For Immediate Release

Chicago, IL – March 6, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Apple Inc. (

AAPL), Motorola Mobility Holdings Inc. (

MMI), BP Plc ( BP), Transocean

Ltd ( RIG) and Halliburton

Company ( HAL).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Monday’s Analyst

Blog:

Apple vs. Samsung: War Continues

Apple Inc. ( AAPL) and Samsung’s court

battles are nothing new. Both the companies have been filing patent

infringement cases against each other in almost every continent in

which they are present. In the latest development, two patent

infringement cases brought on by Apple and Samsung against each

other were dismissed by a regional court in Mannheim, Germany.

Apple’s claim that Samsung has infringed its mobile devices’

‘slide-to-unlock technology’ was dismissed by the German court.

Samsung, in its defense, argued that its slide to unlock technology

was different from that of Apple’s in terms of "gestures of any

path between start and target".

Separately, Samsung’s claim that Apple was violating a certain

3G wireless patent held by Samsung was also dismissed. However,

Samsung is expected to appeal to a higher court in Karlsruhe,

Germany, against the dismissal.

Interestingly, very recently the same court in Karlsruhe,

Germany, ruled in favor of Apple in the patent infringement case

lodged by Motorola Mobility Holdings

Inc. ( MMI). The patent in question was related to 3G

wireless networking standards that threatened to disrupt sales of

Apple’s iconic iPhones and iPads in the country.

Apple has been pretty aggressive in protecting its intellectual

property and has been using court rooms to counter competition in

various countries. Notwithstanding a few failures, the company has

received success in many of the patent litigation cases that it has

filed against Samsung and other fellow competitors such as HTC and

Motorola Mobility.

We believe that Apple’s legal tussles will continue as

competition heats up in the smartphone and tablet space. This will

increase legal expenses and will hurt Apple’s operating profit

going forward. Additionally, the impending lawsuits in different

countries will remain an overhang on the stock going forward.

Despite these factors, we believe that Apple remains the biggest

growth story based on its superior product pipeline, popular apps,

the recently launched iCloud and iPhone 4S, and the upcoming update

of iPad and Apple TV, and loyal customer base. With a solid

balance sheet and robust revenues, we expect Apple to outperform

its peers in the long run. Moreover, we also expect Apple to

succeed in developing countries due to the growing affluence of the

middle class in key markets.

We maintain our Neutral recommendation over the long term (6-12

months). Currently, Apple has a Zacks #1 Rank, which implies a

Strong Buy rating in the near term.

BP, Plaintiffs Settle on $7.8

Billion

BP Plc ( BP) and Plaintiffs’ Steering

Committee (PSC) have reached an agreement of $7.8 billion, over the

reimbursements to be made for the 2010 Gulf of Mexico oil

spill.

The judge had earlier postponed the trial by a week and

rescheduled it for March 5 to give BP and PSC more time to discuss

and settle the matter. PSC embodies a group synchronizing the

efforts of around 90 law firms on behalf of a condominium of

owners, fishermen, hoteliers, restaurateurs and others damaged by

the April 20, 2010 explosion of the Deepwater Horizon drilling rig

and the subsequent oil spill. A settlement between BP and PSC

reduces the complexity of the litigation and signifies a major step

toward achieving a global settlement.

The oil spill had catastrophic effects killing eleven people and

pouring 4.9 million barrels from the mile-deep Macondo oil well.

This is by far the worst offshore U.S. oil spill.

The breach of Clean Water Act along with other laws led the U.S.

government to take legal action against the main defendants in the

trial––BP, Transocean Ltd ( RIG)

and Halliburton Company ( HAL). Several

other companies are also involved in the trial.

Per BP, the estimated settlement of $7.8 billion with PSC covers

a significant extent of legitimate economic loss and medical claims

arising from the Deepwater Horizon accident and oil spill. The

settlement includes an amount of $2.3 billion set aside to

especially help cover claims related to the Gulf seafood industry.

The terms of the settlement are still required to be submitted to

the court for approval.

BP expects to compensate the losses from Gulf Coast Claims

Facility— a trust fund which was initially created with an amount

$20 billion to pay for such claims. Currently, the fund is left

with $9.5 billion. BP had earlier paid $6.1 billion from the fund

to reimburse around 220,000 claimants.

Other than these, BP had also shelled out over $22 billion to

meet other obligations in the Gulf region and made payments in

excess of $8.1 billion to individuals, businesses and government

entities. Another $14 billion was spent for operational purposes.

BP has also promised to pay $105 million for the enhancement of

healthcare facilities among Gulf communities.

The claims would be categorized under two heads — economic loss

claims and medical claims. The claimants demanding medical

benefits, including workers who facilitated the spill clean up

procedure, would be entitled to care for 21 years.

A charge of $37.2 billion, which has already been recorded in

BP’s financial statement, inclusive of the $20 billion trust fund

amount, is unlikely to be affected by this settlement.

The settlement will help BP to resolve issues with the federal

and state governments and move beyond the Gulf oil spill. A

settlement between BP and PSC reduces the complexity of the

litigation and signifies a major step toward achieving a global

settlement. The agreement does not settle the claims BP faces

against the US government and drilling partners.

BP holds a Zacks #3 Rank, which translates into a Hold rating

for a period of one to three months. For the long term, we maintain

a Neutral recommendation on the stock.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

APPLE INC (AAPL): Free Stock Analysis Report

BP PLC (BP): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

MOTOROLA MOBLTY (MMI): Free Stock Analysis Report

TRANSOCEAN LTD (RIG): Free Stock Analysis Report

To read this article on Zacks.com click here.

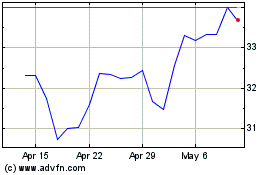

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jul 2024 to Aug 2024

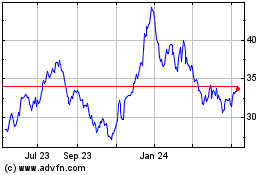

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Aug 2023 to Aug 2024