Natural Gas Stockpiles Up 95 Bcf - Analyst Blog

July 11 2011 - 10:08AM

Zacks

The U.S. Energy Department's weekly

inventory release showed a larger-than-expected build-up in natural

gas supplies on the back of above-average growth in each of the

three storage regions.

This was partially offset by a

strong uptick in demand in the power sector, mainly due to high

temperatures in the Northeast.

The Weekly Natural Gas Storage

Report – brought out by the Energy Information Administration (EIA)

every Thursday since 2002 – includes updates on natural gas market

prices, the latest storage level estimates, recent weather data and

other market activity or events.

The report provides an overview of

the level of reserves and their movements, thereby helping

investors understand the demand/supply dynamics of natural gas.

It is an indicator of current gas

prices and volatility that affect businesses of natural

gas-weighted companies and related support plays like

Anadarko Petroleum Corp. (APC),

Chesapeake Energy (CHK),

EnCana Corp. (ECA), Devon

Energy Corp. (DVN), Nabors

Industries (NBR), Patterson-UTI

Energy (PTEN), Helmerich &

Payne (HP) and Halliburton Co.

(HAL).

Stockpiles held in underground

storage in the lower 48 states rose by 95 billion cubic feet (Bcf)

for the week ended July 1, 2011, higher than expectations of

analysts for 78–82 Bcf surveyed by Platts, the energy information

arm of McGraw-Hill Companies Inc

(MHP).

The increase – the thirteenth

injection in as many weeks – is bigger than both last year’s

build-up of 73 Bcf and the 5-year (2006–2010) average build-up of

80 Bcf for the reported week. The current storage level at 2.527

trillion cubic feet (Tcf) is down 224 Bcf (8.1%) from last year and

is 48 Bcf (1.9%) below the five-year average.

A supply glut had pressured natural

gas futures for most of 2010, as production from dense rock

formations (shale) – through novel techniques of horizontal

drilling and hydraulic fracturing – remained robust, thereby

overwhelming demand.

Storage amounts hit a record high

of 3.840 Tcf in November, while gas prices during the year fell

21%. As a matter of fact, natural gas prices have dropped nearly

70% from a peak of about $13.60 per million Btu (MMBtu) to the

current level of around $4.35, in between sinking to a low of $2.50

in September 2009.

However, stocks of the commodity

slid approximately 2.261 Tcf during the five-month period (November

5, 2010 to April 1, 2011) on the back of a colder-than-normal end

to this past winter, production freeze-offs in January/February,

and the steadily declining rig count. These factors cut into the

U.S. supply overhang, thereby creating a deficit in natural gas

inventories after erasing the hefty surplus over last year’s

inventory level and the five-year average level.

But with the end of the winter's

peak in heating demand, natural gas prices continue to be under

pressure against the backdrop of sustained strong production.

Producers are now hoping that the gap between supply and demand

will further narrow in the coming months as they bet on a

hotter-than-expected summer and an active hurricane season.

ANADARKO PETROL (APC): Free Stock Analysis Report

CHESAPEAKE ENGY (CHK): Free Stock Analysis Report

DEVON ENERGY (DVN): Free Stock Analysis Report

ENCANA CORP (ECA): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

HELMERICH&PAYNE (HP): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

NABORS IND (NBR): Free Stock Analysis Report

PATTERSON-UTI (PTEN): Free Stock Analysis Report

Zacks Investment Research

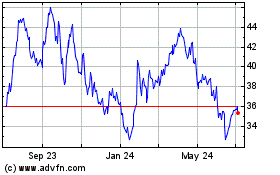

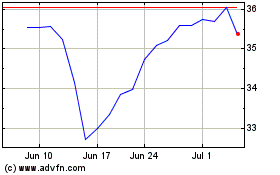

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Apr 2024 to May 2024

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2023 to May 2024