UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-41737

Lifezone Metals Limited

Commerce House, 1 Bowring Road

Ramsey, Isle of Man, IM8 2LQ

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

On September 20, 2023, Lifezone

Metals Limited (the “Company”) announced the financial results of Lifezone Holdings Limited (“LHL”)

for the six months ended June 30, 2023 and issued a shareholder letter. Copies of that announcement and the shareholder letter are furnished

as Exhibit 99.1 and Exhibit 99.2, respectively, to this report on Form 6-K.

A copy of LHL’s unaudited

condensed consolidated interim financial statements as of June 30, 2023 and for the six-month periods ended June 30, 2023 and 2022 is

furnished as Exhibit 99.3 to this report on Form 6-K, a copy of LHL’s management’s discussion and analysis of financial condition

and results of operations for the period ended June 30, 2023 is furnished as Exhibit 99.4 to this report on Form 6-K and a copy of LHL’s

quantitative and qualitative disclosures about market risk is furnished as Exhibit 99.5 to this report on Form 6-K.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Lifezone Metals Limited |

| |

|

|

| Date: September 20, 2023 |

By: |

/s/ Ingo Hofmaier |

| |

Name: |

Ingo Hofmaier |

| |

Title: |

Chief Financial Officer |

3

Exhibit 99.1

Lifezone Metals

Announces Publication of H1 2023 Financial Results and Shareholder Letter

September 20, 2023

New York (United States) – Lifezone

Metals Limited (“Lifezone Metals” or the “Company”) (NYSE: LZM), a modern metals company creating value across

the battery metals supply chain from mine to metals production and recycling, announced today that it has published the Company’s

first half 2023 financial results in a Form 6-K and an accompanying Shareholder Letter.

Highlights

to-date in 2023, as expanded upon in detail in the Shareholder Letter, include:

| ● | Lifezone

Metals’ public listing on the New York Stock Exchange (NYSE) as LZM, creating the first

pure-play NYSE publicly traded nickel resource and cleaner technology company |

| ● | Completion

of a second investment by BHP of $50 million, enabling continued progress at the Kabanga

Nickel (“Kabanga”) project site in North-west Tanzania and on key study areas |

| ● | Progress

on Kabanga DFS and resource definition activities, building on years of studies and 621 kilometres

of historical resource drilling, and further defining the Kabanga resource as the Company

works towards an updated S-K 1300 |

| ● | Updated

Kabanga metallurgical test work results, which indicate Kabanga nickel concentrate is amenable

to processing using Lifezone Metals’ Hydromet Technology, and is integral to the Kabanga-Kahama

nickel refinery flow sheet |

| ● | Headway

on Kabanga site operations, early works and site access, with simultaneous critical path

activities including expanded camp and internal roads upgrades enabling drilling and land

surveys |

| ● | Key

achievements in the areas of Kabanga external affairs, sustainability and permitting, with

a comprehensive program in place comprised of an operating team of 100+ actively focused

on community engagement, environment, Corporate Social Responsibility (CSR) and social performance |

| ● | Acquisition

of Simulus Laboratories, expanding capabilities for Lifezone Metals’ growth strategy

beyond Kabanga |

| ● | Formal

commencement of off-take marketing of Kabanga nickel cathode, creating an off-take monetization

opportunity for the nickel, copper and cobalt production from Kabanga given the interest

in these products from original equipment manufacturers |

| ● | Evolved

Hydromet opportunities beyond Kabanga, entering into a Memorandum of Understanding (MoU)

with a global platinum group metals (PGM) customer for a commercial scale PGM recycling facility

|

Keith

Liddell, Founder & Chair of Lifezone Metals, said: “We are excited to share our first ever Shareholder Letter. As we are new

to the public market, our first instalment of this communication will both introduce Lifezone Metals to those who are new to our story and

present a detailed overview on what we believe are the key accomplishments for our Company so far in 2023.”

The

documents can be accessed via the links below:

| ● | Shareholder

Letter: https://ir.lifezonemetals.com/Q2-2023-shareholder-letter |

| ● | Financial

Results: https://ir.lifezonemetals.com/Q2-2023-financials |

If you would like to sign up for Lifezone Metals

news alerts, please register here.

| H1 2023 Financials and Shareholder Letter Publication 09-20-23 |

1 |

Contacts

Lifezone Metals

Natasha

Liddell

Chief Sustainability & Communications Officer

info@lifezonemetals.com |

Investor Relations

ICR,

Inc.

+1 (646) 200-8879

LifezoneMetalsIR@icrinc.com |

| |

|

Ingo Hofmaier

Chief Financial Officer

ingo.hofmaier@lifezonemetals.com

|

US

Media Enquiries

Bronwyn Wallace

H+K Strategies

+1 (713) 724 3627

Bronwyn.Wallace@hkstrategies.com |

About Lifezone Metals

Lifezone Metals (NYSE: LZM) is a modern metals company creating value across the battery metals supply chain from resource to metals production and recycling. Our mission is to provide commercial access to proprietary technology and cleaner metals production through a scalable platform underpinned by our tailored Hydromet Technology. This technology has the potential to be a cleaner and lower cost alternative to smelting, allowing us to responsibly and cost-effectively provide cleaner metals.

By pairing the Kabanga Nickel project in Tanzania, which we believe is one of the largest and highest-grade undeveloped nickel sulphide deposits in the world, with our proprietary Hydromet Technology, we will work to unlock the value of a key new source of supply to global battery metals markets. We have a long-standing partnership with BHP on the Kabanga Nickel project, with BHP having invested USD100 million, as we work to empower Tanzania to achieve full value creation in-country and become the next premier source of nickel.

www.lifezonemetals.com

Forward-Looking Statements

Certain statements made herein

are not historical facts but may be considered “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended and the “safe

harbor” provisions under the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied

by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook” or the negatives of these terms or variations of them

or similar terminology or expressions that predict or indicate future events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to, statements regarding future events, the business combination between

GoGreen Investments Corporation (“GoGreen”) and Lifezone Holdings Limited (“LHL”) that formed Lifezone Metals,

the estimated or anticipated future results of Lifezone Metals, future opportunities for Lifezone Metals, including the efficacy of Lifezone

Metals’ hydromet technology (“Hydromet Technology”) and the development of, and processing of mineral resources at,

the Kabanga Project, and other statements that are not historical facts.

| H1 2023 Financials and Shareholder Letter Publication 09-20-23 |

2 |

|

|

These statements are based

on the current expectations of Lifezone Metals’ management and are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as

a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lifezone Metals.

These statements are subject to a number of risks and uncertainties regarding Lifezone Metals’ business, and actual results may

differ materially. These risks and uncertainties include, but are not limited to: general economic, political and business conditions,

including but not limited to the economic and operational disruptions and other effects of the COVID-19 pandemic; the outcome of any legal

proceedings that may be instituted against the Lifezone Metals in connection with the business combination; failure to realize the anticipated

benefits of the business combination, including difficulty in integrating the businesses of LHL and GoGreen; the risks related to the

rollout of Lifezone Metals’ business, the efficacy of the Hydromet Technology, and the timing of expected business milestones; Lifezone

Metals’ development of, and processing of mineral resources at, the Kabanga Project; the effects of competition on Lifezone Metals’

business; the ability of Lifezone Metals to execute its growth strategy, manage growth profitably and retain its key employees; the ability

of Lifezone Metals to maintain the listing of its securities on a U.S. national securities exchange; costs related to the business combination;

and other risks that will be detailed from time to time in filings with the U.S. Securities and Exchange Commission (the “SEC”).

The foregoing list of risk factors is not exhaustive. There may be additional risks that Lifezone Metals presently does not know or that

Lifezone Metals currently believes are immaterial that could also cause actual results to differ from those contained in forward-looking

statements. In addition, forward-looking statements provide Lifezone Metals’ expectations, plans or forecasts of future events and

views as of the date of this communication. Lifezone Metals anticipates that subsequent events and developments will cause Lifezone Metals’

assessments to change. However, while Lifezone Metals may elect to update these forward-looking statements in the future, Lifezone Metals

specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Lifezone Metals’

assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking

statements. Nothing herein should be regarded as a representation by any person that the forward-looking statements set forth herein will

be achieved or that any of the contemplated results in such forward-looking statements will be achieved. You should not place undue reliance

on forward-looking statements in this communication, which speak only as of the date they are made and are qualified in their entirety

by reference to the cautionary statements herein.

Certain statements made herein

include references to “clean” or “green” metals, methods of production of such metals, energy or the future in

general. Such references relate to environmental benefits such as lower green-house gas (“GHG”) emissions and energy consumption

involved in the production of metals using the Hydromet Technology relative to the use of traditional methods of production and the use

of metals such as nickel in the batteries used in electric vehicles. While studies by third parties (commissioned by Lifezone Metals)

have shown that the Hydromet Technology, under certain conditions, results in lower GHG emissions and lower consumption of electricity

compared to smelting with respect to refining platinum group metals, no active refinery currently licenses Lifezone Metals’ Hydromet

Technology. Accordingly, Lifezone Metals’ Hydromet Technology and the resultant metals may not achieve the environmental benefits

to the extent Lifezone Metals expects or at all. Any overstatement of the environmental benefits in this regard may have adverse implications

for Lifezone Metals and its stakeholders.

| H1 2023 Financials and Shareholder Letter Publication 09-20-23 |

3 |

Exhibit 99.2

H1 2023 | SHAREHOLDER LETTER 1 H1 2023 Shareholder Letter NYSE: LZM THE SUPPLY CHAIN SOLUTION FOR CLEAN METALS

Forward - Looking Statements This shareholder letter contains certain forward - looking statements within the meaning of the federal securities laws, including statements regarding our performance for the fiscal quarter ending September 30, 2023. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” or the negatives of these terms or variations of them or similar terminology or expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding future events, the estimated or anticipated future results of Lifezone Metals Limited, future opportunities for Lifezone Metals Limited and its affiliates, including the efficacy of our Hydromet Technology and the development of, and processing of mineral resources at our Kabanga Nickel project in North - West Tanzania, and other statements that are not historical facts. These statements are based on the current expectations of our management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only. They are not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. The forward - looking statements in this letter are subject to risks and uncertainties that could cause actual results and events to differ. This includes, without limitation: general economic, political and business conditions; the efficacy of our Hydromet Technology, the timing of expected business milestones; our development of, and processing of mineral resources at the Kabanga Nickel project in North - West Tanzania; our ability to execute our growth strategy, manage growth profitably and retain key employees; the ability of Lifezone Metals Limited to maintain its listing on the New York Stock Exchange. The foregoing list of risk factors is not exhaustive. There may be additional risks that Lifezone Metals Limited presently does not know or that Lifezone Metals Limited currently believes are immaterial that could also cause actual results to differ from those contained in forward - looking statements. In addition, forward - looking statements provide our expectations, plans or forecasts of future events and views as of the date of this shareholder letter. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward - looking statements is included in our filings with the Securities and Exchange Commission (SEC), including our F - 1 filed with the SEC on August 22, 2023. We undertake no obligation to update forward - looking statements to reflect events or circumstances occurring after the date of this shareholder letter. Nothing in this shareholder letter should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results in such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements in this shareholder letter. 2 H1 2023 | SHAREHOLDER LETTER

With Lifezone Metals Limited ( Lifezone Metals or LML ) now trading on the New York Stock Exchange ( NYSE ) under the ticker “ LZM ” following the close of its business combination with GoGreen Investments Corporation on July 6, 2023, we are delighted to present our first Shareholder Letter. We intend to communicate our progress as we execute our business plan through this medium on a quarterly basis, and look forward to demonstrating our successes and continuing to deliver shareholder value. As this is our first edition, we present a brief introduction to Lifezone Metals, our Kabanga Nickel project, our Hydromet Technology and why we are so excited about our future. Lifezone Metals is a modern metals company poised to do our part to enable a cleaner metals supply chain. Our flagship Kabanga Nickel project in North - West Tanzania ( Kabanga Nickel project or Kabanga ) is on track for first ore in 2026 and is one of the largest and highest - grade development ready nickel sulphide deposits in the world, with industry estimates suggesting that it sits in the first quartile of both the all - in cash cost and greenhouse gas emissions curves1. Besides nickel, Kabanga will produce copper and cobalt as by - products. Importantly, the Kabanga Nickel project was issued a special mining license ( SML ) in October 2021 by the Government of Tanzania ( GoT ), which provides Lifezone Metals, through our subsidiary Tembo Nickel Corporation Limited ( Tembo Nickel or TNCL ), with legal tenure over the Kabanga Nickel project area for the life of mine. Equally important is the Framework Agreement entered into with the Government of Tanzania to jointly develop, process and refine the concentrate from the Kabanga Nickel project. To achieve this objective, Lifezone Metals, through Kabanga Nickel Limited ( KNL ), and GoT set up TNCL as a Tanzanian joint venture and holding company and further subsidiaries to carry out metals extraction and refining, respectively in our host country. Our ability to develop the Kabanga Nickel project, an asset that has seen more than $315 million of investment and definition of a mineral resource based on approximately 621 kilometers of exploration drilling, is underpinned by our proprietary Hydromet processing technology. Our Hydromet Technology is a lower - energy intensity, significantly less carbon intensive, and lower cost alternative to conventional smelting. As the global electrification of mobility and energy storage unfolds, simply delivering the rapid growth in metals required for electric vehicle ( EV ) batteries won’t be enough – we need to deliver a cleaner metals supply chain. The Kabanga Nickel project will be a true mine - to - metal operation, incorporating the construction of an underground mine, concentrator, Hydromet Technology refinery and associated infrastructure. That said, Lifezone Metals is more than the Kabanga Nickel project. We see the potential for significant scale up and widespread use of our Hydromet Technology – a technology that we have been studying, testing, and fine tuning for the better part of three decades. As you’ll see herein, we plan to provide updates not only on Kabanga, but as we evolve other commercial opportunities for Hydromet Technology as well across various commodities i.e., base metals, platinum group metals, and rare and precious metals. 1 Bespoke Nickel Market Outlook for Lifezone Limited, a product of Wood Mackenzie, September 2022. 3 H1 2023 | SHAREHOLDER LETTER Dear Lifezone Metals Shareholders

We believe there is no greater validation of our mission than our relationship with BHP, the world’s largest mining company. To - date, BHP has invested $100 million between Lifezone Metals and KNL where BHP owns 17% of KNL, which represents 14.3% look - through interest at the TNCL project level. On completion of our Definitive Feasibility Study ( DFS ) and Initial Assessment ( IA ) on Kabanga, which are expected in Q3 2024, BHP has the option to increase its stake in KNL further. So far in 2023, we have made great strides across the various interconnected aspects that are required to bring the Kabanga Nickel project to life. This includes exploration, technical and operational elements, as well as external affairs and community relations, and commercial fronts at Kabanga, as detailed in subsequent pages. Further, we strengthened our public market readiness with the hiring of Gerick Mouton as Chief Operating Officer and Ingo Hofmaier as Chief Financial Officer. Gerick has a vast track record in strategic mining and mineral processing development and operations, while Ingo brings extensive global corporate finance, commercial and public company experience in commodities. We also strengthened our human resources company - wide, reaching a headcount of 121 staff plus approximately 300 contractors in Tanzania by the end of H1 2023. As we look ahead, much of our focus over the next 12 months will be on delivering the DFS and creating shareholder value by further de - risking of the Kabanga asset. We are also excited to lead Lifezone Metals to progress on a number of fronts, including commercializing our Hydromet Technology and imbedding ESG standards, practices and culture across people and processes; in line with our corporate vision and long - term strategy. The fundamentals that underpin our business are positive, and we believe we have the right team, an outstanding asset and the right technology to deliver the supply chain solution for cleaner metals. We look forward to keeping you apprised of our progress in the quarters and years ahead. Kind regards, Keith Liddell Founder & Chair As we look ahead, much of our focus over the next 12 months will be on delivering the DFS and creating shareholder value by further de - risking of the Kabanga asset. Chris Showalter Chief Executive Officer 4 H1 2023 | SHAREHOLDER LETTER

Public Listing on the NYSE as LZM Creating the first pure - play NYSE publicly traded nickel resource and cleaner technology company Kabanga DFS and Resource Definition Activities Building on years of studies and 621 km of historical resource drilling and further defining the Kabanga resource towards an updated S - K 1300 Kabanga Metallurgical Test Work Results Results indicate Kabanga nickel concentrate is amenable to processing using Lifezone Metals’ Hydromet Technology and is integral to the Kabanga - Kahama nickel refinery flow sheet Kabanga External Affairs, Sustainability and Permitting Comprehensive program in place with an operating team of 100+ actively focused on community engagement, environment, CSR and social performance Simulus Laboratories Acquisition Bringing Simulus in - house expands capabilities for Lifezone Metals’ growth strategy Opportunity to monetize the off - take for the nickel, copper and cobalt production from the Kabanga Nickel project given the interest in these products from original equipment manufacturers Hydromet Beyond Kabanga Recycling capabilities via use of our Hydromet Technology in autocatalytic recycling, Lifezone Metals signed MoU with global platinum group metals ( PGM ) customer for commercial scale PGM recycling facility Kabanga Site Operations, Early Works and Site Access Simultaneous critical path activities with expanded camp and internal roads upgrades, enabling drilling and land surveys IPO H1 Highlights $ Off - take Marketing of Kabanga Nickel Cathode Completion of Second Investment by BHP of $50 Million 5 H1 2023 | SHAREHOLDER LETTER Follow - on investment secured, enabling continued progress at the Kabanga Nickel project site and on key study areas 50M

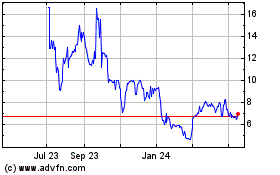

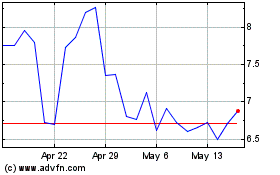

Discussion Public Listing on the NYSE as LZM After entering into a Business Combination Agreement ( BCA ) in December 2022 with GoGreen Investments Corporation (GoGreen), a SPAC, and following the closing of the business combination under the BCA (the Closing), Lifezone Metals listed on the NYSE on July 6, 2023. The BCA was signed by, among others, Lifezone Metals, Lifezone Holdings Limited ( LHL ) and GoGreen on December 13, 2022. The Closing occurred concurrently with the closing of a Private Investment in Public Equity ( PIPE ), with gross proceeds of approximately $86.6 million, including approximately $70.2 million from PIPE investors and approximately $16.4 million of cash held in trust net of redemptions, ahead of payments to settle listing and transaction expenses by GoGreen and Lifezone. At the Closing, Lifezone Metals acquired GoGreen and former GoGreen shareholders received the number of Lifezone Metals shares and warrants equal to their former holdings of GoGreen shares and warrants. Immediately prior to the Closing, holders of all outstanding LHL options (18,054 total) and restricted stock units (30,000 total) elected to exercise or settle, respectively, their options and restricted stock units for LHL shares, and all outstanding LHL shares were subsequently exchanged for Lifezone Metals shares at the Closing. Following the Closing, Lifezone Metals’ shareholders comprised all prior shareholders of LHL, all prior shareholders of GoGreen (including its public shareholders post - redemptions and the SPAC Sponsor) plus all PIPE investors resulting in Lifezone Metals having a total of 79,418,599 shares issued and outstanding. Pursuant to earn - out arrangements under the BCA, former LHL shareholders and the SPAC Sponsor will receive additional Lifezone Metals shares if the daily volume - weighted average price of Lifezone Metals shares equals or exceeds (i) $14.00 per share for any 20 trading days within a 30 trading day period ( Trigger Event 1 ) and (ii) $16.00 per share for any 20 trading days within a 30 trading day period ( Trigger Event 2 ). Of the total shares issued and outstanding, 1,725,000 shares are issued but in escrow and relate to the SPAC Sponsor earn - outs, which are subject to the occurrence of the two trigger events. Lifezone Metals filed a registration statement on Form F - 1 with the Securities and Exchange Commission ( SEC ). Once declared effective by the SEC, the F - 1 will register the resale of certain Lifezone Metals shares and warrants owned by certain previous LHL shareholders, the SPAC Sponsor (including its limited partners), PIPE investors and Simulus vendors. Pursuant to the BCA, a 180 - day lock - up period following the Closing applies to (i) 5,133,600 Lifezone Metals shares and 667,500 warrants received by the SPAC Sponsor and (ii) the Lifezone Metals shares received by the previous LHL shareholders who owned 1.5% or more of the outstanding LHL shares prior to the Closing, in each case, subject to certain exceptions. 1,335,000 Lifezone Metals shares received by the SPAC Sponsor are subject to a 60 - day lock - up. The Lifezone Metals shareholdings are summarized below upon closing of the BCA and with the fully diluted capitalization position. 6 H1 2023 | SHAREHOLDER LETTER

Earn - out Trigger Event 1 ($14.00 per Share) 10.5% 0.7% 12,536,026 862,500 1.1%* 862,500 Previous LHLShareholders Previous GoGreen Sponsor 11.2% 13,398,526 1.1% 862,500 Total 7 H1 2023 | SHAREHOLDER LETTER Earn - out Trigger Event 2 ($16.00 per Share) 10.5% 0.7% 12,536,026 862,500 1.1%* 862,500 Previous LHLShareholders Previous GoGreen Sponsor 11.2% 13,398,526 1.1% 862,500 Total Warrants ($11.50 Exercise Share Price) 11.6% 0.6% 13,800,000 667,500 Previous GoGreen Public Warrants Previous GoGreen Sponsor Warrants 12.1% 14,467,500 Total Fully Diluted % Shares (Fully Diluted) % At Closing Shares At Closing Shareholders 52.5% 62,680,131 78.9% 62,680,131 Previous LHL Shareholders 5.4% 6,468,600 8.1% 6,468,600 Previous GoGreen Sponsor 1.3% 1,527,554 1.9% 1,527,554 Previous GoGreen Public Shareholders 5.9% 7,017,317 8.8% 7,017,317 PIPE Investors 65.0% 77,693,602 97.8% 77,693,602 Total Simulus Consideration Shares 0.4% 500,000 Simulus Vendors 0.4% 78,193,602 Total Fully Diluted Total 79,418,599 100.0% 119,458,154 100.0% * Issued shares but held in escrow

Completion of Second Investment by BHP of $50 Million On February 15, 2023 BHP completed a $50 million additional investment in KNL. As previously announced, this investment increases BHP’s direct equity interest in KNL from 8.9% to 17%. BHP also has an option to further increase its direct equity interest in KNL to 60.7%, subject to the satisfaction of certain conditions, including the satisfactory completion of, and agreement on, the DFS for Kabanga Nickel project and other approvals, providing BHP with a controlling indirect interest of 51% at the TNCL level. BHP’s initial investment included a loan of $40 million to KNL, which was converted into an 8.9% equity interest in KNL. The initial investment by BHP in 2021 also included a $10 million investment into Lifezone Ltd., our Hydromet Technology IP company, now rolled - up into Lifezone Metals. BHP are an established partner to Lifezone Metals and the Kabanga Nickel project. We have formed a collaborative working relationship with the BHP team, as we integrate our teams through on - site visits, steering committees, workshops, secondment of BHP personnel and across - the - board communications and knowledge sharing. Kabanga Resource Definition Activities and DFS During the first half of 2023, Lifezone Metals continued to make progress on various technical aspects of the Kabanga Nickel project, which included releasing an SEC compliant Mineral Resource Estimate ( MRE ) and continued resource definition (infill) drilling. In March 2023, Kabanga’s current MRE was published in a Technical Report Summary under U.S. SEC Regulation S - K 1300 rules for Property Disclosures for Mining Registrants ( S - K 1300 ) with an effective date of February 15, 2023. This was the first time the Kabanga MRE has been reported under SEC guidelines, meaning these estimates are based upon technical studies completed by Qualified Persons ( QPs ) who fulfill the competency requirements under SEC mining property disclosure requirements. The Kabanga MRE as attributable to Lifezone Metals is 25 . 8 Mt (Measured and Indicated) at 2 . 63 % Ni, 0 . 35 % Cu, and 0 . 20 % Co and an additional 14 . 6 Mt (Inferred) at 2 . 57 % Ni, 0 . 34 % Cu, and 0 . 18 % Co, each with an assumed recovery of 87 . 2 % for nickel, 85 . 1 % for copper, and 88 . 1 % for cobalt . 8 H1 2023 | SHAREHOLDER LETTER

1. Mineral Resources are reported exclusive of Mineral Reserves. There are no Mineral Reserves to report. 2. Mineral Resources are reported showing only the LHL attributable tonnage portion, which is 69.713% of the total. 3. Cut off uses the NiEq23 using a nickel price of $9.50/lb, copper price of $4.00/lb, and cobalt price of $26.00/lb with allowances for recoveries, payability, deductions, transport, and royalties. NiEq23% = Ni% + Cu% x 0. 411 + Co% x 2.765. 4. The point of reference for Mineral Resources is the point of feed into a processing facility. 5. All Mineral Resources in the 2023MRE were assessed for reasonable prospects for eventual economic extraction by reporting only material above a cut off grade of 0.58% NiEq23. 6. Totals may vary due to rounding. During the first half of 2023, Lifezone Metals deployed an average of five drill rigs for the Kabanga deposit resource definition drilling on both the Tembo Zone and North Zones, and completed a total of ~29 holes for approximately 16,550 m in the six - month period. Since the acquisition of Kabanga in 2019, the exploration team has drilled approximately 29,290 m of core to June 30, 2023. The primary focus remains infill drilling within the existing geological resource which will support the DFS and IA mine plans as we endeavor to increase the geological confidence and ore classification from Inferred to Indicated. As of July 30, 2023, we completed all the infill drilling at the Tembo Zone with all rigs now focused on the North Zone. Other ongoing drilling activities, undertaken by four additional rigs, relate to surface and mine geotechnical and hydrotechnical drilling supporting the DFS designs and water balance. Cobalt (%) Recovery Copper (%) Nickel (%) Co (%) Grades Ni Cu (%) (%) NiEq23 (%) LHL Tonnage (Mt) Mineral Resource Classification Main – – – – – – – – Measured 88.1 85.1 87.2 0.15 0.28 1.92 2.44 2.14 Indicated 88.1 85.1 87.2 0.15 0.28 1.92 2.44 2.14 Measured+Indicated – – – – – – – – Inferred MNB – – – – – – – – Measured – – – – – – – – Indicated – – – – – – – – Measured+Indicated 88.1 85.1 87.2 0.13 0.20 1.52 1.98 0.51 Inferred North 88.1 85.1 87.2 0.21 2.64 2.64 3.37 4.7 Measured 88.1 85.1 87.2 0.21 3.05 3.05 3.80 11.9 Indicated 88.1 85.1 87.2 0.21 2.93 2.93 3.68 16.6 Measured+Indicated 88.1 85.1 87.2 0.18 2.64 2.64 3.29 12.0 Inferred Tembo 88.1 85.1 87.2 0.20 0.32 2.34 3.03 4.9 Measured 88.1 85.1 87.2 0.15 0.22 1.69 2.20 2.2 Indicated 88.1 85.1 87.2 0.19 0.29 2.14 2.77 7.1 Measured+Indicated 88.1 85.1 87.2 0.18 0.31 2.41 3.05 2.1 Inferred Overall Mineral Resource 88.1 85.1 87.2 0.21 0.34 2.49 3.20 9.6 Measured 88.1 85.1 87.2 0.19 0.36 2.71 3.40 16.3 Indicated 88.1 85.1 87.2 0.20 0.35 2.63 3.33 25.8 Measured+Indicated 88.1 85.1 87.2 0.18 0.34 2.57 3.21 14.6 Inferred 9 H1 2023 | SHAREHOLDER LETTER

Drilling Highlights from Tembo Zone drilling: from the North Zone infill drilling includes massive sulphides: Hole KL22 - 10 intersected 41 m at 2.07% Ni, 0.39% Cu, and 0.16% Co (2.67% NiEq2), including 16.4 m at 2.77% Ni, 0.45% Cu and 0.23% Co (3.59% NiEq) Hole KL22 - 12 intersected 39.6 m at 2.04% Ni, 0.37% Cu, and 0.13% Co (2.55% NiEq), including 19.9 m at 2.83% Ni, 0.44% Cu and 0.19% Co (3.53% NiEq) Hole KL21 - 01 intersected 29.7 m at 1.94% Ni, 0.29% Cu, and 0.16% Co (2.51% NiEq), including 17.0 m at 2.42% Ni, 0.38% Cu, and 0.21% Co (3.15% NiEq) Hole KN22 - 03 intersected 52.0 m at 2.37% Ni, 0.25% Cu, and 0.14% Co (2.85% NiEq), including 39.8 m at 3.03% Ni, 0.32% Cu, and 0.18% Co (3.65% NiEq) Hole KN22 - 01A intersected 27.7 m at 2.56% Ni, 0.32% Cu, and 0.22% Co (3.29% NiEq) 2 NiEq = Ni% + (Cu% * 0.411) + (Co% * 2.765) 10 H1 2023 | SHAREHOLDER LETTER

Oblique Long Section of Kabanga Nickel Project Mineralization Zones showing Drilling Eras and Mineralized Intercepts >0.58% NiEq23 (looking north - west) The Kabanga Nickel project DFS, which is being managed by DRA Global as the appointed principal engineering consultant is well underway and remains on track for completion in Q3 2024. The DFS will define the optimal mine size and production schedule to produce nickel in Tanzania. The DFS mine plan aims to incorporate all the Measured and Indicated Mineral Resources. DRA Global is also accountable for the ore comminution and processing test work, the designs of the concentrator, and surface and mine infrastructure. Other key specialized DFS consultants includes OreWin (resources and reserves, mine optimization, mine planning, and economic analysis), WSP Golder (ground and surface water, waste management and tailing storage facility), Mine Geotech (underground mine geotechnical), BBE (ventilation), Minefill (underground backfilling) and RSK (environmental and social studies). In parallel, the team will complete an IA under the S - K 1300 to demonstrate the potential of the entire Measured, Indicated, and Inferred Mineral Resources. OreWin has been appointed to complete the IA and has also been appointed as our QPs for both Mineral Resources and Mineral Reserves under S - K 1300. Initial mine planning is underway, and it is anticipated that the primary mining method selected will be long - hole stoping, a highly mechanized and well - established mining method that is considered safe and robust. Initial concepts for the mine include decline portals at North Zone and Tembo Zone to access the mineralization. These declines will be used for hauling and servicing from underground, whilst raise bores will be developed for ventilation. Given that all mining will be underground, mining will be highly selective, minimizing waste rock from underground and the team is working on ways to optimize decline developments to reduce environmental impacts on surface. Anticipated Mine Plan Layout for North and Tembo Zones 11 H1 2023 | SHAREHOLDER LETTER

Kabanga Metallurgical Test Work Results Since late 2022, metallurgical test work for the concentrator, a flotation process which will yield a metal concentrate from the ore, has been ongoing at Bureau Veritas laboratory in Perth, Australia. The latest concentrator test work results have been positive with recoveries of ~91% to rougher concentrate, with final recoveries projected to be in the high 80s. Open circuit bench - scale cleaner optimization test work has indicated the potential of achieving concentrate grades of 18 - 20%. Achieving higher concentrate grades will assist by lowering refinery operational costs in terms of reagents, consumables and logistics. We also conducted successful Hydromet Technology testing of fresh flotation concentrate from Kabanga at our laboratory (Simulus) in Perth, Australia in the first half of 2023. Specifically, pressure oxidization autoclave tests resulted in high nickel, copper and cobalt recoveries of 98% into solution. These recoveries exceeded the Company’s own internal expectations. Nickel Grade (%) Nickel Recovery (%) 22.0 20.0 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0 TEST 74 - BASELINE TEST 76 - SPLIT JAMO A TEST 87 - COMB JAMO TEST 90 - SPLIT JAMO A TEST 91 - SPLIT JAMO B Kabanga Nickel Latest Grade - Recovery Curve 12 H1 2023 | SHAREHOLDER LETTER

13 1H 2023 | SHAREHOLDER LETTER The tailings storage facility downstream design is progressing well, with the National Environment Management Council ( NEMC ) of Tanzania having visited the preferred site at Kabanga. The team has established an Independent Tailings Review Board ( ITRB ) chaired by John Wates. John has in excess of 40 years’ experience in design and operational management in tailings, waste management and geotechnics. He is currently involved in senior reviews of significant tailings projects and serves on several global ITRBs. The Lifezone Metals hydromet team concluded the final flow sheet design for the refinery in August 2023 following various trade - off studies conducted during the first half of the year. The refinery will be constructed at Kahama where concentrate containing nickel, copper and cobalt from Kabanga will be processed through an autoclave which will produce a metals - rich solution for purification and final metal refining by electrowinning, a conventional electrolytic chemical reaction process. Residues from the refinery will report to residue storage facilities with some being transported back to Kabanga for underground backfill material. Final nickel, copper and cobalt products will be railed to the Dar es Salaam port for shipment to international customers. CONCENTRATE POX GYPSUM RESIDUE WASH WASH IRON RESIDUE FILTRATION FILTRATION WASH TO REPULP COPPER COBALT BINDER AID WATER NICKEL FILTRATION STEAM CuSX Cu EW PRIMARY NEUTRALISATION ANOLYTE NEUTRALISATION SECONDARY NEUTRALISATION SEPARATION & FILTRATION CYANEX 272 SX TVR Ni EW Co EW Kahama Hydromet Refinery Block Flow Diagram WASH REPULP WASH TO REPULP

Aerial View of Existing Kabanga Camp Layout and Upgrades Kabanga Site Operations, Early Works and Site Access The teams at Lifezone Metals and its Kabanga operating subsidiary, Tembo Nickel, made strong operational progress in the first half of 2023. Early works activities during the period included the ongoing upgrades to the existing exploration camp and the engineering design of primary access roads, the airstrip at Kabanga and the North Zone portal. Work on the existing exploration camp included the construction of additional accommodation and refurbishment of existing accommodation, mess, ablution, laundry, potable water and clinic facilities, construction of a new office block, refurbishment of existing offices, installation of new high - speed fibre and internet connectivity, construction of new workshops, water treatment facilities and the procurement and installation of a new server. Once fully upgraded by the end of the year the camp will be able to accommodate up to 350 people. The site safety systems and processes have been established with the required baseline risk assessments and standard operating procedures ongoing. The establishment of an Occupational Health and Safety (OHS) management system, based on ISO 45001:2018, together with the OHS manual is in progress. An Emergency Response Plan and team has been formulated and is in operation. The team continues the development of the site medical clinic that meets industry standards and three doctors and an OHS nurse with paramedics have been appointed to attend to any health and safety needs on site. An on - site ambulance, complete with emergency response equipment, has been procured and is in operation. The site remains vigilant with regards to the COVID - 19 and Ebola pandemics with measures in place for screening and control. 14 H1 2023 | SHAREHOLDER LETTER In August 2023, the Kabanga Nickel project recorded more than one million hours without a Lost Time Injury since the project was acquired by Lifezone Metals in 2019. This achievement is directly related to the continuous crafting of a positive safety culture from an early stage with the workforce (employees and contractors), through Visible Field Leadership, Planned Tasked Observation, workplace inspections, safety pledges and slogans, reporting of near misses and dedicated leadership. The Kabanga Nickel project safety slogan is: “Your Safety is My Safety”. Kabanga Site Team Celebrating One Million Lost Time Injury Free Hours

The Kabanga airstrip construction and road upgrades in and around the license areas were designed and issued to the Tanzanian market for pricing. The tender documents are expected to be adjudicated this quarter. Tembo Nickel has received the construction approval of the airstrip by the Tanzania Civil Aviation Authority in July 2023. Design work is underway to complete the North Zone portal earthworks, civils and storm water management. Once the design is complete, enquiries will be issued to the Tanzanian market for tender purposes during Q4 2023. Lastly, in June 2023, the NEMC approved an updated Kabanga Environmental and Social Management Plan, meaning construction work on surface infrastructure can commence. Lifezone Metals is committed to being an active participant in the sustainable development of the local communities in our direct zone of influence in close partnership with the people living near the site, the GoT and development partners. The focus in the first six months of 2023 was consolidating base line surveys and valuations for the Kabanga Nickel project area and establishing and implementing workshops with the local communities to ensure full alignment with their needs. In May 2023, the Chief Government Valuer signed off on compensation schedules required for the purchase and relocation of the effected communities within the Kabanga Nickel project footprint area. Further, Tembo Nickel signed a community security and safety Memorandum of Understanding ( MoU ) with the Tanzanian police to ensure and enhance safety and for the community surrounding the Kabanga Nickel project. Beyond our immediate work at Kabanga, progress across our various partners and other relevant stakeholders continued during the first half of 2023, with the various pieces of broader bulk infrastructure requirements evolving. Tanesco, the Tanzanian electricity supply company, is advancing a 5 MW, 33kV line to the Kabanga site. Tembo Nickel also signed an MoU with Tanesco in the first half of 2023, noting that both parties intend to develop a 220kV transmission line and associated substation to supply the required production electrical capacity the Kabanga site and also upgrading and connection to the substation at Kahama for the refinery. Engagement with Tanesco for the 220kV supply is ongoing, and the current focus is to refine and close the scope for the DFS as well as the environmental and social impact assessment required for the transmission line easement, both of which are being prepared by Tanesco. CONSTRUCTION ACCESS ROAD AIRPORT PARKING AIRPORT TERMINAL BUILDING Airstrip Layout 15 H1 2023 | SHAREHOLDER LETTER

Kabanga External Affairs, Sustainability and Permitting In March 2023, we were very pleased to see U.S. Vice President Kamala Harris visit Tanzania, evidencing the strong ties between both governments and recognition on both sides of the important role that Tanzania plays in transformative infrastructure development. Lifezone Metals was present at the State Dinner and is incredibly proud to have been named in the U.S. White House Fact Sheet3 related to VP Harris’ visit. The Company forms part of the U.S. and Tanzanian’s governments’ efforts “aimed at building and expanding resilient, transparent supply chains for clean energy technology that are based on extensive local engagement, respect for the environment and conservation, and safe, high - integrity labor practices.” 16 H1 2023 | SHAREHOLDER LETTER Source: https:// www.voaafrica.com/a/tanzanian - youth - ready - for - vp - harris - /7025971.html 3 https:// www.whitehouse.gov/briefing - room/statements - releases/2023/03/30/fact - sheet - vice - president - harris - announces - initiatives - to - deepen - the - u - s - partnership - with - tanzania - 2/

At Kahama, the site of our Hydromet refinery, progress was made with the signing of an MoU with the Kahama Municipality for the Special Economic Zone ( SEZ ) where the refinery will be located. The SEZ is earmarked for the Tanzanian mining industry and support services. Kahama is a town built around the former Barrick Buzwagi gold mine, which recently closed. The GoT will make use of the existing infrastructure to support the companies operating with the SEZ with potential tax holidays to attract investment. Kahama is located approximately 300 km to the south - east of Kabanga and is supported by existing road infrastructure and a nearby rail line to Dar es Salaam. Lifezone Metals will use this railway line for the transport of construction materials, heavy equipment, reagents, consumables, and final products. Kabanga Nickel Limited signed a Framework Agreement with the government of Tanzania in January 2021, which stipulates the principles of sharing of economic benefits and the government’s 16% carried interest in the Kabanga Nickel project. In October 2021, our operating subsidiary secured a SML for Kabanga. The SML is a requirement for the development of large - scale mining operations (meaning capital of not less than $100 million is required) in Tanzania. In addition to the SML, Lifezone Metals has five prospecting licenses in good standing, that extend towards the north - east along strike from the SML. 17 H1 2023 | SHAREHOLDER LETTER

Our efforts on Corporate Social Responsibility ( CSR ) began as soon as we acquired Kabanga. Through Tembo Nickel, we signed a MoU with the Ngara District Council providing $88,000 towards our 2022 CSR projects. These projects were handed over in April 2023. The 2022 CSR MoU covered a total of eleven projects in different sectors and five popular events. Seven projects related to the education sector to improve the infrastructure at various schools (including classrooms, staff offices, and school desks). Our CSR strategy centers around key pillars: health and hygiene services; education; environment and women. Following on from our 2022 CSR program, on June 6, 2023, Tembo Nickel signed a MoU with the Ngara District Council for $110,000 towards several CSR projects. 18 H1 2023 | SHAREHOLDER LETTER In April 2023, the Tembo Young Talent Program was kicked - off with 10 graduate intakes. The talent pipeline is an important part of our social value and responsibility and importantly develops local talent as we design and construct the production facilities – and we are focused on developing social and sustainability - based practices at Kabanga and Kahama to support this in future. Tembo Young Talent Program Graduates with Tembo Nickel COO, Manny Dos Ramos, April 2023

Simulus Laboratories Acquisition In July 2023 we completed the acquisition of The Simulus Group Pty Limited ( Simulus ), a Perth - based internationally renowned hydrometallurgy laboratory and flow sheet design company. The business has had a relationship with Simulus for more than 15 years, with their facilities having supported several studies and test work on the Kabanga Nickel project, and other projects including a potential refinery utilising Lifezone Metals’ Hydromet Technology in South Africa. By acquiring Simulus, Lifezone Metals is expected to be able to shorten testing times and avoid routine delays that naturally arise when using third party laboratories, and to improve the laboratory to meet Lifezone Metals’ specific hydromet testing and research and development needs. By bringing Simulus in - house, Lifezone Metals is also better able to control costs and project timing. Off - take Marketing of Kabanga Nickel Cathode Post - listing, Lifezone Metals formally commenced its competitive initial off - take marketing process for its nickel product from Kabanga, for which the Company has 40% of the marketing of total refined metal production in the event BHP exercises its option to take majority control of the project post - completion of the DFS. The Company is currently engaged with several global original equipment manufacturers and battery producers, which have expressed an interest in purchasing refined nickel product from Kabanga. There is a recognizable focus on reducing the upstream environmental footprint driven by consumer demand and regulatory targets in the U.S. and Europe, and we expect a shift away from heavy - polluting sources of battery metals into the EV supply chain. The process is supported by RBC Capital Markets. Lifezone Metals and Simulus Teams During Integration Session in Perth 19 H1 2023 | SHAREHOLDER LETTER

Hydromet Beyond Kabanga Lifezone Metals’ value proposition is underpinned by its Hydromet Technology, a technology first conceptualized by Lifezone Metals’ founder and chairman Keith Liddell and Chief Technology Officer Dr. Mike Adams in 1996. Although the Kabanga Nickel project is expected to be the cornerstone project through which we demonstrate our Hydromet Technology’s value proposition, the Company’s business strategy is centered around licensing and deploying Hydromet Technology globally and at scale. To this point, in June 2023, Lifezone Metals entered into a non - binding MoU with a global PGM customer with regard to a proposed commercial collaboration to establish a commercial scale PGM recycling facility that will use our Hydromet Technology to produce non - smelted refined PGMs from the recycling market. Pending a successful piloting program, the facility is expected to be installed in the U.S. by the end of 2025 and will be used to recover PGMs from catalytic converters from spent automotive vehicles. Lifezone Metals will provide technical expertise and will license its Hydromet Technology to the affiliated project entity, as well as capital necessary to fund the facility. Its PGM customer will provide market intelligence to enable the parties to develop a robust business model and will also facilitate arrangements with potential collectors to supply the facility. We look forward to pursuing additional opportunities to deploy, monetize and scale our Hydromet Technology across a variety of applications and for a variety of different end markets. 20 H1 2023 | SHAREHOLDER LETTER

Liquidity Position Kabanga Outlook The current North Zone drilling program is expected to be complete by mid - September 2023, after which focus will shift to a new drilling program that has been developed for the currently untested zone between Tembo North and Safari, known as the Safari Link program. Drilling in Tembo North and Safari shows that the mineralization trend is open along strike. The Safari Link drilling program aims to test for the presence of Tembo - style mineralization as signaled by airborne EM/ magnetics and ground EM coverage, which shows no significant gaps along strike to the north - east of Tembo. As of June 30, 2023, prior to the Business Combination, the Company had consolidated cash and cash equivalents of $44.4 million. As of July 31, 2023, Lifezone Metals had consolidated cash and cash equivalents of $84.4 million. The primary movements between June 30, 2023 and July 31, 2023 related to $74.6 million gross proceeds for Lifezone from the Business Combination and the PIPE Financing transactions, settling the majority of $20.6 million in transaction expenses, the $7.5 million completion payment to the shareholders of Simulus and the balance of outflows in July 2023 of $6.5 million relating to working capital expenses and investments into exploration and evaluation assets. The Safari Link drilling program, which covers a strike length of approximately 1.5 km and comprises 62 diamond core drillholes for approximately 34 km of drilling, has been approved by Tembo Nickel. This program is expected to require approximately six months to complete with six diamond drill rigs and will proceed in three phases: the first of which will test the presence of mineralization in the Safari Link Zone; and the subsequent phases will infill as required to increase confidence in the characteristics and volume of any mineralization that is identified to enable its incorporation into subsequent geological modelling. An update to the S - K 1300 compliant MRE will be published Q4 2023. Recent results from our infill drilling has added confidence in our understanding of the characteristics of the mineralization (position, thickness, and grades) and we are hopeful that this may result in a higher level of confidence in the resource size available to ultimately support an economic mine schedule and Mineral Reserve. As we advance the project in consultation with our partner BHP, the additional Inferred Mineral Resources may expand the mine rate to up to 3 Mtpa. Lifezone Metals remains focused on optimizing the Net Asset Value of the project, which is driven by maximizing the total Resource and to ensure the majority of Measured, Indicated and Inferred Resources are included in mine production plans of the Discounted Cash Flow model. Ongoing mine stope optimizations are underway to establish the most optimal and economic production cases for the DFS and IA. We expect to have these production cases locked in by end Q4 2023. 21 H1 2023 | SHAREHOLDER LETTER

lifezonemetals.com info@lifezonemetals.com lifezone - metals

Exhibit 99.3

LIFEZONE HOLDINGS LIMITED

Unaudited

Condensed Consolidated INTERIM Financial Statements

FOR THE SIX MONTHS ENDED

JUNE 30, 2023

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENT

OF COMPREHENSIVE LOSS

for the six months ended June 30,

2023 and June 30, 2022

| | |

Note | | |

H1 2023 | | |

H1 2022 | |

| | |

| | |

$ | | |

$ | |

| Revenue | |

| 5 | | |

| 506,748 | | |

| 1,114,305 | |

| (Including related party revenues of $495,048 and $1,065,162 for the periods ended June 30, 2023 and June 30, 2022, respectively) | |

| | | |

| | | |

| | |

| Gain (loss) on foreign exchange | |

| 8 | | |

| 86,547 | | |

| (30,473 | ) |

| | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| 8 | | |

| (13,412,649 | ) | |

| (5,515,073 | ) |

| Operating loss | |

| | | |

| (12,819,354 | ) | |

| (4,431,241 | ) |

| Interest income | |

| 6 | | |

| 269,800 | | |

| 27,816 | |

| Interest expense | |

| 7 | | |

| (91,668 | ) | |

| (130,555 | ) |

| Loss before tax | |

| | | |

| (12,641,222 | ) | |

| (4,533,980 | ) |

| Income tax | |

| | | |

| - | | |

| - | |

| Loss for the financial period | |

| | | |

| (12,641,222 | ) | |

| (4,533,980 | ) |

| Other comprehensive income | |

| | | |

| | | |

| | |

| Other comprehensive income that may be reclassified to

profit or loss in subsequent periods (net of tax): | |

| | | |

| | | |

| | |

| Exchange (loss) gain on translation of foreign operations | |

| | | |

| (84,291 | ) | |

| 35,189 | |

| Total other comprehensive (loss) income for the period | |

| | | |

| (84,291 | ) | |

| 35,189 | |

| | |

| | | |

| | | |

| | |

| Total comprehensive loss for the financial period | |

| | | |

| (12,725,513 | ) | |

| (4,498,791 | ) |

| Net loss for the period: | |

| | | |

| | | |

| | |

| Attributable to ordinary shareholders of the company | |

| | | |

| (10,403,600 | ) | |

| (4,214,565 | ) |

| Attributable to noncontrolling interests | |

| | | |

| (2,237,622 | ) | |

| (319,415 | ) |

| | |

| | | |

| (12,641,222 | ) | |

| (4,533,980 | ) |

| Total comprehensive loss: | |

| | | |

| | | |

| | |

| Attributable to ordinary shareholders of the company | |

| | | |

| (10,487,891 | ) | |

| (4,179,376 | ) |

| Attributable to noncontrolling interests | |

| | | |

| (2,237,622 | ) | |

| (319,415 | ) |

| | |

| | | |

| (12,725,513 | ) | |

| (4,498,791 | ) |

| Net loss per share | |

| | | |

| | | |

| | |

| Basic and diluted fer Redeemable Class A ordinary

share | |

| 21 | | |

| (16.77 | ) | |

| (6.79 | ) |

/s/ Ingo Hofmaier

Ingo Hofmaier

Chief Financial Officer

Date: September 20, 2023

See accompanying notes to unaudited condensed

consolidated interim financial statements.

UNAUDITED CONDENSED CONSOLIDATED INTERIM

STATEMENT OF FINANCIAL POSITION

as of June 30, 2023 and December 31,

2022

| | |

Note | | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

$ | | |

$ | |

| Assets | |

| | |

| | |

| |

| Non-current assets | |

| | |

| | |

| |

| Exploration and evaluation assets and mining data | |

| 12 | | |

| 35,921,121 | | |

| 18,455,306 | |

| Patents | |

| 13 | | |

| 613,613 | | |

| 602,867 | |

| Other intangible assets | |

| 13 | | |

| 92,096 | | |

| 92,096 | |

| Property and equipment | |

| 11 | | |

| 1,030,135 | | |

| 884,322 | |

| Right-of-use assets | |

| 11 | | |

| 440,827 | | |

| 352,307 | |

| | |

| | | |

| 38,097,792 | | |

| 20,386,898 | |

| Current assets | |

| | | |

| | | |

| | |

| Inventories | |

| | | |

| 66,942 | | |

| 49,736 | |

| Trade and other receivables | |

| 10 | | |

| 10,247,585 | | |

| 6,005,207 | |

| (Including receivables from related parties of $150,000 and $655,683 as of June 30, 2023, and December 31, 2022, respectively and receivables from affiliated entities of $1,466,634 and $959,935 as of June 30, 2023 and December 31, 2022, respectively) | |

| | | |

| | | |

| | |

| Subscription receivable | |

| 15 | | |

| - | | |

| 50,000,000 | |

| Cash and cash equivalents | |

| 9 | | |

| 44,410,732 | | |

| 20,535,210 | |

| | |

| | | |

| 52,725,316 | | |

| 76,590,153 | |

| Total assets | |

| | | |

| 92,823,051 | | |

| 96,977,051 | |

| | |

| | | |

| | | |

| | |

| Liabilities and equity | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 20 | | |

| 3,101 | | |

| 3,101 | |

| Share premium | |

| 20 | | |

| 25,436,656 | | |

| 25,436,656 | |

| Shared based payment reserve | |

| 20 | | |

| 25,483,348 | | |

| 25,483,348 | |

| Other reserves | |

| 20 | | |

| (15,495,254 | ) | |

| (15,495,254 | ) |

| Foreign currency translation reserve | |

| 20 | | |

| 31,573 | | |

| 115,864 | |

| Redemption reserve | |

| 20 | | |

| 280,808 | | |

| 280,808 | |

| Accumulated deficit | |

| 20 | | |

| (54,694,202 | ) | |

| (44,290,602 | ) |

| Total Shareholders’ (deficit) equity | |

| | | |

| (18,953,970 | ) | |

| (8,466,079 | ) |

| Non-controlling interests | |

| 20 | | |

| 82,215,262 | | |

| 84,452,884 | |

| Total equity | |

| | | |

| 63,261,292 | | |

| 75,986,805 | |

See accompanying notes to

unaudited condensed consolidated interim financial statements.

UNAUDITED CONDENSED CONSOLIDATED INTERIM

STATEMENT OF FINANCIAL POSITION

as of June 30, 2023 and December 31,

2022

| | |

Note | | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

$ | | |

$ | |

| Non-current liabilities | |

| | |

| | |

| |

| Lease liabilities | |

| 16 | | |

| 351,076 | | |

| 290,576 | |

| Long term asset retirement obligation provision | |

| 19 | | |

| 303,000 | | |

| 303,000 | |

| Contingent consideration | |

| 18 | | |

| 3,768,859 | | |

| 3,689,755 | |

| | |

| | | |

| 4,422,935 | | |

| 4,283,331 | |

| Current liabilities | |

| | | |

| | | |

| | |

| Lease liabilities | |

| 16 | | |

| 145,142 | | |

| 105,304 | |

| Trade and other payables | |

| 14 | | |

| 24,993,682 | | |

| 16,601,611 | |

| | |

| | | |

| 25,138,824 | | |

| 16,706,915 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| | | |

| 29,561,759 | | |

| 20,990,246 | |

| | |

| | | |

| | | |

| | |

| Total equity and liabilities | |

| | | |

| 92,823,051 | | |

| 96,977,051 | |

/s/ Ingo Hofmaier

Ingo Hofmaier

Chief Financial Officer

Date: September 20, 2023

See accompanying notes to unaudited condensed consolidated

interim financial statements.

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENT

OF CHANGES IN EQUITY

for the six months ended June 30,

2023 and June 30, 2022

| | |

Note | | |

Share Capital | | |

Share Premium | | |

Shared Based

Payment

Reserve | | |

Other Reserves | | |

Foreign currency translation reserve | | |

Redemption Reserve | | |

Accumulated Deficit | | |

Total Shareholders’ equity | | |

Convertible loans issued | | |

Non-controlling Interest | | |

Total equity | |

| | |

| | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| At January 1, 2022 | |

| | | |

| 1,843 | | |

| 25,436,656 | | |

| 9,988,094 | | |

| - | | |

| - | | |

| 280,808 | | |

| (20,707,260 | ) | |

| 15,000,141 | | |

| 39,040,000 | | |

| (176,238 | ) | |

| 53,863,903 | |

| Transactions with shareholders: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of ordinary shares | |

| | | |

| 1,258 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,258 | | |

| - | | |

| - | | |

| 1,258 | |

| Total transactions with shareholders | |

| | | |

| 1,258 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,258 | | |

| - | | |

| - | | |

| 1,258 | |

| Total loss for the interim financial period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,214,565 | ) | |

| (4,214,565 | ) | |

| - | | |

| (319,415 | ) | |

| (4,533,980 | ) |

| Total other comprehensive income for the interim financial period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 35,189 | | |

| - | | |

| - | | |

| 35,189 | | |

| - | | |

| - | | |

| 35,189 | |

| At June 30, 2022 | |

| | | |

| 3,101 | | |

| 25,436,656 | | |

| 9,988,094 | | |

| - | | |

| 35,189 | | |

| 280,808 | | |

| (24,921,825 | ) | |

| 10,822,023 | | |

| 39,040,000 | | |

| (495,653 | ) | |

| 49,366,370 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| At January 1, 2023 | |

| | | |

| 3,101 | | |

| 25,436,656 | | |

| 25,483,348 | | |

| (15,495,254 | ) | |

| 115,864 | | |

| 280,808 | | |

| (44,290,602 | ) | |

| (8,466,079 | ) | |

| - | | |

| 84,452,884 | | |

| 75,986,805 | |

| Total loss for the interim financial period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (10,403,600 | ) | |

| (10,403,600 | ) | |

| - | | |

| (2,237,622 | ) | |

| (12,641,222 | ) |

| Total other comprehensive loss for the interim financial period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (84,291 | ) | |

| - | | |

| - | | |

| (84,291 | ) | |

| - | | |

| - | | |

| (84,291 | ) |

| At June 30, 2023 | |

| 20 | | |

| 3,101 | | |

| 25,436,656 | | |

| 25,483,348 | | |

| (15,495,254 | ) | |

| 31,573 | | |

| 280,808 | | |

| (54,694,202 | ) | |

| (18,953,970 | ) | |

| - | | |

| 82,215,262 | | |

| 63,261,292 | |

See accompanying notes to unaudited condensed consolidated

interim financial statements.

UNAUDITED CONDENSED CONSOLIDATED INTERIM CASH

FLOW STATEMENT

for the six months ended June 30,

2023 and June 30, 2022

| | |

| | |

June 30 | | |

June 30 | |

| | |

Note | | |

2023 | | |

2022 | |

| | |

| | |

$ | | |

$ | |

| Cash flows from operating activities | |

| | |

| | |

| |

| Consolidated loss for year | |

| | | |

| (12,725,513 | ) | |

| (4,498,791 | ) |

| Adjustments for: | |

| | | |

| | | |

| | |

| Interest income | |

| 6 | | |

| (269,800 | ) | |

| (27,816 | ) |

| Amortization of intangible assets | |

| 13 | | |

| 38,301 | | |

| 33,619 | |

| Foreign exchange (gain) loss | |

| 8 | | |

| (86,547 | ) | |

| 30,473 | |

| Interest expense | |

| 7 | | |

| 91,668 | | |

| 130,555 | |

| Depreciation of property and equipment and right-of-use assets | |

| 11 | | |

| 169,721 | | |

| 69,176 | |

| Operating loss before working capital changes | |

| | | |

| (12,782,170 | ) | |

| (4,262,784 | ) |

| Changes in trade and other receivables | |

| | | |

| (1,072,573 | ) | |

| (1,138,799 | ) |

| Changes in related party receivables | |

| | | |

| (1,374,175 | ) | |

| (150,806 | ) |

| Changes in inventories | |

| | | |

| (17,206 | ) | |

| (40,753 | ) |

| Changes in other current assets | |

| | | |

| (2,202,145 | ) | |

| (94,957 | ) |

| Changes in prepaid mining license | |

| | | |

| 499,903 | | |

| 503,436 | |

| Changes in customer credit to related party | |

| | | |

| - | | |

| (208,550 | ) |

| Changes in trade and other payables | |

| 14 | | |

| 10,892,071 | | |

| 618,571 | |

| Net cash used in operating activities | |

| | | |

| (6,056,295 | ) | |

| (4,774,642 | ) |

| Cash flows from investing activities | |

| | | |

| | | |

| | |

| Interest received from bank | |

| | | |

| 262,959 | | |

| 23,651 | |

| Patent costs incurred | |

| | | |

| (49,047 | ) | |

| (35,395 | ) |

| Expenditures on property and equipment | |

| 11 | | |

| (253,505 | ) | |

| 65,351 | |

| Investment in exploration and evaluation assets | |

| 12 | | |

| (17,465,815 | ) | |

| (1,998,059 | ) |

| Acquisition of subsidiaries, net of cash acquired | |

| 22 | | |

| - | | |

| (7,591 | ) |

| Net cash used in investing activities | |

| | | |

| (17,505,408 | ) | |

| (1,952,043 | ) |

| Cash flows from financing activities | |

| | | |

| | | |

| | |

| Payment of lease liabilities | |

| 16 | | |

| (62,775 | ) | |

| (38,610 | ) |

| Proceeds from receipt of subscription receivable, net of transaction cost | |

| 15 | | |

| 47,500,000 | | |

| - | |

| Net cash provided by (used in) financing activities | |

| | | |

| 47,437,225 | | |

| (38,610 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| | | |

| 23,875,522 | | |

| (6,765,295 | ) |

| Cash and cash equivalents | |

| | | |

| | | |

| | |

| Beginning of period | |

| | | |

| 20,535,210 | | |

| 45,624,110 | |

| End of period | |

| | | |

| 44,410,732 | | |

| 38,858,815 | |

See accompanying notes to unaudited condensed consolidated interim

financial statements

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the six months ended June 30, 2023

Lifezone

Holdings Limited (“LHL”) is a limited company incorporated and domiciled in Isle of Man and whose shares are not publicly

traded. The registered office is located at Commerce House, 1 Bowring Road, Ramsey, IM8 2LQ, Isle of Man. The Unaudited Condensed Consolidated

Interim Financial Statements of LHL, and its subsidiaries (collectively, “LHL Group”) for the six months ended June

30, 2023, were authorized for issue in accordance with a resolution of the Directors of LHL on September 18, 2023 and the Directors of

Lifezone Metals Limited on September 19, 2023.

The

Unaudited Condensed Consolidated Interim Financial Statements of LHL Group have been reviewed by Grant Thornton Ireland, an independent

public accountant prior to filing in accordance with the standards of the United States Public Company Accounting Oversight Board applicable

to reviews of interim financial information.

LHL

Group is a modern metals company engaged in the development, patenting, and licensing of its hydro-metallurgical processing technology

(“Hydromet Technology”) for use in the extractive metallurgy, minerals, and recycling industries. LHL’s primary asset

is the Kabanga Nickel project in Tanzania, considered one of the world’s largest, highest grade and development ready nickel sulfide

deposit globally. Information on LHL Group’s structure is provided in Note 2.3.

Information

on other related party relationships of LHL Group is provided in Note 17.

History

and organization

LHL

was formed as a holding company for Lifezone Limited (“LZL”) and acquired 100% of the equity interest (including outstanding

options and Restricted Stock Units, “RSUs”) in LZL on June 24, 2022, in consideration for issuing shares of LHL on a

1:1 basis to the LZL shareholders at the time (following a 1:200 split of shares of LZL) (the “Lifezone Holdings Transaction”).

Also, on June 24, 2022 (just prior to the Lifezone Holdings Transaction), the shareholders of Kabanga Nickel Limited (“KNL”),

other than LZL and BHP Billiton (UK) DDS Limited (“BHP”), exchanged their shares of KNL for shares of LHL on a 1:1

basis (the “Flip-Up”). The KNL options were also exchanged for options in LHL on a 1:1 basis as part of the Flip-Up.

As

LHL did not have any previous operations, LZL and KNL (together with its subsidiaries) are together viewed as the predecessors

to LHL and its consolidated subsidiaries. As a result, the consolidated financial statements of LHL recognize the assets and liabilities

received in the Lifezone Holdings Transaction and the Flip-Up at their historical carrying amounts, as reflected in the historical financial

statements of LZL and KNL (together with its subsidiaries).

On

December 13, 2022, Lifezone Metals Limited, an Isle of Man company (“LML”) and GoGreen Investments Corporation (“GoGreen”),

an exempted special purchase acquisition company (“SPAC”) incorporated under the laws of the Cayman Islands and formerly

listed on the New York Stock Exchange (“NYSE”), entered into a Business Combination Agreement (“BCA”)

with GoGreen Sponsor 1 LP, a Delaware limited partnership (the “Sponsor”), Aqua Merger Sub, a Cayman Islands exempted

company (the “Merger Sub”) and LHL, a wholly owned direct subsidiary of LML.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the six months ended June 30, 2023

| 1. | General

information (continued) |

History

and Organization (continued)

On July 6, 2023 LML, LHL and GoGreen consummated

the business combination pursuant to the BCA (the “Business Combination”). The transaction was unanimously approved

by GoGreen’s Board of Directors and was approved at the extraordinary general meeting of GoGreen’s shareholders held on June

29, 2023 (the “EGM”). GoGreen’s shareholders also voted to approve all other proposals presented at the EGM.

As a result of the Business Combination, the Merger Sub, as the surviving entity after the Business Combination transaction, and LHL each

became wholly owned subsidiaries of LML.

On the Closing Date, LML’s Ordinary Shares

and the LML Warrants commenced trading on the NYSE, under the new ticker symbols “LZM” and “LZMW”, respectively.

Information on the Business Combination and the

NYSE listing are provided in Note 27.

| 2. | Significant

accounting policies |

LHL

Group’s Unaudited Condensed Consolidated Interim Financial Statements for the six months ended June 30, 2023 have been prepared

in accordance with IAS 34 ‘Interim Financial Reporting’ under the International Financial Reporting Standards (“IFRS”),

as issued by the International Accounting Standards Board (“IASB”) and are reported in U.S. dollars (“USD”

or “$”).

The

Unaudited Condensed Consolidated Interim Financial Statements have been prepared on a historical cost basis unless otherwise stated.

The

same accounting policies, presentation and methods of computation have been followed in these Unaudited Condensed Consolidated Interim

Financial Statements as were applied in the preparation of LHL Group’s financial statements for the year ended December 31, 2022,

except for the impact of the adoption of the Standards and Interpretations as described in Note 2.2

These

standards and amendments do not have a significant impact on these Interim Financial Statements and therefore the disclosures have not

been made.

However,

whilst they do not affect these Unaudited Condensed Consolidated Interim Financial Statements, they will impact on some entities. Entities

should assess the impact of these new Standards on their financial statements based on their own facts and circumstances and make appropriate

disclosures. In addition, if practical expedients are going to be used, then this intention should be disclosed.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the six months ended June 30, 2023

| 2. | Significant

accounting policies (continued) |

| 2.1. | Basis

of preparation (continued) |

The

Unaudited Condensed Consolidated Interim Financial Statements incorporate the results of Business Combinations under common control using

the predecessor value method that occurred in 2022. In the Unaudited Condensed Consolidated Interim Statement of Financial Position,

the acquiree’s identifiable assets and liabilities are initially recognized at their carrying values at the acquisition date. The

increase in the fair value of share-based payment reserves, assumed by LHL Group as part of the Business Combination under common control,

is accounted for directly in equity under Other Reserves. The results of acquired operations are included in the Unaudited Condensed

Consolidated Interim Statement of Comprehensive Income from the date on which control is obtained.

LHL

Group has prepared the Unaudited Condensed Consolidated Interim Financial Statements on the basis that it will continue to operate as

a going concern as discussed in Note 2.5.

The

Unaudited Condensed Consolidated Interim Financial Statements comprise the financial statements of the LHL Group as of June 30, 2023.

Control is achieved when LHL Group is exposed, or has rights, to variable returns from its involvement with the investee and has the

ability to affect those returns through its power over the investee. Specifically, LHL Group controls an investee if, and only if, LHL

Group has:

| ● | power