfer Warrants free and clear of

all liens and encumbrances and that, upon updating the records of ownership, Transferees will have good and marketable title to such

Transfer Warrants.

4. Representations

and Warranties.

Each party hereby represents

and warrants to each other party hereto as of the date of this Agreement and as of the date of the transfer of the Transfer Warrants,

that:

(a) such

party has the power and authority to execute and deliver this Agreement and to carry out its obligations hereunder;

(b) the

execution, delivery and performance by the party of this Agreement and the consummation of the transfer have been duly authorized by

all necessary action on the part of the relevant party (so far as necessary), and no further approval or authorization is required on

the part of such party; and

(c) this

Agreement will be valid and binding on each party and enforceable against such party in accordance with its terms, except as the same

may be limited by applicable bankruptcy, insolvency, reorganization, fraudulent transfer or conveyance, moratorium or similar laws affecting

the enforcement of creditors rights generally and general equitable principles, regardless of whether such enforceability is considered

in a proceeding at law or in equity.

5. Acknowledgements.

Each

party acknowledges and agrees that the transfer has not been registered under the Securities Act or under any state securities laws and

represents that such party:

(a) is

receiving the Transfer Warrants, pursuant to an exemption from registration under the Securities Act with no present intention to distribute

them to any person in violation of the Securities Act or any applicable U.S. state securities laws;

(b) will

not sell or otherwise dispose of any of the Transfer Warrants, except in compliance with the registration requirements or exemption provisions

of the Securities Act and any applicable U.S. state securities laws and in accordance with any transfer limitations;

(c) has

such knowledge and experience in financial and business matters and in investments of this type that it is capable of evaluating the

merits and risks of the Transfer Warrants and of making an informed investment decision, and has conducted a review of the business and

affairs of Pegasus that it considers sufficient and reasonable for purposes of making the transfer.

Further,

each party acknowledges it is responsible for seeking any additional professional advice specific to such individual or entity's circumstances

that may be desired with respect to tax or other consequences or obligations that could arise in connection with the transfer of the

Transfer Warrants as outlined in this Agreement

6.

Severability.

In

case any one or more of the provisions contained herein shall, for any reason, be held to be invalid, illegal, or unenforceable in any

respect by a court of competent jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provisions of

this Agreement, and this Agreement shall be construed as if such provision(s) had never been contained herein, provided that such

provision(s) shall be curtailed, limited or eliminated only to the extent necessary to remove the invalidity, illegality or unenforceability

in the jurisdiction where such provisions have been held to be invalid, illegal, or unenforceable. Upon such determination that any term

or provision is invalid, illegal, or unenforceable, the parties hereto shall negotiate in good faith to modify this Agreement and give

effect to the original intent of the parties as closely as possible in order that the transactions contemplated hereby be consummated

as originally contemplated to the greatest extent possible.

7. Titles

and Headings.

The

titles and section headings in this Agreement are included strictly for convenience purposes.

8.

No Waiver.

It

is understood and agreed that no failure or delay in exercising any right, power or privilege hereunder shall operate as a waiver thereof,

nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any right, power or

privilege hereunder.

9. Governing

Law; Submission to Jurisdiction.

This

Agreement and any matters related thereto shall be governed by and interpreted in accordance with the laws of the State of New York,

without regard to its conflicts of laws rules that would result in the application of any law other than the laws of the State of

New York. Each party (a) irrevocably submits to the exclusive jurisdiction of the U.S. District Court for the Southern District

of New York, or, if that court does not have subject matter jurisdiction, in any state court located in The City and County of New York

(the "Courts"), for purposes of any action, suit or other proceeding arising out of this Agreement; and (b) agrees

not to raise any objection at any time to the laying or maintaining of the venue of any such action, suit or proceeding in any of the

Courts, irrevocably waives any claim that such action, suit or other proceeding has been brought in an inconvenient forum and further

irrevocably waives the right to object, with respect to such action, suit or other proceeding, that such Courts do not have any jurisdiction

over such party. Any party may serve any process required by such Courts by way of notice.

10.

WAIVER OF JURY TRIAL.

EACH

OF THE PARTIES HEREBY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY WITH RESPECT

TO ANY ACTION DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

EACH PARTY (A) CERTIFIES THAT NO REPRESENTATIVE OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY

WOULD NOT, IN THE EVENT OF ANY ACTION, SEEK TO ENFORCE THAT FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES

HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION.

11. Entire

Agreement.

This

Agreement contains the entire agreement between the parties and supersedes any previous understandings, commitments or agreements, oral

or written, with respect to the subject matter hereof. No modification of this Agreement or waiver of the terms and conditions hereof

shall be binding upon either party, unless mutually approved in writing.

12. Counterparts.

This

Agreement may be executed in counterparts (delivered by email or other means of electronic transmission), each of which shall be deemed

an original and which, when taken together, shall constitute one and the same document.

13 Notices.

All

notices, consents, waivers and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered

(i) in person, or (ii) by email or other electronic means, with affirmative confirmation of receipt, in each case to the applicable

party at the following addresses (or at such other address for a party as shall be specified by like notice.

| |

If to Transferor: |

|

Pegasus Digital Mobility Sponsor LLC |

| |

|

|

Attn: Ken Jaffe |

| |

|

|

Email: kjaffe@stratcap.com |

| |

|

|

|

| |

If to Transferee: |

|

|

| |

|

|

|

| |

Christian Schmid |

|

Email: Schmid.Ch@schmid-group.com |

| |

Anette Schmid |

|

Email: Schmid.An@schmid-group.com |

14.

Binding Effect; Assignment.

This

Agreement and all of the provisions hereof shall be binding upon and inure to the benefit of the parties and their respective successors

and permitted assigns. This Agreement shall not be assigned by operation of law or otherwise without the prior written consent of the

other parties, and any assignment without such consent shall be null and void; provided that no such assignment shall relieve the assigning

party of its obligations hereunder.

15.

Third Parties.

Nothing

contained in this Agreement or in any instrument or document executed by any party in connection with the transactions contemplated hereby

shall create any rights in or be deemed to have been executed for the benefit of, any person or entity that is not a party hereto or

thereto or a successor or permitted assign of such a party.

16. Specific

Performance.

Each

party acknowledges that the rights of each party to consummate the transactions contemplated hereby are unique, recognizes and affirms

that in the event of a breach of this Agreement by any party, money damages may be inadequate and the non-breaching parties may not have

an adequate remedy at law, and agree that irreparable damage would occur in the event that any of the provisions of this Agreement were

not performed by an applicable party in accordance with their specific terms or were otherwise breached. Accordingly, each party shall

be entitled to seek an injunction or restraining order to prevent breaches of this Agreement and to seek to enforce specifically the

terms and provisions hereof, without the requirement to post any bond or other security or to prove that money damages would be inadequate,

this being in addition to any other right or remedy to which such party may be entitled under this Agreement, at law or in equity.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto have duly

executed this Agreement as of the date first above written.

| By: |

/s/

James Condon |

|

| |

James Condon |

|

| |

|

|

| By: |

/s/ Christian

Schmid |

|

| |

Christian Schmid |

|

| |

|

|

| By: |

/s/ Anette Schmid

|

|

| |

Anette Schmid |

|

Exhibit 10.3

PRIVATE WARRANT UNDERTAKING AGREEMENT

This

AGREEMENT (this "Agreement"), dated as of January 29, 2024, is made by and among Pegasus Digital Mobility

Sponsor LLC, a Cayman Islands limited liability company (the "Sponsor"), Pegasus Digital Mobility Acquisition Corp.,

a Cayman Islands exempted company ("Pegasus"), Gebr. Schmid GmbH, a German limited liability company (the "Company"),

Pegasus TopCo B.V., a Dutch private limited liability company, ("TopCo") to be converted into a public limited liability

company and to be renamed Schmid Group N.V. promptly following the share exchange contemplated by the Business Combination Agreement

(as defined below), and each of the undersigned individuals (such individuals, collectively, the "Insiders" and together

with the Sponsor, the "Private Warrant Holders"). The Sponsor, Pegasus, the Company, TopCo and the Insiders shall be

referred to herein from time to time collectively as the "Parties" and individually as a "Party". Capitalized

terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the Business Combination Agreement (as defined

below).

WHEREAS,

Pegasus, the Company, TopCo, and Pegasus MergerSub Corp., a Cayman Islands exempted company ("Merger Sub"), entered into

that certain Business Combination Agreement, dated as of May 31, 2023 (as amended by the First Amendment to the Business Combination

Agreement dated as of September 26, 2023 and the Second Amendment to the Business Combination Agreement dated as of January 29,

2024 and as it may be further amended, restated or otherwise modified from time to time in accordance with its terms, the "Business

Combination Agreement") pursuant to which the parties thereto will consummate the Transactions on the terms and subject to the

conditions set forth therein;

WHEREAS,

the Private Warrant Holders together currently hold 9,750,000 private warrants (the "Private Warrants") issued by Pegasus

in connection with its initial public offering in 2021, such warrants are governed by the warrant agreement between Pegasus and Continental

Stock Transfer & Trust Company dated October 21, 2021 (the "Warrant Agreement");

WHEREAS,

the Sponsor has on the day of this Agreement entered into a Warrant Transfer Agreement with Christian Schmid and Anette Schmid in which

the Sponsor has agreed, on the day of the completion of the Business Combination Agreement, to transfer 2,000,000 Private Warrants to

Christian Schmid and Anette Schmid; and

WHEREAS,

the Parties have agreed that the Private Warrant Holders shall agree to certain undertakings in relation to certain rights they have in

relation to their Private Warrants.

NOW,

THEREFORE, in consideration of the premises and the mutual promises contained herein and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Parties, each intending to be legally bound, hereby agree as follows:

| 1. | UnterTAKING TO ONLY CASHLESS EXERCISE PRIVATE WARRANTS |

Each of the Sponsor and each of the

Insider Parties, in its respective capacity as holders of Private Warrants, irrevocably and unconditionally agrees that such Party will

only exercise Private Warrants on a "cashless basis" in accordance with Section 2.6 of the Warrant Agreement and agrees

to ensure that any Permitted Transferees (as defined in the Warrant Agreement) are likewise bound by this Agreement to only exercise Private

Warrants on a "cashless basis". Following the completion of the Business Combination Agreement, TopCo may waive this condition

and allow the Sponsor and/or any of the Insider Parties and/or any of the Permitted Transferees to exercise their Private Warrants other

than on a "cashless basis" in accordance with the Warrant Agreement.

| 2. | UNTERTAKING TO CASHLESS EXERCISE PRIVATE WARRANTS AT $18.00 |

Unless previously exercised or redeemed,

each of the Sponsor and each of the Insider Parties in its respective capacity as holders of Private Warrants, irrevocably and unconditionally

agrees that such Party will exercise their respective Private Warrants on a "cashless basis" in full once the Reference Value

(as defined in the Warrant Agreement) reaches $18.00 per share (subject to adjustments in compliance with Section 4 of the Warrant

Agreement) and agrees to ensure that any Permitted Transferees (as defined in the Warrant Agreement) are likewise bound by this Agreement.

For the avoidance of doubt, each of the Sponsor, each of the Insider Parties and any of the Permitted Transferees are allowed to exercise

Private Warrants in accordance with the Warrant Agreement on a "cashless basis" below $18.00 per share. Following the completion

of the Business Combination Agreement, TopCo may waive this undertaking in relation to the Sponsor and/or any of the Insider Parties and/or

any of the Permitted Transferees.

This Agreement shall terminate and be

void and of no further force and effect, and all rights and obligations of the Parties hereunder shall terminate without any further liability

on the part of any Party in respect thereof, upon the earlier to occur of (the "Termination Date") (a) Closing,

(b) such date and time as the Business Combination Agreement is validly terminated in accordance with its terms or (c) the mutual

written agreement of the Parties hereto; provided that nothing herein will relieve any Party from liability for any breach hereof prior

to the Termination Date, and each Party will be entitled to any remedies at law or in equity to recover losses, liabilities or damages

arising from any such breach. Pegasus shall promptly notify the Sponsor and Insider Parties of the termination of the Business Combination

Agreement after the termination of such agreement.

Notwithstanding anything to the contrary

contained herein or otherwise, but without limiting any provision in the Business Combination Agreement or any other agreement contemplated

by the Transactions, this Agreement may only be enforced against, and any claims or causes of action that may be based upon, arise out

of or relate to this Agreement, or the negotiation, execution or performance of this Agreement or the transactions contemplated hereby,

may only be made against the entities and persons that are expressly identified as Parties to this Agreement in their capacities as such

and no former, current or future stockholder, equity holders, controlling persons, directors, officers, employees, general or limited

partners, members, managers, agents or Affiliates of any Party hereto, or any former, current or future direct or indirect stockholder,

equity holder, controlling person, director, officer, employee, general or limited partner, member, manager, agent or Affiliate of any

of the foregoing (each, a "Non-Recourse Party"), shall have any liability for any obligations or liabilities of the Parties

to this Agreement or for any claim (whether in tort, contract or otherwise) based on, in respect of, or by reason of, the transactions

contemplated hereby or in respect of any oral representations made or alleged to be made in connection herewith. Without limiting the

rights of any Party against the other Parties hereto, in no event shall any Party or any of its Affiliates seek to enforce this Agreement

against, make any claims for breach of this Agreement against, or in connection therewith seek to recover monetary damages from, any Non-Recourse

Party.

Notwithstanding anything in this Agreement

to the contrary, (a) the Sponsor makes no agreement or understanding herein in any capacity other than in the Sponsor's capacity

as a record holder and beneficial owner of its Private Warrants, each Insider makes no agreement or understanding herein in any capacity

other than in such Insider's capacity as a direct or indirect investor in the Sponsor or record holder and beneficial owner of its Private

Warrants, as applicable, and not, in the case of any Insider, in such Insider's capacity as a director, officer or employee of Pegasus,

and (b) nothing herein will be construed to limit or affect any action or inaction by any Insider or any representative of the Sponsor

serving as a member of the board of directors (or other similar governing body) of Pegasus or as an officer, employee or fiduciary of

Pegasus, in each case, acting in such person's capacity as a director, officer, employee or fiduciary of Pegasus.

| 6. | Representations and Warranties |

Each of the parties hereto represents

and warrants that (a) it has the power and authority, or capacity, as the case may be, to enter into this Agreement and to carry

out its obligations hereunder, (b) the execution and delivery of this Agreement and the performance of its obligations hereunder

have been, as applicable, duly and validly authorized by all corporate or limited liability company action on its part and (c) this

Agreement has been duly and validly executed and delivered by each of the parties hereto and constitutes, a legal, valid and binding obligation

of each such party enforceable in accordance with its terms, except as such enforceability may be limited by bankruptcy Laws, other similar

Laws affecting creditors' rights and general principles of equity affecting the availability of specific performance and other equitable

remedies.

| 7. | No Third Party Beneficiaries |

This Agreement shall be for the sole

benefit of the Parties and their respective successors and permitted assigns and is not intended, nor shall be construed, to give any

Person, other than the Parties and their respective successors and assigns, any legal or equitable right, benefit or remedy of any nature

whatsoever by reason this Agreement. Nothing in this Agreement, expressed or implied, is intended to or shall constitute the Parties,

partners or participants in a joint venture.

Each of the Parties hereto is entitled

to rely upon this Agreement and is irrevocably authorized to produce this Agreement or a copy hereof to any interested party in any administrative

or legal proceeding or official inquiry with respect to the matters covered hereby. Each of the Parties hereto shall pay all of their

respective expenses in connection with this Agreement and the transactions contemplated herein. Each of the Parties hereto shall take,

or cause to be taken, all actions and do, or cause to be done, all things necessary, proper or advisable to consummate the transactions

contemplated by this Agreement on the terms and conditions described therein no later than immediately prior to the consummation of the

Transactions.

Any notice or communication required

or permitted hereunder shall be in writing and either delivered personally, emailed or sent by overnight mail via a reputable overnight

carrier, or sent by certified or registered mail, postage prepaid, and shall be deemed to be given and received:

| (a) | when so delivered personally, |

| (b) | when sent, with no mail undeliverable or other rejection notice, if sent by email, or |

| (c) | three business days after the date of mailing to the address below or to such other address or addresses

as such person may hereafter designate by notice given hereunder: |

If to Sponsor:

Pegasus Digital Mobility Sponsor LLC

Attention: Jim Condon

E-mail: jcondon@stratcap.com

with a required copy (which copy shall

not constitute notice) to:

Troutman Pepper

| | Attn: | Heath D. Linsky |

| Email: | heath.linsky@troutman.com |

If to Pegasus:

Pegasus Digital Mobility Acquisition

Corp.

| Attn: | Jeremey Mistry and Stefan

Berger |

| Email: | jmistry@pegasusdm.com; sberger@pegasusdm.com |

with a required copy (which copy shall

not constitute notice) to:

Clifford Chance

Junghofstrasse 14,

60311 Frankfurt am Main,

Germany

| Attn: | George Hacket and Axel Wittmann |

| Email: | george.hacket@cliffordchance.com; |

| | | axel.wittmann@cliffordchance.com |

If to the Company:

Gebr.

Schmid GmbH

Robert-Bosch-Str.

32-36

72250 Freudenstadt

Germany

| Attn: | Christian Schmid, Anette

Schmid and Julia Natterer |

| Email: | natterer.ju@schmid-group.com; |

| | | Schmid.Ch@schmid-group.com; |

| | Schmid.An@schmid-group.com |

with a required copy (which copy shall

not constitute notice) to:

Gleiss Lutz

Taunusanlage 11,

60329 Frankfurt am Main,

Germany

| Attn: | Stephan

Aubel and Alexander Gebhardt |

| Email: | alexander.gebhardt@gleisslutz.com; |

| | stephan.aubel@gleisslutz.com |

| 10. | No Waiver of Rights, Powers and Remedies |

No failure or delay by a Party hereto

in exercising any right, power or remedy under this Agreement, and no course of dealing between the Parties hereto, shall operate as a

waiver of any such right, power or remedy of such Party. No single or partial exercise of any right, power or remedy under this Agreement

by a Party hereto, nor any abandonment or discontinuance of steps to enforce any such right, power or remedy, shall preclude such Party

from any other or further exercise thereof or the exercise of any other right, power or remedy hereunder. The election of any remedy by

a Party hereto shall not constitute a waiver of the right of such Party to pursue other available remedies. No notice to or demand on

a Party not expressly required under this Agreement shall entitle the Party receiving such notice or demand to any other or further notice

or demand in similar or other circumstances or constitute a waiver of the rights of the Party giving such notice or demand to any other

or further action in any circumstances without such notice or demand.

| 11. | Incorporation by Reference |

Sections

1.2 (Construction); 12.3 (Assignment); 12.6 (Governing Law); 12.7 (Captions; Counterparts); 12.9 (Entire Agreement); 12.10 (Amendments);

12.11 (Severability); 12.12 (Jurisdiction); 12.13 (Waiver of Jury Trial); 12.14 (Enforcement) and 12.16 (Non survival of Representations,

Warranties and Covenants) of the Business Combination Agreement are incorporated herein and shall apply to this Agreement mutatis

mutandis.

[signature pages follow]

IN

WITNESS WHEREOF, each of the Parties has caused this Agreement to be duly executed on its behalf as of the day and year first

above written.

| PEGASUS DIGITAL MOBILITY ACQUISITION

CORP. |

|

| |

|

| By: |

/s/ F. Jeremey Mistry |

|

| Name: |

|

|

| Title: |

|

|

| |

|

| PEGASUS DIGITAL MOBILITY SPONSOR

LLC |

|

| |

|

| By: |

/s/ James Condon |

|

| Name: |

|

|

| Title: |

|

|

| |

|

| GEBR. SCHMID GMBH |

|

| |

|

| By: |

/s/ Christian Schmid |

|

| Name: |

|

|

| Title: |

|

|

| |

|

| By: |

/s/ Anette Schmid |

|

| Name: |

|

|

| Title: |

|

|

| |

|

| PEGASUS TOPCO B.V. |

|

| |

|

| By: |

/s/ Stefan Berger |

|

| Name: |

|

|

| Title: |

|

|

INSIDERS:

| By: |

/s/

Sir Ralf Speth |

|

| |

Name: Sir Ralf Speth |

|

| |

|

| By: |

/s/ F. Jeremy Mistry |

|

| |

Name: F. Jeremy Mistry |

|

| |

|

| By: |

/s/ Stefan

Berger |

|

| |

Name: Stefan Berger |

|

| |

|

| By: |

/s/ James

Condon |

|

| |

Name: James Condon |

|

| |

|

| By: |

/s/ Florian

Wolf |

|

| |

Name: Florian Wolf |

|

| |

|

| By: |

/s/ Steven

J. Norris |

|

| |

Name: Steven J. Norris |

|

| |

|

| By: |

/s/ Jeffrey

H. Foster |

|

| |

Name: Jeffrey H. Foster |

|

| |

|

| By: |

/s/ John

Doherty |

|

| |

Name: John Doherty |

|

Exhibit 10.4

|

Clifford

Chance

PARTNERSCHAFT

MIT

BESCHRÄNKTER

BERUFSHAFTUNG |

Pegasus Digital Mobility Acquisition Corp.

AND

PEGASUS TOPCO B.V.,

AND

ANETTE SCHMID

AND

CHRISTIAN SCHMID

EARNOUT AGREEMENT

EARNOUT AGREEMENT

THIS

EARNOUT AGREEMENT, effective as of January 29, 2024 (this “Agreement”), is entered into by and among Pegasus TopCo

B.V., a Dutch private limited liability company, (“TopCo”) to be converted into a public limited liability company

and renamed Schmid Group N.V. promptly following the share exchange contemplated by the Business Combination Agreement (as defined below),

Christian Schmid and Anette Schmid (together the "Holders" individually each a “Holder”) and Pegasus

Digital Mobility Acquisition Corp., a Cayman Islands exempted company (“Pegasus”, together with TopCo and the Holders,

the “Parties” and each a “Party”). Capitalized terms used but not otherwise defined herein shall

have the meanings ascribed to such terms in the Business Combination Agreement (as defined below).

RECITALS

WHEREAS,

the Parties previously entered into the Business Combination Agreement, dated as of May 31, 2023 as amended by the first amendment

to the Business Combination Agreement dated September 26, 2023 and the second amendment to the Business Combination Agreement dated

January 29, 2024 (together, the "Business Combination Agreement").

WHEREAS,

in connection with the transactions contemplated by the Business Combination Agreement, the Holders shall be issued up to 5,000,000 new

ordinary shares of TopCo (the “Earnout Shares”) subject to the terms of this Agreement.

NOW,

THEREFORE, in consideration of the mutual covenants, agreements and understandings herein contained, the receipt and sufficiency of which

are acknowledged, on the terms and subject to the conditions set forth in this Agreement, the Parties, intending to be legally bound,

agree as follows:

| 1. | Issuance of the Earnout Shares. |

(a) At

the Closing, as part of the Transaction, TopCo shall issue to the Holders the Earnout Shares.

(b) The

Earnout Shares shall be issued at par and the aggregate nominal value of the Earnout Shares shall be charged against TopCo’s reserves.

(c) Upon

their issuance, the Earnout Shares will be subject to the restrictions set forth in Section 2 until the earlier of (a) their

vesting in accordance with Section 2 at which time they will automatically become unrestricted shares, and (b) the completion

of the transfer of Unvested Shares (as defined below) in connection with their forfeiture in accordance with Section 2.

| 2. | Vesting of Earnout Shares. |

(a) The

Earnout Shares shall vest as follows:

| (i) | 50% (2,500,000) of the Earnout Shares shall vest upon the occurrence of the Share Price (as defined below)

being greater than $15.00 for a period of more than twenty (20) days out of thirty (30) consecutive trading days after the Closing

Date (as defined in the Business Combination Agreement) but within three (3) years after the Closing Date, whereas 25% (1,250,000)

of the Earnout Shares shall vest to the benefit of Christian Schmid and 25% (1,250,000) of the Earnout Shares shall vest to the benefit

of Anette Schmid, (the “First Trigger Event”); |

| (ii) | an additional 50% of the Earnout Shares shall vest upon the occurrence of the Share Price being greater

than $18.00 for a period of more than twenty (20) days out of thirty (30) consecutive trading days after the Closing Date but

within three (3) years after the Closing Date, whereas 25% (1,250,000) of the Earnout Shares shall vest to the benefit of Christian

Schmid and 25% (1,250,000) of the Earnout Shares shall vest to the benefit of Anette Schmid, (the “Second Trigger Event”

and collectively with the First Trigger Event the “Trigger Events”). |

(b) In

the event that, within three (3) years after the Closing Date, there occurs any transaction resulting in a Change of Control in which

the ordinary shares of TopCo are valued at or above the price thresholds specified in clause (a) of this Section 2, the Earnout

Shares subject to the applicable price thresholds achieved or exceeded in connection with such Change of Control shall immediately vest

and the Holders shall receive the same per share consideration (whether stock, cash or other property) in respect of such Earnout Shares

as the other holders of ordinary shares of TopCo participating in such Change of Control.

As used in

this Section: (A) “Share Price” shall mean the price per ordinary share of TopCo on the New York Stock Exchange

(the “NYSE”) (or any other securities market that the ordinary shares of TopCo are traded or listed on at such time)

(as reported by Bloomberg L.P. or, if not reported therein, in another authoritative source mutually selected by TopCo and the Holders)

as of 4:00 p.m., New York, New York time on the relevant date; and (B) “Change of Control” means any transaction

or series of transactions (1) following which a Person or “group” (within the meaning of Section 13(d) of the

Exchange Act) of Persons (other than TopCo or any of its Subsidiaries), has direct or indirect beneficial ownership of securities (or

rights convertible or exchangeable into securities) representing fifty percent (50%) or more of the voting power of or economic rights

or interests in TopCo or any of its Subsidiaries, (2) constituting a merger, consolidation, reorganization or other business combination,

however effected, following which either (x) the members of the Board of Directors of TopCo immediately prior to such merger, consolidation,

reorganization or other business combination do not constitute at least a majority of the Board of Directors of the company surviving

the combination or, if the surviving corporation is a Subsidiary, the ultimate parent thereof or (y) the voting securities of TopCo

or any of its Subsidiaries immediately prior to such merger, consolidation, reorganization or other business combination do not continue