SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

REPURCHASE SAVINGS AND SIMILAR PLANS PURSUANT

TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

for the year ended December 31, 2022 or

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File No. 001-38103

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

(Full title of the plan)

Janus Henderson Group plc

201 Bishopsgate

EC2M 3AE

United Kingdom

(Name of issuer of the securities held pursuant to the plan and

the address of its principal executive office)

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

TABLE OF CONTENTS

| |

NOTE:

|

All other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosures under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

|

Report of Independent Registered Public Accounting Firm

To the Administrator and Plan Participants of Janus 401(k) and Employee Stock Ownership Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Janus 401(k) and Employee Stock Ownership Plan (the “Plan”) as of December 31, 2022 and 2021 and the related statement of changes in net assets available for benefits for the year ended December 31, 2022, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2022 and 2021, and the changes in net assets available for benefits for the year ended December 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental schedule of assets (held at end of year) as of December 31, 2022 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

Denver, Colorado

June 28, 2023

We have served as the Plan’s auditor since 2018.

|

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

|

| |

|

|

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2022

|

|

|

2021

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and investments:

|

|

|

|

|

|

|

|

|

|

Participant-directed investments

|

|

$ |

394,650,660 |

|

|

$ |

487,644,345 |

|

|

Nonparticipant-directed investments – Janus Henderson Group plc common stock

|

|

|

12,199,330 |

|

|

|

21,850,047 |

|

|

Cash

|

|

|

2,882 |

|

|

|

6,810 |

|

|

Total cash and investments

|

|

|

406,852,872 |

|

|

|

509,501,202 |

|

| |

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

|

1,549,148 |

|

|

|

1,759,286 |

|

| |

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$ |

408,402,020 |

|

|

$ |

511,260,488 |

|

|

The accompanying notes are an integral part of these financial statements.

|

|

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

|

| |

|

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

| |

Year ended

|

|

| |

December 31, 2022

|

|

| |

|

|

|

|

Additions/(deductions) to net assets attributed to:

|

|

|

|

|

Net depreciation in fair value of participant-directed investments

|

$ |

(99,489,306 |

) |

|

Net depreciation in fair value of nonparticipant-directed investments – Janus Henderson Group plc common stock

|

|

(9,541,083 |

) |

|

Dividends and interest

|

|

10,830,584 |

|

|

Net investment loss

|

|

(98,199,805 |

) |

| |

|

|

|

|

Interest income on notes receivable from participants

|

|

77,031 |

|

| |

|

|

|

|

Contributions to net assets attributed to:

|

|

|

|

|

Participants

|

|

16,038,652 |

|

|

Sponsor

|

|

8,570,121 |

|

|

Participant rollovers

|

|

1,686,141 |

|

|

Total contributions

|

|

26,294,914 |

|

| |

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

Plan expenses

|

|

(218,543 |

) |

|

Benefits paid to participants

|

|

(30,812,065 |

) |

|

Total deductions

|

|

(31,030,608 |

) |

| |

|

|

|

|

Net decrease in net assets

|

|

(102,858,468 |

) |

| |

|

|

|

|

Net assets available for benefits:

|

|

|

|

|

Beginning of year

|

|

511,260,488 |

|

| |

|

|

|

|

End of year

|

$ |

408,402,020 |

|

|

The accompanying notes are an integral part of these financial statements.

|

| |

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 AND 2021,

AND FOR THE YEAR ENDED DECEMBER 31, 2022

|

1.

|

DESCRIPTION OF THE PLAN

|

Janus 401(k) and Employee Stock Ownership Plan (the “Plan”) is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”).

The following brief description of the Plan is for general information purposes only. Participants should refer to the Plan agreement for a more complete description of the Plan’s provisions.

Eligibility — Substantially all U.S. based employees of Janus Henderson Group plc (“JHG”, the “Company” or the “Sponsor”) and affiliated employers who have adopted the Plan are eligible to participate in the Plan beginning on their date of employment.

Contributions — The Plan consists of a Roth 401(k) and a 401(k) component. Participants may contribute up to 75% of their annual compensation, as defined in the Plan, subject to certain limitations as set forth by the IRS. Participants may also contribute up to 25% of their annual base salary in after-tax contributions. Participants direct the investment of their contributions into various registered mutual funds offered by the Plan. Participants may also direct their investments through a trustee sponsored brokerage account.

The Sponsor contributes to the 401(k) portion of the Plan a matching contribution equal to 100% of each participant’s eligible contribution up to 5% of the participant’s compensation. Employees that work at least 1,000 hours during the year and remain employed on the last day of the Plan year are also eligible for an annual discretionary contribution to the Plan. The Sponsor contributions to the profit sharing portion are invested based on the direction of the participant. Contributions to the Employee Stock Ownership Plan (“ESOP”) are invested directly in JHG common stock. After three years of service, employees may transfer 100% of their ESOP balance and any future contributions to participant-directed investments. Contributions are subject to certain limitations.

Participants can reinvest dividends earned on JHG common stock to purchase additional shares of JHG common stock or elect to receive dividends in cash.

A participant who is age 50 or older may make catch-up deferral contributions of $6,500 in 2022.

Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans. Contributions are subject to certain Internal Revenue Code (“IRC”) limitations.

Participant Accounts — Individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions, the Sponsor’s contributions and may also include an allocation of Plan earnings and participant forfeitures. Plan losses, withdrawal fees and administrative expenses may be charged to participant’s accounts. Allocations are based on account balances, as defined in the Plan. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s account.

Vesting — Participants are always 100% vested in their own contributions. Vesting in discretionary employer contributions, discretionary ESOP stock bonus contributions and in employer matching contributions are based on years of service with JHG or a subsidiary of JHG. Participants earn one year of service for each calendar year that they work at least 1,000 hours and the vesting percentage for the majority of participants is calculated as follows:

| |

|

Cumulative |

| |

|

Percentage |

|

Years of Service

|

|

Vested

|

|

After 1

|

|

20%

|

|

2

|

|

40%

|

|

3

|

|

60%

|

|

4

|

|

80%

|

|

5

|

|

100%

|

A participant becomes 100% vested in all contributions if employed when the participant reaches normal retirement date (age 65), loses his or her job due to job elimination (as defined by the Plan), or leaves employment due to disability (as defined by the Plan) or death, even if the participant has not yet completed five years of service.

Distribution of Benefits — Distributions generally will be made in the event of retirement, death, disability, resignation, or dismissal. The Plan also provides for early distribution at age 59 1/2 in specific circumstances.

Distributions after termination of employment are made in a lump-sum payment in an amount equal to the value of the participant’s vested interest in his or her account. Terminated participants with an account balance of $1,000 or less are paid a lump-sum distribution without the request or approval of the participant. Balances exceeding $1,000 are paid upon the distribution date elected by the participant, but no later than April 1 of the calendar year following the calendar year in which the age of 70 1/2 is attained.

Distributions may also be made in the event of the financial hardship of the participant, as defined in the Plan.

Notes Receivable from Participants — Participants may only have one loan outstanding at any given time and may borrow an aggregate amount of $50,000 or 50% of their account balance, whichever is less. The loans are secured by the balance in the participant’s account and bear interest at the prime rate plus 1%. Principal and interest are paid ratably through payroll deductions.

Trustee and Recordkeeper — Fidelity Management Trust Company (“Fidelity”) holds and administers all assets of the Plan in accordance with the provisions of the Plan agreement.

Administration of the Plan — The Sponsor has appointed an Advisory Committee to serve as fiduciary with the authority and responsibility to administer the Plan.

Plan Termination — Although it has not expressed any intent to do so, the Sponsor has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination or partial termination, participants will become 100% vested.

Forfeitures — When certain terminations of participation in the Plan occur, the nonvested portion of the participant’s account, as defined by the Plan, represents a forfeiture. Nonvested profit sharing, ESOP and employer matching contributions amounts forfeited by employees are first applied against Plan administration expenses. Any forfeiture amounts remaining after Plan expenses have been paid will be applied against any employer contribution obligation. Should the forfeiture amounts exceed Plan expenses and the Sponsor’s contribution obligations, the excess amount will be allocated to the other participants as a part of and in the same manner as the Sponsor’s contributions for the Plan year in which the forfeitures occurred. During 2022, forfeited amounts applied against Plan expenses totaled $136,544. There were $170,000 forfeitures applied against employer contributions for the year ended December 31, 2022. As of December 31, 2022 and 2021, forfeited nonvested accounts totaled $121,515 and $84,178, respectively.

|

2.

|

SIGNIFICANT ACCOUNTING POLICES

|

Basis of Accounting — The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and changes in net assets available for benefits. Actual results could differ from those estimates.

Risks and Uncertainties — The Plan provides for various investment options as set forth in the Plan agreement. Investment securities are exposed to various risks such as interest rate, market, concentration and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes could materially affect participant account balances and the amounts reported in the statements of net assets available for benefits. Approximately 3% and 4% of net assets available for benefits as of December 31, 2022 and 2021, respectively, were invested in JHG common stock, representing the ESOP portion of the Plan.

Investment Valuation and Income Recognition — The Plan’s investments are stated at fair value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Shares of mutual funds and money market funds are valued at quoted market prices, which represent the net asset value of shares held by the Plan at year-end. Common stock is valued at quoted market prices. Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net depreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Management fees and operating expenses charged to the Plan for investments in the mutual funds are deducted from income earned on a daily basis and are not separately reflected. Consequently, management fees and operating expenses are reflected as a reduction of investment return for such investments.

Notes Receivable from Participants — Notes receivable from participants are measured at their unpaid principal balance plus any accrued interest. Delinquent participant loans are recorded as distributions based on the terms of the Plan agreement. Notes receivable from participants have various maturity dates and interest rates ranging from 2023 to 2038 and 4.25% to 8.00%, respectively.

Administrative Expenses — Plan expenses include loan, distribution and administration fees paid to Fidelity. Other plan expenses include audit, legal and advisory fees. Nonvested profit sharing and ESOP amounts forfeited by employees are used to pay administration fees. Loan and distribution fees are charged against individual participant accounts. The Plan Sponsor may pay Plan expenses at its sole discretion, but is not obligated to pay Plan expenses. Unless paid by the Plan Sponsor, such costs and expenses are charged against Plan assets at the participant account level and deducted by the trustee. Administrative fees paid to Fidelity may be reduced to the extent Plan assets are invested in certain Fidelity and non-Fidelity investment products. Plan expenses were reduced by $52,002 and $51,137 during the years ended December 31, 2022 and 2021, respectively, as a result of such investment.

Payment of Benefits — Benefit payments to participants are recorded upon distribution. There were no participants who have elected to withdraw from the Plan, but have not yet been paid, as of December 31, 2022 and 2021.

Contributions — Contributions are recognized in the year to which they relate.

Income Tax Status — The IRS has determined and informed the Company by a letter dated October 14, 2014, that the Plan was designed in accordance with the applicable regulations of the IRC requirements. The Plan Sponsor believes the Plan has maintained its tax-exempt status. Therefore, no provision for income taxes has been included in the Plan’s financial statements. The Plan was last amended on December 28, 2017 for an administrative matter. The amendment was not impactful to the Plan’s tax-exempt status.

Subsequent Events — Subsequent events were evaluated through the date the financial statements were available to be issued.

|

3.

|

FAIR VALUE MEASUREMENTS

|

Measurements of fair value are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The Plan classifies its investments into Level 1, which refers to securities valued using quoted prices from active markets for identical assets; Level 2, which refers to securities not traded on an active market but for which observable market inputs are readily available; and Level 3, which refers to securities valued based on significant unobservable inputs. The Plan’s policy is to recognize significant transfers between levels at the end of the reporting period. The following tables set forth by level within the fair value hierarchy a summary of the Plan’s investments measured at fair value on a recurring basis as of December 31, 2022 and 2021.

| |

|

Fair value measurements

|

|

| |

|

as of December 31, 2022, using:

|

|

| |

|

Quoted prices in

active markets

for identical

assets (Level 1)

|

|

|

Significant

other

observable

inputs

(Level 2)

|

|

|

Significant

unobservable

inputs

(Level 3)

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$ |

364,460,510 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

364,460,510 |

|

|

Common stock

|

|

|

12,199,330 |

|

|

|

- |

|

|

|

- |

|

|

|

12,199,330 |

|

|

Money market funds

|

|

|

22,864,601 |

|

|

|

- |

|

|

|

- |

|

|

|

22,864,601 |

|

|

Participant-directed brokerage accounts

|

|

|

7,325,549 |

|

|

|

- |

|

|

|

- |

|

|

|

7,325,549 |

|

|

Total

|

|

$ |

406,849,990 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

406,849,990 |

|

| |

|

Fair value measurements

|

|

| |

|

as of December 31, 2021, using:

|

|

| |

|

Quoted prices in

active markets

for identical

assets (Level 1)

|

|

|

Significant

other

observable

inputs

(Level 2)

|

|

|

Significant

unobservable

inputs

(Level 3)

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$ |

460,469,452 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

460,469,452 |

|

|

Common stock

|

|

|

21,850,047 |

|

|

|

- |

|

|

|

- |

|

|

|

21,850,047 |

|

|

Money market funds

|

|

|

18,754,276 |

|

|

|

- |

|

|

|

- |

|

|

|

18,754,276 |

|

|

Participant-directed brokerage accounts

|

|

|

8,420,617 |

|

|

|

- |

|

|

|

- |

|

|

|

8,420,617 |

|

|

Total

|

|

$ |

509,494,392 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

509,494,392 |

|

|

4.

|

NONPARTICIPANT-DIRECTED INVESTMENTS

|

Information about the net assets and the significant components of the changes in net assets relating to the nonparticipant-directed investments for the year ended December 31, 2022, are as follows:

|

Janus Henderson Group plc common stock–at December 31, 2021

|

|

$ |

21,850,047 |

|

| |

|

|

|

|

|

Changes in net assets:

|

|

|

|

|

|

Net depreciation in fair value of investments

|

|

|

(9,541,083 |

) |

|

Dividends reinvested

|

|

|

786,518 |

|

|

Benefits paid to participants

|

|

|

(804,555 |

) |

|

Forfeitures

|

|

|

(8,927 |

) |

|

Transfers to participant-directed investments

|

|

|

(82,670 |

) |

| |

|

|

|

|

|

Net change

|

|

|

(9,650,717 |

) |

| |

|

|

|

|

|

Janus Henderson Group plc common stock–at December 31, 2022

|

|

$ |

12,199,330 |

|

|

5.

|

EXEMPT PARTY-IN-INTEREST TRANSACTIONS

|

Certain Plan investments are shares of mutual funds managed by JHG and mutual funds and brokerage accounts managed by Fidelity. Certain Plan expenses include loan, distribution and administrative fees paid to Fidelity. JHG is the sponsoring employer of the Plan and Fidelity is the trustee and, therefore, these transactions qualify as exempt party-in-interest transactions.

In addition to mutual funds managed by JHG, the Plan also holds JHG common stock. As of December 31, 2022 and 2021, the Plan held 518,611 and 520,933 shares of JHG common stock with a cost basis of $13,567,005 and $13,665,953, respectively. During the year ended December 31, 2022, the Plan recorded dividend income attributable to JHG common stock of $786,518.

Certain employees of JHG perform administrative work and financial reporting for the Plan and are not compensated by the Plan.

|

6.

|

LITIGATION AND OTHER REGULATORY MATTERS

|

Sandra Schissler v Janus Henderson US (Holdings) Inc., Janus Henderson Advisory Committee, and John and Jane Does 1-30

On September 9, 2022, a class action complaint, captioned Schissler v. Janus Henderson US (Holdings) Inc., et al., was filed in the United States District Court for the District of Colorado. Named as defendants are Janus Henderson US (Holdings) Inc. (“Janus US Holdings”) and the Advisory Committee to the Janus 401(k) and Employee Stock Ownership Plan (“Plan”). The complaint purports to be brought on behalf of a class consisting of participants and beneficiaries of the Plan that invested in Janus Henderson funds on or after September 9, 2016. On January 10, 2023, in response to defendants' motion to dismiss filed on November 23, 2022, an amended complaint was filed against the same defendants. The amended complaint names two additional plaintiffs, Karly Sissel and Derrick Hittson. As amended, the complaint alleges that for the period September 9, 2016, through September 9, 2022, among other things, defendants breached fiduciary duties of loyalty and prudence by (i) selecting higher-cost Janus Henderson funds over less expensive investment options; (ii) retaining Janus Henderson funds despite their alleged underperformance; and (iii) failing to consider actively managed funds outside of Janus Henderson to add as investment options. The amended complaint also alleges that Janus US Holdings failed to monitor the Advisory Committee with respect to the foregoing. The amended complaint seeks various declaratory, equitable and monetary relief in unspecified amounts. On February 9, 2023, defendants filed an amended motion to dismiss the amended complaint. On March 13, 2023, plaintiffs filed an opposition to the amended motion to dismiss. Defendants filed their reply to plaintiffs' opposition on March 28, 2023. A ruling on the amended motion to dismiss is pending. Janus US Holdings believes the claims asserted in the amended complaint are without merit and intends to vigorously defend against these claims.

******

SUPPLEMENTAL SCHEDULE

|

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

|

|

EIN 43-1804048, PLAN NO. 003

|

| |

|

|

|

|

FORM 5500, SCHEDULE H, PART IV, LINE 4i — SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

AS OF DECEMBER 31, 2022

|

|

Identity of issue, borrower, lessor, or similar party

|

|

Shares

|

|

Description of investment,

including maturity date,

rate of interest, collateral,

par or maturity date

|

|

Current value (2)

|

|

| |

|

|

|

|

|

|

|

|

|

|

Fidelity Freedom® Index 2005 Fund Investor Class (1)

|

|

|

2,353 |

|

Mutual Fund

|

|

$ |

28,091 |

|

|

Fidelity Freedom® Index 2010 Fund Investor Class (1)

|

|

|

10,855 |

|

Mutual Fund

|

|

|

130,037 |

|

|

Fidelity Freedom® Index 2015 Fund Investor Class (1)

|

|

|

1,125 |

|

Mutual Fund

|

|

|

14,563 |

|

|

Fidelity Freedom® Index 2020 Fund Investor Class (1)

|

|

|

25,465 |

|

Mutual Fund

|

|

|

359,062 |

|

|

Fidelity Freedom® Index 2025 Fund Investor Class (1)

|

|

|

12,629 |

|

Mutual Fund

|

|

|

200,928 |

|

|

Fidelity Freedom® Index 2030 Fund Investor Class (1)

|

|

|

75,322 |

|

Mutual Fund

|

|

|

1,265,402 |

|

|

Fidelity Freedom® Index 2035 Fund Investor Class (1)

|

|

|

111,054 |

|

Mutual Fund

|

|

|

2,078,936 |

|

|

Fidelity Freedom® Index 2040 Fund Investor Class (1)

|

|

|

61,487 |

|

Mutual Fund

|

|

|

1,165,798 |

|

|

Fidelity Freedom® Index 2045 Fund Investor Class (1)

|

|

|

94,455 |

|

Mutual Fund

|

|

|

1,859,823 |

|

|

Fidelity Freedom® Index 2050 Fund Investor Class (1)

|

|

|

135,898 |

|

Mutual Fund

|

|

|

2,679,914 |

|

|

Fidelity Freedom® Index 2055 Fund Investor Class (1)

|

|

|

29,088 |

|

Mutual Fund

|

|

|

472,105 |

|

|

Fidelity Freedom® Index 2060 Fund Investor Class (1)

|

|

|

23,062 |

|

Mutual Fund

|

|

|

316,866 |

|

|

Fidelity Freedom® Index 2065 Fund Investor Class (1)

|

|

|

23,704 |

|

Mutual Fund

|

|

|

263,352 |

|

|

Fidelity Freedom® Index Income Fund Investor Class (1)

|

|

|

127 |

|

Mutual Fund

|

|

|

1,390 |

|

|

Fidelity® 500 Index Fund (1)

|

|

|

309,417 |

|

Mutual Fund

|

|

|

41,189,564 |

|

|

Fidelity® Emerging Markets Index Fund (1)

|

|

|

410,001 |

|

Mutual Fund

|

|

|

3,866,305 |

|

|

Fidelity® Extended Market Index Fund (1)

|

|

|

75,861 |

|

Mutual Fund

|

|

|

4,780,760 |

|

|

Fidelity® Total International Index Fund (1)

|

|

|

585,556 |

|

Mutual Fund

|

|

|

6,856,863 |

|

|

Fidelity® U.S. Bond Index Fund (1)

|

|

|

533,214 |

|

Mutual Fund

|

|

|

5,428,118 |

|

|

Janus Henderson Absolute Return Income Opportunities Fund (1)

|

|

|

47,152 |

|

Mutual Fund

|

|

|

405,505 |

|

|

Janus Henderson Adaptive Global Allocation Fund (1)

|

|

|

139,576 |

|

Mutual Fund

|

|

|

1,277,120 |

|

|

Janus Henderson Adaptive Risk Managed U.S. Equity Fund (1)

|

|

|

913,124 |

|

Mutual Fund

|

|

|

8,108,543 |

|

|

Janus Henderson Asia Equity Fund (1)

|

|

|

42,098 |

|

Mutual Fund

|

|

|

394,035 |

|

|

Janus Henderson Balanced Fund (1)

|

|

|

430,868 |

|

Mutual Fund

|

|

|

16,196,309 |

|

|

Janus Henderson Contrarian Fund (1)

|

|

|

687,927 |

|

Mutual Fund

|

|

|

15,774,164 |

|

|

Janus Henderson Developed World Bond Fund (1)

|

|

|

299,568 |

|

Mutual Fund

|

|

|

2,258,741 |

|

|

Janus Henderson Emerging Markets Fund (1)

|

|

|

280,271 |

|

Mutual Fund

|

|

|

2,329,053 |

|

|

Janus Henderson Enterprise Fund (1)

|

|

|

120,490 |

|

Mutual Fund

|

|

|

14,628,631 |

|

|

Janus Henderson European Focus Fund (1)

|

|

|

14,991 |

|

Mutual Fund

|

|

|

566,200 |

|

|

Janus Henderson Flexible Bond Fund (1)

|

|

|

688,771 |

|

Mutual Fund

|

|

|

6,412,456 |

|

|

Janus Henderson Forty Fund (1)

|

|

|

581,536 |

|

Mutual Fund

|

|

|

22,080,908 |

|

(continued)

|

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

|

|

EIN 43-1804048, PLAN NO. 003

|

| |

|

|

|

|

FORM 5500, SCHEDULE H, PART IV, LINE 4i — SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

AS OF DECEMBER 31, 2022

|

|

Identity of issue, borrower, lessor, or similar party

|

|

Shares

|

|

Description of investment,

including maturity date,

rate of interest, collateral,

par or maturity date

|

|

Current value (2)

|

|

| |

|

|

|

|

|

|

|

|

|

|

Janus Henderson Global Allocation Fund - Conservative (1)

|

|

|

28,210 |

|

Mutual Fund

|

|

$ |

291,688 |

|

|

Janus Henderson Global Allocation Fund - Growth (1)

|

|

|

99,842 |

|

Mutual Fund

|

|

|

1,130,214 |

|

|

Janus Henderson Global Allocation Fund - Moderate (1)

|

|

|

25,378 |

|

Mutual Fund

|

|

|

270,532 |

|

|

Janus Henderson Global Bond Fund (1)

|

|

|

86,309 |

|

Mutual Fund

|

|

|

668,895 |

|

|

Janus Henderson Global Equity Income Fund(1)

|

|

|

447,410 |

|

Mutual Fund

|

|

|

2,688,936 |

|

|

Janus Henderson Global Life Science Fund (1)

|

|

|

225,806 |

|

Mutual Fund

|

|

|

15,138,007 |

|

|

Janus Henderson Global Real Estate Fund (1)

|

|

|

282,812 |

|

Mutual Fund

|

|

|

3,170,318 |

|

|

Janus Henderson Global Research Fund (1)

|

|

|

115,381 |

|

Mutual Fund

|

|

|

9,085,062 |

|

|

Janus Henderson Global Select Fund (1)

|

|

|

263,536 |

|

Mutual Fund

|

|

|

4,124,332 |

|

|

Janus Henderson Global Sustainable Equity Fund (1)

|

|

|

96,501 |

|

Mutual Fund

|

|

|

1,097,215 |

|

|

Janus Henderson Global Technology Fund (1)

|

|

|

338,487 |

|

Mutual Fund

|

|

|

11,522,094 |

|

|

Janus Henderson Growth and Income Fund (1)

|

|

|

134,664 |

|

Mutual Fund

|

|

|

8,510,739 |

|

|

Janus Henderson High-Yield Fund (1)

|

|

|

499,057 |

|

Mutual Fund

|

|

|

3,448,482 |

|

|

Janus Henderson International Opportunities Fund (1)

|

|

|

21,457 |

|

Mutual Fund

|

|

|

389,024 |

|

|

Janus Henderson Mid Cap Value Fund (1)

|

|

|

401,380 |

|

Mutual Fund

|

|

|

5,896,274 |

|

|

Janus Henderson Multi-Sector Income Fund (1)

|

|

|

512,651 |

|

Mutual Fund

|

|

|

4,270,386 |

|

|

Janus Henderson Overseas Fund (1)

|

|

|

300,008 |

|

Mutual Fund

|

|

|

11,835,308 |

|

|

Janus Henderson Research Fund (1)

|

|

|

428,838 |

|

Mutual Fund

|

|

|

20,314,035 |

|

|

Janus Henderson Responsible International Dividend Fund (1)

|

|

|

51,595 |

|

Mutual Fund

|

|

|

671,245 |

|

|

Janus Henderson Short Duration Flexible Bond Fund (1)

|

|

|

663,367 |

|

Mutual Fund

|

|

|

1,864,062 |

|

|

Janus Henderson Small Cap Value Fund (1)

|

|

|

293,229 |

|

Mutual Fund

|

|

|

6,436,370 |

|

|

Janus Henderson Small-Mid Cap Value Fund (1)

|

|

|

264,076 |

|

Mutual Fund

|

|

|

3,359,048 |

|

|

Janus Henderson Triton Fund (1)

|

|

|

392,566 |

|

Mutual Fund

|

|

|

9,786,675 |

|

|

Janus Henderson Venture Fund (1)

|

|

|

90,010 |

|

Mutual Fund

|

|

|

6,530,189 |

|

|

Vanguard Balanced Index Fund

|

|

|

1,607,685 |

|

Mutual Fund

|

|

|

63,760,772 |

|

|

Vanguard Inflation-Protected Securities Fund

|

|

|

90,711 |

|

Mutual Fund

|

|

|

2,099,959 |

|

|

Vanguard Short-Term Corporate Bond Index Fund

|

|

|

132,508 |

|

Mutual Fund

|

|

|

2,711,107 |

|

(continued)

|

JANUS 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN

|

|

EIN 43-1804048, PLAN NO. 003

|

| |

|

|

|

|

FORM 5500, SCHEDULE H, PART IV, LINE 4i — SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

AS OF DECEMBER 31, 2022

|

|

Identity of issue, borrower, lessor, or similar party

|

|

Shares

|

|

Description of investment,

including maturity date,

rate of interest, collateral,

par or maturity date

|

|

Current value (2)

|

|

| |

|

|

|

|

|

|

|

|

|

|

Fidelity Brokeragelink External Funds (1,3)

|

|

|

1,588,078 |

|

Fidelity Brokeragelink Mutual Fund

|

|

$ |

1,588,078 |

|

|

Fidelity Brokeragelink Fidelity Funds (1,3)

|

|

|

2,928,951 |

|

Fidelity Brokeragelink Mutual Fund

|

|

|

2,928,951 |

|

|

Fidelity Brokeragelink Unit (1,3)

|

|

|

781,884 |

|

Fidelity Brokeragelink Mutual Fund

|

|

|

781,884 |

|

|

Fidelity Brokeragelink Interest-Bearing Cash Reserves (1,3)

|

|

|

2,026,636 |

|

Fidelity Brokeragelink Interest-bearing Cash

|

|

|

2,026,636 |

|

|

Janus Henderson Group plc common stock (1,4)

|

|

|

518,611 |

|

Common Stock

|

|

|

12,199,330 |

|

|

Fidelity Government Money Market Fund (1)

|

|

|

17,040,606 |

|

Money Market Fund

|

|

|

17,040,606 |

|

|

Janus Henderson Government Money Market Fund (1)

|

|

|

5,823,995 |

|

Money Market Fund

|

|

|

5,823,995 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

|

|

|

|

|

$ |

406,849,990 |

|

| |

|

|

|

|

|

|

|

|

|

|

Notes receivable from participants (1,5)

|

|

|

|

|

Participant loans

|

|

|

1,549,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total investments and notes receivable from participants

|

|

|

|

|

|

|

$ |

408,399,138 |

|

|

(1) Indicates a party-in-interest (Note 5).

|

|

(2) Cost information is not required for participant directed investments and is therefore not included.

|

|

(3) Fidelity Brokeragelink mutual funds and interest-bearing cash are participant-directed brokerage accounts.

|

|

(4) The cost basis of the Janus Henderson Group plc common stock is $13,567,005.

|

|

(5) With various maturity dates and interest rates ranging from 2023 to 2038 and 4.25% to 8.00%, respectively.

|

INDEX TO EXHIBITS

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the Plan) have duly caused this Annual Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Janus 401(k) and Employee Stock Ownership Plan

|

|

|

|

|

|

|

|

Date: June 28, 2023

|

By:

|

/s/ Karlene Lacy

|

|

| |

|

|

|

|

|

Name: Karlene Lacy

|

|

|

|

Title: Global Head of Tax, Share Plans and Payroll

|

|

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in the Registration Statement on Form S-8 (No. 333-218365) of Janus Henderson Group plc of our report dated June 28, 2023 relating to the financial statements and supplemental schedule of Janus 401(k) and Employee Stock Ownership Plan, which appears in this Form 11-K.

/s/ PricewaterhouseCoopers LLP

Denver, CO

June 28, 2023

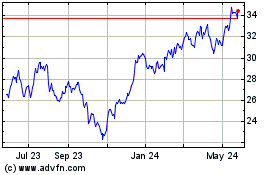

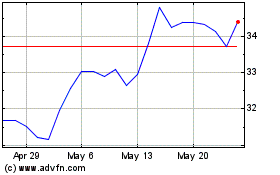

Janus Henderson (NYSE:JHG)

Historical Stock Chart

From Apr 2024 to May 2024

Janus Henderson (NYSE:JHG)

Historical Stock Chart

From May 2023 to May 2024