0001861541

false

KY

0001861541

2023-07-14

2023-07-14

0001861541

pgss:UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember

2023-07-14

2023-07-14

0001861541

us-gaap:CommonClassAMember

2023-07-14

2023-07-14

0001861541

pgss:RedeemableWarrantsEachExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember

2023-07-14

2023-07-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

July 14, 2023

Date of Report (date of earliest event reported)

Pegasus Digital Mobility Acquisition Corp.

(Exact name of Registrant as specified in its

charter)

| Cayman Islands |

|

001-40945 |

|

98-1596591 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

71 Fort Street

George Town

Grand Cayman

Cayman Islands |

|

KY1-1106 |

| (Address of principal executive offices) |

|

(Zip Code) |

+1345 769-4900

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A Ordinary Share and one-half of one redeemable Warrant |

|

PGSS.U |

|

New York Stock Exchange |

| Class A Ordinary Shares, par value $0.0001 per share |

|

PGSS |

|

New York Stock Exchange |

| Redeemable Warrants, each exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share |

|

PGSS.WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

On

July 14, 2023, the Company issued a press release announcing

that its board of directors, in accordance with Article 54.9 of the Company's second amended and restated memorandum and articles

of association, had approved the further extension of the period of time the Company has to consummate a business combination until December 31,

2023. The Company intends to utilize the further time available to it until December 31, 2023 to consummate its proposed business

combination with Gebr. SCHMID GmbH (the "SCHMID Group").

As

previously indicated in the definitive proxy statement distributed to shareholders and filed with the SEC on March 29, 2023, and

in accordance with Article 54.10 of the Company's second amended and restated memorandum and articles of association, holders

of the Company's Class A ordinary shares, par value $0.0001 per share issued in the Company's initial public offering (the "Public

Shares" and the holders of such Public Shares, the "Public Shareholders") have the opportunity to redeem their

Public Shares for cash for a pro-rata share of the funds held in the Company's trust account on the third extension date of July 26,

2023 (the "Third Extension Date"). Public Shareholders who wish to redeem their Public Shares should refer to the previously

published proxy statement, which includes the second amended and restated articles of association of the Company, for further information

and follow the procedures outlined in the press release included as an exhibit hereto, including providing written notice of their election

to redeem their Public Shares prior to 5:00 p.m., Eastern Time, on July 26, 2023 to Continental Stock Transfer & Trust Company

at spacredemptions@continentalstock.com.

The Company further announced that its Sponsor

has voluntarily committed to make a monthly contribution to the Company's trust account commencing on August 1, 2023 and paid on

the first day of each month thereafter until the earliest of (i) the date on which the Company consummates a business combination

or (ii) December 31, 2023. The monthly contribution shall be equal to $0.03 (three U.S. cents) per Public Share then outstanding.

The Company further announced the publication

of a presentation prepared by the SCHMID Group in connection with a possible business combination.

A copy of the press release and the investor presentation is attached

to this Current Report on Form 8-K as Exhibit 99.1 and Exhibit 99.2 and are incorporated herein by

reference.

Forward-Looking Statements

This Current Report on Form 8-K includes "forward-looking

statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact included in this press release are forward-looking statements. Forward-looking

statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the "Risk

Factors" section of the Company's registration statement and final prospectus for the offering filed with the SEC. Copies are available

on the SEC's website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the

date of this release, except as required by law.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: July 14, 2023 |

Pegasus

Digital Mobility Acquisition Corp. |

| |

|

|

| |

By: |

/s/

F. Jeremey Mistry |

| |

Name: |

F. Jeremey

Mistry |

| |

Title: |

Chief Financial Officer |

EXHIBIT 99.1

PEGASUS DIGITAL MOBILITY ACQUISITION CORP. ANNOUNCES

THIRD EXTENSION AND FURTHER VOLUNTARY PAYMENTS INTO TRUST ACCOUNT

Greenwich, CT, July 14, 2023 – Pegasus

Digital Mobility Acquisition Corp. (NYSE: PGSS.U) (the "Company"), a blank check company formed for the purpose of effecting

a merger, share exchange, asset acquisition, share purchase, reorganisation or similar business combination with one or more businesses

or assets (a "Business Combination"), announced that its board of directors (the "Board") has approved

the further extension of the period of time the Company has to consummate a Business Combination, in accordance with Article 54.9

of the Company’s second amended and restated memorandum and articles of association (the "Articles"), until December 31,

2023 (the "Third Extension”). The Company intends to utilize the further time available to it until December 31,

2023 to consummate its proposed Business Combination with Gebr. SCHMID GmbH.

The Company further announced that its

sponsor, Pegasus Digital Mobility Sponsor LLC, a Cayman Islands limited liability company (the "Sponsor") has

voluntarily committed to make a monthly contribution into the Company's trust account (the "Trust Account")

commencing on August 1, 2023 and paid on the first day of each month thereafter until the earliest of (i) the date on

which the Company consummates a Business Combination or (ii) December 31, 2023. The monthly contribution shall be equal to

$0.03 (three U.S. cents) per Public Share (as defined below) then outstanding. The contribution amount shall be made available and

paid on a monthly basis after the issuance of a non-convertible unsecured promissory note from the Company to the Sponsor in

connection therewith. Should the Company's Board determine that it will not be able to consummate the initial Business Combination

by December 31, 2023 and that the Company shall instead liquidate, the Sponsor's obligation to continue to make such

contributions shall immediately cease. If the Board determines that more time is needed to consummate the initial Business

Combination, a shareholders' vote in an extraordinary general meeting will be required to change the Articles of the Company.

As

previously indicated in the definitive proxy statement distributed to shareholders and filed with the SEC on March 29, 2023 in connection

with the extraordinary general meeting held on April 19, 2023 (the "EGM"), in accordance with Article 54.10

of the Articles, holders of the Company’s Class A ordinary shares, par value $0.0001 per share issued in the Company's

initial public offering (the "Public Shares" and the holders of such Public Shares, the "Public Shareholders")

have the opportunity to redeem their Public Shares for a per-share price, payable in cash, as calculated by Continental Stock Transfer &

Trust Company ("Continental") and equal to the aggregate amount then on deposit in the Trust Account, including interest

earned on the funds held in the Trust Account not previously released to the Company to pay its taxes, divided by the number of then outstanding

Public Shares, on the third extension date of July 26, 2023 (the "Third Extension Date"). Pursuant to the Articles,

the Company may not redeem Public Shares in an amount that would cause the Company’s net tangible assets to be less than $5,000,001

following such redemption, which condition may not be waived by the Company's board of directors.

Public Shareholders may elect to redeem all

or a portion of their Public Shares. For the avoidance of doubt, Public Shareholders who choose to redeem in July 2023 will not be

entitled to any further amounts deposited by the Sponsor into the Trust Account in respect to any redeemed Public Shares. Any Public Shareholders

who do not redeem all of their Public Shares in connection with the Third Extension will retain the right to vote on the Business Combination

when and if it is submitted to shareholders (as long as they are a shareholder on the applicable record date) and will have a right to

redeem any remaining Public Shares at such time in accordance with the Articles.

Based

upon the amount held in the Trust Account following redemptions in connection with the EGM, the deposit by the Sponsor following the second

extension and estimated interest income and taxes, the Company estimates that the per-share price at which Public Shares may be redeemed

from cash held in the Trust Account would be approximately $10.72 on July 26, 2023. The closing price of Public Shares on July 13,

2023 was $10.70. The Company cannot assure shareholders that they will be able to sell their Public Shares in the open market, even if

the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in its securities

when such shareholders wish to sell their shares. The Company expects that the proceeds held in the Trust Account will continue

to be invested in United States government treasury bills with a maturity of 185 days or less or in money market funds investing

solely in U.S. Treasuries and meeting certain conditions under Rule 2a-7 under the Investment Company Act of 1940,

as amended, as determined by the Company, or in an interest bearing demand deposit account until the earlier of: (i) the

completion of its initial business combination and (ii) the distribution of the Trust Account.

Eligible

shareholders who wish to redeem their Public Shares should refer to the previously published proxy statement, which includes the Articles,

for further information. Any Public Shareholders wishing to exercise this redemption right in connection with the Third Extension and

tender their Public Shares for redemption must:

|

(i) (a) hold

Public Shares or (b) hold Public Shares as part of the combined units offered in the Company’s IPO, which each consisted

of one Public Share and one-half of one redeemable warrant (the "Public Warrants" and together with the Public Shares,

the "Units") and elect to separate such Units into the underlying Public Shares and Public Warrants prior to exercising

your redemption rights with respect to the Public Shares; and

(ii) prior

to 5:00 p.m., Eastern Time, on July 26, 2023, (a) submit a written request to Continental at spacredemptions@continentalstock.com,

the Company’s transfer agent, that the Company redeem your Public Shares for cash and (b) deliver your Public Shares to

Continental, the Company's transfer agent, physically or electronically through The Depository Trust Company

("DTC"). The Company also requests that any requests for redemption include the identity as to the beneficial owner

making such request, including such beneficial owner’s legal name, phone number, and address.

Holders of Units

must elect to separate the underlying Public Shares and Public Warrants prior to exercising redemption rights with respect to the Public

Shares. If holders hold their Units in an account at a brokerage firm or bank, holders must notify their broker or bank that they elect

to separate the Units into the underlying Public Shares and Public Warrants, or if a holder holds Units registered in its, his or her

own name, the holder must contact Continental, the Company's transfer agent, directly and instruct it to do so.

Through DTC's DWAC (Deposit Withdrawal At Custodian)

system, this electronic delivery process can be accomplished by the shareholder, whether or not it is a record holder or its shares are

held in "street name," by contacting the transfer agent or its broker and requesting delivery of its shares through the DWAC

system. Delivering shares physically may take significantly longer. In order to obtain a physical share certificate, a shareholder’s

broker and/or clearing broker, DTC, and the Company's transfer agent will need to act together to facilitate this request. It is the Company’s

understanding that shareholders should generally allot at least two weeks to obtain physical certificates from the transfer agent. The

Company does not have any control over this process or over the brokers or The Depository Trust Company. Shareholders who request physical share certificates and wish to redeem may be unable

to meet the deadline for tendering their shares before exercising their redemption rights and thus will be unable to redeem their shares.

There is a nominal cost associated with the above-referenced

tendering process and the act of certificating the shares or delivering them through The Depository Trust Company's DWAC system. The transfer

agent will typically charge a tendering broker a fee and it is in the broker’s discretion whether or not to pass this cost on to

the redeeming shareholder. However, this fee would be incurred regardless of whether or not shareholders seeking to exercise redemption

rights are required to tender their shares, as the need to deliver shares is a requirement to exercising redemption rights, regardless

of the timing of when such delivery must be effectuated.

The

Public Shares of any holders who validly exercise their redemption rights will cease to be outstanding on the Third Extension Date and

will only represent the right to receive a pro rata share of the aggregate amount then on deposit in the Company's Trust Account

as outlined above and within the Articles. You will have no right to participate in, or have any interest in, the future

growth of the Company, if any. You will be entitled to receive cash for your Public Shares only if you properly and timely demand redemption.

Each Public Shareholder wishing to redeem is urged to consult its own tax advisor with respect to the particular tax consequences to such

investor of exercising the redemption rights with respect to the Public Shares, including the applicability and effect of U.S. federal,

state, local and non-U.S. tax laws. |

Cautionary Statement

Regarding Forward-Looking Statements

This press release contains

statements that constitute "forward-looking statements" within the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press release

are forward-looking statements. Forward-looking statements involve predictions, projections and other statements about future events that

are based on current expectations and assumptions and, as a result, are subject to certain risks and uncertainties, including but not

limited to:

| · | the occurrence of any event, change or other circumstances that could give rise to the termination of

the Business Combination; |

| · | the outcome of any legal proceedings that may be instituted against the Company, the SCHMID Group, the

combined company or others following the announcement of the Business Combination and any definitive agreements with respect thereto; |

| · | the inability to complete the Business Combination due to the failure to obtain approval of the shareholders

of the Company or to satisfy other conditions to closing; |

| · | changes to the proposed structure of the Business Combination that may be required or appropriate as a

result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; |

| · | the ability to meet stock exchange listing standards following the consummation of the Business Combination; |

| · | the risk that the Business Combination disrupts current plans and operations of the Company or the SCHMID

Group as a result of the announcement and consummation of the Business Combination; |

| · | the ability to recognise the anticipated benefits of the Business Combination, which may be affected by,

among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with

customers and suppliers and retain its management and key employees; |

| · | costs related to the Business Combination; |

| · | changes in applicable laws or regulations and delays in obtaining, adverse conditions contained in, or

the inability to obtain regulatory approvals required to complete the Business Combination; |

| · | the possibility that the Company, the SCHMID Group or the combined company may be adversely affected by

other economic, business, and/or competitive factors; |

| · | the estimates of expenses and profitability and underlying assumptions with respect to stockholder redemptions

and purchase price and other adjustments; and |

| · | other risks and uncertainties set forth in the section entitled "Risk Factors" in the Company's

prospectus on Form S-1 approved by the SEC. |

The foregoing list of

factors is not exhaustive. The forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and the SCHMID Group and the Company assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise. Copies of the Company's registration

statement are available on the SEC’s website, www.sec.gov.

Additional Information

and Where to Find It

INVESTORS

AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ ANY DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THE COMPANY FILES

WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security

holders will be able to obtain free copies of any documents (including any amendments or supplements thereto) filed with the SEC through

the website maintained by the SEC at www.sec.gov or by directing a request to:

Pegasus Contact Information

Investor Relations

investor-relations@pegasusdm.com

Exhibit 99.2

| Investor Presentation

July 2023

1 |

| DISCLAIMER

2

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL.

THIS PRESENTATION IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

This presentation (together with any oral statements made in connection herewith, the “Presentation”) is exclusively for the benefit and internal use of the recipient and solely as a preliminary basis for discussion. This Presentation has been prepared to assist interested parties in making

their own evaluation with respect to a potential business combination between Pegasus Digital Mobility Corporation, a Cayman Islands exempted company (“Pegasus”) and Gebr. Schmid GmbH, a German limited liability company (together with its consolidated subsidiaries, the “Company”,

the “Group” or the “SCHMID Group”) and related transactions (the “Business Combination”) and for no other purpose.

This Presentation does not purport to be comprehensive or all-inclusive and is for information purposes only and is being delivered for the sole purpose of assisting recipients in determining whether to proceed with a further investigation of the proposed Business Combination. It does not

purport to contain all of the information that may be required to make a full analysis of the SCHMID Group or the Business Combination. This Presentation is based on information which have not been independently verified or audited. Any estimates and projections contained herein

involve significant elements of subjective judgment and analysis, which may or may not be correct, to the fullest extent permitted by law, in no circumstances will Pegasus and the SCHMID Group, or any of their respective subsidiaries, stockholders, affiliates, representatives, partners,

directors, officers, employees, advisers or agents, provide any guarantee, representation or warranty (express or implied) or assume any responsibility with respect to the authenticity, origin, validity, accuracy or completeness of the information and data contained herein or assumes any

obligation for damages, losses or costs (including, without limitation, any direct or consequential losses) or losses of profit resulting from any errors or omissions in this Presentation, reliance on the information contained within it, or on opinions communicated in relation thereto or

otherwise arising in connection therewith. Changes and events occurring after the date hereof may, therefore, affect the validity of the information, data and /or conclusions contained in this Presentation and neither the SCHMID Group nor Pegasus assume any obligation to update and /

or revise this Presentation or the information and data upon which it has been based. You should not consider any information in this Presentation to be legal, investment, business, tax or accounting advice or a recommendation. You should consult your own attorney, accountant,

business advisor, financial advisor and tax advisor for legal, investment, business, tax and accounting advice regarding any of the proposed transactions presented in or in connection with this Presentation. By accepting this Presentation, you confirm that you are not relying upon the

information contained herein to make any decision.

The distribution of this Presentation in certain jurisdictions may be restricted by law and, accordingly, recipients of this Presentation represent that they are able to receive this Presentation without contravention of any unfulfilled registration requirements or other legal restrictions in the

jurisdiction in which they reside or conduct business.

Forward-LookingStatements

This Presentation contains certain forward-looking statements with respect to the proposed Business Combination, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by the SCHMID Group and the markets in which it

operates, and the SCHMID Group’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,

” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result,” and similar expressions. Forward-looking statements involve predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking statements in this Presentation, including but not limited to those outlined in the press release published by Pegasus on July 10, 2023 and filed with the SEC under the heading “Cautionary Statement Regarding Forward-Looking Information”.

The forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the SCHMID Group and Pegasus assume no obligation and do not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise, nor do they give any assurance that either the SCHMID Group or Pegasus will achieve their expectations.

Preliminary Financial Information

The Presentation includes preliminary financial information and financial information prepared in accordance with German GAAP. Such information has not been prepared in accordance with International Financial Reporting Standards as adopted by the International Accounting Standards

Board (“IFRS”). Audited IFRS financial statements are in process of being prepared and will be included in the registration statement expected to be filed with the SEC on Form F-4 in relation to the proposed business combination between Pegasus and the Company. Such audited figures may

materially differ from the financial information presented herein.

In addition, this Presentation includes certain financial metrics such as EBITDA which are neither defined under German GAAP nor under IFRS. These measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with IFRS

and should not be considered as an alternative to net income, operating income or any other performance measures. The SCHMID Group and Pegasus believe that these additional financial metrics (including on a forward-looking basis) provide useful supplemental information about the

Group.

A reconciliation of the information provided is unavailable without unreasonable efforts as they exclude items which are unavailable on a prospective basis and the conversion of our financial information and audit under IFRS is ongoing. Such information, estimates and ambitions are calculated in a

manner that is consistent with the accounting policies applied by us in preparing our financial statements under German GAAP.

Use of Projections

Any financial information in this Presentation (including specifically the projections) that are forward-looking statements are based on estimates and assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond the SCHMID Group’s and

Pegasus’s control. Such information and projections are necessarily speculative and involve increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain

and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. All subsequent written and oral forward-looking statements concerning the SCHMID Group

and Pegasus, the proposed Business Combination or other matters and attributable to the SCHMID Group and Pegasus or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. The information contained in this Presentation is

provided as of the date of this Presentation and is subject to change without notice. |

| DISCLAIMER

3

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL.

THIS PRESENTATION IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

Trademarks

Pegasus and SCHMID Group own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation may also contain trademarks, service marks, trade names and copyrights of other companies,

which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with SCHMID Group or Pegasus, or an endorsement or sponsorship by or of SCHMID

Group or Pegasus. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, © or ® symbols, but such references are not intended to indicate, in any way, that Pegasus or SCHMID Group will not

assert, to the fullest extent under applicable law, their rights or the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights.

Industryand Market Data

In addition, this Presentation includes certain data and other information from third-party sources. While the SCHMID Group and Pegasus believe that these sources are reliable, neither the SCHMID Group nor Pegasus nor any of their advisers has independently verified the data

contained therein. Accordingly, undue reliance should not be placed on any of the third-party statistics, data and other information contained in the Presentation. All information not separately sourced is from the SCHMID Group’s and Pegasus’s data and estimates.

No Offer or Solicitation

This Presentation does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction.

ThePresentation and the information contained herein are not an offer of securities for sale in the United States. Any securities described herein have not been and will not be registered under the under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state

securities laws, and may not be offered or sold in the United States except pursuant to an exemption from, or a transaction not subject to, the registration requirements of the U.S. Securities Act.

This presentation and its contents have not been approved by the UK Financial Conduct Authority or an authorized person (as defined in the Financial Services and Markets Act 2000 (the "FSMA")) for distribution. This presentation is only being distributed to and is only directed to (i)

persons outside the United Kingdom; (ii) investment professionals falling within Article 19(5) of the Financial Services and Market Act 2000 (Financial Promotion) Order 2005 (the "Order"); (iii) high net worth entities, and other persons to whom it may be lawfully communicated, falling

within Article 49(2) (a) to (d) of the Order; and (iv) any other person to whom it may otherwise lawfully be made in accordance with the Order (all such persons being referred to as "relevant persons"). Any investment activity to which this communication may relate is only available to, and

any invitation, offer or agreement to engage in such investment activity will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this presentation or any of its contents. The recipients of this presentation should not engage in any

behavior in relation to qualifying investments or related investments (as defined in the FSMA and the Code of Market Conduct made pursuant to FSMA) which would or might amount to market abuse for the purposes of FSMA.

In member states of the European Economic Area ("EEA"), the Presentation is directed only at persons who are "qualified investors" within the meaning of Regulation (EU) 2017/1129. The Presentation must not be acted on or relied on in any member state of the EEA by persons who are not

qualified investors. Any investment or investment activity to which the Presentation relates is available only to qualified investors in any member state of the EEA.

UK MiFIR professionals/ECPs only eligible counterparties and professional clients only (all distribution channels).

MiFID II professionals/ECPs only eligible counterparties and professional clients (all distribution channels).

Additional Information

In connection with the proposed Business Combination, Pegasus TopCo B.V. is expected to file with the SEC a registration statement on Form F-4 containing a preliminary proxy statement of Pegasus and a preliminary prospectus and, after the registration statement is declared

effective, Pegasus will file a definitive proxy statement and definitive prospectus relating to the proposed Business Combination and will mail such definitive proxy statement/prospectus and other relevant materials to its shareholders. This Presentation does not contain all the

information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Pegasus’s shareholders and other interested persons are advised

to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information

about SCHMID Group, Pegasus TopCo B.V., Pegasus and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to shareholders of Pegasus as of a record date to

be established for voting on the proposed Business Combination. Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement, prospectus and other documents filed with the SEC, without charge, once available, at the

SEC’s website at www.sec.gov, or by directing a request to:

investor-relations@pegasusdm.com |

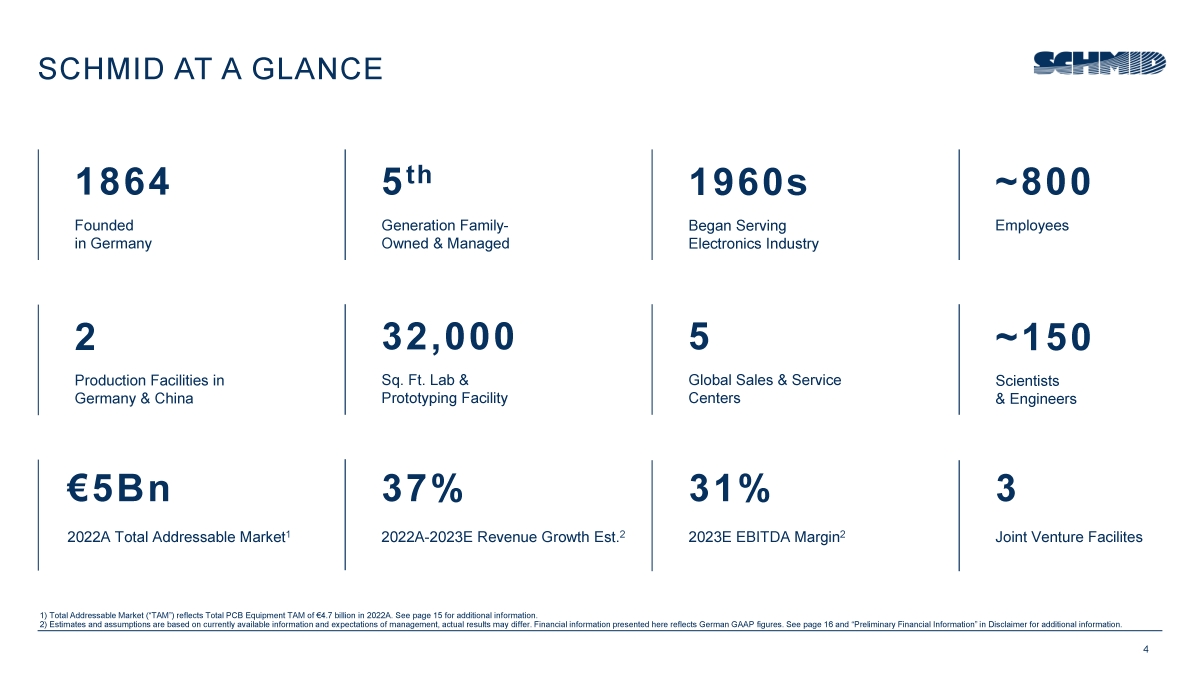

| 1864

Founded

in Germany

5

th

Generation Family-Owned & Managed

~800

Employees

~150

Scientists

& Engineers

2

Production Facilities in

Germany & China

31%

2023E EBITDA Margin2

32,000

Sq. Ft. Lab &

Prototyping Facility

5

Global Sales & Service

Centers

3

Joint Venture Facilites

37%

2022A-2023E Revenue Growth Est.2

1960s

Began Serving

Electronics Industry

€5Bn

2022A Total Addressable Market1

SCHMID AT A GLANCE

4

1) Total Addressable Market (“TAM”) reflects Total PCB Equipment TAM of €4.7 billion in 2022A. See page 15 for additional information.

2) Estimates and assumptions are based on currently available information and expectations of management, actual results may differ. Financial information presented here reflects German GAAP figures. See page 16 and “Preliminary Financial Information” in Disclaimer for additional information. |

| SCHMID & PEGASUS: JOINT FORCES FOR SUCCESS

− CEO & Chairman SCHMID Group joined 1998

− CEO of SCHMID Group since 2000

− Board positions at Schweizer Electronic AG, a

stock listed company

− China trade award and the first German

Chairman of a stock-listed company in Taiwan

Dipl. Wirtsch-Ing. (FH)

Helmut Rauch

− COO SCHMID Group joined 1994

− COO of SCHMID Group since 1997

− SAP introduction in 1996

− Build up China entity in 2003 (100% ownership)

Prof. Dr. Sir Ralf Speth FRS

FREng KBE

− Chief Executive Officer and Chairman

− 40+ years experience

− Member of the BoD of Tata Sons

− Non-executive director and vice-chairman of

the board of Jaguar-Land Rover, former

SCHMID Leadership Team Pegasus Team

Dipl. –Kffr. Julia Natterer

− CFO SCHMID Group joined 2021

− 2010 – 2020 Director Finance &

Controlling at SUESS MicroTec SE,

− Former Certified Public Accountant

(CPA) and Tax Advisor at KPMG

Laurent Nicolet

− Vice President Electronics joined 2006

− 2000 – 2006 CTO Multek (USA, DE, China)

− 1988 – 2000: CTO of Cicorel, PCB manufacturing

in Switzerland

− 1982 – 1988: CTO of Seprolec, PCB

manufacturing

Dr. Christian Buchner

− Vice President Photovoltaics joined 2004

− 2004 – 2009 CEO of SCHMID Technologies

Niedereschach

− 1996 – 2004 CEO of Heidelberg Instruments

Dr. Stefan Berger

− Chief Investment Officer

− 15+ years experience

− Former Director of Electrification at Jaguar-Land Rover

− Served as Vice President to the Chairman’s

Office at Tata Sons

Dipl.Ing. (FH) Thomas

Widmann

− Vice President R&D and Engineering joined 1999

− 1999 – 2020: Vice President Electrical Engineering

− 1998 – 1999: Software developer at HOMAG

− 1992 – 1998: Software developer at ARBURG

F. Jeremey Mistry

− Chief Financial Officer

− 20+ years experience

− Co-Founder, Pali Hill Capital Management

(venture capital & advisory)

− Former Head of Industrials/ Automotive

sector investment banking, Morgan Stanley

(India)

Dipl. Wirtsch-Ing. (FH)

Christian Schmid

5 |

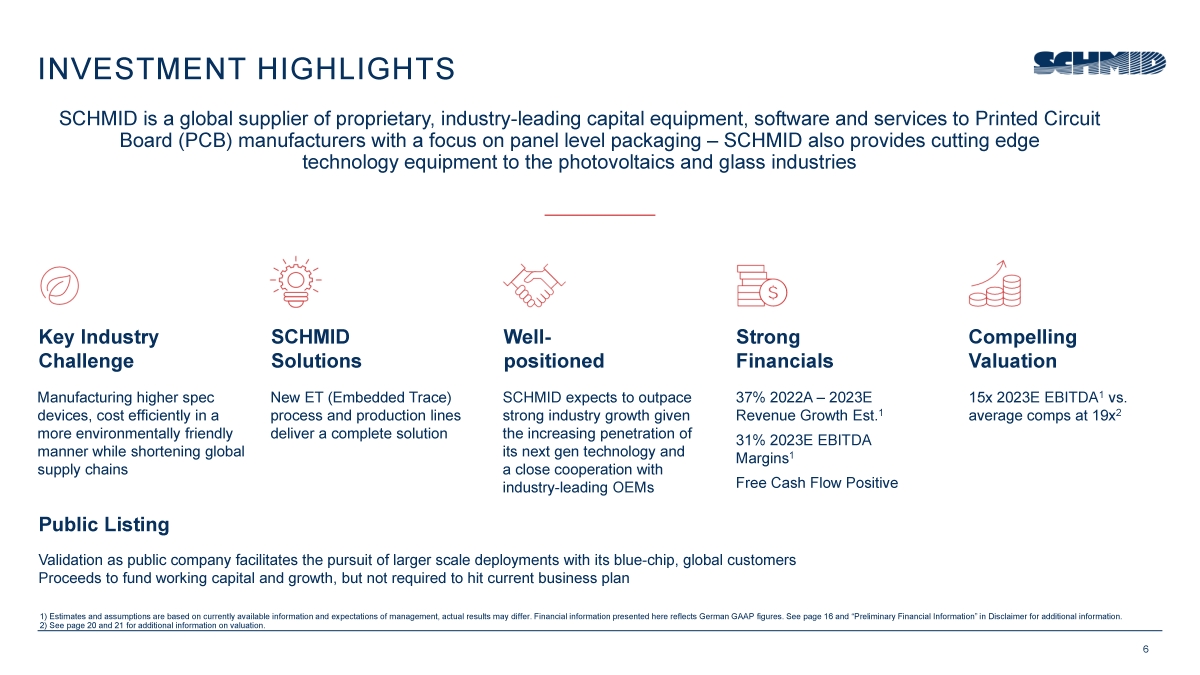

| INVESTMENT HIGHLIGHTS

Manufacturing higher spec

devices, cost efficiently in a

more environmentally friendly

manner while shortening global

supply chains

Public Listing

SCHMID

Solutions

Well-positioned

Strong

Financials

Compelling

Valuation

New ET (Embedded Trace)

process and production lines

deliver a complete solution

37% 2022A – 2023E

Revenue Growth Est.1

31% 2023E EBITDA

Margins1

Free Cash Flow Positive

15x 2023E EBITDA1 vs.

average comps at 19x2

SCHMID expects to outpace

strong industry growth given

the increasing penetration of

its next gen technology and

a close cooperation with

industry-leading OEMs

Validation as public company facilitates the pursuit of larger scale deployments with its blue-chip, global customers

Proceeds to fund working capital and growth, but not required to hit current business plan

Key Industry

Challenge

SCHMID is a global supplier of proprietary, industry-leading capital equipment, software and services to Printed Circuit

Board (PCB) manufacturers with a focus on panel level packaging – SCHMID also provides cutting edge

technology equipment to the photovoltaics and glass industries

6

1) Estimates and assumptions are based on currently available information and expectations of management, actual results may differ. Financial information presented here reflects German GAAP figures. See page 16 and “Preliminary Financial Information” in Disclaimer for additional information.

2) See page 20 and 21 for additional information on valuation. |

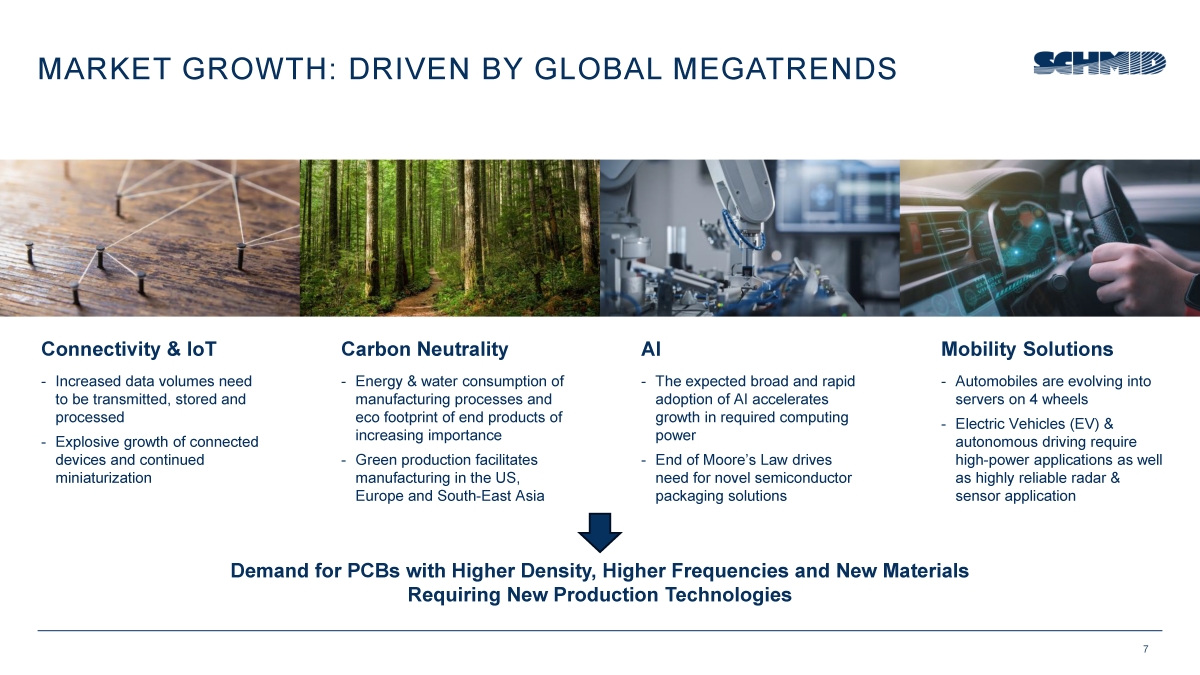

| Connectivity & IoT

- Increased data volumes need

to be transmitted, stored and

processed

- Explosive growth of connected

devices and continued

miniaturization

Carbon Neutrality

- Energy & water consumption of

manufacturing processes and

eco footprint of end products of

increasing importance

- Green production facilitates

manufacturing in the US,

Europe and South-East Asia

AI

- The expected broad and rapid

adoption of AI accelerates

growth in required computing

power

- End of Moore’s Law drives

need for novel semiconductor

packaging solutions

Mobility Solutions

- Automobiles are evolving into

servers on 4 wheels

- Electric Vehicles (EV) &

autonomous driving require

high-power applications as well

as highly reliable radar &

sensor application

Demand for PCBs with Higher Density, Higher Frequencies and New Materials

Requiring New Production Technologies

MARKET GROWTH: DRIVEN BY GLOBAL MEGATRENDS

7 |

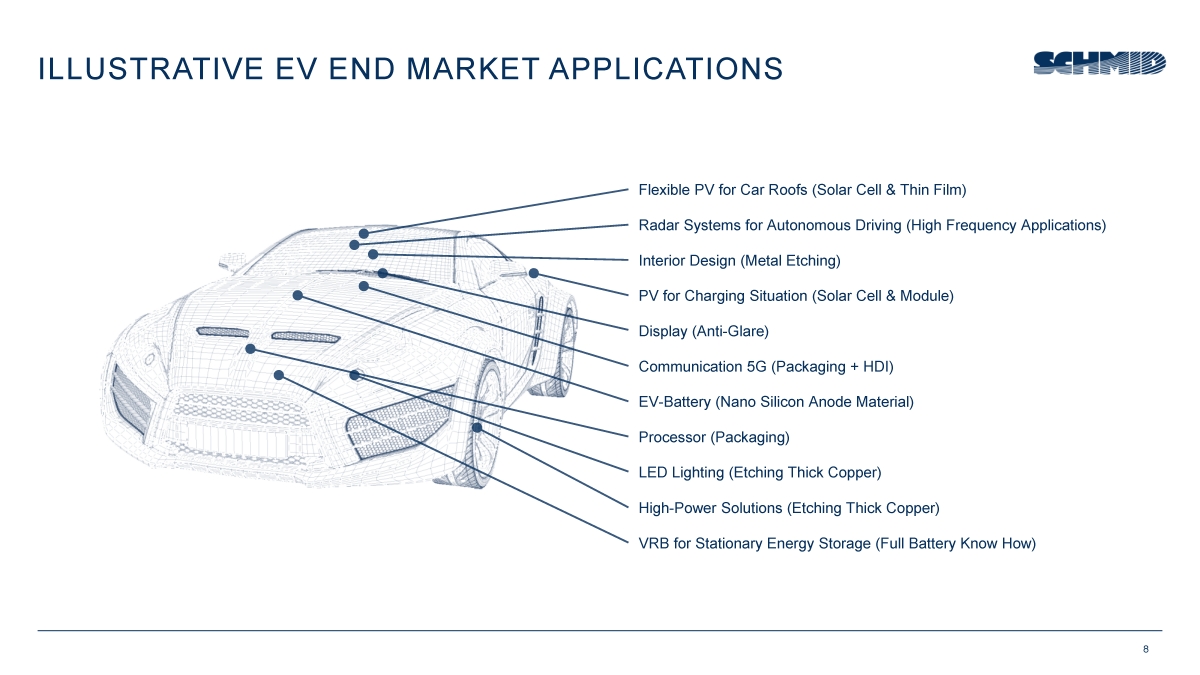

| Flexible PV for Car Roofs (Solar Cell & Thin Film)

Radar Systems for Autonomous Driving (High Frequency Applications)

Interior Design (Metal Etching)

PV for Charging Situation (Solar Cell & Module)

Display (Anti-Glare)

Communication 5G (Packaging + HDI)

EV-Battery (Nano Silicon Anode Material)

Processor (Packaging)

LED Lighting (Etching Thick Copper)

High-Power Solutions (Etching Thick Copper)

VRB for Stationary Energy Storage (Full Battery Know How)

ILLUSTRATIVE EV END MARKET APPLICATIONS

8 |

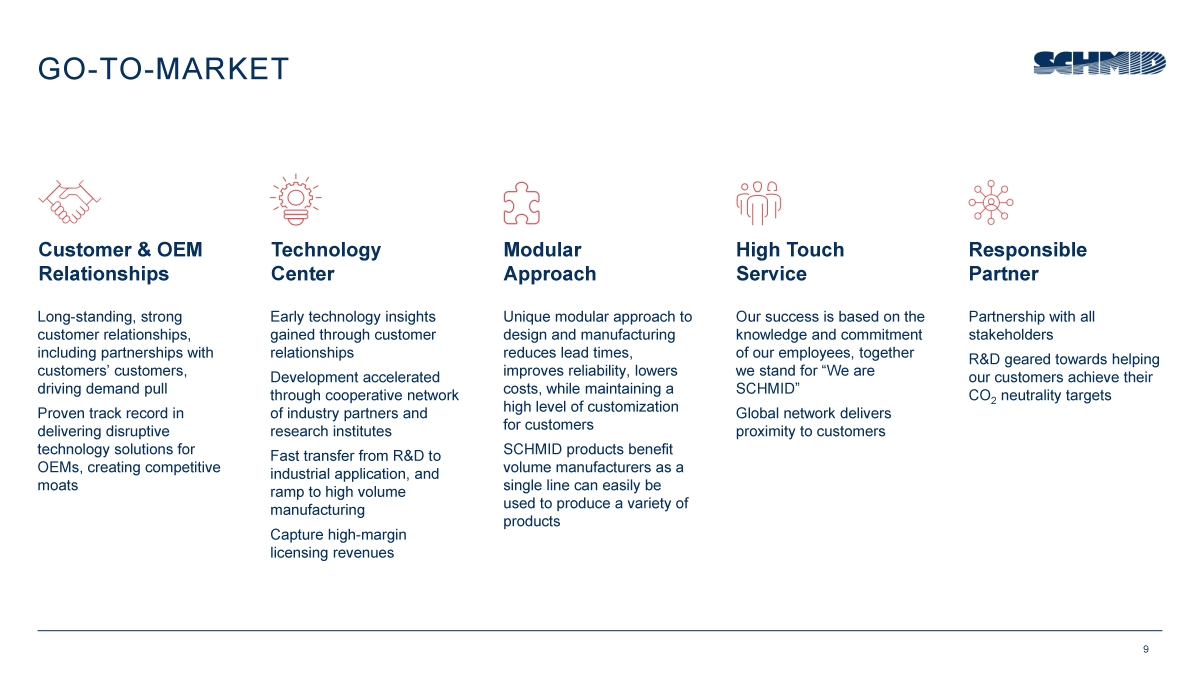

| GO-TO-MARKET

Long-standing, strong

customer relationships,

including partnerships with

customers’ customers,

driving demand pull

Proven track record in

delivering disruptive

technology solutions for

OEMs, creating competitive

moats

Technology

Center

Modular

Approach

High Touch

Service

Responsible

Partner

Early technology insights

gained through customer

relationships

Development accelerated

through cooperative network

of industry partners and

research institutes

Fast transfer from R&D to

industrial application, and

ramp to high volume

manufacturing

Capture high-margin

licensing revenues

Unique modular approach to

design and manufacturing

reduces lead times,

improves reliability, lowers

costs, while maintaining a

high level of customization

for customers

SCHMID products benefit

volume manufacturers as a

single line can easily be

used to produce a variety of

products

Our success is based on the

knowledge and commitment

of our employees, together

we stand for “We are

SCHMID”

Global network delivers

proximity to customers

Partnership with all

stakeholders

R&D geared towards helping

our customers achieve their

CO2 neutrality targets

Customer & OEM

Relationships

9 |

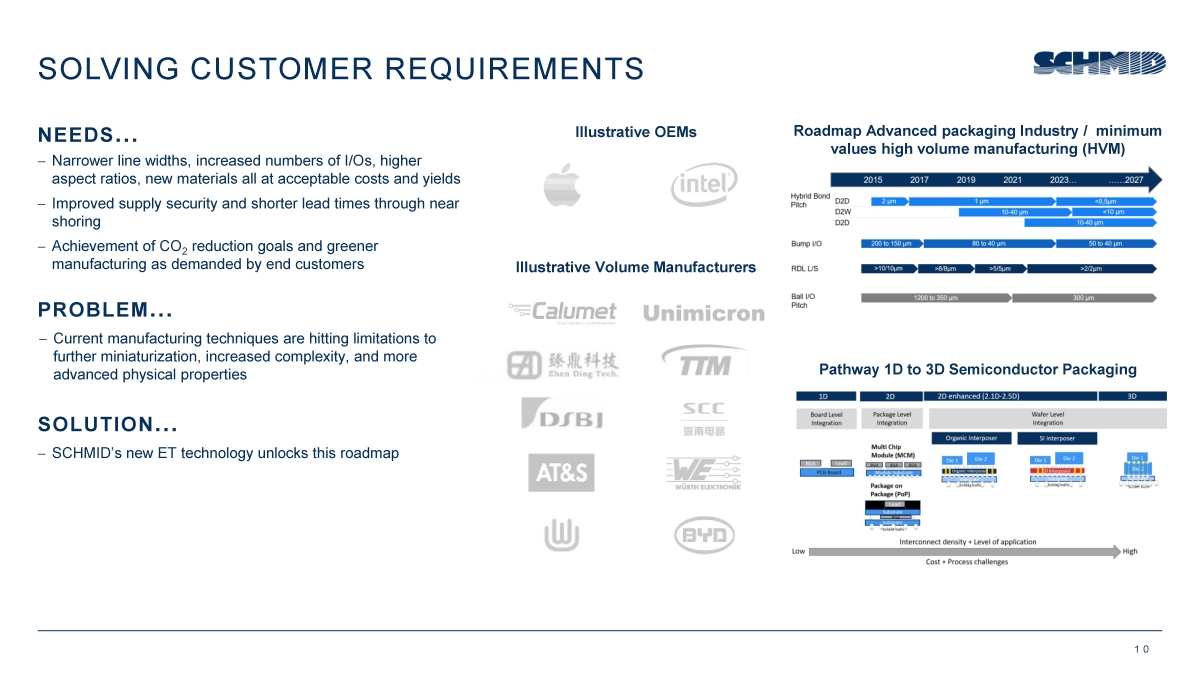

| − Narrower line widths, increased numbers of I/Os, higher

aspect ratios, new materials all at acceptable costs and yields

− Improved supply security and shorter lead times through near

shoring

− Achievement of CO2

reduction goals and greener

manufacturing as demanded by end customers

SOLVING CUSTOMER REQUIREMENTS

NEEDS...…

PROBLEM...…

− Current manufacturing techniques are hitting limitations to

further miniaturization, increased complexity, and more

advanced physical properties

SOLUTION...…

− SCHMID’s new ET technology unlocks this roadmap

Illustrative OEMs

Illustrative Volume Manufacturers

1 0

Roadmap Advanced packaging Industry / minimum

values high volume manufacturing (HVM)

Pathway 1D to 3D Semiconductor Packaging |

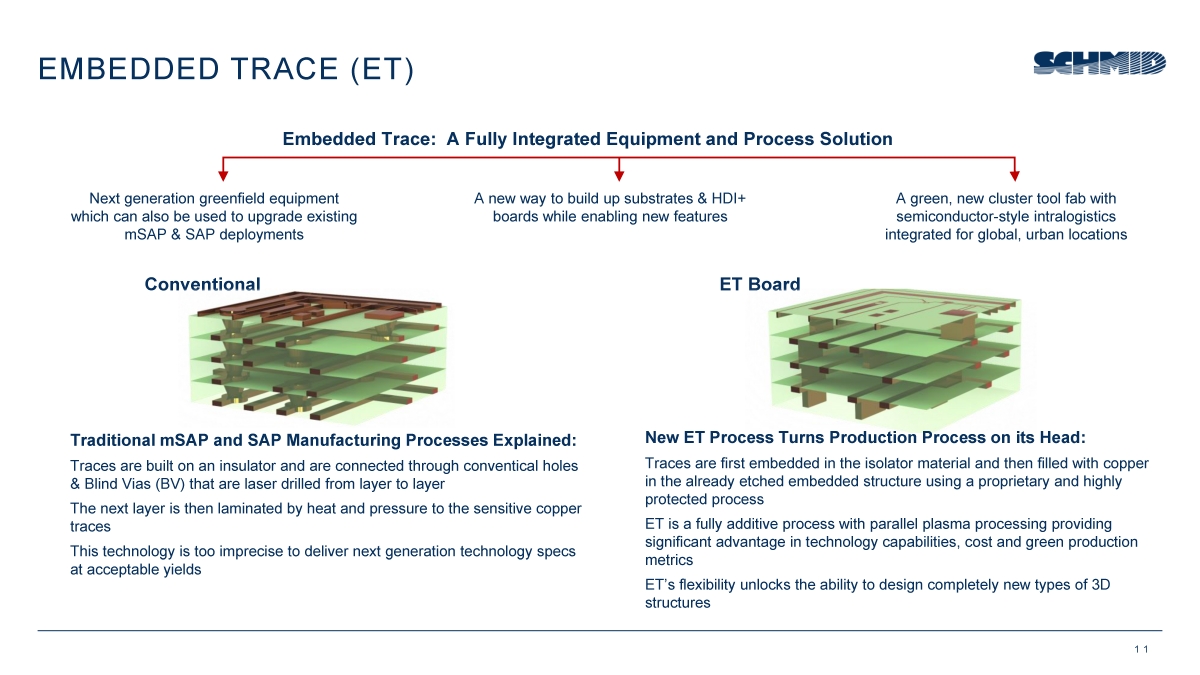

| Conventional ET Board

Traditional mSAP and SAP Manufacturing Processes Explained:

Traces are built on an insulator and are connected through conventical holes

& Blind Vias (BV) that are laser drilled from layer to layer

The next layer is then laminated by heat and pressure to the sensitive copper

traces

This technology is too imprecise to deliver next generation technology specs

at acceptable yields

New ET Process Turns Production Process on its Head:

Traces are first embedded in the isolator material and then filled with copper

in the already etched embedded structure using a proprietary and highly

protected process

ET is a fully additive process with parallel plasma processing providing

significant advantage in technology capabilities, cost and green production

metrics

ET’s flexibility unlocks the ability to design completely new types of 3D

structures

Next generation greenfield equipment

which can also be used to upgrade existing

mSAP & SAP deployments

A new way to build up substrates & HDI+

boards while enabling new features

A green, new cluster tool fab with

semiconductor-style intralogistics

integrated for global, urban locations

EMBEDDED TRACE (ET)

Embedded Trace: A Fully Integrated Equipment and Process Solution

1 1 |

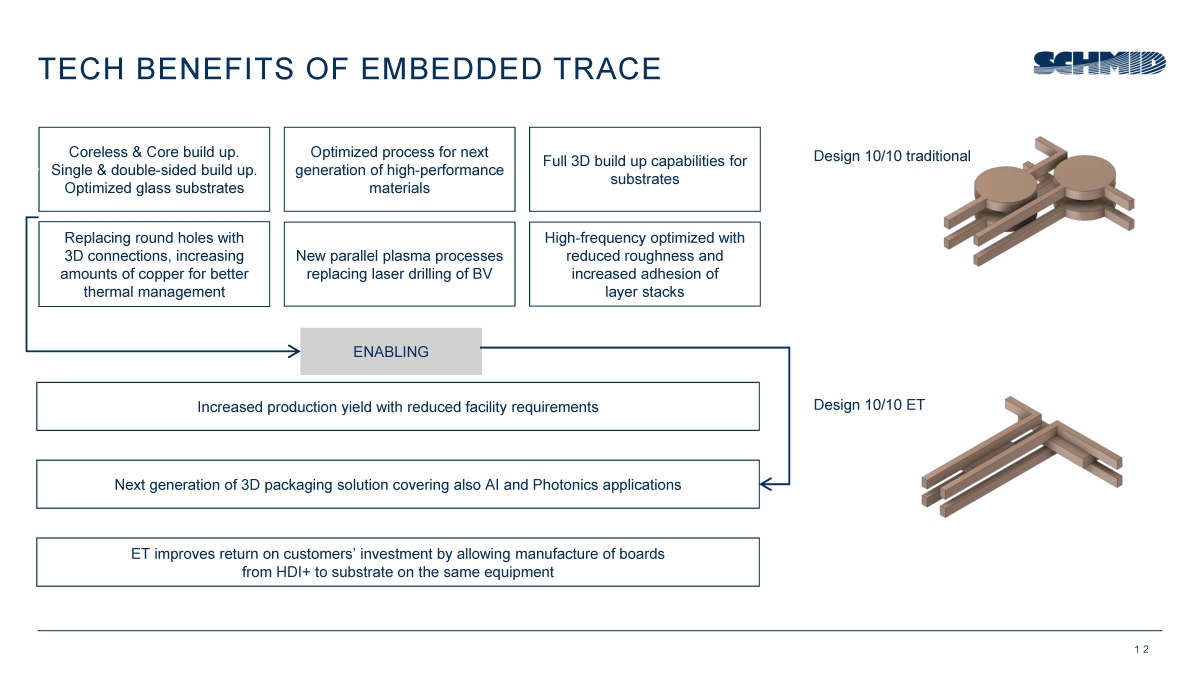

| Coreless & Core build up.

Single & double-sided build up.

Optimized glass substrates

Optimized process for next

generation of high-performance

materials

Full 3D build up capabilities for

substrates

Replacing round holes with

3D connections, increasing

amounts of copper for better

thermal management

New parallel plasma processes

replacing laser drilling of BV

High-frequency optimized with

reduced roughness and

increased adhesion of

layer stacks

Increased production yield with reduced facility requirements

ET improves return on customers’ investment by allowing manufacture of boards

from HDI+ to substrate on the same equipment

Next generation of 3D packaging solution covering also AI and Photonics applications

Design 10/10 traditional

Design 10/10 ET

ENABLING

TECH BENEFITS OF EMBEDDED TRACE

1 2 |

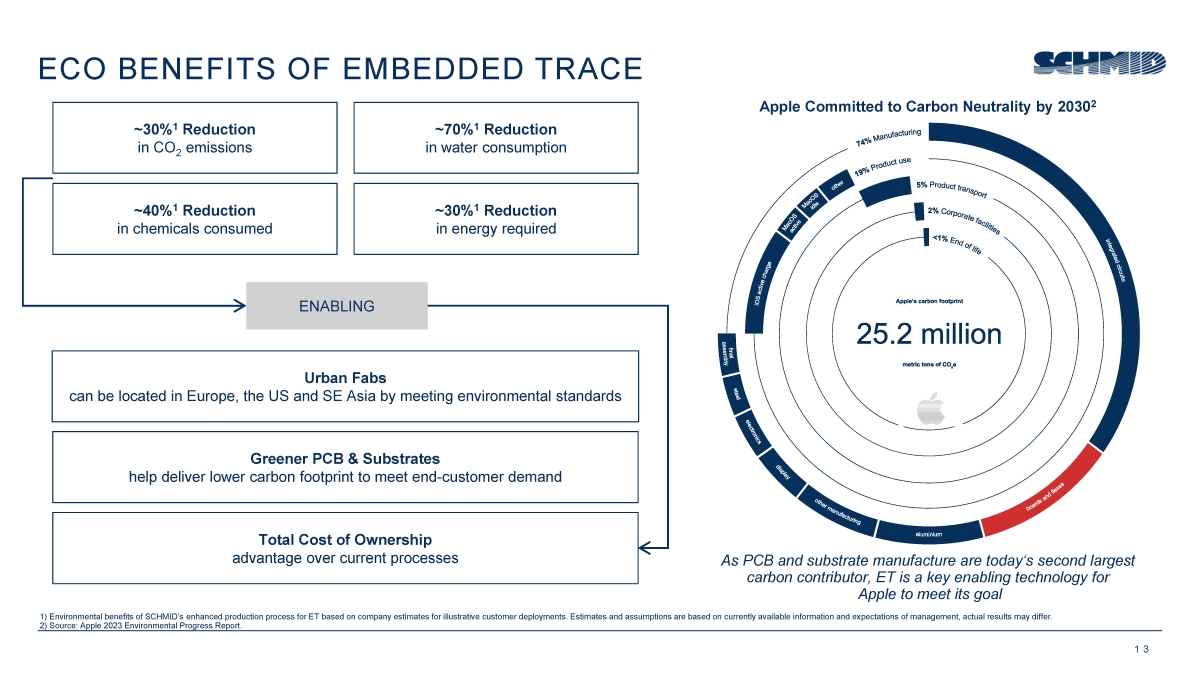

| ECO BENEFITS OF EMBEDDED TRACE

~30%1 Reduction

in CO2 emissions

~70%1 Reduction

in water consumption

~40%1 Reduction

in chemicals consumed

~30%1 Reduction

in energy required

Urban Fabs

can be located in Europe, the US and SE Asia by meeting environmental standards

Greener PCB & Substrates

help deliver lower carbon footprint to meet end-customer demand

Total Cost of Ownership

advantage over current processes

ENABLING

Apple Committed to Carbon Neutrality by 20302

As PCB and substrate manufacture are today‘s second largest

carbon contributor, ET is a key enabling technology for

Apple to meet its goal

1 3

1) Environmental benefits of SCHMID’s enhanced production process for ET based on company estimates for illustrative customer deployments. Estimates and assumptions are based on currently available information and expectations of management, actual results may differ.

2) Source: Apple 2023 Environmental Progress Report. |

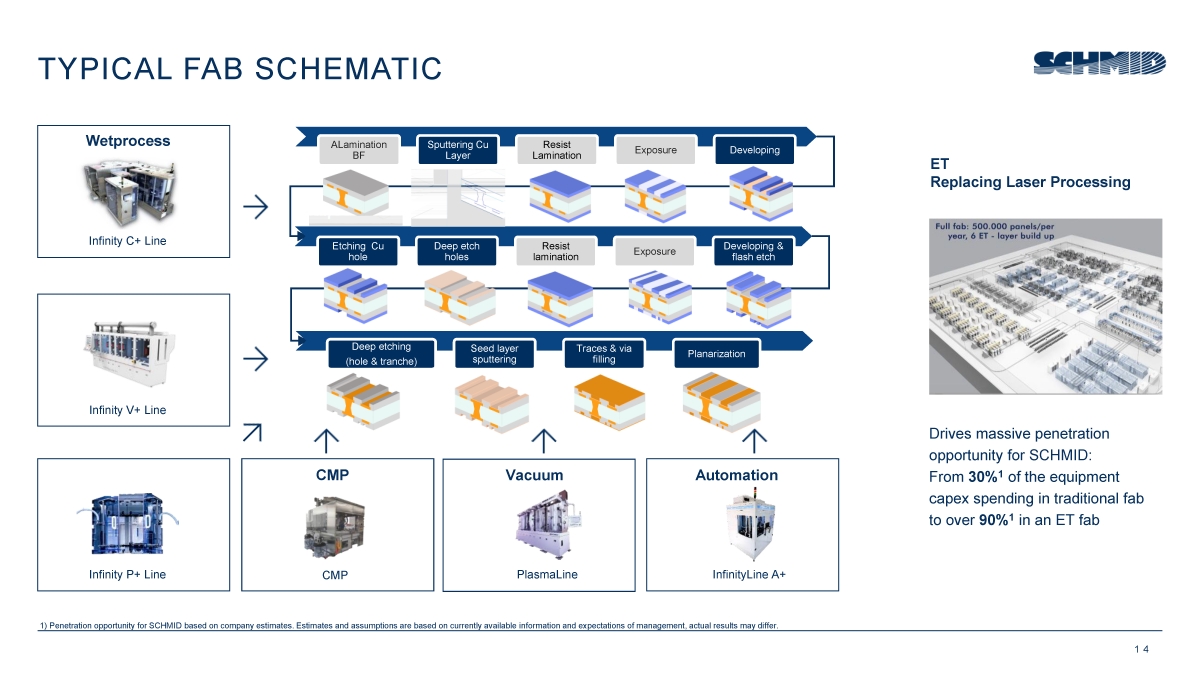

| TYPICAL FAB SCHEMATIC

Drives massive penetration

opportunity for SCHMID:

From 30%1 of the equipment

capex spending in traditional fab

to over 90%1

in an ET fab

ET

Replacing Laser Processing

Wetprocess

Infinity C+ Line

Infinity V+ Line

Infinity P+ Line

Vacuum

PlasmaLine

Automation

InfinityLine A+

ALamination

BF

Sputtering Cu

Layer

Resist

Lamination Exposure

Etching Cu

hole

Deep etch

holes

Resist

lamination

Developing

Developing &

flash etch

Deep etching

(hole & tranche)

Seed layer

sputtering

Exposure

Traces & via

filling Planarization

CMP

1 4

CMP

1) Penetration opportunity for SCHMID based on company estimates. Estimates and assumptions are based on currently available information and expectations of management, actual results may differ. |

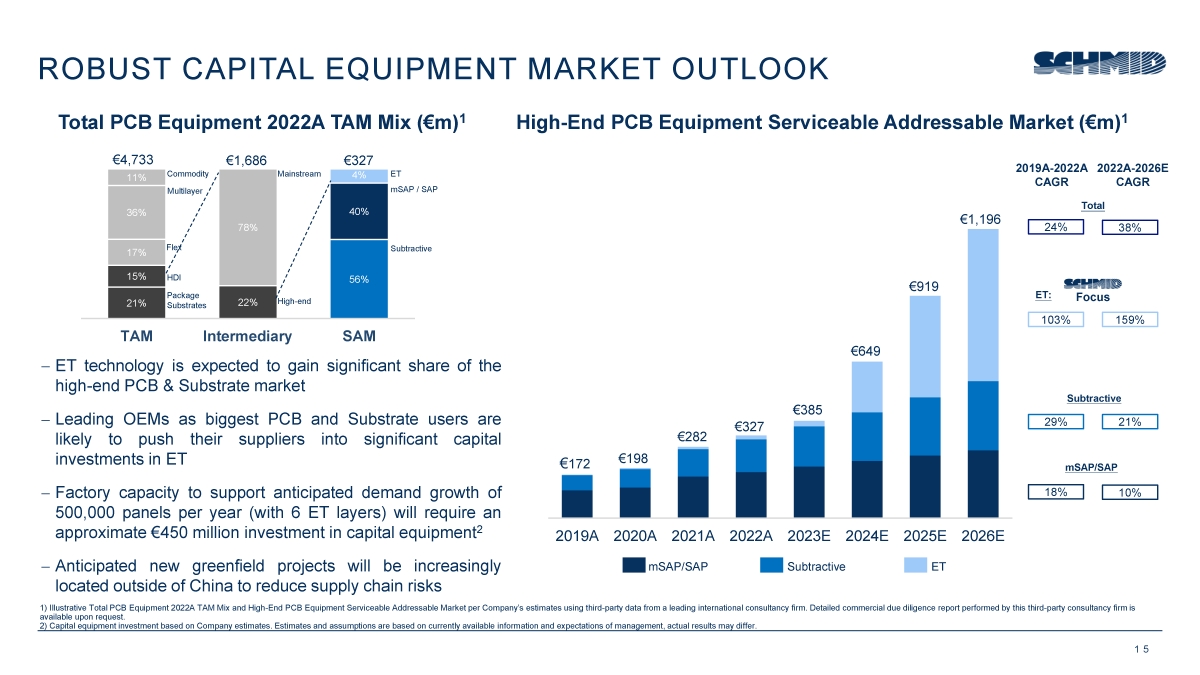

| Focus

mSAP/SAP Subtractive ET

ROBUST CAPITAL EQUIPMENT MARKET OUTLOOK

1 5

High-End PCB Equipment Serviceable Addressable Market (€m)1

2019A-2022A

CAGR

2022A-2026E

CAGR

103% 159%

29% 21%

18% 10%

ET:

Subtractive

mSAP/SAP

24% 38%

Total

2019A 2020A 2021A 2022A 2023E 2024E 2025E 2026E

€172 €198

€282

€327

€385

€649

€919

€1,196

1) Illustrative Total PCB Equipment 2022A TAM Mix and High-End PCB Equipment Serviceable Addressable Market per Company’s estimates using third-party data from a leading international consultancy firm. Detailed commercial due diligence report performed by this third-party consultancy firm is

available upon request.

2) Capital equipment investment based on Company estimates. Estimates and assumptions are based on currently available information and expectations of management, actual results may differ.

− ET technology is expected to gain significant share of the

high-end PCB & Substrate market

− Leading OEMs as biggest PCB and Substrate users are

likely to push their suppliers into significant capital

investments in ET

− Factory capacity to support anticipated demand growth of

500,000 panels per year (with 6 ET layers) will require an

approximate €450 million investment in capital equipment2

− Anticipated new greenfield projects will be increasingly

located outside of China to reduce supply chain risks

21% 22%

56% 15%

78%

40%

17%

4%

36%

11%

TAM Intermediary SAM

€4,733 €1,686 €327

Commodity

Multilayer

Flex

HDI

Package

Substrates High-end

Mainstream ET

mSAP / SAP

Subtractive

Total PCB Equipment 2022A TAM Mix (€m)1 |

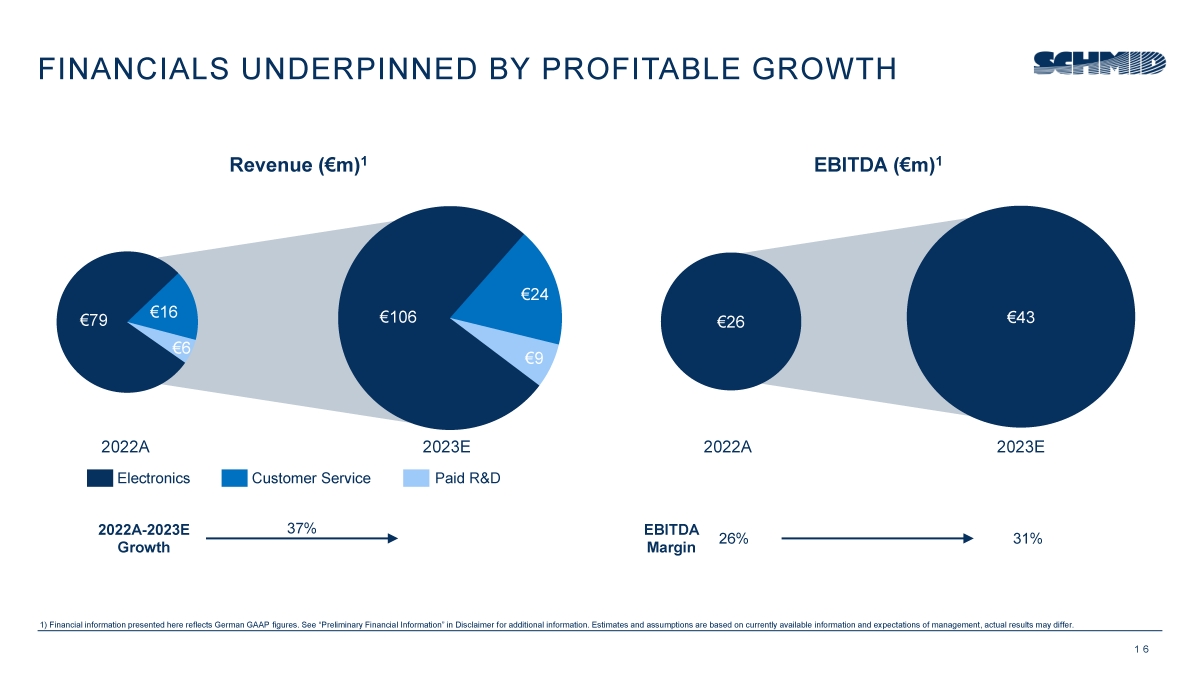

| Revenue (€m)1

FINANCIALS UNDERPINNED BY PROFITABLE GROWTH

1 6

EBITDA (€m)1

€26 €43

1) Financial information presented here reflects German GAAP figures. See “Preliminary Financial Information” in Disclaimer for additional information. Estimates and assumptions are based on currently available information and expectations of management, actual results may differ.

€106

€24

€9

€79 €16

€6

2022A 2023E 2022A 2023E

EBITDA

Margin 26% 31%

Electronics Customer Service Paid R&D

2022A-2023E 37%

Growth |

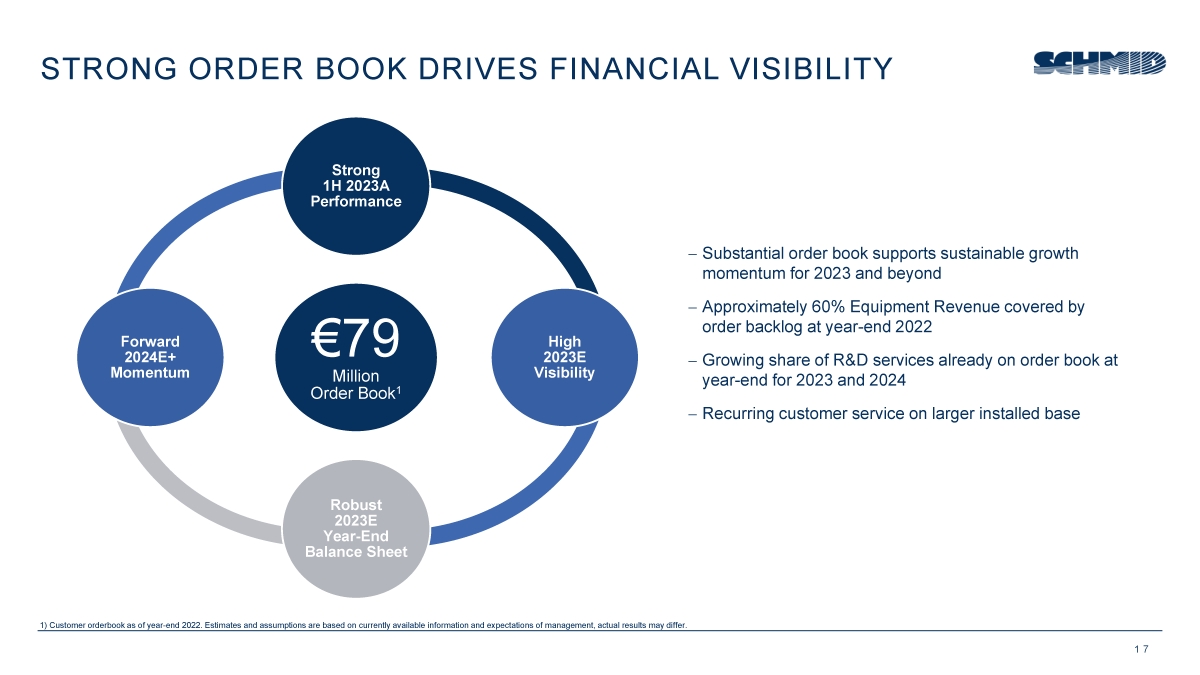

| − Substantial order book supports sustainable growth

momentum for 2023 and beyond

− Approximately 60% Equipment Revenue covered by

order backlog at year-end 2022

− Growing share of R&D services already on order book at

year-end for 2023 and 2024

− Recurring customer service on larger installed base

STRONG ORDER BOOK DRIVES FINANCIAL VISIBILITY

1 7

€79

Million

Order Book1

Strong

1H 2023A

Performance

High

2023E

Visibility

Robust

2023E

Year-End

Balance Sheet

Forward

2024E+

Momentum

1) Customer orderbook as of year-end 2022. Estimates and assumptions are based on currently available information and expectations of management, actual results may differ. |

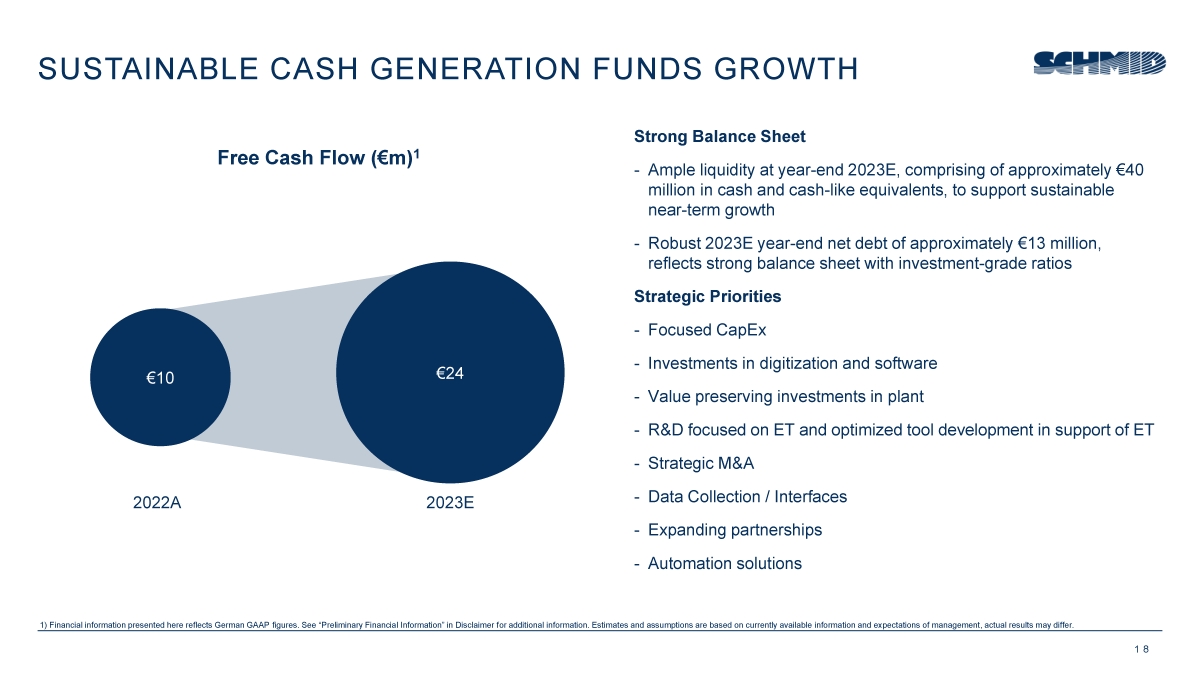

| Strong Balance Sheet

- Ample liquidity at year-end 2023E, comprising of approximately €40

million in cash and cash-like equivalents, to support sustainable

near-term growth

- Robust 2023E year-end net debt of approximately €13 million,

reflects strong balance sheet with investment-grade ratios

Strategic Priorities

- Focused CapEx

- Investments in digitization and software

- Value preserving investments in plant

- R&D focused on ET and optimized tool development in support of ET

- Strategic M&A

- Data Collection / Interfaces

- Expanding partnerships

- Automation solutions

SUSTAINABLE CASH GENERATION FUNDS GROWTH

1 8

Free Cash Flow (€m)1

1) Financial information presented here reflects German GAAP figures. See “Preliminary Financial Information” in Disclaimer for additional information. Estimates and assumptions are based on currently available information and expectations of management, actual results may differ.

€10 €24

2022A 2023E |

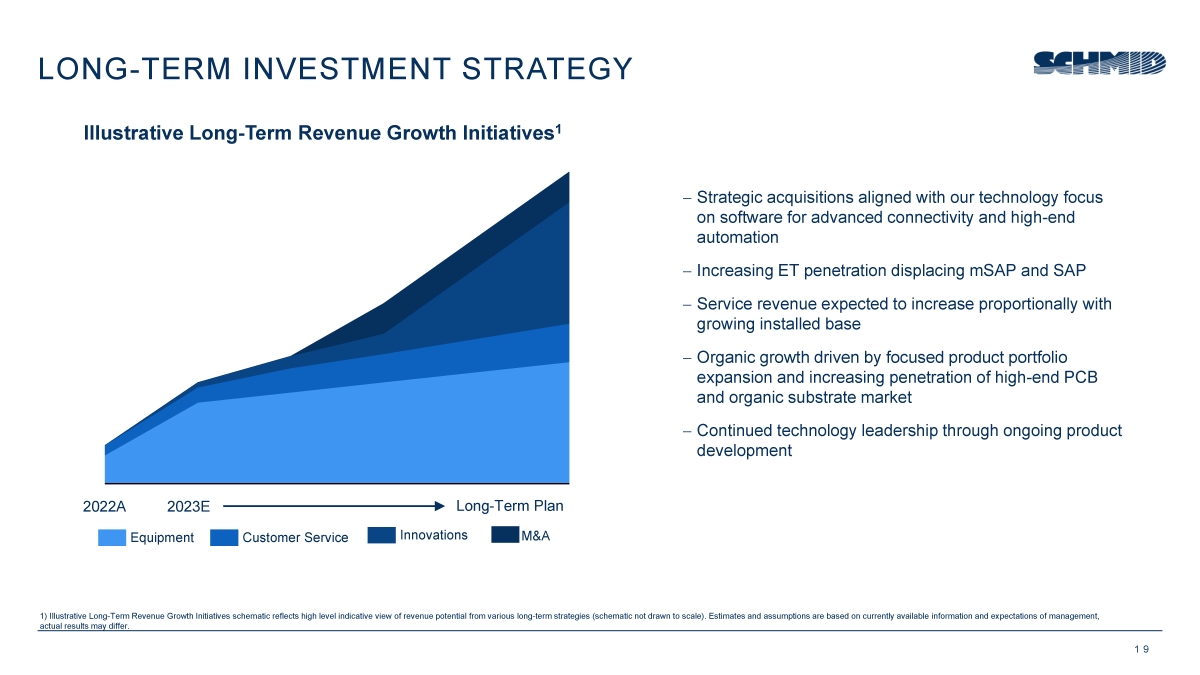

| − Strategic acquisitions aligned with our technology focus

on software for advanced connectivity and high-end

automation

− Increasing ET penetration displacing mSAP and SAP

− Service revenue expected to increase proportionally with

growing installed base

− Organic growth driven by focused product portfolio

expansion and increasing penetration of high-end PCB

and organic substrate market

− Continued technology leadership through ongoing product

development

2022A 2023E

Equipment Customer Service Innovations M&A

LONG-TERM INVESTMENT STRATEGY

1 9

Illustrative Long-Term Revenue Growth Initiatives1

Long-Term Plan

1) Illustrative Long-Term Revenue Growth Initiatives schematic reflects high level indicative view of revenue potential from various long-term strategies (schematic not drawn to scale). Estimates and assumptions are based on currently available information and expectations of management,

actual results may differ. |

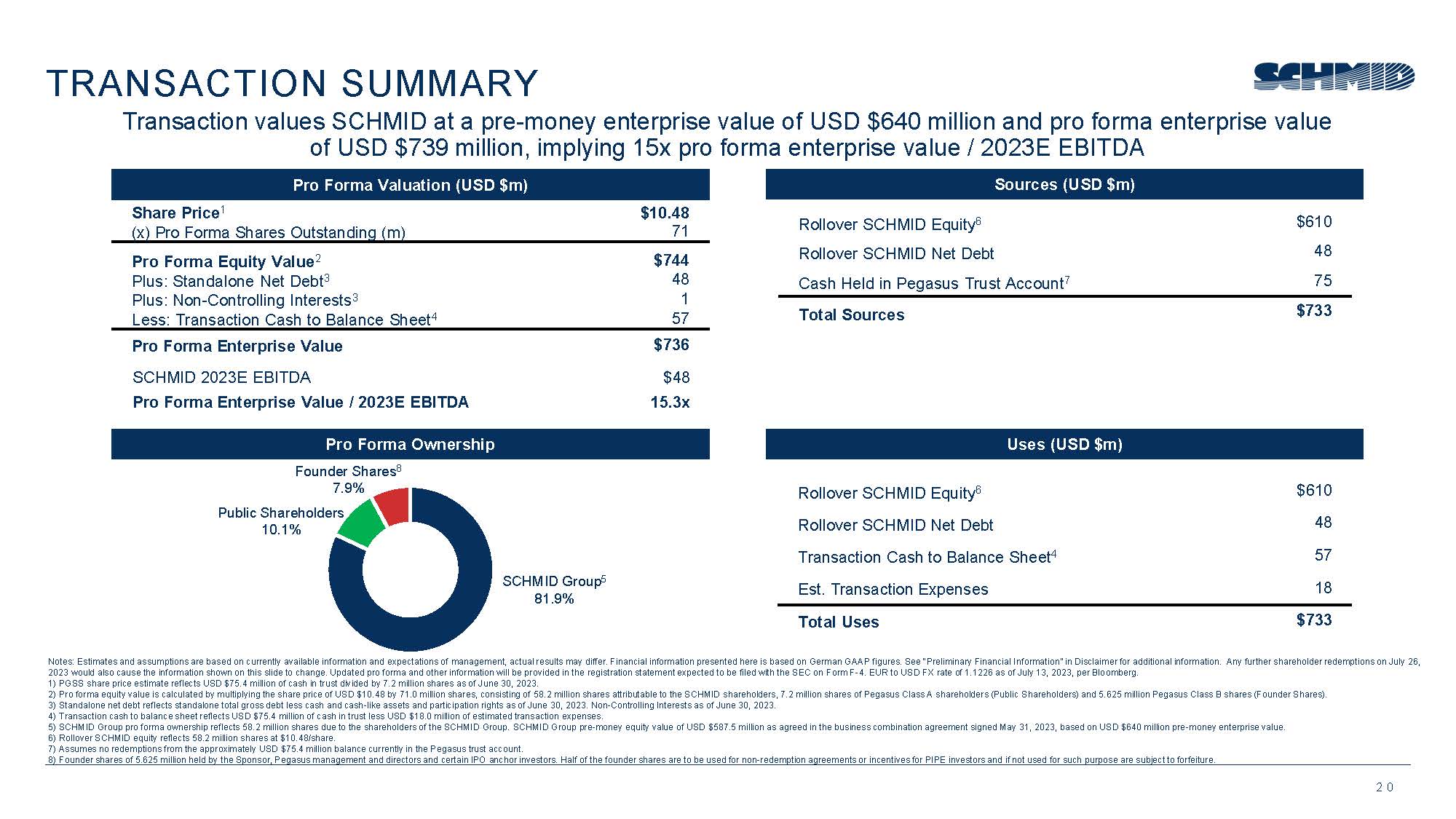

| TRANSACTION SUMMARY

Transaction values SCHMID at a pre-money enterprise value of USD $640 million and pro forma enterprise value

of USD $739 million, implying 15x pro forma enterprise value / 2023E EBITDA

Pro Forma Valuation (USD $m) Sources (USD $m)

Uses (USD $m)

Rollover SCHMID Equity5 $613

Rollover SCHMID Net Debt 48

Cash Held in Pegasus Trust Account6 75

Total Sources $736

Rollover SCHMID Equity5 $613

Rollover SCHMID Net Debt 48

Transaction Cash to Balance Sheet3 57

Est. Transaction Expenses 18

Total Uses $736

Share Price1 $10.48

(x) Pro Forma Shares Outstanding 71

Pro Forma Equity Value $747

Plus: Standalone Net Debt2 48

Plus: Non-Controlling Interests2 1

Less: Transaction Cash to Balance Sheet3 57

Pro Forma Enterprise Value $739

Notes: Estimates and assumptions are based on currently available information and expectations of management, actual results may differ. Financial information presented here is based on German GAAP figures. See “Preliminary Financial Information” in Disclaimer for additional information. Any further

shareholder redemptions on July 26, 2023 would also cause the information shown on this slide to change. Updated pro forma and other information will be provided in the registration statement expected to be filed with the SEC on Form F-4. EUR to USD FX rate of 1.1226 as of July 13, 2023, per Bloomberg.

1) PGSS share price estimate reflects USD $75.4 million of cash in trust divided by 7.2 million shares as of June 30, 2023.

2) Standalone net debt reflects standalone total gross debt less cash and cash-like assets and participation rights as of June 30, 2023. Non-Controlling Interests as of June 30, 2023.

3) Transaction cash to balance sheet reflects USD $75.4 million of cash in trust less USD $18.0 million of estimated transaction expenses.

4) SCHMID Group pro forma ownership reflects 58.5 million shares based on USD $590.8 million pre-money equity value at $10.10 exchange ratio. SCHMID Group pre-money equity value of USD $590.8 million based on USD $640 million pre-money enterprise value.

5) Rollover SCHMID equity reflects 58.5 million shares at $10.48/share.

6) Assumes no redemptions from the approximately USD $75.4 million balance currently in the Pegasus trust account.

2 0

Pro Forma Ownership

Public Shareholders

10.1%

Sponsor

7.9%

SCHMID Group4

82.0%

SCHMID 2023E EBITDA $48

Pro Forma Enterprise Value / 2023E EBITDA 15.3x |

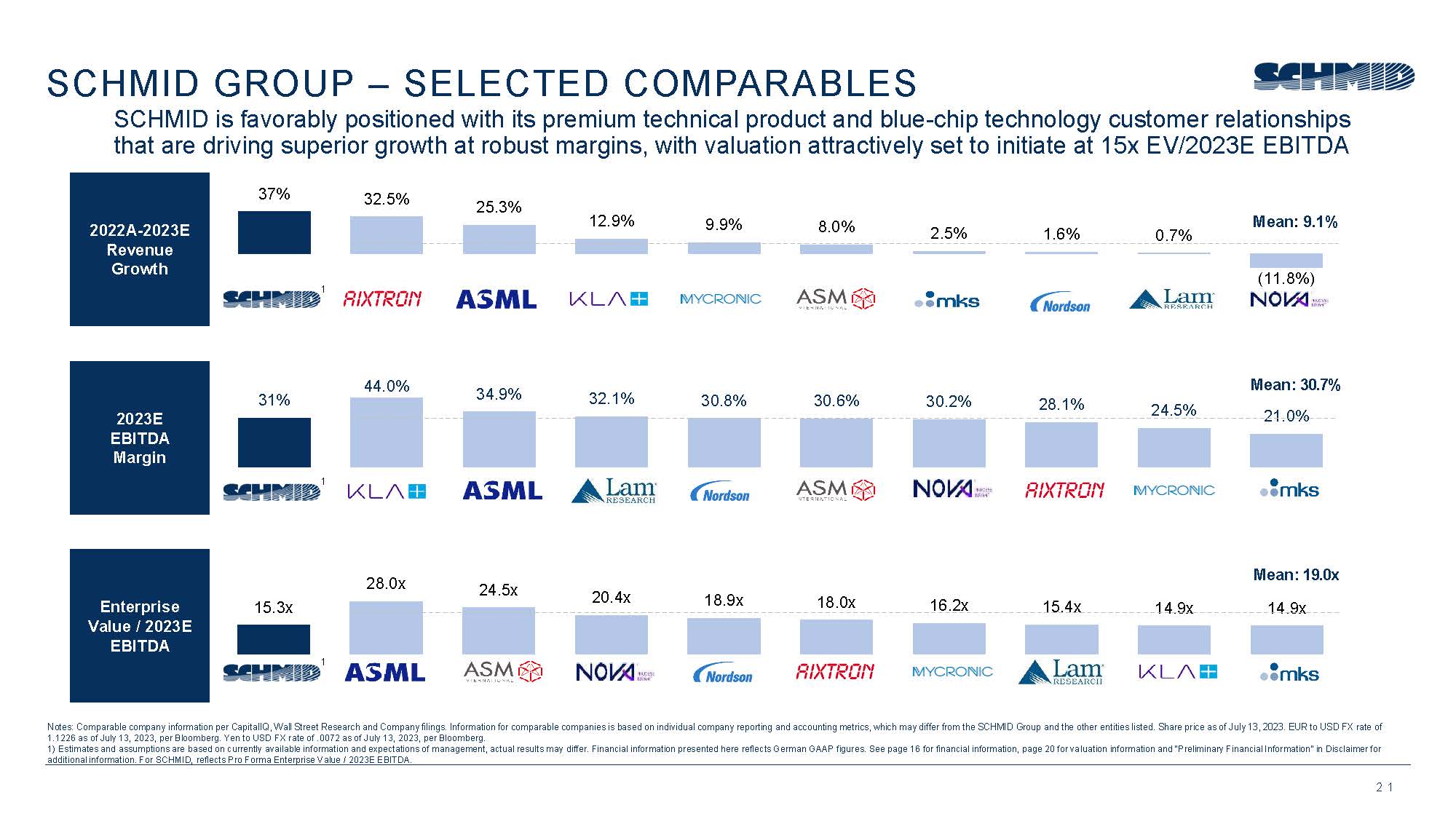

| 15.3x

28.0x 24.5x 20.4x 18.9x 16.2x 18.0x 15.4x 14.9x 14.9x

31%

44.0% 34.9% 32.1% 30.8% 30.6% 30.2% 28.1% 24.5% 21.0%

37% 32.5% 25.3%

12.9% 8.0% 9.9% 2.5% 1.6% 0.7%

(11.8%)

SCHMID is favorably positioned with its premium technical product and blue-chip technology customer relationships

that are driving superior growth at robust margins, with valuation attractively set to initiate at 15x EV/2023E EBITDA

SCHMID GROUP – SELECTED COMPARABLES

2022A-2023E

Revenue

Growth

Mean: 9.1%

Notes: Comparable company information per CapitalIQ, Wall Street Research and Company filings. Information for comparable companies is based on individual company reporting and accounting metrics, which may differ from the SCHMID Group and the other entities listed. Share price as of July 13,

2023. EUR to USD FX rate of 1.1226 as of July 13, 2023, per Bloomberg. Yen to USD FX rate of .0072 as of July 13, 2023, per Bloomberg.

1) Estimates and assumptions are based on currently available information and expectations of management, actual results may differ. Financial information presented here reflects German GAAP figures. See page 16 for financial information, page 20 for valuation information and “Preliminary Financial

Information” in Disclaimer for additional information. For SCHMID, reflects Pro Forma Enterprise Value / 2023E EBITDA.

2 1

2023E

EBITDA

Margin

Enterprise

Value / 2023E

EBITDA

Mean: 30.7%

Mean: 19.0x

1

1

1 |

| Thank you for

your attention

Please feel free to contact us if you have any questions.

www.schmid-group.com |

| C o n f i d e n t i a l |

Cover

|

Jul. 14, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 14, 2023

|

| Entity File Number |

001-40945

|

| Entity Registrant Name |

Pegasus Digital Mobility Acquisition Corp.

|

| Entity Central Index Key |

0001861541

|

| Entity Tax Identification Number |

98-1596591

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

71 Fort Street

|

| Entity Address, City or Town |

George Town

|

| Entity Address, State or Province |

KY

|

| Entity Address, Postal Zip Code |

KY1-1106

|

| City Area Code |

345

|

| Local Phone Number |

769-4900

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share and one-half of one redeemable Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one Class A Ordinary Share and one-half of one redeemable Warrant

|

| Trading Symbol |

PGSS.U

|

| Security Exchange Name |

NYSE

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Ordinary Shares, par value $0.0001 per share

|

| Trading Symbol |

PGSS

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants, each exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable Warrants, each exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share

|

| Trading Symbol |

PGSS.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pgss_UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pgss_RedeemableWarrantsEachExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

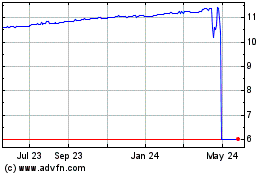

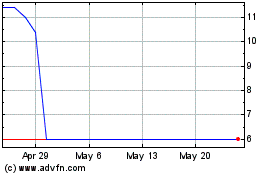

Pegasus Digital Mobility... (NYSE:PGSS)

Historical Stock Chart

From Apr 2024 to May 2024

Pegasus Digital Mobility... (NYSE:PGSS)

Historical Stock Chart

From May 2023 to May 2024